US Healthcare Analytics Market Size, Growth, Share & Trends Analysis

US Healthcare Analytics Market by Type (Predictive, Diagnostic), Application (Claim, RCM, Fraud, Precision Health, RWE, Imaging, Supply Chain, Workforce, Population Health), End User (Payer, Hospital, ACO, ASC), Market Insights, Trends - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

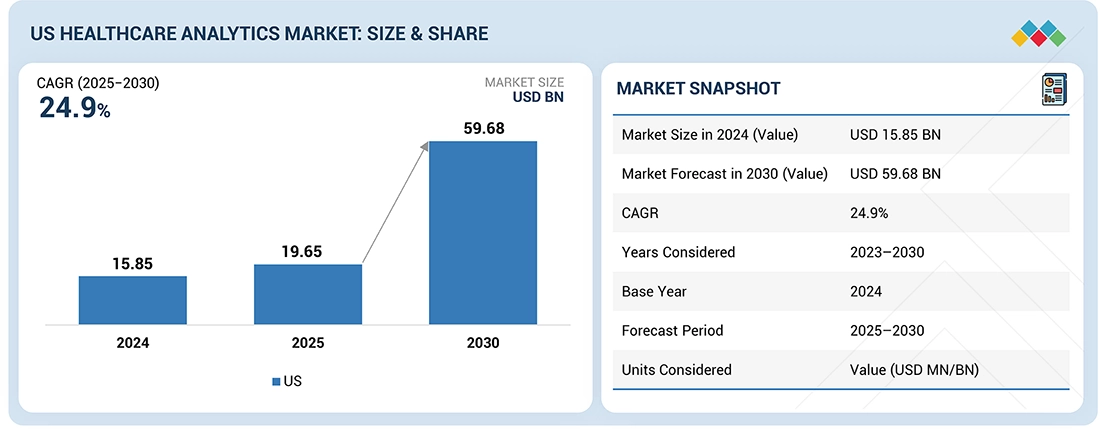

US Healthcare Analytics market, valued at US$15.85 billion in 2024, stood at US$19.65 billion in 2025 and is projected to advance at a resilient CAGR of 24.9% from 2024 to 2030, culminating in a forecasted valuation of US$59.68 billion by the end of the period. The growth of the US healthcare analytics market is driven by the rising adoption of advanced data analytics to improve clinical decision-making, increasing healthcare digitization and EHR integration, and the growing need to reduce operational costs while enhancing patient outcomes. AI- and ML-based predictive analytics and the expansion of value-based care models are accelerating market demand.

KEY TAKEAWAYS

-

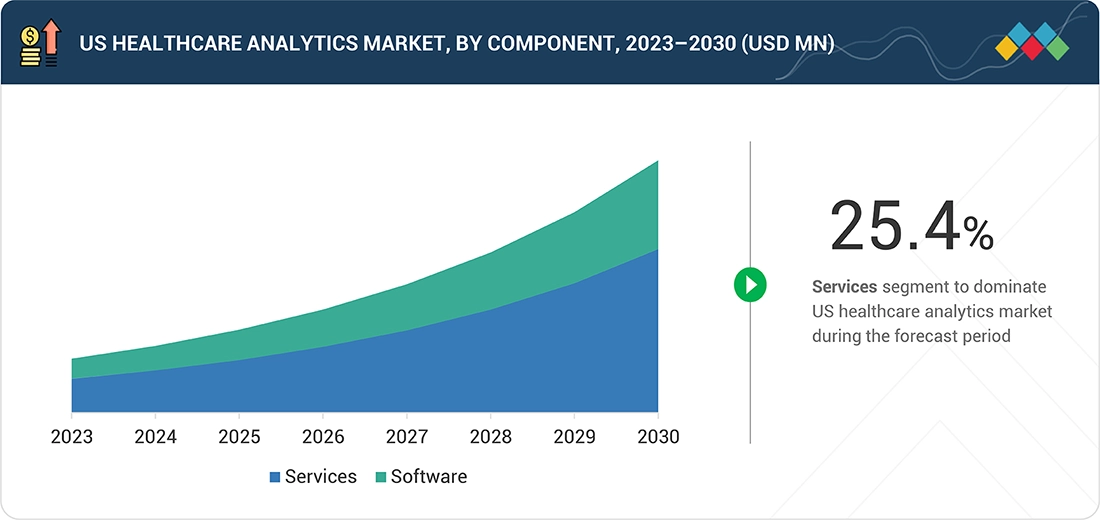

By ComponentBy component, the services segment is expected to register the highest CAGR of 25.4%. This is attributed to the growing demand for specialized consulting, implementation, and maintenance support as healthcare organizations adopt complex analytics solutions.

-

By TypeBy type, the descriptive analytics segment accounted for the largest share of 32.4% in the US healthcare analytics market, primarily due to its widespread use in summarizing historical data, identifying trends, and supporting foundational decision-making across various healthcare operations.

-

By ApplicationBy application, the clinical analytics segment accounted for the largest share of the US healthcare analytics market. This is due to its critical role in improving patient outcomes, enhancing diagnostic accuracy, and supporting evidence-based care through real-time and predictive insights.

-

By End UserBy end user, the providers segment is expected to register the highest CAGR of 25.1% driven by the growing need to optimize clinical workflows, enhance patient care quality, and support value-based care initiatives through advanced analytics adoption.

-

Competitive LandscapeOptum, Inc., Oracle, and Merative were identified as some of the star players in the US healthcare analytics market, given their strong market share and product footprint.

-

Competitive LandscapeArcadia Solutions, LLC., Evidation Health, Inc., and Healthcorum, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The healthcare analytics market in US is developing at a very high rate, as healthcare organizations rely on data-driven tools to improve clinical outcomes, streamline operations, and support value-based care. Population health management tools enable real-time decision-making that is getting advanced with analytics, such as AI-enabled predictive models. The increased adoption of EHR, the rising focus on cost-efficiency, and the increased implementation of automation are accelerating the adoption of analytics solutions in the healthcare ecosystem.

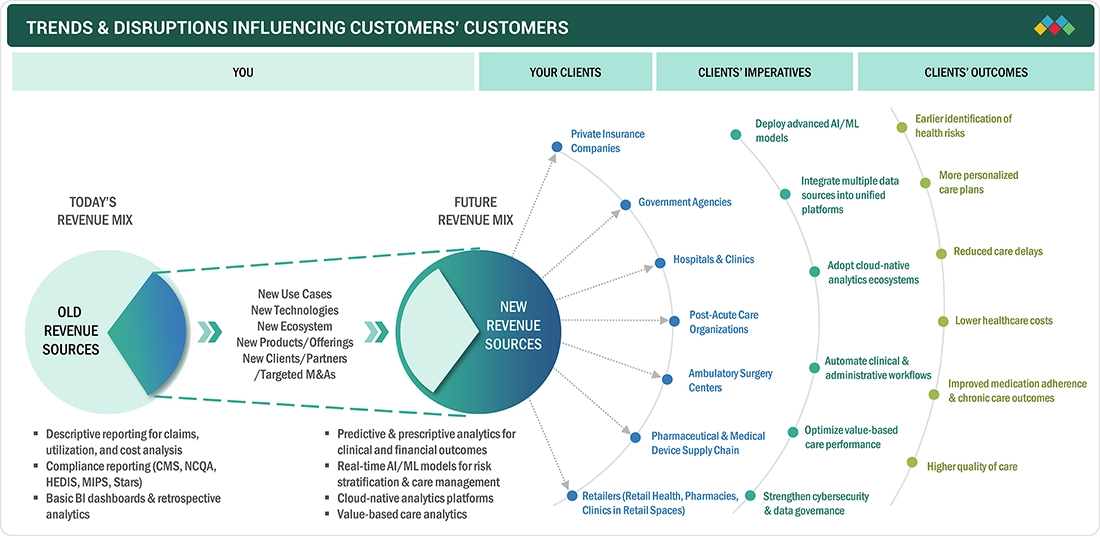

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business in the US healthcare analytics market is accelerated by the increasing need for data-driven decision-making, operational efficiency, and improved patient outcomes across the healthcare ecosystem. Hospitals, physician groups, payers, and life sciences organizations are the primary end users. Their increasing reliance on advanced analytics for population health management, cost optimization, and clinical performance improvement is accelerating market adoption. The expanding use of AI-enabled tools, real-time data integration, and predictive models is transforming workflows, enhancing care quality, and strengthening overall organizational performance for analytics solution providers in the US.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid Expansion of Value-based Care and Alternative Payment Models

-

Large Volume of Healthcare Data from Electronic Health Records, Claims, Wearables, and Genomics

Level

-

Highly Fragmented Healthcare System & Data Silos

-

High Cost of Advanced Analytics Platforms

Level

-

Expansion of AI/ML Applications in Clinical Decision Support

-

Increasing Use of Real-World Evidence (RWE) for Drug Development

Level

-

Shortage of Skilled Healthcare Data Professionals

-

Concerns Around Data Privacy & Security and HIPAA Compliance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid Expansion of Value-based Care and Alternative Payment Models

The US healthcare analytics market is growing due to the rapid adoption of value-based care and alternative payment models. Providers and payers are increasingly in need of data-driven solutions to measure outcomes, manage risk, and control costs. These models priorities quality, which leads to high demand in terms of predictions and real-time performance monitoring. Other uses of analytics solutions include the ability to identify high-risk patients, decrease readmissions, and enhance care coordination, which are all essential to the success of value-based reimbursement.

Restraint: Highly Fragmented Healthcare System & Data Silos

The US healthcare system is highly fragmented, which limits the development of the healthcare analytics market because it is characterized by the lack of data silos between providers, payers, and care settings. Incompatible EHR systems and interoperability are barriers to integration of data, lower the quality of data, and prevent holistic insights about the patient on a patient-level basis. As a result, analytics solutions are more expensive to implement, slower to deploy and less effective, thus slowing adoption, particularly by small and mid-sized healthcare organizations.

Opportunity: Expansion of AI/ML Applications in Clinical Decision Support

The growth of AI and machine learning usage in clinical decision support is a significant opportunity for the US healthcare analytics market. These technologies offer more precise diagnoses, detecting risks early, and recommending treatment individually, which contributes to clinical effectiveness. The shift toward AI-driven tools implemented in healthcare facilitates real-time decision-making and automates the analysis of complex data. This leads to an increase in demand for advanced analytics platforms. The shift also promotes increased investment in interoperable data infrastructure and predictive models of the next generation.

Challenge: Shortage of Skilled Healthcare Data Professionals

The lack of qualified healthcare data specialists is a significant threat to the US healthcare analytics market. Several organizations lack the expertise to handle the complex sets of data and implement the latest analytics tools to support their operations. There is a shortage of data scientists, informaticists, and AI specialists, which slows the implementation process and diminishes the effectiveness of analytics initiatives. This skills gap enhances reliance on external vendors and elevates operational expenses, which is more difficult to harness the emerging technologies by healthcare providers and payers.

US HEALTHCARE ANALYTICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Analytics platforms integrating claims, clinical, and real-world data to support population health and value-based care | Better risk stratification| Improved care quality| More efficient healthcare spending. |

|

Cloud-based data analytics tools for EHR integration, predictive modeling, and performance optimization across healthcare systems | Enhanced decision-making| Streamlined operations| Stronger insights for clinical and financial outcomes |

|

AI-driven analytics solutions for clinical decision support, payer-provider collaboration, and population health insights | More accurate clinical assessments| Improved patient outcomes and more efficient care delivery |

|

Healthcare analytics platforms focused on supply chain optimization, medication management, and operational performance improvement | Reduced waste| Better resource utilization| Improved hospital efficiency |

|

Advanced statistical and AI analytics for forecasting, clinical research, fraud detection, and quality improvement initiatives | Stronger predictive capabilities| Reduced operational risk| Improved overall healthcare performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Optum, Inc., Oracle, and Merative are major stakeholders in the US healthcare analytics market ecosystem. They offer an enhanced analytics platform to enhance clinical decision making, operational efficiency, and population health management. These solutions enable real-time data integration, predictive modelling, and performance insights that aid value-based care and cost optimization. The scalability and data exchange increase more through cloud infrastructure and interoperability partners within healthcare settings. Life sciences organizations, payers, and providers are utilizing these platforms to achieve better results, streamline operations, and enhance the robustness of healthcare delivery.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Healthcare Analytics Market, By Component

In 2024, the services segment dominated the US healthcare analytics market. This is due to the growing demand for implementation, integration, and consulting services as healthcare organizations adopt complicated analytics platforms. Service providers assist in streamlining data management, regulatory compliance, and optimizing interoperability across clinical and administrative systems. The growth of this segment is driven by the increasing demand for continuous maintenance, training, and the development of specialized analytics products.

US Healthcare Analytics Market, By Type

In 2024, the descriptive analytics segment dominated the US healthcare analytics market, driven by the growing need to analyze historical data, identify patterns, and generate actionable insights that support routine clinical, operational, and financial decision-making. Its ease of adoption, ability to enhance reporting efficiency, and critical role in establishing a foundation for advanced analytics further contributed to its widespread use across healthcare organizations.

US Healthcare Analytics Market, By Application

The clinical analytics segment dominated the US healthcare analytics market in 2024. Clinical analytics have an essential role in enhancing patient outcomes, diagnostic accuracy, and evidence-based care. These solutions are widely used by healthcare providers for risk stratification, care coordination, and real-time clinical insights. The further increase in the quality improvement and value-based care boosted the need for clinical analytics in the healthcare ecosystem.

US Healthcare Analytics Market, By End User

In 2024, the providers segment accounted for the largest share of the US healthcare analytics market due to their increased application of analytics to enhance the quality of care, clinical workflow efficiency, and reduce operational inefficiencies. There is an increasing use of population health management, outcome measurement, and value-based care initiatives in hospitals and health systems that utilize data-driven tools. The increased focus on real-time insights, cost containment, and patient experience further facilitated great acceptance among providers.

US HEALTHCARE ANALYTICS MARKET: COMPANY EVALUATION MATRIX

Optum, Inc. (Star) is a strong competitor in the US healthcare analytics market with a significant market presence, fueled by a comprehensive analytics platform, AI-powered insights, and integrated across payer and provider networks. Its strong data infrastructure and proven outcomes make it stronger in leadership. With its solutions of advanced analytics, interoperability capabilities, and growing client relationships, CitiusTech Inc. (Emerging Leader) gathers momentum. Although Optum leads with its size and the depth of capabilities, CitiusTech can easily shift to the leaders quadrant as the need to have high-quality and specialized analytics rises.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Optum, Inc. (US)

- Oracle (US)

- Merative (US)

- Mckesson Corporation (US)

- SAS Institute Inc. (US)

- Veradigm (US)

- Wipro (India)

- CVS Health (US)

- IQVIA (US)

- CitiusTech Inc. (US)

- Inovalon (US)

- MedeAnalytics, Inc. (US)

- Cotiviti, Inc. (US)

- ExlService Holdings, Inc. (US)

- Health Catalyst (US)

- Apixio (US)

- Komodo Health, Inc. (US)

- Aetion, Inc. (US)

- HealthEC, LLC (US)

- Arcadia Solutions, LLC. (US)

- Sisense Ltd. (US)

- Tredence Inc. (US)

- Evidation Health, Inc. (US)

- HealthCorum (US)

- Enlitic (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 15.85 Billion |

| Market Forecast in 2030 (Value) | USD 59.68 Billion |

| Growth Rate | CAGR of 24.9% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Country Covered | US |

| Parent & Related Segment Reports |

Healthcare Analytics Market Europe Healthcare Analytics Market Asia Pacific Healthcare Analytics Market |

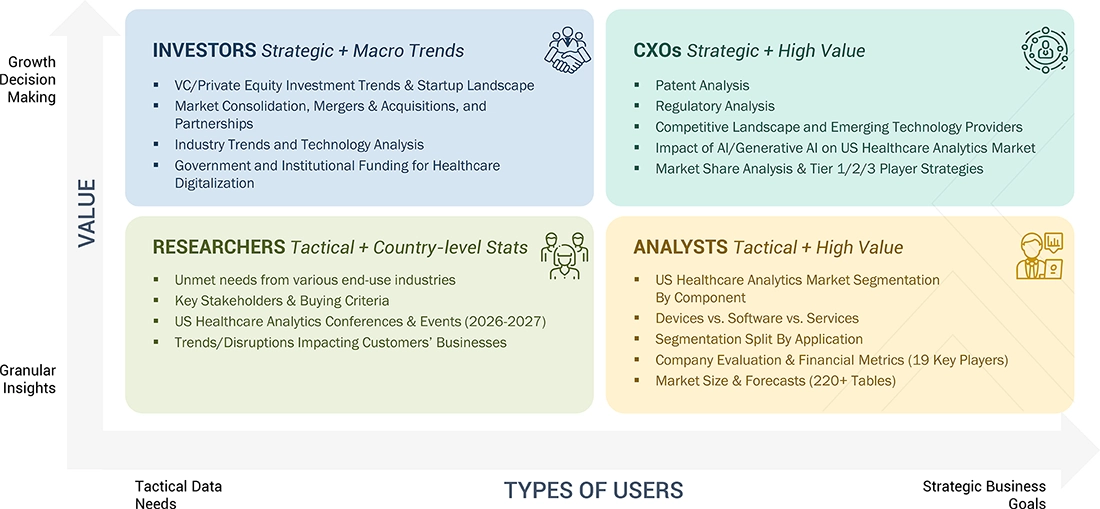

WHAT IS IN IT FOR YOU: US HEALTHCARE ANALYTICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Key vendors in the US healthcare analytic (Optum, CVS Health/Aetna, SAS, Cerner, MedeAnalytics), covering clinical, financial, operational, population-health, and AI/ML analytics |

|

| Market Entry & Growth Strategy |

|

|

| Regulatory & Risk Analysis | Surveillance of the US regulatory frameworks, such as HIPAA, HITECH, CMS interoperability requirements, risk-adjustment analytics requirements, and data-governance standards. |

|

| Technology Adoption Trends | Insights into adoption of predictive analytics, AI-based clinical decision support, population health analytics, cloud-based analytics environments, and real-time data integration (EHR, claims, SDOH) |

|

RECENT DEVELOPMENTS

- December 2024 : Morgan Healthcare invested in Merative to help employers address challenges in accessing and consolidating medical data. This investment enables proactive benefits management and improvements in healthcare quality through solutions such as Truven and MarketScan Databases while also supporting Merative's growth and advancements in data infrastructure.

- May 2024 : World Economic Forum & Capgemini launched a global Digital Healthcare Transformation Community to foster health data collaboration, promote interoperability, and support universal health coverage through data sharing initiatives.

- April 2024 : Oracle and DNAnexus, Inc. partnered to help scientists and medical experts handle, analyze, and collaborate on multi-omic, clinical, and real-world data.

Table of Contents

Methodology

The study involved five major activities to estimate the current size of the US Healthcare Analytics Market . Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of US Healthcare Analytics Market . It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the US Healthcare Analytics Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the US Healthcare Analytics Market . These methods were also used extensively to estimate the size of various subsegments in the market.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the US Healthcare Analytics Market .

Market Definition

Healthcare analytics is the efficient use of data and related business insights developed through statistical, quantitative, predictive, comparative, diagnostics, and other emerging applied analytical models. These tools help reveal and understand historical data patterns, predict future outcomes, and provide actionable insights to drive fact-based decision-making for the improved clinical, financial, and operational performance of healthcare organizations.

Stakeholders

- Stakeholders

- Healthcare IT firms

- Healthcare Analytics Vendors

- Health Insurance Exchanges

- Healthcare Payers

- Healthcare Providers

- Venture Capitalists

- Research and Consulting Firms

- Accountable Care Organizations (ACOs)

Report Objectives

- To define, describe, and forecast the US Healthcare Analytics Market based on component, type, application, end-user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall US Healthcare Analytics Market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile the key players of the US Healthcare Analytics Market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, agreements, sales contracts, and alliances in the US Healthcare Analytics Market during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Healthcare Analytics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Healthcare Analytics Market