Subsea Thermal Insulation Materials Market

Subsea Thermal Insulation Materials Market by Type (Polyurethane, Polypropylene, Silicone Rubber, Epoxy, Aerogel, EPDM, Other Types), Filler Type (Glass Microspheres, Other Filler Types), Application (Pipe-in-Pipe, Direct Insulation & Pipe Covers, Equipment, Field Joints, Other Applications), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Subsea thermal insulation materials market is expected to reach USD 316.6 million by 2030 from USD 256.7 million in 2025, at a CAGR of 4.28% during the forecast period (2025-2030). Subsea thermal insulation materials are specialized materials used in maintaining the temperature of fluids like oil/gas, as they are transported through subsea pipelines. These materials prevent heat loss to the surrounding seawater. This reduces the risk of hydrate formation and wax deposition thus improving flow efficiency and safety. They are used in pipelines, risers, manifolds, and other subsea infrastructure and can withstand high pressures, corrosive environments, and extreme temperatures found in deepwater operations. The subsea thermal insulation materials market is experiencing robust growth, driven by the increasing number of offshore oil & gas explorations and developments.

KEY TAKEAWAYS

-

BY TYPEThe Subsea thermal insulation materials market by technology includes Polyurethane, Polypropylene, Silicone Rubber, Epoxy, Aerogel, and Other Types. Polyurethane segment accounted for largest share of subsea thermal insulation materials market in 2024.

-

BY APPLICATIONThe Subsea thermal insulation materials market by application includes Pipe-in-Pipe, Direct insulation & Pipe Covers, Equipment, Field Joints, and Other Applications. The Direct insulation & pipe covers segment is projected to register the fastest growth during forecast period.

-

BY FILLER TYPEThe Subsea thermal insulation materials market by filler type includes Glass Microspheres and Other Filler types. Glass microspheres segment to register fastest growth during forecast period. These hollow glass spheres enhance the protective capabilities of insulation materials, particularly in the extreme conditions typically found in underwater environments.

-

BY REGIONThe Asia Pacific subsea thermal insulation materials market is poised for robust growth in the coming years, driven largely by escalating energy demands and intensified marine exploration initiatives. Countries such as China, India, Malaysia, and Indonesia are actively pursuing the exploration of new offshore oil and gas reserves to enhance their energy security and reduce dependency on foreign supplies.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic product launches, collaborations, acquisitions, and expansions from leading players such as Aspen Aerogels, Inc. (US), Cabot Corporation (US), AIS (UK), Tenaris S.A. (Luxembourg), Vipo AS (Norway), and Kingspan Group (Ireland). These companies are strong in their home regions and are exploring geographic diversification options to grow their businesses.

The subsea thermal insulation materials market is experiencing robust growth, driven by the increasing number of offshore oil & gas explorations and developments. Energy companies are intensifying their investments to uncover new hydrocarbon reserves in marine environments, especially in deepwater and ultra-deepwater settings. In these environments the hydrocarbons are transported through extensive subsea pipelines that are subjected to low temperatures. The risk of hydrate formation i.e, ice-like blockages caused by the solidification of hydrocarbons and water pose a significant threat to pipeline integrity and flow assurance. Effective subsea thermal insulation materials are critical in maintaining the temperature of the transported fluids, mitigating the risk of hydrate formation, and ensuring uninterrupted flow through the pipeline system.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The subsea thermal insulation materials market is evolving with innovations such as aerogel and hybrid composites that offer superior thermal efficiency and lighter weight for deepwater operations. Digital monitoring systems are being integrated to track insulation performance in real time, reducing maintenance costs. Sustainability is a key disruptor, driving demand for recyclable and eco-friendly materials. However, high installation costs and supply chain challenges continue to limit broader adoption and slow innovation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of offshore oil & gas projects

-

Rising Upstream Oil & Gas Investment

Level

-

Volatility in crude oil prices

-

High cost of subsea thermal insulation materials and installation

Level

-

Technological advancements in deepwater projects

-

Growing global demand for refined petroleum products

Level

-

Tighter offshore regulations

-

Aging infrastructure and retrofitting challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of offshore oil & gas projects

The offshore oil & gas development emerged as a pivotal focus within global extraction initiatives in 2024. This develoopment saw significant projects advancing in marine settings. As per the data from the Global Energy Monitor’s Global Oil & Gas Extraction Tracker (GOGET), approximately 8 billion barrels of oil equivalent (bboe) was discovered through new offshore exploration. Notably, around 6.5 bboe commenced production, reflecting modest year-on-year growth. A striking 85% of all newly discovered hydrocarbons originated from just 10 offshore fields, underscoring the concentration of resources in key locations. The year also witnessed 12 Final Investment Decisions (FIDs) granted for offshore projects, highlighting the industry’s increasing commitment to deepwater ventures. Offshore operations significantly contributed to the landscape, accounting for 71% of the total reserves that began production in 2024, driven by 19 new project launches.

Restraint: Volatility in crude oil prices

The global crude oil market is influenced by the interplay of market supply and demand, as well as geopolitical factors and economic policies. Price volatility often originates from abrupt events, such as geopolitical unrest in oil-producing regions or natural disasters impacting offshore production facilities. In the short term, the responsiveness of oil supply to fluctuating demand is limited; unexpected disruptions or market uncertainties can result in pronounced price swings. This volatility significantly affects capital-intensive offshore and deepwater oil and gas projects, which extensively utilize subsea thermal insulation materials. During periods of declining oil prices, companies may defer or cancel high-cost exploration and production projects to safeguard their financial viability.

Opportunity: Rising upstream oil & gas investments

The demand for refined petroleum products, such as gasoline, diesel, aviation fuel, and petrochemical feedstocks, is propelling the need for crude oil development. To address the increasing demand, oil & gas companies are intensifying their offshore exploration and production activities, particularly in deepwater regions that harbor untapped petroleum reserves. The recent expansion of refining operations in emerging markets underscores the importance of upstream activities to ensure a stable crude oil supply supported by high-performance subsea insulation systems. Notable refinery expansions in Asia Pacific and the Middle East have catalyzed offshore extraction efforts in deepwater areas such as the South China Sea, the Persian Gulf, and the eastern Mediterranean. The complexity of underwater installations in these regions amplifies the demand for advanced insulation systems.

Challenge: Aging infrastructure and retrofitting challenges

The maintenance of oil & gas infrastructure is increasingly challenged by operation under extreme weather conditions, coupled with stringent safety and environmental regulations. The global energy supply heavily relies on these critical assets, necessitating specialized personnel, infra upgrades, and retrofits for their upkeep and operation.

Subsea Thermal Insulation Materials Marke: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AIS provided a turnkey solution combining ContraTherm® C25 with an engineered clamping system for heavy-lift jumper installations in Brazil. | Enabled safe, efficient installation of subsea jumpers while leveraging proven expertise and prior collaboration with the EPC client. |

|

Local operators in Australia manually applied Vikotherm® R3 subsea thermal insulation on a high-temperature manifold after remote training from Norway. | Achieved fast, safe, and effective on-site insulation with minimal engineering and design effort, despite travel restrictions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis section provides detailed information about companies working in the subsea thermal insulation materials market. The subsea thermal insulation materials market features three main groups of stakeholders, including raw material suppliers, manufacturers, and end users. Within this ecosystem, each entity maintains complex interconnections that shape and receive impact from market demand and regulatory standards, supply chain efficiencies, and technological progress.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Subsea thermal insulation materials Market, By Type

The Polyurethane segment accounted for largest share of subsea thermal insulation materials market in 2024. The enhanced thermal insulation capabilities of polyurethane have positioned it as an ideal solution in this context, primarily due to its strong resistance to seawater, high pressure, and aggressive chemical environments. Its durability and resilience make polyurethane a reliable protective choice for subsea pipeline installations and associated equipment. Additionally, the lightweight nature of polyurethane is particularly advantageous for subsea systems, where minimizing weight is crucial for deepwater and ultra-deepwater projects.

Subsea thermal insulation materials Market, By Application

The Direct insulation & pipe covers segment is projected to register the fastest growth during forecast period. The subsea thermal insulation materials market is poised for significant expansion, driven primarily by the increasing demand for direct insulation and pipe covers. As offshore oil & gas initiatives explore deeper and colder environments, pipelines and subsea equipment face harsh thermal and pressure conditions. The ability to maintain optimal flow rates of hydrocarbons in these extreme settings is critical, making effective insulation solutions indispensable. Direct insulation and pipe covers serve as protective layers that safeguard pipelines and related equipment, enhancing thermal stability in challenging underwater environments. These systems have gained traction due to their ease of application, robust performance, and proven efficacy in preventing the formation of hydrates and waxes that could otherwise impede flow and disrupt operations.

Subsea thermal insulation materials Market, By Filler Type

The Glass microspheres segment is projected to register fastest growth during forecast period. These hollow glass spheres enhance the protective capabilities of insulation materials, particularly in the extreme conditions typically found in underwater environments. The expansion of offshore oil & gas projects in deeper and colder waters is fueling the demand for insulation materials that can perform reliably under high pressure and low-temperature conditions. Glass microspheres significantly contribute to the lightweight nature of insulation materials while ensuring the retention of thermal efficiency and structural integrity. This characteristic is critical for deepwater operations, where managing the weight of equipment and pipelines is of paramount importance.

REGION

Asia Pacific to be fastest-growing market during forecast period

Asia Pacific region is emerging as the fastest regional segment within the Subsea thermal insulation materials market. This is driven largely by escalating energy demands and intensified marine exploration initiatives. Countries such as China, India, Malaysia, and Indonesia are actively pursuing the exploration of new offshore oil and gas reserves to enhance their energy security and reduce dependency on foreign supplies. This trend catalyzes the need for advanced insulation solutions, particularly as exploration activities extend into deeper, more challenging underwater environments. Economic development initiatives to enhance infrastructure further stimulate offshore exploration across the region. Simultaneously, heightened environmental regulations and security requirements necessitate high-performance insulation materials.

Subsea Thermal Insulation Materials Marke: COMPANY EVALUATION MATRIX

In the Subsea thermal insulation materials market matrix, Kingspan Group (Star), leads the market. It is especially strong in pre-insulated pipe systems and high-performance insulation, bolstered by its LOGSTOR business and an integrated innovation, distribution and client network. Balmoral Group (Emerging leader), known for its ELASTOTHERM® subsea insulation solutions that perform in hot-wet conditions, and its strong R&D, manufacturing and testing capabilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 246.2 Million |

| Market Forecast in 2030 (Value) | USD 316.6 Million |

| Growth Rate | CAGR of 4.28% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Type: Polyurethane, Polypropylene, Silicone Rubber, Epoxy, Aerogel, and Other Types By Application: Pipe-in-Pipe, Direct insulation & Pipe Covers, Equipment, Field Joints, and Other Applications. By Filler Type: Glass Microspheres and Other Filler types |

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

WHAT IS IN IT FOR YOU: Subsea Thermal Insulation Materials Marke REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Detailed Subsea Thermal Insulation Materials Market Study for APAC countries | Market assessment across key APAC countries with segmentation by type, filler type, and end-use industry. | Offered in-depth regional insights covering offshore project investments, government initiatives, and local manufacturing capabilities shaping demand. |

| Detailed Competitive Landscape and Innovation Analysis | Profiling of key players including market leaders and emerging innovators with details on product portfolios, patents, and R&D activities. | Enabled understanding of competitive positioning, innovation priorities, and market entry strategies of leading and emerging subsea insulation providers. |

RECENT DEVELOPMENTS

- April 2025 : Balmoral Comtec, a subsidiary of Balmoral Group and a key provider of buoyancy, protection, and insulation solutions for the global offshore energy sector, invested USD 1 million (£1 million) in an innovative Wave and Current Simulation Facility at Balmoral Business Park in Aberdeen.

- November 2023 : Tenaris S.A. acquired Mattr’s pipe coating business unit (Shawcor) for a total of USD 182.6 million, which includes estimated working capital and USD 16.9 million in cash. As announced on August 14, 2023, the transaction has received all necessary regulatory approvals in Mexico and Norway.

- November 2022 : AIS expanded its subsea portfolio by acquiring CRP Subsea. Located in Skelmersdale, England, CRP Subsea, formerly known as Trelleborg Offshore UK, specializes in buoyancy and protection solutions made from polymer and syntactic foam, serving the offshore renewables and oil and gas sectors.

- June 2021 : Kingspan Group acquired LOGSTOR. LOGSTOR is an industrial leader dedicated to energy efficiency and sustainability. With all necessary approvals from European antitrust authorities secured, Kingspan now holds full legal ownership of LOGSTOR.

- June 2021 : VIPO partnered with Demeta, a Green Chemistry company, to develop innovative subsea thermal insulation materials. Supported by the Norwegian Research Council funding, the partnership aims to research, produce, and bring to market advanced materials tailored for deep and ultra-deep-sea offshore applications.

Table of Contents

Methodology

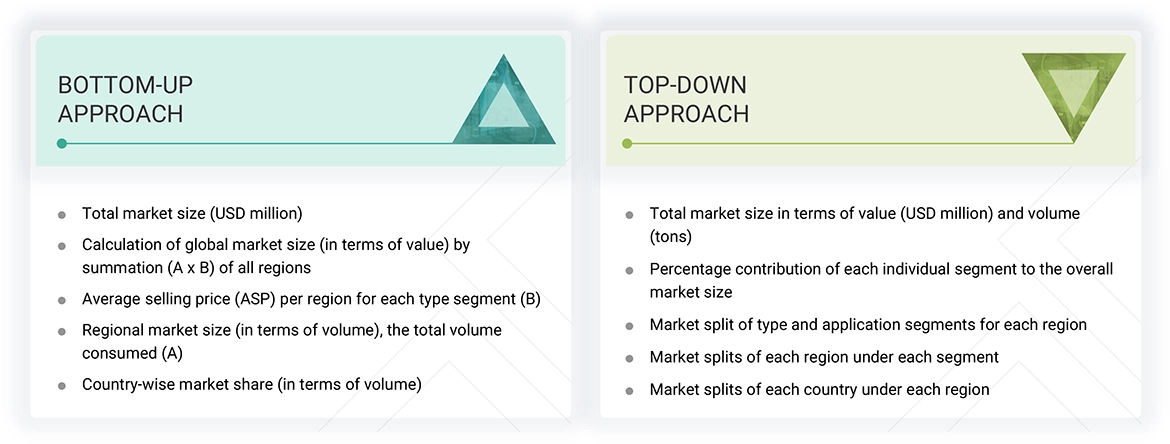

The analysis comprised four key activities to assess the current scale of the global subsea thermal insulation materials market. Initially, comprehensive secondary research was conducted to gather data on the market, relevant peer products, and the overarching parent product category. Subsequently, these findings and the underlying assumptions and market size estimates were validated through primary research with industry experts throughout the value chain of subsea thermal insulation materials. A combination of top-down and bottom-up methodologies was then applied to quantify the total market size. Finally, market segmentation breakdown and data triangulation techniques were utilized to ascertain the dimensions of various market segments.

Secondary Research

The market size for the companies offering subsea thermal insulation materials was arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the subsea thermal insulation materials market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of subsea thermal insulation materials vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the subsea thermal insulation materials market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of subsea thermal insulation materials offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

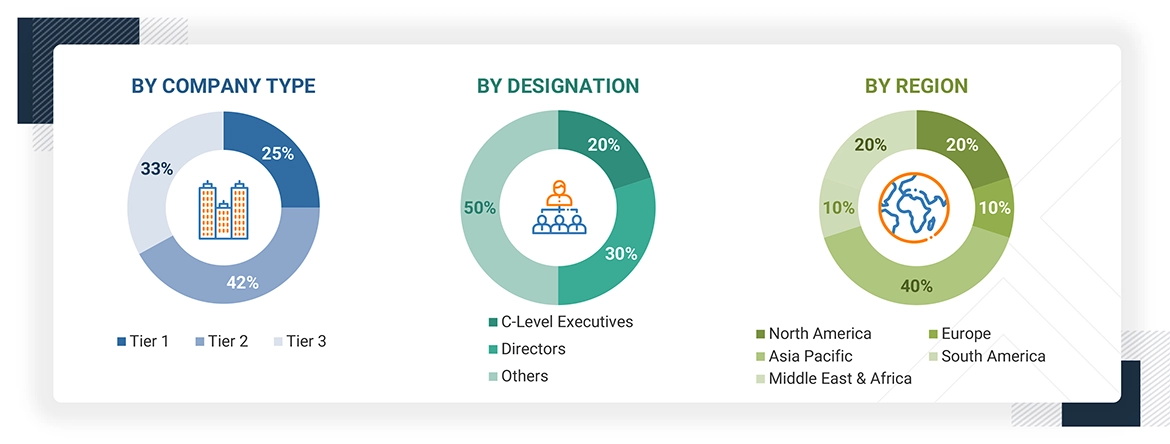

Following is the breakdown of primary respondents:

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global subsea thermal insulation materials market. These approaches were also used extensively to estimate the size of various dependent market segments.

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Subsea thermal insulation materials are specialized materials designed to insulate subsea pipelines, equipment, and structures in offshore oil & gas operations. These materials prevent wax and hydrate formation during oil and gas transportation. Subsea insulation is typically categorized into wet insulation, which is directly exposed to seawater and requires the use of water-impermeable, durable materials to retain thermal performance, and dry insulation, often implemented through Pipe-in-Pipe (PiP) systems, where an insulated carrier pipe is enclosed within an outer pipe. Polyurethane, polypropylene, silicone rubber, epoxy, and aerogel are the types of subsea thermal insulation materials considered in the report. These materials are used in pipe-in-pipe (PiP), pipe covers and flowlines, equipment, and field joints.

Stakeholders

- Subsea thermal insulation materials manufacturers

- Raw material suppliers

- Distributors

- Industry associations and regulatory bodies

- Polyurethane and polypropylene manufacturers

- Subsea insulation service providers

- Silicone rubber, epoxy, and aerogel manufacturers

- End users

Report Objectives

- To define, describe, and forecast the size of the global subsea thermal insulation materials market based on type, filler type, application, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as acquisitions, expansions, and partnerships, in the subsea thermal insulation materials market

- To provide the impact of AI/GenAI on the market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Subsea Thermal Insulation Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Subsea Thermal Insulation Materials Market

Warren

Jan, 2019

Report ion sub-sea thermal insulation market.

Michael

Nov, 2019

Interested in knowing best price for subsea thermal insulation market.

Henry

Oct, 2015

Information on Silica Aerogel and Mineral Wool with a specific focus on high growth markets..