Satellite NTN Market Size, Share & Analysis, 2025 To 2030

Satellite NTN Market by Technology (NR NTN, IoT NTN), Hardware (RF Front End, Antenna, Onboard Processors), Application (eMBB, mMTC, uRLLC), Frequency (L, S, C, Ku and Ka, HF/VHF/UHF-band), Orbit, End Use and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The satellite NTN market is projected to grow from USD 0.56 billion in 2025 to USD 2.79 billion by 2030 at a CAGR of 38.0%. In terms of volume, the satellite NTN market is expected to grow from 359 units in 2025 to 1,186 units in 2030. Market growth is driven by 5G integration, real-time data transfer, reduced ground reliance, IoT expansion, autonomous vehicles, and remote connectivity demand, enabling global coverage and distributed market expansion.

KEY TAKEAWAYS

- Europe is expected to account for a 25.4% share of the satellite NTN market in 2025.

- By orbit, the LEO segment is expected to register the highest CAGR of 38.2%.

- By frequency, the Ku and Ka-band segment is projected to grow at the fastest rate from 2025 to 2030.

- By end-use sector, the commercial segment is projected to dominate the market and grow at the fastest rate from 2025 to 2030.

- Airbus, Thales Alenia Space, and NEC Corporation were identified as star players in the satellite NTN market, given their strong market share and extensive product footprint.

- Radiall, ETL Systems Ltd., and Aethercomm, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The future outlook for the satellite NTN industry is strong, driven by 5G integration, IoT expansion, and remote connectivity needs. Advancements in LEO and GEO constellations, coupled with high-capacity payloads and low-latency solutions, are likely to support growth across commercial, defense, and enterprise applications through 2030.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The satellite NTN market is driven by 5G integration, advanced payload technologies, and AI-enabled network optimization. Emphasis on global IoT, low-latency connectivity, and resilient architectures is reshaping telecom, defense, and enterprise strategies while opening new revenue opportunities across emerging sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Standardization of 3GPP to drive investments in direct-to-device

-

Acceleration of LEO deployments for low-latency NTN

Level

-

Latency and quality-of-service tradeoffs compared to terrestrial networks

-

Regulatory Barriers in cross-border spectrum and licensing hindering NTN deployment

Level

-

Development of multi-orbit hybrid network architectures

-

Expanded NTN-enabled 5G backhaul in rural markets

Level

-

Risks of orbital congestion and spectrum interference

-

Complex integration of NTN and terrestrial networks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Standardization of 3GPP to drive investments in direct-to-device and IoT satellite connectivity

The adoption of 3GPP Release 17 enabled standardized NR-NTN and IoT-NTN protocols, accelerating the commercialization of satellite connectivity. This harmonization united operators, chipset vendors, and satellite firms, fostering rapid cross-industry deployment. Companies like Lynk Global, AST SpaceMobile, Sateliot, and Skylo have already demonstrated regulatory approvals and successful trials, confirming the commercial viability of satellite NTN services.

Restraint: Latency and quality-of-service tradeoffs compared to terrestrial networks

NTNs provide global reach but face high-latency and bandwidth limits, particularly in GEO networks with >500 ms delays, unsuitable for real-time use. Even LEO systems experience variable QoS due to weather and beam coupling. Trials, like AST SpaceMobile’s with AT&T, highlight inconsistencies. Until advanced processing and inter-satellite links mature, NTNs will complement rather than rival terrestrial 5G.

Opportunity: Development of multi-orbit hybrid network architectures for enhanced global connectivity

Hybrid LEO-GEO networks are emerging to combine low-latency and wide-coverage benefits, ensuring flexible, resilient connectivity. Partnerships like OneWeb and Set Network (2023) highlight demand for reliable global internet, especially in aviation, maritime, and defense. Multi-orbit integration helps MNOs expand 5G-backed services to underserved regions, while regulatory progress supports the scalability and cost reduction of hybrid NTN architectures worldwide.

Challenge: Complex integration of NTNs and terrestrial networks

NTNs face integration challenges with 5G and fiber due to latency, weather impacts, and reliance on radio waves. Seamless switching between satellite and land networks requires advanced technologies to maintain reliability in dynamic environments. Trials by AST SpaceMobile and OneWeb show potential, but achieving consistent interoperability demands significant technological progress and cross-industry collaboration to ensure smooth deployment.

satellite NTN market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrated NTN into Snapdragon Satellite for direct-to-device messaging | Global SMS in no-coverage zones; emergency-ready |

|

Used LEO satellites for rural/remote UK connectivity | Broadband for underserved areas, schools, farms, emergency services |

|

Hybrid GEO-LEO NTN for enterprise networking/SCADA | QoS with secure IoT telemetry, tracking, and surveillance |

|

Space-based broadband for 4G/5G smartphones | Direct connectivity without towers; rural/maritime coverage |

|

LEO IoT NTN for agriculture, mining, and logistics | Low-power, long-battery IoT data transfer, and remote monitoring |

|

LEO constellation for broadband services | Affordable high-speed global internet with AWS integration |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The satellite NTN market ecosystem is driven by payload manufacturers such as Airbus, Thales Alenia Space, L3Harris, Celestia, Swissto12, and UTI. Component providers, including Safran, Honeywell, Teledyne, Comtech, Analog Devices, Smiths Interconnect, and Qorvo, enable subsystem innovation. Telecom operators and service integrators ensure deployment and lifecycle management. End users span enterprises, governments, and defense agencies, driving advancements in payload design, component efficiency, and interoperability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Satellite NTN Market, By Hardware

Antennas are central to NTN hardware, enabling signal transmission, beamforming, and user connectivity. Advances in phased array and electronically steerable antennas enhance performance for multi-orbit, multi-band NTN systems.

Satellite NTN Market, By Orbit

LEO satellites dominate due to their low-latency performance, global coverage, and scalability. Their ability to support real-time services and broadband applications makes them the preferred choice for commercial, defense, and remote connectivity use cases.

Satellite NTN Market, By Frequency

L-Band leads as it offers reliable performance under adverse weather, lower propagation losses, and robust signal penetration. Its suitability for mobility, IoT, and safety-critical services ensures its dominance in satellite NTN deployments.

Satellite NTN Market, By End-use Sector

Commercial users drive adoption with the growing demand for broadband, IoT, and enterprise connectivity. Airlines, maritime operators, and enterprises increasingly rely on satellite NTN to extend services beyond terrestrial coverage.

Satellite NTN Market, By Technology

NR NTN dominates as 3GPP standards enable seamless satellite-terrestrial integration. Its interoperability with mobile networks ensures faster adoption, supporting global coverage for broadband, IoT, and mission-critical applications.

Satellite NTN Market, By Application

eMBB leads applications with rising demand for high-speed data, video streaming, and enterprise-grade broadband. LEO constellations paired with advanced NTN technologies deliver seamless high-capacity connectivity for underserved and remote areas.

REGION

Europe to be fastest-growing region in global satellite NTN market during forecast period

Europe is set to be the fastest-growing region in the satellite NTN market, driven by ESA and Horizon Europe funding, a strong industrial base led by Airbus and Thales, and harmonized regulatory frameworks. Focus on integrating NTN with terrestrial 5G, enhancing rural connectivity, and sustainability initiatives further accelerate regional growth and scalability.

satellite NTN market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the satellite NTN market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. Airbus is positioned as a leading player with a strong focus on advanced NTN technologies, while Swissto12 is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Satellite NTN Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.28 Billion |

| Market Forecast in 2030 (value) | USD 2.79 Billion |

| Growth Rate | CAGR of 38.0% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, and Rest of the World |

WHAT IS IN IT FOR YOU: satellite NTN market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Comprehensive Satellite NTN Market Analysis with focus on RF Transceivers | A comprehensive satellite NTN market study with dedicated RF transceiver coverage, including historic and forecast analysis of market volume (units) and value (USD million) up to 2035. The study provided deep segmentation by technology (NR NTN, legacy), and frequency bands (L-, S-, Ka-, Ku-), ensuring highly detailed insights tailored to client requirements. |

|

RECENT DEVELOPMENTS

- March 2025 : Thales Alenia partnered with Ericsson and Qualcomm in France to connect a 5G standards-based NTN call using a simulated LEO satellite channel.

- February 2025 : Airbus Defense and Space, Eutelsat, and MediaTek conducted the first successful 5G NTN trial over OneWeb LEO satellites.

- March 2025 : Astrum Mobile contracted SWISSto12 to build NEASTAR-1, enabling 5G NTN broadcast services across Asia Pacific.

- January 2025 : Mercury Systems won a USD 24.5M contract to develop data processing and storage subsystems for a US Defense satellite.

- January 2021 : NEC secured a contract from AST SpaceMobile (US) to manufacture satellite platform components for space-based broadband networks.

Table of Contents

Methodology

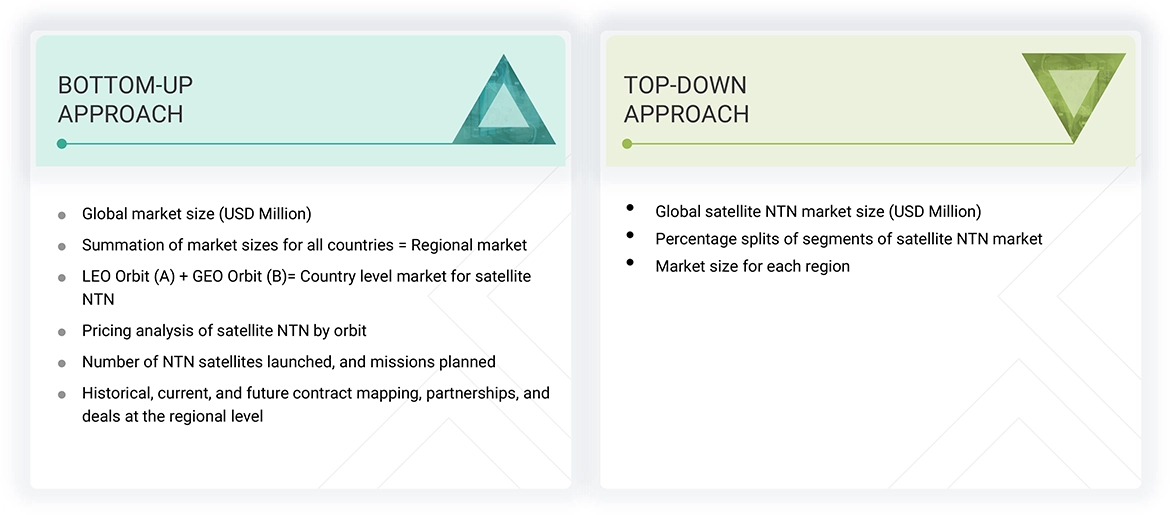

This research study extensively used secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect useful information on the satellite NTN market. Secondary sources included the space library and leading satellite NTN component providers’ product brochures. Primary sources included experts from core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess the prospects of the satellite NTN market. The deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The ranking of companies in the satellite NTN market was carried out using secondary data from paid and unpaid sources and by analyzing their product portfolios and service offerings. These companies were rated based on the performance and quality of products. Primary sources further validated the data points.

Secondary sources referred to for this research study included the European Space Agency (ESA); the National Aeronautics and Space Administration (NASA); the United Nations Conference on Trade and Development (UNCTAD); the Satellite Industry Association (SIA); annual reports; investor presentations; and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to determine the market’s overall size, which primary respondents validated.

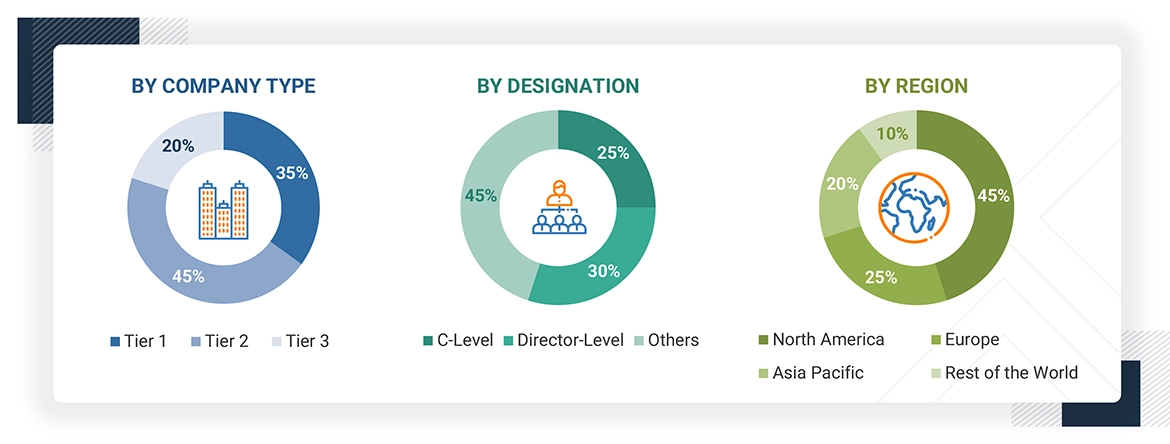

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the satellite NTN market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across four regions: North America, Europe, Asia Pacific, and the Rest of the World. The primary data was collected through questionnaires, emails, and telephonic interviews. These interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. They also helped analyze the market based on technology, hardware, orbit, end use sector, application, and frequency, for the regions mentioned above.

Note 1: The tier of companies has been defined based on their total revenue as of 2024.

Note 2: Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million

Note 3: C-level designations include CEO, COO, and CTO.

Note 4: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the market size. The research methodology used to estimate the market size included the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Satellite NTN Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the NTN satellite market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures described below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

Satellite Non-terrestrial Network (NTN) is a communication system where satellites in low, medium, and geostationary orbits provide connectivity services to people and devices on the ground, in the air, and at sea. The 3rd-generation Partnership Project has standardized the system.

Satellite NTN allows direct communication links between user devices, such as smartphones and IoT sensors, satellites, or through relay stations on the ground. It supports services like internet access, phone calls, data transfer for IoT applications, and emergency communications in remote or hard-to-reach places.

Key Stakeholders

- Satellite Communication System Manufacturers

- Satellite Payload Component Suppliers (RF Modules, Antennas, Onboard Processors)

- Satellite Integrators and Prime Contractors

- NTN Ground Infrastructure Providers (Gateways, Hubs, SDN Orchestrators)

- Semiconductor and SoC/RFIC Vendors

- Network Service Providers and Telecom Operators

- Research and Standards Bodies (e.g., 3GPP, ETSI, ITU)

- Government Agencies and Regulatory Authorities

- Satellite Constellation Operators (LEO/MEO/GEO)

- End Use Sectors (Defense, Maritime, Aviation, Rural Broadband, IoT Providers)

Report Objectives

- To define, describe, and forecast the satellite NTN market based on orbit, frequency, technology, payload component, hardware, end use sector, and region

- To forecast the size of various segments of the market across North America, Europe, Asia Pacific, and the Rest of the World

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the satellite NTN market

- To provide an overview of the regulatory landscape with respect to satellite NTN regulations across regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To evaluate the degree of competition in the market by analyzing recent developments, such as contracts, agreements, and acquisitions adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis and revenue analysis of key players

Customization Options

MarketsandMarkets also offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

- Acceleration of LEO deployments for low-latency NTN

- 3GPP standardized driving investments in direct-to-device and IoT satellite connectivity

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Satellite NTN Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Satellite NTN Market