Sensor Patch Market Size, Share & Trends

Sensor Patch Market by Wearable Type (Bodywear, Neckwear, Footwear, Wristwear), Product Type (Temperature, Blood Glucose, Blood Pressure, Heart Rate, ECG, Blood Oxygen, and Others), Application, End-use Industry and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The sensor patch market is projected to grow from USD 6.32 billion in 2025 to USD 23.91 billion by 2030, at a CAGR of 30.5%. Glucose monitoring devices are gaining traction due to the increasing incidence and prevalence of lifestyle diseases, e.g., diabetes, that require regular monitoring. Moreover, the proven efficacy of such testing kits has resulted in their growing adoption by doctors. The glucose monitoring sensor patch industry is expected to witness high growth owing to the increasing number of people suffering from diabetes.

KEY TAKEAWAYS

-

BY WEARABLE TYPEThe sensor patch market comprises wristwear, neckwear, footwear, and bodywear. The market for neckwear sensor patches is growing rapidly due to the increasing use of these patches to provide vital medical information to users for immediate emergency help.

-

BY PRODUCT TYPEThe sensor patch market has been segmented based on product type into temperature sensor patch, blood glucose sensor patch, blood pressure/flow sensor patch, heart rate sensor patch, ECG sensor patch, blood oxygen sensor patch, and others. The increase in diabetic patients worldwide and the need for regular monitoring are driving the blood glucose sensor patch market. Thus, the blood glucose sensor patch segment holds the largest market share.

-

BY APPLICATIONThe sensor patch market has been segmented based on application into diagnostics, monitoring, and medical therapeutics. Sensor patches can increase the efficacy of healthcare analytics by acquiring accurate data regularly. The accuracy of sensor patches in blood pressure and glucose monitoring applications will drive the market.

-

BY END-USE INDUSTRYThe sensor patch market has been segmented based on the end-use industry into healthcare, fitness, and sports. Innovations in sensor patches have given rise to diverse applications for monitoring and diagnosing purposes in these industries. The increasing healthcare expenditure from the public and government sectors and rising consumer awareness for wearable devices are driving the sensor patch market in these industries.

-

BY REGIONAsia Pacific is expected to record the highest CAGR of 32.7%, fueled by the adoption of PoC devices to address lifestyle diseases and enhance people's general health, which has led to the increased use of sensor patches.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Abbott Laboratories announced partnership with Medtronic to collaborate on an integrated continuous glucose monitoring (CGM) system based on Abbott's FreeStyle Libre technology that will connect with Medtronic's automated insulin delivery (AID) and smart insulin pen systems.

The sensor patch market is attributed to the increasing use of sensor patches to monitor glucose levels in individuals with diabetes, the increasing elderly population, and the increased adoption of wireless mobile healthcare systems. Additionally, the growing adoption of telehealth is boosting market growth. This is attributed to the increasing use of sensor patches to monitor glucose levels in individuals with diabetes, the elderly population, and the increased adoption of wireless mobile healthcare systems. Additionally, the growing adoption of telehealth is boosting market growth. Wearable sensor patches find increasing opportunities for continuously monitoring patients' vital signs, premature infants, children, athletes, or fitness buffs, and individuals in remote areas far from medical and health services.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The disruptions and emerging trends impacting customers' businesses in the sensor patch market include increasing demand for remote monitoring, point of care, and telehealth across various industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for portable medical devices and wearable sensors

-

Increasing elderly population

Level

-

Regulatory issues

Level

-

Growing adoption of telehealth

-

High-growth opportunities in wearable device market

Level

-

Issues related to data security due to connected medical devices

-

Design complexities and thermal considerations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing use of sensor patch to monitor glucose levels in individuals with diabetes

Glucose sensor patches are generally used to detect glucose concentrations in individuals with diabetes. Glucose monitoring devices are gaining traction due to the increasing incidence and prevalence of lifestyle diseases, e.g., diabetes, which require regular monitoring. Moreover, the proven efficacy of such testing kits has resulted in their growing adoption by doctors. The glucose monitoring sensor patch market is expected to witness high growth owing to the increasing number of people suffering from diabetes.

Restraint: Regulatory issues

Sensor or wearable patches are designed to capture and transmit personal data for analysis or sharing purposes. These new technologies are operating in a regulatory and policy grey area. As everything from patches to wearable devices becomes connected to the internet, these gadgets become vulnerable to malware and other security and privacy issues. As the sensors in wearable electronics rapidly evolve and policy issues emerge, consumers will look for the government to establish roles and responsibilities related to privacy, security, data ownership, and consent. Regulatory compliance remains a significant barrier to the widespread adoption of sensor patches, particularly in healthcare applications where these devices must meet stringent medical device approval standards set by bodies such as the US FDA, the European Medicines Agency (EMA), and other regional regulatory authorities.

Opportunity: Growing adoption of telehealth

Telehealth is an emerging concept in the healthcare sector that can change the current care format and allow cost-effectively access to improved health outcomes. Telehealth is a provision and distribution of healthcare remotely using telecommunication technology. Under telehealth, remote patients can obtain clinical services more easily, and hospitals can provide emergency and intensive care services remotely. With the inclusion of more health monitoring wearables, the healthcare industry is moving toward telehealth. These devices can transmit health-related data from patients to doctors and vice versa. Moreover, the massive volume of data generated through telehealth will help achieve better healthcare and scientific research outcomes. Therefore, sensor patches, being inexpensive, flexible, and user-friendly, are expected to make a valuable contribution to telehealth.

Challenge: Issues related to data security due to connected medical devices

The wearable technology ecosystem is a data-driven concept. In wearable technology, a massive chunk of data is generated from wearable-enabled devices, sensors, and patches. With this technology's growing use, the data intrusion rate is also increasing rapidly. Wearable technology platforms are newly developed, and security standards are lacking. Data security and privacy have become significant areas of concern for patients and medical service providers owing to the increasing global adoption of sensor patches. The vulnerability of connected medical devices in terms of personal information leakages is a challenge for the growth of the sensor patch market.

Sensor Patch Marke: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Glucose monitoring, cardiac markers, infectious diseases | Lingo’s coaching program helps people see the connections between their food choices and glucose data and create healthier habits over time. |

|

Clinical diagnostics, glucose monitoring, temperature monitoring | The CGM system measures glucose levels and sends data wirelessly to a display device through a transmitter. |

|

Heart rate monitoring, glucose monitoring, temperature monitoring | Early indicators of patient decline, tubeless, wearable and fully disposable insulin delivery device. |

|

Temperature monitoring and ECG sensor | These ECG sensors are ideal for medical, health and fitness, and industrial sectors, where instantaneous measurements are required and a battery is not feasible or desired. |

|

Heart rate and ECG monitoring | This product is perfect for continuously monitoring ECG remotely for up to 14 days. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The overall sensor patches ecosystem consists of component & raw material suppliers, OEMs & System Integrators, technology providers, suppliers & distributors, and end users. A few companies involved in the ecosystem are Medtronic (US), Abbott Laboratories. (US), and DexCom, Inc. (US), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Sensor Patch Market, by Product Type

The blood glucose segment is expected to hold the largest share of the sensor patch market by 2030. Blood glucose sensor patches are used to measure glucose concentration in blood or sweat. These patches are designed for diabetic patients, runners, cyclists, athletes, and players to keep track of their blood glucose levels. Diabetic patients who use insulin monitor the glucose level in their blood to determine the requirement of the next insulin dose. Some major manufacturers of blood glucose monitors and sensors include Medtronic (US), Abbott Laboratories (US), and DexCom, Inc. (US).

Sensor Patch Market, by Wearable Type

The bodywear segment is expected to hold the largest share of the sensor patch market by 2030. Bodywear includes armwear, chest patches, and sensor-based contact lenses. Armwear patches are used for various healthcare applications, such as measuring and monitoring blood pressure, body temperature, and heart rate. These devices can be connected to iOS or Android phones via Bluetooth. Chest straps are worn on the chest and are used to monitor the heart rate while running. Athletes and fitness conscious people use these devices.

Sensor Patch Market, by Application

The monitoring segment is expected to capture the largest market share throughout the forecast period. Recent advancements in telecommunications, microelectronics, sensor manufacturing, and data analysis techniques have opened new possibilities for using wearable technology in the digital health ecosystem to achieve various health outcomes. In the past, the large size of sensors and front-end electronics made it difficult to use them in wearable devices to gather physiological and movement data. With miniature circuits, microcontroller functions, front-end amplification, and wireless data transmission, wearable sensor patches can be deployed in digital health monitoring systems.

Sensor Patch Market, by End-use Industry

The fitness and sport segment is likely to record the highest CAGR from 2025 to 2030. The growing demand for sensor patches in sports is attributed to the advances brought by these patches in terms of improved monitoring and tracking. Sensor patches transform how athletes train, perform, and recover from injuries. The increasing average life expectancy of the population worldwide would further drive the growth of the sensor patch market in the fitness and sports industry.

REGION

Asia Pacific to be fastest-growing market for sensor patches during forecast period

The Asia Pacific region is projected to record the highest CAGR in the sensor patch market during the forecast period. Asia Pacific is expected to be among the key markets for sensor patch applications in the future due to its high population density. Other significant factors contributing to the growth of the sensor patch market in Asia Pacific include the development of healthcare systems and the increasing number of lifestyle diseases in the region. The sensor patch market in Asia Pacific amalgamates a few leading markets, such as China, Japan, and India.

Sensor Patch Marke: COMPANY EVALUATION MATRIX

In the sensor patch market matrix, Abbott Laboratories (Star) leads with a strong market presence and an extensive product portfolio, enabling widespread adoption across the healthcare and fitness and sports industry. Koninklijke Philips NV (Emerging Leader) is steadily gaining traction with its innovative sensor patch-focused healthcare industry. While Abbott Laboratories dominates through scale and an established customer base, Koninklijke Philips NV demonstrates solid growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS - Top Sensor Patch Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.59 Billion |

| Market Forecast in 2030 (Value) | USD 23.91 Billion |

| Growth Rate | CAGR of 30.5% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Thousand/Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Latin America, and Africa |

WHAT IS IN IT FOR YOU: Sensor Patch Marke REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific Sports Tech Startup | Competitive landscape of fitness and sports-performance patches (sweat, hydration, lactate monitoring) | Expanded roadmap into sports & lifestyle markets |

RECENT DEVELOPMENTS

- May 2025 : iRhythm Technologies, Inc. announced the commercial launch of its Zio long-term continuous ECG monitoring (LTCM) system in Japan, commercially introduced in this market as the Zio ECG Recording and Analysis System.

- December 2024 : Dexcom, Inc. launched a proprietary Generative AI (GenAI) platform, making Dexcom the first CGM manufacturer to integrate GenAI into glucose biosensing technology. The new Dexcom GenAI platform will analyze individual health data patterns to reveal a direct association between lifestyle choices and glucose levels while providing actionable insights to help improve metabolic health.

- August 2024 : Abbott Laboratories partnered with Medtronic to collaborate on an integrated continuous glucose monitoring (CGM) system based on Abbott's FreeStyle Libre technology that will connect with Medtronic's automated insulin delivery (AID) and smart insulin pen systems. Integrating Abbott's CGM sensor with Medtronic's AID algorithms will enable automatic insulin adjustments to keep glucose in range.

- February 2024 : iRhythm Technologies, Inc. partnered with Epic Systems Corporation to use Epic's Aura platform to streamline access to iRhythm's Zio long-term continuous monitoring and ambulatory mobile cardiac telemetry services through improved operational efficiency for clinicians.

- May 2023 : Medtronic entered into a set of definitive agreements to acquire EOFlow Co. Ltd, manufacturer of the EOPatch device—a tubeless, wearable, and fully disposable insulin delivery device. The addition of EOFlow, together with Medtronic's Meal Detection Technology algorithm and next-generation continuous glucose monitor (CGM), is expected to expand the company's ability to address the needs of more individuals with diabetes.

Table of Contents

Methodology

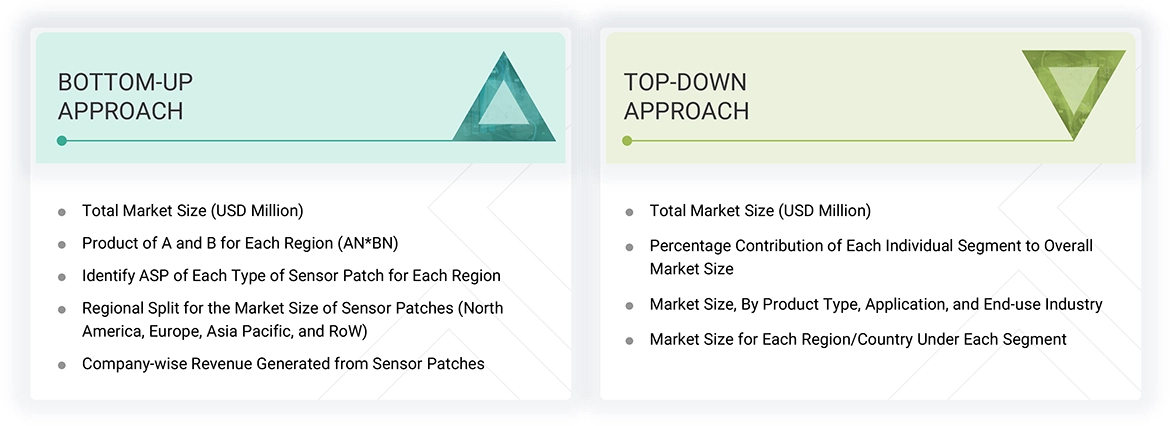

The study involved major activities in estimating the sensor patch market size. Exhaustive secondary research was done to collect information on sensor patches. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the sensor patch.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was mainly carried out to obtain critical information about the industry’s supply chain, value chain, the total pool of key players, and market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold- and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the Semiconductor Industry Association, Global Semiconductor Alliance, and Taiwan Semiconductor Industry Association.

Secondary research was mainly used to obtain critical information about the industry's supply chain and value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both the market and technology-oriented perspectives. Secondary data was gathered and analyzed to determine the overall market size, which was validated by primary research.

Primary Research

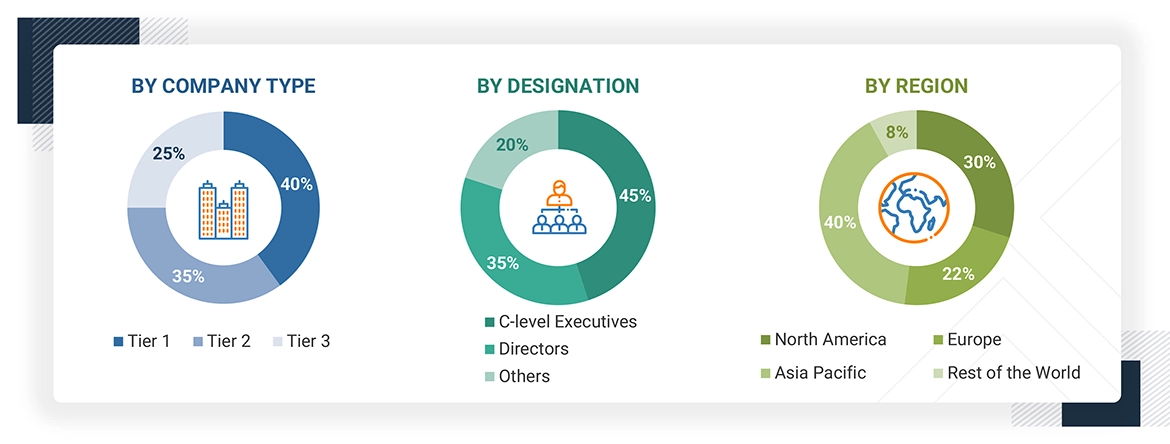

Extensive primary research was conducted after understanding and analyzing the current scenario of the sensor patch market through secondary research. A number of primary interviews were held with demand and supply side key opinion leaders in four key regions: North America, Europe, Asia Pacific, and Rest of the World. Nearly 25% of the primary interviews were held with the demand side and 75% with the supply side. The primary data was gathered primarily through telephonic interviews, which were 80% of the total primary interviews. Surveys and e-mails were also utilized to collect data.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives and researchers, as well as members of various sensor patch organizations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report implements top-down and bottom-up approaches to estimate and validate the size of the sensor patch market and various other dependent submarkets. Secondary research identifies key players in this market, and their market shares in the respective regions are determined through primary and secondary research.

This entire research methodology included the study of annual and financial reports of top companies, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The figures below show the overall market size estimation process employed for this study.

Bottom-Up Approach

- Identifying the entities in the semiconductor value chain influencing the entire sensor patch industry, along with the related software and service providers

- Analyzing each type of entity along with related companies and system integrators, and identifying service providers for the implementation of products and services

- Understanding the demand generated by the sensor patch-related companies

- Tracking ongoing and upcoming implementations of sensor patch developments by various companies and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the type of contracts, services, products and services, and software deployed by these sensor patch industry players that would help in analyzing the break-up of the scope of work carried out by each major sensor patch company

- Estimating the market size by analyzing sensor patch companies based on their different countries, and then combining the data to get the market estimate by region

- Verifying and cross-checking the estimates at every level through discussions with key opinion leaders, including CXOs, directors, operations managers, and MarketsandMarkets’ domain experts

- Studying various paid and unpaid sources of information, such as annual reports, press releases, and white papers

Top-Down Approach

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the sensor patch market

- Building and developing the information related to the revenue generated by selling various sensor patch products, services, and software

- Conducting multiple on-field discussions with key opinion leaders across major companies involved in the manufacture of products, services, and software

- Estimating geographic splits using secondary sources, based on factors such as the number of players in a specific country and region, operational types, level of services offered, and types of software implemented

Sensor Patch Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the sensor patch market from the estimation process explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed (wherever applicable) to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The size of the sensor patch market was validated using both top-down and bottom-up approaches.

Market Definition

A wearable sensor patch uses various sensing and transducing principles to monitor and diagnose physiological parameters that can be tracked and analyzed remotely. Sensor patches are attached to the human body to monitor vital signs and provide specific treatments when required. Sensor patches are categorized under wearable devices with embedded intelligence, connectivity, and extensive usability. These patches offer a unique and modern solution for condition/activity monitoring, feedback, and drug delivery services, such as drug delivery or stimulation, localization, identification, personal/contextual notifications, information display, and virtual assistance.

Key Stakeholders

- Raw material suppliers

- Manufacturers and distributors of sensor patches and wearable patches

- Original equipment manufacturers (OEMs)

- Device suppliers and distributors

- Software application providers

- Manufacturers of medical and health monitoring devices

- System integrators

- Middleware providers

- Assembly, testing, and packaging vendors

- Research institutes and organizations

- Technology standards organizations, forums, alliances, and associations

- Governments, financial institutions, and regulatory bodies

Report Objectives

- To define, describe, and forecast the sensor patch market, by product type, wearable type, application, end-use industry, and region, in terms of value

- To define, describe, and forecast the global sensor patch market, by product type, in terms of volume

-

To forecast the sizes of various segments with respect to four major regions—

North America, Europe, Asia Pacific, and Rest of the World (RoW) - To provide a detailed analysis of the sensor patch supply chain

- To strategically analyze the micromarkets with respect to individual growth trends and prospects, and their contributions to the total market

- To analyze competitive developments, such as expansions, agreements, partnerships, acquisitions, product developments, and research & development (R&D), in the sensor patch market

- To analyze the opportunities for market players and provide details of the competitive landscape of the market.

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with a detailed competitive landscape of the market

- To analyze the supply chain, market/ecosystem map, trend/disruptions impacting customer business, technology analysis, Porter’s five force analysis, trade analysis, patent analysis, key conferences & events, and regulations related to the sensor patch market

Available Customizations

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

What are the major driving factors and opportunities for the players in the sensor patch market?

The growth of the sensor patch market is primarily driven by rising demand for portable medical devices and wearable sensors, a rapidly increasing elderly population, and the surging use of sensor patches for glucose monitoring in diabetic patients. The rapidly expanding wearable device market is likely to create lucrative growth opportunities.

Which region is expected to hold the largest share of the sensor patch market in 2025?

North America is projected to capture the largest market share in 2025 due to the massive demand for early adoption of new technological advancements, such as nanotechnology, and the presence of key market players, which will positively impact the market in this region.

Who are the leading players in the global sensor patch market?

Leading players operating in the worldwide sensor patch market are Abbott Laboratories (US), Medtronic PLC (Ireland), DexCom, Inc. (US), iRhythm Technologies, Inc. (US), and Texas Instruments Incorporated (US).

Which product is expected to drive the sensor patch market?

Heart rate sensor patches are expected to drive the market.

What will be the global sensor patch market size in 2025 and 2030?

The global sensor patch market is projected to grow from USD 6.32 billion in 2025 to USD 23.91 billion by 2030, at a CAGR of 30.5%.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportAdjacent Markets

- Ingestible Sensor Market

- Medical Sensors Market

- Biosensors Market

- Blood Glucose Monitor Market

- Portable Medical Devices Market; By Equipment (Cardiac, Respiratory, Hemodynamic, Fitness & Wellness, Independent Ageing, Insulin pumps, Ultrasound), Semiconductor Components (Memory, PMIC, Processor, Display, Sensor, Connectivity) (2013

Personalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sensor Patch Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Sensor Patch Market