Probiotic Yeast Market

Probiotic Yeast Market by Product Type (Functional Food & Beverages, Dietary Supplements, Animal Feed), Yeast Strain Type (Saccharomyces boulardii, Saccharomyces cerevisiae, Others), End User, Distribution Channel, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

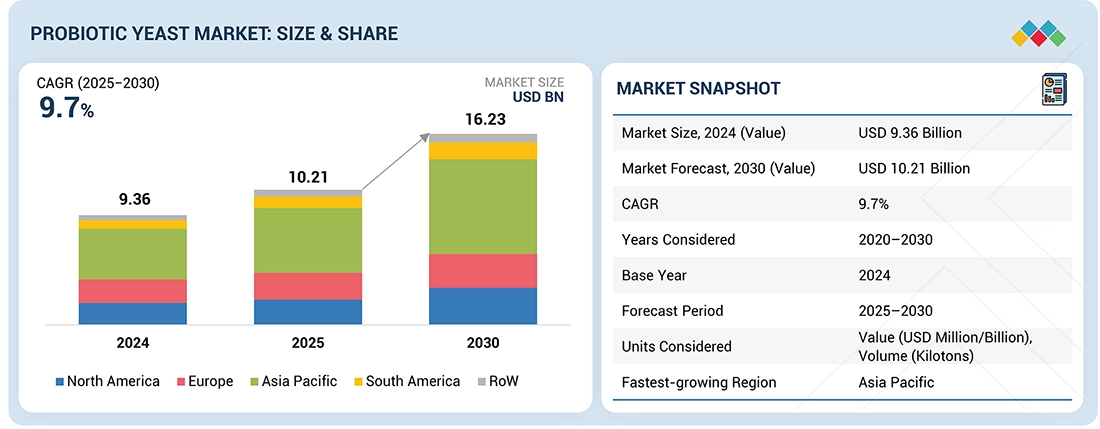

The global probiotic yeast market is estimated to be valued at USD 10.21 billion in 2025 and is projected to reach USD 16.23 billion by 2030, growing at a CAGR of 9.7%. Market growth is driven by increasing demand for digestive health, immune support, and preventive nutrition across food & beverages, dietary supplements, pharmaceuticals, and animal nutrition applications. Yeast-based probiotics, primarily derived from strains such as Saccharomyces boulardii and Saccharomyces cerevisiae, are gaining wider acceptance due to their high stability, resistance to antibiotics, and suitability for both human and animal use.

KEY TAKEAWAYS

-

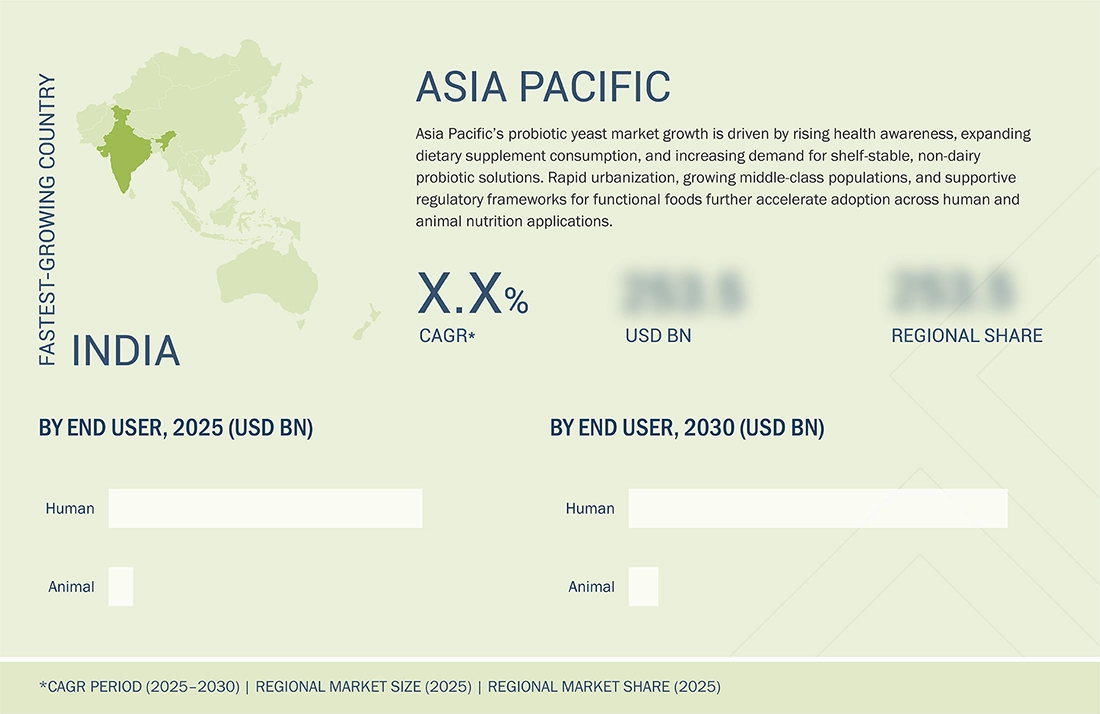

By RegionAsia Pacific accounted for 47.11% of the probiotic yeast market share in 2024.

-

By Product TypeBy product type, the dietary supplements segment is projected to register the highest CAGR of 8.1% during the forecast period.

-

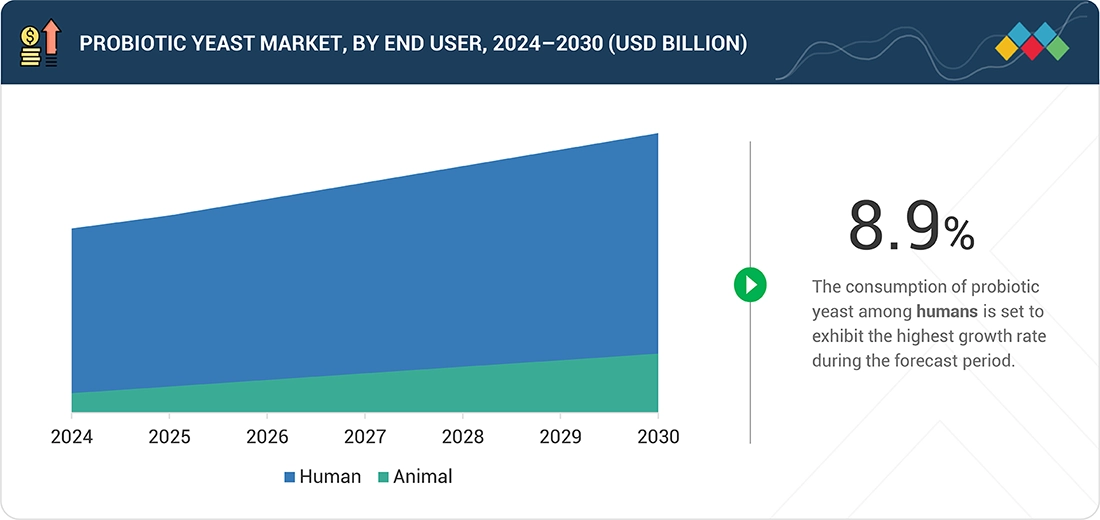

By End-use ApplicationBy end-use application, the human nutrition segment is set to grow the fastest, supported by gut health and immunity demand.

-

By Distribution ChannelBy distribution channel, hypermarket/supermarket is projected to be the fastest-growing channel at a CAGR of 9.5% from 2025 to 2030.

-

Competitive Landscape - Key PlayersKey players include Yakult Honsha Co., Ltd., Danone, and Nestlé, supported by strong brand equity and regional distribution.

-

Competitive Landscape - StartupsEmerging players such as Sanzyme Biologics Pvt. Ltd. and AceBiome are gaining traction in the probiotic yeast market through targeted yeast-based formulations.

The probiotic yeast market is estimated to be valued at USD 10.21 billion in 2025 and is projected to reach USD 16.23 billion by 2030, growing at a CAGR of 9.7%. The market is undergoing strong growth, the main cause of which is the enlargement of a wide range of functional foods, preventive health care, and digestive health solutions in food & beverages, dietary supplements, pharmaceuticals, and animal nutrition domains. Yeast-based probiotics are the variants primarily produced from Saccharomyces cerevisiae and Saccharomyces boulardii and are gradually becoming the vital commercial players because of their durability, antibiotic-resistance, and their suitability and significance for human as well as animal subjects.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

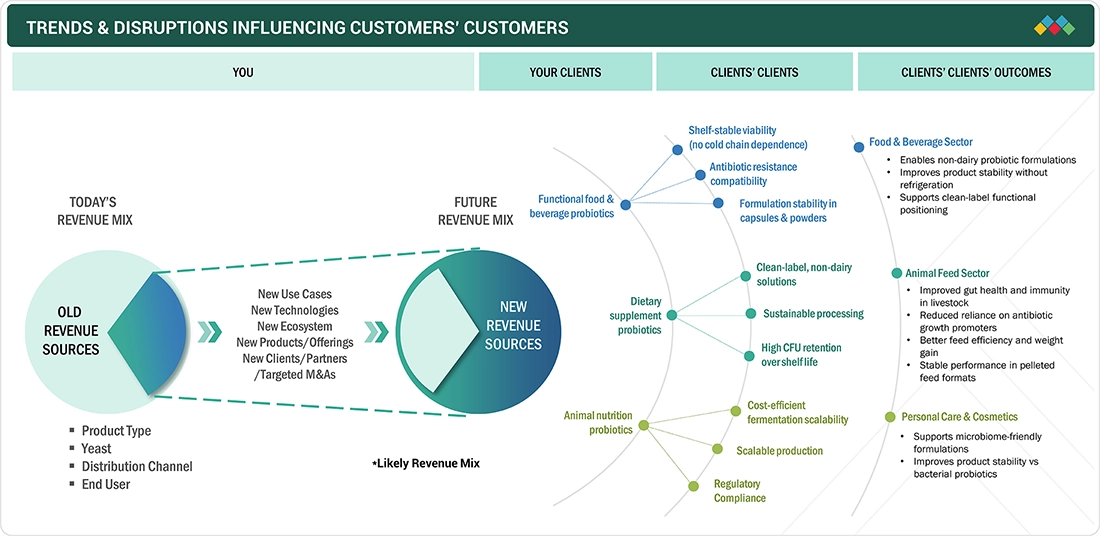

The probiotic yeast market is experiencing transformative shifts characterized by a move toward customized product segmentation, particularly focusing on yeast-specific strains like Saccharomyces, and an increasing emphasis on dietary supplements and clinical nutrition due to their stability and compatibility with antibiotics. Demand for shelf-stable products that require no refrigeration is rising, fueled by consumer preferences for clean-label and transparent ingredients. Moreover, yeast probiotics are gaining traction in animal nutrition as a sustainable alternative to antibiotics, enhancing gut health and feed efficiency. These trends are driving revenue growth through new applications in supplements and animal feed, marking a departure from traditional dairy-based offerings and opening new market opportunities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing focus on digestive health, immunity, and preventive healthcare

-

Expansion of yeast probiotics in animal nutrition

Level

-

Limited consumer awareness of yeast-based probiotics compared to bacterial strains

-

Higher formulation and validation costs for clinically substantiated yeast strains

Level

-

Growth in non-dairy and clean-label probiotic products

-

Increasing use of yeast probiotics in clinical nutrition and post-antibiotic therapies

Level

-

Price pressure from low-cost probiotic alternatives

-

Supply-chain disruptions affecting fermentation inputs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing focus on digestive health, immunity, and preventive healthcare

The probiotic yeast market is primarily driven by the increasing emphasis on digestive health, immune support, and preventive healthcare across global human nutrition markets. The rising incidence of gastrointestinal disorders, antibiotic-associated digestive issues, and immune-related health concerns has encouraged consumers to seek clinically supported probiotic solutions. Yeast-based probiotics, particularly Saccharomyces strains, are gaining preference due to their natural resistance to antibiotics, stability under varied storage conditions, and suitability for long-term daily consumption. These attributes make yeast probiotics especially relevant for dietary supplements and clinical nutrition products, supporting consistent market growth across both developed and emerging regions.

Restraint: Limited consumer awareness of yeast-based probiotics compared to bacterial strains

Despite functional advantages, market growth is restrained by limited consumer awareness of yeast-based probiotics relative to bacterial alternatives. Bacterial probiotics have long been associated with fermented foods and dairy products, creating stronger consumer familiarity and trust. In several emerging markets, limited education around microbiome science and probiotic differentiation further constrains adoption. Additionally, healthcare professionals and retailers often prioritize well-established bacterial strains, making market penetration more challenging for yeast-based products without extensive clinical communication and branding investment.

Opportunity: Growth in non-dairy and clean-label probiotic products

The growing demand for non-dairy, allergen-free, and clean-label nutrition presents a significant opportunity for the probiotic yeast market. Yeast probiotics align well with plant-based, vegan, and lactose-free dietary trends, enabling manufacturers to develop inclusive health products for sensitive consumer groups. Expanding use in shelf-stable supplements, post-antibiotic recovery formulations, and preventive healthcare solutions further strengthens growth prospects. Moreover, increasing regulatory restrictions on antibiotic use in animal nutrition are opening new avenues for yeast probiotics in feed applications, supporting market diversification beyond human nutrition.

Challenge: Price pressure from low-cost probiotic alternatives

The market faces competitive pressure from low-cost probiotic alternatives, particularly in mass-market supplement categories where price sensitivity is high. Bacterial probiotics, produced at scale and marketed aggressively, often compete on cost, limiting pricing flexibility for yeast-based products. Additionally, fluctuations in fermentation input costs and supply chain disruptions can impact production economics. To mitigate these challenges, manufacturers must focus on clinical differentiation, formulation stability, and targeted application positioning to sustain margins and long-term competitiveness.

probiotic-yeast-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Saccharomyces boulardii-based probiotic formulations for digestive health and post-antibiotic recovery | Improved gut barrier function, reduced antibiotic-associated diarrhea risk, and consistent clinical performance |

|

Yeast-based probiotic dietary supplements and clinical nutrition products for digestive and immune support | Enhanced formulation stability, non-dairy positioning, and improved tolerance across age groups |

|

Probiotic yeast applications in infant nutrition and medical nutrition supplements | Improved digestive tolerance, immune support, and suitability for sensitive populations |

|

Yeast probiotic ingredients for capsules, sachets, and functional nutrition products | High shelf stability, scalable fermentation, and reliable CFU delivery over product life cycle |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global probiotic yeast market operates within a multi-layered value chain that includes strain suppliers, manufacturers, regulatory authorities, and distribution channels. Strain suppliers provide critical yeast strains, mainly from the Saccharomyces species, which are essential for formulating probiotic products. Manufacturers then transform these strains into finished products, leveraging fermentation capabilities and formulation expertise to meet quality and regulatory standards across various sectors, including functional foods and dietary supplements. Regulatory bodies oversee safety and compliance, influencing market entry and product positioning. On the demand side, large retail chains and pharmacy networks enhance market access and consumer reach, contributing to the widespread adoption of yeast-based probiotics and shaping the competitive landscape of the industry.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Probiotic Yeast Market, by Product Type

Dietary supplements form the leading segment in the global probiotic yeast market, driven by the increasing preference for preventive healthcare and convenient nutrition solutions in both developed and emerging markets. Yeast-based probiotics, especially Saccharomyces strains, are favored for their stability, resistance to antibiotics, and ability to maintain viable cell counts without the need for refrigeration. This segment thrives on strong consumer demand for digestive health and immune support, with a growing awareness of the gut-immune system connection prompting a shift toward long-term supplementation. Regulatory frameworks in various regions facilitate quicker supplement approvals compared to functional foods, while the non-dairy and allergen-free nature of yeast probiotics caters to vegan and lactose-intolerant consumers. Consequently, dietary supplements dominate the probiotic yeast market, bolstered by robust retail presence, clinical validation, and consistent consumption patterns.

Probiotic Yeast Market, by End User

Human nutrition is the leading segment of the probiotic yeast market, driven by the growing need for solutions addressing digestive disorders, immune-related conditions, and lifestyle health concerns. Yeast-based probiotics are favored for their safety, antibiotic resistance, and appropriateness for vulnerable populations, including children and the elderly. They are commonly used for digestive balance, immune support, and gut health, benefiting from endorsements by healthcare professionals and wellness practitioners. The rising awareness of microbiome health, coupled with increased disposable incomes and urbanization, especially in regions like Asia Pacific and Europe, further fuels demand. Although animal nutrition is a significant growth area, human nutrition is prioritized due to higher value, better branding opportunities, and a wider range of applications in supplements and clinical settings.

Probiotic Yeast Market, by Distribution Channel

Hypermarkets and supermarkets dominate the global probiotic yeast market due to their broad consumer reach, visibility of health-focused products, and the integration of functional nutrition into everyday shopping. These retail formats serve as key purchasing points for yeast-based probiotics marketed as daily wellness solutions, particularly in shelf-stable supplements and fortified foods. As these products do not require refrigeration, they thrive in large retail environments where cold-chain systems may be limited. The trend of one-stop shopping has led to increased purchases of health supplements alongside regular groceries, with retailers enhancing health and wellness sections for better product discovery. In emerging markets like Asia Pacific and Latin America, organized retail chains have improved access to probiotics, bolstered by private-label offerings and promotional activities that further drive affordability and consumer engagement.

REGION

Asia Pacific is set to be the fastest-growing region in the probiotic yeast market

Asia Pacific is projected to be the fastest-growing region in the probiotic yeast market, driven by a rapidly urbanizing population, increasing disposable incomes, and heightened awareness of health and wellness. Key countries like China, Japan, South Korea, and India are seeing sustained demand for probiotic supplements due to rising concerns over digestive health and immunity. Yeast-based probiotics are particularly popular because they align with non-dairy diets and offer shelf-stable formulations. Improved access through organized retail, e-commerce, and local manufacturing has made these products more affordable. Additionally, supportive regulations and a focus on antibiotic reduction in livestock production are further fueling growth in both human and animal nutrition sectors, solidifying the region's leading position in the market.

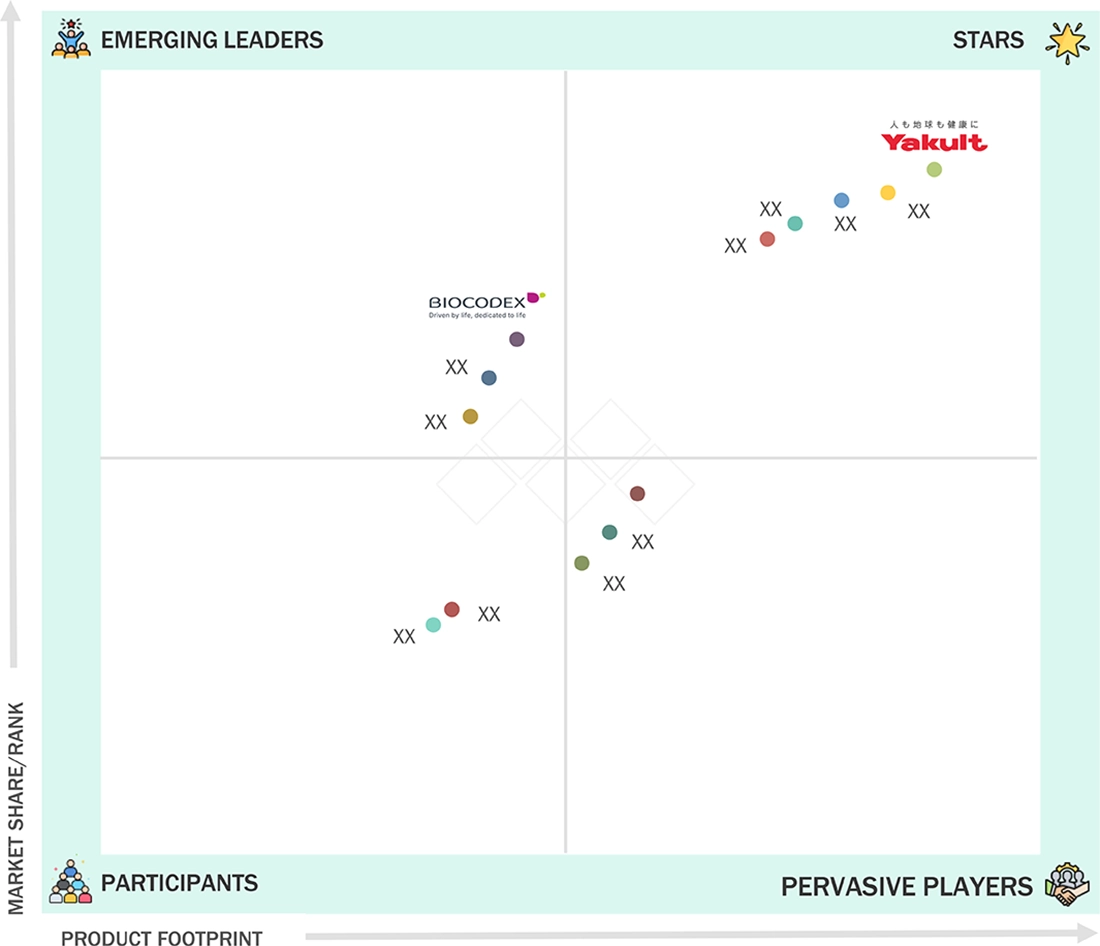

probiotic-yeast-market: COMPANY EVALUATION MATRIX

The probiotic yeast market is characterized by the presence of established fermentation and nutrition companies with strong technical capabilities and global reach. Key participants such as Lallemand Inc. (Canada), Lesaffre Group (France), DSM-Firmenich (Netherlands), ADM (US), and Kerry Group (Ireland) hold competitive positions due to their expertise in yeast strain development, large-scale fermentation, and application support across dietary supplements, functional foods, and animal nutrition. These companies benefit from integrated operations spanning R&D, production, and regulatory compliance, enabling consistent quality and scalability. In addition, food and nutrition players such as Nestlé (Switzerland), Danone (France), Yakult Honsha Co., Ltd. (Japan), and Morinaga Milk Industry Co., Ltd. (Japan) participate through finished products and clinical nutrition offerings incorporating yeast-based probiotics. Overall, company competitiveness in this market is evaluated based on strain portfolio depth, formulation stability, manufacturing scale, regulatory readiness, and geographic presence, rather than aggressive pricing or brand-led promotion.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Nestlé (Switzerland)

- Danone (France)

- Yakult Honsha Co., Ltd. (Japan)

- Morinaga Milk Industry Co., Ltd. (Japan)

- Lallemand Inc. (Canada)

- Lesaffre Group (France)

- DSM-Firmenich (Netherlands)

- ADM (US)

- Kerry Group (Ireland)

- Biocodex (France)

- Gnosis by Lesaffre (France)

- IFF (US)

- Novonesis (Denmark)

- H&H Group (Hong Kong)

- By-Health Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 9.36 Billion |

| Market Forecast, 2030 (Value) | USD 16.23 Billion |

| Growth Rate | CAGR of 9.7% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, South America, RoW |

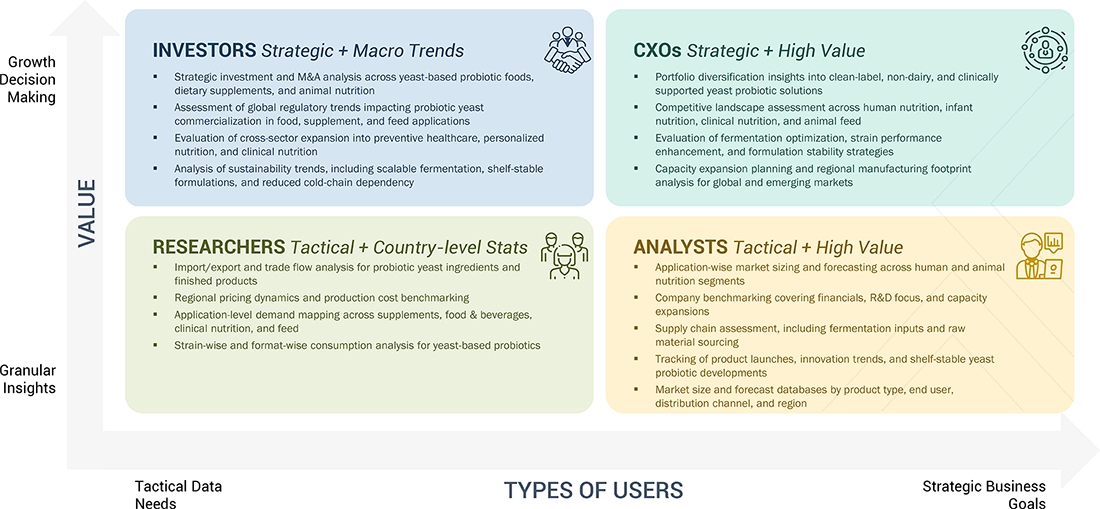

WHAT IS IN IT FOR YOU: probiotic-yeast-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Probiotic Yeast Ingredients Market |

|

|

| Digestive Health Supplements Market |

|

|

| Animal Nutrition (Yeast Probiotics) |

|

|

RECENT DEVELOPMENTS

- June 2024 : DSM-Firmenich (Netherlands) announced the divestment of its yeast extract business to Lesaffre as part of portfolio optimization, while retaining a technology partnership to ensure continuity in yeast-based fermentation expertise relevant to nutrition and health applications.

- October 2024 : Lesaffre (France) completed the acquisition of DSM-Firmenich’s yeast extract business, strengthening its global fermentation capabilities and expanding its yeast-based ingredient portfolio supporting probiotics, nutrition, and health-related applications.

- February 2025 : Novonesis (Denmark) acquired DSM-Firmenich’s share in the Feed Enzyme Alliance, expanding its commercial footprint in microbial and yeast-related solutions for nutrition and animal feed markets, with implications for probiotic yeast scalability.

- September 2025 : Lallemand Health Solutions (Canada) showcased new yeast-based probiotic innovations at Vitafoods Asia, highlighting clinically supported solutions targeting digestive health, women’s health, and healthy aging across supplement and clinical nutrition segments.

- October 2025 : Gnosis by Lesaffre (France) advanced R&D initiatives focused on yeast-derived biotics for targeted gut health and personalized nutrition applications, reinforcing its innovation pipeline in probiotic yeast solutions.

- July 2025 : ADM (US) strengthened its fermentation-based nutrition strategy by expanding development and commercialization of yeast-derived ingredients to support functional nutrition, gut health, and animal feed applications.

Table of Contents

Methodology

The study involved two major approch in estimating the current size of the Probiotic Yeast Market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Probiotic Yeast Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to yeast, type, form, application, and region. Stakeholders from the demand side, such as processed food and functional food products manufacturer who manufacture the products were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of Yeast and the outlook of their business which will affect the overall market.

|

COMPANY NAME |

designation |

|

ADM (US) |

General Manager |

|

Associated British Foods plc (UK) |

Sales Manager |

|

Alltech (US) |

Manager |

|

AngelYeast Co., Ltd (China) |

Head of processing department |

|

Lallemand Inc. (Canada) |

Marketing Manager |

|

Leiber (Germany) |

Sales Executive |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Probiotic Yeast Market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to estimate the Probiotic Yeast Market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying numerous factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the FAO, yeast is a unicellular fungus that reproduces asexually by budding or division, particularly the genus Saccharomyces, which is important in food fermentations. It is used in the preparation of food products, animal nutrition, and pet nutrition products, which helps in improving the health and performance of animals. According to Lallemand Inc., “the ban of antibiotic growth promoters in feed for production of animal foods in the European Union has led to increased interest in evaluating the effect of yeast products on the gastrointestinal ecosystem, rumen microbial populations, and overall animal performance.

Furthermore, the large-scale industrial production and commercial use of yeasts were initiated around the end of the 19th century. Yeasts approved for use in food products are rich in nutrition, proteins, enzymes, and vitamins. Hence, yeast can be used in the food industry as a nutritional supplement. Yeast is used in basic cultures for manufacturing specific fermented food products, such as dairy, bakery, fermented meat and vegetable products, and vinegar.

Key Stakeholders

- Yeast manufacturers

- Yeast importers and exporters

- Yeast traders, distributors, and suppliers

- Food associations of several countries

- Intermediary suppliers including traders and distributors of food & beverage, feed, and bio-ethanol products

- Feed yeast distributors and wholesalers

- Feed additive manufacturers, formulators, and suppliers

- Public and commercial research institutions/agencies/laboratories

- Government regulatory authorities and agricultural research organizations

- Livestock farm and industry associations, and farm cooperative societies

Report Objectives

- To determine and project the size of the Probiotic Yeast Market with respect to the type, applications, form, genus, yeast extract (qualitative) and region in terms of value and volume over five years, ranging from 2024 to 2029.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the Probiotic Yeast Market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

- To provide insights on key product innovations and investments in the Probiotic Yeast Market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the European Probiotic Yeast Market into key countries.

- Further breakdown of the Rest of Asia Pacific Probiotic Yeast Market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Probiotic Yeast Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Probiotic Yeast Market