US Healthcare Environmental Services Market: Growth, Size, Share, and Trends

US Healthcare Environmental Services Market by Type (Janitorial Services/Core Cleaning, Infection Control & Prevention services, Front of House Cleaning/Brand Experience), Facility Type (Acute Care (Acute Hospitals), Post-Acute Care) - Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The US healthcare environmental services market is projected to reach USD 9.53 billion by 2029 from USD 6.75 billion in 2024, at a CAGR of 7.1% during the forecast period. The growing focus on infection prevention and hygiene standards across healthcare facilities is a key factor driving the growth of the U.S. healthcare environmental services market. Increasing hospital-acquired infection (HAI) incidences, coupled with rising healthcare expenditure and regulatory emphasis on maintaining safe, sanitized care environments, are expected to significantly propel market expansion over the forecast period.

KEY TAKEAWAYS

-

BY TYPEBased on type, the US healthcare environmental services market is segmented into core cleaning services, infection control & prevention services, enhanced cleaning technology, front-of-house cleaning & brand experience, and other services. The core-cleaning services segment is expected to grow at the highest CAGR during the forecast period, primarily due to the need for regular cleaning and keeping health facility premises clean to prevent the spread of infection among patients and staff.

-

BY FACILITY TYPEThe US healthcare environmental services market is categorised by facility type, encompassing acute-care, post-acute care, and non-acute care facilities. In 2023, the acute-care facilities sub-segment accounted for the largest share of this market. Growth is driven by modernization initiatives, adoption of automated and IoT-enabled cleaning technologies, and hospitals’ focus on hygiene, patient comfort, and infection control.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and collaborations. For instance, in July 2024, Sodexo (France) partnered with UVD Robots (Denmark), the global leader in market share for autonomous UV robots. This collaboration aims to enhance Sodexo's fully standardized, evidence-based program, Protecta, by improving environmental hygiene and ensuring safety for both staff & clients. Additionally, the partnership will elevate disinfection solutions across facilities in the US.

A combination of demographic, medical, and lifestyle factors is driving growth in the U.S. healthcare environmental services market. The rising prevalence of chronic diseases, an aging population, and growing emphasis on infection prevention and patient safety are intensifying the need for advanced cleaning, disinfection, and waste management solutions. These trends are creating sustained demand for efficient, technology-driven environmental service practices across healthcare facilities nationwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

An emerging trend in the U.S. healthcare environmental services market is the rapid integration of advanced and sustainable technologies. Hospitals are increasingly adopting AI-powered cleaning systems, autonomous floor-scrubbing robots, and IoT-based monitoring tools to enhance efficiency and consistency in hygiene maintenance. Green cleaning practices—using eco-friendly disinfectants and waste-reducing processes—are gaining traction in response to stricter environmental and safety regulations. The shift toward data-driven, automated, and sustainable environmental services is transforming hospital operations, reducing costs, and elevating infection control standards across healthcare facilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Emphasis on high HCAHPS scores pushes hospitals to invest in better healthcare environmental services

-

High prevalence of Hospital-acquired infections (HAIs)

Level

-

Healthcare facilities with an in-house EVS department

Level

-

Rising importance of Healthcare environmental services (EVS) Technicians

Level

-

Labor Shortages and High Turnover rates

-

Budgetary issues at hospitals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Emphasis on high HCAHPS scores pushes hospitals to invest in better healthcare environmental services

The Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) survey is a 27-question tool that assesses factors including hospital cleanliness. These scores are essential for hospitals as they directly influence reimbursement rates from government payers, including Medicare and Medicaid and private insurers. Hospitals with higher HCAHPS scores may receive higher payments under value-based purchasing programs to reward quality care. The environmental services (EVS) personnel are crucial in impacting a hospital's HCAHPS scores. Additionally, as these scores are publicly reported, they can influence a hospital's reputation and patient volume. As a result, more environmental service (EVS) providers are being contracted by healthcare facilities to enhance their HCAHPS scores.

Restraint: Healthcare facilities with an in-house EVS department

In order to maintain high levels of hygiene standards and lower the cost of outsourcing environmental services, numerous healthcare facilities select the route of employing their own environmental services personnel. This method enables them to guarantee the appropriate infection control, as well as respecting the environmental safety regulations during the cleaning process of medical equipment, supplies and different parts of the building. There are also consultant firms who provide in-house Environmental Services (EVS) teams of health care institutions with the tools and services they need to sustain the best standards of cleanliness, health and operational efficiency.

Opportunity: Rising importance of Healthcare environmental services (EVS) Technicians

Environmental services (EVS) staff protect patients, visitors, and staff from infectious pathogens by maintaining clean and sanitized healthcare environments. Post-pandemic, the EVS staff are considered essential contributors to patient safety and community well-being. This shift has created many opportunities for EVS staff, mainly by adopting advanced certifications such as Certified Health Care Environmental Services Professional (CHESP) and Certified Health Care Environmental Services Technician (CHEST).

Challenge: Labor Shortages and High Turnover rates

The healthcare industry is grappling with a significant EVS (environmental services) worker shortage. Recruiting younger people and retaining them are becoming increasingly difficult to maintain. Also, existing EVS workers are being increasingly lured to other industries facing similar shortfalls. Barriers such as high work demands, interruptions, perceptions of low status or value, and a lack of communication are causing high turnover rates for EVS staff in the healthcare industry.

US Healthcare Environmental Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Protecta Services – A comprehensive infection prevention and environmental hygiene program integrating advanced disinfection, data-driven cleaning protocols, and staff training for healthcare facilities. | Enhances infection control and hygiene compliance; reduces hospital-acquired infections (HAIs); ensures audit-ready traceability; supports consistent cleaning standards across multiple sites. |

|

OMIT Program – Outcome-based Management of Infection and Terminal cleaning program that combines IoT-enabled monitoring tools, UV-C disinfection, and AI analytics to optimize EVS operations | Improves cleaning efficiency and visibility; reduces pathogen load and recontamination risk; delivers measurable infection prevention outcomes; enhances accountability and performance tracking. |

|

AIWX Connect – A smart facility management and cleaning optimization platform leveraging AI, IoT sensors, and predictive analytics to streamline environmental services in healthcare facilities. | Enables real-time hygiene monitoring; improves workforce productivity and scheduling; reduces operational costs; enhances patient and staff safety through data-driven cleanliness validation. |

|

EnhancedClean Program – A three-step, evidence-based cleaning and disinfection framework that integrates EPA-approved disinfectants, electrostatic spraying, and staff certification to meet CDC and OSHA standards. | Reduces pathogen transmission risk; enhances infection prevention compliance; boosts occupant confidence; provides documentation for regulatory audits; ensures consistent, science-backed hygiene outcomes. |

|

SaniMaster Program – A healthcare-grade disinfection and cleaning protocol using hospital-grade disinfectants, UV-C tools, and ATP testing to validate cleanliness in patient care areas. | Kills 99.99% of common pathogens; supports measurable infection control; improves environmental hygiene scores; reassures patients and staff with visible, science-driven cleanliness standards. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The U.S. healthcare environmental services (EVS) market functions within an integrated ecosystem involving service providers, healthcare facilities, regulatory authorities, and frontline healthcare workers. Service providers deliver cleaning, disinfection, and waste management solutions that align with hospitals’ goals of reducing healthcare-associated infections (HAIs) and maintaining safe, hygienic environments. Healthcare facilities rely on EVS teams to ensure operational efficiency, infection control, and patient satisfaction. Regulatory and advocacy bodies like the CDC, EPA, AORN, and OSHA play a pivotal role in enforcing hygiene and safety standards. Together, these stakeholders create a collaborative framework focused on safety, sustainability, and performance excellence across healthcare environments

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Healthcare Environmental Services Market, By Type

Based on type, the US healthcare environmental services market is segmented into core cleaning services, infection control & prevention services, enhanced cleaning technology, front-of-house cleaning & brand experience, and other services. In 2023, the core-cleaning services segment accounted for the largest share of the market. Core cleaning services are essential in maintaining a clean and safe environment within healthcare facilities. The demand for janitorial/core cleaning services in healthcare facilities has steadily increased as hospitals strive to comply with strict regulatory requirements from agencies such as the Centers for Disease Control and Prevention (CDC) and the Occupational Safety and Health Administration (OSHA). To control the increasing prevalence of infectious diseases, several healthcare facilities opt to contract core-cleaning services from specialized vendors, fueling market growth.

US Healthcare Environmental Services Market, By Facility Type

Based on facility type, the US healthcare environmental services market is segmented into acute care, post-acute care, and non-acute care facilities. Acute care facilities (comprising various hospital types) have witnessed the highest adoption of outsourcing services in recent years. Technological advancements such as robotic cleaning machines, UV disinfection machines, and microfiber clothes are being increasingly adopted by acute care facilities, thereby increasing the demand for healthcare environmental service providers specializing in these solutions.

REGION

US to grow at high rate during forecast period

The U.S. healthcare environmental services market is witnessing robust growth, supported by strong regulatory oversight, technological innovation, and evolving healthcare infrastructure. The country’s high incidence of healthcare-associated infections (HAIs) and stringent compliance mandates from agencies such as the CDC, EPA, and OSHA are driving hospitals to adopt advanced cleaning and disinfection solutions. Federal and state-level funding initiatives aimed at improving hospital hygiene, sustainability programs promoting green cleaning, and modernization of healthcare facilities are further accelerating market expansion. The growing number of large healthcare networks and outpatient centers is creating consistent demand for scalable, tech-enabled EVS solutions. In addition, the U.S. focus on workforce safety, infection prevention training, and the integration of AI, robotics, and IoT-based systems into facility management is reshaping service models.

US Healthcare Environmental Services Market: COMPANY EVALUATION MATRIX

In the U.S. healthcare environmental services market matrix, Sodexo (Star) leads with a strong brand presence, comprehensive service offerings across facility management, hygiene, and infection prevention, and deep operational expertise in healthcare settings. The company’s continued investment in technology-driven cleaning solutions, sustainability initiatives, and workforce training, combined with its nationwide footprint, reinforces its market leadership and premium positioning. ServiceMaster Clean (Emerging Leader) is rapidly expanding its presence through service diversification, adoption of advanced disinfection technologies, and strategic partnerships with healthcare providers. With focused investments in digital cleaning solutions, compliance training, and a growing regional footprint, ServiceMaster Clean is increasingly establishing itself as a competitive force within the EVS sector. While Sodexo maintains its dominance through innovation, regulatory compliance, and large-scale operational capability, ServiceMaster Clean shows strong potential to ascend toward the leaders’ quadrant by capitalizing on rising demand for safe, cost-effective, and high-quality environmental services across U.S. healthcare facilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 6.32 BN |

| Market Forecast in 2029 (Value) | USD 9.53 BN |

| Growth Rate | CAGR of 7.1% from 2024-2029 |

| Years Considered | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By type: core cleaning services, infection control & prevention services, enhanced cleaning technology, front-of-house cleaning & brand experience, and other services I By facility type: acute care facilites, post-acute care facilites, and non-acute care facilities |

| Regions Covered | US |

WHAT IS IN IT FOR YOU: US Healthcare Environmental Services Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Services Analysis | Assesed the local market. Detailed benchmarking of services offfered by key players | Identify interconnections and potential supply chain blind spots within the medical ecosystem |

| Company Information |

RECENT DEVELOPMENTS

- July 2024 : Sodexo (France) partnered with UVD Robots (Denmark), the global leader in market share for autonomous UV robots. This collaboration aims to enhance Sodexo's fully standardized, evidence-based program, Protecta, by improving environmental hygiene and ensuring safety for both staff & clients. Additionally, the partnership will elevate disinfection solutions across facilities in the US.

- January 2024 : Sodexo (France) partnered with The Leapfrog Group (US), a national watchdog focused on healthcare safety. As a partner, Sodexo advises Leapfrog on industry trends and supports its strategic vision to improve healthcare quality.

- July 2023 : Prisma Health (US) partnered with Compass Group (UK) to enhance environmental services, effective September 1, 2023, transitioning nearly 700 EVS team members across its hospitals to Crothall Healthcare, a division of Compass Group PLC, contingent upon meeting pre-employment screening requirements.

- November 2022 : Corvus (US) established a new territorial master franchise in Knoxville, Tennessee. Corvus of Knoxville will assist local franchise owners in providing high-quality office cleaning services to businesses & facilities in the area, utilizing Corvus’ nationally recognized brand and proven systems.

- November 2021 : Kellermeyer Bergensons Services, LLC (US) acquired BRAVO! Building Services (US). BRAVO! will operate independently as a KBS company.

Table of Contents

Methodology

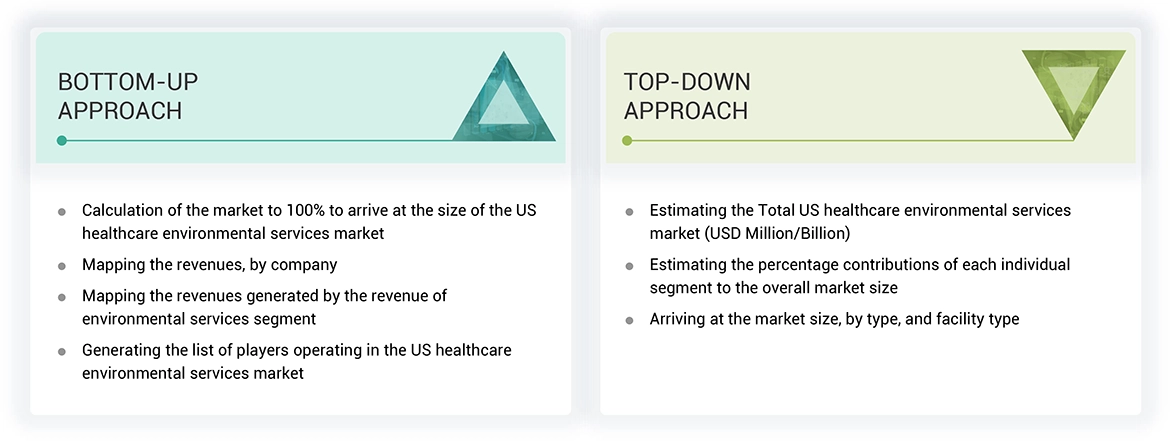

The study involved four major activities to estimate the current size of the US Healthcare Environmental Services market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for the study of US Healthcare Environmental Services market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply side and other participants were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, EVS directors, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the US healthcare environmental services market. The primary sources from the other participants group including, hospital and other health facility EVS staff, cleaning staff, health facility personnel. And others including, private consultants, and officials from government regulatory bodies.

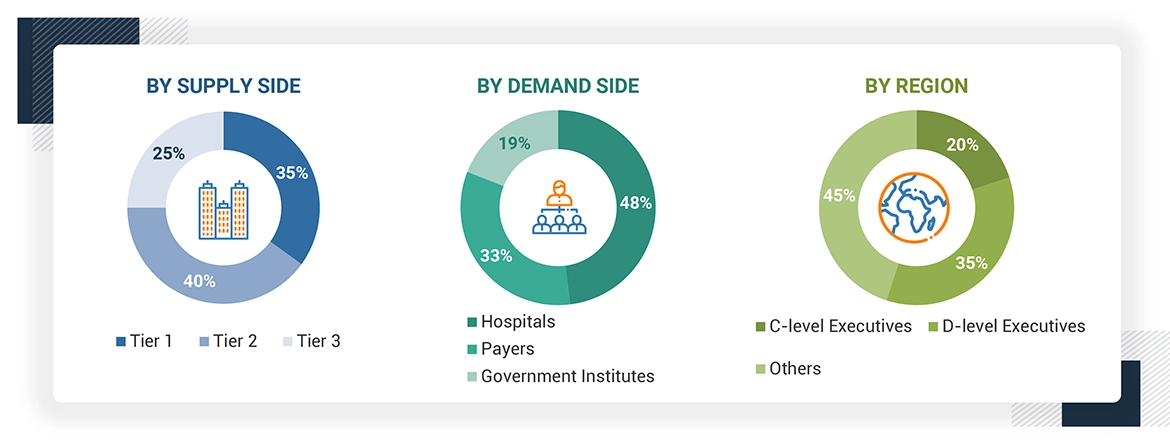

The following is a breakdown of the primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue.

As of 2023: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, and facility types).

Data Triangulation

After arriving at the market size, the total US healthcare environmental services market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Market Definition

Healthcare environmental services are broadly referred to as those services that implement infection prevention & control strategies through monitoring & control activities, making the healthcare facility suitable for human use/reuse by avoiding contamination and the spread of diseases. These services consist of highly trained staff involved in the cleaning & disinfection of medical equipment, patient rooms, and other areas, using cleaning supplies and equipment.

Stakeholders

- Environmental service providers

- Infection prevention & control product manufacturers

- Infection prevention & control product distributors

- Hospitals

- Government & regulatory bodies

- Physician’s offices/clinics

- Healthcare providers

- Academic and research institutions

- Venture capitalists and investors

- Market research & consulting firms

Report Objectives

- To define, describe, segment, and forecast the US environmental services market by type and facility types

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the US environmental services market.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall US environmental services market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the healthcare environmental services market in the US

- To profile key players in the US environmental services market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions, expansions, collaborations, partnerships, agreements and other developments in the US environmental services market

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Healthcare Environmental Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in US Healthcare Environmental Services Market

Walter

Mar, 2022

I need the detailed information on the recent developments in the global US Healthcare Environmental Services Market.

Judith

Mar, 2022

Who is the targeted audience for this study of US Healthcare Environmental Services Market?.