Polybutylene Adipate Terephthalate Market

Polybutylene Adipate Terephthalate Market by Grade, Application (Films, Sheets & Bin Liners, Coatings & Adhesives, Molded Products, Fibers), End-use Industry (Packaging, Consumer Goods, Agriculture, Bio-medical), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The polybutylene adipate terephthalate (PBAT) market is expected to reach USD 2.76 billion by 2030 from USD 1.51 billion in 2025, at a CAGR of 12.8% during the forecast period. The PBAT market is growing rapidly, fueled by growing demand for biodegradable plastics in packaging, agriculture, and consumer goods. PBAT has an excellent balance of flexibility, biodegradability, and compatibility with other biodegradable polymers such as PLA and starch blends, which makes it a good fit for compostable films, mulch films, and disposable packaging alternatives. European, Asian, and North American countries are starting to enforce regulations against single-use plastic, which is accelerating the switch toward broader uptake of sustainable alternatives like PBAT.

KEY TAKEAWAYS

-

BY GRADEThe PBAT market is categorized by grades such as extrusion grade, thermoforming grade, and other specialty grades. Extrusion-grade PBAT dominates the market owing to its extensive use in blown and cast film applications for packaging, agricultural mulch films, and shopping bags. Thermoforming-grade PBAT is increasingly adopted for trays, cups, and other rigid packaging that require high toughness and compostability. Continuous advancements in compounding technology and blend optimization with polymers such as PLA and starch are expanding PBAT’s applicability across both flexible and rigid packaging formats.

-

BY APPLICATIONPBAT finds wide application in films, sheets & bin liners, coatings & adhesives, molded products, fibers, and other niche applications. Films and sheets account for the largest share, driven by rising demand for compostable packaging and consumer goods that comply with circular economy initiatives. PBAT-based coatings and adhesives are increasingly used in laminates for food packaging and paper cups to replace non-degradable PE coatings. Molded products, including disposable cutlery and trays, are emerging as high-growth segments due to improved mechanical and thermal performance of PBAT blends.

-

BY END-USE INDUSTRYThe PBAT market serves key end-use industries such as packaging, consumer goods, agriculture, biomedical, and others. The packaging sector dominates, supported by strong demand for compostable films and bags in foodservice, e-commerce, and retail. Agriculture is an emerging end-use area, with PBAT used in biodegradable mulch films that minimize soil pollution and support sustainable farming practices. Consumer goods applications, including household and hygiene products, are expanding rapidly with the availability of cost-effective PBAT blends. The biomedical sector is exploring PBAT for controlled-release and resorbable applications due to its biocompatibility and degradability profile.

-

BY REGIONThe Asia Pacific region is projected to be the fastest-growing market for PBAT, driven by supportive government policies, growing packaging demand, and increasing adoption of biodegradable plastics in China, India, South Korea, and Japan. Europe remains a leading consumer due to stringent sustainability regulations such as the EU Single-Use Plastics Directive and the Green Deal. North America is also experiencing accelerated growth supported by the rising preference for compostable alternatives in retail and foodservice packaging. Ongoing investments in bio-based PBAT production capacity and supportive policy frameworks are expected to sustain long-term growth across all major regions.

-

COMPETITIVE LANDSCAPEKey players in the PBAT market are focusing on capacity expansions, joint ventures, and technological collaborations to strengthen their position in the global biodegradable plastics industry. Companies such as BASF SE (Germany), Novamont S.p.A. (Italy), Chang Chun Group (China), Kingfa Sci. & Tech. Co., Ltd. (China), and GO YEN CHEMICAL INDUSTRIAL CO., LTD. (Taiwan) are at the forefront of PBAT production and innovation. Strategic efforts include integrating bio-based feedstocks, improving polymerization catalysts, and developing high-performance PBAT grades compatible with compostable blends such as PLA and PHA. These initiatives aim to meet rising global demand while ensuring compliance with international environmental and compostability standards.

Polybutylene Adipate Terephthalate (PBAT) is an aliphatic–aromatic copolyester recognized for its excellent biodegradability, flexibility, and mechanical strength, making it a key material in the transition toward sustainable plastics. PBAT is primarily used in the production of compostable films, bags, coatings, and molded products that comply with international compostability standards such as EN 13432 and ASTM D6400. Growing environmental awareness, regulatory bans on single-use plastics, and the rapid development of industrial and home composting infrastructure are accelerating PBAT adoption across multiple industries. Moreover, increasing collaboration between bio-based chemical producers and packaging converters is fostering innovation in PBAT formulations, improving performance, processability, and cost efficiency for large-scale applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The effects on consumer businesses in the Polybutylene Adipate Terephthalate (PBAT) market are driven by evolving sustainability mandates, shifting consumer preferences, and technological advancements in biodegradable plastics. Key end users include packaging manufacturers, consumer goods producers, agricultural film converters, and biomedical product developers, while target applications span compostable films and bags, coatings, molded products, and fibers. Growing global restrictions on single-use plastics, coupled with increasing consumer demand for eco-friendly and certified compostable products, are reshaping procurement and production strategies across these industries. These changes directly affect operational costs, product design, and supply chain structures for brand owners and converters. Consequently, PBAT producers and compounders are being compelled to enhance material performance, secure sustainable feedstock sources, and innovate in blends and formulations to meet the evolving regulatory, environmental, and end-user performance requirements in both industrial and consumer applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift in consumer preference toward bio-based plastics

-

Increasing use of packaging and compostable applications

Level

-

Technical characteristics and performance issues of PBAT

-

High production cost of PBAT

Level

-

Development of new applications

-

High potential of PBAT in emerging economies

Level

-

Competition from alternative bioplastics.

-

Consumer misunderstanding regarding biodegradability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift in consumer preference toward bio-based plastics

Consumer awareness regarding sustainable plastic solutions and ongoing efforts to eliminate non-biodegradable conventional plastics are driving the market growth of biodegradable plastics, such as PBAT. Traditional plastics, which are typically petroleum-based, take decades to decompose and remain in landfills for long periods. In contrast, biodegradable plastics break down more quickly when discarded and integrate back into the natural environment. The decomposition rate of biodegradable plastics, due to the action of microorganisms, is significantly faster than that of traditional plastics. Additionally, there is growing concern about the potential health risks associated with conventional plastics. PBAT, being a non-toxic material, is a safer and healthier option. For example, PVC (polyvinyl chloride) has been linked to genetic disorders, ulcers, hearing loss, and vision issues. As consumers become increasingly aware of the environmental impact of their purchasing decisions, there is a notable rise in demand for sustainable and environmentally friendly products, including those made from PBAT.

Restraint: Technical characteristics and performance issues of PBAT

The technical and performance characteristics of PBAT impose significant limitations on its market penetration across various sectors, including packaging, electronics, agriculture, and automotive. PBAT’s thermal stability is lower than that of conventional plastic materials, making it unsuitable for applications that require thermal resistance. Additionally, PBAT exhibits inferior mechanical properties compared to traditional plastics, with reduced strength, stiffness, and impact resistance. These limited mechanical properties can render PBAT inappropriate for high-performance applications. Furthermore, PBAT has poor resistance to UV light, leading to degradation and embrittlement over time when exposed to sunlight. It also tends to absorb moisture more readily than traditional plastic materials, which limits its use in applications that require minimal moisture absorption.

Opportunity: Development of new applications

The potential uses of bio-based polymers are quite extensive and comparable to those of traditional polymers. With the government’s increasing emphasis on sustainability and social responsibility, favorable green purchasing policies have emerged. This creates significant growth opportunities for the bio-based polymers market, particularly in consumer goods applications. Packaging applications are expected to experience considerable growth as well. In the agriculture industry, biodegradable mulch films serve various purposes. Additionally, food packaging products, including trays, cutlery, and cups, represent a high-demand and important application for bio-based polymers. Bio-based polymers are also being explored in the biomedical field. For example, poly(butylene adipate-co-terephthalate) (PBAT) is used in surgical implants, as it dissolves in the body over time and is gradually replaced by natural tissues. Many companies are heavily investing in research and development related to biodegradable plastics, leading to numerous applications in the medical industry, such as stitching materials, screws, and implants.

Challenge: Competition from alternative bioplastics

PBAT is an exciting biodegradable polymer that competes with other bioplastics, including PLA, PHA, and starch blends. These alternatives offer similar environmental benefits and are gaining traction in markets such as packaging, agriculture, and biomedical applications. As sustainability and green procurement become increasingly important to governments, competition in the bioplastics sector is intensifying. For instance, PLA is commonly used in rigid packaging and disposable utensils, while PHA is being developed for medical and marine biodegradable applications. Starch-based polymers are a cost-effective choice for short-lifecycle products, like compostable bags. In this competitive landscape, PBAT manufacturers are under pressure to enhance the performance and cost-efficiency of their products while also creating differentiation in the rapidly evolving bioplastic market.

Polybutylene Adipate Terephthalate Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Novamont S.p.A. develops PBAT-based biopolymers under its Mater-Bi brand for use in compostable shopping bags, food packaging films, and agricultural mulch films. | Offers full biodegradability in industrial composting, reduces plastic waste, and supports circular economy and sustainability goals. |

|

Anhui Jumei Biological Technology Co., Ltd. manufactures cost-effective PBAT resins for flexible packaging, single-use products, and agricultural applications. | Enables large-scale substitution of traditional plastics, ensures compostability, and reduces carbon footprint through bio-based raw material sourcing. |

|

BASF SE produces PBAT under the ecoflex brand, used in blends for compostable films, coatings, and packaging materials. | Provides high mechanical performance, processability, and compatibility with PLA and starch-based polymers, supporting sustainable packaging solutions. |

|

Kingfa Sci. & Tech. Co., Ltd. offers PBAT compounds optimized for film extrusion and 3D printing applications in biodegradable packaging and consumer goods. | Combines flexibility and strength with biodegradability, promotes eco-friendly product design, and reduces dependency on fossil-based plastics. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The PBAT market ecosystem consists of several key players, including raw material suppliers, PBAT resin manufacturers, compounders or masterbatch manufacturers, distributors, and end-user industries. Raw materials for PBAT production include adipic acid, terephthalic acid, and butanediol, which are polymerized to create PBAT. PBAT producers manufacture resin on a commercial or industrial scale, often modifying its properties to meet specific application needs. Compounders blend PBAT with PLA, starch, or other biopolymers to optimize performance for users. Distributors leverage logistical advantages and established commercial relationships to penetrate new markets. End-user industries, such as packaging, agriculture (specifically for mulch films), consumer goods, and biomedical applications, utilize PBAT for sustainable solutions. This is particularly important where biodegradation, flexibility, and compostability are required to comply with regulatory commitments to sustainability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Polybutylene Adipate Terephthalate Market, By Grade

The extrusion grade segment is anticipated to be the fastest-growing segment of the PBAT market during the forecast period. This growth is driven by its wide range of applications in high-volume markets, including flexible packaging, agricultural films, and compostable bags. The extrusion grade of PBAT is well-suited for both film blowing and sheet extrusion processing. It offers high flexibility, good biodegradability, and compatibility with various other polymers, such as PLA-corn starch blends. These features make extrusion grades ideal for producing compostable plastic films, which are increasingly mandated or encouraged by environmental policies in various regions of Europe, North America, and Asia. Additionally, the extrusion grade segment benefits from numerous government regulations that outlaw single-use plastics and from the growing number of consumers seeking sustainable alternatives to traditional plastics. The extrusion grade is easy to process, works well in co-extrusion applications with a variety of polymers, and consistently demonstrates reliable mechanical properties.

Polybutylene Adipate Terephthalate Market, By Application

The films segment is anticipated to be the fastest-growing application in the PBAT market during the forecast period, owing to its widespread use in flexible, compostable packaging solutions. PBAT-based films are increasingly replacing conventional plastics in shopping bags, courier packaging, agricultural mulch films, and food wrappers due to their biodegradability, flexibility, and strength. PBAT films have excellent mechanical properties and are compatible with existing film production technologies used in the food and consumer goods industry, where blown film and cast film extrusion are common. They are ideal for compostable packaging applications because of their moisture barrier performance and ability to decompose under industrial compost conditions.

Polybutylene Adipate Terephthalate Market, By End-use Industry

The agriculture segment is expected to be the fastest growing end-use industry in the Polybutylene Adipate Terephthalate (PBAT) market during the forecast period. This growth is primarily driven by the increasing adoption of biodegradable mulch films, plant pots, and agricultural packaging materials designed to reduce plastic waste and improve soil health. PBAT’s excellent flexibility, compostability, and compatibility with other biodegradable polymers such as polylactic acid (PLA) and polybutylene succinate (PBS) make it an ideal material for agricultural film applications. These films help enhance soil temperature, conserve moisture, suppress weeds, and reduce the need for chemical fertilizers, all while eliminating the environmental challenges associated with conventional polyethylene films. Government policies in regions such as China, India, and the European Union are increasingly promoting biodegradable mulch films as part of sustainable farming initiatives, which is significantly boosting PBAT demand in agriculture.

REGION

Asia Pacific is expected to be the fastest-growing region in the global polybutylene adipate terephthalate market during the forecast period

The PBAT market is expected to grow most rapidly in the Asia Pacific region during the forecast period due to the increasing demand for biodegradable plastics and strong regulatory momentum to promote sustainable material use in the region. China, India, and South Korea are all rapidly adopting compostable packaging alternatives to address growing environmental concerns and challenges in plastic waste management. The growing number of bans and restrictions on traditional plastics, initiated by government actions in the region, is also driving the development and usage of films, bags, and agricultural mulch products made from PBAT. China is still the largest producer and consumer of PBAT globally, and several domestic manufacturers are developing new, larger-scale production sites and entering joint ventures with foreign companies to ramp up their production capacity.

Polybutylene Adipate Terephthalate Market: COMPANY EVALUATION MATRIX

In the landscape of the Polybutylene Adipate Terephthalate (PBAT) market, Novamont S.p.A. (Star) holds a significant position, recognized for its pioneering efforts in developing high-performance, fully biodegradable PBAT materials under its Mater-Bi brand. The company’s strong R&D foundation, collaborations with packaging and agricultural sectors, and emphasis on circular economy principles have solidified its leadership in the sustainable bioplastics domain. Anhui Jumei Biological Technology Co., Ltd. (Emerging Leader) is rapidly gaining traction through its expanding PBAT production capacity and cost-competitive biodegradable resins, targeting packaging, film, and consumer goods markets across Asia and beyond. While Novamont leads through technological innovation, brand strength, and sustainability-driven partnerships, Anhui Jumei demonstrates strong potential to move toward the leaders' quadrant as global demand for compostable and eco-friendly plastics continues to accelerate.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 1. BASF SE (Germany)

- 2. Chang Chun Group (China)

- 3. Kingfa Sci. & Tech. Co., Ltd. (China)

- 4. Novamont S.p.A. (Italy)

- 5. GO YEN CHEMICAL INDUSTRIAL CO LTD (Taiwan)

- 6. Anhui Jumei Biological Technology Co., Ltd. (China)

- 7. Hangzhou Peijin Chemical Co., Ltd. (China)

- 8. Jin Hui Zhao Long High Tech Co., Ltd. (China)

- 9. T.EN Zimmer GmbH (Germany)

- 10. Mitsui Plastics, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.35 Billion |

| Market Forecast in 2030 (value) | USD 2.76 Billion |

| Growth Rate | CAGR of 12.8 % from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Polybutylene Adipate Terephthalate Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Polybutylene Adipate Terephthalate (PBAT) Manufacturer | Detailed profiles of leading PBAT producers (financials, production capacities, technology routes petrochemical vs bio-based feedstocks, product grades for film/injection/moldings, compostability & certification status such as EN 13432 / ASTM D6400, sustainability disclosures, and go-to-market strategies). | Identify fastest-growing regional end-markets (Asia-Pacific packaging & shopping bags, Europe compostable packaging & mulch film, North America retail & foodservice disposables). Detect supply-chain vulnerabilities (bio-feedstock availability succinic acid, 1,4-butanediol vs petro routes; catalyst/monomer tightness; specialty additives and stabilizers; limited commercial scale for bio-PBAT). Target high-value customers (large retail brands, packaging converters, industrial composters, agricultural film producers). Highlight regulatory inflection points that drive demand (single-use plastic bans, EU SUPD/Green Deal measures, expanded producer responsibility, municipal composting mandates). |

| Biodegradable Polymer Compounder / Blends Manufacturer | Mapping of PBAT demand by product form and application (blown/cast films, stretch & seal films, compostable bags, mulch films, flexible packaging laminates, injection/sheet for compostable cutlery & trays), plus blend solutions (PBAT/PLA, PBAT/PHA, PBAT/starch) and compatibilizer/masterbatch offerings. Included technical performance comparisons (tear strength, elongation, sealability, biodegradation rates) and scale-up case studies. | Accelerate market entry with blend recipes optimized for cost-performance (e.g., PLA/PBAT ratios for film sealability and compostability). Identify substitution and cannibalization risks (PBAT vs oxo-bio blends, certified compostable PHA, biodegradable PBAT alternatives). Recommend target converters and co-packers for partner pilots. Provide guidance on certification timelines and third-party compostability testing to support customer claims. |

| PBAT Downstream Applications & End-use Solutions Provider | Comparative benchmarking of PBAT-based finished goods by sector (retail & grocery bags, foodservice disposables, agricultural mulch film, home compostable liners, industrial packaging, medical packaging where allowed), plus lifecycle and EOL (end-of-life) mapping industrial vs home composting, anaerobic digestion, mechanical recycling constraints. | Uncover premium opportunities in certified compostable offerings for major retailers and food-service chains. Strengthen positioning with compliance-ready, label-safe product families (claims vetted against EN/ASTM standards and regional composting infrastructure). Forecast substitution potential and pricing sensitivity vs fossil-based PE/PP and PLA blends. Recommend partnerships (bio-monomer suppliers, industrial composters, waste management firms) and pilot regions where infrastructure and regulations create the fastest adoption (selected EU countries, parts of APAC and Latin America). |

RECENT DEVELOPMENTS

- June 2024 : BASF SE launched Ecoflex F Blend C1200 BMB, a biomass-balanced, certified compostable PBAT-based biopolymer that combines sustainability with high performance.

- October 2023 : Versalis secured full ownership of Novamont S.p.A.

- August 2022 : Kingfa Sci. & Tech. Co., Ltd. entered a memorandum of understanding (MoU) with TÜV Rheinland Greater China, a globally recognized third-party testing and certification body.

- June 2022 : Confoil, an Australian manufacturer of food packaging, and BASF SE collaborated to develop certified compostable dual ovenable paper trays for packaging.

- January 2021 : Novamont S.p.A. acquired BioBag group, a leading Norwegian waste collection and packaging bag supplier.

Table of Contents

Methodology

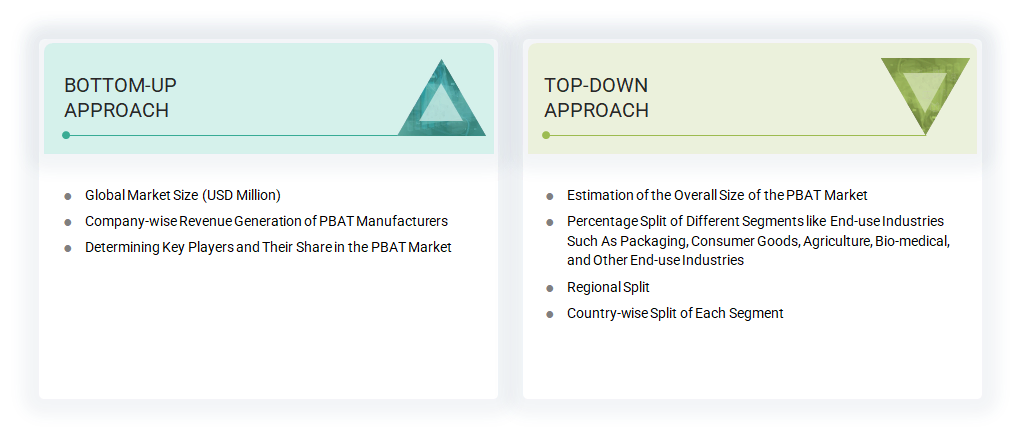

The study involves two major activities in estimating the current market size for the polybutylene adipate terephthalate (PBAT) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering PBAT and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the PBAT market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the PBAT market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief executive officers (CXOs), vice presidents (VPs), directors from business development, marketing, product development/innovation teams, and related key executives from PBAT industry vendors, material providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to grade, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking PBAT services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of PBAT and future outlook of their business which will affect the overall market.

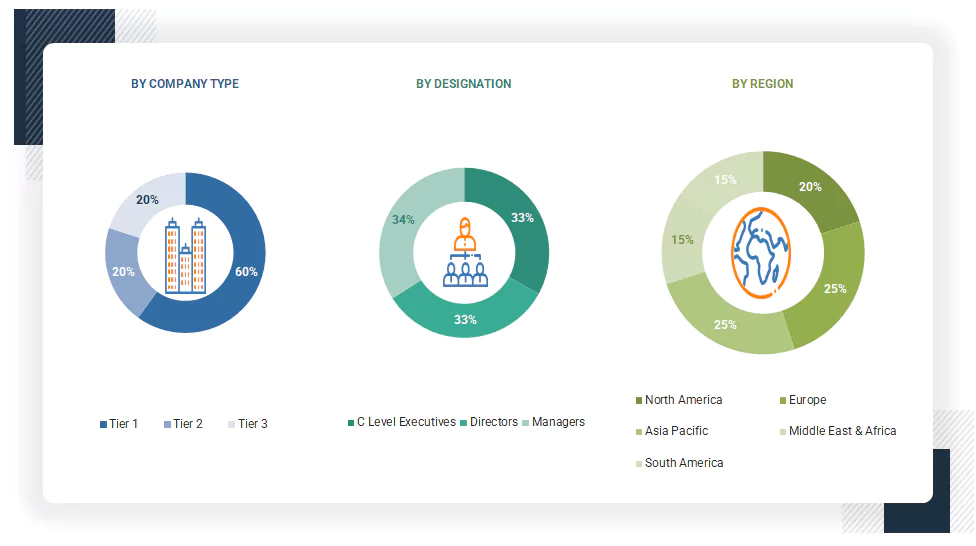

The Breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the PBAT market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for PBAT in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the PBAT industry for each end-use industry. For each end-use industry, all possible segments of the PBAT market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

PBAT is a biodegradable and compostable aliphatic aromatic copolyester. PBAT is synthesized from 1,4-butanediol, adipic acid, and terephthalic acid, and is engineered to offer properties similar to conventional low-density polyethylene (LDPE), including flexibility, toughness, and thermal stability, while being capable of complete biodegradation under industrial composting conditions. The market spans various segments based on grade, application, end-use industry (packaging, agriculture, consumer goods, bio-medical, and others), and region. Driven by increasing environmental regulations, consumer preference for sustainable products, and advancements in biopolymer technology, the PBAT market is gaining momentum as a critical component in the transition away from petroleum-based plastics. It plays a central role in enabling circular material flows across sectors that require short-life yet high-performance plastic alternatives.

Stakeholders

- PBAT Manufacturers

- PBAT Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the PBAT market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing market growth

- To analyze and project the global PBAT market by grade, application, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which factors are propelling the growth of the PBAT market?

The rising government regulations on single-use plastics, increased demand for compostable and biodegradable packaging, and greater consumer awareness of sustainability are contributing to the growth of the PBAT market. The expansion of retail and e-commerce sectors that favor eco-friendly packaging, along with supportive policies and investment incentives in countries like China and India, also drive the market. Additionally, rapid growth in the agriculture and food packaging sectors, and increasing corporate commitments to sustainable product development, are key factors.

What are the key drivers of the PBAT market?

Limited technical performance of PBAT compared to conventional plastics, reliance on composting infrastructure, and growing competition from alternative bioplastics such as PLA and PHA are key drivers of the PBAT market.

What are the primary opportunities in the PBAT market?

Increased sustainability in packaging, government green procurement initiatives, and expanding applications in agriculture and biomedical fields present strong growth opportunities for PBAT producers.

What are the primary barriers to the growth of the PBAT market?

High manufacturing costs, a lack of consumer education about compostable products, and an underdeveloped composting infrastructure are key barriers to PBAT adoption.

Who are the major players in the PBAT market?

BASF SE (Germany), Chang Chun Group (China), Kingfa Sci. & Tech. Co., Ltd. (China), Novamont S.p.A (Italy), and GO YEN CHEMICAL INDUSTRIAL CO LTD (Taiwan) are the major key players in the PBAT market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Polybutylene Adipate Terephthalate Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Polybutylene Adipate Terephthalate Market