2

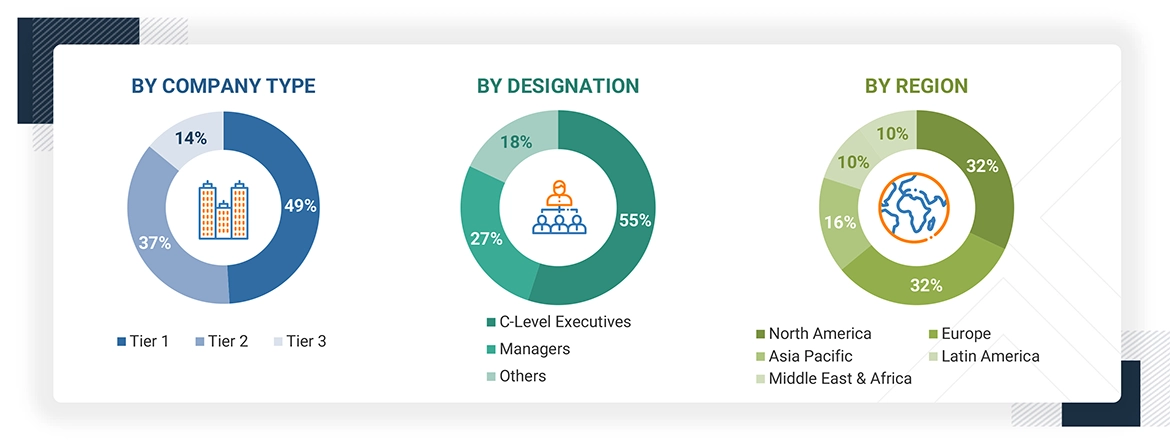

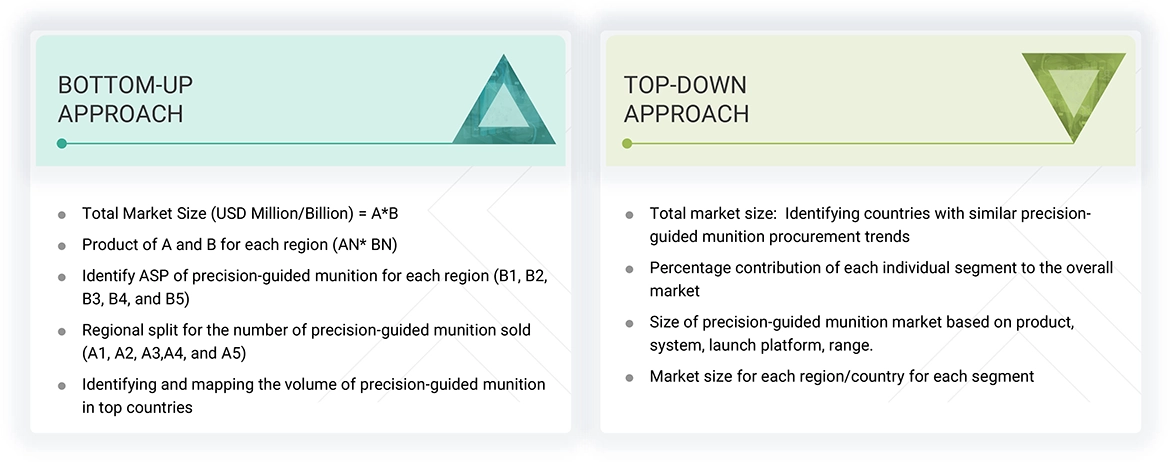

RESEARCH METHODOLOGY

39

5

MARKET OVERVIEW

Precision-guided munitions market driven by AI integration, military modernization, and miniaturization innovations.

55

5.2.1.1

ELEVATED DEMAND FOR PRECISION-GUIDED MUNITIONS TO MINIMIZE COLLATERAL DAMAGE

5.2.1.2

REDUCED LOGISTICAL BURDEN OF MODERN WARFARE

5.2.1.3

SURGE IN MILITARY MODERNIZATION PROGRAMS

5.2.1.4

EVOLVING NATURE OF WARFARE

5.2.2.1

STRINGENT ARMS TRANSFER REGULATIONS AND EXPORT CONTROL FRAMEWORKS

5.2.2.2

HIGH MANUFACTURING COSTS

5.2.3.1

MINIATURIZATION OF MUNITIONS

5.2.3.2

DEVELOPMENT OF HYBRID PRECISION-GUIDED MUNITIONS

5.2.3.3

ADVENT OF RECOVERABLE AND MULTI-MISSION MUNITIONS

5.2.3.4

INTEGRATION OF AI AND AUTONOMOUS CAPABILITIES

5.2.4.1

INTEGRATION CONSTRAINTS ASSOCIATED WITH LARGER PRECISION-GUIDED MUNITIONS

5.2.4.2

STORAGE AND SHELF LIFE LIMITATIONS

5.3

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.6.1.1

MILLIMETER-WAVE RADAR SEEKERS

5.6.1.2

IMAGE-AIDED INS/GPS TECHNOLOGY

5.6.2

COMPLEMENTARY TECHNOLOGIES

5.6.2.1

AI-POWERED MISSION PLANNING

5.6.2.2

SWARMING PROTOCOLS

5.6.3

ADJACENT TECHNOLOGIES

5.6.3.1

ELECTRO-OPTICAL TARGETING SYSTEMS

5.6.3.2

AUTOMATIC TARGET RECOGNITION ALGORITHMS

5.7.1

GMLRS-ER BY LOCKHEED MARTIN

5.7.2

STORM SHADOW BY MBDA

5.7.3

SPICE 250 BY RAFAEL

5.7.4

GBU-39 SMALL DIAMETER BOMB (SDB II) BY BOEING

5.8.1

IMPORT SCENARIO (HS CODE 9306)

5.8.2

EXPORT SCENARIO (HS CODE 9306)

5.9

KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.10.3

PRICE IMPACT ANALYSIS

5.10.4

IMPACT ON COUNTRY/REGION

5.10.5

IMPACT ON END USERS

5.11

REGULATORY LANDSCAPE

5.12

KEY CONFERENCES AND EVENTS, 2025–2026

5.13

INVESTMENT AND FUNDING SCENARIO

5.14.1

AVERAGE SELLING PRICE, BY PRODUCT

5.14.2

AVERAGE SELLING PRICE, BY REGION

5.16.2

IMPACT OF AI ON DEFENSE SECTOR

5.16.3

ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

5.16.4

IMPACT OF AI ON PRECISION-GUIDED MUNITION MARKET

5.17

MACROECONOMIC OUTLOOK

5.19

TOTAL COST OF OWNERSHIP

6

INDUSTRY TRENDS

Discover how cutting-edge tech and AI redefine precision strike capabilities and battlefield dominance.

105

6.2.4

LOW-COST PRECISION STRIKE KITS

6.2.5

REAL-TIME IN-FLIGHT RETARGETING

6.2.6

DUAL-USE ISR AND STRIKE INTEGRATION

6.3.1

AI-ENABLED TARGET RECOGNITION

6.3.2

CYBER-RESILIENT GUIDANCE AND CONTROL SYSTEMS

6.3.3

INTEGRATION OF SPACE-BASED ASSETS INTO PRECISION STRIKE

6.3.4

BATTLEFIELD DIGITIZATION AND NETWORK-CENTRIC WARFARE

6.4

SUPPLY CHAIN ANALYSIS

7

PRECISION-GUIDED MUNITION MARKET, BY PRODUCT

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 14 Data Tables

113

7.2.1.1

EMPHASIS ON LONG-RANGE PRECISION FIRES AND RAPID RESPONSE CAPABILITIES

7.2.1.2

USE CASE: BRIMSTONE BY MBDA

7.2.2.1

EMERGING THREAT ENVIRONMENTS AND EVOLVING PLATFORM STRATEGIES

7.2.2.2

USE CASE: OPFIRES BY DARPA-LOCKHEED MARTIN

7.3.1

MOBILE AIR DEFENSE INTERCEPTORS

7.3.1.1

RISE OF MOBILE, MULTI-VECTOR AERIAL THREATS

7.3.1.2

USE CASE: BARAK 8 BY IAI, RAFAEL, AND DRDO

7.3.2

MANPAD INTERCEPTORS

7.3.2.1

HEIGHTENED AIR THREAT LANDSCAPE AND ELEVATED DEMAND FOR MOBILE AIR DEFENSE SOLUTIONS

7.3.2.2

USE CASE: MISTRAL 3 BY MBDA

7.4.1.1

INCREASED ADOPTION DUE TO LONG-RANGE AND RAPIDLY DEPLOYABLE FIREPOWER

7.4.1.2

USE CASE: HIMARS BY LOCKHEED MARTIN

7.4.2.1

NEED FOR LOW-COST, LIGHTWEIGHT PRECISION STRIKE OPTIONS

7.4.2.2

USE CASE: FZ275 LGR BY THALES

7.5.1.1

GROWING TRACTION DUE TO IMPROVED ACCURACY AND OPERATIONAL EFFECTIVENESS

7.5.1.2

USE CASE: XM395 BY NORTHROP GRUMMAN

7.5.2

GUIDED ARTILLERY SHELLS

7.5.2.1

TRANSFORMATION OF CONVENTIONAL ARTILLERY INTO HIGH-PRECISION, LONG-RANGE STRIKE SYSTEMS

7.5.2.2

USE CASE: M982 EXCALIBUR BY RTX AND BAE SYSTEMS

7.5.3.1

COMPATIBILITY WITH FOURTH- AND FIFTH-GENERATION AIRCRAFT AND UAVS

7.5.3.2

USE CASE: GBU-39/B SDB I BY BOEING

7.6.1.1

GROWING THREATS FROM SURFACE COMBATANTS, CARRIERS, AND AMPHIBIOUS FLEETS

7.6.1.2

USE CASE: BLACK SHARK BY LEONARDO

7.6.2.1

RISING PROLIFERATION OF STEALTHY, LONG-ENDURANCE SUBMARINES IN MODERN NAVAL FLEETS

7.6.2.2

USE CASE: MU90 IMPACT BY THALES AND NAVAL GROUP

7.6.3.1

INCREASING THREAT OF NAVAL CONFRONTATIONS IN COASTAL AND ENCLOSED SEA REGIONS

7.6.3.2

USE CASE: MILAS BY MBDA

7.7.1.1

EXCELLENT SURVEILLANCE AND PRECISION STRIKE CAPABILITIES IN MULTIPLE-USE OPERATIONS

7.7.1.2

USE CASE: SKYSTRIKER BY ELBIT SYSTEMS

7.7.2.1

EXTENSIVE USE IN CONTESTED ENVIRONMENTS DUE TO LOW COST AND REAL-TIME TARGET ACQUISITION

7.7.2.2

USE CASE: HAROP BY IAI

8

PRECISION-GUIDED MUNITION MARKET, BY SYSTEM

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 12 Data Tables

130

8.2

GUIDANCE & NAVIGATION SYSTEMS

8.2.1

INERTIAL NAVIGATION SYSTEMS

8.2.1.1

PREVALENCE OF ELECTRONIC WARFARE, SPOOFING, AND SATELLITE DENIAL IN CONTESTED ENVIRONMENTS

8.2.1.2

USE CASE: EXCALIBUR M982 BY RTX AND BAE SYSTEMS

8.2.2

GLOBAL POSITIONING SYSTEMS

8.2.2.1

NEED FOR HIGH-PRECISION NAVIGATION OVER LONG DISTANCES

8.2.2.2

USE CASE: JDAM BY BOEING

8.2.3

TERRAIN CONTOUR MATCHING RADAR

8.2.3.1

RESURGENCE OF ELECTRONIC WARFARE AND GNSS SPOOFING

8.2.3.2

USE CASE: TOMAHAWK BY RTX

8.3

TARGET ACQUISITION SYSTEMS

8.3.1.1

DEVELOPMENT OF SMALLER AND MORE EFFICIENT INFRARED SYSTEMS FOR PRECISION-GUIDED MUNITIONS

8.3.1.2

USE CASE: BRIMSTONE II BY MBDA

8.3.2.1

SUPERIOR PERFORMANCE IN ALL-WEATHER, BEYOND-VISUAL-RANGE, AND HIGH-SPEED ENGAGEMENT SCENARIOS

8.3.2.2

USE CASE: ASTER 30 BY MBDA

8.3.2.4

SEMI-ACTIVE HOMING

8.3.3.1

EMPHASIS ON LOW-COLLATERAL-DAMAGE STRIKES IN MODERN WARFARE

8.3.3.2

USE CASE: GBU-53/B STORMBREAKER BY RTX

8.3.4.1

OPERATIONAL VERSATILITY AND ENHANCED STRIKE ACCURACY

8.3.4.2

GBU-53/B STORMBREAKER BY RTX

8.4.1.1

WIDE ACCEPTANCE IN SHORT-RANGE BALLISTIC MISSILES AND LOITERING MUNITIONS

8.4.1.2

USE CASE: AGM-114 HELLFIRE BY LOCKHEED MARTIN

8.4.2.1

SHIFT TOWARD LONGER-RANGE, HIGH-AGILITY, AND PRECISION STRIKE CAPABILITIES

8.4.2.2

USE CASE: R-27 (AA-10 ALAMO) BY SOVIET UNION

8.4.3.1

GROWING COMPLEXITY OF MISSION PROFILES AND INCREASING DEMAND FOR AGILE MUNITIONS

8.4.3.2

USE CASE: HSTDV BY DRDO

8.4.4.1

ABILITY TO DELIVER SUSTAINED HIGH-SPEED FLIGHT OVER EXTENDED RANGES

8.4.4.2

USE CASE: METEOR BY MBDA

8.4.5.1

DEFENSE INITIATIVES AIMED AT ACCELERATING RESEARCH AND DEVELOPMENT

8.4.5.2

USE CASE: HAWC BY DARPA

8.4.6.1

HIGH DEMAND FOR COMPACT, COST-EFFECTIVE, AND EXTENDED-RANGE STRIKE CAPABILITIES FROM MILITARIES

8.4.6.2

USE CASE: AGM-86B ALCM BY RTX

8.4.7.1

INNOVATIONS IN DEFENSE PROGRAMS

8.4.7.2

USE CASE: SKYSTRIKER BY ELBIT SYSTEMS AND SWITCHBLADE 300 BY AEROVIRONMENT

8.5.1.1

SUITABLE FOR URBAN OPERATIONS, AIRFIELD DENIAL, AND MISSIONS REQUIRING CONTROLLED DESTRUCTION

8.5.1.2

USE CASE: TOMAHAWK BLOCK IV BY RTX

8.5.2

CONTINUOUS ROD WARHEADS

8.5.2.1

EFFECTIVENESS AGAINST FAST-MOVING AIRBORNE TARGETS

8.5.2.2

USE CASE: AIM-120 AMRAAM D BY RTX

8.5.3

FRAGMENTATION WARHEADS

8.5.3.1

DEPLOYMENT IN URBAN COMBAT, COUNTER-INSURGENCY MISSIONS, AND AIR DEFENSE OPERATIONS

8.5.3.2

USE CASE: NASAMS BY RTX

8.5.4

KINETIC ENERGY PERPETRATORS

8.5.4.1

INCREASING CONCERNS ABOUT DEEPLY BURIED TARGETS AND HARDENED ENEMY ASSETS

8.5.5

THERMOBARIC/SHAPED CHARGE WARHEADS

8.5.5.1

RISING STRATEGIC IMPORTANCE DUE TO EFFECTIVENESS IN ENGAGING FORTIFIED, ENCLOSED, AND ARMORED TARGETS

8.5.5.2

USE CASE: BRIMSTONE BY MBDA

8.5.6.1

REPLACEMENT OF TRADITIONAL CLUSTER MUNITIONS

8.5.6.2

USE CASE: CBU-105 BY TEXTRON

8.6.1.1

FOCUS ON REDUCING RELIANCE ON HEAVY OR LIMITED-LIFE ONBOARD BATTERIES

8.6.1.2

USE CASE: AGM-86 ALCM BY BOEING

8.6.2.1

ELEVATED DEMAND FOR COMPACT, HIGH-ENERGY, AND RELIABLE POWER SOLUTIONS

8.6.2.2

USE CASE: IM-92 STINGER BY RTX

9

PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

153

9.2.1

RAPID DEPLOYMENT AND REPOSITIONING CAPABILITIES IN DYNAMIC COMBAT ENVIRONMENTS

9.3.1

EXTENSIVE USE IN HIGH-PRIORITY MISSIONS

9.4.1

ABILITY TO MAINTAIN STRONG DEFENSE POSTURE

10

PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

157

10.2.1

FASTER RESPONSE TIMES AND HIGHER OPERATIONAL FLEXIBILITY

10.3.1

REDUCED OPERATIONAL RESPONSE TIMES AND INCREASED TARGETING ACCURACY

11

PRECISION-GUIDED MUNITION MARKET, BY SPEED

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 3 Data Tables

160

11.2.1

EXTENDED RANGE AND PRECISE TARGETING CAPABILITIES

11.3.1

RAPID RESPONSE AND DEEP-STRIKE VERSATILITY

11.4.1

UNMATCHED SPEED, PRECISION, AND STRATEGIC DISRUPTION

12

PRECISION-GUIDED MUNITION MARKET, BY RANGE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

164

12.2.1

DEPLOYMENT OF AGILE DEFENSE SYSTEMS FOR CLOSE-RANGE THREAT NEUTRALIZATION

12.3.1

GLOBAL TREND TOWARD SELF-RELIANT MISSILE MANUFACTURING

12.4.1

IMPROVED TACTICAL AND STRATEGIC OPERATIONS WITH LONG-RANGE CAPABILITIES

12.5.1

ENHANCED NATIONAL DETERRENCE THROUGH DEEP-STRIKE MISSILE TECHNOLOGIES

13

PRECISION-GUIDED MUNITION MARKET, BY REGION

Comprehensive coverage of 7 Regions with country-level deep-dive of 14 Countries | 212 Data Tables.

168

13.2.3.1

ROBUST MILITARY-INDUSTRIAL INFRASTRUCTURE AND STRATEGIC IMPERATIVES TO DRIVE MARKET

13.2.4.1

EMPHASIS ON DEFENSE MODERNIZATION TO DRIVE MARKET

13.3.3.1

STRATEGIC INDO-PACIFIC REALIGNMENT TO DRIVE MARKET

13.3.4.1

DEFENSE INDUSTRIAL SOVEREIGNTY AND MULTINATIONAL COLLABORATIONS TO DRIVE MARKET

13.3.5.1

COMMITMENT TO PRECISION-FOCUSED DETERRENCE TO DRIVE MARKET

13.3.6.1

EXPANDING DEFENSE MANUFACTURING CAPABILITIES TO DRIVE MARKET

13.3.7.1

ROBUST DOMESTIC R&D CAPACITY TO DRIVE MARKET

13.4.3.1

MILITARY MODERNIZATION EFFORTS AND INCREASED DEFENSE BUDGET TO DRIVE MARKET

13.4.4.1

EVOLVING DEFENSE POLICIES AND REGIONAL SECURITY CONCERNS TO DRIVE MARKET

13.4.5.1

STRATEGIC DEFENSE INVESTMENTS AND FOCUS ON MILITARY SELF-SUFFICIENCY TO DRIVE MARKET

13.4.6.1

EMPHASIS ON STRENGTHENING DEFENSE CAPABILITIES AMID GROWING SECURITY THREATS TO DRIVE MARKET

13.4.7.1

SUBSTANTIAL INCREASE IN DEFENSE SPENDING TO DRIVE MARKET

13.4.8

REST OF ASIA PACIFIC

13.5.3.1

VISION 2030 AGENDA AND STRATEGIC PARTNERSHIPS TO DRIVE MARKET

13.5.4.1

PERSISTENT ASYMMETRIC THREATS TO DRIVE MARKET

13.5.5.1

FOCUS ON INDIGENOUS INNOVATION AND ROBUST EXPORT-ORIENTED DEFENSE INDUSTRY TO DRIVE MARKET

13.5.6

REST OF MIDDLE EAST

13.6.3.1

INCREASING INVESTMENTS IN COUNTER-INSURGENCY AND BORDER CONTROL TECHNOLOGIES TO DRIVE MARKET

13.6.4.1

INCREASED DEFENSE MODERNIZATION INITIATIVES TO DRIVE MARKET

14

COMPETITIVE LANDSCAPE

Discover strategic insights and market dominance trends shaping key players and emerging leaders.

255

14.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

14.3

MARKET SHARE ANALYSIS, 2024

14.4

REVENUE ANALYSIS, 2021–2024

14.5

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

14.5.5.1

COMPANY FOOTPRINT

14.5.5.2

REGION FOOTPRINT

14.5.5.3

PRODUCT FOOTPRINT

14.6

COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

14.6.1

PROGRESSIVE COMPANIES

14.6.2

RESPONSIVE COMPANIES

14.6.5

COMPETITIVE BENCHMARKING

14.6.5.1

LIST OF START-UPS/SMES

14.6.5.2

COMPETITIVE BENCHMARKING OF START-UPS/SMES

14.7

COMPANY VALUATION AND FINANCIAL METRICS

14.8

BRAND/PRODUCT COMPARISON

14.9

COMPETITIVE SCENARIO

14.9.1

PRODUCT LAUNCHES/DEVELOPMENTS

15

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

289

15.1.1.1

BUSINESS OVERVIEW

15.1.1.2

PRODUCTS OFFERED

15.1.1.3

RECENT DEVELOPMENTS

15.1.2

LOCKHEED MARTIN CORPORATION

15.1.5

GENERAL DYNAMICS CORPORATION

15.1.9

ISRAEL AEROSPACE INDUSTRIES LTD.

15.1.15

ELBIT SYSTEMS LTD.

15.1.16

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

15.1.21

POLSKA GRUPA ZBROJENIOWA

15.2.2

BHARAT DYNAMICS LIMITED

16.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATES

TABLE 2

US PRECISION-GUIDED MUNITION PROCUREMENT, 2024

TABLE 3

ROLE OF COMPANIES IN ECOSYSTEM

TABLE 4

IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2021–2024 (USD THOUSAND)

TABLE 5

EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2021–2024 (USD THOUSAND)

TABLE 6

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCTS (%)

TABLE 7

KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

TABLE 8

US-ADJUSTED RECIPROCAL TARIFF RATES

TABLE 9

KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR PRECISION-GUIDED MUNITION MARKET

TABLE 10

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15

KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 16

AVERAGE SELLING PRICE OF PRECISION-GUIDED MUNITIONS, BY PRODUCT, 2024 (USD MILLION)

TABLE 17

AVERAGE SELLING PRICE OF PRECISION-GUIDED MUNITIONS, BY REGION, 2024 (USD MILLION)

TABLE 18

OPERATIONAL DATA FOR PRECISION-GUIDED MUNITION PRODUCTS, 2021–2024 (UNITS)

TABLE 19

OPERATIONAL DATA FOR PRECISION-GUIDED MUNITION PRODUCTS, 2025–2030 (UNITS)

TABLE 20

BILL OF MATERIALS FOR JOINT DIRECT ATTACK MUNITIONS

TABLE 21

BILL OF MATERIALS FOR GUIDED MULTIPLE LAUNCH ROCKET SYSTEMS

TABLE 22

TOTAL COST OF OWNERSHIP FOR JOINT DIRECT ATTACK MUNITIONS

TABLE 23

TOTAL COST OF OWNERSHIP FOR GUIDED MULTIPLE LAUNCH ROCKET SYSTEMS

TABLE 24

BUSINESS MODELS IN PRECISION-GUIDED MUNITION MARKET

TABLE 26

PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 27

PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 28

TACTICAL MISSILES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 29

TACTICAL MISSILES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 30

INTERCEPTOR MISSILES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 31

INTERCEPTOR MISSILES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 32

GUIDED ROCKETS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 33

GUIDED ROCKETS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 34

GUIDED AMMUNITION: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 35

GUIDED AMMUNITION: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 36

TORPEDOES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 37

TORPEDOES: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 38

LOITERING MUNITIONS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 39

LOITERING MUNITIONS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 40

PRECISION-GUIDED MUNITION MARKET, BY SYSTEM, 2021–2024 (USD MILLION)

TABLE 41

PRECISION-GUIDED MUNITION MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

TABLE 42

GUIDANCE & NAVIGATION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 43

GUIDANCE & NAVIGATION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 44

TARGET ACQUISITION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 45

TARGET ACQUISITION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 46

PROPULSION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 47

PROPULSION SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 48

WARHEADS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 49

WARHEADS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 50

POWER SUPPLY SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 51

POWER SUPPLY SYSTEMS: PRECISION-GUIDED MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 52

PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 53

PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 54

PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 55

PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 56

PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 57

PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 58

HYPERSONIC MISSILES, BY COUNTRY

TABLE 59

PRECISION-GUIDED MUNITION MARKET, BY RANGE, 2021–2024 (USD MILLION)

TABLE 60

PRECISION-GUIDED MUNITION MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 61

PRECISION-GUIDED MUNITION MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 62

PRECISION-GUIDED MUNITION MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 63

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 64

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 65

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 66

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 67

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 68

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 69

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 70

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 71

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 72

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 73

US: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 74

US: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 75

US: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 76

US: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 77

US: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 78

US: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 79

US: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 80

US: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 81

CANADA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 82

CANADA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 83

CANADA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 84

CANADA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 85

CANADA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 86

CANADA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 87

CANADA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 88

CANADA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 89

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 90

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 91

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 92

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 93

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 94

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 95

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 96

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 97

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 98

EUROPE: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 99

UK: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 100

UK: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 101

UK: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 102

UK: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 103

UK: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 104

UK: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 105

UK: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 106

UK: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 107

FRANCE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 108

FRANCE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 109

FRANCE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 110

FRANCE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 111

FRANCE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 112

FRANCE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 113

FRANCE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 114

FRANCE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 115

GERMANY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 116

GERMANY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 117

GERMANY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 118

GERMANY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 119

GERMANY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 120

GERMANY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 121

GERMANY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 122

GERMANY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 123

ITALY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 124

ITALY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 125

ITALY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 126

ITALY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 127

ITALY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 128

ITALY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 129

ITALY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 130

ITALY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 131

RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 132

RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 133

RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 134

RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 135

RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 136

RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 137

RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 138

RUSSIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 139

REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 140

REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 141

REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 142

REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 143

REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 144

REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 145

REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 146

REST OF EUROPE: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 147

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 148

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 149

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 150

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 151

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 152

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 153

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 154

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 155

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 156

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 157

CHINA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 158

CHINA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 159

CHINA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 160

CHINA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 161

CHINA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 162

CHINA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 163

CHINA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 164

CHINA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 165

INDIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 166

INDIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 167

INDIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 168

INDIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 169

INDIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 170

INDIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 171

INDIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 172

INDIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 173

JAPAN: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 174

JAPAN: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 175

JAPAN: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 176

JAPAN: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 177

JAPAN: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 178

JAPAN: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 179

JAPAN: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 180

JAPAN: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 181

SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 182

SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 183

SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 184

SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 185

SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 186

SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 187

SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 188

SOUTH KOREA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 189

AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 190

AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 191

AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 192

AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 193

AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 194

AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 195

AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 196

AUSTRALIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 197

REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 198

REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 199

REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 200

REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 201

REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 202

REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 203

REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 204

REST OF ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 205

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 206

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 207

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 208

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 209

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 210

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 211

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 212

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 213

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 214

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 215

SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 216

SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 217

SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 218

SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 219

SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 220

SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 221

SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 222

SAUDI ARABIA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 223

ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 224

ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 225

ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 226

ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 227

ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 228

ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 229

ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 230

ISRAEL: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 231

TURKEY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 232

TURKEY: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 233

TURKEY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 234

TURKEY: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 235

TURKEY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 236

TURKEY: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 237

TURKEY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 238

TURKEY: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 239

REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 240

REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 241

REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 242

REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 243

REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 244

REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 245

REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 246

REST OF MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 247

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 248

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 249

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 250

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 251

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 252

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 253

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 254

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 255

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 256

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 257

LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 258

LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 259

LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 260

LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 261

LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 262

LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 263

LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 264

LATIN AMERICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 265

AFRICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2021–2024 (USD MILLION)

TABLE 266

AFRICA: PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

TABLE 267

AFRICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2021–2024 (USD MILLION)

TABLE 268

AFRICA: PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

TABLE 269

AFRICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2021–2024 (USD MILLION)

TABLE 270

AFRICA: PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

TABLE 271

AFRICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2021–2024 (USD MILLION)

TABLE 272

AFRICA: PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

TABLE 273

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

TABLE 274

PRECISION-GUIDED MUNITION MARKET: DEGREE OF COMPETITION

TABLE 275

REGION FOOTPRINT

TABLE 276

PRODUCT FOOTPRINT

TABLE 277

SPEED FOOTPRINT

TABLE 278

LIST OF START-UPS/SMES

TABLE 279

COMPETITIVE BENCHMARKING OF START-UPS/SMES

TABLE 280

PRECISION-GUIDED MUNITION MARKET: PRODUCT LAUNCHES/ DEVELOPMENTS, 2021–2025

TABLE 281

PRECISION-GUIDED MUNITION MARKET: DEALS, 2021–2025

TABLE 282

PRECISION-GUIDED MUNITION MARKET: OTHERS, 2021–2025

TABLE 283

NORTHROP GRUMMAN: COMPANY OVERVIEW

TABLE 284

NORTHROP GRUMMAN: PRODUCTS OFFERED

TABLE 285

NORTHROP GRUMMAN: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 286

NORTHROP GRUMMAN: DEALS

TABLE 287

NORTHROP GRUMMAN: OTHERS

TABLE 288

LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

TABLE 289

LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

TABLE 290

LOCKHEED MARTIN CORPORATION: DEALS

TABLE 291

LOCKHEED MARTIN CORPORATION: OTHERS

TABLE 292

RTX: COMPANY OVERVIEW

TABLE 293

RTX: PRODUCTS OFFERED

TABLE 295

BOEING: COMPANY OVERVIEW

TABLE 296

BOEING: PRODUCTS OFFERED

TABLE 297

BOEING: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 300

GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

TABLE 301

GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

TABLE 302

GENERAL DYNAMICS CORPORATION: DEALS

TABLE 303

GENERAL DYNAMICS CORPORATION: OTHERS

TABLE 304

BAE SYSTEMS: COMPANY OVERVIEW

TABLE 305

BAE SYSTEMS: PRODUCTS OFFERED

TABLE 306

BAE SYSTEMS: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 307

BAE SYSTEMS: OTHERS

TABLE 308

ASELSAN A.S.: COMPANY OVERVIEW

TABLE 309

ASELSAN A.S.: PRODUCTS OFFERED

TABLE 310

ASELSAN A.S.: DEALS

TABLE 311

ASELSAN A.S.: OTHERS

TABLE 312

MBDA: COMPANY OVERVIEW

TABLE 313

MBDA: PRODUCTS OFFERED

TABLE 314

MBDA: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 317

ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY OVERVIEW

TABLE 318

ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS OFFERED

TABLE 319

ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

TABLE 320

ISRAEL AEROSPACE INDUSTRIES LTD.: OTHERS

TABLE 321

THALES: COMPANY OVERVIEW

TABLE 322

THALES: PRODUCTS OFFERED

TABLE 325

RHEINMETALL AG: COMPANY OVERVIEW

TABLE 326

RHEINMETALL AG: PRODUCTS OFFERED

TABLE 327

RHEINMETALL AG: DEALS

TABLE 328

RHEINMETALL AG: OTHERS

TABLE 329

LEONARDO S.P.A.: COMPANY OVERVIEW

TABLE 330

LEONARDO S.P.A.: PRODUCTS OFFERED

TABLE 331

LEONARDO S.P.A.: DEALS

TABLE 332

LEONARDO S.P.A.: OTHERS

TABLE 333

KONGSBERG: COMPANY OVERVIEW

TABLE 334

KONGSBERG: PRODUCTS OFFERED

TABLE 335

KONGSBERG: DEALS

TABLE 336

KONGSBERG: OTHERS

TABLE 337

SAAB AB: COMPANY OVERVIEW

TABLE 338

SAAB AB: PRODUCTS OFFERED

TABLE 340

SAAB AB: OTHERS

TABLE 341

ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

TABLE 342

ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

TABLE 343

ELBIT SYSTEMS LTD.: OTHERS

TABLE 344

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

TABLE 345

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS OFFERED

TABLE 346

RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: DEALS

TABLE 347

LEIDOS: COMPANY OVERVIEW

TABLE 348

LEIDOS: PRODUCTS OFFERED

TABLE 350

GENERAL ATOMICS: COMPANY OVERVIEW

TABLE 351

GENERAL ATOMICS: PRODUCTS OFFERED

TABLE 352

GENERAL ATOMICS: DEALS

TABLE 353

GENERAL ATOMICS: OTHERS

TABLE 354

DENEL DYNAMICS: COMPANY OVERVIEW

TABLE 355

DENEL DYNAMICS: PRODUCTS OFFERED

TABLE 356

HANWHA GROUP: COMPANY OVERVIEW

TABLE 357

HANWHA GROUP: PRODUCTS OFFERED

TABLE 358

HANWHA GROUP: DEALS

TABLE 359

HANWHA GROUP: OTHERS

TABLE 360

POLSKA GRUPA ZBROJENIOWA: COMPANY OVERVIEW

TABLE 361

POLSKA GRUPA ZBROJENIOWA: PRODUCTS OFFERED

TABLE 362

POLSKA GRUPA ZBROJENIOWA: DEALS

TABLE 363

POLSKA GRUPA ZBROJENIOWA: OTHERS

TABLE 364

ROSTEC: COMPANY OVERVIEW

TABLE 365

ROSTEC: PRODUCTS OFFERED

FIGURE 1

PRECISION-GUIDED MUNITION MARKET SEGMENTATION

FIGURE 2

RESEARCH DESIGN MODEL

FIGURE 4

BOTTOM-UP APPROACH

FIGURE 5

TOP-DOWN APPROACH

FIGURE 6

DATA TRIANGULATION

FIGURE 7

LOITERING MUNITIONS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

FIGURE 8

AIRBORNE SEGMENT TO BE DOMINANT IN 2025

FIGURE 9

GUIDANCE & NAVIGATION SYSTEMS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

FIGURE 10

SUPERSONIC SEGMENT TO ACCOUNT FOR HIGHEST SHARE IN 2030

FIGURE 11

NORTH AMERICA TO BE LARGEST MARKET FOR PRECISION-GUIDED MUNITIONS DURING FORECAST PERIOD

FIGURE 12

SUBSTANTIAL INVESTMENTS, MILITARY MODERNIZATION PROGRAMS, AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

FIGURE 13

SUPERSONIC TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

FIGURE 14

AUTONOMOUS TO HOLD HIGHER SHARE THAN SEMI-AUTONOMOUS DURING FORECAST PERIOD

FIGURE 15

AIRBORNE SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

FIGURE 16

INDIA TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 17

PRECISION-GUIDED MUNITION MARKET DYNAMICS

FIGURE 18

ADVANTAGES OF MINIATURIZATION

FIGURE 19

ADVANTAGES OF HYBRID MISSILES

FIGURE 20

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 21

VALUE CHAIN ANALYSIS

FIGURE 22

ECOSYSTEM ANALYSIS

FIGURE 23

IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2021–2024 (USD THOUSAND)

FIGURE 24

EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY, 2021–2024 (USD THOUSAND)

FIGURE 25

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PRODUCTS

FIGURE 26

KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

FIGURE 27

INVESTMENT AND FUNDING SCENARIO, 2020–2024

FIGURE 29

IMPACT OF AI ON DEFENSE SECTOR

FIGURE 30

ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

FIGURE 31

IMPACT OF AI ON PRECISION-GUIDED MUNITION MARKET

FIGURE 32

MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

FIGURE 33

MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

FIGURE 34

BILL OF MATERIALS FOR JOINT DIRECT ATTACK MUNITIONS

FIGURE 35

BILL OF MATERIALS FOR GUIDED MULTIPLE LAUNCH ROCKET SYSTEMS

FIGURE 36

TOTAL COST OF OWNERSHIP FOR PRECISION-GUIDED MUNITIONS

FIGURE 37

BUSINESS MODELS IN PRECISION-GUIDED MUNITION MARKET

FIGURE 38

TECHNOLOGY ROADMAP OF PRECISION-GUIDED MUNITIONS

FIGURE 39

EVOLUTION OF PRECISION-GUIDED MUNITION TECHNOLOGY

FIGURE 40

SUPPLY CHAIN ANALYSIS

FIGURE 41

PATENT ANALYSIS

FIGURE 42

PRECISION-GUIDED MUNITION MARKET, BY PRODUCT, 2025–2030 (USD MILLION)

FIGURE 43

PRECISION-GUIDED MUNITION MARKET, BY SYSTEM, 2025–2030 (USD MILLION)

FIGURE 44

PRECISION-GUIDED MUNITION MARKET, BY LAUNCH PLATFORM, 2025–2030 (USD MILLION)

FIGURE 45

PRECISION-GUIDED MUNITION MARKET, BY MODE OF OPERATION, 2025–2030 (USD MILLION)

FIGURE 46

PRECISION-GUIDED MUNITION MARKET, BY SPEED, 2025–2030 (USD MILLION)

FIGURE 47

PRECISION-GUIDED MUNITION MARKET, BY RANGE, 2025–2030 (USD MILLION)

FIGURE 48

PRECISION-GUIDED MUNITION MARKET, BY REGION, 2025–2030

FIGURE 49

NORTH AMERICA: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

FIGURE 50

EUROPE: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

FIGURE 51

ASIA PACIFIC: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

FIGURE 52

MIDDLE EAST: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

FIGURE 53

REST OF THE WORLD: PRECISION-GUIDED MUNITION MARKET SNAPSHOT

FIGURE 54

MARKET SHARE OF KEY PLAYERS, 2024

FIGURE 55

REVENUE ANALYSIS OF KEY PLAYERS, 2021–2024 (USD MILLION)

FIGURE 56

COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

FIGURE 57

COMPANY FOOTPRINT

FIGURE 58

COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

FIGURE 59

VALUATION OF PROMINENT PLAYERS

FIGURE 60

FINANCIAL METRICS OF PROMINENT PLAYERS

FIGURE 61

BRAND/PRODUCT COMPARISON

FIGURE 62

NORTHROP GRUMMAN: COMPANY SNAPSHOT

FIGURE 63

LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

FIGURE 64

RTX: COMPANY SNAPSHOT

FIGURE 65

BOEING: COMPANY SNAPSHOT

FIGURE 66

GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

FIGURE 67

BAE SYSTEMS: COMPANY SNAPSHOT

FIGURE 68

ASELSAN A.S.: COMPANY SNAPSHOT

FIGURE 69

ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

FIGURE 70

THALES: COMPANY SNAPSHOT

FIGURE 71

RHEINMETALL AG: COMPANY SNAPSHOT

FIGURE 72

LEONARDO S.P.A.: COMPANY SNAPSHOT

FIGURE 73

KONGSBERG: COMPANY SNAPSHOT

FIGURE 74

SAAB AB: COMPANY SNAPSHOT

FIGURE 75

ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

FIGURE 76

RAFAEL ADVANCED DEFENSE SYSTEMS LTD: COMPANY SNAPSHOT

FIGURE 77

LEIDOS: COMPANY SNAPSHOT

FIGURE 78

HANWHA GROUP: COMPANY SNAPSHOT

Bada

Oct, 2019

The reason I want to purchase this report is because I want to know the size of the arms market in each country in detail. It would be nice to have as much detail as possible on each weapon system..