Sulfuric Acid Market

Sulfuric Acid Market by Raw Material (Elemental Sulfur, Base Metal Smelters, Pyrite Ore), Application (Fertilizers, Chemical Manufacturing, Metal Processing, Petroleum Refining, Textiles, and Automotive), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global sulfuric acid market is expected to grow from USD 41.23 billion in 2025 to USD 49.94 billion by 2030, at a CAGR of 3.9% during the forecast period. Sulfuric acid is an industrial chemical used across various sectors because of its versatility and strong acidic properties. It is mainly produced from raw materials like pyrite ore, elemental sulfur, and base metal smelters. Elemental sulfur is the most commonly used raw material for producing sulfuric acid due to its easier availability than other raw materials. The acid is also produced in different forms, including concentrated sulfuric acid, battery acid, and chamber acid, and it is processed through two main methods: the contact process and the double contact double absorption (DCDA) process, to meet different end-use needs. From a market perspective, sulfuric acid can generally be classified by its applications in fertilizers, metal processing, chemical manufacturing, petroleum refining, pulp and paper, textiles, automotive, and other industries. Market growth is also driven by the increasing need for higher agricultural productivity, the expansion of infrastructure due to urbanization, and the rising demand for refined metals and chemicals, all of which rely heavily on sulfuric acid in their production processes.

KEY TAKEAWAYS

-

BY RAW MATERIALRaw Materials include elemental sulfur, pyrite oil, base metal smelters, and other raw materials

-

BY GRADEGrades include technical grade, CP grade (chemically pure), and battery grade

-

BY PROCESSProcesses include the contact process and double contact double absorption (DCDA)

-

BY APPLICATIONApplications include fertilizers, metal processing, pulp & paper, petroleum refining, textiles, automotive, chemical manufacturing, and other applications

-

BY FORM TYPEForm Type includes concentrated sulfuric acid, tower/glover acid, chamber/fertilizer acid, battery acid, 66 degree Baume sulfuric acid, and dilute sulfuric acid

-

BY REGIONThe Sulfuric Acid market covers Asia Pacific, North America, Western Europe, Central & Eastern Europe, the Middle East and Africa, and South America. Asia Pacific is the largest market for sulfuric acid in terms of value.

-

COMPETITIVE LANDSCAPEThe major market players have adopted strategies, such as expansion, agreements, partnerships, acquisitions, and joint ventures. For instance, Ecovyst Inc. announced that Eco Services Operations Corp., a wholly owned subsidiary of Ecovyst, has completed its acquisition of the Waggaman, Louisiana sulfuric acid production assets of Cornerstone Chemical Company.

The sulfuric acid market is expanding steadily, with demand driven mainly by fertilizer production, industrial growth in Asia and other regions, and stricter environmental standards. Key players are boosting capacity and forming new partnerships, while rising use in fertilizers, automotive, chemical manufacturing, textiles, and other applications to support global market growth

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Disruptions in client industries are reshaping the sulfuric acid market, as evolving customer trends and applications drive demand across fertilizers, metal processing, pulp & paper, petroleum refining, automotive, and chemical manufacturing. The shift toward advanced technologies, sustainability, and new partnerships alters revenue streams for sulfuric acid producers, impacting downstream users and ultimately transforming the growth outlook for industry suppliers. Fluctuations in end-user requirements directly influence the revenue and product strategies of sulfuric acid manufacturers, mirroring broad changes across global supply chains.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong demand for sulfuric acid in numerous applications

-

Increased usage of sulfuric acid in agricultural sector

Level

-

Restriction on use of sulfuric acid due to health and environmental concerns

-

High import duties and regulations on trade of sulfuric acid

Level

-

Increasing use of sulfuric acid in wastewater treatment

Level

-

Difficulties involved in transportation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong demand for sulfuric acid in numerous applications

The sulfuric acid market is exhibiting robust growth due to its increasing use in agriculture and rising demand from various other industries. Sulfuric acid is a key raw material in producing fertilizers such as phosphate fertilizers, including ammonium phosphate and superphosphates. These fertilizers are essential for maintaining and enhancing soil fertility, which supports the growing food production needs driven by a rising global population. As the population grows and food demand increases, agriculture continues to expand, especially in emerging economies where modern farming practices and fertilizer use are on the rise. This expansion boosts the ongoing demand for sulfuric acid. Besides agriculture, sulfuric acid plays a vital role in many industrial processes. It is commonly used in chemical manufacturing, metalworking, oil refining, and the automotive industry. For instance, in chemical synthesis, it functions as a catalyst and a dehydrating agent. In the mining and metallurgy industries, sulfuric acid is used for ore leaching and mineral processing. The electronics industry also relies on sulfuric acid for surface treatment and cleaning. This broad range of industrial applications, combined with the increased focus on food security and higher crop yields, is driving the long-term growth of the sulfuric acid market.

Restraint: Restrictions on the use of sulfuric acid due to health and environmental impact

The growth of the sulfuric acid market is hampered by increasing concerns about health risks, environmental issues, and complex trade regulations. Sulfuric acid is a highly corrosive chemical that, when exposed to, can cause serious health problems such as respiratory issues, skin and eye burns, and long-term damage to internal organs if proper safety procedures are not followed. These risks have led many countries to implement strict occupational health and safety rules and have also resulted in more restrictions on the use of sulfuric acid in various industries, such as metal processing, chemical manufacturing, and fertilizer production, where large volumes of the chemical are used. Environmental risks associated with sulfuric acid—such as acid rain, groundwater contamination, and soil damage—have prompted countries to enforce stricter emission standards and disposal rules. These factors collectively increase the costs for both producers and users of sulfuric acid. Additionally, international trade of sulfuric acid faces high import taxes and costly compliance hurdles, especially since regulated sectors depend heavily on imports or domestic production. Trade barriers limit the availability of sulfuric acid in price-sensitive markets and discourage small and mid-sized manufacturers from expanding. Overall, these interconnected issues related to safety, environmental impact, and trade restrictions significantly limit the overall growth of the sulfuric acid market.

Opportunity: Rising use of sulfuric acid in wastewater treatment

The increasing use of sulfuric acid in wastewater treatment presents a significant growth opportunity for the sulfuric acid market. As industrial growth and rapid urbanization continue, the volume of wastewater generated by industries such as chemical, textile, and metal processing has surged. In this context, sulfuric acid plays a crucial role in adjusting pH levels, neutralizing alkaline wastewater, and facilitating the precipitation of heavy metals and other pollutants. With tightening environmental regulations worldwide, companies and municipalities are investing more in advanced effluent treatment systems, with sulfuric acid as a primary chemical input. Additionally, the push to meet discharge standards and protect freshwater sources is compelling both developed and developing countries to enhance their water treatment infrastructure. Sulfuric acid’s effectiveness, availability, and cost-efficiency make it ideal for large-scale treatment applications. This rising demand from the water and wastewater sector is opening new growth avenues for sulfuric acid producers, as demand expands beyond traditional markets like agriculture and manufacturing. As sustainability and resource management gain prominence, sulfuric acid’s role in environmental protection through water treatment is becoming increasingly valued.

Challenge: Difficulties involved in transportation of sulfuric acid

The logistics of transporting sulfuric acid are some of the main factors limiting global sulfuric acid market growth. As a highly corrosive and reactive chemical, sulfuric acid requires specialized containers, corrosion-resistant tankers, and strict safety protocols, making its logistics expensive and complicated. Any transportation accidents or spills pose serious environmental and public safety risks, leading to strict regulations and compliance standards. These safety concerns also create an additional burden for sellers and manufacturers — a burden that is especially heavy in regions lacking proper infrastructure or logistics. Additionally, shipping sulfuric acid becomes even more challenging in many developing countries due to the shortage of trained workers. Border authorities may also slow down or completely block the transportation of hazardous goods, affecting the timely supply of sulfuric acid to key sectors such as fertilizer, chemicals, and metal refining. Moreover, insurance costs and risk management strategies related to transportation add to the overall cost of sulfuric acid, influencing its price competitiveness. These infrastructural challenges can also hinder the overall growth of the sulfuric acid market, as they lead to supply chain inefficiencies and discourage new market entrants.

Sulfuric Acid Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used in the production of fertilizers (phosphates, ammonium sulfate) | Increases agricultural productivity and supports global food security |

|

Uses sulfuric acid in phosphate fertilizer manufacturing | Ensures high crop yield, helps meet rising food demand |

|

Uses sulfuric acid in large volumes for the production of phosphate fertilizers such as MAP (Monoammonium Phosphate) and DAP (Diammonium Phosphate) | Ensures high phosphate content in fertilizers, improves soil fertility, and supports large-scale agriculture |

|

Uses sulfuric acid in metal leaching and mineral processing (copper, zinc, nickel) | Improves recovery rates, enhances efficiency of metal refining |

|

Employs sulfuric acid to process phosphate rock into phosphoric acid, which is then used to manufacture fertilizers | Maximizes phosphate extraction efficiency, enhances global fertilizer supply, and supports sustainable farming |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The sulfuric acid market ecosystem consists of raw material suppliers (e.g., M.K. Chemical Industries, Tiger-Sul), sulfuric acid manufacturers (e.g., BASF, Aurubis), and end users (e.g., Mosaic, Nutrien). Sulfuric acid is used in various applications such as fertilizers, textiles, automotive, chemical manufacturing, metal processing, and others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Sulfuric Acid Market, By Raw Material

The pyrite ore segment, by raw material, is expected to exhibit the highest CAGR by volume within the sulfuric acid market during the forecast period. Pyrite ore, also known as iron sulfide, is a naturally occurring mineral and of the traditional raw materials. When roasted, pyrite releases sulfur dioxide, which can then be converted into sulfuric acid through the contact or double contact absorption processes. Although elemental sulfur remains the dominant raw material, pyrite ore is increasingly considered in regions where large quantities are cheaply available and where elemental sulfur is scarce. The use of pyrite ore for sulfuric acid production is especially favored in countries with robust mining sectors, where pyrite is a by-product of extracting base metals such as gold and copper. Utilizing pyrite is cost-effective because it reduces reliance on imported sulfur and supports domestic production. Additionally, environmental regulations encouraging by-product sources and the global growth in sulfuric acid consumption are boosting the use of pyrite ore as a raw material for sulfuric acid production.

Sulfuric Acid Market, By Application

Among application segments, the automotive segment is expected to record the highest CAGR in the sulfuric acid market during the forecast period, mainly due to its essential role in lead-acid battery manufacturing. Sulfuric acid is the core component of these batteries, which remain the preferred choice for starting, lighting, and ignition systems in traditional vehicles and for backup power in electric and hybrid vehicles. Although lithium-ion batteries are increasingly used in more vehicles, the lower cost, recyclability, and existing infrastructure for lead-acid batteries keep them popular in commercial vehicles and inexpensive passenger cars. As vehicle ownership rises in emerging markets and replacement demand remains strong in developed markets, steady growth in sulfuric acid use for battery production is evident. Additionally, sulfuric acid is a key material in recycling spent batteries to extract and purify lead. Stricter quality requirements and higher purity grades for battery applications drive the growth of this segment. This growing demand for premium-grade sulfuric acid for both manufacturing and recycling is fueling the automotive segment’s substantial expansion within the overall market.

REGION

The Middle East and Africa are projected to record the highest CAGR during the forecast period

The Middle East and Africa are expected to record the highest CAGR in terms of the value of the sulfuric acid market for the forecast period, due to industrial developments, increasing investments in infrastructure, and rising demand in several key end-use sectors. One of the most prominent growth drivers in the region is the focus on mining and metal refining activities, as countries with substantial natural resources are ramping up efforts to extract and process base metals like copper, zinc, and phosphate. Sulfuric acid plays a vital role in hydrometallurgical processes such as leaching, which are critical in these operations. Additionally, the agriculture sector in the region is steadily evolving, with an emphasis on improving crop yields to support regional food security initiatives; this has increased demand for phosphate-based fertilizers, with sulfuric acid being a key component. The expansion of refining and petrochemical facilities, particularly in countries investing heavily in diversifying their industrial base, is also boosting sulfuric acid consumption. Notably, the development of local manufacturing hubs and new production capacities reduces imports and supports domestic supply. These factors are expected to continue driving faster growth in this region’s sulfuric acid market compared to other parts of the world.

Sulfuric Acid Market: COMPANY EVALUATION MATRIX

In the sulfuric acid market matrix, Mosaic (Star) leads with a strong market share and strategically integrates sulfuric acid production to support its dominant phosphate fertilizer operations, optimizing the supply chain and enhancing cost efficiency. Lanxess (Emerging Leader) is gaining visibility with its extensive product footprint for sulfuric acid.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 36.83 BN |

| Market Forecast in 2030 | USD 49.94 BN |

| CAGR (2025–2030) | 3.9% |

| Years considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Million Tons) |

| Report Coverage | The report defines, segments, and projects the sulfuric acid market size based on form type, grade, application, process, raw material, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as joint ventures, agreements, acquisitions, and expansions they undertake in the market. |

| Segments Covered | • Grade (Technical Grade, CP Grade (Chemically Pure), Battery Grade) |

| Regional Scope | Asia Pacific, North America, Western Europe, Central & Eastern Europe, the Middle East and Africa, and South America |

WHAT IS IN IT FOR YOU: Sulfuric Acid Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based Graphene Manufacturer | • Analysis of sulfuric acid demand in phosphate fertilizer production | • Secure raw material supply |

| Graphene-Based Composites Manufacturer | • Forecasting consumption by region | • Support agricultural productivity goals |

| Battery Manufacturer | • Benchmarking key suppliers | • Identify opportunities for cost optimization |

| U.S.-based Graphene Raw Material Supplier | • Assessment of sulfuric acid use in alkylation for cleaner fuels | • Compliance with fuel quality standards |

| Automotive Graphene Customer | • Scenario modeling under evolving emission norms | • Optimize refining operations |

RECENT DEVELOPMENTS

- May 2025 : Ecovyst Inc. announced that Eco Services Operations Corp., a wholly owned subsidiary of Ecovyst, completed its acquisition of the Waggaman, Louisiana sulfuric acid production assets of Cornerstone Chemical Company.

- April 2025 : BASF announced that it will expand its production capacity for semiconductor-grade sulfuric acid, which is an essential ultra-pure chemical. The new production facility at its Ludwigshafen site in Germany will feature state-of-the-art purity capabilities to meet the growing demand for advanced semiconductor chip manufacturing across Europe. Operations are expected to begin by 2027, aligning with the capacity expansion of key customers. The BASF investment will be in a high double-digit million-euro range.

- March 2025 : Ecovyst Inc. agreed to acquire the sulfuric acid production assets of Cornerstone Chemical Company in Waggaman, Louisiana. The acquisition aims to increase Ecoservices’ capacity to serve both regeneration and virgin sulfuric acid customers and offers greater flexibility within the Company’s existing plant network along the Gulf Coast.

- July 2022 : Chemtrade Logistics and Kanto Group announced a joint venture, KPCT Advanced Chemicals LLC, to develop a greenfield high-purity sulfuric acid plant. The companies plan to build the plant in Arizona, with an expected start-up in 2024.

- July 2021 : BASF, Zhejiang Jiahua Energy Chemical Industry Co. Ltd., and Zhejiang Jiafu New Material Technology Co. Ltd. signed an agreement to increase electronic-grade sulfuric acid production capacity in China.

Table of Contents

Methodology

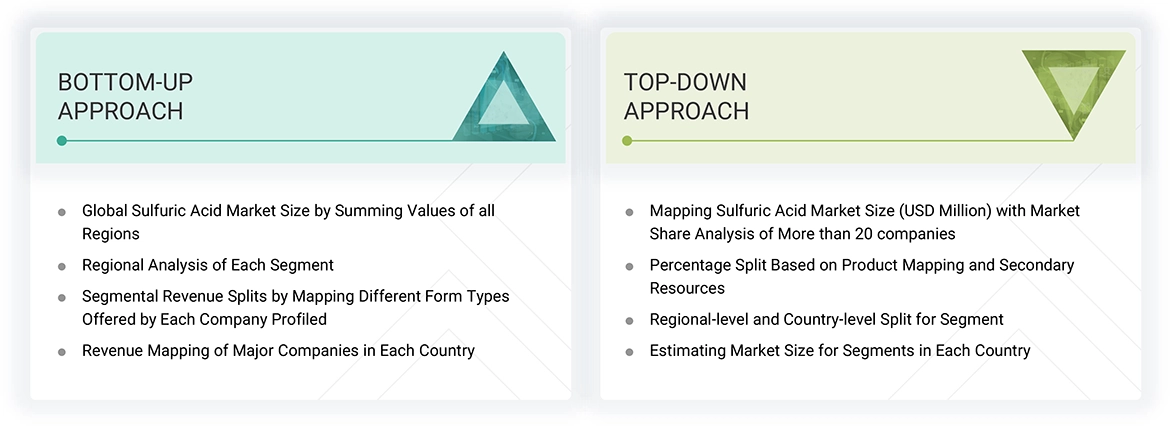

The research involved four main steps in assessing the current size of the sulfuric acid market. Comprehensive secondary research was carried out to collect information on the overall market, the related markets, and the core market. The next step was to validate these findings, assumptions, and measurements with industry experts across the sulfuric acid supply chain through primary research. The total market size was determined using both top-down and bottom-up approaches. Afterward, market segmentation analysis and data triangulation were applied to define the sizes of market segments and sub-segments.

Secondary Research

The research approach used to evaluate and forecast the access control market begins with collecting revenue data from leading suppliers through secondary research. Various sources, such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were employed to gather information for this study. These sources included annual reports, press releases, and investor presentations from companies; white papers; reputable periodicals; writings by respected authors; statements from regulatory agencies; trade directories; and databases. Vendor offerings have also been analyzed to determine market segmentation.

Primary Research

The sulfuric acid market includes various stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations involved in the supply chain. On the demand side, growth is driven by industries like fertilizers, chemical manufacturing, textiles, automotive, pulp & paper, and other applications. On the supply side, advancements in technology are prominent. To gather both qualitative and quantitative data, interviews were conducted with key sources from both the supply and demand sides.

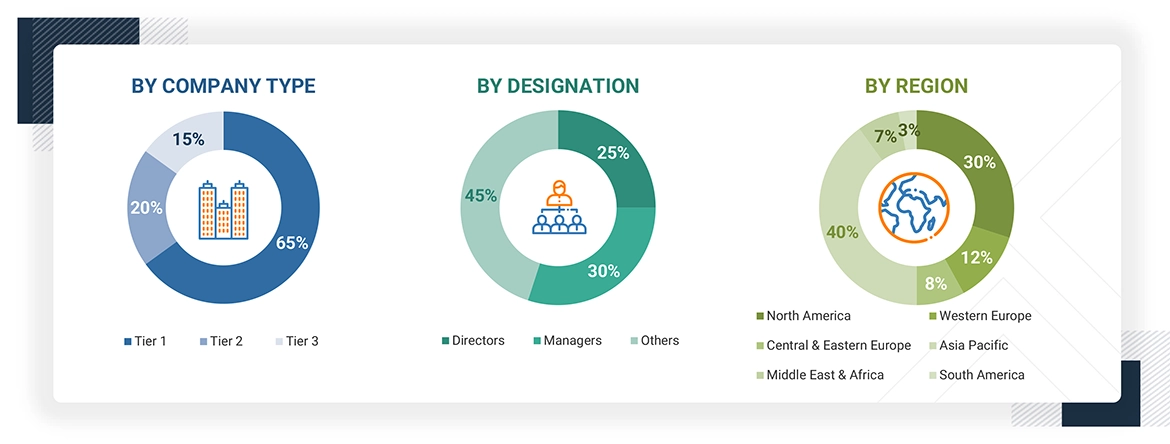

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were employed to estimate and verify the overall size of the sulfuric acid market. These methods were also widely used to determine the size of various sub-segments within the market. The research methodology used to calculate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and size of the sulfuric acid market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters affecting the market covered in this research were considered, examined in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews for insights from key leaders such as CEOs, directors, and marketing executives.

Global Sulfuric Acid Market Size: Bottom-Up and Top-Down Approach

Data Triangulation

After estimating the overall market size using the methods described above, the market was divided into various segments and sub-segments. Data triangulation and market breakdown procedures were employed as needed to complete the market engineering process and determine precise statistics for each segment and sub-segment. The global market size was calculated by summing the data from individual countries and regions.

Market Definition

Sulfuric acid is a highly dense, colorless, slightly yellow liquid, one of the most widely used industrial chemicals worldwide. It is mainly produced from raw materials such as elemental sulfur, pyrite ore, and off-gases from base metal smelters, depending on resource availability and production costs. The production process typically uses the Contact Process or the more efficient Double Contact Double Absorption (DCDA) method, designed to maximize conversion efficiency and reduce emissions. Sulfuric acid comes in several grades tailored for different industrial applications, including technical grade for general use, battery grade for lead-acid batteries, and CP grade (chemically pure) for laboratory and precision work. It is also available in various forms, such as concentrated sulfuric acid, tower or Glover acid, chamber or fertilizer acid, battery acid, 66-degree Baume sulfuric acid, and dilute sulfuric acid, depending on concentration and application needs. Its broad range of uses includes fertilizers, metal processing, petroleum refining, chemical manufacturing, pulp and paper production, textile processing, and the automotive industries. The versatility, reactivity, and availability of sulfuric acid make it a fundamental component in many industrial supply chains.

Stakeholders

- Sulfuric acid manufacturers

- Sulfuric acid suppliers

- Sulfuric acid traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals and materials sectors

- Industry associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, governments, investment banks, venture capitalists, and private equity firms

Report Objectives

- To define, describe, and forecast the size of the global sulfuric acid market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global sulfuric acid market

- To analyze and forecast the size of various segments (raw material, grade, form type, process, and application) of the sulfuric acid market based on six major regions—North America, Asia Pacific, Western Europe, Central & Eastern Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the critical driver for the sulfuric acid market?

The growth of the sulfuric acid market is driven by its high demand across various industries.

Which region is expected to register the highest CAGR in the sulfuric acid market during the forecast period?

The Middle East & Africa region is estimated to register the highest CAGR during the forecast period.

What is the primary end-use industry of sulfuric acid?

Fertilizers represent the major end-use industry for sulfuric acid.

Who are the major players in the sulfuric acid market?

Key players include PhosAgro Group (Russia), Aurubis AG (Germany), Mosaic (US), OCP (Morocco), and Jiangxi Copper Corporation (China).

What is the expected CAGR of the sulfuric acid market from 2025 to 2030?

The market is expected to grow at a CAGR of 3.9% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sulfuric Acid Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Sulfuric Acid Market