Smart Labels Market

Smart Labels Market by Technology (RFID labels, EAS labels, NFC labels, sensing labels, others), Application (Retail & inventory tracking, pallet tracking), End-Use (FMCG, logistics, retail, healthcare), Component - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The smart labels market has been estimated to rise from USD 11.4 billion in 2024 to 17.3 billion by 2029, a CAGR of 8.7%, due entirely to heightened use for retail, logistics, healthcare, and manufacturing. The heightened implementation of RFID and NFC technology, expansion of IoT-enabled tracking systems, and real-time management of inventory will significantly encourage market growth. The elevated use of smart labels to enhance efficiencies in the supply chain, enable product authentication, and monitor temperature will facilitate market growth. In addition, advancements in new materials, such as flexible substrates, improved adhesives, and expanded data storage capacity, contribute to improved durability and reliability while enhancing the performance of smart labels in e-commerce applications and cold chain logistics for monitoring perishables. The enhanced encoding technologies and integrated with AI-enabled analytics have also yielded improvements in performance and overall operating efficiencies. In conclusion, the smart labels market should experience strong growth with increases across many industrial segments.

KEY TAKEAWAYS

-

BY COMPONENTThe smart labels market segmented by component includes batteries, transceivers, microprocessors, memory, and others. The batteries segment accounts for a major share of the smart labels product, primarily as batteries supply power to all RFID tags, NFC chips, and IoT sensors to operate continuously for tracking and monitoring applications. The battery helps maintain real-time data transfer and ensure continuous operation across the retail, logistics, and healthcare sectors.

-

BY TECHNOLOGYThe smart labels market by technology includes RFID, EAS, NFC tags, sensing, and dynamic display. RFID technology has a major share in the smart labels market, with superior tracking capabilities, a longer reading distance, and widespread adoption in supply chain and inventory management applications.

-

BY APPLICATIONThe smart labels market by application includes retail inventory, perishable goods, and electronic & IT assets. Retail inventory tracking is the largest application segment, driven by the need to provide real-time stock visibility, automate the replenishment process, and provide a better level of customer experience through stores and the distribution centers.

-

BY END USE INDUSTRYThe smart labels market by end-use industry includes retail, logistics, healthcare, automotive, and manufacturing. Retail and logistics lead the market in adoption, primarily due to the need for inventory management, supply chain optimization and improved operational efficiency. In healthcare, smart labels are used for patient safety, tracking medications, and cold chain monitoring of temperature-sensitive products.

-

BY REGIONThe Asia Pacific region is expected to anticipate the fastest growth with a CAGR OF 8.8% that outpaces the industry average, driven by fast e-Commerce growth, growth in manufacturing, and increased smart city efforts throughout China, India, and Japan.

-

COMPETITIVE LANDSCAPEAvery Dennison Corporation (US), CCL Industries, Inc. (Canada), Zebra Technologies Corporation (US), SATO Holdings Corporation (Japan) are leading companies of syntactic foam market. These companies are pursuing both organic and inorganic growth strategies, such as product launches, acquisitions, and expansions, to increase their market presence.

The increased demand from retail, logistics, healthcare, and manufacturing industries is paving the way for growth in the smart labels market. The increase in the adoption of RFID and NFC technologies coupled with IoT-enabled tracking systems and increased real-time inventory management will be a major driver of healthy market growth. The applications of smart labels are being expanded in supply chain optimization, product authentication, temperature monitoring, and improved consumer engagement. Advances in flexible substrates, adhesives, data storage capacity, and AI analytics integration will contribute to improved performance and operational efficiency. Infrastructure projects driven by e-commerce expansion, cold chain logistics, and retail automation will create an additional pathway for sustained demand growth in smart labels market. In addition, stringent regulations for traceability and compliance to safety will support adoption in the related pharmaceutical and food industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of smart labels manufacturers, and target applications are the clients of smart labels manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of smart labels manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

§Protection against theft, loss, and counterfeiting

-

§Lack of human intervention

Level

-

§Lack of standards

-

§Technical limitations

Level

-

§Increasing demand in logistics

-

§Technological advancement in printed electronics

Level

-

§Reflection and absorption of RF signals by metallic and liquid objects

-

High initial cost

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver – Protection against theft, loss, and counterfeiting

Counterfeiting remains a global issue impacting a variety of industries, and companies have become increasingly aware of the effects of counterfeit parts running through their supply chains. Counterfeit products often find their way into critical sectors, like automotive and aviation, impacting product quality, damaging brand reputations, and possibly compromising consumer safety. Counterfeit products that can pass as genuine products can lead to product failures or business interruptions, which result in financial losses and long-term harm to a business' reputation. Counterfeit products also pose a risk for retail businesses, as they deal with continual inventory shrinkage from external theft, employee theft, poor inventory management, and poor operational processes. Organized retail crime teams have taken notice of security breaches, whereas employee theft impacts the business, further affecting profitability. The response to these threats is a comprehensive approach and preventive measures, such as enhanced surveillance systems, secure storage, and strict management of inventory. RFID technology is a great tool that provides real-time tracking of inventory, fewer interruptions in supply chains and during check out processes with radio waves transmitting data to readers. Through RFID systems combined with sales and video data, it can help track and identify stolen items when alleged theft occurred and provide evidence on loss prevention and recovery efforts to aid toward loss mitigation and profitability for retailers.

Restraint –Technical limitations

The efficiency of smart labels such as RFID can be impacted by substrates such as metal and liquid, making them less valuable in certain environments. For example, RFID chips cannot be detected through metal. Attaching an RFID tag to a metal object will cause RF waves to reflect off the metal and interfere with the performance of the RFID tag antenna and will render the RFID tag useless. Other forms of electromagnetic interference can also affect this technology and may require modifications to be made to the physical environment in which RFID will be used. Furthermore, the number of readers and types of readers can also contribute significantly to the costs, depending on the application.

Opportunity – Technological advancement in printed electronics

Printed electronics refer to a series of printing techniques used to produce electrical components on multiple types of substrate materials and relies on traditional printing technologies such as screen printing, flexography, gravure, offset lithography, or inkjet devices to fabricate patterned electronic structures. The distinctive aspects of printed electronics, including flexibility, adjustable thickness, moisture resistance, and environmental protection, provide an essential set of opportunities across the supply chain—manufacturers, technology developers, supply chain collaborators, distributors, retailers, and end-users—to collect data from integrated sensing, and distinctive identifying features that collect small but useful sets of data. Recent advances in printed electronics are now capable of producing basic memory, sensors, logic circuits, displays, batteries, and communication. The advantages of printed electronics keep coming back to rapid prototyping but finding a production process that is cost friendly and scalable. Smart labels, which allow value-added applications particularly on production scales, tend to be the most developed in a way to drive down costs and increase market acceptance of the technology.

Challenge – High initial cost

Adopting smart labeling technology requires a large upfront expenditure on infrastructure, equipment, and software solutions, which represents a significant financial barrier for small to medium-sized enterprises (SMEs). Expenses include upgrading facilities with RFID-driven systems, purchasing more advanced hardware components like scanners and readers, and installing advanced software integrating with preexisting operational systems, sometimes requiring special additions to make them compatible and run smoothly.

smart-label-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Mineral Fusion, a leading natural cosmetics brand, wanted to enhance consumer engagement as it launched its new summer line. With about 60 new product SKUs, each offering unique ingredients and benefits, the brand needed a way to effectively communicate this information and engage with customers in a more interactive and impactful manner at the point of sale.. | Mineral Fusion partnered with Avery Dennison to implement its DirectLink label technology, which uses near field communication (NFC). By tapping an NFC-enabled smartphone to the product label, consumers could instantly access dynamic content, such as videos, product details, and application tips. For the summer line launch, DirectLink connected shoppers to a behind-the-scenes video showcasing the new products, their benefits, and how to use them, directly enhancing the in-store experience. |

|

A well-known fashion apparel brand in Ningbo, China, faced challenges in managing its fast fashion supply chain. To maintain its competitive edge, the brand needed a solution allowing fast moves, efficient logistics, and streamlined warehousing operations. The existing system struggled with slow sorting and packing processes, leading to increased lead times and operational costs. | The brand partnered with Invengo to implement an RFID-based smart logistics and warehousing solution. This system leveraged UHF RFID technology, which works effectively in harsh environments and allows goods to be identified in motion and batches without needing to stop or unpack. RFID tags were applied to each product, and with the help of tunnel mode, the system could scan goods as they moved along the conveyor belt. The real-time data collected was uploaded to the warehousing system, enabling fast, accurate sorting, packing, and inventory tracking. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The smart labels market operates within a vertically integrated framework, spanning from raw material sourcing to deployment across industries such as retail, logistics, healthcare, automotive, and consumer goods. Key technologies including RFID, NFC, and IoT sensors, combined with substrates and adhesives, deliver critical properties such as durability, flexibility, data storage capacity, and environmental resistance. Manufacturing processes adhere to rigorous industry standards, employing methods such as printing, encoding, chip embedding, and antenna integration to ensure reliability and compliance with safety and performance requirements. Regulatory frameworks, sustainability initiatives, and technological advancements drive innovation and market adoption, enhancing operational performance across the value chain and supporting growing demand for real-time tracking, supply chain visibility, and consumer engagement. Smart labels are engineered to meet specific industry requirements across various applications, with raw materials including antennas, chips, substrates, and adhesives sourced and manufactured to precise specifications for scenarios ranging from inventory management to product authentication and temperature monitoring. These components undergo rigorous testing to ensure performance in diverse operational environments while adhering to industry standards and safety regulations. Application techniques such as integration, encoding, and customization ensure uniform implementation across products and packaging for retail, manufacturing, and logistics sectors. The integration of advanced capabilities including blockchain compatibility, AI-driven analytics, and IoT connectivity enhances market growth and operational efficiency across the value chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Labels Market, By Component

Batteries are the largest product type within smart labels due to their essential function in facilitating tracking capabilities, data communications, and environmental monitoring. Smart labels often include RFID tags, NFC (Near-field communication) chips, or IoT-based sensors; all of which require power to operate. Batteries enable these devices to track location, temperature changes, and alerts for notifications. Battery-based smart labels are utilized primarily within the pharmaceutical and food markets to track speed, temperature, or notice distrubances for perishable products while in transit, which ensures safety and quality standards are met. Battery-powered smart label's growth is anticipated to be due to the expanding use of tracking technology in logistics, health, and retail environments. The increased growth of batteries used across smart labels is expected to be fueled by the technological advancements that drive performance and battery life. Today's batteries are smaller, lighter, and longer-lasting, which aligns closely to the size and power needs for smart label applications.

Smart Labels Market, By Application

Retail and inventory tracking is the largest application segment of the smart labels market, with the need for inventory management systems, supply chain efficiencies, and customer satisfaction driving its growth. In retail settings, smart labels that use RFID technology provide real-time visibility to stock levels across retail and distribution locations and help eliminate time and effort in performing manual inventory counts while also minimizing errors. These labels to monitor the movement of stock, manage restocking needs, and track the quantities of lost or misplaced inventory. Retailers, including Zara, have used RFID smart labels for inventory tracking to solve the difficulties in managing large numbers of SKUs, at the same time maximizing sales and customer satisfaction. Smart labels provide maximum efficiencies for monitoring not only location of items but also condition while they are in the supply network, allowing for retailers and logistics providers to enhance the accuracy of their supply chain, increase security, and minimize waste. Likewise, as eCommerce continues to grow and expand globally, the pull toward real-time inventory tracking will increase dramatically. Smart labels applied to retail and inventory tracking applications can help retailers respond faster to consumer demand while improving product availability and the shopping experience overall, especially in the fashion and perishables industries where the efficiency and responsiveness of supply is critical to their operational success.

Smart Labels Market, By End Use Industry

Logistics is the leading end-use industry segment in the smart labels market, given the need for accurate tracking, monitoring, and management of products across large distribution networks. RFID and IoT-enabled tags and smart labels are now integral to logistics and supply chain operations because of their ability to provide immediate visibility and accuracy of information. The tags enable supply chain providers to monitor their shipments throughout the distribution process so they do not get lost or misplaced. Smart labels provide supply chain organizations the ability to monitor inventories accurately without much manual input in order to help logistics organizations to reduce costs and increase efficiency. Global shipping leaders like FedEx and DHL have implemented smart labels and tags in their package tracking to increase delivery efficiency and customer satisfaction. The growth of e-commerce has impacted logistics networks as they must now deliver faster and with increased accuracy, which has also led to increased smart label usage. The adoption of smart labels in logistics will continue to increase due to consumer pressures to have faster and transparent deliveries that have consistency and reliability. Furthermore, continuous improvements to RFID and other IoT-enabled technologies will continue to improve logistics operations, which will further improve the market position of smart labels in logistics.

REGION

Asia Pacific's Urban Growth and Regulations Drive Intumescent Coatings Demand

The smart labels market in 2023 was predominantly led by North America while the Asia Pacific region followed suit. The quarter has a strong technology infrastructure, advanced levels of automation and digitalization uptake, and significant investment in research and development. The region's established sectors include logistics, healthcare, retail, and manufacturing that depend on smart labels for optimizing the efficiency of the processing and tracking of their products. For instance, Walmart and other retail companies use smart labeling for product processing and inventory management, while healthcare companies like Pfizer use smart labeling to monitor the temperature of temperature-sensitive products in the supply chain (e.g. vaccines). Within the past two years, North America has become the largest e-commerce market that has led to an increase in demand for smart labels.

smart-label-market: COMPANY EVALUATION MATRIX

In the syntactic foam market matrix, Avery Dennison Corporation (Star), leads the market. The company has developed a strong position in construction and energy, utilizing a complete product range, long-standing technical reputation, and global supply chains to impact the market. Brady Corporation is an emerging leader that is developing momentum through R&D efforts, and technical innovation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Avery Dennison Corporation (US)

- CCL Industries, Inc. (Canada)

- Zebra Technologies Corporation (US)

- SATO Holdings Corporation (Japan)

- Alien Technology, LLC (US)

- 3M (US)

- UPM (Finland)

- TOPPAN Holdings Inc. (Japan)

- Invengo Information Technology Co., Ltd. (China)

- Brady Corporation (US)

- R.R. Donnelley & Sons Company (US)

- MPI Label Systems (US)

- OPRFID Technologies (China)

- William Frick & Company (US)

- Schreiner Group (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD10.5 Billion |

| Market Forecast in 2030 (Value) | USD 17.3 Billion |

| Growth Rate | CAGR of 8.7% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Components, Batteries, Transceivers, Microprocessors, Memory By Technology, RFID, EAS, NFC Tags, Sensing, Dynamic display By Application, Retail inventory, Perishable goods, Electronic & IT assets, Pallet Tracking, Equipment By End-use Industry: Retail, Logistics, Healthcare, Automotive, Manufacturing |

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

WHAT IS IN IT FOR YOU: smart-label-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Smart Labels | • Detailed company profiles of smart labels competitors (financials, product portfolio) • Market segmentation by technology (RFID, EAS, NFC tags, sensing, dynamic display)) • Market segmentation by application (retail inventory, perisable goods, electronic & IT assests) | • Identified & profiled key players for smart labels companies • Track adoption trends in high-growth APAC industries (logistics, retail, FMCG, healthcare, manufacturing, auromotive) |

RECENT DEVELOPMENTS

- October 2024 : Avery Dennison Corporation expanded its AD TexTrace portfolio with the introduction of heat-seal and durable printed fabric label solutions.

- October 2024 : TOPPAN Holdings Inc. acquired 100% ownership of Selinko SA, a company specializing in the development and sale of ID authentication platforms primarily in Europe, completing the process to make it a wholly owned subsidiary.

- August 2023 : CCL Industries announced a partnership with Imprint Energy, a global leader in the development of thin, flexible, rechargeable batteries. This collaboration aims to create the world's most sustainable and environmentally friendly power-dense batteries, designed to power the next generation of product labels (smart labels).

Table of Contents

Methodology

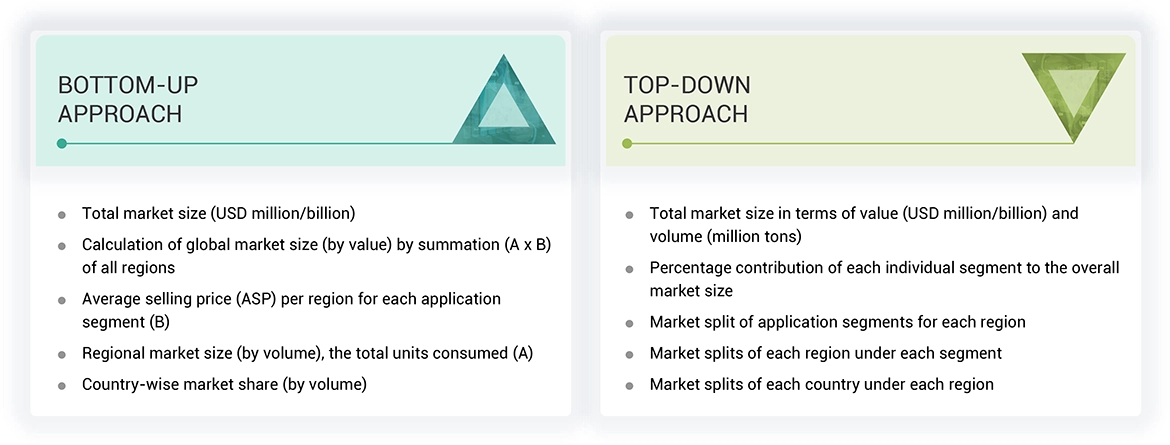

The study involved four major activities for estimating the current size of the global smart labels market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of smart labels through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the smart labels market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering smart labels is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to, to identify and collect information for this study on the smart labels market. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of smart labels vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the smart labels market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of smart labels offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

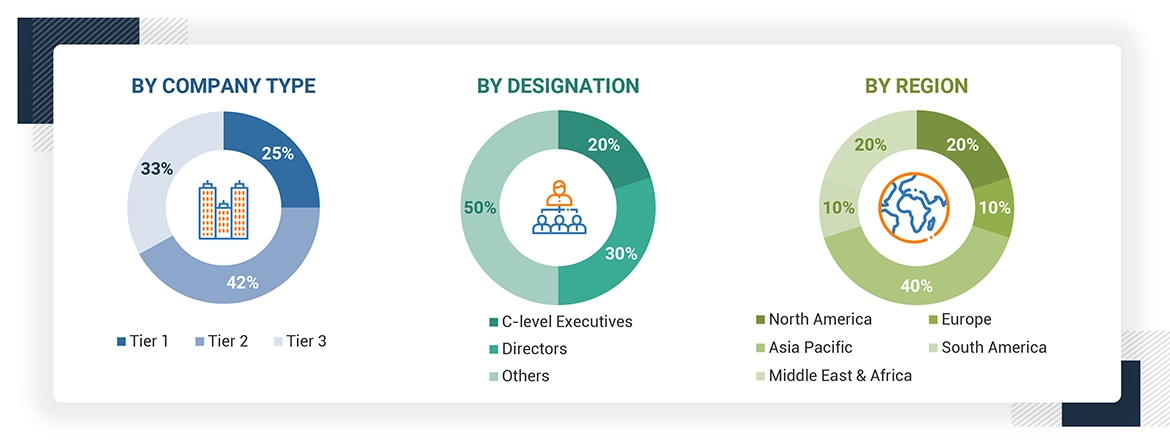

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the smart labels market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The smart labels industry signifies the market that deals with intelligent labeling products that come with features like RFID, NFC, QR codes, and sensors. These labels provide real-time location tracking, monitoring, and data gathering capabilities and additional features including product identification, and tracking of perishable goods and products against counterfeiting across sectors including the retail, health care, logistics, and manufacturing industries.

Stakeholders

- Smart Label Manufacturers

- Raw Material Suppliers

- Technology Providers

- Logistics and Distribution Companies

- Research & Development Entities

- Industry Associations and Regulatory Bodies

- End Users

Report Objectives

- To estimate and forecast the smart labels market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market technology, application, component, end-use industry, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as acquisition, agreements, expansions and partnerships in the smart labels market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Labels Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smart Labels Market