Ophthalmic Imaging Market: Growth, Size, Share, and Trends

Ophthalmic Imaging Market by Product Type (Optical Coherence Tomography Systems, Ophthalmic Ultrasound Systems, Fundus Cameras), Application (Glaucoma, Retinopathies), End User (Hospitals, Ophthalmology Clinics, Optometry Clinics) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ophthalmic imaging market is experiencing significant growth, this growth is driven by the increasing prevalence of ocular disorders, advancements in imaging technologies, and the integration of artificial intelligence (AI) for enhanced diagnostic accuracy. Additionally, the rising demand for portable imaging devices and tele-ophthalmology services is further propelling market expansion

KEY TAKEAWAYS

-

BY TECHNOLOGYBased on technology, the ophthalmic imaging market is divided into AI enabled equipment and Non AI enabled equipment. In 2024, the Non AI enabled equipmet segment held the largest share of the global ophthalmic imaging market. Hospitals and clinics continue to rely on these traditional imaging systems for routine diagnostics, retinal assessments, and glaucoma monitoring, supporting steady adoption globally.

-

BY PRODUCTBased on product, the market of ophtalmic imaging market is divided into optical coherence tomography systems, ophthalmic ultrasound systems, fundus cameras, slit lamps, specular microscopes, tonometers, ophthalmoscopes, retinoscopes, other ophthalmic imaging equipment. In 2024, the optical coherence tomography systems segment held the largest share of the global ophtalmic imaging market. Their extensive use in detecting conditions like macular degeneration and diabetic retinopathy drives strong adoption across hospitals and specialized eye clinics globally.

-

BY APPLICATIONBased on application, the ophthalmic imaging market has been categorized into glaucoma, cataracts, retinopathies, refractive disorders, age-related macular degeneration, other application. In 2024, glaucoma held the largest market share in the ophthalmic imaging market. Advanced imaging modalities like OCT and fundus photography play a key role in assessing optic nerve damage, driving demand for glaucoma-related diagnostic imaging solutions.

-

BY END USERThe ophthalmic imaging market has been categorized by end user into hospitals, ophthalmology clinics, optometry clinics, other end user. Hospitals hold the largest share of the ophthalmic imaging market due to the high patient influx and availability of advanced diagnostic infrastructure. They offer comprehensive eye care services, including screening and management of retinal disorders and glaucoma, supported by skilled ophthalmologists and integrated imaging systems for accurate diagnosis and treatment planning.

-

BY REGIONDuring the forecast period, the Asia Pacific region is projected to record the highest growth rate in the ophthalmic imaging market. This surge is driven by growing prevalence of eye disorders (diabetic retinopathy, cataracts, glaucoma), expanding aging populations, increasing healthcare expenditure, advances in imaging technology (e.g. OCT, fundus cameras), and efforts to improve healthcare infrastructure plus wider adoption of tele-ophthalmology in underserved rural areas.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships, collaborations, and approvals. For instance, Topcon Corporation (Japan) and Moorfields Eye Hospital, UCL Institute of Ophthalmology launched Cascader Limited to advance AI-driven eyecare and Oculomics. a new medical technology company that aims to transform the detection and management of eye disease through artificial intelligence (AI). Cascader also builds on the growing field of Oculomics – the use of advanced retinal imaging to uncover insights into systemic conditions.

The ophthalmic imaging market is driven by the rising prevalence of eye diseases and an aging global population, which boosts demand for advanced diagnostic tools. Significant technological advancements, such as AI integration and portable imaging devices, further accelerate adoption. However, high costs of equipment and reimbursement challenges in certain regions act as major restraints, limiting accessibility and implementation, especially in low-resource settings. Key opportunities include the expansion of tele-ophthalmology, increased healthcare investments in emerging economies, and the growing need for early, accurate detection of vision-threatening conditions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ophthalmic imaging market is witnessing rapid transformation driven by the growing prevalence of eye diseases, technological advancements, and the increasing need for early and accurate diagnosis. Conventional tools like fundus cameras and slit lamps are now being complemented or replaced by advanced imaging technologies such as optical coherence tomography (OCT), ophthalmic ultrasound, and corneal topography systems. These innovations allow for enhanced image resolution, faster diagnostics, and integration with AI for predictive analytics. New high-growth opportunities are emerging through AI-integrated imaging systems, portable and handheld OCT/ultrasound devices, and cloud-enabled diagnostic platforms, which are enabling access to eye care in remote and underserved regions. This transition is also reshaping business models, as end users—including hospitals, ophthalmology clinics, and optometry practices—increasingly demand connected, scalable, and interoperable solutions to improve diagnostic accuracy and workflow efficiency. These shifts are encouraging companies to invest in automation, digitalization, and smart imaging ecosystems to stay competitive.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing Prevalence of Eye Disorders and Aging Population

-

Technological Advancements in Imaging Modalities

Level

-

High Capital Cost of Imaging Equipment

-

Maintenance and Downtime of High-End Systems

Level

-

Expansion in Emerging Markets

-

AI-Enabled Screening and Workflow Optimization

Level

-

Shortage of Skilled Ophthalmic Technicians and Clinicians

-

Data Privacy and AI Regulation Challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Prevalence of Eye Disorders and Aging Population

The growing prevalence of eye disorders and aging populations is a major driver of the ophthalmic imaging market. Conditions like AMD, diabetic retinopathy, and glaucoma require early diagnosis and regular monitoring. With over 2.2 billion people affected by visual impairment globally, the need for advanced imaging tools such as OCT and fundus cameras is rising. Demand is particularly high in aging regions like Japan, Germany, and Italy. Rising diabetes cases and longer life expectancy further drive market growth, supported by ongoing technological advancements in imaging modalities.

Restraint: High Capital Cost of Imaging Equipment

The high capital cost of ophthalmic imaging equipment, often ranging from USD 30,000 to 80,000, limits adoption in low-resource settings and small clinics. Additional expenses for installation, training, and maintenance add to the burden. While large hospitals can absorb these costs, clinics in regions like Sub-Saharan Africa and Southeast Asia struggle. Limited financing and outdated diagnostic reliance further hinder access. Although portable and affordable solutions are emerging, affordability and public health funding gaps remain major restraints on broader market penetration.

Opportunity: Expansion in Emerging Markets

Emerging markets like India, Brazil, and Southeast Asia offer strong growth potential for ophthalmic imaging due to large populations, rising eye disease prevalence, and increasing healthcare investments. However, limited access to advanced tools in rural areas hinders early diagnosis. Governments, NGOs, and companies like Remidio and Forus Health are addressing this through portable, AI-enabled imaging devices. Public-private partnerships and evolving reimbursement systems are further boosting adoption, improving access, and driving long-term growth for manufacturers in the ophthalmic imaging space.

Challenge: Shortage of Skilled Ophthalmic Technicians and Clinicians

The shortage of skilled ophthalmic technicians and clinicians hampers the effective use of advanced ophthalmic imaging systems, impacting diagnostic accuracy and patient outcomes. This problem is acute in countries like India, Brazil, and Mexico, especially in rural areas with limited training access. The lack of standardized certification and continuing education further widens the skills gap. While modular training programs and AI tools are being developed, workforce shortages continue to restrict the expansion of ophthalmic imaging services in high-need regions.

Ophthalmic Imaging Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developer of diagnostic and surgical ophthalmic imaging systems including OCT and fundus cameras. | Provides highly accurate imaging and analysis for glaucoma, cataracts, and macular degeneration, improving patient management and surgical precision. |

|

Manufacturer of ophthalmic diagnostic instruments, including fundus cameras and slit lamps. | Enhances digital imaging capabilities and workflow integration, supporting early detection of retinal and refractive disorders. |

|

Provider of advanced ophthalmic equipment such as tonometers and refraction systems. | Offers versatile imaging solutions for both clinics and hospital settings, improving diagnostic efficiency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the ophthalmic imaging market is a highly collaborative and interconnected network comprising component suppliers, imaging system manufacturers, academic and research institutions, regulators, distributors, investors, and end users. These stakeholders collectively contribute to the advancement, regulatory approval, commercialization, and adoption of ophthalmic diagnostic technologies. The ecosystem spans from early-stage R&D—focusing on innovations in optical systems, image processing, and AI diagnostics—to large-scale manufacturing, international distribution, and clinical implementation. The synergy between universities, imaging labs, regulatory agencies, private investors, and care providers shapes the speed of innovation and the reach of imaging solutions globally. Ecosystem performance hinges on timely investment, seamless cross-border regulatory alignment, and user education to ensure accurate diagnostics. Understanding this ecosystem helps identify gaps in access, prioritize strategic partnerships, and implement sustainable delivery models that ensure the early detection and monitoring of vision-threatening disorders across diverse care settings.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Ophthalmic Imaging Market, By Technology

Non-AI-enabled ophthalmic imaging equipment will hold the largest market share due to its widespread availability, lower cost, and established use in routine eye care. Many clinics, especially in developing regions, continue to rely on traditional systems like standard OCT and fundus cameras. Their proven effectiveness, ease of use, and compatibility with existing workflows support sustained dominance in the current market

Ophthalmic Imaing Market, By Product

OCT systems hold the largest market share in the ophthalmic imaging market due to their ability to deliver high-resolution, cross-sectional images essential for diagnosing retinal and optic nerve disorders. Widely used for conditions like glaucoma and AMD, their non-invasive nature and integration with AI technologies drive widespread clinical adoption and continued market dominance.

Ophthalmic Imaing Market, By Application

Glaucoma holds the largest share of the ophthalmic imaging market due to several factors. The increasing global prevalence of glaucoma, especially among the aging population, drives demand for early detection and continuous monitoring. Advanced imaging modalities like Optical Coherence Tomography (OCT) and fundus cameras enable precise assessment of optic nerve damage and intraocular pressure changes. Rising awareness among patients and healthcare providers, coupled with the availability of specialized diagnostic facilities in hospitals and eye clinics, further fuels the adoption of ophthalmic imaging for glaucoma management worldwide.

Ophthalmic Imaing Market, By End User

Hospitals hold the largest market share in the ophthalmic imaging market by end users because they routinely manage complex eye conditions and high patient volumes. With access to advanced diagnostic equipment like OCT and fundus imaging, well-trained specialists, and favorable reimbursement systems, hospitals drive strong, sustained demand for ophthalmic imaging devices

REGION

Asia Pacific to be fastest-growing region in global oxygen concentrators market during forecast period

The Asia-Pacific ophthalmic imaging market is projected to grow at the highest CAGR due to multiple factors. Rising prevalence of eye disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration is driving demand for advanced diagnostics. Technological advancements in imaging systems like OCT, a rapidly aging population, and increasing healthcare infrastructure investments in countries like China, India, and Japan further support growth. Additionally, government initiatives promoting healthcare access and affordability are boosting adoption, making the region a key growth hub globally.

Ophthalmic Imaging Market: COMPANY EVALUATION MATRIX

In the ophthalmic imaging market, Carl Zeiss Meditec AG (Star) has a strong and established product portfolio and a vast geographic presence. Visionix (Emerging Leader) has substantial product innovations compared to its competitors. While they have broad product portfolios, they do not have a strong growth strategy for business development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 (Value) | USD 2.69 BN |

| Revenue Forecast in 2030 (Value) | USD 3.84 BN |

| Growth Rate | 6.30% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Technology: AI enabled equipment and Non AI enabled equipment By Product: Optical Coherence Tomography systems, Ophthalmic Ultrasound Systems, Fundus Cameras, Slit Lamps, Specular Microscopes, Tonometers, Ophthalmoscopes, Retinoscopes, Other Ophthalmic Imaging Equipment By Application: Glaucoma, Cataracts, Retinopathies, Refractive Disorders, Age-Related Macular Degeneration, Other Application By End User: Hospitals, Ophthalmology Clinics, Optometry Clinics, Other End User |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

WHAT IS IN IT FOR YOU: Ophthalmic Imaging Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of ophthalmic imaging devices: Optical Coherence Tomography (OCT) systems, Fundus Cameras, Slit Lamps, Ophthalmic Ultrasound Systems, Specular Microscopes, Tonometers, Ophthalmoscopes, and other imaging solutions. | Analysis of product innovations such as AI-enabled diagnostics, multimodal imaging integration, and automated retinal disease detection. |

| Company Information | Profiles of key ophthalmic imaging players such as Carl Zeiss Meditec AG (Germany), Topcon Corporation (Japan), NIDEK Co., Ltd. (Japan), Alcon Inc. (Switzerland), Optopol Technology Sp. z o.o (Poland), Essilor International S.A. (France), Bausch & Lomb Incorporated (US), Visionix (France), Heidelberg Engineering GmbH (Germany), and Halma Plc (UK). | Market share benchmarking and competitive landscape analysis of top 3–5 players across North America, Europe, Asia Pacific, and the Middle East. |

| Geographic Analysis | Detailed regional analysis of North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. | Country-level sizing and growth forecasts for key markets such as the US, Germany, Japan, China, India, and Brazil. |

RECENT DEVELOPMENTS

- May 2025 : Topcon Corporation (Japan) and Moorfields Eye Hospital, UCL Institute of Ophthalmology launched Cascader Limited to advance AI-driven eyecare and Oculomics. a new medical technology company that aims to transform the detection and management of eye disease through artificial intelligence (AI). Cascader also builds on the growing field of Oculomics – the use of advanced retinal imaging to uncover insights into systemic conditions

- May 2025 : Topcon Corporation (Japan) announced a strategic investment into Pangaea Data, a health AI company specializing in identifying untreated and under-treated patients at scale, The collaboration aims to accelerate the application of Pangaea’s clinically validated AI platform to address critical care gaps in eye health and systemic disease.

- October 2023 : Carl Zeiss Meditec AG (Germany) and Boehringer Ingelheim (Germany) collaborated to develop predictive analytics to enable early detection of eye diseases and more personalized treatments to prevent vision loss for people with serious eye diseases

- April 2023 : Carl Zeiss Meditec AG (Germany) and Boehringer Ingelheim (Germany) collaborated to develop predictive analytics to enable early detection of eye diseases and more personalized treatments to prevent vision loss for people with serious eye diseases

Table of Contents

Methodology

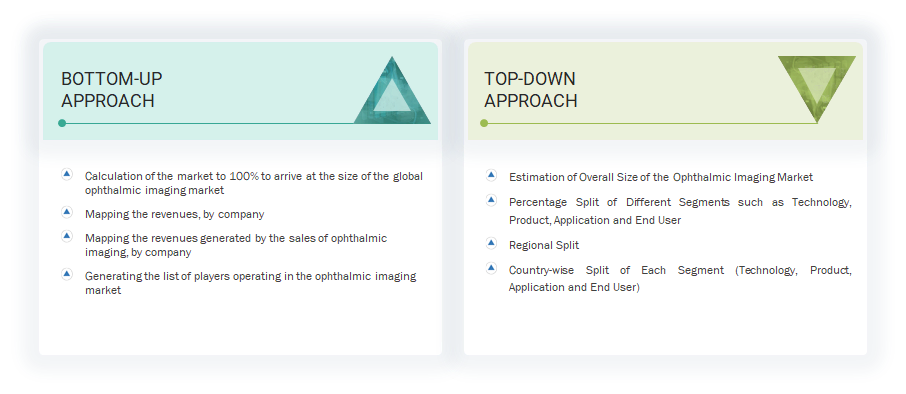

The study involved major activities in estimating the current market size for the ophthalmic imaging market. Exhaustive secondary research was done to collect information on the ophthalmic imaging market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the ophthalmic imaging market.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, Factiva, whitepapers, and companies’ in-house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the ophthalmic imaging market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply- and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the ophthalmic imaging market. Primary sources from the demand side included pediatric hospitals, maternity & birthing centers, clinics, researchers, lab technicians, purchase managers, and stakeholders in corporate & government bodies.

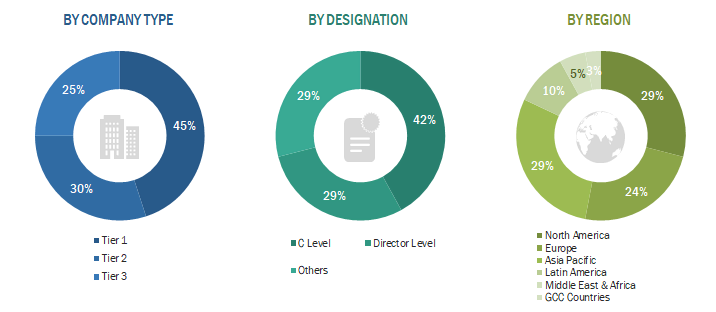

Breakdown of Primary Interviews

Note 1: C-level primaries include CEOs, COOs, and CTOs.

Note 2: Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=< USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ophthalmic imaging market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

When the market size was determined, the entire market was split into three segments. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of ophthalmic imaging. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of big corporations' product portfolios and individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Ophthalmic imaging refers to the use of specialized devices and techniques to capture detailed images of the eye to diagnose and monitor ocular diseases. It includes technologies such as optical coherence tomography (OCT), ophthalmic ultrasound systems, fundus cameras, slit lamps, corneal topography systems, specular microscopes, tonometers, ophthalmoscopes, and retinoscopes.

Stakeholders

- Manufacturers of ophthalmic imaging products and related devices

- Suppliers and distributors of ophthalmic imaging devices

- Hospitals, ophthalmology clinics, diagnostic centers, and medical colleges

- Optometry clinics

- Medical device procurement agencies

- Government bodies/municipal corporations

- Business research and consulting service providers

- Venture capitalists

- US Food and Drug Administration (US FDA)

- European Union (EU)

Report Objectives

- To define, describe, and forecast the ophthalmic imaging market based on product, indication, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall ophthalmic imaging market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the ophthalmic imaging market in six regions, namely, North America (US and Canada), Europe (Germany, UK, France, Spain, Italy, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), the Middle East & Africa, and GCC Countries.

- To strategically profile the key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches, expansions, agreements, and acquisitions, of the leading players in the market

Frequently Asked Questions (FAQ)

Which are the top industry players in the global ophthalmic imaging market?

The top market players are Carl Zeiss Meditec AG (Germany), Topcon Corporation (Japan), Nidek Co., Ltd. (Japan), Alcon Inc. (Switzerland), Optopol Technology Sp. z o.o (Poland), Essilor International S.A. (France), Bausch & Lomb Incorporated (US), and Halma Plc (UK), among others.

Which segments have been included in this report?

This report includes segments based on technology, product, application, end user, and region.

Which geographical region leads in the ophthalmic imaging market?

North America led the ophthalmic imaging market in 2024. The report also considers Europe, Asia Pacific, Latin America, the Middle East and Africa, and GCC countries.

Which is the leading segment in the ophthalmic imaging market, by product?

The OCT systems segment accounted for the largest share of the ophthalmic imaging market by product.

What is the CAGR of the global ophthalmic imaging market?

The global ophthalmic imaging market is projected to grow at a CAGR of 6.3% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Ophthalmic Imaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Ophthalmic Imaging Market