The study involved four major activities in estimating the current size of the global SEL market. In the first step, exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total SEL market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

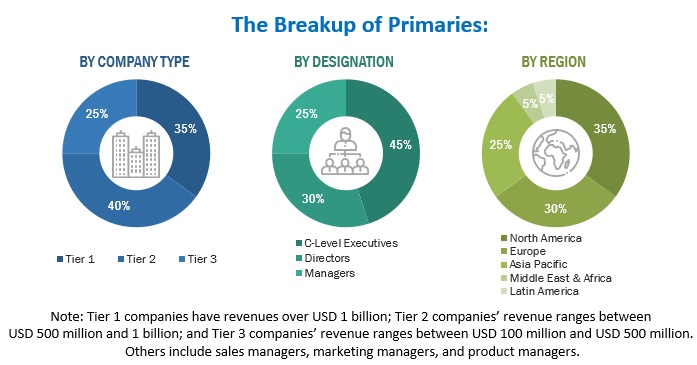

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the SEL market along with the associated service providers, and system integrators working in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

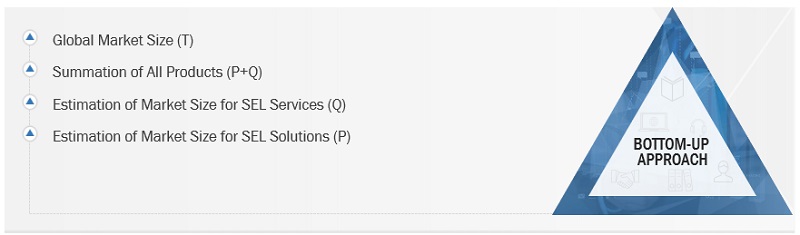

The top-down and bottom-up approaches were used to estimate and forecast the SEL market and other dependent submarkets. The bottom-up procedure was used to arrive at the overall market size of the global SEL market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the SEL market have been identified through extensive secondary research.

-

Regarding value, the market size has been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

SEL Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

SEL Market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Collaborative for Academic, Social, and Emotional Learning (CASEL), social and emotional learning can be integral to education and human development. SEL is the process through which all young people and adults acquire and apply the knowledge, skills, and attitudes to develop healthy identities, manage emotions and achieve personal and collective goals, feel and show empathy for others, establish and maintain supportive relationships, and make responsible and caring decisions. SEL advances educational equity and excellence through authentic school-family-community partnerships to develop learning environments and experiences with trusting and collaborative relationships, rigorous and meaningful curriculum and instruction, and ongoing evaluation. SEL can help address various forms of inequity and empower young people and adults to co-create thriving schools and contribute to safe, healthy, and just communities.

Key Stakeholders

-

SEL Providers

-

Independent Software Vendors (ISVs)

-

SEL Content Developers

-

Education Consultants

-

System Integrators

-

Educationists

-

Corporate Trainers

-

Compliance Regulatory Authorities

-

Government Authorities

-

University Bodies

-

Professors and Teachers

-

Investment Firms

Report Objectives

-

To determine, segment, and forecast the global SEL market by offering solutions, services, core competency, type, end user, and regions in terms of value.

-

To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

-

To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the SEL market

-

To study the complete value chain and related industry segments and perform a value chain analysis of the SEL market landscape.

-

To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total SEL market

-

To analyze the industry trends, pricing data, patents, and innovations related to the SEL market.

-

To analyze the opportunities for stakeholders by identifying the high-growth segments of the SEL market

-

To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

-

Track and analyze competitive developments, such as mergers and acquisitions, product launches and developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of an additional two market players

Growth opportunities and latent adjacency in Social and Emotional Learning Market