Titanium Market

Titanium Market by Product Type (Titanium Dioxide, Titanium Metal), Titanium Dioxide End-use Industry (Paints & Coatings, Plastics & Rubber, Paper), Titanium Metal End-use Industry (Aerospace & Defense, Chemical & Process Industry, Energy & Power, Desalination), and Region - Global Forecast to 2030

Updated on : December 16, 2025

TITANIUM MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Titanium Market was valued at USD 24.84 billion in 2025 and is projected to reach USD 29.87 billion by 2030, growing at 3.8% cagr from 2025 to 2030. The market is mainly driven by the increasing demand for lightweight materials in high-performance applications, advancements in manufacturing processes, and growing investments in infrastructural projects. The growing adoption of lightweight and high-performance materials is driving the use of titanium in various end-use industries to improve efficiency, performance, and durability. Titanium also plays a major role in the paints & coatings industry in the form of titanium dioxide. Titanium dioxide, known for its excellent whiteness, brightness, and opacity, makes it an ideal choice for high-quality coatings in automotive and construction

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe titanium market comprises two main product types including titanium dioxide, and titanium metal (milled products, powder). Titanium metal is expected to register the highest CAGR in terms of value during the forecasted period, due to high demand in next-generation aircraft, and other industrial sectors.

-

BY END-USE INDUSTRY, TITANIUM DIOXIDEThe end-use industry segment of titanium dioxide includes paints & coatings, plastics & rubber, paper, other end-use industries. The paints & coatings industry is projected to register highest CAGR during the forecast period, as titanium dioxide enhances both the visual appeal and protective qualities of paint, making it indispensable for both decorative and industrial applications

-

BY END-USE INDUSTRY, TITANIUM METALKey end-use industries of titanium metal include aerospace & defense, chemical & process industry, energy & power, desalination, other end-use industries. The aerospace & defense segment is projected to dominate the global titanium metal market due to the growing demand from the industry to produce lightweight and durable aircraft components, such as engines and airframes. Some of the major aircraft manufacturers, such as Boeing and Airbus are utilizing titanium to reduce the weight of aircraft and improve efficiency.

-

BY REGIONThe aluminum brazing market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific is the largest market for global titanium market, while North America is projected to register the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, The Chemours Company (US), Venator Materials, PLC. (UK), Tronox Holdings, PLC (US) have entered into a number of agreements and partnerships to cater to the growing demand for titanium dioxide and metal across innovative applications.

The global titanium market, covering both titanium metal and titanium dioxide, is experiencing strong growth driven by increased demand in aerospace & defense, automotive, medical, and construction industries. Titanium metal is prized for its high strength-to-weight ratio, corrosion resistance, and biocompatibility, fueling its adoption in aircraft structures, engine parts, implants, and renewable energy equipment. Titanium dioxide is mainly used in paints, coatings, plastics, and paper due to its excellent whiteness, opacity, and UV resistance, supported by expansion in construction and automotive sectors. Innovations in manufacturing methods, including 3D printing and advanced extraction techniques, and government regulations pushing for sustainability and lower emissions, further enable broader adoption and production efficiency

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. The shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of titanium suppliers, which will further affect the revenues of titanium dioxide and titanium metal manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

TITANIUM MARKET DYNAMICS

Level

-

Increasing use of titanium dioxide in paints & coatings industry

-

Increasing number of aircraft deliveries

Level

-

Stringent environmental policies regarding production of titanium dioxide

-

Complex manufacturing process

Level

-

Efficient use of titanium dioxide in lithium-ion battery components

-

Growing adoption of titanium powder in additive manufacturing

Level

-

Uncertainty about safety of titanium dioxide

-

Fluctuations in prices of raw materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing use of titanium dioxide in paints & coatings industry

The increasing demand for titanium in the paints & coatings industry is the major factor driving market growth. The paints & coatings industry is witnessing a significant rise in the use of titanium dioxide due to its exceptional properties that enhance product performance and durability. Titanium dioxide is a highly effective white pigment known for its superior opacity, brightness, and ability to reflect light, which results in vibrant and long-lasting colors. Its high refractive index provides better coverage by reducing the amount of paint required for a given surface, thus improving cost efficiency. It also offers excellent UV resistance that prevents coatings from degradation caused by exposure to sunlight, which is crucial for exterior paints and industrial coatings

Restraint: Stringent environmental policies regarding the production of titanium dioxide

Several waste products are released during the production of titanium dioxide; therefore, several restrictions have been implemented by governments across the world to control the emissions and ensure the proper disposal of this waste. Titanium dioxide is manufactured either by using sulfuric acid, which is called the sulfate process, or chlorine, which is known as the chloride process. In the sulfate process, the quantity of waste released is higher. China is the leading manufacturer of titanium dioxide globally. Most manufacturing plants in China utilize the sulfate process to manufacture titanium dioxide and dump large quantities of sulfuric acid into the sea. Titanium dioxide itself is acidic, and its improper disposal creates numerous environmental problems

Opportunity: Growing adoption of titanium powder in additive manufacturing

Additive manufacturing is a family of processes in which parts are first molded in a CAD program that slices them into thin layers. Parts are then built layer by layer in specialized machines according to the pattern in the program. The major benefit of additive manufacturing is that it reduces the wastage of material and increases the sustainability of the final product. Recently, in April 2025, TRUMPF, a leading company for machine tools, laser technology, and electronics for industrial applications, qualified 6K additives titanium powder for use in its TruPrint additive manufacturing machines that enhance the flexibility and material options available to the users of these systems. This development is particularly significant for industries such as aerospace, medical technology, and automotive, wherein high-performance materials are critical

Challenge: Uncertainty about the safety of titanium dioxide

The use of titanium dioxide in food and consumer products has raised concerns about its impact on human health, as it is suspected to be carcinogenic. According to the European Union, titanium dioxide is carcinogenic to humans since its inhalation harms human health and leads to diseases such as lung cancer. According to the International Agency for Research on Cancer (IARC), titanium dioxide is possibly carcinogenic to humans by means of inhalation. The classification of titanium dioxide as a human carcinogen has led to several restrictions on the amount used in consumer products

Titanium Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes titanium alloys (Ti-6Al-4V, Ti-5553) for aircraft structural components, jet engine parts, and landing gear due to their high strength-to-weight ratio and corrosion resistance. | Enhances fuel efficiency, reduces aircraft weight, and increases fatigue life under extreme aerospace conditions |

|

Applies titanium additive manufacturing (3D printing) for complex aircraft parts and brackets to replace heavier steel components. | Enables design optimization, reduced assembly steps, and lower production waste |

|

Uses titanium dioxide in automotive paints and architectural coatings for brightness and color stability. | Provides enhanced reflectivity, improved weather resistance, and longer coating life |

|

Incorporates TiO2 into specialty glass and optical products to improve refractive index and UV absorption. | Enhances optical clarity, reduces UV degradation, and supports specialty glass durability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

TITANIUM MARKET ECOSYSTEM

The titanium ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. Raw material suppliers provide titanium ores, such as ilmenite and rutile, to titanium manufacturers. Distributors and suppliers establish contact between manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

TITANIUM MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Titanium Market, By Product Type

Titanium dioxide accounted for the largest share in the global titanium market, as it offers a high refractive index and effectively absorbs UV radiation, chemical stability, biocompatibility, whiteness, opacity, resistance to corrosion, and better electric insulation. Titanium dioxide is a naturally occurring white pigment that is mainly produced in two forms: rutile and anatase. Titanium dioxide is commonly used as a pigment in a wide range of end-use industries, including paints & coatings, plastics & rubber, paper, and others. In the paints & coatings industry, titanium dioxide plays a critical role due to its exceptional white pigmentation, opacity, and high refractive index. It enhances the coverage of paints, allowing a thinner layer to effectively cover surfaces, which reduces the need for multiple coats. It is also used in the plastics & rubber industry to enhance the durability of plastic products and improve the opacity and color of rubber products such as tires, seals, and gaskets. As titanium dioxide offers durability and longevity, it is also utilized in the paper industry for decorative papers

Titanium Dioxide Market, By End-use Industry

The paints & coatings segment dominated the the titanium dioxide market, due to the increasing demand for high-performance coatings in various end-use industries such as automotive, construction, and industrial. As industrialization and urbanization continue to increase globally, there is a growing need for durable and esthetically appealing coatings that offer enhanced UV resistance, durability, and resistance to corrosion. The automotive industry is a major consumer of high-performance coatings as manufacturers focus on enhancing vehicle esthetics, durability, and fuel efficiency. The growing shift toward environmentally friendly and sustainable products is driving the demand for non-toxic, high-quality coatings, further driving the adoption of titanium dioxide

Titanium Metal Market, By End-use Industry

The chemical & process industry and energy & power segment are projected to register the highest CAGRs in the titanium metal market during the forecast period. In the chemical & process industry, titanium metal is widely used for applications in heat exchangers, pipes, and reactors as it offers resistance to aggressive chemicals while enhancing the stability and durability of equipment in industries such as petrochemicals, pharmaceuticals, and food processing. In the energy & power industry, titanium metal is majorly used for nuclear, solar, and geothermal energy production, as it has the ability to endure high stress, temperature, and corrosion. Due to the growing demand for renewable energy technologies, titanium ingots are utilized in wind turbines, solar installations, and hydrogen storage tanks. Their lightweight and corrosion-resistant properties ensure reliable performance in harsh environments, such as offshore wind farms and desert solar arrays

REGION

North America to be fastest-growing region for titanium market during forecast period

The North America region is projected to dominate the titanium market during the forecast period due to the presence of major titanium dioxide and titanium metal manufacturers. The Chemours Company and Tronox Holdings Plc. are some of the well-established players in the titanium dioxide market, which are driving the demand for titanium dioxide in various end-use industries, such as paints & coatings, plastics & rubber, and paper. Due to changing consumer preferences and a growing shift toward sustainability, manufacturers are engaged in the production of sustainable products. The US, being the largest producer and consumer of titanium, has increased the demand for titanium alloys in the aerospace & defense industry. The region is witnessing significant demand for titanium metals from the Boeing Company for the production of lightweight and durable aircraft structures, which helps fuel efficiency and aircraft performance

Titanium Market: COMPANY EVALUATION MATRIX

In the titanium dioxide market, The Chemours Company (Star) leads with a strong market share and extensive product footprint, serving key industries such as coatings, plastics, and laminates with its Ti-Pure brand. Tayca Co., Ltd. (Emerging Leader) is recognized for its innovative specialty chemicals and made-to-order production system . While The Chemours Company dominates through innovation, and sustainability, Tayca Co., Ltd.shows significant potential to move toward the leaders’ quadrant as the demand for titanium dioxide continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

TITANIUM MARKET PLAYERS

TITANIUM MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 23.79 Billion |

| Market Forecast in 2030 (Value) | USD 29.87 Billion |

| Growth Rate | CAGR of 5.0% from 2025-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Titanium Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Raw Material Supplier (Titanium Ingots, Slabs, Sponge, TiO2 Pigments) |

|

|

| Titanium Alloy and Pigment Manufacturers |

|

|

| OEMs and Component Manufacturers (Aerospace Structures, Medical Devices, Automotive, Industrial Equipment) |

|

|

| End-use Industries (Aerospace, Medical, Automotive, Industrial, Consumer Goods) |

|

|

RECENT DEVELOPMENTS

- February 2025 : The Chemours Company introduced the Ti-Pure TS-6706, a TMP- and TME-free version of its flagship universal titanium dioxide (TiO2) grade, Ti-Pure R-706. This innovation addresses evolving regulatory requirements while maintaining the high-quality standards associated with the original product. Ti-Pure TS-6706 offers attributes such as high gloss, excellent durability, a blue undertone, and effective hiding power, making it suitable for various coating applications where appearance is critical

- February 2024 : Kronos Worldwide, Inc. partnered with DKSH Performance Materials to distribute its titanium dioxide pigments for coatings and plastics applications in Australia, New Zealand, Japan, and the Philippines. This partnership builds upon successful collaborations in Spain since 2015 and Portugal since 2017. DKSH will provide business development, marketing, sales, and logistics services for Kronos' titanium dioxide pigments, which are essential in the production of paints, coatings, plastics, paper, fibers, cosmetics, pharmaceuticals, glass, and ceramics

- March 2024 : ATI expanded its production capacity by establishing its state-of-the-art 12,500-ton billet forging press, known as BSOII, at its facility in Bakers, North Carolina. This new press enhances ATI's capacity to produce titanium for aerospace and defense applications, offering 25% higher tonnage than the company's legacy press and achieving closer tolerances

Table of Contents

Methodology

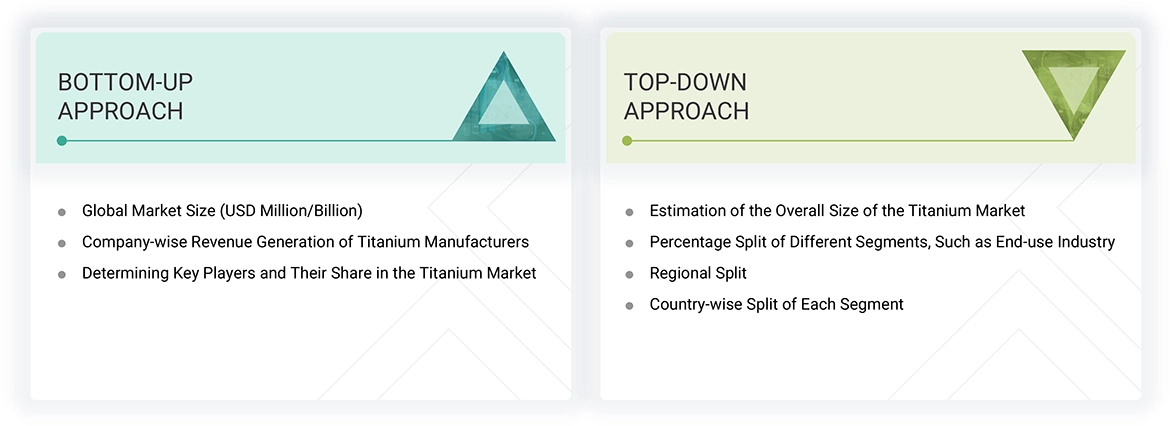

The study involves two major activities in estimating the current market size for the titanium market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering titanium and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the titanium market, which was validated through interviews with experts.

Primary Research

Extensive primary research was conducted after obtaining information regarding the titanium market scenario through secondary research. Several interviews were conducted with market experts from both, the demand and supply sides across the major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development/marketing directors, product development/innovation teams, related key executives from the titanium industry, system integrators, component providers, distributors, and key opinion leaders. Interviews with experts were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customers/end users who are titanium services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of titanium and future outlook of their business which will affect the overall market.

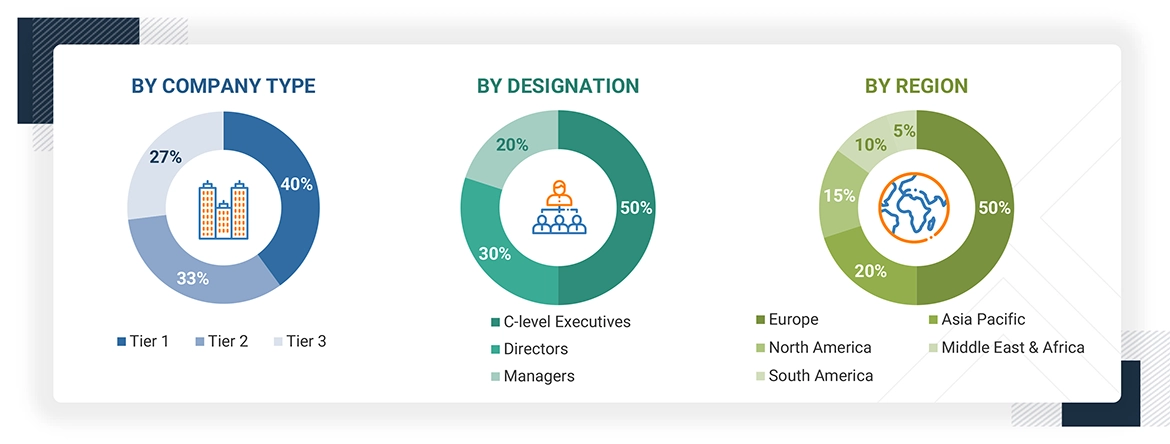

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the titanium market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on the demand for titanium in different end-use industries at the regional level. Such procurements provide information on the demand aspects of the titanium industry for each end-use industry. For each end-use industry, all possible segments of the titanium market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both, the top-down and bottom-up approaches.

Market Definition

Titanium is the ninth-most common element in the Earth’s crust. The majority of the titanium extracted is in the form of titanium dioxide, which is used as a pigment. The rest is used in making metals. Titanium dioxide (TiO2, titanium (IV) oxide, or Titania) occurs naturally in various rocks and mineral sands. It is a white solid inorganic substance that is thermally stable, chemically inert, non-flammable, has excellent ultraviolet (UV) resistant qualities, and acts as a UV-absorbent. It has the highest refractive index and is one of the whitest materials on Earth. When ground into a fine powder, it transforms into a white pigment that provides whiteness and opacity to products. It is mainly sourced from the minerals anatase, brookite, ilmenite, leucoxene, perovskite, rutile, and sphene. Titanium dioxide is utilized in paints & coatings, plastics, paper, inks, and other end-use industries.

In the form of metal, titanium is known for its superior performance properties, such as high strength-to-weight ratio, low density, ductility, biocompatibility, high melting point, and corrosion resistance. In the commercially pure form, titanium has low strength and high ductility and is, therefore, used in applications that require low strength. However, in applications that demand high strength, titanium alloys are mainly used.

Stakeholders

- Titanium Manufacturers

- Titanium Distributors and Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the titanium market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global titanium market by product type, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the titanium market? What key strategies have market players adopted to strengthen their market presence?

Major companies include Venator Materials PLC (UK), The Chemours Company (US), Tronox Holdings Plc (US), LB Group (China), Kronos Worldwide, Inc. (US), INEOS (UK), Cinkarna Celje d.d. (Slovenia), Evonik (Germany), TAYCA Co., Ltd. (Japan), ILUKA RESOURCES LIMITED (Australia), AMG (Netherlands), ATI (US), Toho Titanium Co., Ltd. (Japan), Precision Castparts Corp. (Titanium Metals Corporation) (US), UST-KAMENOGORSK TITANIUM AND MAGNESIUM PLANT JSC (Kazakhstan), VSMPO-AVISMA Corporation (Russia), OSAKA Titanium Technologies Co., Ltd. (Japan), and Baoji Titanium Industry Co., Ltd. (China). Key strategies include product launches, acquisitions, and expansions.

What are the drivers and opportunities for the titanium market?

The market is driven by increasing demand from the aerospace & defense industry and the growing use of titanium dioxide in paints & coatings. These trends offer lucrative opportunities for market players.

Which region is expected to hold the largest market share?

Asia Pacific is expected to hold the largest market share due to rising industrialization and urbanization, which boost titanium demand across multiple end-use industries.

What is the projected growth rate of the titanium market over the next five years?

The titanium market is projected to grow at a CAGR of 3.8% during the forecast period in terms of value.

How is the titanium market aligned for future growth?

The market is well-positioned for growth due to increasing demand for titanium dioxide and metal across industries that prioritize high-performance, lightweight, and durable materials.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Titanium Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Titanium Market

Jack

May, 2022

Is it possible for you to share data of Titanium Market Forecasts till 2022 - 2027.