Rubber Track Market

Rubber Track Market By Application (Construction & Mining, Agriculture & Harvestery), Equipment Type (CTL, Mini Excavator, Tractor, Combine Harvester, Others), Thread Pattern, Track Type, Sales Channel, Rubber Track Pad and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The rubber tracks OE market is projected to grow from USD 1.04 billion in 2025 to USD 1.63 billion by 2032 at a CAGR of 6.6%. The rubber tracks market is expanding as OEMs are increasingly adopting low-vibration, low-ground-pressure undercarriages that enhance machine stability and performance on varied terrain.

KEY TAKEAWAYS

-

BY REGIONThe European rubber tracks market accounted for a share of over 38% in 2024.

-

BY APPLICATIONThe agriculture & harvesters segment is projected to register a higher CAGR (7.1%) than the construction & mining segment during the forecast period.

-

BY TREAD PATTERNThe zig-zag segment is projected to grow at the highest rate from 2025 to 2032.

-

BY EQUIPMENT TYPEThe agriculture tractors segment is projected to grow at the highest CAGR of 7.2% during the forecast period.

-

COMPETITIVE LANDSCAPEBridgestone and Camso were identified as STAR players in the global rubber tracks market, primarily due to their strong business networks and strategic growth, which have enabled them to establish their market positions.

New-generation tracks incorporate reinforced steel cords, aramid layers, and multi-compound tread formulations, enabling smoother torque transfer, improved NVH characteristics, and better compatibility with electric and hybrid compact equipment that require lower rolling resistance and reduced drivetrain shock. However, the market also faces challenges. For example, rubber tracks can experience accelerated wear in abrasive, high-load applications, increasing lifecycle costs, while fluctuations in rubber and reinforcement material prices continue to pressure manufacturing costs and OEM pricing stability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The rubber tracks market is undergoing significant transformation as OEM integration, electrification, and material advancements are reshaping customer expectations and competitive dynamics. The rising demand for high-performance, low-vibration tracked equipment across the construction and agriculture sectors is accelerating the shift toward premium compounds, advanced tread geometries, and intelligent track systems. At the same time, rental fleet expansion and digital maintenance solutions are redefining purchasing behavior, prompting suppliers to innovate more quickly and deliver greater lifecycle value. These disruptions are creating growth opportunities while elevating performance, customization, and efficiency requirements across the ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Performance Advantages Driving Shift from Tires to Rubber Tracks

-

Growth of Vineyard, Orchard, and Specialty Crop Cultivation

Level

-

High Cost and Compatibility

Level

-

Electrification of Agriculture and Construction Equipment

-

Rental Market Push

Level

-

Weight and Efficiency Penalties on Specific Drive Systems

-

Lack of Viable End-of-Life Solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth of Vineyard, Orchard, and Specialty Crop Cultivation

The rise in vineyard, orchard, and specialty crop cultivation is accelerating the adoption of rubber-tracked tractors due to their ability to minimize soil compaction and enhance traction in soft, uneven terrain. In these high-value crop environments, maintaining soil structure is critical, as higher compaction restricts root aeration, reduces water infiltration, and reduces yield. Rubber tracks distribute weight more evenly across a larger contact area, lowering ground pressure by 40–60% compared to traditional tire configurations. This feature enables operators to navigate precisely through narrow rows, often as narrow as 1.5 m in vineyards, without damaging crops or compacting the soil. Additionally, the continuous contact and flexible tread design of rubber tracks improve traction and stability on sloped terrain, a common challenge in hillside vineyards and terraced orchards. The continuous belt and internal damping of rubber tracks minimize torsional spikes when operating between rows, protecting PTO-driven implements, such as sprayers and under-canopy mowers, from resonance and misalignment. Further, specialized track lug geometry provides stable longitudinal grip on mulched, moist, or terraced vineyard soils, reducing slippage-induced rutting and preventing chassis oscillation that can damage trellis structures. These features make rubber-tracked platforms particularly well-suited for spraying, inter-row cultivation, and harvesting operations that demand both precision and ground care. Leading OEMs are developing specialized tracked tractors in the 50–150 HP segment tailored to such applications. For instance, New Holland’s TK4 series crawler tractors integrate a low-profile rubber track system designed for narrow vineyard rows that reduce vibration and improve operator comfort.

Restraint: High Cost and Compatibility

Rubber track systems have a higher upfront cost than traditional options, with skid steer tracks typically priced at USD 3,000–4,500, compared to USD 600–1,000 for tires. This stems from complex construction involving vulcanized rubber, embedded steel cords, and multi-layer carcass designs built to tight tolerances. As a result, smaller contractors and rental operators often hesitate to adopt tracked machines despite their long-term advantages. Additionally, the wide variation in track pitch, width, tread patterns, and link counts creates significant inventory and compatibility challenges, especially since replacement sets can cost USD 3,800–4,000. Distributors must stock numerous stock units to support different equipment models which increasing inventory costs, depreciation risk, and logistical burden.

Opportunity: Rental Market Push

The rapid expansion of rental fleets in North America and Europe, where rental penetration reached 57% in 2024 according to the American Rental Association, is emerging as a major growth catalyst for the rubber tracks market. Rental operators increasingly favor rubber-tracked platforms for compact and mid-sized OHVs because they offer unmatched versatility across asphalt, turf, clay, and loose gravel, eliminating tire-swaps and minimizing surface damage. This directly improves fleet utilization and reduces idle time, making tracked machines more profitable rental assets. OEMs such as Bobcat, Caterpillar, and Takeuchi are increasingly supplying factory-installed rubber track variants for rental-oriented models. As rental companies digitize their fleets, telematics is increasingly being used to track rubber track wear, tension irregularities, and undercarriage stress in real-time. Modern rubber tracks reinforced with steel cords or multi-layer compounds can operate longer before replacement, and telematics allows fleets to safely maximize this extended life. This predictive maintenance approach significantly lowers the cost-per-hour of ownership for rental operators. With rental equipment typically being relatively new (many excavators in fleets are just 2–3 years old), the combination of durable rubber tracks and sensor-driven monitoring offers a particularly strong value proposition for rental businesses.

Challenge: Weight and Efficiency Penalties on Certain Drive Systems

While rubber tracks offer superior traction, flotation, and surface protection, they introduce additional weight and mechanical drag that can impact drivetrain efficiency. Compared to pneumatic tires, rubber tracks typically add 10–15% more mass to a compact or mid-sized machine due to their reinforced steel cords, dense rubber compounds, and complex undercarriage design. In diesel-powered equipment, this translates into slightly higher fuel consumption, whereas in electric equipment, it directly affects energy efficiency and reduces per-charge operating range. This is a challenge in components, such as electric compact track loaders, mini-excavators, and utility tractors, where optimizing power-to-weight ratios is essential to extend runtime. For instance, manufacturers like Bobcat and Volvo CE have noted that tracked electric loaders and excavators require recalibrated control software and enhanced cooling systems to offset drivetrain heat buildup and maintain battery efficiency. This adds to engineering complexity and cost.

rubber-track-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Caterpillar’s 259D3 CTL uses heavy-duty rubber tracks designed for high-cycle rental environments and diverse terrain demands. | Longer wear life, superior ride comfort, and reduced slippage—helping rental companies improve equipment uptime and utilization |

|

Bobcat equips compact track loaders like the T66 and T76—with rubber tracks optimized for mixed-terrain construction, landscaping, and urban utility work. | Low ground disturbance for turf/asphalt, reduced vibration for operators, and higher stability in grading and digging applications—ideal for city and residential projects |

|

Kubota’s agricultural and compact equipment lineup (e.g., KX080-4 excavator and KVT85 tractor) uses rubber tracks for improved traction on soft soil and wet-field operations. | Better flotation in rice paddies, improved fuel efficiency, and reduced soil compaction for high-value crop farming |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The rubber tracks market functions within an interconnected ecosystem of raw material suppliers, rubber track manufacturers, OEM equipment builders, distribution/aftermarket, end users, and regulatory & sustainability bodies. OEMs drive adoption through factory-installed tracked platforms, while suppliers advance performance with improved compounds and reinforced designs. Distributors and dealers expand market reach by ensuring availability and high utilization, and the aftermarket sustains long-term demand through replacement and service cycles. Together, this ecosystem supports continuous innovation and steady market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rubber Tracks Market, By Application

The agriculture & harvesters segment is estimated to be a significant adopter of rubber tracks because high-horsepower tractors and combines (> 200 HP) increasingly require low-compaction, high-flotation undercarriages for precision farming and large-field operations. Europe and Asia Pacific drive substantial demand through tracked harvesters and paddy-field tractors, reinforced by OEM platforms like CLAAS LEXION Terra Trac, New Holland CR Revelation, and Kubota track tractors, which generate higher-value, higher-volume track consumption than compact construction equipment.

Rubber Tracks Market, By Equipment Type

The agriculture tractors segment is projected to lead the rubber tracks market during the forecast period. This projected growth is due to the use of high-horsepower tractors, typically 200 HP and above; reduce soil compaction; and need for high pulling efficiency in large-scale farming. Europe and North America witness increased growth for this segment, since large cereal, corn, and mixed-crop farms in these areas need better flotation and lower ground disturbance. In Asia Pacific, rubber-tracked tractors are essential for rice paddies and wet-field operations and are supported by OEMs like Kubota, Yanmar, and Iseki. Moreover, technical advancements, such as high-tensile steel-cord carcasses, wider track belts, and self-cleaning tread designs further enhance durability and field productivity, which is making farm tractors the largest and most dominant equipment category in rubber track usage.

Rubber Tracks Market, By Tread Pattern

C-pattern is the most widely adopted tread pattern in the rubber tracks market because it offers the best combination of traction, stability, and long wear life across mixed-terrain applications. Its interlocking C-shaped lugs provide strong forward grip with reduced vibration, which makes it a preferred choice for high-utilization construction fleets. Leading OEM models such as John Deere 331 P-Tier, CASE TR270B CTL, and CASE CX42D mini-excavator feature C-pattern tracks. Moreover, recent enhancements in lug reinforcement and abrasion-resistant compounds further strengthen its durability, solidifying the C-pattern as the dominant tread design in compact and mid-sized equipment.

Rubber Tracks Market, By Track Type

The continuous wire strand dominate the market, with ~80% of global OE installations on equipment, such as compact track loaders (CTLs), mid-size mini-excavators (3–6 tons), and high-load specialty agriculture machines. These equipment types demand high tensile strength, maximum resistance to stretching, and reduced risk of de-tracking, all of which are delivered by a single uninterrupted steel cable core. North America and Europe have witnessed a high adoption of these tracks due to their intensive duty cycles and operator preference for longer service life and lower cost-per-hour. OEMs such as Caterpillar (239D3, 259D3, 299D3 series), Bobcat (T66, T76), Kubota (SVL series), Takeuchi (TL8, TL12), and agriculture OEMs like CLAAS and New Holland prefer continuous-wire tracks to ensure performance consistency and warranty reliability.

Rubber Tracks Market, By Sales Channel

The OE segment is projected to lead the market in this category during the forecast period as global OEMs increasingly integrate factory-installed track systems into new compact construction and high-horsepower agricultural equipment. OEM-installed tracks ensure precise fit, higher durability, and warranty alignment, which makes them a preferred choice for contractors and farmers seeking reliability and lower lifecycle risk. Additionally, strong production volumes of mini-excavators, CTLs, and agriculture tractors further amplify OE demand, positioning the OEM channel as the primary driver of market growth.

REGION

Europe is estimated to be the largest market in the global rubber tracks market in 2025.

Europe is estimated to lead the rubber tracks market in 2025. In Europe, there is a high concentration of compact and mid-size crawler equipment, especially mini-excavators, CTLs, and high-horsepower agriculture tractors, which consistently drive the demand for rubber tracks in OE and aftermarket replacement. Major regional OEMs, such as JCB, Volvo CE, Liebherr, CNH, and CLAAS, specify premium undercarriage systems and OEM-qualified tracks, resulting in higher per-unit value and faster replacement cycles. Recent developments like Trelleborg’s ART1000 launch and Volvo CE’s expansion of crawler excavator production are further strengthening local supply of rubber tracks. Additionally, Europe’s preference for block tread patterns suited to its diverse terrains supports sustained, high-volume rubber track adoption across construction and agriculture.

rubber-track-market: COMPANY EVALUATION MATRIX

The figure illustrates the competitive landscape of the global rubber tracks market. It positions key players based on their market share and product footprint. Bridgestone Industrial (Star) leads with a strong market presence, strategic growth, strong business networks and a broad product portfolio. This reinforces the company's position as a leader and ability to meet evolving market demands for efficient and compact equipment, enhancing its brand recognition and customer trust.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Bridgestone Industrial (Japan)

- Mclaren Industries Inc. (US)

- Global Track Warehouse (Australia)

- Camso (Canada)

- Soucy (Canada)

- Yokohama TWS (Sweden)

- Grizzly Rubber Tracks (US)

- Astrak (Scotland)

- Mattracks Inc. (US)

- Jiaxing Taite Rubber (China)

- VMT International (Netherlands)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Value in 2024 | USD 1.04 Billion |

| Market Forecast in 2032 | USD 1.63 Billion |

| Growth Rate | CAGR of 6.6% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, competitive landscape, driving factors, trends & disruptions, market size and forecast for rubber pads, industry trends, and others |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, Americas, and Middle East & Africa |

WHAT IS IN IT FOR YOU: rubber-track-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Tire Manufacturer |

|

|

RECENT DEVELOPMENTS

- April 2025 : JIAXING TAITE RUBBER CO., LTD made a remarkable appearance at the 'Bauma 2025' with its new high-durability rubber track solutions to address common industry challenges, such as premature wear and short service life.

- March 2025 : JIAXING TAITE RUBBER CO., LTD unveiled its full range of track chassis at '2025 Heilongjiang Agricultural Machinery Exhibition.' These products feature an increased ground contact area, effectively reducing ground pressure.

- February 2025 : Astrak completed the acquisition of West-Trak NZ Limited, one of New Zealand's foremost suppliers of wear part solutions for heavy machinery. This strategic acquisition marked a major milestone in Astrak Group’s global expansion, extending its presence beyond Europe and North America into the Southern Hemisphere.

- January 2024 : Mattracks announced the launch of the narrowest tracks in the industry. The width of the track is between 9.6” and 12” inches. Specifically designed for row crops, these narrow tracks can reduce compaction by up to 40 percent, as compared to tires, contributing to higher yields and profits.

- December 2023 : Mattracks Inc. launched the new skid steer compatible RT125 TC. The RT125 TC track series doubles the usefulness of the skid steer loader by allowing operators to convert from tires to tracks or vice versa in a very short interval of time. Designed for skid steers up to 12,500 lbs.

Table of Contents

Methodology

The research study involved the use of various secondary sources, such as company annual reports/presentations, industry association publications, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases. These sources were used to identify and collect information for an extensive study of the rubber tracks market. Primary sources included experts from related industries, OEMs, and suppliers, who were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

Secondary sources included the rubber track industry association, internal databases, corporate filings (such as annual reports, investor presentations, and financial statements), and data from trade and business. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

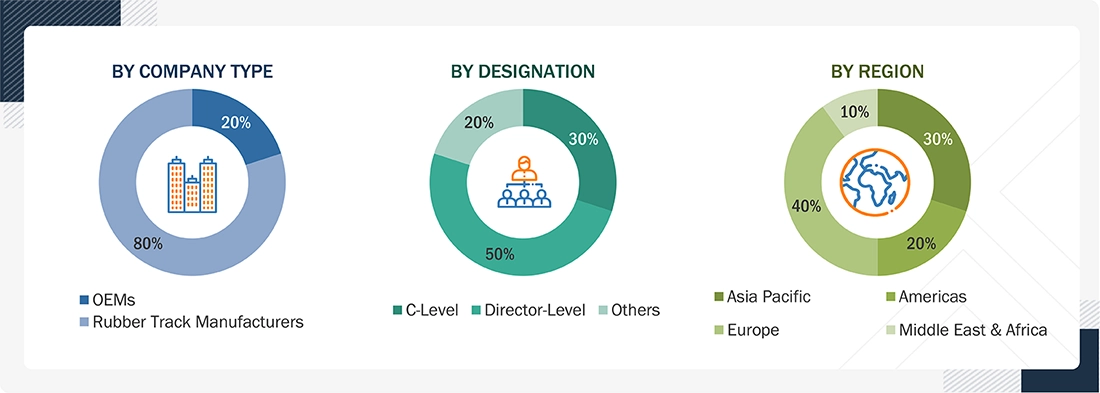

Extensive primary research was conducted after understanding the rubber tracks market scenario through secondary research. Several primary interviews were conducted with market experts from demand (OEMs) and supply (Manufacturers and distributors) sides across four major regions: The Americas, Europe, Asia Pacific, and the Middle East & Africa). 80% of primary interviews were conducted with rubber track manufacturers and 20% of the primary interviews were conducted with off-highway OEMs (Manufacturers of mini-excavators, compact track loaders, agricultural tractors & combine harvesters).

Primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various organizational departments, such as sales, operations, and administration, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to validate the findings from the primaries. This and insights by in-house subject-matter experts led to the conclusions described in the remainder of this report.

Note: Others include Sales Managers, Operational Heads, and Supply Chain Heads/Managers.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

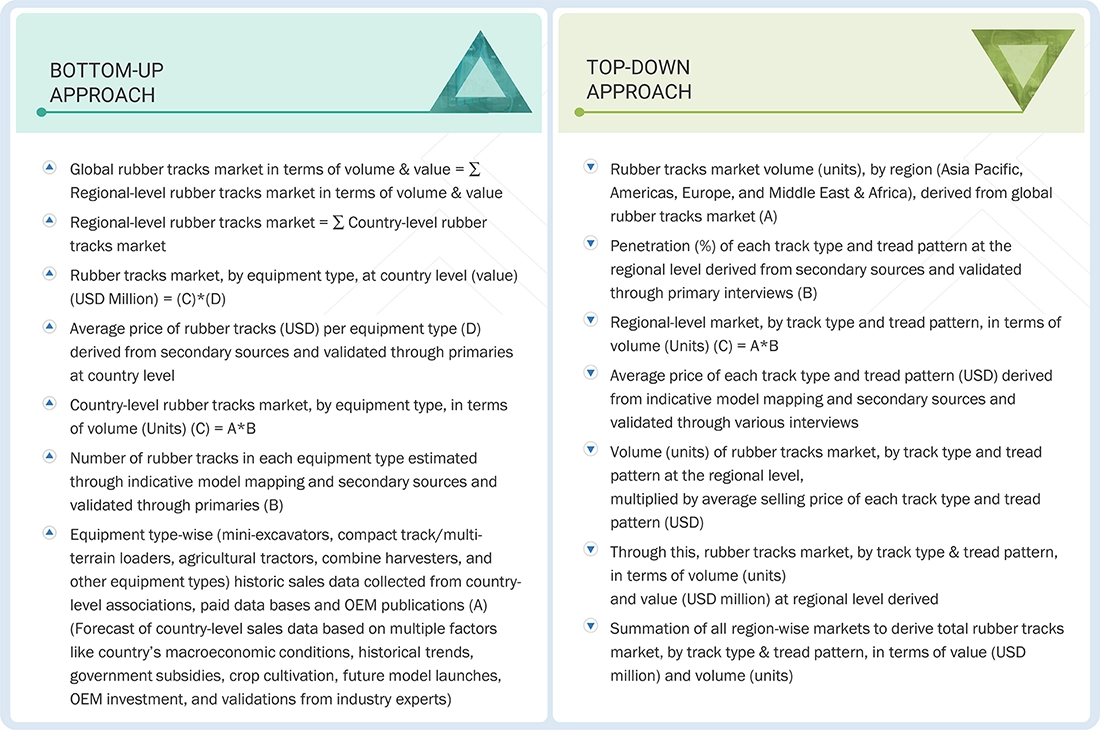

Market Size Estimation

- The bottom-up approach was used to derive the market size based on volume and value. This was followed by primary interviews and feature mapping on a regional basis from the MarketsandMarkets repository.

- The market size was validated through in-depth interviews with industry experts, excerpts available in the discussion guide in the appendix, and secondary research. The report-writing phase began after arriving at the final numbers for the market size.

Bottom-Up Approach

The bottom-up approach was used to estimate and validate the size of the global rubber tracks market. The country-wise historic sales data, by equipment type (Mini-excavators, compact track/multi-terrain loaders, agricultural tractors, combine harvesters, and other equipment types), within the construction, mining, and agriculture industries, was sourced from country/regional level associations, paid databases, OEM publications, and other secondary sources. These sales were forecast based on macroeconomic indicators, industry growth, GDP trends, and government initiatives per region.

The number of rubber tracks in equipment (Mini-excavators, compact track/multi-terrain loaders, agricultural tractors, combine harvesters, and other equipment types) was identified through an indicative model mapping and secondary sources and validated through primary interviews. The number of rubber tracks used per equipment type was then multiplied by country-level sales of the respective equipment type to arrive at the country-level volume market (units) of rubber tracks by equipment type.

In the next step, the country-level rubber tracks’ average OE price (AOP) was estimated for each equipment type through supplier and dealer websites and validated through primary interviews. Each country’s rubber tracks ASP, by equipment type, has been derived from secondary sources and validated through primary sources. The volume of rubber tracks (by equipment type) was multiplied by this average OE price (AOP) to get the country-level market by equipment type in terms of value (USD million).

The rubber tracks market has been projected based on various parameters, such as analysis of historical data; market trends; and growth of drivers, such as increasing off-highway equipment sales, an increase in infrastructural development activities, and growing aftermarket sales. The forecast is based on equipment sales and is dependent on economic conditions and market demand. Also, with increased infrastructure and agricultural activities, the working hours for equipment have increased. Factors like future infrastructure projects, investments, and farm mechanization rate have been studied while estimating the aftermarket demand.

Factors such as technological advancements in rubber track materials, emerging market opportunities, and competitive landscape assessments have also been considered to arrive at the country-wise forecast for the rubber tracks.

The summation of the volume and value of the country-level market in respective regions has given the regional market size. Further summation of regional markets has helped derive the global market volume and value for rubber tracks by equipment type. The findings have been verified with various industry participants at each level.

Top-Down Approach

The top-down approach was used to estimate and validate the market, by track type (Overlapping/non-continuous and continuous), pattern type (Block-pattern, C-pattern, straight-bar, multi-bar, zig-zag, and others), application (agriculture & harvesters and construction & mining), and by sales channel (OE and aftermarket) in terms of volume and value. The rubber tracks market volume (units) and value (USD million) by region (Asia Pacific, Europe, the Americas, and Middle East & Africa) have been derived from the bottom-up approach, as mentioned earlier. The penetration of each track type (Overlapping/non-continuous and continuous) and tread pattern (Block-pattern, C-pattern, straight-bar, multi-bar, zig-zag, and others) at the regional level has been derived from an indicative model mapping and secondary sources and further validated through various interviews.

The penetration of each tread pattern (Block-pattern, C-pattern, straight-bar, multi-bar, zig-zag, and others) and track type (Overlapping/non-continuous and continuous) has been multiplied by the regional rubber tracks market to get the rubber tracks market in terms of volume (units) and value (USD million), by track type and pattern type for each region. All region-wise markets have been summed up to derive the total rubber tracks market volume (units) and value (USD million) by track type.

Rubber Track Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the rubber tracks market through the methodology mentioned above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data of the market by volume and value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from the supply and demand sides.

Market Definition

A rubber track is a continuous loop track composed of layered rubber and embedded steel cords that fit around the undercarriage of tracked vehicles. It delivers traction and stability on various terrains while minimizing ground disturbance compared to metal tracks. Rubber tracks combine flexibility with strength, which makes them essential for machinery operating in agriculture, construction, and landscaping environments.

Key Stakeholders

- Rubber track manufacturers

- Off-highway vehicle manufacturers

- Aftermarket distributors and dealers

- Undercarriage system & drivetrain suppliers

- Rental companies

- Recycling/End-of-life ecosystem

- Country-level associations

Report Objectives

-

To define, describe, and forecast the global rubber tracks market, in terms of value and volume, based on the categories given below:

- By application (Construction/mining, agriculture & harvesters) at the regional level

- By equipment type (Agriculture tractors, compact track/multi-terrain loaders, mini-excavators, combine harvester, and other equipment types) at the regional level

- By tread pattern (Block-pattern, C-pattern, straight-bar, multi-bar, zig-zag, and others) at the regional level

- By track type (Overlapping/non-continuous wire strand and continuous wire strand) at the regional level

- By channel (OE and aftermarket) at the regional level

- Country-level analysis (Asia Pacific, Europe, Americas, and Middle East & Africa) of equipment type segments

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To understand the rubber track pads’ market size, forecast, and trends

- To strategically analyze trade analysis, pricing analysis, case study analysis, patent analysis, technology analysis, regulatory analysis, key conferences and events, trends/disruptions impacting buyers, and the investment and funding case scenario

- To analyze the competitive landscape of the global players in the market, along with their market share/ranking

- To analyze the strategic partnership & OEMs’ tie-ups at the regional level

- To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and participants according to the strength of their product portfolio and business strategies

- To analyze a detailed listing of OEMs and their brands, OEM-wise technical specifications, mergers & acquisitions, partnerships, collaborations, expansions, and product launches/developments, company evaluation matrix, competitive scenario, company valuation and financial metrics, and brand and product comparison sections

Customization Options

Along with the market data, MarketsandMarkets offers customizations per company-specific needs.

The following customization options are available for the report:

- Rubber Tacks Market, By Track Type, At The Country Level

- Rubber Tracks Market, By Tread Pattern, At The Country Level

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Rubber Track Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Rubber Track Market