UQD Coupling Market Size, Share & Trends, 2025 To 2030

UQD Coupling Market by Type (Fixed, Rigid), Material (Steel, Brass, Aluminum, Polymer, Carbon Fiber Reinforced, Composite), Vertical (Data Center, HPC, Liquid, IT & Electronics Cooling, Energy Storage, Industrial Automation) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The universal quick disconnect (UQD) market is expected to grow from USD 0.39 billion in 2025 to USD 0.75 billion by 2030, at a CAGR of 14.3% from 2025 to 2030. The market is driven by the rapid expansion of data centers and high-performance computing, which require advanced liquid cooling solutions to prevent overheating in dense environments. Increasing adoption in energy storage, electronics cooling, and industrial automation also demands efficient, tool-free connections for minimal downtime.

KEY TAKEAWAYS

- The Asia Pacific UQD coupling market accounted for a 32.9% revenue share in 2024.

- By material, the metals segment is projected to hold the largest share of 96.0% in 2025, supported by superior properties of metals, such as strength, durability, which make them ideal for high-performance and heavy-duty applications.

- By application, the data center segment is projected to grow at the fastest rate from 2025 to 2030.

- Stäubli International AG, Danfoss, Parker Hannifin Corp, were identified as some of the Star players in the UQD coupling market, given their strong market share and product footprint.

- BEEHE, IMMERSEKOOL, VAV International, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The universal quick disconnect (UQD) coupling market is propelled by the rising demand for dependable IT cooling solutions, as digital transformation accelerates across various industries. Growing investments in renewable energy storage systems demand sturdy coupling technologies to guarantee safety and efficiency. Furthermore, the automotive industry's move towards electrification increases the need for UQDs in battery cooling systems. Global expansion, particularly in the Asia-Pacific and North America regions, fosters market growth through customized regional innovations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The UQD coupling market is experiencing major trends and disruptions that are changing the customer's business landscape. As depicted in the revenue mix analysis, the shift from traditional sources to new ones, driven by hot bets like thermal interface solutions, liquid cooling, and electronic control manufacturing, is creating significant future revenue opportunities. Key disruptions include quick-disconnect couplings with sensors for real-time monitoring and leak detection, along with non-split designs for clean room and precision cooling applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Global rise in data centers

-

Growing emphasis on sustainability in corporate governance

Level

-

High Cost of Advanced Materials and Manufacturing Processes

-

Stringent safety and performance regulations

Level

-

Rapid development of digital infrastructure in emerging economies

-

Expanding electric vehicle market

Level

-

Inability to meet stringent environmental demands

-

Compatibility issues with existing systems and variations in connection standards

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Global rise in data centers

The global growth of data centers is a key factor driving the UQD coupling market, as increasing demand for cloud and high-performance computing boosts the need for efficient liquid cooling systems. UQD couplings allow for quick, leak-free connections, ensuring optimal thermal management and system reliability in data-heavy environments.

Restraint: High cost of advanced materials and manufacturing processes

High costs related to advanced materials and precise manufacturing methods act as a major barrier for the UQD Coupling Market. Metals like stainless steel, aluminum, and brass require specialized fabrication to ensure durability and corrosion resistance, raising overall production costs and limiting adoption among price-sensitive industrial and IT applications.

Opportunity: Rapid development of digital infrastructure in emerging economies

Rapid growth of digital infrastructure in emerging economies offers a significant opportunity for the UQD coupling market. Increasing investments in data centers, smart factories, and renewable energy storage systems across Asia Pacific and other regions are driving the demand for efficient, modular, and easy-to-maintain quick disconnect solutions.

Challenge: Inability to meet stringent environmental demands

The inability to meet strict environmental standards challenges the UQD coupling market. Manufacturers face increasing pressure to develop eco-friendly materials and reduce fluid leakage risks to adhere to global sustainability standards, especially in energy, electronics cooling, and industrial automation sectors.

UQD Coupling Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Multi-coupling solutions for liquid cooling systems in data centers and high-performance computing|Quick disconnect couplings for battery cooling and thermal management in energy storage applications|Precision fluid connectors for automated industrial processes | Zero-spillage technology for cleanroom compatibility|High flow rates with minimal pressure drop for efficient cooling|Proven reliability in mission-critical thermal management|Reduced maintenance downtime with tool-free connections|Enhanced safety in high-pressure cooling loops |

|

Quick couplings for electronics cooling and immersion cooling systems|Thermal interface solutions for IT cooling infrastructure and server racks|Modular coupling systems for scalable data center liquid cooling architectures | Energy-efficient heat transfer optimization|Compact design for space-constrained installations|Fast installation reducing deployment time|Temperature and pressure resilience for demanding environments|Sustainability through reduced coolant loss and improved PUE |

|

High-pressure metal quick couplings for energy storage thermal management|Multi-material (steel, aluminum, brass) coupling portfolio for diverse applications|Contamination-control couplings for critical electronics cooling in cleanrooms | Maximum durability under extreme pressure cycles|Global availability and supply chain reliability|Comprehensive technical support and application engineering|Precision tolerances for consistent performance|Broad certification compliance for international markets|Integrated safety features preventing accidental disconnection |

|

Precision quick disconnects for aluminum and brass liquid cooling manifolds|Non-spill couplings for high-performance computing and AI infrastructure|Corrosion-resistant steel couplings for industrial automation fluid systems | Superior chemical compatibility across diverse coolants|Low insertion force for ergonomic operator experience|Leak-proof performance ensuring system integrity|Wide temperature range capability|Cost-effective solutions without compromising quality|Customization options for OEM integration |

|

Hydraulic quick couplings adapted for liquid cooling distribution networks|Robust metal couplings for industrial automation coolant delivery|High-flow quick disconnects for large-scale IT cooling infrastructure in hyperscale data centers | Proven hydraulic heritage applied to cooling applications|Exceptional flow capacity for high-heat-load systems|Long service life reducing total cost of ownership|Resistance to vibration and mechanical stress|Easy field serviceability|Compatibility with existing cooling infrastructure for retrofit projects |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The UQD coupling market ecosystem is driven by a diverse network of manufacturers, technology integrators, and end-use verticals that require high-reliability fluid connections. At the center are coupling manufacturers that create advanced solutions with leak-proof, quick-release mechanisms suitable for high-flow and low-pressure drop applications. These products are increasingly adopted in key verticals such as data centers, where thermal management and liquid cooling efficiency are vital. High-performance computing (HPC) systems and IT infrastructure also utilize UQD couplings to improve system uptime and energy efficiency. In industrial automation, energy storage systems, and electronics cooling, these couplings provide reliable and easy-to-maintain connections.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

UQD Coupling Market, By Material

Metals hold the largest share in the UQD coupling market because of their superior strength, corrosion resistance, and ability to withstand high temperatures. Materials like stainless steel, aluminum, and brass provide durability and reliability in environments with high pressure and temperature, making them perfect for critical industrial and liquid cooling uses.

UQD Coupling Market, By Application

Data centers hold the largest share in the UQD coupling market, fueled by the rising demand for efficient liquid cooling systems to manage heat produced by high-performance computing and AI workloads. UQD couplings enable secure, quick, and leak-free fluid connections, ensuring increased uptime, easier maintenance, and better energy efficiency in large-scale data center operations.

REGION

Asia Pacific to hold largest share in global UQD coupling market during forecast period

Asia Pacific is expected to hold the largest market share in the UQD coupling industry, driven by the rapid expansion of data centers, high-performance computing infrastructure, and industrial automation across countries such as China and Japan.

UQD Coupling Market: COMPANY EVALUATION MATRIX

In the UQD coupling companies matrix, Stäubli International AG (Star) remains at the top with a strong market presence and a broad product range, enabling widespread adoption of UQD coupling solutions across data centers, high-performance computing, and IT cooling. CHUAN CHU INDUSTRIES (Emerging Leader) is steadily gaining momentum with innovative, high-efficiency solutions for liquid cooling and electronics applications. While Stäubli International AG leads through scale and a well-established customer base, CHUAN CHU INDUSTRIES shows solid growth potential to move toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.35 Billion |

| Market Forecast in 2030 (Value) | USD 0.75 Billion |

| Growth Rate | CAGR of 14.3% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (Million Units) and Volume (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: UQD Coupling Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Data Center Operator (Hyperscale) |

|

|

| European High-Performance Computing Facility |

|

|

| Asia-Pacific Energy Storage System Integrator |

|

|

| North American Industrial Automation OEM |

|

|

| Middle East IT Cooling Solutions Provider |

|

|

RECENT DEVELOPMENTS

- October 2024 : Danfoss and HyprCool showcased a liquid-cooled server rack at Data Centre World Asia, emphasizing their partnership to enhance data center cooling efficiency. HyprCool's jet impingement technology, combined with Danfoss' couplings and hoses, ensured reliable fluid distribution, lowered energy use, and supported high-performance processors in tight spaces.

- October 2024 : Parker Hannifin Corp partnered with Intel Corporation and contributed to the Open Compute Project (OCP) by developing Universal Quick Disconnect (UQD) and Blindmate (UQDB) couplings that align with Intel's UQD Specification. These products enable seamless integration, leak-free thermal management, and energy-efficient cooling in data centers. Their flexibility allows for accommodating design misalignments, optimizing server blade configurations, and supporting sustainable operations.

- September 2024 : Shenzhen Envicool Technology Co., Ltd. partnered with Intel Corporation in the DCAI China Liquid Cooling Innovation & Accelerator Program, offering full-chain liquid cooling solutions, including cold plates, CDUs, and quick disconnects. Successfully passing Intel's strict reliability and performance tests, Envicool helped set industry standards, promoting sustainable data center operations and green computing through innovative liquid cooling technology.

- August 2024 : Stäubli International AG and LEONI collaborated to advance heavy-duty charging technologies, focusing on improving fast-charging performance. Together, they carried out extensive testing to refine Stäubli's QCC fast-charging connector and MCS (Megawatt Charging System) solutions. LEONI contributed its expertise in cooled high-power cables, which was instrumental in enhancing overall system integration. This collaboration particularly supports high-powered charging applications in demanding environments like mining, ensuring reliable, efficient, and thermally optimized performance under extreme conditions.

Table of Contents

Methodology

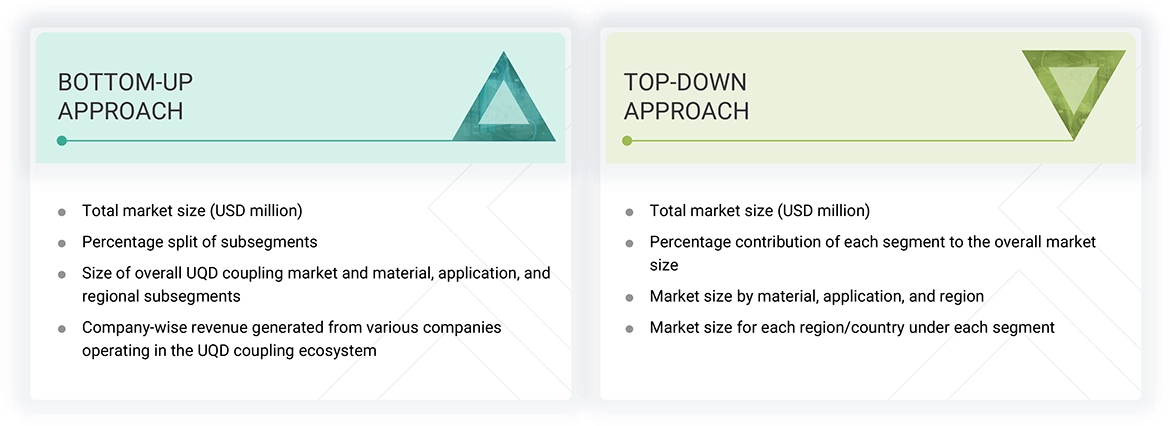

The study involved four major activities in estimating the current size of the UQD coupling market. Exhaustive secondary research helped collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect necessary information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Source |

Web Link |

|

Semiconductor Industry Association (SIA) |

www.semiconductors.org |

|

Global Semiconductor Alliance |

www.gseglobal.org |

|

European Semiconductor Industry Association |

www.eusemiconductors.eu |

|

Taiwan Semiconductor Industry Association |

www.tsia.org.tw/EN/index |

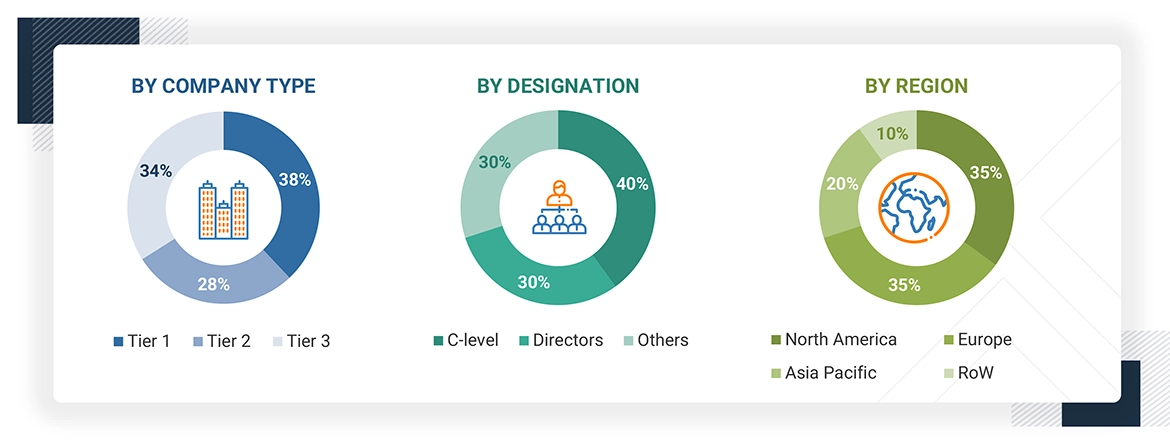

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the UQD coupling market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of UQD coupling solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies have been defined based on their total revenue as of 2023: tier 1: revenue greater than USD 1 billion, tier 2: revenue between USD 500 million and USD 1 billion, and tier 3: revenue less than USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

UQD Coupling Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

The Universal Quick Disconnects (UQD) is a global standard for spill-free quick disconnect couplings designed for liquid cooling in data centers. Developed as part of the Open Compute Project (OCP), UQD is an Intel-led initiative to establish an open standard for efficient and reliable liquid cooling solutions. These couplings are designed to meet the cooling requirements of modern data centers, offering superior performance and reliability for liquid cooling to ensure peak performance in critical applications.

Key Stakeholders

- System manufacturers and OEMs

- Raw Material Suppliers

- Distributors & Retailers

- System Integrators and Engineering Firms

- End Users

- Regulatory Bodies & Standards Organizations

Report Objectives

- To define, describe, and forecast the UQD coupling market, by material, application, and region, in terms of value

- To describe and forecast the market for various segments with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To describe and forecast the market size in terms of volume

- To provide detailed information about the key factors, such as drivers, opportunities, challenges, and ecosystem influencing the market's growth

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the UQD coupling market

- To strategically profile the key players, comprehensively analyze their market share and core competencies2, and provide a detailed competitive landscape for market leaders

- To analyze competitive developments, such as partnerships, collaborations, agreements, mergers & acquisitions, expansions, and product launches & developments, in the UQD coupling market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the UQD coupling market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the UQD coupling market.

Key Questions Addressed by the Report

At what CAGR is the UQD coupling market anticipated to grow from 2025 to 2030?

The global UQD coupling market is expected to record a CAGR of 14.3% between 2025 and 2030.

Which regions are expected to pose significant demand for UQD couplers during the forecast period?

The Asia Pacific and North America are likely to witness substantial demand for the UQD coupling market owing to the explosive growth in AI, 5G, and cloud computing across India, China, and Southeast Asia. This growth fuels demand for UQD couplings in liquid cooling and fluid handling within data centers

What are the significant growth opportunities in the UQD coupling market?

Significant opportunities in the UQD coupling market stem from the rising adoption of electric vehicles, expansion of hyperscale data centers, and growing automation in manufacturing. Demand for leak-free, quick-disconnect systems in cleanroom environments, thermal management, and robotics further boosts market potential. Advancements in smart couplings with sensors for predictive maintenance and the increasing need for energy-efficient systems in emerging economies open new avenues for innovation and market expansion.

Who are the key UQD coupling market players?

Stäubli International AG (Switzerland), Danfoss (Denmark), Parker Hannifin Corp (US), Colder Products Company (US), Gates Corporation (US), CEJN AB (Sweden), Hydraflex (US), Shenzhen Envicool Technology Co., Ltd. (China), Zhejiang Dinuo Intelligent Equipment Co., Ltd (China), and IMMERSEKOOL (South Korea) are the major players in the UQD coupling market.

What are the major applications in the UQD coupling market?

Data center, high-performance computing, and liquid cooling & electronics cooling are the major applications in the UQD coupling market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the UQD Coupling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in UQD Coupling Market