Electrical Bushings Market

Electrical Bushings Market by Type (Oil Impregnated Paper, Resin Impregnated Paper, Others), Insulation Material (Porcelain, Polymer, Glass), Application (Transformer, Switchger), Voltage, End User, and Region - Global Forecast 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The electrical bushings market is expected to grow from an estimated in USD 3.67 billion in 2024 to USD 4.77 billion by 2029, at a CAGR of 5.4% during the forecast period. The electrical bushing market is driven by the rising demand for reliable power transmission and distribution infrastructure across utilities and industrial sectors. Rapid expansion of renewable energy projects, grid modernization initiatives, and the integration of high-voltage equipment are increasing the need for advanced bushings with improved insulation and thermal performance. Growth in urbanization and industrialization, particularly in emerging economies, is accelerating investments in substations and transformers. Additionally, replacement of aging grid infrastructure and the shift toward higher voltage ratings to reduce transmission losses are further supporting sustained demand for electrical bushings worldwide.

KEY TAKEAWAYS

-

BY REGIONThe electrical bushings market for the Asia Pacific region is estimated to dominate with a share of 46.1% in 2024.

-

BY TYPEBy Type, the Oil impregnated paper bushings segment is expected to hold largest market share of 55% by 2029 during the forecast period.

-

BY INSULATION MATERIALBy Insulation Material, the polymer segment is expected to witness highest CAGR of 5.9% in the electrical bushings market during the forecast period.

-

BY VOLTAGEBy Voltage, the above 230 kv segment is expected to expected to witness highest CAGR of 6.0% in the electrical bushings market during the forecast period.

-

BY APPLICATIONBased on by application, the tranformers segment is estimated to dominate with a share of 68.2% by 2029

-

BY END USERBy end user, the utilities segment is expected to account for the largest share of the electrical bushings market in 2024.

-

COMPETITIVE LANDSCAPEMajor players in the electrical bushings market are adopting both organic and inorganic strategies, including partnerships and investments, to expand their market presence. Companies such as Siemens, ABB, and electrical bushings are actively forming collaborations to meet the growing demand for advanced delectrical bushings solutions.

-

COMPETITIVE LANDSCAPEThe strong product ecosystem and global market penetration of LIYOND ELECTRIC CO., LTD., BTRAC LTD, MARS Transformers position them among the most influential startups and SMEs in the electrical bushings landscape.

The electrical bushing industry is also driven by rising investments in high voltage and ultra-high voltage transmission lines to facilitate the transfer of electricity over a longer distance. The increasing use of electricity in railroad systems, data centers, and industrial applications provides a thrust to the demand for electrical bushings that facilitate safety and efficiency in applications. Technological innovations such as resin-impregnated paper or polymer bushings are becoming increasingly popular due to their easy maintenance and long lifespan. In addition, the increasing need to meet safety standards while designing electrical equipment has led to the rising demand for high-performance bushings.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The graph emphasizes the trends and disruptions in the customer business in the electrical bushing industry. The graph not only depicts the decline in the share of classical technologies like oil-impregnated paper and porcelain bushing, but also shows the rising importance of newer technologies like RIP, RIS, polymer, and smart bushing. The increasing demand for high voltage and eco-insulation materials is pushing the need for smarter bushing technologies like digitalization, IoT, and predictive analysis. The increasing importance of smart grids, Industry 4.0, and predictive analysis in the utilities, and customer businesses is anticipated to shape the revenue growth in the corresponding bushing technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Mounting demand for reliable power due to industrialization

-

Rapid modernization of aging grid infrastructure

Level

-

High initial and upfront costs

-

Availability of low-cost alternatives

Level

-

Increasing integration of renewable energy into power grids

-

Rising emphasis on expansion of smart grid infrastructure

Level

-

Complex manufacturing and customization requirements

-

Complexities associated with maintenance and replacement

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Mounting demand for reliable power due to industrialization

The increasing demand for reliable power is a major electrical bushings market driver. Multiple factors fuel this demand. As people migrate to cities, the need for robust power infrastructure to support homes, businesses, and industries intensifies. Growing economies and increasing disposable incomes fuel the demand for electricity-powered appliances and consumer goods, putting additional strain on power grids. Expanding industrial activity globally translates to a significant increase in electricity consumption for powering machinery and production processes. Such expansion necessitates developing and upgrading power infrastructure, including transformers and switchgear, which rely heavily on high-performance electrical bushings to ensure safe and efficient operation.

Restraint: High initial and upfront costs

High initial costs associated with electrical bushings significantly restrain the growth of the global electrical bushings market. Electrical bushings are critical components in various high-voltage applications, including transformers, switchgear, and other electrical equipment. However, the advanced materials and technologies used in their production—especially for medium- and high-voltage bushings—substantially increase their upfront costs. The expenses related to high-quality insulation materials, such as polymeric or glass bushings, and the specialized manufacturing processes for these components contribute to higher prices.

Opportunity:Increasing integration of renewable energy into power grids

The expansion of smart grid infrastructure presents a significant opportunity for the global electrical bushings market. Smart grids, designed to enhance the efficiency, reliability, and sustainability of electricity systems, are rapidly adopted worldwide. These advanced grids incorporate digital communication technologies, sensors, and automation to effectively manage electricity flow, leading to a growing demand for high-quality electrical components such as bushings. Additionally, smart grid infrastructure supports the integration of distributed energy resources (DERs), such as rooftop solar, electric vehicles (EVs), and energy storage systems. According to the US Energy Information Administration (EIA), DER capacity is expected to grow by 15% annually through 2030. This growth necessitates advanced grid infrastructure with enhanced flexibility and connectivity, driving demand for bushings that meet the high-performance standards of modern grid equipment.

Challenge: Complex manufacturing and customization requirements

The global electrical bushings market is facing significant challenges due to complex manufacturing processes and the growing demand for customization. Electrical bushings are essential components in power transmission and distribution systems, designed to provide insulation and ensure the safe passage of electrical current through grounded barriers. However, precise specifications required for different voltage levels, environmental conditions, and application types necessitate advanced manufacturing techniques and tailored designs, which can hinder production efficiency and increase costs. This complexity stems from various materials and processes involved.

ELECTRICAL BUSHINGS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hitachi Energy collaborated with a European transmission system operator (TSO) to upgrade 400 kV extra-high-voltage transformers as part of a grid reliability and safety enhancement program. The project involved replacing conventional oil-impregnated paper (OIP) bushings with resin-impregnated paper (RIP), oil-free bushings equipped for condition monitoring. The upgrade was critical to support higher power flows from cross-border interconnections and growing renewable energy integration. | The oil-free RIP bushings significantly reduced fire and environmental risks, improved insulation reliability, and lowered maintenance requirements. Enhanced thermal and electrical performance enabled higher load capability and extended transformer service life. The modernization improved grid availability, supported compliance with strict European safety regulations, and strengthened the operator’s ability to integrate variable renewable energy sources. |

|

Siemens partnered with Technische Betriebe Glarus Nord (TBGN), a Swiss distribution grid operator serving ~20,000 residents, to modernize a 16 kV medium-voltage distribution substation. Facing increasing grid complexity due to renewable integration and mountainous terrain, TBGN required improved measurement accuracy, fault detection, and real-time grid transparency. Siemens deployed its SIBushing technology, an intelligent cable connection bushing with integrated low-power instrument transformers (LPITs), combined with SIPROTEC protection relays across transformer and circuit-breaker panels. | The smart bushing solution enabled accurate current and voltage measurement, real-time condition monitoring, and rapid fault isolation during overloads or short circuits. Integrated temperature sensors improved cable health monitoring and predictive maintenance. The deployment enhanced grid transparency, operational efficiency, and safety while supporting sustainable power supply and renewable integration, positioning TBGN as a benchmark utility for intelligent medium-voltage grid management. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The electrical bushing market ecosystem spans the full value chain, from raw materials to end-user utilities. Raw material suppliers such as Elkem, 3M and BASF provide specialty polymers, silicones and insulating compounds that enable high-performance bushings. Manufacturers and assemblers including GE, Hitachi Energy and Trench convert these materials into engineered bushing solutions for transmission and distribution networks. Distributors like Graybar, Rexel and Sonepar manage logistics, inventory and channel reach to utilities worldwide. End users such as National Grid, Duke Energy and China Southern Power Grid deploy these bushings in high-voltage assets to ensure reliable grid operation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electrical bushings market, By Type

The Oil-Impregnated Paper (OIP) subsegment constitutes the largest market share of the global electrical bushings market in the By Type segmentation. It is a product with high reliability, excellent dielectric properties, and long history of usage in high-voltage applications. OIP bushings combine paper insulation with oil impregnation, thereby enhancing electrical performance through providing superior insulation strength and reducing the likelihood of electrical breakdown. They are capable of handling high voltage and heavy load conditions. This makes them widely adopted in critical applications such as power transformers, circuit breakers, and reactors across transmission and distribution networks.

Electrical bushings market, By Insulation Material

The Polymer subsegment of the By Insulation Material market segment holds the second-largest market share in the global electrical bushings market with its excellent technical performance, robustness, and economical. Polymer-insulated bushings possess several benefits, which include lightweight construction and high mechanical strength with reduced transportation, installation, and maintenance complexities. Moisture, pollution, and extreme environmental conditions pose less resistance to polymer insulated bushings, making it more favorable for critical applications in coastal, high-pollution, and adverse weather areas. These features guarantee extended service life with less failure percentage, especially for high-voltage transformers, circuit breakers, and switchgear systems. With the increasing acceptance of renewable energy systems and smart grid technologies, their demand is augmented because of reliability and efficiency criteria of modern grids.

Electrical bushings market, By Voltage

The above 230 kV voltage segment is expected to witness the highest CAGR of 6.0% in the electrical bushings market during the forecast period, driven by rapid expansion of high-voltage and extra-high-voltage transmission infrastructure worldwide. Growing integration of large-scale renewable energy sources, such as offshore wind and utility-scale solar, requires long-distance power transmission at higher voltage levels to minimize losses and enhance efficiency. Utilities are increasingly investing in 245 kV, 400 kV, and above transmission networks to support cross-border interconnections, grid reliability, and load balancing. Additionally, replacement of aging EHV infrastructure in developed regions is accelerating demand for advanced bushings with superior insulation, thermal stability, and safety features. Technological advancements such as oil-free RIP and RIS bushings, along with smart bushings featuring condition monitoring, are further boosting adoption in this segment. Stringent grid safety standards and the need for higher power handling capacity are reinforcing growth in above 230 kV applications.

Electrical bushings market, By Application

The Transformers subsegment is expected to hold the largest market share in the By Application market segment of the global electrical bushings market. It is because they are indispensable parts of power transmission and distribution systems. Electrical bushings are critical for insulating and safely guiding high-voltage conductors through transformer casings, ensuring efficient and reliable energy transfer. Growing investments in upgrading and expanding power grids, as well as growing demand for electricity in urban and industrial areas, have generated high demand for transformers. The trend of integration of renewable energy - including solar and wind farms - across the globe has boosted the installation of step-up and step-down transformers, thereby adding to the demand for high-quality electrical bushings.

Electrical bushings market, By End User

By end user, the utilities segment is expected to account for the largest share of the electrical bushings market in 2029, driven by continuous investments in power transmission and distribution infrastructure. Electric utilities are upgrading and expanding substations, transformers, and switchgear to meet rising electricity demand, integrate renewable energy sources, and enhance grid reliability. Large-scale grid modernization programs, including the replacement of aging transformers and high-voltage equipment, are significantly increasing demand for new and retrofit electrical bushings. Utilities also operate assets across high-voltage and extra-high-voltage levels, where bushings are critical for insulation performance, safety, and long-term operational stability. In addition, stricter regulatory standards related to grid safety, environmental protection, and outage reduction are encouraging utilities to adopt advanced bushing technologies such as oil-free RIP and smart bushings with condition monitoring. The scale, longevity, and critical nature of utility-owned assets ensure sustained and dominant demand for electrical bushings.

REGION

Asia Pacific is expected to dominate relay market during forecast period with highest CAGR

The largest share of the global market of electrical bushings comes from Asia Pacific, since growth is extremely fast in the development of infrastructures, industrialization, and electricity demand increase. Investment into generating, transmitting, and distributing power networks is picking up in countries like China, India, Japan, and South Korea, and hence requires a high-quality electrical bushing. The surge in integration of renewable energy into the distribution mix, complemented by large-scale undertakings involving smart grid technologies, has heightened demand for strong and efficient electrical components.

ELECTRICAL BUSHINGS MARKET: COMPANY EVALUATION MATRIX

ABB, a leading provider of electrical bushings is classified under the “Star” category due strong product portfolio, a wide presence, and adopt effective business strategies.These are leading market players adopting strategic growth plans, such as product launches and innovative technology developments. These players have a broad product portfolio for customers worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 1. ABB (Switzerland)

- 2. Siemens (Germany)

- 3. Trench Group (Germany)

- 4. Schneider Electric (France)

- 5. Eaton (Ireland)

- 6. General Electric Company (US)

- 7. Hitachi Energy Ltd. (Switzerland)

- 8. Nexans (France)

- 9. CG Power & Industrial Solutions Ltd. (India)

- 10. Hubbell (US)

- 11. Gamma Insulators (US)

- 12. Polycast International (US)

- 13. RHM International, LLC (US)

- 14. Reliance Potteries (India)

- 15. PFISTERER Holding SE (Germany)

- 16. Webster Wilkinson Ltd. (UK)

- 17. Bushing (Beijing) HV Electric Co., Ltd (China)

- 18. Yash Highvoltage Insulators Pvt. Ltd. (India)

- 19. Nu-Cork Products Pvt Ltd (India)

- 20. Jiangshan Scotech Electrical Co., Ltd. (China)

- 21. ChinSun (China)

- 22. Dalian Hivolt Power System Co.,Ltd. (China)

- 23. Nanjing Electric HV Bushing Co.,Ltd. (China)

- 24. Baoding Hewei Power Technology Co., Ltd (China)

- 25. Massa Izolyator Mehru Pvt. Ltd. (MIM Pvt. Ltd.) (India)

- 26. SUKRUT Electric Co. Pvt. Ltd. (India)

- 27. Barberi Rubinetterie Industriali S.r.l. (Italy)

- 28. SAVER S.p.A. (Italy)

- 29. Yueqing Liyond Electric Co., Ltd. (China)

- 30. Meister International, LLC. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 3.53 Billion |

| Market Forecast in 2029 (Value) | USD 4.77 Billion |

| Growth Rate | 5.4% |

| Years Considered | 2021–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, Asia Pacific, North America, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: ELECTRICAL BUSHINGS MARKET REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- January 2024 : GE Vernova’s Grid Solutions business entered a partnership with Polimex Mostostal (PXM) to build the onshore infrastructure, including a 275/400 kV high voltage substation, such as STATCOMs, and onshore export lines for efficient power transfer to the Polish Power System.

- October 2024 : Siemens partnered with Alliander, a major Dutch network company, for flexibility management to accelerate the energy transition and tackle key challenges in distribution grid management. Alliander will use Siemens’ Gridscale X platform to reduce grid congestion and increase grid utilization.

- October 2024 : Trench Group entered into an agreement with GE Vernova’s Grid Solutions. Under this agreement, Trench Group will provide critical high-voltage components, including power transformer bushings, HVDC DC wall bushings, coils, and instrument transformers. This partnership underscores Trench Group’s expertise in high-voltage components, particularly for HVDC (High Voltage Direct Current) applications, which are essential for advancing global energy infrastructure.

- February 2024 : ABB acquired SEAM Group, a US-based energized asset management and advisory services provider. This acquisition is intended to expand ABB’s Electrification Service portfolio, particularly in the US market. The acquisition will enable ABB to offer enhanced predictive, preventive, and corrective maintenance, electrical safety, renewables, and asset management services.

Table of Contents

Methodology

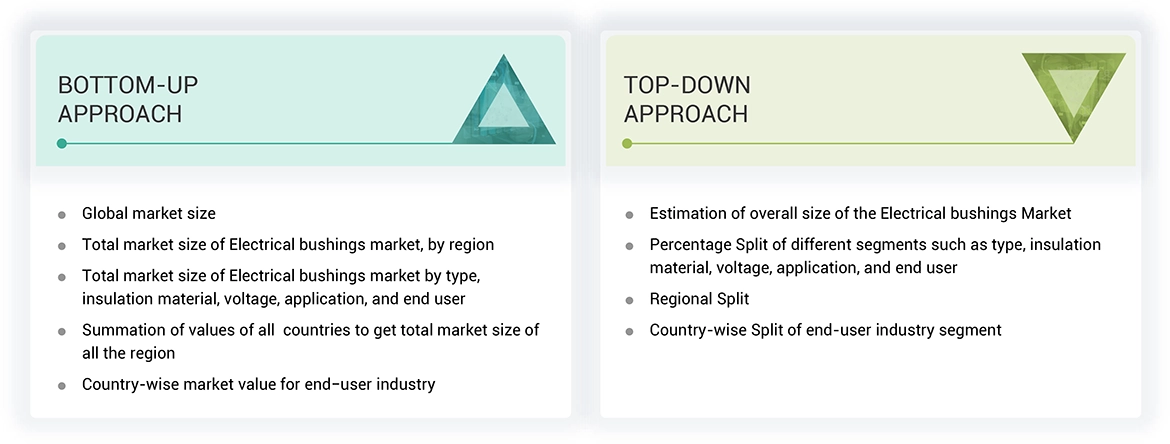

The study involved major activities in estimating the current size of the electrical bushings market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the electrical bushing market.

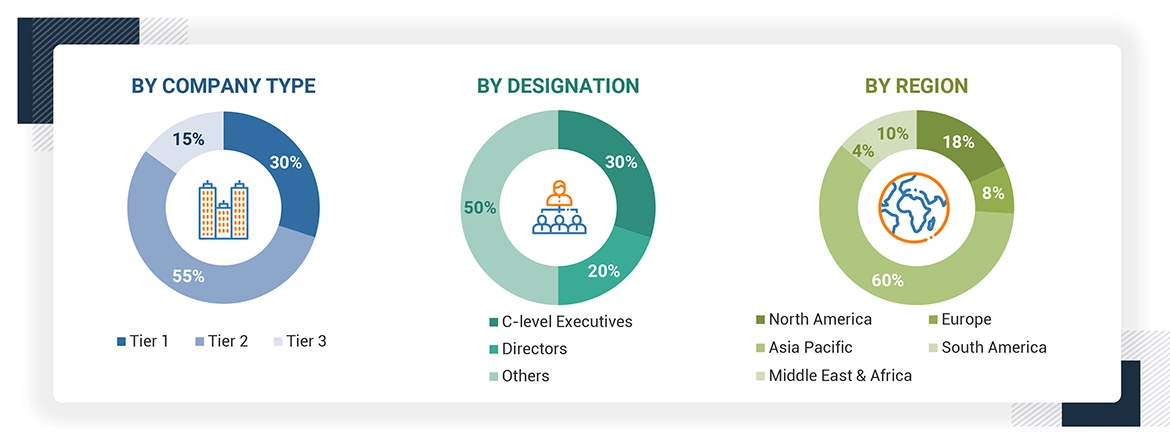

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. Following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion,

Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the electrical bushing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Electrical Bushings Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

The global electrical bushings market involves the design, production, and distribution of insulating components that allow safe electrical flow between high-voltage conductors and equipment such as transformers, circuit breakers, and generators. These bushings are essential in reducing energy loss and ensuring electrical safety by providing strong insulation and mechanical support. The market encompasses different kinds of insulators, including resin impregnated paper (RIP), resin impregnated synthetic (RIS), and porcelain. These are designed to meet the demand for a given voltage level and specific application for different power transmission, distribution, and industrial systems. Advances in the modernization of the grid and renewable energy integration and the overall increase in investment in the power infrastructure across geographies are driving the industry for utilities, industries, and the commercial segment.

Stakeholders

- Component manufacturers and suppliers

- Consulting companies in power sector

- Electric utilities

- Electrical bushings manufacturers and suppliers

- Government and power research organizations

- Manufacturing industries

Report Objectives

- To define, describe, segment, and forecast the electrical bushings market, by type, insulation, voltage, application, end user, and region

- To forecast the electrical bushing market, by region, in terms of volume

- To forecast the market size, by value, for five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, value chain analysis, porters five forces analysis, trade analysis, case study analysis, technology analysis, influencing the growth of the market

- To strategically analyze the subsegments concerning individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as product launches, mergers, acquisitions, expansions, and supply contracts in the market

- o study the impact of generative AI on the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electrical Bushings Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electrical Bushings Market