Pediatric Vascular Access Market Size, Growth, Share & Trends Analysis

Pediatric Vascular Access Market by Type (Catheters (CVC, PIVC, PICC), Ports, IV Sets, Infusion Pumps), Application (Drug Administration, Blood Transfusion, Diagnostics & Testing), End User (Hospitals, ASCs) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The pediatric vascular access market is projected to reach USD 0.83 billion by 2030 from USD 0.54 billion in 2024, at a CAGR of 7.4% during the forecast period. The market for pediatric vascular access is driven by the increasing prevalence of preterm births, and advancements in pediatric care technologies are key factors fueling the growth of the pediatric vascular access market.

KEY TAKEAWAYS

-

By ProductBased on type, the global pediatric vascular access market has been segmented into Catheters, Implantable Ports, Port needles, Catheter Securement and Stabilization, Catheter caps and Closures, Vascular Closure Devices, IV Connectors, Syringes and Needles, Infusion Pumps, IV Sets and Accessories, Intraosseous Infusion Device, Anesthesia Injection Device, Guidance Devices, and Others. Among these, the catheters segment accounted for the largest share in the pediatric vascular access market in 2023. This is due to its indispensable role in addressing the complex care needs of high-risk newborns. Technological advancements, including ultra-miniaturized designs, antimicrobial coatings, and securement systems, have significantly reduced complications such as infections, dislodgement, and vessel damage, making catheters safer and more effective for fragile pediatric patients.

-

By ApplicationBased on the application, the pediatric vascular access market is segmented into drug administration, fluid & nutrition administration, blood transfusion, and diagnostic & testing. The fluid & nutrition administration segment holds a significant share in the pediatric vascular access market due to the critical need for precise and continuous fluid, medication, and nutritional support in neonatal care. Pediatric patients, particularly those admitted to the NICU, often face challenges such as low birth weight, prematurity, and underdeveloped organs that require specialized parenteral nutrition and hydration.

-

By End UserBased on the end user, the pediatric vascular access market is segmented into hospitals, ambulatory surgical centers & clinics, home care settings, and other end users (nursing homes, laboratories, and diagnostic & imaging centers). In 2023, the hospital segment accounted for the largest share in the market, due to the critical role hospitals play in providing advanced care for high-risk newborns. Hospitals serve as the primary setting for intensive neonatal interventions, where specialized vascular access devices are essential for managing complex conditions such as preterm birth complications, congenital anomalies, and critical illnesses.

-

By RegionBy region, the market is divided into North America, Europe, Asia Pacific, Latin America, & Middle East & Africa. In 2023, North America accounted for the major share in the market. This growth can be attributed to a highly developed healthcare infrastructure, particularly advanced neonatal intensive care units (NICUs), which rely heavily on specialized vascular devices such as umbilical catheters, infusion pumps, and real-time monitoring systems to manage high-risk infants.

-

Competitive LandscapeThe pediatric vascular access market is highly fragmented, with key players such as Becton Dickinson and Company, Teleflex Incorporated, B. Braun SE, Terumo Corporation, Nipro Medical Corporation, and Medtronic Plc. These companies focus on innovation, product diversification, and global expansion through strategic collaborations and acquisitions. Leading players emphasize the development of ergonomic, safety-enhanced, and infection-resistant devices tailored for hospitals, ASCs, clinics, and home care settings, thereby strengthening their competitive edge and market positioning.

The increasing government initiative to build new healthcare infrastructure is increasing the demand for these devices from hospitals, Ambulatory Surgical Centers (ASCs), and clinics, among others. In addition, a growing need for advanced pediatric vascular devices due to it’s better patient care offering. and increasing the healthcare budgets in developing nations are driving this demand even further.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The pediatric vascular access market is experiencing key trends and disruptions driven by the need for miniaturized, safety-enhanced, and infection-resistant devices. Customers’ customers, such as hospitals and neonatal care units, are increasingly adopting advanced catheters, implantable ports, and needleless connectors designed for delicate vasculature. Innovations such as antimicrobial coatings, ultrasound-guided insertions, and smart infusion systems are enhancing procedural precision, reducing infection risks, and improving patient comfort, thereby supporting safer and more efficient pediatric care outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapidly growing pediatric population

-

Rise of pediatric cancer

Level

-

Costly placement and maintenance of pediatric vascular access devices

Level

-

Technological advancements in vascular access devices

Level

-

Shortage of skilled healthcare professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of preterm births

The rising incidence of preterm births is a critical driver for the pediatric vascular access market. According to the World Health Organization (WHO), approximately 1 in 10 babies worldwide is born preterm (before 37 weeks of gestation), with rates increasing in high-income and low-to-middle-income countries. Preterm infants face heightened risks of cardiovascular and respiratory complications, such as patent ductus arteriosus (PDA), necrotizing enterocolitis (NEC), and hypotension, necessitating specialized vascular access devices for diagnostics, interventions, and monitoring. For instance, umbilical artery catheters (UACs) and peripheral intravenous (IV) access devices are essential for administering fluids, medications, and nutrients in fragile neonates.

Restraint: Higher prices of vascular access devices

The high cost of vascular access devices, such as infusion pumps and guidance systems, represents a significant barrier to market growth, particularly in emerging economies. These devices often require advanced technologies and specialized manufacturing processes, driving up production and distribution expenses. High prices of the products are prohibitive for healthcare facilities in low- and middle-income countries (LMICs), where neonatal intensive care units (NICUs) already operate under strained budgets.

Opportunity: Technological advancements

The high cost of vascular access devices, such as infusion pumps and guidance systems, represents a significant barrier to market growth, particularly in emerging economies. These devices often require advanced technologies and specialized manufacturing processes, driving up production and distribution expenses. High prices of the products are prohibitive for healthcare facilities in low- and middle-income countries (LMICs), where neonatal intensive care units (NICUs) already operate under strained budgets.

Challenge: Balancing innovations with cost-effectiveness

A critical challenge facing the pediatric vascular access market is the tension between developing cutting-edge technologies and ensuring affordability across diverse economic landscapes. Manufacturers must navigate the dual pressures of innovating for clinical efficacy while maintaining profitability, particularly when serving high-income and resource-constrained markets. This balancing act is compounded by the unique demands of neonatal care, where devices must be ultra-miniaturized, ultra-safe, and highly precise —qualities that often come at a steep cost.

Pediatric Vascular Access Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Neoflon Pro neonatal PIV cannula (24–26G) with BD Vialon biomaterial and Instaflash needle technology for accessing small, fragile vessels in NICU care . | Visual flashback, ergonomic control, and needlestick-safety features support atraumatic access and help reduce premature catheter removal concerns in neonates . |

|

Arrow pediatric central/umbilical venous catheters used for critically ill neonates requiring fluids, TPN, medications, and transfusions, with imaging/ultrasound confirmation recommended for safe placement . | Provides rapid central access in infants while image-guided positioning helps mitigate complications associated with UVC/CVC placement . |

|

MicroClave neutral needle-free connectors used in custom NICU IV systems to standardize closed access and reduce infections and medication errors . | Straight fluid path, minimal deadspace, and clear housing aid effective low-volume flushing and hub disinfection to lower contamination risk in neonatal lines . |

|

24G peripheral IV cannula with smooth catheter-to-needle transition, ETFE cannula, radiopacity, and color-coded hub for delicate vasculature in infants . | Flashback window enables quick venous confirmation and atraumatic insertion to improve first-pass success and patient comfort in neonates . |

|

Premicath 1Fr/28G neonatal PICC designed for premature infants (<1 kg) for short- to medium-term infusion (up to 29 days) of TPN and medications, with fixation wings and radiopaque markings . | Thermosensitive polyurethane minimizes vessel trauma and centimeter markings plus introducer options support accurate, stable placement for sustained neonatal therapy |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem market map of the pediatric vascular access market includes products used in hospitals, Ambulatory Surgical Centers (ASCs), clinics, homecare settings, and others (other end users include nursing homes, diagnostic and imaging centers, and specialized care facilities). Manufacturers in the pediatric vascular access market include organizations that heavily invest in research and development. Distributors include third parties and e-commerce sites linked to the organization for the pediatric vascular access market. Research and product development include in-house research facilities, contract research organizations, and contract development and manufacturing organizations that play a key role in outsourcing services for product development to manufacturers. End users adopt these devices at various stages of application. These end customers are the key stakeholders in the supply chain of the pediatric vascular access market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pediatric vascular access market, By Product

Based on type, the global pediatric vascular access market has been segmented into Catheters, Implantable Ports, Port needles, Catheter Securement and Stabilization, Catheter Cap and Closures, Vascular Closure Devices, IV Connectors, Syringes and Needles, Infusion Pumps, IV Sets and Accessories, Intraosseous Infusion Device, Anesthesia Injection Device, Guidance Devices, and Others. Among these, the catheters segment accounted for the largest share in the pediatric vascular access market in 2023. The large share of this segment can primarily be attributed to the widespread use of catheters in the treatment of cancer, chronic kidney disease, and cardiovascular diseases.

Pediatric vascular access market, By Application

Based on the application, the pediatric vascular access market is segmented into drug administration, fluid & nutrition administration, blood transfusion, and diagnostic & testing. The fluid & nutrition administration segment holds a significant share in the pediatric vascular access market due to advancements in neonatal care practices and the shift toward early intervention and continuous monitoring, which have further expanded the use of vascular access devices for fluid and nutrition delivery. Healthcare providers prioritize these devices for their ability to maintain long-term vascular access, reduce the risk of multiple needle sticks, and ensure accurate delivery of critical therapies.

Pediatric vascular access market, By End User

Based on end user, the pediatric vascular access market has been segmented into hospitals, ambulatory surgical centers (ASCs) & clinics, homecare settings, and other end users (nursing homes and diagnostic & imaging centers). In 2023, the hospitals segment accounted for the largest share in the pediatric vascular access market. The growth of this segment can be attributed to the fact that most vascular procedures are performed in hospital settings.

REGION

Asia Pacific to be fastest-growing region in pediatric vascular access market during forecast period

The pediatric vascular access market in the Asia Pacific region is experiencing rapid growth due to demographic, economic, and healthcare infrastructure dynamics. With a rapidly growing population and rising incidence of preterm births, particularly in China and India, the demand for specialized vascular access devices tailored to neonates is surging. Governments across the region are prioritizing improvements in neonatal care, investing in advanced NICUs, and upgrading healthcare facilities to align with global standards.

Pediatric Vascular Access Market: COMPANY EVALUATION MATRIX

The pediatric vascular access market is fragmented, with key players including Becton, Dickinson and Company (BD), Teleflex Incorporated, B. Braun SE, Terumo Corporation, Nipro Medical Corporation, and Medtronic Plc. BD (Star) leads with a comprehensive and innovative product portfolio catering to pediatric needs. B. Braun SE and Terumo Corporation maintain a strong global footprint through advanced and ergonomically designed products. Companies such as Nipro Corporation (Emerging Leader) focus on expanding through strategic collaborations and product innovation to enhance safety, usability, and clinical outcomes across hospital and homecare settings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Becton Dickinson and Company (US)

- Teleflex Incorporated (US)

- ICU Medical (US)

- Nipro (Japan)

- Vygon (France)

- B Braun SE (Germany)

- Terumo Corporation (Japan)

- Medtronic Plc (Ireland)

- Cook (US)

- AngioDynamics, Inc (US)

- Merit Medical Systems, Inc (US)

- Amecath (Egypt)

- Medical Components, Inc (US)

- Healthline Medical Products (US)

- Access Vascular, Inc (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 0.54 Billion |

| Market Forecast, 2030 (Value) | USD 0.83 Billion |

| Growth Rate (2024–2030) | CAGR of 7.4% from 2024 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Unit Considered | Value (USD Million/Billion); Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Pediatric Vascular Access Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company Information |

|

Insights on market share analysis by region |

| Geographic Analysis |

|

Country level demand mapping and localization strategy planning. |

RECENT DEVELOPMENTS

- December 2024 : Teleflex Incorporated launched its new Pressure Injectable Arrowg+ard Blue Plus MSB Procedure Kit in Europe, the Middle East, and Africa. The addition of the pressure-injectable catheter enhances the company’s central vascular access portfolio, meeting the expanded needs of clinicians and improving patient safety.

- September 2024 : B. Braun SE announced that the US Food and Drug Administration (FDA) granted 510(k) clearance for the Introcan Safety 2 Deep Access IV Catheter, the newest addition to the Introcan Safety 2 IV Catheter portfolio.

- May 2024 : Teleflex Incorporated launched the Arrow EZ-IO Intraosseous Access Procedure Tray. The addition of the intraosseous device enhances the company’s vascular access portfolio, meeting the expanded needs of physicians in critical care management.

- October 2023 : B. Braun SE launched its new Introcan Safety 2 IV Catheter with multi-access blood control. It is the latest development from the company in a long line of passive needle-stick prevention catheters.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

- 5.3 INDUSTRY TRENDS

-

5.4 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- IMAGING AND NAVIGATION TECHNOLOGIES- CATHETER SECUREMENT AND STABILIZATION TECHNOLOGIESCOMPLEMENTARY TECHNOLOGIES- ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)ADJACENT TECHNOLOGIES- INFECTION CONTROL TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCE ANALYSIS

-

5.6 REGULATORY LANDSCAPEREGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATION

-

5.7 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR THE PEDIATRIC VASCULAR ACCESS MARKETINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.8 TRADE ANALYSIS

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCTAVERAGE SELLING PRICE TREND, BY REGION

- 5.10 KEY CONFERENCES & EVENTS DURING 2024-2025

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12 UNMET NEEDS/END USER EXPECTATIONS IN PEDIATRIC VASCULAR ACCESS MARKET

- 5.13 IMPACT OF AI/GEN AI IN THE PEDIATRIC VASCULAR ACCESS MARKET

- 5.14 ECOSYSTEM/ MARKET MAP

- 5.15 CASE STUDY ANALYSIS

- 5.16 VALUE CHAIN ANALYSIS

- 5.17 ADJACENT MARKET ANALYSIS

- 5.18 PEDIATRIC VASCULAR ACCESS MARKET, INVESTMENT AND FUNDING SCENARIO

-

5.19 IMPACT OF 2025 US TARIFF –PEDIATRIC VASCULAR ACCESS MARKETINTRODUCTIONKEY TARIFF RATESPRICE IMPACT ANALYSISIMPACT ON COUNTRY/REGIONIMPACT ON END-USE INDUSTRIES

- 6.1 INTRODUCTION

-

6.2 CATHETERSCENTRAL VENOUS CATHETERS (CVC)PERIPHERAL INTRAVENOUS CATHETERS (PIVC)PERIPHERALLY INSERTED CENTRAL CATHETERS (PICC)MIDLINE CATHETERS

- 6.3 IMPLANTABLE PORTS

- 6.4 PORT NEEDLE

- 6.5 CATHETER SECUREMENT AND STABILIZATION

- 6.6 CATHETER CAP AND CLOSURES

- 6.7 VASCULAR CLOSURE DEVICES

- 6.8 IV CONNECTORS

- 6.9 SYRINGES AND NEEDLES

- 6.10 INFUSION PUMPS

- 6.11 IV SETS AND ACCESSORIES

- 6.12 INTRAOSSEOUS INFUSION DEVICE

- 6.13 ANAESTHESIA INJECTION DEVICE

- 6.14 GUIDANCE DEVICES

- 6.15 OTHERS

- 7.1 INTRODUCTION

- 7.2 DRUG ADMINISTRATION

- 7.3 FLUID AND NUTRITION ADMINISTRATION

- 7.4 BLOOD TRANSFUSION

- 7.5 DIAGNOSTICS AND TESTING

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.3 AMBULATORY SURGICAL CENTERS (ASCS) AND CLINICS

- 8.4 HOMECARE SETTINGS

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUSCANADA

-

9.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEGERMANYFRANCEUKITALYSPAINREST OF EUROPE

-

9.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINAJAPANINDIAAUSTRALIASOUTH KOREAREST OF ASIA PACIFIC

-

9.5 LATIN AMERICAMACROECONOMIC OUTLOOK FOR LATIN AMERICABRAZILMEXICOREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAMACROECONOMIC OUTLOOK FOR LATIN AMERICAGCC COUNTRIESREST OF MIDDLE EAST & AFRICACOMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- 10.4 PEDIATRIC VASCULAR ACCESS MARKET, BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.5 VALUATION AND FINANCIAL METRICS OF KEY PEDIATRIC VASCULAR ACCESS VENDORS

-

10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT, KEY PLAYERS, 2024- COMPANY FOOTPRINT- REGION FOOTPRINT- TYPE FOOTPRINT- END USER FOOTPRINT- APPLICATION FOOTPRINT

-

10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- DETAILED LIST OF STARTUPS/SMES- COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

10.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONS

-

11.1 KEY PLAYERSBECTON DICKINSON AND COMPANYTELEFLEX INCORPORATEDICU MEDICAL, INC.B. BRAUN SEANGIODYNAMICS, INC.TERUMO CORPORATIONNIPRO MEDICAL CORPORATIONMOZARC MEDICAL HOLDING LLC.VYGONROMSONSPRODIMEDCOOK MEDICALACCESS VASCULAR INCMEDICAL COMPONENTS INC

-

11.2 OTHER PLAYERS3MARGON MEDICAL DEVICESGUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTDPFM MEDICALMEDI-TECH DEVICES PVT. LTD.MEDLINE INDUSTRIES, LPKIMALDELTA MEDNEWTECH MEDICAL DEVICESSHANGHAI PUYI MEDICAL INSTRUMENTS CO., LTD

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 AVAILABLE CUSTOMIZATION

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

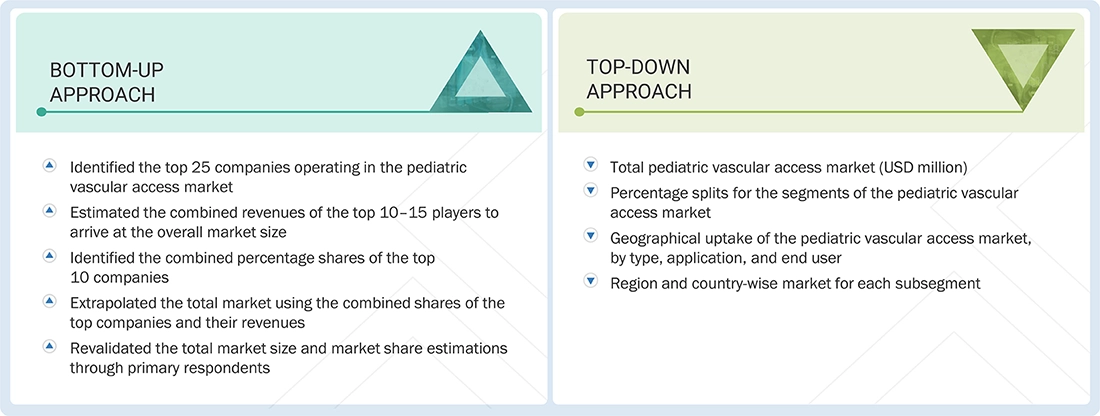

Methodology

The study involved major activities in estimating the current market size for the pediatric vascular access market. Exhaustive secondary research was done to collect information on the pediatric vascular access industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the pediatric vascular access market.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), International Trade Administration (ITA), Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global Pediatric Vascular Access market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the pediatric vascular access market. The primary sources from the demand side include pharmaceutical companies, vaccination centers, hospitals & clinics, pharmacies, and research academics and universities. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global pediatric vascular access market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. Also, the global pediatric vascular access market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various manufacturers of pediatric vascular access devices, at the regional and/or country level

- Mapping of annual revenue generated by listed major players from the pediatric vascular access market (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global pediatric vascular access market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-up Approach and Top-down Approach)

Data Triangulation

After arriving at the overall size of the global pediatric vascular access market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Pediatric vascular access refers to specialized medical tools and equipment designed to facilitate safe vascular access, intervention, or monitoring in infants and newborns. These devices, including umbilical vein catheters, peripheral intravenous (IV) access devices, arterial lines, and vascular shunts, are critical in reducing procedural risks such as infection, hemorrhage, or tissue damage in vulnerable pediatric populations.

Stakeholders

- Healthcare Service Providers

- Pediatric Vascular Access Device Manufacturers

- Ambulatory Surgery Centers

- Health Insurance Payers

- Medical Device Companies

- Research & Consulting Firms

- Vendors/Service Providers of Pediatric Vascular Access Devices

Report Objectives

- To describe, analyze, and forecast the pediatric vascular access market by type, application, end user, and region

- To describe and forecast the pediatric vascular access market for key regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets for individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies in the pediatric vascular access market

- To analyze competitive developments such as collaborations, acquisitions, product launches, and expansions, in the pediatric vascular access market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pediatric Vascular Access Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pediatric Vascular Access Market