Shoreside Shore Power Market

Shoreside Shore Power Market by Power Output (Up to 30 MVA, 30–60 MVA, Above 60 MVA), Vessel (Cruise, Ferry, Container Vessel, Ro-ro Vehicle Carrier, Bulk Carrier, Tanker, General Cargo), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

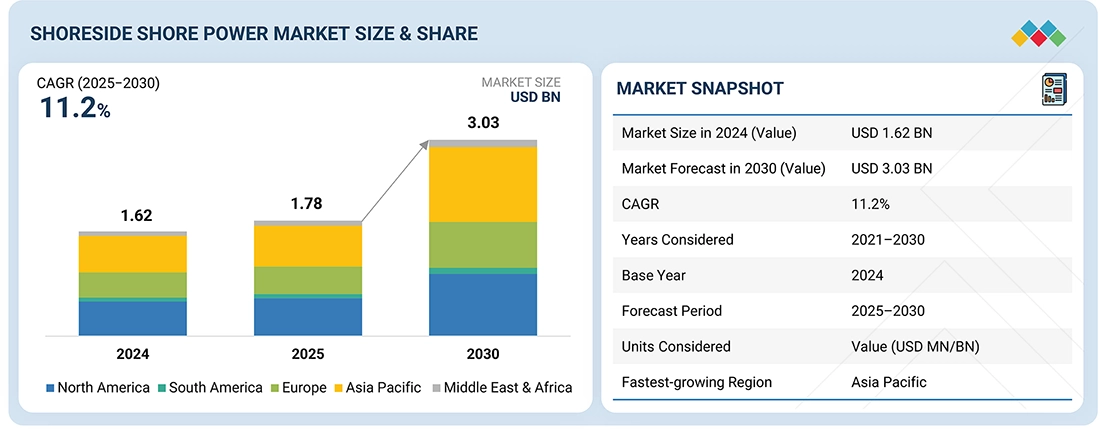

The shoreside shore power market is projected to reach USD 3.03 billion by 2030 from USD 1.78 billion in 2025, at a CAGR of 11.2% during the forecast period. With the rising container volumes, cruise tourism, and cargo movement, global ports invest heavily in modernization projects. Electrification of berths through shoreside power is integrated into most port upgrade programs. Ports prefer shoreside systems as they enable centralized control, easier maintenance, and compatibility with various ship types. This infrastructure-first approach accelerates adoption of shoreside equipment such as transformers, switchgear, power distribution units, and cable handling systems.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to witness a CAGR of 12.6% in the shoreside shore power market from 2025 to 2030.

-

BY CONNECTIONBased on connection, the retrofit connection is expected to hold the largest market share by 2030.

-

BY POWER OUTPUTBy power output, the up to 30 MVA is likely to witness the highest CAGR in the shoreside shore power market during the forecast period.

-

BY VESSELIn terms of vessel, the cruise segment is anticipated to dominate with a 33.8% share of the shoreshide shore power market by 2030.

-

COMPETITIVE LANDSCAPEABB (Switzerland), Siemens (Germany), Schneider Electric (France), GE (US), and Cavotec SA (Switzerland) are increasingly collaborating with regional port authorities, shipyard developers, and energy utilities across regions to deploy shore power infrastructure tailored to local regulatory requirements, growing port electrification initiatives, and sustainability goals.

-

COMPETITIVE LANDSCAPEPower Docks LLC and Flex Marine Power Ltd. are among the most influential startups and SMEs in the shoreside shore power landscape.

Substantial public funding, grants, and tax incentives across the US, Europe, China, and South Korea are lowering the capital burden on ports. Programs such as the US EPA’s Clean Ports Program, and the EU’s Green Deal allocate millions toward shore power deployment, making shoreside installations financially feasible and accelerating the shoreside shore power market growth.

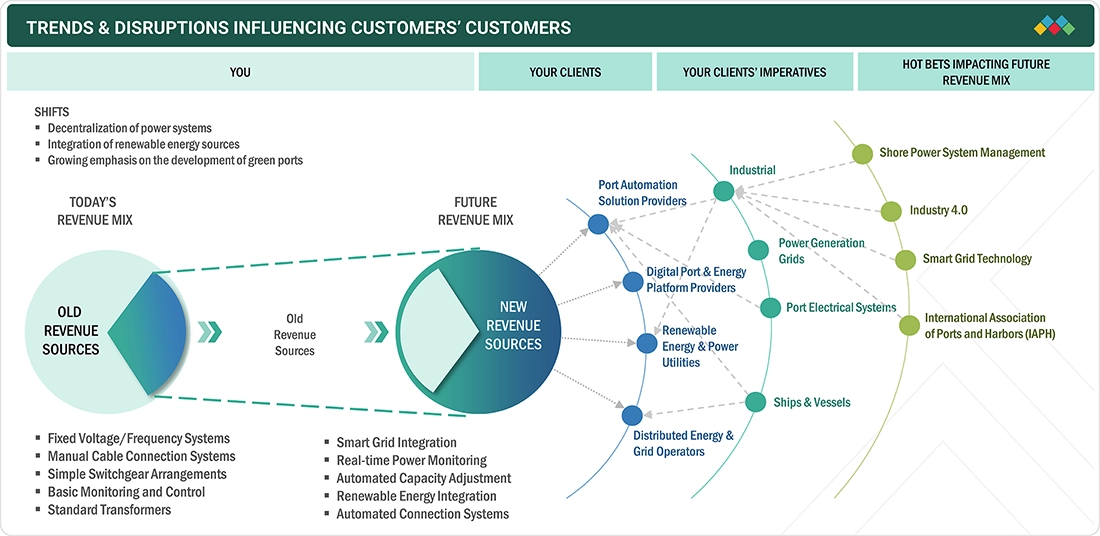

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

New emerging trends transform customers' customers in the shoreside shore power market. This reflects a transition from old revenue sources like fixed voltage, manual cable connections, switchgear, and monitoring to new revenue sources, such as power monitoring in real time, smart grid integration, automatic capacity adjustment, renewable energy integration, and automatic connection systems. These new revenue streams are a result of other transformations, such as decentralized energy grids, integration of renewable energy sources, and green ports. Consequently, industrial consumers, energy grid for power generation, port electrical infrastructure, and ships and vessels are aligning their revenue streams with shore power management, Industry 4.0, smart grid technology, and the International Association of Ports and Harbors (IAPH).

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Regulatory mandates and public funding

-

Concentrated port throughput and high-impact abatement economics

Level

-

High initial capital and split-incentive economics

-

Grid capacity, interconnection, and peak-demand constraints

Level

-

Bundling with renewables, BESS, and smart energy services

-

Programmatic retrofits and public-private financing models

Level

-

Standardization, interoperability, and multi-stakeholder alignment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Regulatory mandates and public funding accelerate deployments

One of the drivers for the shoreside shore power market is strong regulatory pressure combined with sizeable public funding. Governments and port authorities in major markets are translating air-quality and decarbonization commitments into procurement pipelines. Mandates and target dates force the hand of ports and shipowners to get moving on OPS, while grant programs and stimulus packages help reduce the upfront capital hurdle for terminals. Almost billions have been funneled into port electrification projects via the US EPA's Clean Ports awards and wider federal infrastructure funding, making previously marginal projects bankable and facilitating accelerated multi-berth rollouts. The EU's various initiatives and national funds underpin planned OPS installations, many Asia Pacific governments have paired mandates with subsidy programs. Policy and funding shrink decision timelines, make capex recoverable through public assistance or structured tariffs, and signal long-term demand to OEMs and integrators transforming regulatory intent into executable capital projects and sustained the market growth.

Restraint: Grid constraints and integration challenges

Despite policy support, shoreside projects remain capital-intensive. Transformers, frequency converters, switchgear, automated cable systems, civil works, and upstream grid reinforcement create substantial upfront cost. Economic friction is further exacerbated by the presence of a split-incentive problem whereby ports finance shoreside assets, while shipowners must pay for costly retrofits during drydock windows. If there are few compatible ships, then ports suffer from low utilization. If few ports invest, shipowners delay retrofits. Grants help but rarely cover full system+retrofit costs, while private terminals looking for quicker payback remain cautious. This coordination failure increases transaction costs, complicates tariff design, and slows scale-up unless solutions are implemented. The result is a structural restraint on rapid, universal shoreside deployment despite clear long-term benefits.

Opportunity: Bundling with renewables, BESS, and smart energy services

Pairing shoreside OPS with on-site renewables and battery energy storage systems (BESS) creates a compelling value proposition: storage smooths peak demand, reduces the need for expensive upstream reinforcement, and enables a lower-carbon power product attractive to ESG-minded shipowners. Hybrid projects solar/wind + BESS + OPS can access green finance, carbon credits and demand-response revenues, improving project bankability. Smart energy platforms and microgrids allow ports to time charging to low-cost or high-renewable periods, further reducing lifecycle costs. Several leading ports are piloting such integrated systems, validating commercial models that transform OPS from a pure infrastructure spend into a multi-service, revenue-generating energy asset. For integrators and OEMs, this opens recurring O&M and digital-services revenue streams and accelerates adoption through clearer ROI.

Challenge: Standardization, interoperability, and multi-stakeholder alignment

A decisive challenge is to harmonize technical and commercial standards across ports, utilities, shipbuilders, and regulators. Differences in frequency, connector formats, metering protocols, and billing arrangements result in bespoke engineering, contractual complexity, and legal risk. Even where there is IEC/ISO guidance, inconsistent implementation increases transaction cost and slows procurement. Commercially, there is unclear liability for power-quality incidents and varied tariff models, which create negotiation friction capable of delaying projects. Overcoming this requires coordinated standard adoption, contractual templates, and demonstrator projects that prove interoperable operations across jurisdictions. Without strong multi-stakeholder alignment, projects remain bespoke and fragmented-impeding the large-scale, repeatable rollouts needed to meet global decarbonization timelines.

SHORESIDE SHORE POWER MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Turnkey berth electrification: transformers, frequency converters, switchgear and EPC for container & cruise terminals | Reliable, grid-compliant power delivery | Faster deployments | Simplified utility coordination |

|

Integrated shore-to-ship systems combining power conversion, substations and digital energy-management for multi-berth ports | Scalable engineered solutions with load management | Predictive maintenance to reduce downtime |

|

Modular power-distribution, metering and microgrid controls plus containerized power units for rapid shore-power rollout | Improves energy visibility | Enables renewables/storage integration | Lowers capex risk |

|

High-capacity frequency converters, transformers and monitoring systems to address 50/60 Hz and power-quality issues | Ensures stable frequency/voltage matching | Protects vessel systems while enhancing grid stability |

|

Automated cable reels, shore connectors and cable-management hardware for safe, rapid connection/disconnection at berths | Reduces manual handling | Speeds vessel turnaround | Saves berth space with compact automation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The shoreside shore power ecosystem is built on a coordinated value chain involving raw material suppliers, component manufacturers, shore power system assemblers/manufacturers, and end users. Raw material suppliers, such as Prysmian, Nexans, and LS Cable & System, provide high-voltage cables and conductive materials essential for delivering stable electrical power from the grid to port infrastructure. These materials support component manufacturers, such as Danfoss, Hitachi Energy, and Toshiba, who produce frequency converters, transformers, switchgear, and power electronics that enable ships to safely connect to onshore electricity. Leading system assemblers and integrators, including ABB, Siemens, and Schneider Electric, combine these components into complete shoreside power solutions that include substations, cable management systems, and automated shore-to-ship interfaces. On the demand side, end users, such as Damen, Meyer Werft, and Fincantieri, influence the adoption through their shipbuilding expertise and collaboration with ports to ensure vessel compatibility. Collectively, this ecosystem drives the clean, low-emission port operations worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Shoreside Shore Power Market, By Connection

The retrofit segment is expected to hold the largest share of the shoreside shore power market as most existing ports and terminals are upgrading their infrastructure to meet tightening emission regulations. Instead of building entirely new electrification systems, ports prefer retrofitting as it allows them to integrate shore power with existing grids, substations, and berth layouts at a lower cost and with shorter installation timelines. Growing government incentives, compliance deadlines, and the need to minimize operational disruptions further accelerate retrofits. As ports modernize to reduce emissions rapidly, retrofit solutions become the most scalable and cost-efficient option, driving their dominance.

Shoreside Shore Power Market, By Power Output

The up to 30 MVA segment is expected to witness the highest CAGR during the forecast period as it meets the power needs of most medium and large vessels, including ferries, containers, Ro-Ro ships, and cruise ships, with basic hoteling operations. The trend shows that ports favor smaller capacity systems initially due to low capital expenditure and adaptability. Moreover, 30 MVA systems are often preferred by ports developing multiple facilities as they offer compatibility with varying vessel types. Government-supported projects and developments at early stages will usually be within this range and will contribute significantly due to faster adoption rates.

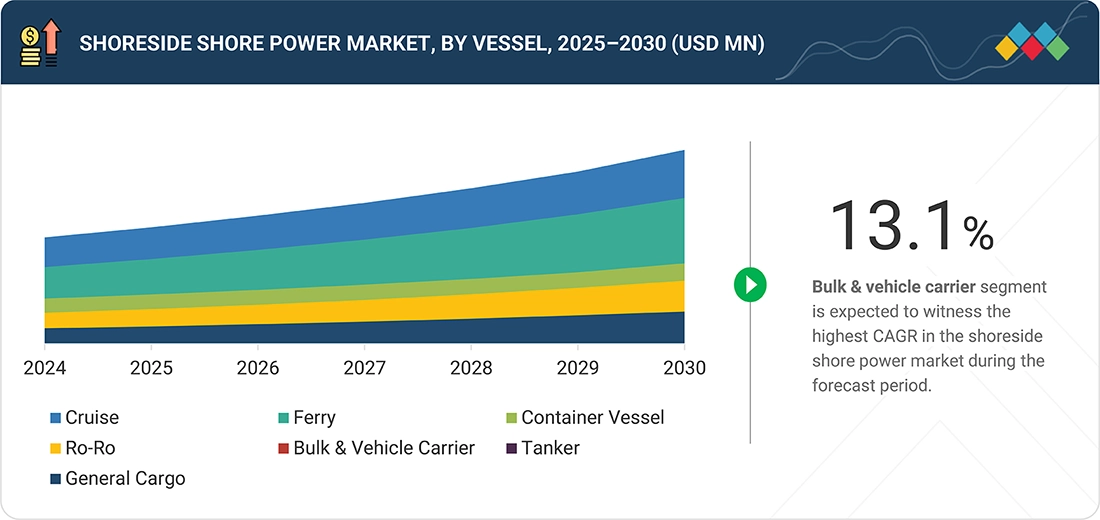

Shoreside Shore Power Market, By Vessel

The cruise segment is expected to hold the largest market share due to the extremely high energy consumption by these ships while operating at hotels, sometimes greater than cargo and tanker ships. The reason for stricter air emission standards at cruise ports is that they are usually set up near large cities. Due to these factors, cities such as Miami, Vancouver, Barcelona, and Singapore are highly involved in setting up berth-to-power systems exclusively for cruises. The increase in ship emissions also forces the cruise sector to practice sustainability, promoting ship-to-power technologies.

REGION

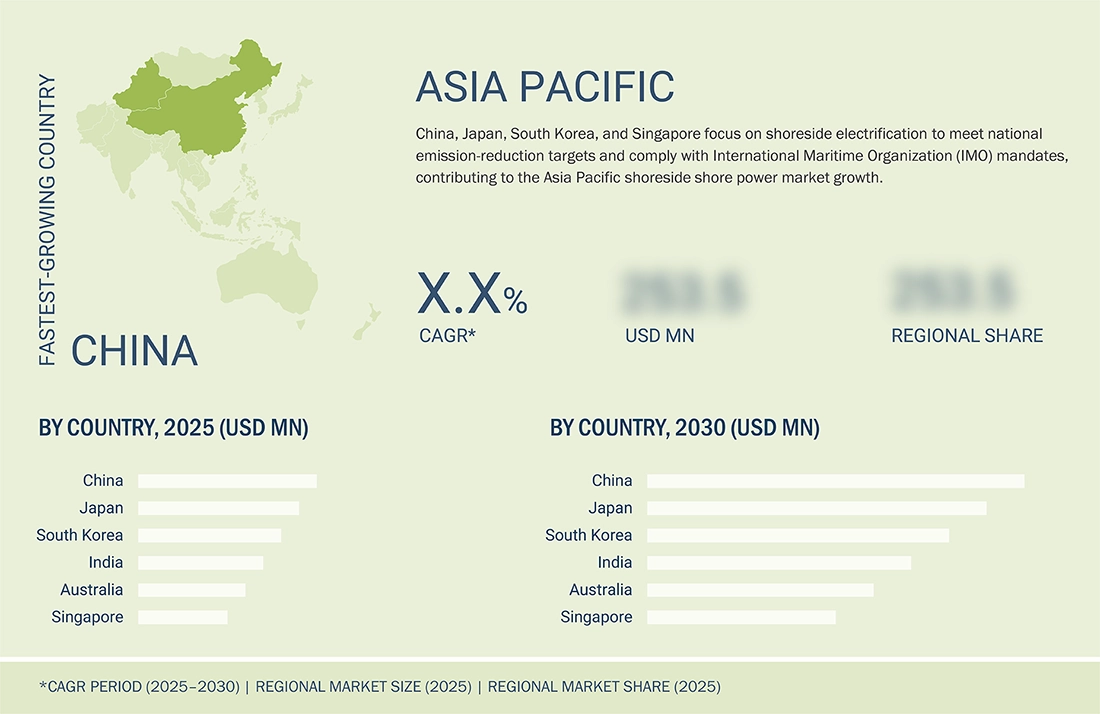

Asia Pacific to be fastest-growing region in global shoreside shore power market during forecast period

In Asia Pacific, stringent emission regulations and clean-air mandates at large, busy ports and increasing container, ferry, and cruise traffic boosts the demand for quieter, cleaner operations. National and local funding, subsidies, and PPPs reduce upfront barriers and accelerate rollouts. Fleet retrofit programs and shipowner incentives expand the addressable market. Technological standardization-ISSC/ISO, modular containerized systems, and advanced frequency converters eases implementation. Integration with renewables and battery storage improving economics and grid compatibility make shore power a bankable, fast-scaling solution across the region.

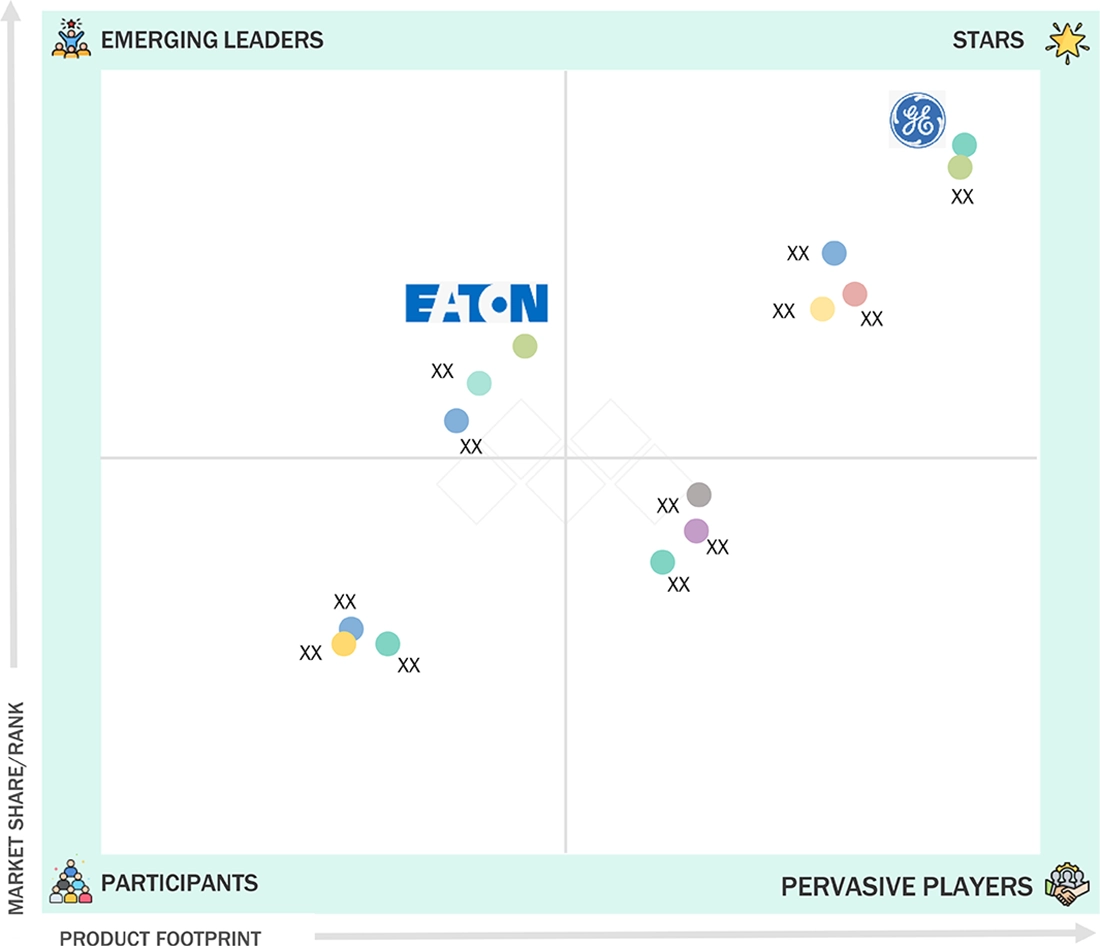

SHORESIDE SHORE POWER MARKET: COMPANY EVALUATION MATRIX

In the shoreside shore power market matrix, Generic Electric Company (Star) leads with a strong market share and extensive product footprint, This is one of the leading players in terms of developments such as product launches, innovative technologies, and the adoption of strategic growth plans. Eaton (Emerging Leader) is gaining visibility. These players have a highly focused product portfolio. However, they do not have powerful growth strategies for their overall business.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- General Electric Company (US)

- Cavotec SA (Switzerland)

- Eaton (Ireland)

- Wartsla (Finland)

- Htachi Energy Ltd. (Switzerland)

- Danfoss (Denmark)

- Powercon A/S (Denmark)

- Wabtec Corporation (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.62 Billion |

| Market Forecast in 2030 (Value) | USD 3.03 Billion |

| Growth Rate | CAGR of 11.2 % from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, South America, Europe, Asia Pacific, Middle East & Africa |

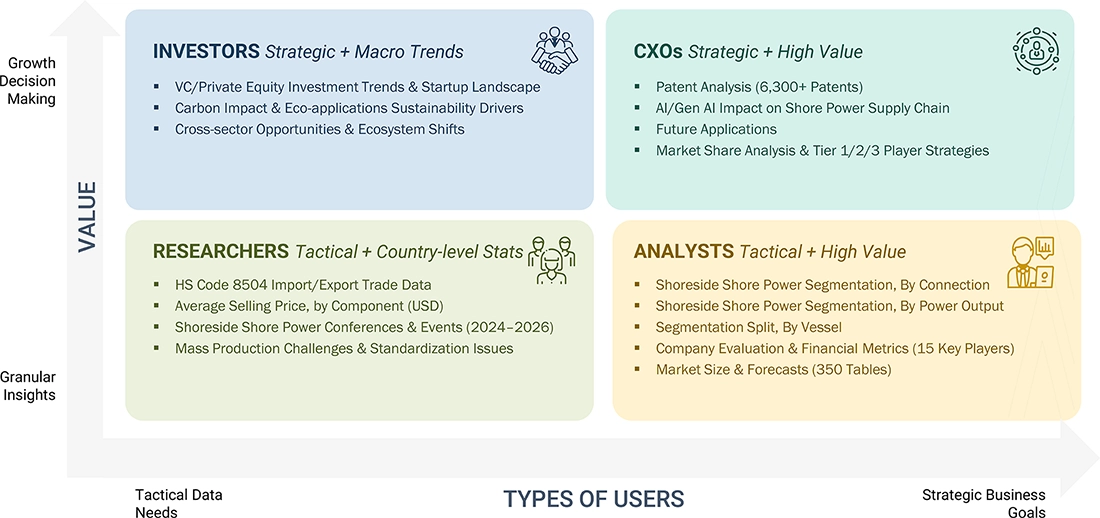

WHAT IS IN IT FOR YOU: SHORESIDE SHORE POWER MARKET REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- March 2024: GE Vernova signed a contract with ST Engineering Marine Limited to supply its ship's electric grid for the Republic of Singapore Navy's six new Multi-Role Combat Vessels (MRCVS). These will be the Navy's first vessels powered by GE Vernova's energy-efficient Integrated Full Electric Propulsion (IFEP) system, which optimizes power distribution and management across the ships.

- April 2024: Siemens Smart Infrastructure launched Electrification X, a new addition to the Siemens Xcelerator portfolio, aimed at modernizing and transforming outdated electrification systems. It is designed to drive the digital transformation of electrification infrastructure across commercial, industrial, and utility sectors. Electrification X offers a growing, dynamic, and interoperable portfolio of loT SaaS solutions to improve energy efficiency, support e-mobility, and optimize industrial energy systems.

- April 2023: Schneider Electric signed a partnership of a consultancy project to establish the UK's first green shipping corridor between the Ports of Dover, Calais, and Dunkirk. This initiative is part of the UK's Clean Maritime Demonstration Competition (CMDC). As a technical partner, Schneider Electric would evaluate green energy solutions for marine and land-based vessels and vehicles, enabling zero-emission transport of goods and passengers between the ports.

- May 2023: ABB introduced an industry-first electric propulsion system, ABB Dynafin, which mimics the motion of a whale's tail for optimal efficiency, paving the way for innovative vessel designs. This groundbreaking technology supports the shipping industry's target of reducing annual greenhouse gas emissions by at least 50% by 2050. An independent study has confirmed that the Dynafin system can lower propulsion energy consumption by up to 22% compared to traditional shaftline systems.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the Shoreside Shore Power Market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the shore powers market.

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. Following is the breakdown of primary respondents:

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Shoreside Shore Power Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

Shore power, also known as cold ironing or alternative maritime power (AMP), refers to the supply of electricity from the shore directly to a moored vessel, allowing it to switch off its own on-vessel diesel generators. It, therefore reduces fuel burning and greenhouse gas emissions in a berthed vessel. In addition, shore power has been applied in several types of vessels, among them, vessels cruising, transport ferries, container shipping, and tankers. The main drivers of shore power adoption are, therefore, environmental regulations, government initiatives, and calls for more sustainable and greener port operations, good ways to reduce noise and air pollution, thus improving health and safety conditions for port workers and other local communities. Advances in power management, renewable energy integration, and growth in investments related to port electrification are all resulting in growth in shore power.

Stakeholders

- Government & research organizations

- Institutional investors

- Investors/Shareholders

- Environmental research institutes

- Manufacturers’ associations

- Shore power manufacturers, dealers, and suppliers

- Organizations, forums, alliances, and associations

- Shore Power equipment manufacturing companies

- Shore Power project developers

- Government and research organizations

- Universities and Research institutes

Report Objectives

- To define, describe, segment, and forecast the Shoreside Shore Power Market by installation type, connection, component, power output, and region, in terms of value

- To forecast the market size for four key regions: North America, Europe, Asia Pacific, Middle East & Africa and South America along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, Porter’s five forces analysis, and regulations pertaining to the market

- To analyze opportunities for stakeholders in the market and draw a competitive landscape for market players

- To strategically analyze the ecosystem, regulations, patents, and trading scenarios pertaining to the market

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players with respect to their market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, partnerships, and collaborations, in the market

- To study the impact of AI/Gen AI on the market under study, along with the global macroeconomic outlook

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Shoreside Shore Power Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Shoreside Shore Power Market