Refinery and Petrochemical Filtration Market

Refinery and Petrochemical Filtration Market by Filter Type (Coalescer Filter, Cartridge Filter, Electrostatic Precipitator, Filter Press, Bag Filters, and Others) Application, End User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global refinery and petrochemical filtration market is projected to reach USD 6.76 billion by 2030 from an estimated USD 5.08 billion in 2025, at a CAGR of 5.9% during the forecast period. Rising global energy demand is fueling increased investments in the downstream oil & gas sector, which is driving growth of the refinery and petrochemical filtration market. These investments aim to enhance processing capacity, improve product quality, and meet stringent environmental standards, creating strong momentum for advanced and efficient filtration solutions.

KEY TAKEAWAYS

-

BY FILTER TYPEThe coalescer filter segment is estimated to account for the largest share of the overall market during the forecast period. The adoption of coalescer filters is growing in the refinery and petrochemical industry as they are highly effective at removing contaminants and impurities from various fluids (oil and fuel) and gases.

-

BY APPLICATIONThe liquid-liquid separation segment is projected to be the second-fastest-growing segment during the forecast period. Liquid-liquid separation is essential in refineries and petrochemical industries. Water separation is vital in crude oil processing. The presence of water in crude oil emulsions increases the cost of production and transportation of petroleum oil and causes pump failure, pipeline corrosion, and other problems, such as catalyst poisoning in downstream.

-

BY END USERThe petrochemical industry is projected to emerge as the fastest-growing end user during the forecast period. Increasing infrastructure investments in the petrochemical industry are anticipated to drive the demand for petrochemical filtration. The rising investment in petrochemical plants is driven by increasing demand for products such as plastics, synthetic fibers, fertilizers, and chemicals as economies develop and populations grow.

-

BY REGIONThe Asia Pacific is expected to be the fastest-growing refinery and petrochemical filtration market during the forecast period. Countries in this region have undergone rapid industrialization, which has fueled the demand for crude oil and petroleum products. Increasing investment in the development of refineries and petrochemical plants is driving the refinery and petrochemical filtration market growth.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, 3M, Parker Hannifin Corp., and Pall Corporation have entered into a number of collaborations and partnerships to cater to the growing demand for refinery and petrochemical filtration.

The petrochemical and refinery filtration market is increasingly driven by the rising emphasis on operational efficiency, regulatory compliance, and environmental sustainability. As global refineries and petrochemical plants confront challenges related to stricter emission standards, water conservation, and process optimization, filtration technologies have become essential for ensuring product quality, minimizing waste, and extending equipment lifespan. Growing concerns over pollution control, resource management, and the need for advanced separation solutions are accelerating the adoption of next-generation filtration systems across the industry. Additionally, the shift towards digitalization and integrated monitoring enables plants to achieve predictive maintenance, reduce downtime, and enhance reliability. Modern filtration solutions leveraging innovations in material science and smart monitoring align with broader industry trends focused on sustainability, energy efficiency, and regulatory compliance, ensuring the market's continued evolution and resilience.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The refinery and petrochemical filtration market is estimated to record a CAGR of 5.9% during the forecast period. The increase in investment in refinery and petrochemical infrastructure development is expected to drive the refinery and petrochemical filtration market. The increasing shale oil and gas adoption worldwide is also likely to create lucrative growth opportunities for the refinery and petrochemical filtration market players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Implementation of government mandates and policies for environmental protection

-

Increasing expenditure on refinery and petrochemical infrastructure development

Level

-

Availability of low-cost and inferior-quality filtration products

-

Increasing focus on use of renewable energy

Level

-

Rising shale development activities to enhance shale refining potential

-

Expanding transportation sector

Level

-

Supply chain constraints

-

Frequent replacement and disposal of filters

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Implementation of government mandates and policies for environmental protection

Globally, there is an increasing emphasis on environmental protection laws and regulations designed to address the adverse impacts of carbon emissions. These frameworks focus on promoting the use of non-hazardous substances, encouraging modifications in production processes, and advancing the adoption of sustainable conservation practices. A key aspect of these regulations is the push for material reutilization, which reduces waste generation and minimizes environmental pollution. By fostering recycling and resource efficiency, such measures contribute to cleaner industrial operations and lower ecological footprints. North America and Europe have been early adopters of stringent environmental protection laws, setting benchmarks for emissions control and sustainable practices. These regions have established comprehensive regulatory frameworks that not only set emission limits but also incentivize companies to invest in cleaner technologies. Meanwhile, developing economies across the Asia Pacific, the Middle East, and Africa are progressively implementing similar emissions standards as part of broader efforts to curb pollution and align with international climate goals.

Restraint: Availability of low-cost and inferior-quality filtration products

The prices of refinery and petrochemical filters vary widely based on the product type and filter media used in the filter. To maintain consistent filtrate quality, manufacturers follow different industry standards. These filters are essential in refineries and petrochemical plants. They remove contaminants, avoid unexpected operational issues, lower the maintenance costs, and save natural resources. The technology and performance demand for these products lead to their relatively high prices. The industry also deals with significant competition from gray market products. These products provide low-cost alternatives and maintenance services but often lack quality. They threaten brand value and create risks for buyers who focus more on price than performance.

Opportunity: Rising shale development activities to enhance shale refining potential

Shale and oil sands are significant energy sources in North America, South America, and Asia Pacific. North America has rapidly grown its unconventional resources like shale and tight oil, driven by horizontal drilling and hydraulic fracturing. Shale's growth is supported by discoveries and tech advances. However, refining constraints challenge this expansion, as many facilities aren't built for light shale crude. In the US, most refineries suit heavier crude, mismatching supply from regions like the Permian Basin, with limited export options. This will likely lead to substantial investment in shale refining infrastructure. According to the International Energy Agency (IEA), Canada, along with Iraq, Brazil, and Iran, will play a major role in global oil production in the coming years. Canadian oil sands output is projected to rise from 2.4 million barrels per day in 2015 to 3.8 million by 2040. In Canada, pressure pumping has become a common method for oil and gas extraction. At the same time, growing shale development in countries like China, the U.S., and Argentina is fueling production activities. This surge is creating a stronger need for refinery and petrochemical infrastructure, along with more advanced filtration systems to support efficient and sustainable operations.

Challenge: Supply chain constraints

The refinery and petrochemical industry is vital to the global economy. It supplies fuels and chemical products to support transportation and various other industries. However, manufacturers of filtration products face significant supply chain challenges that impact production and profits. A major concern is the limited availability of specialized raw materials, like specific filter media, which are necessary for making high-quality filters. Shortages can delay production and increase costs as manufacturers pay extra to secure supplies.

refinery and petrochemical filtration market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A Texas refinery operating two coking units encountered significant issues with its hydrocracking unit’s high-temperature gas oil backwash feed filter system, especially due to increased use of opportunity crudes. The main problem was frequent unscheduled maintenance caused by persistent filter element changeouts for external cleaning, which led to safety concerns and costly maintenance. These challenges resulted in operational setbacks and high expenses, particularly after the turnaround cycle began, making filter maintenance a continuous burden. | To resolve these problems, Jonell Systems implemented a pre-filtration solution by installing a custom-engineered High-Temperature High Flow Cartridge Filter upstream of the backwash feed filter. This resulted in completely eliminating external filter element cleaning and significantly reduced filter maintenance needs. The refinery achieved savings of approximately USD 2 million per year in filter maintenance, and the reduced catalyst changeouts contributed to multi-million dollar cost reductions, ultimately exceeding USD 50 million in savings over six years. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The refinery and petrochemical filtration market ecosystem integrates a range of companies across multiple value chain stages, each contributing to the performance, reliability, and sustainability of critical filtration operations. At the filtration manufacturing stage, leading players such as 3M (US), Eaton (Ireland), Pall Corporation (US), and Camphill (Sweden) design and supply high-efficiency filters and separation systems tailored for demanding refinery and petrochemical processes, including particulate, liquid, and gas phase contaminant removal. These manufacturers continually innovate in filter media and separation technology to meet rigorous safety, product quality, and environmental requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Refinery and Petrochemical Filtration Market, By Filter type

The bag filter segment is the second-largest and is growing quickly due to its versatility, efficiency, and cost-effectiveness. Bag filters play a crucial role in filtering fluids. The particles suspended in fluids pass through the filter bag and settle inside, effectively removing solid contaminants. In refineries and petrochemical plants, bag filters are widely used in various processing stages. They clean feedstocks by removing solid particles and impurities before the material enters the processing unit, helping protect equipment and ensuring smoother refinery operations.

Refinery and Petrochemical Filtration Market, By Application

The liquid-liquid separation segment holds the second-largest share in the refinery and petrochemical filtration market due to its critical role in the downstream oil & gas sector. The high share of the liquid-liquid segment is driven by increasing refining capacity worldwide, stringent regulations for cleaner fuels, and the need to enhance operational efficiency, product purity, and equipment lifespan through effective water and impurity removal.

Refinery and Petrochemical Filtration Market, By End User

The refineries segment is expected to account for the largest market share throughout the forecast period. This is driven by significant investments in upgrading and expanding refining facilities around the world. The increase in refining capacity is driven by rising global energy demand and a steady supply of oil and gas. This situation creates a need for effective filtration solutions to ensure efficient operations, product quality, and adherence to strict environmental standards. Modern refining processes require efficient filtration to protect equipment, maintain output quality, and reduce downtime.

REGION

North America to be the largest region in the global rifinery and petrochemical filtration market during the forecast period

North America is estimated to be the largest refinery and petrochemical filtration market during the forecast period. Industries in North America are constantly evolving, with new developments and emerging trends. The region's energy consumption growth, coupled with the development of oil and gas production and refining capacities, drives the market for refinery and petrochemical filtrations.

refinery and petrochemical filtration market: COMPANY EVALUATION MATRIX

In the petrochemical and refinery filtration market matrix, 3M (Star) leads with a strong market presence and broad technology portfolio, enabling large-scale adoption across critical refining and petrochemical processes focused on safety, product quality, and regulatory compliance. Camfil (Emerging Leader) is rapidly gaining industry traction with advanced filtration solutions that cater to evolving sustainability and efficiency requirements in modern plants.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.81 Billion |

| Market Forecast in 2030 (Value) | USD 6.76 Billion |

| Growth Rate | CAGR of 5.9% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: refinery and petrochemical filtration market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- May 2025 : Eaton launched three high-performance hydraulic filter series: DUA, LWF, and DNR, which are designed for industrial and lubrication filtration. The DUA duplex filter supports continuous operation under pressures up to 320 psi, which is ideal for power plants and manufacturing. The LWF in-line pressure filters offer flexibility on suction, pressure, or return lines with pressures up to 232 psi. The DNR duplex filter features a three-way valve for uninterrupted filtration, which is suitable for lubrication in gearboxes and turbines. All provide durability, efficiency, and reliability for power generation, manufacturing, and petrochemical sites.

- April 2024 : Eaton launched SENTINEL MAXPO and DURAGAF MAXPOXL specialty filter bags designed for oil, chemical, and petrochemical filtration. These polypropylene needle felt bags feature a fully welded construction with an additional internal melt-blown polypropylene core that enhances dirt-holding capacity and oil absorption. The DURAGAF MAXPOXL range offers a two—to five-times longer lifespan than standard bags, reducing operational costs. Both ranges are available with nominal retention rates from 1 to 200 µm, optimizing filtration efficiency and durability in industrial applications.

- May 2023 : 3M partnered with Svante to develop and scale advanced carbon capture filtration materials for industrial and refinery applications. 3M leverages its filtration technology expertise to mass-produce materials for direct air capture and point-source carbon capture in refineries and petrochemical plants.

- March 2023 : Porvair Filtration Group launched new products: Biofil 3, Biofil 3 Plus, Hydrofil Junior, and Sinterflo WF—all part of expanded filtration product ranges. Some products are applicable as pre-filters or polishing filters in chemical, petrochemical, and related industrial applications.

Table of Contents

Methodology

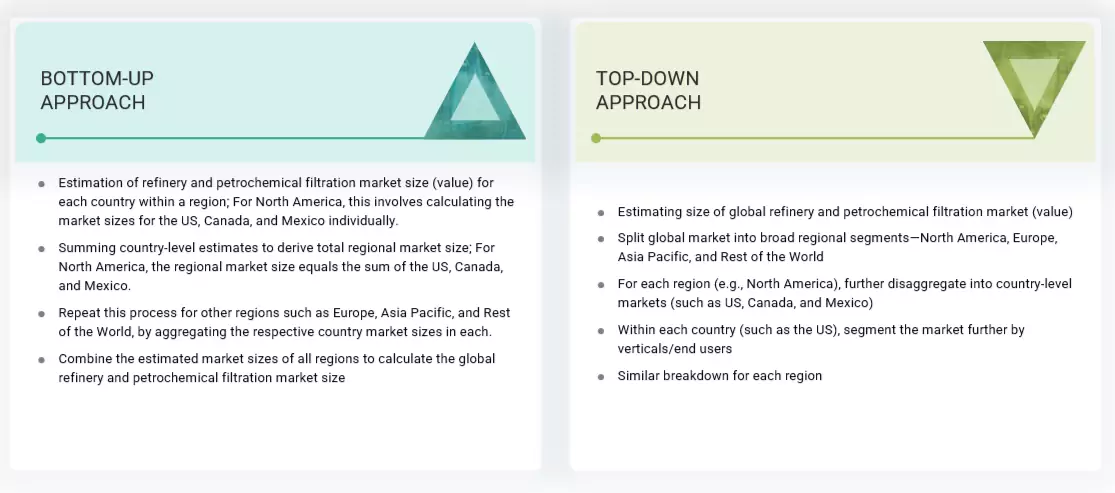

The study involved major activities in estimating the current size of the refinery and petrochemical filtration market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the refinery and petrochemical filtration market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the refinery and petrochemical filtration market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

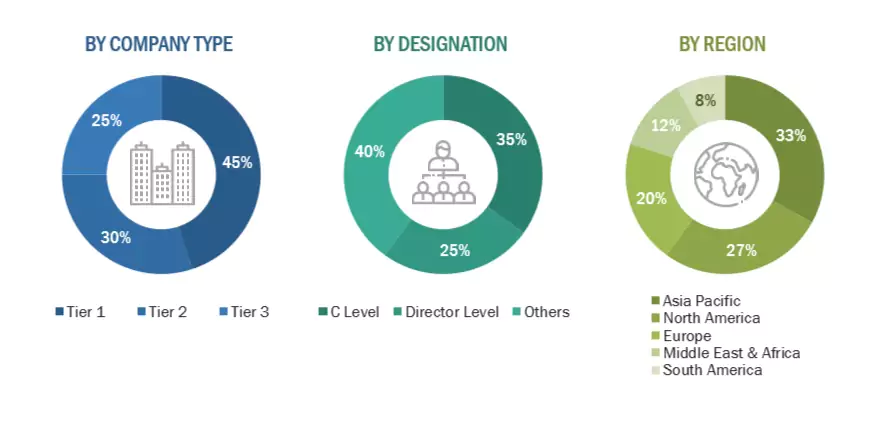

The refinery and petrochemical filtration market comprises several stakeholders, such as refinery and petrochemical filtration manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for refinery and petrochemical filtration in liquid-liquid separation, liquid-gas separation, and other applications. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Note: “Others” include sales managers, engineers, and regional managers

The tier of the companies is defined on the basis of their total revenue as of 2024; Tier 1 = > USD 1

billion, Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the refinery and petrochemical filtration market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Refinery and Petrochemical Filtration Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

The refinery and petrochemical filtration market refers to the specialized filtration systems used in refineries and petrochemical plants. These filtration systems remove impurities, contaminants, and particles from process streams, ensuring product quality, protecting equipment, and maintaining smooth operations. Various types of filters, such as cartridge, bag, filter press, coalescers, and electrostatic precipitators, among others, are employed for this purpose. The growth of the refinery and petrochemical filtration market can be attributed to the development of the downstream sector across major countries in North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Stakeholders

- Associations, forums, and alliances related to the refinery and petrochemical filtration market

- Consulting companies in the energy sector

- Government and research organizations

- Refinery owners

- Petrochemical plant owners

- Public and private downstream companies

- State and national regulatory authorities

- Energy management companies

- Government & research organizations

- OEMs

- Refinery and petrochemical filtration equipment manufacturers

- Support infrastructure equipment providers

- Oil and gas engineering, procurement, and construction (EPC) companies

Report Objectives

- To define, describe, and forecast the refinery and petrochemical filtration market based on filter type, end user, application, and region, in terms of value and volume

- To describe and forecast the refinery and petrochemical filtration market for various segments with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the refinery and petrochemical filtration value chain, along with industry trends, use cases, security standards, and Porter’s five forces analysis

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments in the refinery and petrochemical filtration market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market.

- To analyze growth strategies adopted by market players, such as partnerships, mergers & acquisitions, agreements, and product launches, in the refinery and petrochemical filtration market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What is the current size of the refinery and petrochemical filtration market?

The size of the refinery and petrochemical filtration market is USD 4.81 billion in 2024.

What are the major drivers for the refinery and petrochemical filtration market?

Implementation of government mandates and policies for environmental protection and increasing downstream infrastructure investments are the major driving factors for the refinery and petrochemical filtration market.

Which region is estimated to account for the largest share of the refinery and petrochemical filtration market during the forecasted period?

North America is expected to dominate the refinery and petrochemical filtration market between 2025 and 2030, followed by Asia Pacific and the Middle East & Africa. Rising energy demand and increased downstream investments are driving the market in this region.

Which is the largest segment, by filter type, in the refinery and petrochemical filtration market during the forecasted period?

The coalescer segment is estimated to account for the largest market share during the forecast period. Coalescers are widely used for separating liquids from liquids and gases in process streams in refineries and the petrochemical industry.

Which is the fastest-growing end user of the refinery and petrochemical filtration market during the forecasted period?

The petrochemical industry segment is expected to be the fastest-growing end user during the forecast period due to the massive investment in petrochemical industry infrastructure to cater to the increasing demand for different petrochemicals in various industries.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Refinery and Petrochemical Filtration Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Refinery and Petrochemical Filtration Market