Piezoelectric Devices Market Size, Share and Trends, 2025 To 2030

Piezoelectric Devices Market by Product (Sensors, Actuators, Motors, Generators, Transducers, Transformers, and Resonator), Material (Polymer, Crystal, Ceramic, and Composites), Element (Discs, Rings and Plates) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

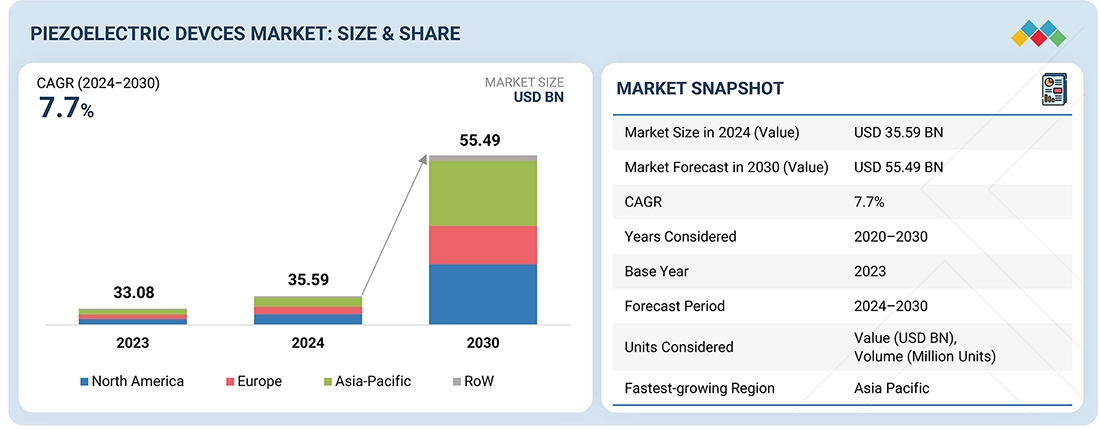

The piezoelectric devices market is projected to reach USD 55.49 billion by 2030 from USD 35.59 billion in 2024, at a CAGR of 7.7% from 2024 to 2030. The market is driven by the increasing product applications in industries, such as automotive, aerospace & defense, and consumer electronics.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific piezoelectric devices market accounted for a 43.4% share in 2024.

-

By ProductBy product, the piezoelectric generators segment is expected to register the highest CAGR of 12.9%.

-

By MaterialBy material, the piezoelectric polymers segment is projected to grow at the fastest rate from 2024 to 2030.

-

By ElementBy element, the piezo discs segment is expected to dominate the market.

-

By ApplicationBy application, the healthcare segment will grow the fastest during the forecast period.

-

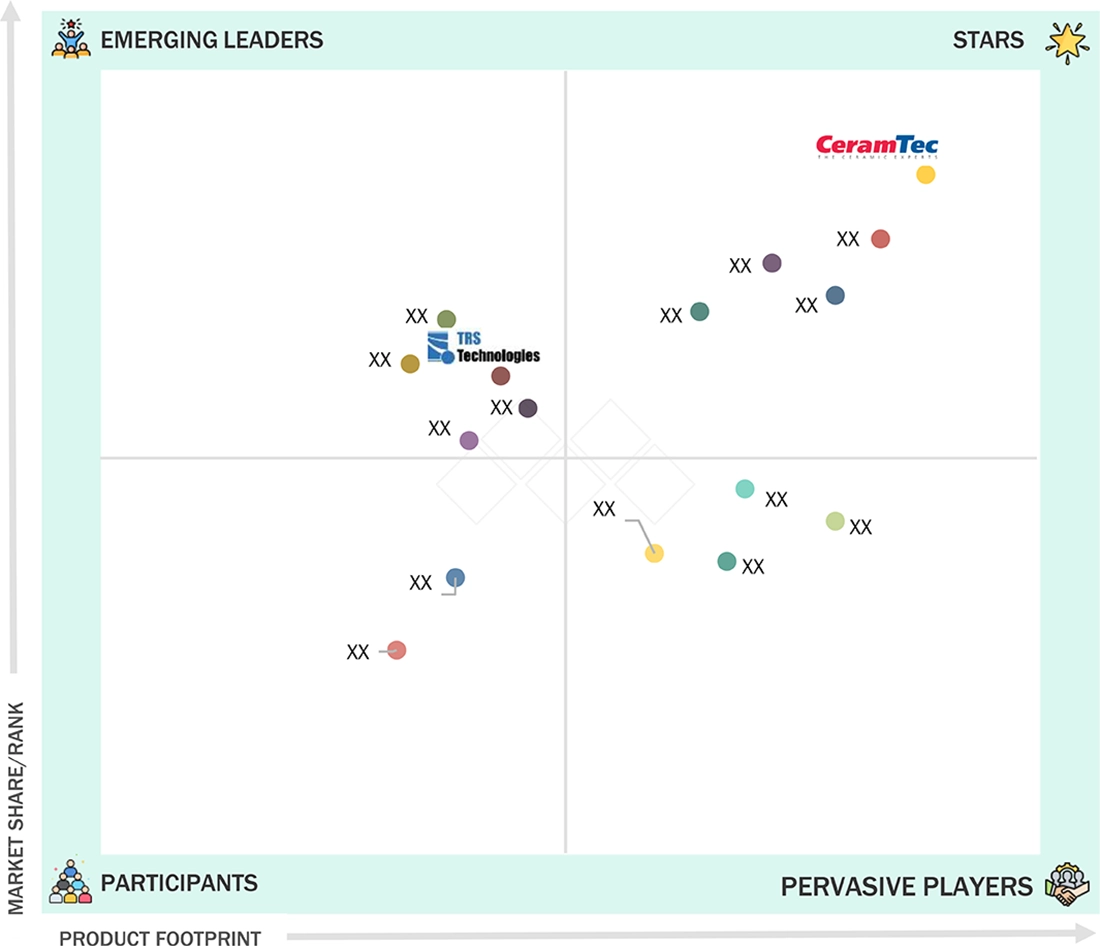

Competitive LandscapeCeramTec GmbH (Germany), CTS Corporation (US), Kistler Group (Switzerland), Physik Instrumente (PI) SE & Co. KG. (US), Aerotech (US) were identified as some of the star players in the piezoelectric device market (global), given their strong market share and product footprint.

-

Competitive LandscapePiezo Studio, Ionix AT, and Brain Scientific Inc., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The piezoelectric devices market is experiencing rapid expansion. The market is driven by the increasing product applications in industries, such as automotive, aerospace & defense, and consumer electronics. Piezoelectric sensors and actuators enhance vehicle performance and safety in the automotive sector. They are installed in systems for various applications, such as tire pressure monitoring, fuel injection, and engine management, enhancing efficiency and reliability, especially in electric and hybrid vehicles.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

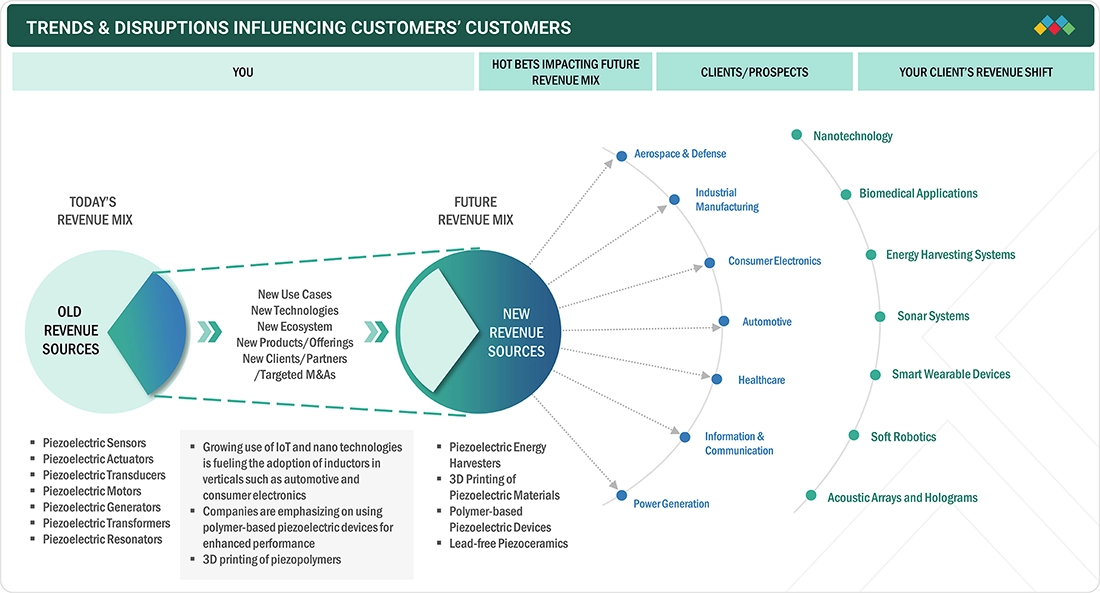

The piezoelectric devices market is undergoing a major revenue shift as the growing demand for piezoelectric devices in the aerospace & defense, industrial and manufacturing, automotive, healthcare, and consumer electronics sectors is driving the market. The technological revolution of the Industrial Internet of Things (IIoT) is expected to create lucrative opportunities for providers of piezoelectric devices to power smart devices, sensors, and transducers in the network. Adopting new hybrid technologies in the automotive sector has resulted in a high demand for piezoelectric devices for automotive safety and connectivity applications. The consumer electronics segment is witnessing the emergence of new technologies such as smart wearables and flexible electronics, thereby further contributing to the market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of piezoelectric materials to enhance efficiency of aircraft structures

-

Increasing adoption of machine learning and deep learning algorithms

Level

-

High costs of templated grain growth (TGG) ceramics

-

Stringent government policies restricting use of lead-based piezoelectric materials

Level

-

Growing use of piezoelectric nanomaterials in electronic devices

-

Rising adoption of piezoelectric polymers in biomedical and surgical applications

Level

-

Developing alternative materials to PZT ceramic materials with similar properties

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Rising adoption of piezoelectric materials to enhance efficiency of aircraft structures

Major players in the aerospace industry are often involved in manufacturing, selling, and servicing commercial aircraft, space vehicles, and satellites. This industry requires advanced solutions to enhance the efficiency, durability, and performance of aircraft, planes, helicopters, and submarines. One significant technology employed is piezoelectric actuators, which are used in active vibration-damping techniques. These actuators help monitor various mechanical structures and components of modern aircraft to prevent undesirable vibrations, reduce noise levels, lower fuel consumption, and minimize energy waste.

Restraint: High costs of templated grain growth (TGG) ceramics

The templated grain growth (TGG) process allows for the production of single crystals and textured ceramics with properties similar to single crystals. In TGG, the desired crystal nucleates and grows on aligned single-crystal template particles, which leads to an increased proportion of oriented material upon heating. The template particles must be anisometric in form to facilitate alignment during shaping. Additionally, these particles must be single crystals and chemically stable at the growth temperature to serve as preferred sites for epitaxy and subsequent oriented growth of the matrix.

Opportunity: Growing use of piezoelectric nanomaterials in electronic devices

Lead zirconate titanate (PZT) nanoparticles and nanopowder, which have a relative permittivity ranging from 300 to 20,000, exhibit a quick response time when utilized in detectors. These materials can be applied in circuits operating at low and high voltages, and they demonstrate excellent mechanical and acoustic coupling. PZT nanoparticles and nanopowder are commonly used in piezoelectric resonators, ultrasonic transducers, and infrared (IR) spectroscopy as inorganic ferroelectric agents with piezoelectric properties. Their chemical inertness and physical strength make them one of the most prevalent piezoelectric compounds.

Challenge: Developing alternative materials to PZT ceramic materials with similar properties

PZT is the primary piezoelectric ceramic used in the development of piezoelectric products. However, its toxicity significantly threatens its dominance in this field, prompting urgent global efforts to identify environmentally friendly alternatives. The recognition of lead toxicity creates a challenge in finding substitute materials for the numerous products that rely on PZT for their functionality. According to the RoHS directive, any homogeneous component containing more than 0.1% lead by weight is subject to restrictions. This regulation is crucial, as some of the best piezoelectric materials contain up to 60% lead, potentially limiting their use in everyday applications in the future. Consequently, PZT has been identified as a substance of very high concern (SVHC).

PIEZOELECTRIC DEVICES MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

CeramTec develops and manufactures a wide array of piezoceramic materials and components for industrial, medical, automotive, and energy sectors. | Their piezoelectric solutions are fundamental to high-resolution ultrasonic imaging (medical ultrasound), ultrasound surgical tools, flow measurement (smart meters), level detection, ultrasonic cleaning/welding, proximity sensing, and non-destructive testing |CeramTec is also leading in environmentally-friendly, lead-free piezoceramics for compliance in sensitive medical and industrial applications |

|

CTS Corporation offers custom and standard piezoelectric devices, including bulk/multilayer ceramics and built-to-print sensors/transducers, for diverse industries. | CTS piezoelectric products are widely used in med-tech (diagnostics, therapies), aerospace (acoustics, sensing), industrial measurement (flow, vibration), and underwater acoustics |Their expertise spans sensors, actuators, and transducer assemblies for demanding commercial and industrial applications, enabling precision and reliability for OEMs and system integrators |

|

Kistler develops advanced piezoelectric sensors, notably for measuring force, pressure, and acceleration in dynamic environments. | Their piezoelectric sensing technology (e.g., PiezoStar) enables simultaneous measurement of multiple physical parameters, used in automotive testing, industrial process control, medical diagnostics (e.g., radiology equipment), and aerospace| The integrated signal conditioning and data acquisition allows real-time analysis, making Kistler a leader in precision measurement and instrumentation markets. |

|

PI manufactures precision motion and nanopositioning systems powered by piezoelectric technology, such as linear/rotation stages, hexapods, and actuators. | Their piezo-based motion solutions are crucial in semiconductor production, high-end microscopy, optics/photonics research, and robotics | The combination of proprietary piezo actuators, control electronics, and software enables sub-nanometer positioning and dynamic control, widely adopted by research, biomedical, and advanced manufacturing sectors. |

|

Aerotech produces automation and motion control systems using piezoelectric actuators, used for smart manufacturing, especially in edge AI inference and defect detection. | Aerotech’s piezo-driven positioning stages and systems deliver high-speed, high-precision motion for semiconductor, electronics, and materials processing industries |In combination with AI, their systems drive real-time defect analysis, predictive maintenance, and productivity gains in advanced factory environments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The piezoelectric devices ecosystem mainly consists of raw material suppliers, manufacturers, suppliers & distributors, and end users. Raw material suppliers provide essential components such as ceramics and crystals. Manufacturers ensure the availability of high-quality raw materials and optimize the processing, following which the suppliers offer logistic and inventory management. Finally, end users, for example, aerospace & defense and automotive industries, install them for applications, such as sensors and actuators, to drive innovation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Piezoelectric devices Market, By Product

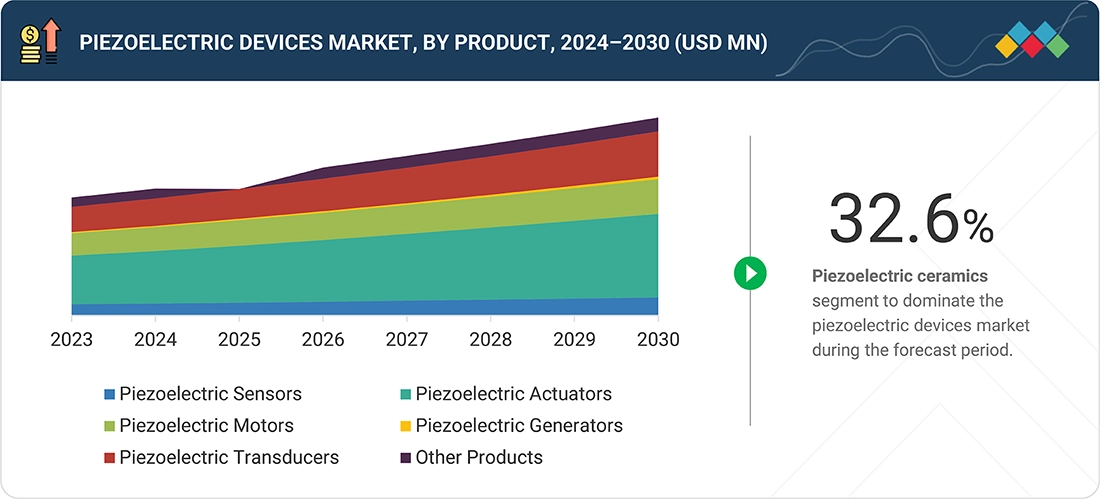

Piezoelectric generators segment to record highest CAGR during forecast period. Piezoelectric generators are used to produce and store energy when subjected to mechanical stress. They work on the direct and reverse piezoelectric effects. In the direct piezoelectric effect, the electric charge is displaced when the piezoelectric material undergoes mechanical deformation. Piezoelectric generators can produce high-voltage outputs and low-electrical currents. These generators offer several advantages, such as simple design, compact structure, high stability, high durability, and maintenance-free. Owing to this, they are widely used in applications, such as wireless electronic devices, energy harvesting systems, and embedded MEMS devices. Additionally, they are used as a power generation source for portable and low-power-consuming devices, such as munitions and wireless sensors that monitor automobile tire pressure.

Piezoelectric devices Market, By Material

Piezoelectric ceramics will dominate the piezoelectric devices market during the forecast period. The primary reason is the rising demand for ceramic-based lead zirconate titanate (PZT), which provides immense displacement and gives a huge voltage, increasing their demand. Direct and converse piezoelectric effects are strong in piezoelectric ceramics. Piezoelectric ceramics have high piezoelectric sensitivity and may take on various forms. Lead zirconate titanate (PZT) is a commonly used piezoelectric ceramic material.

Piezoelectric devices Market, By Element

Piezo Discs segment held largest markets size in 2024. This is due to the increased adoption of piezoelectric discs in major applications such as high-intensity ultrasound treatment equipment and sensors compared with piezoelectric rings and plates. Moreover, they are available in different sizes and are compatible with metals such as gold, silver, and nickel.

Piezoelectric devices Market, By Application

Healthcare segment to register highest CAGR in piezoelectric devices market during forecast period. The healthcare sector is completely dependent on advanced techniques, such as imaging, diagnostic scanning, and robotic surgeries, to serve patients. Therefore, medical device manufacturers understand the advantages of incorporating piezoelectric components and materials in life-saving medical devices, such as respirators, ventilators, and atomization systems. Piezoelectric devices are widely used in the healthcare sector, from which one of the primary applications of piezoelectric materials is applied in ultrasound imaging.

REGION

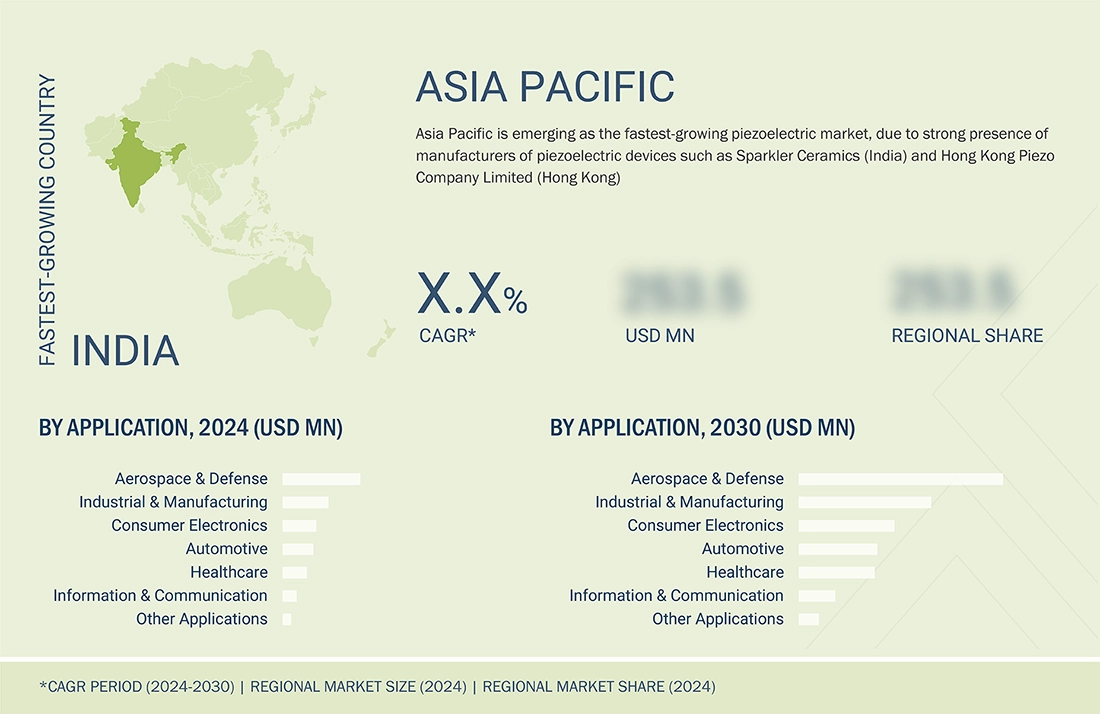

Asia Pacific to be fastest-growing region in global AI server market during forecast period

Asia Pacific to witness highest CAGR in piezoelectric devices market between 2024 and 2030. The growth of the piezoelectric devices market in Asia Pacific can be attributed to the robust presence of piezoelectric device manufacturers in countries, such as China, Japan, and South Korea, who offer low-cost and highly efficient piezoelectric devices. Additionally, the market will be driven by the rising adoption of portable electronic devices, including laptops, smartphones, and smartwatches, the increasing deployment of digital technologies in industrial & manufacturing sectors, and the growing use of information & communication technologies in transportation & healthcare industries.

PIEZOELECTRIC DEVICES MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030: COMPANY EVALUATION MATRIX

In the piezoelectric devices market matrix, CeramTec GmbH (Star) leads with a strong market share and extensive product footprint, This is one of the leading players in terms of developments such as product launches, innovative technologies, and the adoption of strategic growth plans. TRS Technologies, Inc. (Emerging Leader) is gaining visibility The company hold a small share of the market. However, the company have innovative product and service portfolios.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- CeramTec GmbH

- CTS Corporation

- Kistler Group

- Huawei Technologies Co., Ltd.

- Physik Instrumente (PI) SE & Co. KG.

- Piezosystem jena

- KEMET Corporation

- Piezo Technologies

- APC International, Ltd.

- Mad City Labs, Inc

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 35.59 Billion |

| Market Forecast in 2030 (Value) | USD 55.49 Billion |

| Growth Rate | CAGR of 7.7% from 2024-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

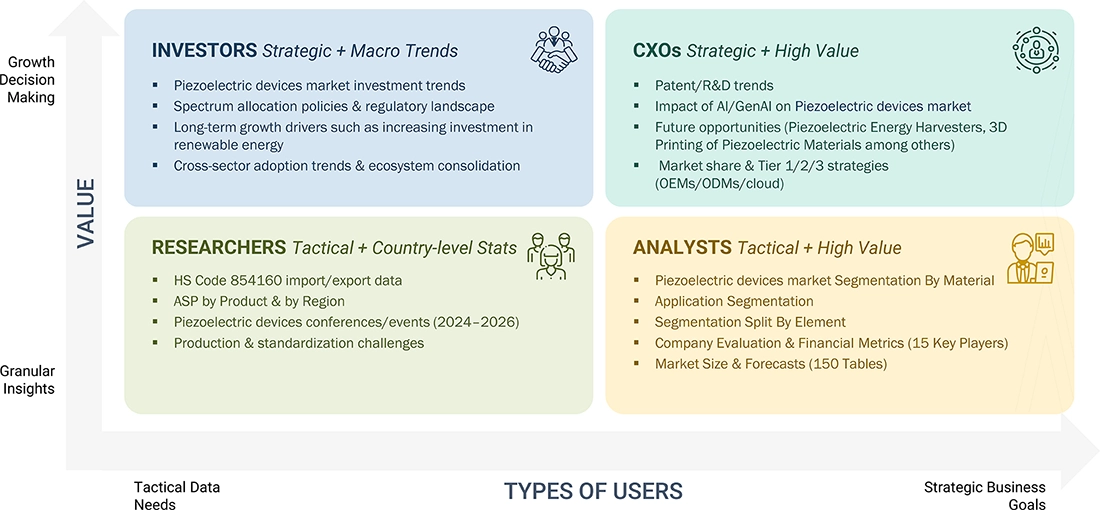

WHAT IS IN IT FOR YOU: PIEZOELECTRIC DEVICES MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Consumer Electronics OEMs |

|

|

| Industrial & Robotics Companies |

|

|

RECENT DEVELOPMENTS

- June 2024 : CeramTec GmbH (Germany) launched the ceramic substrate Sinalit. It is an enabler for more diversity in solutions and more sustainability. The properties of silicon nitride enable performance improvements in many areas and strengthen them. It contributes to a successful energy transition in electromobility or new energies.

- February 2024 : Aerotech (US), one of the global leaders in precision motion control and automation, expanded its partnership with Korean distributor ANI Motion Tech. The latest joint venture is a new manufacturing and research facility in Korea’s Songdo Knowledge Information Industrial Complex.

- January 2023 : Kistler Group (Switzerland) launched a piezoelectric sensor solution specially designed for angled structures such as airplane wings. The new cylindrical accelerometer 8775A meets various requirements in aerospace applications, such as high sensitivity, low noise threshold, and low weight.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

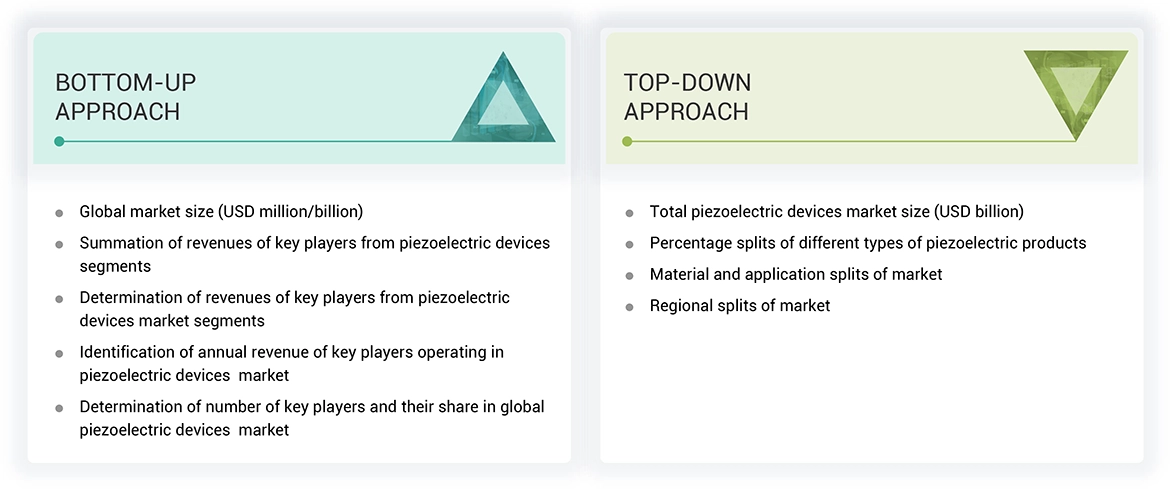

The study involved four major activities in estimating the current size of the piezoelectric devices market—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the supply chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Source |

Web Link |

|

International Organization of Motor Vehicle Manufacturers (OICA) |

|

|

Kraftfahrt-Bundesamt (KBA) - Federal Motor Transport Authority |

|

|

German Association of the Automotive Industry (VDA) |

|

|

General Aviation Manufacturers Association (GAMA) |

|

|

Society of Motor Manufacturers and Traders (SMMT) |

|

|

World Trade Organization (WTO) |

|

|

International Trade Centre (ITC) |

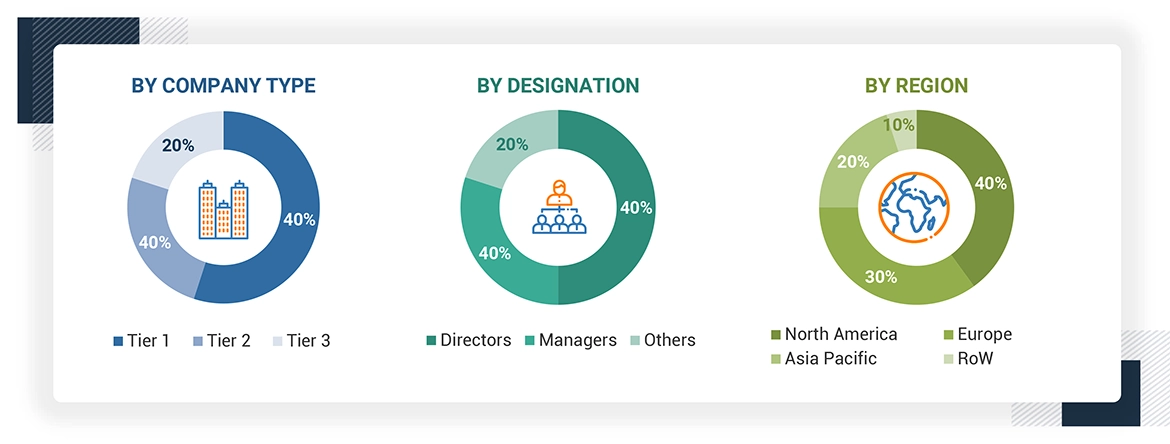

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the supply chain market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of supply chain solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Piezoelectric Devices Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Piezoelectricity is defined as the ability of certain materials to produce an electric charge on the application of mechanical stress. Therefore, piezoelectric devices are defined as devices that can produce electrical energy from mechanical energy. For example, they convert vibrations, pressure, force, and acceleration into electricity. Such devices are commonly referred to as energy harvesters and can be used in applications where external power is unavailable, and batteries are not feasible.

Key Stakeholders

- Raw Materials Suppliers

- Technology Investors

- Original Equipment Manufacturers (OEMs)

- Third-party Service Providers

- Government Labs

- In-house Testing Labs

- System Integrators

- Distributors, Resellers, and Traders

- Research Institutions & Organizations, Piezoelectric Technology Forums, Alliances, and Consortium & Associations

- End Users

Report Objectives

- To describe, segment, and forecast the piezoelectric devices market, by material, element, and application, in terms of value

- To describe and forecast the piezoelectric devices market, by product, in terms of value and volume

- To describe and forecast the market for four key regions, namely North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To describe elements with varied shapes and operation modes of piezoelectric devices

- To provide detailed information regarding the market dynamics (drivers, restraints, opportunities, and challenges) influencing the growth of the piezoelectric devices market

- To provide a detailed overview of the supply chain and ecosystem pertaining to the piezoelectric devices, along with their average selling prices

- To strategically analyze the ecosystem, tariffs & regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches & developments, expansions, partnerships, contracts, and acquisitions in the piezoelectric devices market

- To strategically profile the key players in the piezoelectric devices market and comprehensively analyze their market ranking and core competencies

- To analyze the impact of Impact of Gen AI/AI on the market and macroeconomic outlook for each region

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the piezoelectric devices market

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company in the piezoelectric devices market.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Piezoelectric Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Piezoelectric Devices Market