Supercapacitor Market Size, Share & Trends 2030

Supercapacitor Market by Type (Electric Double Layer Capacitors, Hybrid Capacitors, Pseudocapacitors), Capacitance Range (<100 F, 100-1,000 F, >1,000 F), Electrode Material (Carbon, Composites, Metal Oxides, Conducting Polymers) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global supercapacitor market is projected to grow from USD 1.35 billion in 2025 to USD 2.84 billion by 2030, at a CAGR of 16.1%. Growth is driven by adoption of automotive, consumer electronics, renewable energy, and industrial automation. With high power density, fast charge-discharge, and long lifespan, supercapacitors are becoming critical for EVs, smart grids, and backup systems. Material innovations in graphene and hybrid electrodes further improve performance and cost efficiency, positioning supercapacitors as a bridge between batteries and capacitors in future energy architectures.

KEY TAKEAWAYS

-

BY TYPEThe market is segmented into electric double-layer, hybrid, and pseudocapacitors. Electric double-layer capacitors lead adoption, driven by EV growth and efficiency gains. Hybrid capacitors are rising in demand for compact, high-power applications, while pseudocapacitors show future potential with enhanced energy storage and fast charge-discharge capability.

-

BY CAPACITANCE RANGEThe supercapacitor market is segmented into <100 F, 100–1,000 F, and >1,000 F categories. Supercapacitors below 100 F are widely used in devices needing rapid energy discharge with minimal maintenance. The 100–1,000 F range offers an optimal balance of energy density, power output, and design flexibility, making it suitable for diverse industrial applications. Supercapacitors above 1,000 F are gaining traction for their ability to deliver rapid energy bursts and support load balancing, particularly in automotive and grid applications.

-

By End UserThe market is segmented into automotive & transportation, energy & power, consumer electronics, industrial, and others. Automotive leads with EV and hybrid applications that enhance acceleration and battery life. Energy & power growth is driven by renewable integration, while consumer electronics adopt supercapacitors for efficiency and reduced battery load. Industrial use focuses on reliability and backup power, while other applications include aerospace and medical devices.

-

BY REGIONAsia Pacific is projected to record the fastest growth in the supercapacitor market, with a CAGR of 17.6%. This expansion is driven by rising adoption in electric vehicles, renewable energy storage, and consumer electronics, supported by rapid industrialization and government-led electrification initiatives across China, Japan, and India.

-

COMPETITIVE LANDSCAPELeading players such as Maxwell Technologies, LS Materials, Eaton, and CAP-XX are adopting both organic and inorganic growth strategies, including product innovation, strategic partnerships, and targeted investments, to strengthen their market presence and meet the rising demand for supercapacitor solutions across automotive, energy, and electronics sectors.

The supercapacitor market is projected to grow steadily over the next decade, driven by the rising demand for high-power energy storage and rapid charge–discharge solutions. Integration into electric vehicles, renewable energy systems, and consumer electronics is accelerating adoption, positioning supercapacitors as a critical technology for enhancing energy efficiency, extending battery life, and reducing operational costs across industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business in the supercapacitor market arises from evolving energy demands and industry transitions. Automotive, renewable energy, consumer electronics, and industrial sectors are the primary users of supercapacitors, with high-power storage and efficiency as key focus areas. Shifts toward electrification, renewable integration, and compact energy solutions directly affect operational performance and cost savings for end users. These factors, in turn, drive demand for advanced supercapacitors, shaping the market's growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing need for advanced energy storage components for electric vehicles

-

Mounting demand for fast-charging energy storage solutions

Level

-

Limited suitability for long-term energy storage

-

High initial costs compared with conventional batteries

Level

-

Rising integration of supercapacitors into next-generation aircraft systems

-

Continuous innovation in materials science and manufacturing processes

Level

-

Lack of standardized performance benchmarks, testing protocols, and safety certifications

-

Temperature sensitivity and durability concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing need for advanced energy storage components for electric vehicles

The rapid shift toward electric vehicles is accelerating the demand for supercapacitors, as they deliver high power density, enable regenerative braking, and reduce stress on batteries. By complementing lithium-ion batteries, supercapacitors extend vehicle range and improve system performance, positioning them as critical components in next-generation mobility solutions.

Restraint: Limited suitability for long-term energy storage

Despite their strengths in power delivery, supercapacitors have lower energy density than conventional batteries, restricting their use in applications requiring prolonged energy storage. This limitation reduces their competitiveness in grid-scale storage and long-duration renewable integration projects.

Opportunity: Rising integration of supercapacitors into next-generation aircraft systems

Supercapacitors are increasingly being integrated into next-generation aircraft systems for emergency backup power, peak load management, and onboard energy efficiency. Their lightweight, high-reliability design addresses aviation's critical need for safety, performance, and fuel efficiency.

Challenge: Lack of standardized performance benchmarks, testing protocols, and safety certifications

The absence of globally recognized testing protocols, performance benchmarks, and safety certifications creates buyer uncertainty and hinders interoperability. Without standardization, scaling supercapacitor deployment across industries remains complex and fragmented.

Supercapacitor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Ultracapacitor modules (5 V–160 V), Standard Series, and XP Series used across energy & power, automotive, consumer electronics, industrial, and medical applications | High power density, long cycle life (up to 1,000,000 cycles) | Wide operating temperature range, durable performance in harsh conditions |

|

CellDule 16.2V 200F EDLC module, LS UltraGrid (19” Rack) ESS, and LS UltraGrid Rack Module for automotive, energy, telecom towers, industrial, and medical applications | Compact, lightweight design | Doubled power and energy density | Rapid active power delivery | Modular scalability | Integrated CMS and SoH/SoA prediction software |

|

DMF, DMT, DMH, S3, G, H Series ultra-thin prismatic supercapacitors, plus lithium-ion hybrid capacitors for IoT, automotive, aerospace, and medical devices | Ultra-thin form factor | High reliability | Rapid response, up to 1,000 F capacity | Combining energy density with fast charge–discharge |

|

Cylindrical, medium/large supercapacitor cells, supercapacitor modules (XLRV, XLM, XLR), and hybrid cells for automotive, industrial, and renewable applications | Scalable voltage/capacitance range | Integrated balancing | High reliability | Enhanced energy density |

|

DLCAP Supercapacitor Module Series, DKA/DKG radial lead type, and DXE/DXG/DXF screw terminal series for automotive, consumer electronics, aerospace, and industrial use | High voltage, low ESR, long life, compact size options | Reliable energy storage with application-specific flexibility across multiple industries |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Key players operating in the supercapacitor market are Maxwell Technologies (US), LS Materials (South Korea), Nippon Chemi-Con Corporation. (Japan), Eaton (Ireland), and CAP-XX (Australia). These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint. The supercapacitor market ecosystem comprises a wide array of stakeholders, including raw material providers, supercapacitor manufacturers, and distributors, each playing a crucial role in developing, integrating, and commercializing advanced energy storage solutions. These participants collectively drive innovation, ensure quality standards, and enable efficient deployment of supercapacitor technologies across diverse industries worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Supercapacitor Market, by Type

The electric double-layer capacitor (EDLC) segment held the largest share in 2024, driven by its high efficiency, long cycle life, and suitability for applications requiring rapid charge-discharge cycles. Widely adopted in automotive, consumer electronics, and industrial systems, EDLCs are the backbone of supercapacitor deployment. Their ability to deliver reliable, short-term energy storage at lower maintenance costs further strengthens their dominance in the market.

Supercapacitor Market, by Capacitance Range

The <100 F segment held the largest share in 2024, as these supercapacitors are highly effective in applications requiring rapid energy discharge and minimal maintenance. Their widespread use in consumer electronics, IoT devices, and small-scale industrial systems reinforces their dominance, driven by demand for compact, reliable, and cost-efficient energy storage solutions.

Supercapacitor Market, by End User

The automotive & transportation segment accounted for the largest share in 2024, supported by the growing adoption of electric vehicles, hybrid vehicles, and rail systems. Supercapacitors are widely used to improve acceleration, support regenerative braking, and extend battery life, making them indispensable for enhancing energy efficiency and overall vehicle performance.

REGION

Asia Pacific to be fastest-growing region in global supercapacitor market during forecast period

Asia Pacific is projected to be the fastest-growing market for supercapacitors, driven by the rapid adoption of electric vehicles, renewable energy integration, and expanding consumer electronics production. Strong government support for clean energy and electrification, industrial automation, and digital transformation initiatives is accelerating demand. Countries such as China, Japan, and India are at the forefront of this growth, leveraging supercapacitors to enhance efficiency, sustainability, and performance across multiple sectors.

Supercapacitor Market: COMPANY EVALUATION MATRIX

Maxwell Technologies (Star) leads with a strong market presence and an extensive portfolio of ultracapacitor modules and systems in the supercapacitor market matrix, enabling large-scale adoption across automotive, renewable energy, and industrial applications. Cornell Dubilier (Emerging Leader) is gaining traction with innovative capacitor solutions for transportation, energy storage, and power management applications. While Maxwell dominates with scale, advanced product offerings, and established global reach, Cornell Dubilier shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.19 Billion |

| Market Forecast in 2030 (Value) | USD 2.84 Billion |

| Growth Rate | CAGR of 16.1% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Thousand) and Volume (Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Supercapacitor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| EV Manufacturer |

|

|

| Renewable Energy Company |

|

|

| Consumer Electronics Brand (Asia) |

|

|

RECENT DEVELOPMENTS

- March 2025 : CAP-XX Limited and SCHURTER AG partnered to strengthen their positions in the energy storage sector, particularly supercapacitors. The collaboration focused on joint R&D, manufacturing, and sales, underpinned by formal agreements on IP, financing, and project management. SCHURTER leveraged its Innovation Platform to enhance cooperation. The partnership aims to accelerate innovation and deliver cutting-edge energy storage solutions for global markets.

- March 2025 : CAP-XX Limited signed a global distribution agreement with Premier Farnell, a part of Avnet Inc., to expand the international reach of its supercapacitor product line. The partnership enables Farnell to offer CAP-XX's high-performance supercapacitors through its global e-commerce platforms—Farnell in Europe, Newark in North America, and Element14 in Asia. This agreement is designed to boost product accessibility for design engineers and drive market penetration via Farnell's logistics and support infrastructure.

- July 2024 : Skeleton Technologies partnered with Siemens Digital Industries to supply high-power supercapacitors for Siemens' Smart Power Management platform. The partnership focuses on enhancing energy efficiency and ensuring continuous industrial operations by integrating Skeleton's ultracapacitor technology into Siemens' machinery. Key applications include peak load compensation, braking energy recovery, and backup power support, enabling improved performance and reliability in industrial environments.

- May 2024 : Skeleton Technologies announced a USD 649 million investment over five years to expand production capacity and establish R&D operations in Toulouse, France. The initiative includes the construction of a SuperBattery manufacturing facility in the Occitanie region, aimed at enhancing production capabilities and advancing next-generation energy storage technologies. This strategic expansion supports Skeleton's mission to accelerate innovation and meet growing demand for high-performance energy solutions.

- September 2023 : Knowles Corporation acquired Cornell Dubilier for USD 263 million to expand its film, electrolytic, and mica capacitors portfolio. The acquisition enhances Knowles' presence in high-growth sectors such as medtech, aerospace, and industrial electrification. This move supports growing demand for advanced energy storage and supercapacitor solutions, reinforcing Knowles' strategic focus on innovation and market expansion.

Table of Contents

Methodology

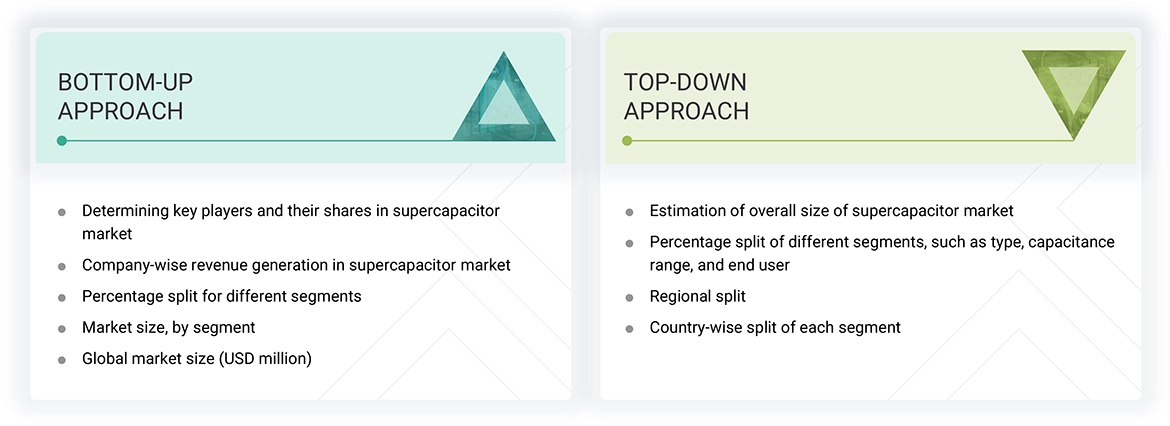

The study involved four major activities in estimating the current size of the supercapacitor market. Exhaustive secondary research has been conducted to gather information on the market, adjacent markets, and the overall supercapacitor landscape. These findings, assumptions, and projections were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the supercapacitor market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size and further validated by primary research.

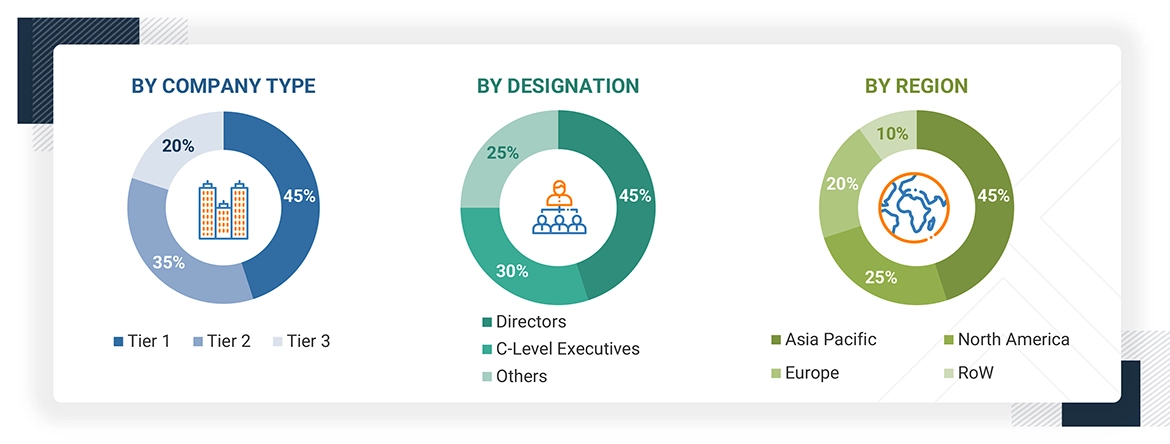

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the supercapacitor market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Other designations include sales and product managers.

The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 500 million; Tier 2 - revenue between USD 100 million and USD 500 million; and Tier 3 revenue less than or equal to USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the supercapacitor market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Supercapacitor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the supercapacitor market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

The supercapacitor market encompasses high-performance energy storage devices, also known as ultracapacitors, valued for their exceptional power density, rapid charge-discharge capability, and long lifecycle. These devices are classified by type into electric double layer capacitors (EDLCs) and hybrid capacitors, each offering distinct energy storage mechanisms. The choice of electrode materials—primarily carbon, composites, and others, such as metal oxides and conducting polymers, plays a crucial role in defining efficiency, cost, and overall performance. Supercapacitors are increasingly deployed across key industries, including automotive & transportation, energy storage, consumer electronics, industrial equipment, aerospace, and medical devices. Regionally, the market spans North America, Europe, Asia Pacific, and RoW, with growth driven by rising demand for electric vehicles, renewable energy integration, grid stabilization, and advancements in sustainable technologies and material science.

Key Stakeholders

- Material and Technology Providers

- Supercapacitor Manufacturers

- Research Institutes and Organizations

- Automotive OEMs

- Consumer Electronics Manufacturers

- Industrial Equipment Manufacturers

- Energy Storage System Integrators

- Government and Research Organizations

- Testing, Inspection, and Certification Providers

- Distributors and Resellers

Report Objectives

- To define, describe, and forecast the supercapacitor market, by type, capacitance range, end user, and region, in terms of value

- To define, describe, and forecast the supercapacitor market in terms of volume

- To describe and forecast the market with regard to four main regions: North America, Europe, Asia Pacific, and RoW, along with their respective countries, in terms of value

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of the supercapacitor market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the supercapacitor market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the supercapacitor market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, and mergers & acquisitions, adopted by key market players in the supercapacitor market

Available customizations:

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the total CAGR expected to be recorded for the supercapacitor market between 2025 and 2030?

The global supercapacitor market is expected to record a CAGR of 16.1% from 2025 to 2030.

What are the driving factors for the supercapacitor market?

The supercapacitor market is primarily driven by the rising demand for efficient energy storage solutions that offer rapid charging and discharging capabilities, long cycle life, and high power density. Growing adoption across sectors for backup power, voltage stabilization, and regenerative braking systems also accelerates the market growth.

What is the impact of AI on the supercapacitor market?

Artificial intelligence (AI) significantly impacts the supercapacitor market by accelerating material discovery, optimizing design processes, and improving manufacturing efficiency. AI-driven simulations and predictive analytics enable faster identification of advanced materials with superior energy density and longevity. In production, AI enhances quality control, reduces waste, and streamlines process automation. These innovations support faster time-to-market and cost-effective development, strengthening the competitiveness and scalability of supercapacitor technologies.

Which are the significant players operating in the supercapacitor market?

Maxwell Technologies (US), LS Materials (South Korea), Nippon Chemi-Con Corporation. (Japan), Eaton (Ireland), and CAP-XX (Australia) are major companies operating in the supercapacitor market.

Which region is expected to offer lucrative growth for the supercapacitor market by 2030?

During the projected period, Asia Pacific is expected to offer lucrative opportunities in the supercapacitor market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Supercapacitor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Supercapacitor Market

David

May, 2018

We would like to know more information on implementing graphene in the production of high-energy dense super capacitors. And related market size?.

Sergej

Mar, 2019

looking for a cost breakdown for supercapacitors and pricing strategies adopted by leading players..

Fabrizio

Aug, 2015

can you provide Market Share Analysis Of Supercapacitor Market? And we would like to know methodology behind the same..

ramesh

Jan, 2019

I have been working on carbon based electrode materials for supercapacitors. I would like to know global importance and upcoming trend impacting the market..

Mirth

Jul, 2016

I am interested to know the units sold for each of the supercapacitor product type? For example, does the report give the percentage of the supercapacitor market or supercapacitor units sold into automated meters or electronic screwdrivers? .

tiezhen

Dec, 2018

I would like to know the current and future market situation of supercapacitor. What all information will be available in this report?.

Alessandro

Sep, 2019

Dose you report includes information about Energy Storage along with a upcoming technological trends in Supercapacitors? also I would like to know more about the market size for China .

Charles

Aug, 2019

our company is entering into supercapacitors business. So need to know every details possible related to the APAC market. .

CHING

May, 2014

Is report covers pricing analysis of supercapacitors? As well as after sales services? As our company is mainly into after sales service business, so we would like to know more about it..

Shahabuddin

Apr, 2016

We are interested to market Supercapacitor in European market specifically for solar panel, laptop, IPS and other uses. Do you have any information on this? .

ANIKET

Feb, 2018

Dose this report covers the survey analysis of end users? As our company is more concerned about the end-user perspective..

Nihal

Jan, 2019

Dose report contains supercapacitor price trends and the market size depending upon energy density?.