Oral Proteins & Peptides Market: Growth, Size, Share, and Trends

Oral Proteins & Peptides Market by Molecule (Semaglutide, Linaclotide, Calcitonin), Drug Class (GLP-1, GPE, CGRP), Therapeutic Area (Nephrology, Gastroenterology, Genetic, CNS, Obesity, Diabetes), Formulation (Tablet, Capsule) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global oral proteins & peptides market is projected to reach USD 19.93 billion by 2030 from USD 9.31 billion in 2025, at a CAGR of 16.4% during the forecast period. The growth of this market is majorly driven by the presence of a robust R&D pipeline, improved efficacy offered by oral proteins & peptides, and the increasing burden of chronic diseases. On the other hand, high entry barriers to new entrants due to the current duopoly and stringent regulatory approval process restrain the growth of this market.

KEY TAKEAWAYS

- The North America oral proteins & peptides market accounted for a 81.9% revenue share in 2023.

- By molecule, the Trofinetide segment is expected to register the highest CAGR.

- By drug class, the Glucagon like peptide-1 (GLP-1) receptor agonist segment is accounted for a 41.9% revenue share in 2023.

- By therapeutic area, the diabetes segment is expected to dominate the market.

- By formulation, the tablet segment is expected to dominate the market.

- By therapeutic area, the diabetes segment is projected to grow at the fastest rate from 2023 to 2029.

- By end user, the home-care settings segment will grow the fastest during the forecast period.

- Novo Nordisk and AbbVie were identified as some of the star players in the Oral proteins and peptides market (global), given their strong market share and product footprint.

- Companies Structure Therapeutics, and Entera Bio, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market players

The oral proteins & peptides market is witnessing steady growth, driven by the rising prevalence and cost of chronic diseases, advancements in drug delivery technologies, patient preference and compliance for the oral route of drug administration, and the increasing adoption of inorganic growth strategies, such as collaborations and agreements, which are reshaping the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The oral proteins and peptides market is undergoing rapid transformation driven by advances in non-invasive delivery technologies aimed at improving patient compliance and replacing injectable formulations. Innovations such as nanoparticle encapsulation, enteric coatings, protease inhibitors, and permeation enhancers are helping overcome challenges of enzymatic degradation and poor bioavailability. The success of oral semaglutide has validated this delivery route, spurring investments and expanding clinical pipelines for metabolic and gastrointestinal disorders. Furthermore, AI-driven peptide design, regulatory incentives, and collaborations between pharma, biotech, and CDMOs are accelerating development. However, high manufacturing costs, limited scalability, and variable absorption profiles remain key restraints, creating both challenges and opportunities for disruptive technology adoption and differentiation in this emerging segment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing burden of chronic diseases

-

Advancements in drug delivery technologies

Level

-

High cost of drug development

-

Contraindication of oral proteins and peptides

Level

-

Robust clinical trial pipeline for oral proteins & peptides

-

Growing demand for personalized medicine

Level

-

Hurdles in formulation and stability

-

Availability of alternative therapies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing burden of chronic diseases

Chronic diseases such as diabetes, heart disease, stroke, and cancer remain among the leading causes of morbidity and mortality worldwide. With rising life expectancy, both the prevalence and economic burden of these conditions continue to increase. According to the Mayo Clinic Foundation, the global cost of chronic diseases is projected to reach USD 47 trillion by 2030. In the U.S., the CDC estimates that nearly 90% of the nation’s USD 4.5 trillion annual healthcare spending is directed toward people with chronic and mental health conditions. Several oral peptide drugs have already been approved for the management of chronic diseases, including RYBELSUS (Semaglutide) for type 2 diabetes, DAYBUE (Trofinetide) for Rett syndrome, LUPKYNIS (Voclosporin) for lupus nephritis, and TRULANCE (Plecanatide) for chronic idiopathic constipation and irritable bowel syndrome with constipation.

Restraint: High cost of drug development

The development of oral proteins and peptides is advancing rapidly, offering significant potential to improve patient adherence and quality of life. However, the high cost of development remains a major restraint, limiting broader adoption and market availability. These therapies face inherent challenges, including enzymatic degradation in the gastrointestinal tract and poor intestinal absorption. To overcome these barriers, complex formulation strategies are required to protect molecules from harsh stomach conditions and enhance bioavailability. Approaches such as enteric coatings, permeation enhancers, and nanoparticle carriers have shown promise but involve substantial expense. Advanced technologies, such as liposomes, micelles, and nano-encapsulation, further improve stability and absorption, but add considerable costs through extensive research, clinical testing, and manufacturing requirements.

Opportunity: Robust clinical trial pipeline for oral proteins & peptides

The current clinical pipeline for oral proteins and peptides encompasses a wide range of therapeutic areas, including obesity and overweight conditions, hormonal disorders, and plaque psoriasis. Candidates such as somatostatin analogs, PCSK6 inhibitors, and interleukin-23 (IL-23) receptor antagonists highlight the expanding potential of oral peptides beyond traditional indications, creating new market opportunities. Notably, oral GLP-1 receptor agonists (e.g., Semaglutide) are showing strong results in clinical trials, signaling the development of effective oral alternatives to injectable peptide therapies. This broadens their clinical and commercial applications.

Challenge: Hurdles in formulation and stability

The formulation and stability of oral proteins and peptides remain major challenges that limit market growth. Unlike traditional small molecules, proteins and peptides are large, complex, and highly sensitive to environmental conditions. When administered orally, they encounter the harsh gastrointestinal (GI) environment, where proteolytic enzymes such as pepsin (in the stomach) and trypsin and chymotrypsin (in the small intestine) break them down into inactive fragments. This enzymatic degradation greatly reduces their bioavailability, making it difficult to achieve effective therapeutic levels through oral delivery.

MARKET ECOSYSTEM

The oral proteins & peptides market ecosystem consists of raw material suppliers (e.g., ABITEC, Jost Chemical Co.), oral proteins & peptides product manufacturers (e.g., Novo Nordisk, AbbVie, Bausch Health Companies), and end users such as hospitals & Specialty clinics, long-term care facilities (e.g., Cleveland Clinic, National Center for Assisted Living). Raw materials like chemical intermediates, solvents, and key starting materials (KSMs) are processed into APIs through advanced chemical synthesis, fermentation, or biologics manufacturing. End users drive demand through the development of innovative therapies in diabetes, nephrology, and genetic disorders, while manufacturers deliver high-quality, oral protein & peptide therapeutics. Collaboration across the value chain, from secure sourcing of raw materials to reliable supply of oral protein & peptide for finished formulations, is essential to ensure innovation, supply chain resilience, and sustainable market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oral Proteins & Peptides Market, By Molecule

In 2024, the semaglutide segment accounted for the largest share of the global oral proteins and peptides market. Semaglutide is an analog of glucagon-like peptide-1 (GLP-1), a hormone that regulates blood sugar levels and appetite. It is primarily used for the management of type 2 diabetes and obesity. The drug works by enhancing insulin secretion in response to elevated blood glucose levels, reducing glucagon release (which otherwise increases blood sugar), and promoting a sense of fullness after meals, thereby aiding in the reduction of food intake. Oral semaglutide, marketed as RYBELSUS, is the first FDA-approved oral GLP-1 receptor agonist for type 2 diabetes treatment.

Oral Proteins & Peptides Market, By Drug Class

In 2024, GLP-1 receptor agonists dominated the oral proteins and peptides market, driven by the increasing prevalence of chronic diseases and the rising launch of novel oral products. For instance, in September 2019, Novo Nordisk (Denmark) launched RYBELSUS (semaglutide), the first oral GLP-1 receptor agonist (GLP-1 RA), for the management of type 2 diabetes. Furthermore, Novo Nordisk is advancing another oral semaglutide candidate, currently in Phase 3 clinical trials, for the treatment of obesity and overweight individuals.

Oral Proteins & Peptides Market, By Therapeutic Area

The diabetes segment is expected to dominate the oral proteins and peptides market, driven by the increasing incidence of diabetes. Recent advancements in biotechnology have enabled the development of oral proteins and peptides as innovative treatment options for diabetes. Among these, insulin mimetics such as glucagon-like peptide-1 (GLP-1) receptor agonists play a pivotal role. They enhance insulin secretion in response to food intake, suppress glucagon release (reducing excess glucose production by the liver), and slow gastric emptying, thereby promoting satiety and reducing appetite. These mechanisms help lower HbA1c levels, a key marker of long-term blood glucose control.

Oral Proteins & Peptides Market, By Formulation

In 2024, tablets accounted for the largest share in the oral proteins & peptides market. The increasing adoption of tablet formulations due to their ease of administration is likely to support segment growth. Some examples of tablets include Semaglutide (Novo Nordisk) and Plecanatide (Bausch Health Companies). Researchers are focusing on high-potency drugs that would also reduce side effects such as nausea and vomiting.

Oral Proteins & Peptides Market, By End User

In 2024, home care settings accounted for a major market share due to the shift in therapy preference from supervised clinics to routine self-management at home. For chronic indications (e.g., type 2 diabetes, endocrine and GI disorders), tablets remove infusion-center visits, nurse time, and injection training, cutting total care costs and aligning with payer and provider incentives to decentralize treatment. Convenience and privacy boost initiation and persistence, while specialty-pharmacy logistics, e-pharmacy delivery, telehealth check-ins, and adherence tools (reminder apps, smart packaging) reinforce at-home use.

REGION

Europe to be fastest-growing region in global oral proteins & peptides market during forecast period

The European market is expected to register the highest CAGR during the forecast period, driven by strong research infrastructure, increasing investment by market players, the presence of key manufacturers of oral proteins & peptides in the region, rising prevalence of chronic diseases, and increasing research and development activities for the development of innovative oral proteins and peptides. For instance, in February 2024, Orbis Medicines, a startup, received seed financing of USD 28 million led by Novo Holdings and Forbion. Orbis Medicines is developing macrocyclic peptides that can be administered orally.

Oral Proteins & Peptides Market: COMPANY EVALUATION MATRIX

In the oral proteins & peptides market matrix, Novo Nordisk (Star) leads with a strong market share and broad product footprint, backed by its global scale, diversified therapeutic portfolio, and integrated manufacturing capabilities that ensure a reliable supply of oral proteins and peptide drugs. Pfizer (Emerging Leader) is gaining traction with its incretin/peptide obesity therapies through the Metsera acquisition, which brings a peptide-engineering platform plus four clinical programs, including two oral GLP-1 candidates poised for trials.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Novo Nordisk A/S (Denmark)

- AbbVie Inc. (US)

- Pfizer Inc. (US)

- Acadia Pharmaceuticals Inc. (US)

- Aurinia Pharmaceuticals Inc. (Canada)

- Bausch Health Companies Inc. (Canada)

- Chiesi Farmaceutici S.p.A. (Italy)

- EnteraBio Ltd. (Israel)

- Merck & Co., Inc. (US)

- Johnson & Johnson Services, Inc. (US)

- R-Pharm JSC (Russia)

- Proxima Concepts (US)

- SWK Holdings Corporation (US)

- AstraZeneca (UK)

- Regor Therapeutics Group (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.07 Billion |

| Market Forecast in 2030 (value) | USD 19.93 Billion |

| Growth Rate | CAGR of 16.4% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

WHAT IS IN IT FOR YOU: Oral Proteins & Peptides Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Molecule-specific |

|

|

| Therapy-specific (indication focus) | Indication snapshots for Diabetes, Genetic Disprders (others on request) |

|

| Geographic (market entry & access) |

|

|

| Company profiles | Company profiles: platform, pipeline, recent data, partnerships, key developments |

|

RECENT DEVELOPMENTS

- January 2025 : AbbVie completed the acquisition of Nimble Therapeutics for USD 4.6 Bn to add Nimble's oral peptide IL23R inhibitor, which is in preclinical development for psoriasis, to its immunology pipeline.

- December 2024 : Merck and Hansoh Pharma announced a global license agreement for HS-10535, an investigational oral GLP-1 receptor agonist. Under the deal size of USD 1.9 Bn, Merck gains exclusive rights to develop, manufacture, and commercialize HS-10535.

- November 2024 : Novo Nordisk A/S invested USD 6.09 billion in expanding its manufacturing facilities in Denmark. The investment will increase its API capacity, supporting the current and future portfolio for serious chronic diseases, including GLP-1 products.

- October 2024 : Acadia Pharmaceuticals received approval from Health Canada for DAYBUE (trofinetide) for the treatment of Rett syndrome, making it the first and only drug approved for this rare neurodevelopmental disorder in the country.

- September 2024 : Aurinia Pharmaceuticals received approval for voclosporin (LUPKYNIS) from the Japanese Ministry of Health, Labour, and Welfare for the treatment of lupus nephritis (LN) in combination with mycophenolate mofetil (MMF).

Table of Contents

Methodology

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global oral proteins and peptides market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the oral proteins and peptides market. The secondary sources used for this study include the World Health Organization (WHO), National Institutes of Health (NIH), United States Food and Drug Administration (US FDA), European Medicines Agency (EMA), National Center for Biotechnology Information (NCBI), BioPharm International, International Diabetes Federation, ScienceDirect, ClinicalTrials.gov, PubMed, European Federation of Pharmaceutical Industries and Associations (EFPIA), European Lead Factory (ELF), India Brand Equity Foundation (IBEF), UK Research Partnership Investment Fund (UKRPIF), Pharmaceutical Research and Manufacturers of America (PhRMA), Eurostat, and Factiva; research journals; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; and trade, business, professional associations. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

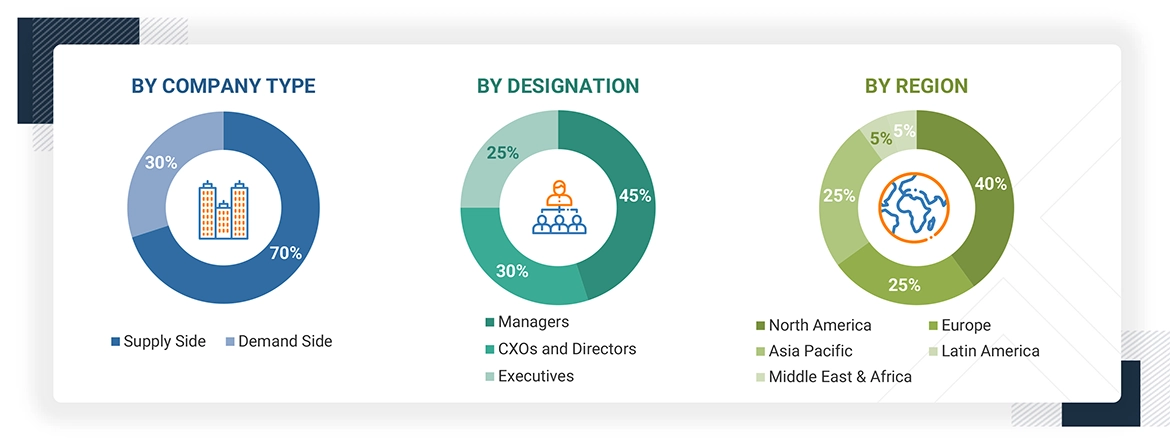

Extensive primary research was conducted after acquiring basic knowledge about the global oral proteins and peptides market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as pharmaceutical and biotechnology companies, CROs, CMOs, and academic & research institutes, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across six major regions, including the Asia Pacific, North America, Europe, Latin America, the Middle East, and Africa. Approximately 70% and 30% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

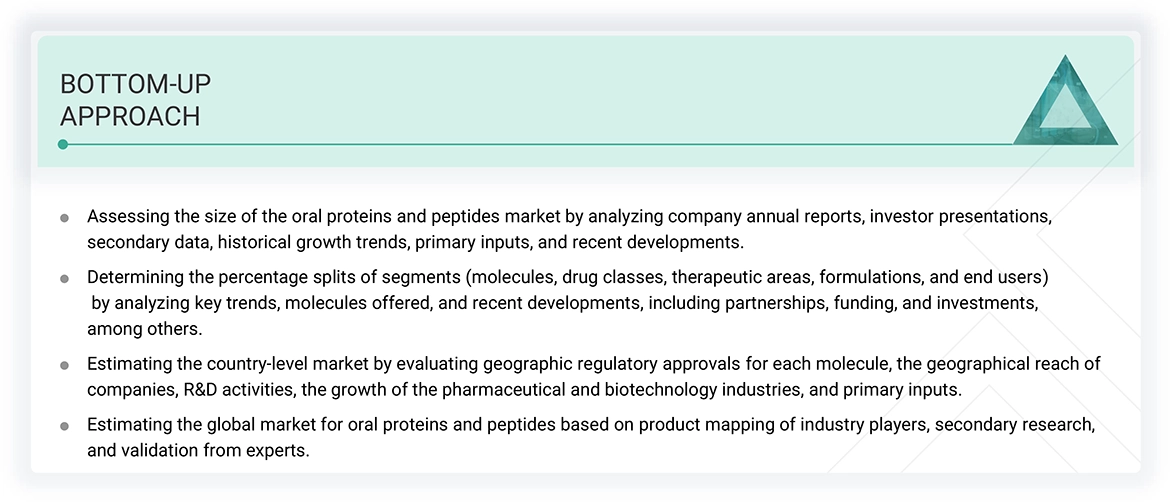

The bottom-up approach was used to estimate and validate the total size of the oral proteins and peptides market. These methods were also extensively utilized to estimate the size of various subsegments within the market. The research methodology used to estimate the market size includes the following:

- The list of approved oral proteins and peptides was identified through extensive secondary and primary research.

- The oral protein and peptide products in the pipeline were identified from clinical trial registries and from secondary and primary research related to peptide and protein therapeutics.

- The revenues generated from these oral proteins and peptides were determined through annual reports and secondary sources (including paid databases).

- The products were categorized according to market segments. Percentage shares and splits were calculated based on revenue contributions for each segment. This information was validated using secondary sources and insights from industry experts.

- All assumptions, approaches, and individual shares/revenue estimates were validated through expert interviews.

Global Oral Proteins and Peptides Market Size: Bottom-up Approach

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Oral proteins and peptides are therapeutic drugs made from proteins or peptides (short chains of amino acids) that are meant to be taken by mouth. These biologically active molecules are designed to treat a variety of medical conditions, including chronic diseases such as diabetes, hormonal disorders, and autoimmune disorders.

Stakeholders

- Pharmaceutical & biotechnology companies

- Hospitals

- Specialty clinics

- Long-term care facilities

- Patient advocacy organizations

- Academic researchers and government research organizations

- Private research institutes

- Contract manufacturing organizations (CMOs)

- Contract research organizations (CROs)

- Venture capitalists

Report Objectives

- To define, describe, and forecast the oral proteins and peptides market based on molecule, drug class, therapeutic area, formulation, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall oral proteins and peptides market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to six main regions: North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa

- To profile the key players in the oral proteins and peptides market and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments in the oral proteins and peptides market, such as acquisitions, product launches/approvals, expansions, agreements, partnerships, and collaborations

- To benchmark players within the oral proteins and peptides market using the ‘Company Evaluation Matrix' framework, which analyzes market players based on various parameters within the broad categories of business strategy and product strategy

Key Questions Addressed by the Report

Who are the key players in the oral proteins and peptides market?

The key players are Novo Nordisk A/S (Denmark), AbbVie Inc. (US), and Pfizer Inc. (US).

Which molecule segment dominates the oral proteins and peptides market?

Semaglutide dominates the market by molecule, due to the rising prevalence of diabetes and expanded R&D for new indications.

Which drug class segment of the oral proteins and peptides market accounted for the largest share?

In 2024, GLP-1 receptor agonists held the largest market share, supported by a strong clinical trial pipeline.

Which therapeutic area segment of the oral proteins and peptides market accounted for the largest share?

In 2024, diabetes was the leading therapeutic area, driven by increased approvals of oral protein and peptide-based treatments.

What is the size of the oral proteins and peptides market?

The market is expected to grow at a CAGR of 22.1%, from USD 8.85 billion in 2025 to USD 24.00 billion by 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Oral Proteins & Peptides Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Oral Proteins & Peptides Market