RIP & RIF Bushings Market

RIP & RIF Bushings Market by Type (Resin-impregnated Paper Bushings, Resin-impregnated Fiberglass Bushings), Application (Transformer, Switchgear, Other Applications), End User (Utilities, Industrial, Residential & Commercial), and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The RIP & RIF bushings market is projected to grow from USD 1.16 billion in 2024 to USD 1.83 billion by 2032, registering a CAGR of 5.9% during the forecast period. The global market is driven by several key factors that underscore its growing significance across industries. The increasing focus on renewable energy generation and grid modernization projects fuels the demand for advanced electrical bushings, particularly in high-voltage applications.

KEY TAKEAWAYS

-

BY TYPEKey type segments include RIP and RIF. The resin-impregnated paper bushings segment held the largest share of the global RIP & RIF bushings market in 2024 due to its superior electrical and mechanical performance, reliability, and cost-effectiveness in high-voltage and ultra-high-voltage applications. RIP bushings are preferred for their excellent thermal conductivity, low partial discharge characteristics, and reduced risk of insulation failure, making them ideal for critical power equipment, such as transformers, switchgear, and circuit breakers.

-

BY APPLICATIONKey application segment includes transformers, switchgears and other applications. The transformers segment is estimated to capture the largest market share in 2032, driven by its indispensable role in high-capacity power transmission and distribution networks. Transformers rely on bushings for safe and efficient current flow, especially in high-voltage environments, making them a critical component in energy infrastructure.

-

BY END USERKey end user segment includes utilities, industrial and residential & commercial. The utilities segment captured the largest market share in 2024 due to the critical role utilities play in power generation, transmission, and distribution. With ongoing urbanization and the increasing demand for reliable electricity, utilities consistently upgrade their infrastructure, which heavily depends on bushings for operational efficiency and safety.

-

BY REGIONThe RIP & RIF Bushings market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific held the largest share of the global RIP & RIF bushings market in 2023 and is projected to witness the highest CAGR during the forecast period due to rapid industrialization and urbanization across key economies, such as China, India, and Southeast Asian nations. These countries heavily invest in energy infrastructure development to meet the rising electricity demand from expanding residential, commercial, and industrial sectors.

-

COMPETITIVE LANDSCAPEThe market is moderately competitive, with Key players operating in the global RIP & RIF bushings market are ABB (Switzerland), Siemens (Germany), Eaton (Ireland), General Electric Company (US), Hitachi Energy Ltd. (Switzerland), Trench Group (Germany), RHM International, LLC (US), Bushing (Beijing) HV Electric Co., Ltd. (China), Yash Highvoltage Insulators Pvt. Ltd., Nu-Cock Products Pvt. Ltd. (India), and PFISTERER Holding SE (Germany), among others.

The global RIP & RIF bushings market is experiencing robust growth, fueled by increased investment in modernizing power infrastructure, the rising adoption of renewable energy, and the surge in electricity demand across both developed and developing economies. As utilities and industrial sectors emphasize grid reliability and efficiency, the demand for advanced, high-performance electrical components, such as RIP & RIF bushings, is on the rise. These bushings are essential for ensuring the safe and efficient operation of high-voltage equipment, including transformers and switchgears, especially in applications that require superior insulation and mechanical strength. Additionally, the growing global focus on decarbonization and energy transition enhances the market’s trajectory as renewable energy projects and grid expansion initiatives continue to proliferate.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from evolving energy demand trends and technological disruptions. Utilities and industrial users are key clients of RIP & RIF Bushings manufacturers, and their downstream applications include residential, commercial, and renewable energy sectors. As the energy landscape transitions toward smart grids, distributed generation, and broad electrification, the revenue and market opportunities for end users and bushing suppliers change accordingly.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Mounting demand for reliable power due to industrialization

-

. Rapid modernization of aging grid infrastructure

Level

-

High initial and upfront costs

-

. Availability of low-cost alternatives

Level

-

Increase in integration of renewable energy into power grids

-

. Rise in emphasis on expansion of smart grid infrastructure

Level

-

Complex manufacturing and customization requirements

-

. Complexities associated with maintenance and replacement

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Mounting demand for reliable power due to industrialization

In 2023, a decline in electricity consumption in developed nations contributed to a 2.2% increase in global power demand. While countries such as China, India, and several Southeast Asian nations experienced rising electricity demand, advanced economies saw notable reductions. This drop in demand was primarily due to sluggish economic conditions and high inflation, which hindered manufacturing and industrial activities. Over the next three years, global electricity demand is expected to grow rapidly, with an average annual growth rate of 3.4% projected through 2026. This anticipated growth is likely to be driven by economic expansion, boosting electricity demand in developed and emerging economies.

Restraint: High initial and upfront costs

High initial costs associated with electrical bushings significantly restrain the growth of the global RIP & RIF bushings market. Electrical bushings are critical components in various high-voltage applications, including transformers, switchgear, and other electrical equipment. However, the advanced materials and technologies used in their production—especially for medium- and high-voltage bushings—substantially increase their upfront costs. The expenses related to high-quality insulation materials, such as polymeric or glass bushings, and the specialized manufacturing processes for these components contribute to higher prices.

Opportunity: Increase in integration of renewable energy into power grids

The International Energy Agency projects that energy investments in 2023 will total approximately USD 2.8 trillion. Of this amount, over USD 1.7 trillion is dedicated to clean energy applications, which include renewable power, nuclear energy, electrical grids, energy storage, low-emission fuels, efficiency improvements, and renewables for electrification. Several factors are driving this increase in clean energy investments. These include the economic advantages arising from high and fluctuating fossil fuel prices, strong policy support such as the US Inflation Reduction Act, and new government-led initiatives focused on grid modernization in Europe, Japan, China, and other regions. Additionally, there is a concerted effort to align climate objectives with energy security, particularly in regions dependent on energy imports, along with strategic industrial policies to secure positions in the growing clean energy market.

Challenge: Complex manufacturing and customization requirements

The global RIP & RIF bushings market faces significant challenges due to complex manufacturing processes and the growing demand for customization. Electrical bushings are essential components in power transmission and distribution systems, designed to provide insulation and ensure the safe passage of electrical current through grounded barriers. However, precise specifications required for different voltage levels, environmental conditions, and application types necessitate advanced manufacturing techniques and tailored designs, which can hinder production efficiency and increase costs. This complexity stems from the various materials and processes involved.

RIP RIF bushings market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implementation of BIIT bushing (RIF bushing with integrated low-power instrument transformers) manufactured by RHM International. Features a dry-type capacitance-graded insulation structure with three capacitive screens for insulation, voltage division, and EMI immunity. Integrates sensor, collector, and converter; designed for smart grid/IEC 61850 compliance. | Simplifies and reduces maintenance, ensures cost-effective, robust operation, enhances monitoring and diagnostic capabilities, and enables greater reliability, precision, and remote integration with smart grid systems. |

|

Upgrade of medium-voltage switchgear with Siemens SIBushing—an intelligent cable connection bushing with low-power instrument transformers (LPIT). Enables accurate measurement, advanced protection (SIPROTEC 7SY82), and real-time grid management. Fault/local heating detection and predictive maintenance supported via integrated sensors and control center links. | Achieves sustainable, secure, and efficient power supply, supports integration of renewables, improves fault detection and response, enables real-time monitoring, and sets a benchmark for intelligent grid management and transparency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The RIP & RIF Bushings market ecosystem is composed of a well-integrated network of raw material suppliers, manufacturers, distributors, and end users, working together to meet the growing demands of modern power infrastructure. Raw material suppliers such as Elkem, BASF, and 3M provide advanced materials critical for producing high-performance bushings. Manufacturers and assemblers like GE, Hitachi Energy, and Trench design and produce RIP & RIF bushings, leveraging these materials to create reliable, maintenance-free insulation solutions suited for high-voltage transmission and distribution systems. These products are then distributed by key players, including Graybar, Rexel, and Sonepar, who facilitate a broad market reach and support to utilities and industrial users. Major end users such as National Grid, Duke Energy, and China Southern Power Grid implement these bushings in their power networks to enhance grid reliability, operational efficiency, and comply with evolving environmental and safety standards. The ecosystem's development is guided by regulatory bodies like IEC, IEEE, and the Bureau of Indian Standards, which set global standards to ensure quality, safety, and interoperability across the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

RIP & RIF Bushings Market, By Type

The resin-impregnated Paper bushings (RIP) segment is estimated to hold a larger market share during the forecast period due to widespread adoption of RIP bushings, particularly in high-voltage applications. The rise of RIP bushings can specifically be attributed to their large installation in voltage rating use with transformers and switchgears, owing to their advantageous performance characteristics compared to traditional oil-impregnated bushings. They offer improved dielectric performance and thermal stability along with greater ability to resist moisture and contaminants from the environment.

RIP & RIF Bushings Market, By Application

The transformers segment is expected to be the largest application in the RIP & RIF bushings market throughout the forecast period because of the continuing growth and modernization of transmission and distribution infrastructure development around the world. The transformers are key components of electrical grid systems, and bushings are essential interfaces for safely transferring high-voltage current beyond the grounded enclosure. Demand for electricity is increasing, urbanization is accelerating the need for increased capacity for electricity delivery to consumers, and large amounts of renewable energy are being incorporated into the electrical grid. The increase in the number of power and distribution transformers needed will continue to increase significantly over the forecast period.

RIP & RIF Bushings Market, By End user

Utilities are expected to experience the highest growth rate in the global RIP & RIF bushings market from 2025 to 2032. This is due to utility companies focusing more on modernizing aging infrastructure grids and improving operational reliability. Incorporating renewable energy sources into the existing power transmission and distribution networks adds complexity. With the increasing use of renewable energy sources, there is an additional requirement for supreme-grade insulating materials that endure high voltages, environmental stress, and maintenance-free longevity in service.

REGION

Asia Pacific to be the largest region in the global RIP & RIF Bushings market during the forecast period

Asia Pacific will lead the global RIP & RIF bushings market during the forecast period, driven by urbanization, increasing power demand, and heavy investments in grid infrastructure among key economies such as China, India, Japan, and South Korea. The region is witnessing large-scale grid modernization, renewable integration, and electrification projects, all of which necessitate upgraded power transmission and distribution equipment such as superior-quality bushings. Government-sponsored rural electrification programs, smart grid installations, and substation expansion are also promoting the use of resin-impregnated paper and fiberglass bushings.

RIP RIF bushings market: COMPANY EVALUATION MATRIX

In the RIP & RIF Bushings market matrix, ABB stands out as the Star Player, holding a leading position through a robust global presence and a broad product portfolio that caters to high-performance and eco-friendly solutions for utilities, industrials, and renewable energy sectors. RHM International, as the Emerging Leader, is gaining market momentum with its advanced dry-type RIP/RIF bushing technologies and integrated sensing features.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.16 BN |

| Revenue Forecast in 2032 | USD 1.83 BN |

| Growth Rate | 5.90% |

| Actual data | 2021–2032 |

| Base year | 2024 |

| Forecast period | 2024–2032 |

| Units considered | Value (USD BN), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: RIP RIF bushings market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End User & Application Segmentation | Comprehensive list of RIP & RIF bushings customers segmented by utilities, industrial, and residential & commercial end users. | Insights into demand and growth trends, plus addressable market size and opportunity breakdown across each end user segment. |

RECENT DEVELOPMENTS

- October 2024 : Siemens partnered with Alliander, a prominent Dutch network company, to enhance flexibility management and support the energy transition. This collaboration aims to address significant challenges in distribution grid management. Alliander will utilize Siemens’ Gridscale X platform to minimize congestion and improve overall grid utilization.

- October 2024 : Trench Group agreed with GE Vernova’s Grid Solutions. Through this partnership, Trench Group will supply essential high-voltage components, including power transformer bushings, HVDC wall bushings, coils, and instrument transformers. This collaboration highlights Trench Group's expertise in high-voltage components, particularly for High Voltage Direct Current (HVDC) applications, which are crucial for advancing global energy infrastructure.

- September 2024 : Siemens acquired Trayer Engineering Corporation, which is known for its innovative switchgear solutions. This acquisition is intended to enhance Siemens’s product portfolio in the grid technology sector, specifically focusing on improving the reliability and resilience of power distribution networks. By integrating Trayer Engineering’s expertise, Siemens aims to provide more comprehensive and advanced solutions that address the evolving demands of the energy market.

- 2023 : ABB expanded its partnership with Northvolt to electrify Revolt Ett, the world’s largest battery recycling facility. This partnership involves battery recycling, with ABB providing process electrification to Revolt Ett, which Northvolt established in Skellefteå, northern Sweden.

Table of Contents

Methodology

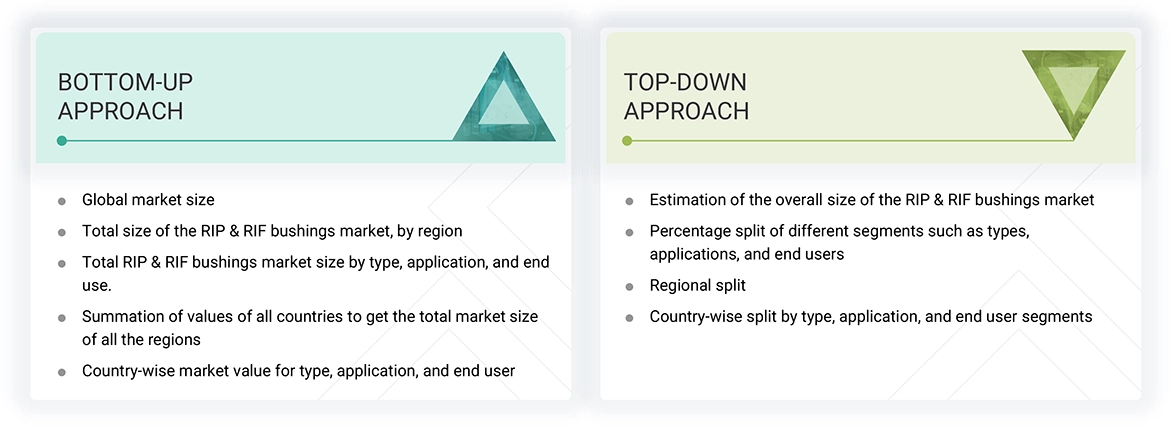

The study involved major activities in estimating the current size of the RIP & RIF bushings market. Exhaustive secondary research was done to collect information on the peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

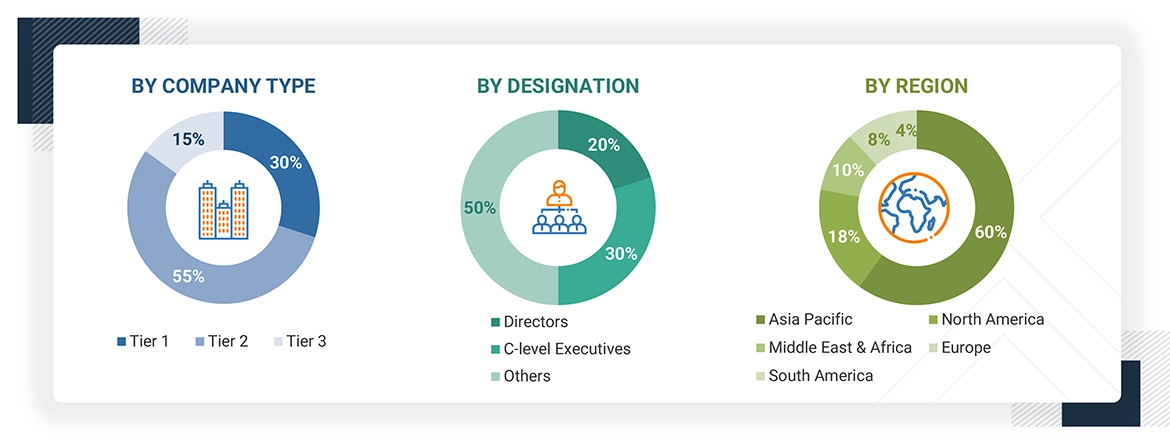

The primary research for this report involved interviews with sources from both the supply and demand sides to gather qualitative and quantitative insights. Supply-side sources included industry experts such as CEOs, VPs, and marketing directors from companies in the RIP & RIF bushings market.

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. The following is the breakdown of primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the RIP & RIF bushings market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

RIP & RIF Bushings Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

RIP & RIF bushings are critical components in power transmission and distribution systems, serving as insulators that enable electrical conductors to pass safely through grounded barriers, such as walls, transformers, or circuit breakers. They are designed to withstand high voltage while maintaining insulation and mechanical support, ensuring efficient and safe current flow in various applications, such as transformers, switchgears, and circuit breakers, among others.

Stakeholders

- Component manufacturers and suppliers

- Power sector consulting companies

- Electric utilities

- Electrical bushing manufacturers and suppliers

- Government and power research organizations

- Manufacturing industries

Report Objectives

- To define, describe, segment, and forecast the RIP & RIF bushings market, by type, application, end user, and region, in terms of value

- To forecast the market size for five key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their key countries, in terms of value

- To provide detailed information about drivers, restraints, opportunities, and challenges, value chain analysis, Porter’s five forces analysis, trade analysis, case study analysis, and technology analysis, and Gen AI/AI impact analysis influencing the growth of the market

- To strategically analyze the subsegments concerning individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To analyze competitive developments, such as product launches, acquisitions, and expansions, in the RIP & RIF bushings market

- To study the macroeconomic outlook and the impact of generative AI/AI on the RIP & RIF bushings market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What is the size of the RIP & RIF bushings market in 2024?

The RIP & RIF bushings market was valued at USD 1.16 billion in 2024.

What are the major drivers for the RIP & RIF bushings market?

The demand for reliable power transmission, rapid grid modernization, and increased adoption of renewable energy drives the RIP & RIF bushings market. Rising electricity consumption across various sectors and the need for compact and durable insulation solutions are boosting market growth. Additionally, investments in smart grids, high-voltage infrastructure, and replacing aging electrical components further accelerate global adoption.

What is the largest RIP & RIF bushings market during the forecast period?

During the forecast period, Asia Pacific is expected to be the largest RIP & RIF bushings market. This dominance is driven by rapid urbanization, extensive grid infrastructure development, rising industrialization, and increasing renewable energy installations across countries such as China, India, Japan, and South Korea. Government initiatives to modernize power transmission networks and expand access to reliable electricity in rural and urban areas fuel the demand for advanced bushing technologies in the region.

Which type is expected to hold the largest market share during the forecast period and why?

Due to their high mechanical strength, better insulation, fire resistance, and environmental sustainability, the Resin-impregnated Paper (RIP) bushings segment is expected to lead the RIP & RIF Bushings market. Their dry-type construction eliminates oil leak risks, making them ideal for modern transformers and switchgear in high-voltage and environmentally sensitive areas.

Which end user will hold most of the market share in the coming years?

During the forecast period, the utilities segment will dominate the RIP & RIF bushings market due to rising investments in transmission and distribution infrastructure, increased electrification, and the need for reliable grid modernization. Utilities favor RIP & RIF bushings for their high performance, safety, and low maintenance, especially in high-voltage applications. As the shift toward smart grids and renewable energy continues, utility companies seek durable insulation solutions for a consistent power supply, strengthening their market position.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the RIP & RIF Bushings Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in RIP & RIF Bushings Market