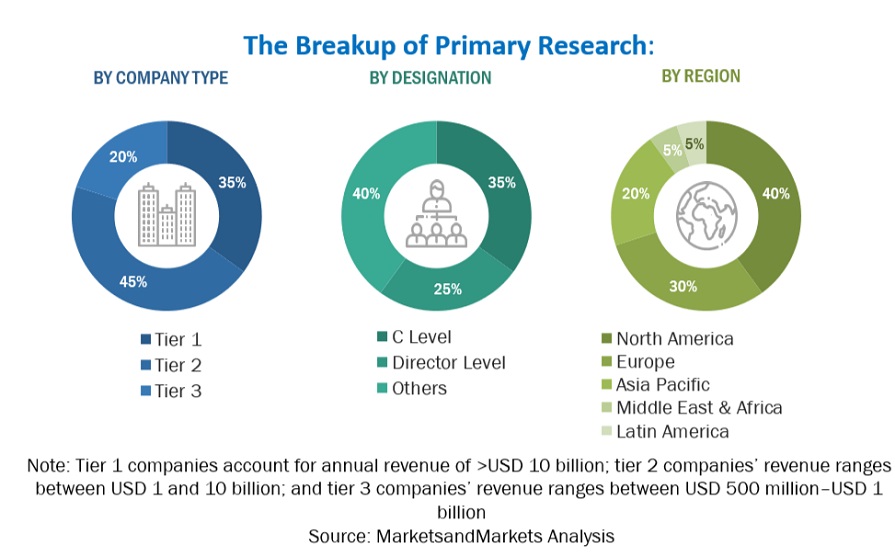

The smart grid analytics market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred smart grid analytics providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors websites. Additionally, smart grid analytics spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to software, hardware, services, technology, applications, warehouse sizes, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and smart grid analytics expertise; related key executives from smart grid analytics solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using smart grid analytics solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of smart grid analytics solutions and services, which would impact the overall smart grid analytics market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

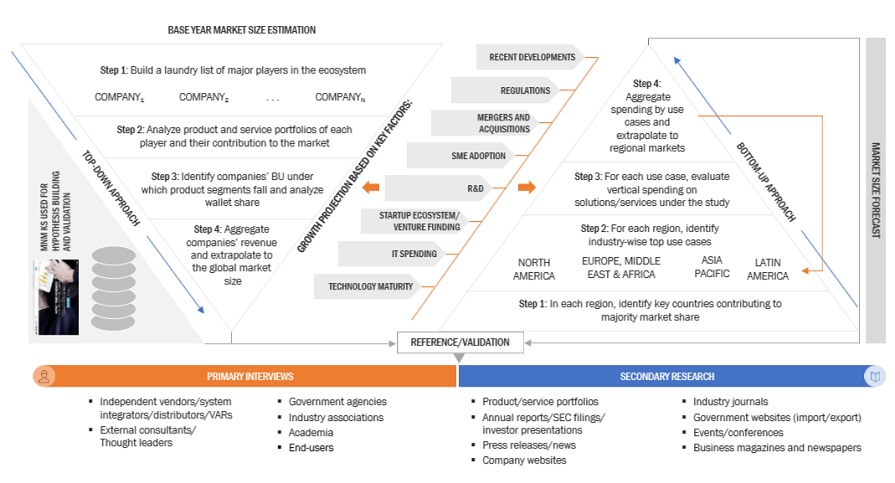

Multiple approaches were adopted for estimating and forecasting the smart grid analytics market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Market Size Estimation Methodology-Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the smart grid analytics market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on breadth of software and services according to analytics type, applications, deployment modes, and organization size. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of smart grid analytics solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of smart grid analytics solutions and services among different end users, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major smart grid analytics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall smart grid analytics market size and segments’ size were determined and confirmed using the study.

Global Smart grid analytics Market Size: Bottom-Up and Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Smart grid analytics refers to the application of advanced data analytics, artificial intelligence, and machine learning techniques to enhance the efficiency, reliability, and sustainability of electric power grids. It involves the analysis of large volumes of data generated by smart meters, sensors, and other grid components to optimize grid operations, predict equipment failures, and manage distributed energy resources effectively. Smart grid analytics enables utilities to improve grid performance, reduce operational costs, and meet regulatory requirements, thereby transforming traditional power grids into more intelligent and responsive systems.

Stakeholders

-

Smart grid analytics software developers

-

Cybersecurity firms

-

Business analysts

-

Cloud service providers

-

Consulting service providers

-

Enterprise end-users

-

Distributors and Value-added Resellers (VARs)

-

Government agencies

-

Independent Software Vendors (ISV)

-

Managed service providers

-

Market research and consulting firms

-

Support & maintenance service providers

-

System Integrators (SIs)/migration service providers

-

Technology providers

Report Objectives

-

To define, describe, and forecast the smart grid analytics market, by offering (software, and services), organization size, application, and analytics type

-

To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

-

To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

-

To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

-

To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To profile the key players and comprehensively analyze their market ranking and core competencies

-

To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the smart grid analytics market

-

To analyze the impact of recession in the smart grid analytics market across all the regions

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

-

Further breakup of the North American smart grid analytics market

-

Further breakup of the European market

-

Further breakup of the Asia Pacific smart grid analytics market

-

Further breakup of the Middle Eastern & African smart grid analytics market

-

Further breakup of the Latin America smart grid analytics market

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Smart Grid Analytics Market