Pressure Switch Market

Pressure Switch Market by Type (Electromechanical and Solid State), Pressure Range (Below 100 Bars, 100-400 Bars, Above 400 Bars), Endľuse Industry (Automotive & Transportation, Water & Wastewater, Oil & Gas), Application, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The pressure switch market is projected to grow from USD 2.80 billion in 2025 to USD 3.51 billion by 2030, growing at a CAGR of 4.6%. The global pressure switch market is fueled by increasing industrial automation, rigorous safety standards, and escalating demand in HVAC, oil & gas, and water treatment applications.

KEY TAKEAWAYS

-

BY TYPEThe pressure switch market is segmented into two primary types: electromechanical, solid-state pressure switches. Electromechanical pressure switches dominate the market due to their cost-effectiveness, reliability, and widespread application across various industries.

-

BY PRESSURE RANGEThe pressure switch market, segmented by pressure range covers below 100 bars, 100-400 bars, above 400 bars. The below 100 bars range, by pressure category, commands the biggest market share of the global pressure switch market with its ubiquitous use in a variety of industries such as HVAC, water & wastewater, automotive, oil & gas, and manufacturing

-

BY APPLICATIONThe pressure switch market, segmented by application, plays a pivotal role in addressing diverse operational needs across industries. HVAC systems, monitoring & control systems, safety & alarm systems, hydraulic and pneumatic systems are emerging as cornerstone segments driving demand

-

BY END USEThe end use segment includes automation & transportation, residential & Commercial, manufacturing, oil & gas, water & waste water treatment, power generation. The pressure switch market’s end-use industry segmentation reflects its widespread utility across diverse industries, each with unique demands and growth dynamics.

-

BY REGIONThe regions in the pressure switch market includes Asia Pacific, Norh America, Europe, Middle East & Africa, South America. Asia Pacific is the fastest growing region, fueled by rapid industrialization and increasing demand for energy-efficient automation solutions

-

COMPETITIVE LANDSCAPEKey players such as ABB (Switzerland), Eaton (Ireland), and Danfoss (Denmark) dominate the market with a strong product portfolio, extensive distribution networks, and continuous R&D investments to enhance product efficiency and reliability.

The growing use of intelligent pressure monitoring systems in manufacturing and power industries boosts the efficiency of operations. Apart from this, the growth of renewable energy projects and infrastructure expansion drive market growth. The focus on predictive maintenance and Industry 4.0 integration also propel demand faster, while innovations in electromechanical and solid-state pressure switches increase industry reliability and performance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global pressure switch market is undergoing significant transformations due to evolving industrial requirements, regulatory changes, and advancements in technology. These trends and disruptions are shaping customer business strategies, procurement decisions, and operational efficiencies across multiple industries. With the increasing emphasis on automation, energy efficiency, and real-time monitoring, end users are re-evaluating their pressure switch solutions to remain competitive in their respective sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of global HVAC system market

-

Surging private equity and venture capital investment in global industrial automation industry

Level

-

High competition from alternative technologies

-

Limited adoption in emerging economies

Level

-

Increasing clean energy investment

-

Advancements in IoT and smart sensor technologies

Level

-

Complex regulatory landscape

-

Maintenance and calibration challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of global HVAC system market

The global pressure switch market is experiencing significant growth, driven in part by the increasing installation of HVAC systems worldwide. Pressure switches are integral components in HVAC systems, ensuring operational efficiency and safety by monitoring and controlling pressure levels within various system components. Recent data underscores the robust demand for HVAC products. Carrier Global, a leading HVAC manufacturer, reported an 11% organic growth in its HVAC segment in the fourth quarter, with notable strength in the Americas, particularly in the commercial and North American residential markets. This surge is attributed to rising global temperatures and increasing air pollution, which have heightened the need for air conditioning and purification systems. Additionally, the rapid adoption of energy-efficient heat pumps, driven by stricter energy regulations for buildings, has further propelled HVAC installations. The expansion of HVAC systems directly correlates with heightened demand for pressure switches. These devices play a crucial role in monitoring refrigerant pressures, ensuring system integrity, and preventing potential failures. As the global emphasis on energy efficiency and indoor air quality intensifies, the reliance on advanced pressure monitoring solutions within HVAC systems is expected to grow, thereby driving the pressure switch market forward.

Restraint: High competition from alternative technologies

The global pressure switch market faces significant competition from alternative technologies, particularly electronic pressure sensors and programmable logic controllers (PLCs), which offer higher precision, durability, and seamless integration with smart monitoring systems. These advancements challenge the demand for traditional electrochemical and solid-state pressure switches, limiting market growth in industries that prioritize automation and digitalization. Electronic pressure sensors are increasingly replacing pressure switches in various industrial applications due to their superior accuracy, faster response times, and capability for continuous monitoring. Unlike pressure switches operating on a binary on/off mechanism, electronic sensors provide real-time pressure readings, enabling precise control and predictive maintenance. This advantage is particularly critical in industries such as oil & gas, aerospace, and industrial automation, where operational efficiency and safety are paramount. According to the US Department of Energy (DoE), industrial automation investments, including sensor-based monitoring systems, are projected to surpass USD 200 billion by 2025, signaling a strong shift toward digital pressure monitoring solutions. This trend reduces the reliance on traditional pressure switches, which lack the data-driven capabilities offered by electronic sensors.

Opportunity: Increasing clean energy investment

The rising global investments in renewable energy and smart grids present a significant growth opportunity for the global pressure switch market. With energy investment set to surpass USD 3 trillion for the first time in 2024—of which USD 2 trillion is allocated to clean energy technologies and infrastructure—the demand for advanced monitoring and control devices, including pressure switches, is expected to increase substantially. Pressure switches play a crucial role in renewable energy applications such as wind and solar power generation, energy storage, and grid modernization, where precise pressure regulation is essential for safety, efficiency, and system reliability. The accelerated pace of clean energy investment since 2020 has resulted in renewable power, grid infrastructure, and storage outpacing total spending on fossil fuels. According to the International Energy Agency (IEA), global investment in grids, which had stagnated at around USD 300 billion per year since 2015, is expected to rise to USD 400 billion in 2024, driven by new policies and funding across the United States, Europe, China, and Latin America. Grid modernization initiatives aimed at enhancing resilience and integrating renewable energy sources are fostering the adoption of smart grid solutions, in which pressure switches are vital components for maintaining system stability and performance.

Challenge: Complex regulatory landscape

The global pressure switch market faces significant challenges due to the complex and evolving regulatory landscape, which varies across regions and industries. Pressure switches are critical components in various applications, including manufacturing, oil & gas, water & wastewater, healthcare, and HVAC systems, where safety, environmental impact, and product quality are highly regulated. However, navigating the diverse and stringent compliance requirements across multiple jurisdictions poses operational and financial burdens for manufacturers. Pressure switches must comply with a wide range of safety and performance standards to ensure reliability and operational efficiency. Different regions enforce varying certification processes, making it difficult for manufacturers to achieve global standardization. For instance, in North America, pressure switches used in industrial applications must meet Underwriters Laboratories (UL) standards, Canadian Standards Association (CSA) certifications, and National Electrical Manufacturers Association (NEMA) ratings. In contrast, Europe follows the CE marking requirements, which mandate compliance with the Pressure Equipment Directive (PED), ATEX for explosion-proof environments, and EN standards for industrial automation. Meanwhile, Asia-Pacific countries, including China and India, have their own Compulsory Certification (CCC) and Bureau of Indian Standards (BIS) regulations, adding further complexity to global market entry. The variation in these regulatory frameworks forces manufacturers to redesign products, conduct extensive testing, and obtain multiple certifications, increasing time-to-market and compliance costs

Pressure Switch Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

WIKA supported a leading manufacturer specializing in elevated food silos for storing bulk goods such as powdered milk, flour, and sugar by addressing a significant safety risk of overpressure and explosion during pneumatic filling. The company provided its model MA mechanical pressure switch, which monitored pressure levels inside the silos and automatically shut down the pump when a pre-defined limit was exceeded. This ensured the filling process was safely halted to prevent overpressure and explosion hazards. | Provided explosion-proof certification (ideal for gas and dust environments) | Operated without auxiliary power, ensuring reliability in safety-critical applications | Featured durable aluminum alloy casing, capable of withstanding pressures up to 600 bar | Approved for hazardous environments (IECEx or ATEX certified | Available in SIL 2 and SIL 3 versions, offering enhanced safety assurance | Ensured effective protection of food silos from overpressure and explosion risks. |

|

Hydra-Electric helped a major airframe manufacturer overcome frequent failures of low-pressure switches in aircraft fuel systems operating in high-humidity and extreme temperature conditions. The company designed the Series 12H/G pressure switch, engineered to endure harsh icing, altitude, and temperature fluctuations, ensuring reliable operation. | Engineered to withstand icing and temperature extremes | Innovative venting design prevents moisture buildup and freezing | Passed 200-cycle flight simulation testing under real-world conditions | Delivered durable and reliable performance for long-term fuel system functionality |

|

ITT Aerospace Controls assisted an aerospace manufacturer in improving the reliability of aircraft fire suppression systems by developing highly reliable pressure switches that continuously monitor bottle pressure and alert pilots of any pressure drops to prevent system failure during emergencies. | Rapid response mechanism alerts pilots instantly of pressure loss | Enables timely bottle replacement before failure | Supports dual-use suppression systems for multiple aircraft zones | Ensures compliance with aviation safety regulations | Enhances aircraft reliability and fire suppression safety |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global pressure switch market ecosystem consists of the key players: raw material suppliers, manufacturers, , distributors, end users, and regulatory authorities.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PRESSURE SWITCH MARKET, BY TYPE

The electromechanical category, by segment, is the market leader in the worldwide pressure switch market with high reliability, low cost, and extensive industrial application. Electromechanical pressure switches are used extensively owing to their tough build and support for harsh operating conditions such as high temperature, high pressure, and corrosive environments. These switches have mechanical elements, including diaphragms, pistons, or bellows, and so are very sturdy and less likely to fail with electronic components, guaranteeing reproducible performance where it matters.

PRESSURE SWITCH MARKET, BY PRESSURE RANGE

The below 100 bars range, by pressure category, commands the biggest market share of the global pressure switch market with its ubiquitous use in a variety of industries such as HVAC, water & wastewater, automotive, oil & gas, and manufacturing. Pressure switches of this range see extensive use in low and medium-pressure applications, including fluid control, compressed air systems, and industrial automation, where accurate pressure monitoring and regulation are critical to safety and efficiency.

PRESSURE SWITCH MARKET, BY APPLICATION

The HVAC systems segment, based on application, is estimated to account for the highest market share from 2025 to 2030 in the global pressure switch market because of the increasing need for energy-efficient heating, ventilation, and air conditioning solutions in residential, commercial, and industrial applications. Pressure switches are vital in HVAC systems as they monitor and control pressure levels in air compressors, refrigeration systems, boilers, and heat pumps to provide optimal performance, energy efficiency, and system life.

PRESSURE SWITCH MARKET, BY END USE

The automotive industry constitutes the largest segment in the market for pressure switches globally, which is attributed to the growing installation of sophisticated engine management and advanced safety systems within contemporary vehicles. Pressure switches form a crucial component of braking system, fuel injection, transmission management, and climate control systems that guarantee maximum car performance and protection. Increased requirements for hybrid and electric cars (EVs) have continued to spur pressure demands in the field of precise battery cooling pressure monitoring and energy management systems. Increased government controls over vehicle fuel consumption and exhaust emissions, notably in Europe, North America, and Asia Pacific, are further prompting car makers to include pressure switches with higher performance in their manufacturing processes. The development of autonomous and connected cars, as well as rising investments in intelligent automotive technologies, continues to drive the need for dependable and long-lasting pressure switches in this sector.

REGION

Asia-Pacific to be fastest-growing region in global pressure switch market during forecast period

The Asia Pacific region is the market leader for the global pressure switch market on account of booming industrialization, growing manufacturing bases, and intensifying infrastructure developments in key economies like China, India, Japan, and South Korea. Gaining demand for automation in industrial segments like oil & gas, chemicals, water & wastewater, and power generation has considerably pushed the use of pressure switches to ensure effective process monitoring and system dependability.

Pressure Switch Market: COMPANY EVALUATION MATRIX

In the pressure switch market matrix, ABB (Star) in the pressure switch market because of its strong global presence, advanced automation solutions, and continuous innovation in industrial safety and control systems. WIKA Alexander Wiegand SE & Co. KG (Emerging Leader) in the pressure switch market due to its strong focus on precision engineering and expanding portfolio of smart pressure monitoring solutions for industrial applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.70 Billion |

| Market Forecast in 2030 (Value) | USD 3.51 Billion |

| Growth Rate | CAGR of 4.6% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Pressure Switch Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Component manufacturer | Competitive landscape analysis with focus on strategic moves by key players (e.g., ABB, Eaton, Schneider Electric) |

|

RECENT DEVELOPMENTS

- October 2024 : Eaton announced the expansion of its manufacturing footprint in Puducherry, India. This move is part of the company's broader strategy to enhance its production capabilities and meet the growing demand for its electrical solutions.

- October 2024 : Siemens signed a partnership with Alliander, a major Dutch network company, for flexibility management to accelerate the energy transition and tackle key challenges in distribution grid management. Alliander would use Siemens' Gridscale X platform to reduce congestion and increase grid utilization.

- March 2024 : Schneider Electric announced its plan to invest USD 381.1 million by 2026 to establish India as a manufacturing hub for domestic sales and exports. As part of this initiative, the company inaugurated a new facility in Bengaluru with a USD 11.91 million investment to produce cooling solutions for data centers.

- February 2024 : ABB acquired SEAM Group, a US-based energized asset management and advisory services provider. This acquisition is intended to expand ABB's Electrification Service portfolio, particularly in the US market.

- January 2024 : ABB agreed to acquire Real Tech, a Canadian company that provides optical sensor technologies for real-time water monitoring and analysis. This will help ABB to strengthen their market position in measurement and analytics business.

Table of Contents

Methodology

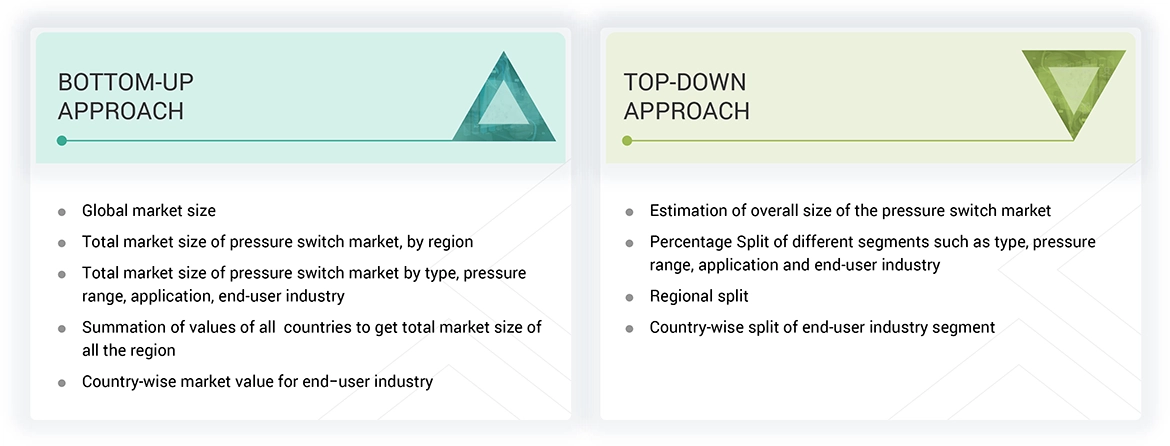

The study involved major activities in estimating the current size of the pressure switch market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the pressure switch market.

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

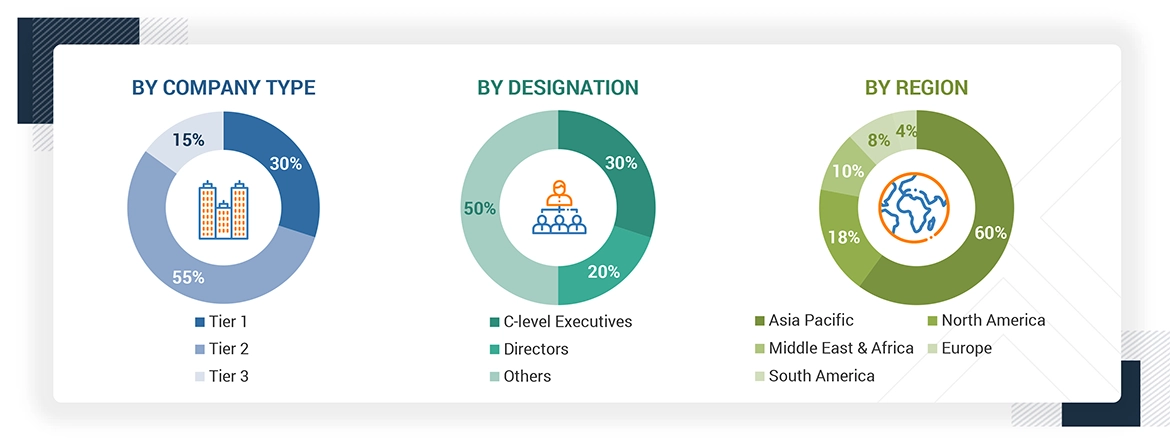

Following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion, Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the pressure switch market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

The global pressure switch market encompasses the manufacturing, distribution, and deployment of electromechanical and solid-state pressure switches used to monitor and control fluid and gas pressure across industrial, commercial, and residential applications. These switches play a critical role in automation, safety, and process optimization by triggering responses when predefined pressure thresholds are reached. Key industries driving market demand include manufacturing, oil & gas, water & wastewater, HVAC, automotive, aerospace, and healthcare, where pressure switches ensure system efficiency, equipment protection, and regulatory compliance. Market growth is fueled by advancements in Industrial IoT (IIoT), smart manufacturing, and Industry 4.0, along with increasing adoption of automation and safety standards in industrial processes.

Stakeholders

- Automotive & transportation sector

- Component manufacturers and suppliers

- Consulting companies in power sector

- Government and power research organizations

- Industrial automation service providers

- Pressure switch suppliers and manufacturers

- Process and manufacturing industries

- Automated parts manufacturing association

- Society of Indian automotive and engine manufacturers association

Report Objectives

- To define, describe, segment, and forecast the pressure switch market, by type, pressure range, application, end–user industry, and region, in terms of value

- To forecast the pressure switch market, by region, in terms of volume

- To forecast the market size for five key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their key countries, in terms of value

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, value chain analysis, porters five forces analysis, trade analysis, case study analysis, technology analysis, influencing the growth of the market

- To strategically analyze the subsegments concerning individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To track and analyze competitive developments, such as product launches, acquisitions, and expansions, in the pressure switch market

- To study the macroeconomic outlook and the impact of generative AI/AI on the pressure switch market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pressure Switch Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pressure Switch Market