Protocatechuic Acid Market

Protocatechuic Acid Market by Grade (Ultra- High Purity Grade, Industrial Grade, Lower Grade), By Production (Chemical Synthesis, Natural Extraction/ Bio Based), By Form (Powder/ Crystalline, Liquid, Granules And Others), By Application (Preservative & Antioxidants, Chemical Intermediates, Polymers, Dyes, Feed Additive & Nutraceuticals, Rust Inhibitor And Others), By End-use Industry (Pharmaceutical, Cosmetics/ Personal Care, Food & Beverage, Agriculture And Others) And By Regional Global Forecast to 2030

Updated on : November 27, 2025

PROTOCATECHUIC ACID MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global protocatechuic acid market was valued at USD 14.6 million in 2025 and is projected to reach USD 24.0 million by 2030, growing at 10.5% cagr from 2025 to 2030. The global protocatechuic acid (PCA) market is experiencing rapid growth due to a combination of health trends, technological advancements, and increasing industrial demand. One of the primary drivers is the rising prevalence of chronic diseases such as cancer, diabetes, cardiovascular disorders, and neurodegenerative conditions. Since PCA has been proven to have antioxidant, anti-inflammatory, anticancer, and antimicrobial properties, it is increasingly being studied and adopted in the pharmaceutical industry as a therapeutic ingredient and drug intermediate. Alongside this, the global shift toward natural and plant-based products is driving demand in nutraceuticals and cosmetics, where PCA is utilized in dietary supplements, anti-aging formulations, and skin-protective products.

KEY TAKEAWAYS

-

BY GRADEThe Protocatechuic Acid (PCA) market is segmented by purity levels, with ultra-high purity grade (>99.5%) dominating due to its critical role in pharmaceuticals and advanced nutraceuticals, where stringent quality standards ensure efficacy in anti-inflammatory and antioxidant formulations. Industrial grade (99.5%-95%) holds the largest share for cost-effective applications in chemical intermediates and polymers, while lower grade (<95%) caters to bulk uses in agriculture and feed additives, balancing affordability with performance.

-

BY PRODUCTIONProduction methods include chemical synthesis, which leads for scalable, consistent output in industrial applications, and natural extraction/bio-based, gaining traction for eco-friendly credentials in cosmetics and food sectors. Bio-based methods leverage renewable plant sources like green tea and fruits, aligning with sustainability trends and reducing environmental impact.

-

BY FORMPCA is available in powder and crystalline forms for versatile handling in dyes, preservatives, and nutraceuticals; liquid for easy integration in cosmetics and pharmaceuticals; granules for efficient feed additives and agriculture; and others like bio-based variants for specialty coatings. Powder dominates due to stability and precise dosing.

-

BY APPLICATIONKey applications encompass preservatives and antioxidants in food & beverages to extend shelf life and combat oxidation; chemical intermediates for polymers and dyes; feed additives and nutraceuticals for animal health and human supplements; rust inhibitors in industrial processes; and others like bio-based films for packaging, driven by demand for natural antimicrobials.

-

BY END-USE INDUSTRYThe pharmaceutical sector leads as the primary consumer of PCA for drug development targeting cancer and diabetes, leveraging its anti-cancer properties. Cosmetics/personal care follows closely with skin-protective formulations, while food & beverage utilizes it for natural preservation. Agriculture employs it in crop protection, and others explore its potential in bioplastics and electronics.

-

BY REGIONThe global PCA market is expanding steadily, with Asia-Pacific leading due to rapid industrialization in China and India, strong demand in nutraceuticals, and bio-based production hubs. North America and Europe emphasize high-purity grades for pharma and cosmetics amid regulatory focus on sustainability; Latin America and Middle East & Africa show growth in agriculture and food sectors.

-

COMPETITIVE LANDSCAPEThe protocatechuic acid (PCA) market is driven by product innovation, capacity expansions, and strategic collaborations among global leaders such as Cayman Chemical (US) and Viablife Biotech Co., Ltd. (China). These companies are focusing on developing advanced PCA variants with enhanced antioxidant efficacy, purity levels exceeding 99%, and sustainable bio-based production methods to cater to the growing demand from pharmaceutical, nutraceutical, and cosmetics industries.

The growth of the protocatechuic acid (PCA) industry is driven by several key factors. Rising demand for natural and plant-derived bioactive compounds in pharmaceuticals, nutraceuticals, and cosmetics is a major driver, as PCA is valued for its antioxidant, anti-inflammatory, and neuroprotective properties. The increasing adoption of ultra-high purity grades supports applications requiring precise, safe, and reliable compounds, particularly in drug development and research.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Shifts in consumer preferences or market disruptions have a direct ripple effect on the protocatechuic acid (PCA) industry. Changes in demand for natural antioxidants, nutraceuticals, or plant-derived therapeutics can significantly impact the purchasing patterns of PCA end-users, such as pharmaceutical and nutraceutical companies. This, in turn, impacts the revenues of PCA suppliers and ultimately affects the financial performance of PCA manufacturers. As the market becomes increasingly reliant on high-purity grades and bioactive applications, even minor fluctuations in end-user demand can have substantial effects throughout the PCA value chain, underscoring the interconnected nature of the industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising consumer preferences towards Natural Antioxidants & Clean Label Products

-

Expanding Cosmetic & Personal Care industry revenues are pushing the demand of PCA

Level

-

Constrained competition from the substituted products in the industry

Level

-

From Plastic Waste to Bioactive Wealth: PET-to-PCA Upcycling for a Sustainable Future

-

Green Extraction Technologies: Unlocking Sustainable Opportunities for Protocatechuic Acid Innovation

Level

-

Limited Industrial-Scale Applications of PCA due to high costs, low yields, and regulatory barriers for PCA

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising consumer preferences towards Natural Antioxidants & Clean Label Products.

Growing consumer awareness of health and environmental benefits has led to a preference for natural antioxidants like protocatechuic acid (PCA), which is derived from plants and offers antioxidant, anti-inflammatory, and antimicrobial properties. People are increasingly choosing clean label products—those free from artificial additives—in food, cosmetics, and pharmaceuticals, driving demand for PCA as a natural preservative and health-enhancing compound. This shift reflects a broader lifestyle trend towards wellness and sustainability, encouraging its use in everyday products.

Restraint: Constrained competition from the substituted products in the industry.

PCA faces challenges from alternative antioxidants and preservatives such as vitamin C, vitamin E, and synthetic compounds, which are often more affordable and widely available. These substitutes are preferred in cost-sensitive applications like food preservation and industrial uses, limiting PCA's market share. The difficulty in matching the consistency and price of these alternatives creates a barrier, making it harder for PCA to gain widespread adoption.

Opportunity: From Plastic Waste to Bioactive Wealth: PET-to-PCA Upcycling for a Sustainable Future

Converting plastic waste, such as polyethylene terephthalate (PET), into PCA through innovative bio-refining processes offers a sustainable solution. This approach reduces environmental pollution while creating a new source of PCA, appealing to industries focused on eco-friendly practices. By transforming waste into a valuable bioactive compound, this method opens possibilities for sustainable production in pharmaceuticals and food preservation.

Challenge: Limited Industrial-Scale Applications of PCA due to high costs, low yields, and regulatory barriers for PCA

Scaling PCA production is difficult due to the high costs of extraction and processing, coupled with low yields from natural sources. Additionally, strict regulations for its use in food, pharmaceuticals, and cosmetics require extensive testing and approval, which can be time-consuming and expensive. Variability in raw material quality and supply chain issues further complicate large-scale adoption, posing significant hurdles to its industrial growth.

Protocatechuic Acid Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of PCA-based antioxidant and anti-inflammatory formulations for chronic disease management | Enhanced therapeutic efficacy| Reduced oxidative stress| Potential applications in cardiovascular and neuroprotective drugs |

|

Use of PCA in skin-care formulations as a natural antioxidant and anti-aging ingredient | Improved skin protection from free radicals| Eco-friendly alternative to synthetic antioxidants| Enhanced brand sustainability image |

|

Incorporation of PCA as a natural preservative and antioxidant in functional foods & beverages | Longer shelf life| Clean-label solutions| Consumer preference for natural ingredients |

|

Research into PCA-derived biodegradable polymers and coatings for sustainable packaging | Development of eco-friendly materials| Reduced environmental impact| Alignment with circular economy goals |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The protocatechuic acid ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The raw material suppliers provide Protocatechuic acid to manufacturers. Distributors and suppliers establish contact between manufacturing companies and end-users to streamline the supply chain, thereby increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Protocatechuic acid Market, By Production process

Chemical synthesis has become the leading production method for protocatechuic acid (PCA) because it successfully combines the essential factors of scalability, cost efficiency, high purity, and product consistency, which are critical for industries with rapidly growing demand. While PCA is naturally present in raw materials such as berries, olives, rice bran, and green tea, relying on natural extraction has serious limitations. The yields from plant sources are very low, and production depends heavily on agricultural cycles, seasonal availability, and regional climate conditions. This creates uncertainty in supply and makes it difficult to sustain continuous production at commercial volumes. On top of that, extraction methods are often expensive, resource-intensive, and prone to variations in quality and purity due to biological and environmental influences.

Protocatechuic acid Market, By Grade

The ultra-high purity grade segment leads the protocatechuic acid (PCA) market because it caters to industries where precision, safety, and regulatory compliance are paramount. This grade is critical for pharmaceuticals, biotechnology, and advanced life sciences, as even minor impurities can compromise results, reduce efficacy, or pose risks to human health.

Protocatechuic acid Market, By form

Powder and crystalline forms of protocatechuic acid hold the largest market share because they offer higher purity, stability, and ease of handling compared to liquid or granular alternatives, making them the preferred choice across key industries such as pharmaceuticals, nutraceuticals, cosmetics, and research laboratories. Their well-defined structure ensures consistent solubility and reliable dosing, which is critical for applications in drug formulation, dietary supplements, and active ingredient development. Additionally, the longer shelf life and cost-effectiveness of these forms, combined with their widespread availability for large-scale industrial and academic use, further strengthen their dominance in the protocatechuic acid market.

Protocatechuic acid market, By Application

Preservative and antioxidant applications dominate the protocatechuic acid industry because of the compound’s strong free radical scavenging ability, antimicrobial properties, and natural origin, which make it highly suitable for food, beverage, cosmetic, and pharmaceutical formulations. Its effectiveness in extending shelf life, preventing oxidative degradation, and maintaining product quality aligns with the rising demand for clean-label and natural alternatives to synthetic additives. Moreover, with consumer awareness of health and safety increasing, industries are prioritizing natural antioxidants like protocatechuic acid over conventional chemicals, driving its widespread adoption and ensuring this segment holds the largest market share.

Protocatechuic acid market, By End-use industry

The pharmaceutical industry is the largest end-use sector of the protocatechuic acid market because of its wide-ranging therapeutic properties, including anti-inflammatory, antioxidant, antimicrobial, anticancer, and cardioprotective effects, which make it a valuable ingredient in drug research and development. Its natural origin and multifunctional bioactivity align with the industry’s shift toward safer, plant-derived compounds for disease prevention and treatment. Additionally, ongoing clinical studies exploring its role in managing chronic conditions such as diabetes, cardiovascular disorders, and neurodegenerative diseases further strengthen its adoption. The pharmaceutical sector’s higher regulatory and quality standards also favor the use of pure powder and crystalline forms of protocatechuic acid, cementing its position as the leading consumer of this compound.

REGION

Asia Pacific to be fastest-growing region in global Polyvinyl butyral market during forecast period

Asia Pacific is the largest market for the protocatechuic acid industry, driven by its strong base in pharmaceutical, nutraceutical, food, and cosmetic manufacturing, as well as the region’s rapidly growing healthcare and wellness sectors. Countries like China, India, Japan, and South Korea possess extensive research and production capabilities, driving the large-scale consumption of natural antioxidants and bioactive compounds, such as protocatechuic acid. The region also benefits from the abundance of raw materials, cost-effective production, and increasing government support for traditional medicine and plant-derived therapeutics. Rising consumer awareness of health benefits, along with expanding export opportunities for herbal and functional products, further solidifies Asia Pacific’s dominant share in the global protocatechuic acid market.

Protocatechuic Acid Market: COMPANY EVALUATION MATRIX

In the protocatechuic acid market matrix, Cayman Chemical (Star) leads with a dominant market share and a strong global footprint, backed by its wide range of protocatechuic acid products used extensively in pharmaceutical antioxidants and cosmetics applications. Aktin Chemical (Emerging leaders) leverages its advanced extraction technologies and consistent product innovations to strengthen its competitive positioning, particularly in Asia and Europe. Meanwhile, Sigma-Aldrich (Participants) is expanding visibility through its diversified specialty chemicals portfolio, emphasizing protocatechuic acid applications in food preservation and nutraceuticals. While Taizhou Zhongda Chemical maintains leadership through scale and technological depth, Aktin Chemical and Sigma-Aldrich demonstrate rising potential to capture greater market share as demand for natural phenolic compounds and sustainable health ingredients continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Vertexyn Bioworks Co., Ltd. (China)

- Green Chemicals Co., Ltd. (Japan)

- Nanjing NutriHerb BioTech Co.,Ltd (China)

- Shaanxi LonierHerb Bio-Technology Co., Ltd. (China)

- SimSon Pharma Limited (China)

- Central Drug House (India)

- Cayman Chemical (US)

- Taizhou Zhongda Chemical Co., Ltd. (China)

- Hangzhou Viablife Biotech Co., Ltd. (China)

- ChemFaces (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 13.2 Million |

| Revenue Forecast in 2030 | USD 24.0 Million |

| Growth Rate | CAGR of 10.5% from 2025–2030 |

| Actual data | 2021–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD Million), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Protocatechuic Acid Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-Level Breakdown | Instead of only regional coverage, the report provides country-specific data (e.g., China, India, Japan, South Korea, USA, Germany, Brazil). Includes demand drivers, production trends, import/export flows, and regulatory outlooks. | Helps stakeholders identify high-growth national markets, plan accurate entry strategies, and forecast demand with better precision. |

| Application-Specific Deep Dive | Customized analysis of PCA applications with detailed sub-segmentation:• Preservatives & Antioxidants: Food preservatives, cosmetic preservatives, industrial antioxidants• Chemical Intermediates: Pharmaceutical intermediates, agrochemical intermediates, specialty chemical intermediates• Polymers: Polymer additives, resin modifiers, plastic stabilizers• Dyes: Textile dyes, leather dyes, ink colorants• Feed Additives & Nutraceuticals: Animal feed additives, nutritional supplements, functional health ingredients• Industrial Additives: Rust inhibitors, metal coatings, industrial lubricant additives, corrosion protection solutions• Others: Miscellaneous applications | Supports clients in targeting niche applications, optimizing R&D investments, and building specialized product portfolios for diverse industries. |

| Purity/Form Type Customization | Comparative analysis of PCA available in powder, crystalline, and liquid forms. Covers performance benchmarks such as solubility, stability, shelf life, and suitability across pharmaceuticals, nutraceuticals, cosmetics, and industrial uses. | Enables manufacturers and buyers to optimize selection based on performance, cost, and suitability, while unlocking opportunities in high-purity and premium-grade applications. |

| Competitive Benchmarking | Extended profiling of global and regional players such as Cayman Chemical, LKT Labs, Sigma-Aldrich (Merck), and emerging Asia Pacific suppliers. Includes SWOT analysis, product positioning, pricing, and innovation pipelines. | Provides clients with a clear competitive landscape, helping them identify positioning opportunities, potential partners, and strategies for market entry/acquisitions. |

RECENT DEVELOPMENTS

- March 2020 : Taizhou Zhongda Chemical introduced a new sustainable extraction method for protocatechuic acid, enhancing efficiency and reducing environmental impact.

- August 2024 : Nanjing Jingzhu Biotechnology focused on technological advancements and production capacity expansion to strengthen market presence in the PCA industry.

Table of Contents

Methodology

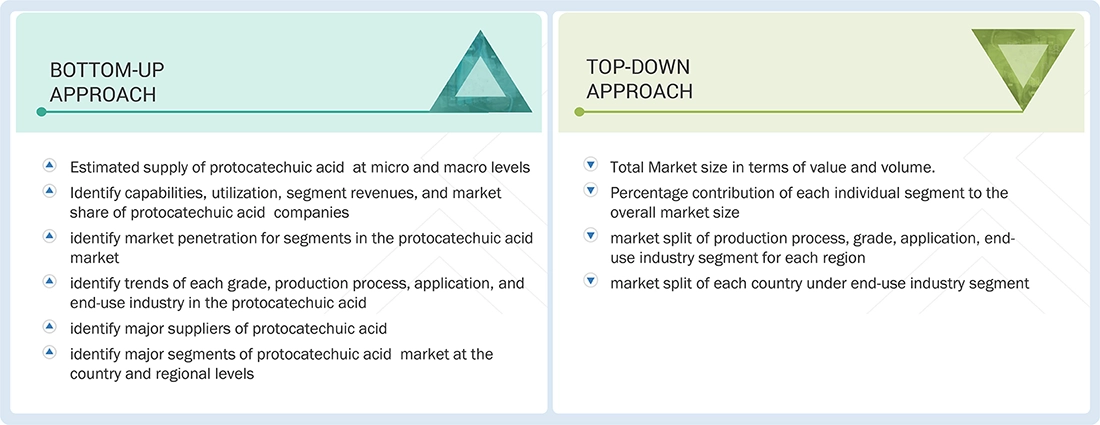

The study involved four major activities in estimating the market size of the protocatechuic acid. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key Protocatechuic acid classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Protocatechuic acid comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the protocatechuic acid have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Protocatechuic acid industry. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Protocatechuic acid and future outlook of their business, which will affect the overall market.

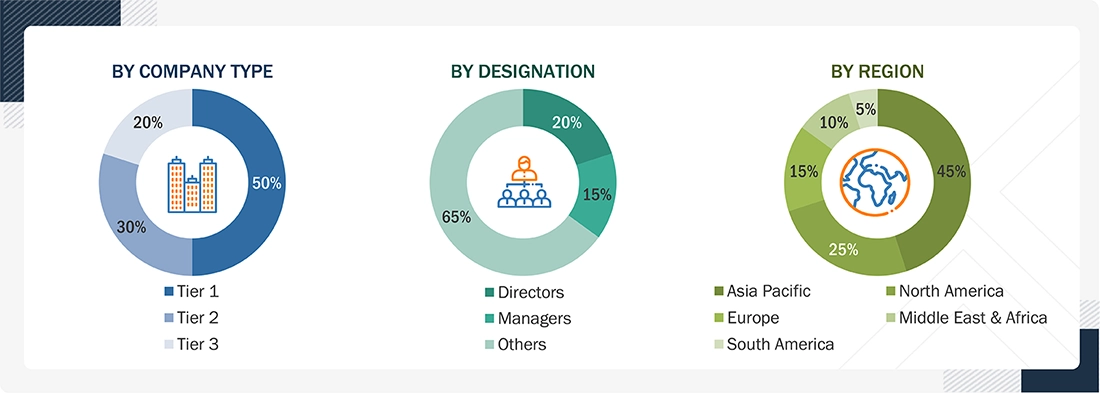

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024, available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for Protocatechuic acid in the region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns based on type, electrode material, application, and end-use industries, region were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis, and presented in this report.

Data Triangulation

After arriving at the total market size from the estimation process above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources: top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Protocatechuic acid (PCA) is a naturally occurring phenolic compound and a type of dihydroxybenzoic acid that belongs to the family of hydroxybenzoic acids, widely recognized for its potent antioxidant, anti-inflammatory, and antimicrobial properties. Structurally, PCA contains two hydroxyl groups attached to a benzene ring, which enable it to neutralize free radicals and reduce oxidative stress, making it an important bioactive molecule in health-related applications. It is commonly found in various natural sources such as green tea, berries, olives, rice bran, and certain medicinal plants, often as a metabolite of more complex polyphenols like anthocyanins and procyanidins. Additionally, it serves as a chemical intermediate in organic synthesis, contributing to the production of dyes, flavors, and polymers. With its multifunctional biological activities and versatile applications, protocatechuic acid is gaining significant attention in both scientific research and industrial markets worldwide.

Stakeholders

- Protocatechuic acid manufacturers

- Protocatechuic acid traders, distributors, and suppliers

- Raw material suppliers

- Government and private research organizations

- Associations and industrial bodies

- R&D institutions

- Environmental support agencies

Report Objectives

- To define, describe, and forecast the size of the Protocatechuic acid, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on grade, production process, application, end-use industries, and region.

- To forecast the size of the market with respect to major regions, namely, North America, Europe, the Middle East & Africa, South America, along with their key countries.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as partnerships, agreements, joint ventures, collaborations, announcements, awards, and expansion in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Protocatechuic Acid Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Protocatechuic Acid Market