US Periodontal Disease Treatment Market Size, Growth, Share & Trends Analysis

US Periodontal Disease Treatment Market by Product (Equipment, Consumables), Disease (Gingivitis, Periodontitis), Treatment (Bone Grafting, Scaling, Flap Surgery, Regeneration), End User (Clinics, Private DSOs) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

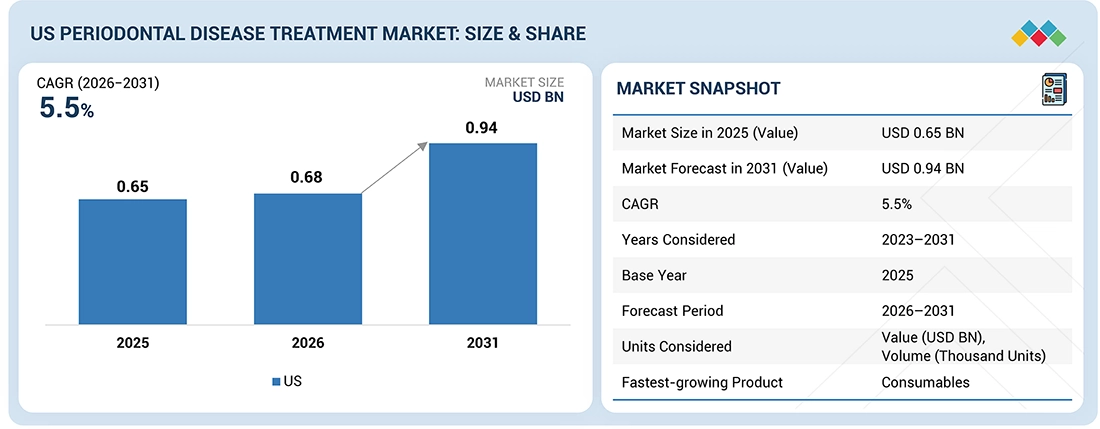

The US Periodontal Disease Treatment market, valued at USD 0.65 billion in 2025, stood at USD 0.68 billion in 2026 and is projected to advance at a resilient CAGR of 5.5% from 2026 to 2031, culminating in a forecasted valuation of USD 0.94 billion by the end of the period. Periodontal disease treatment in the US encompasses a wide range of technologies and solutions designed to support the diagnosis, treatment, and long-term management of gum-related conditions in dental practices. These include both therapeutic tools, such as scaling and root planing instruments, ultrasonic scalers, periodontal lasers, and surgical equipment, and diagnostic technologies, such as periodontal probes, digital dental imaging systems, and intraoral scanners. Depending on clinical requirements, periodontal treatment solutions range from routine tools used in non-surgical therapy to advanced regenerative and surgical systems that enable complex periodontal procedures. These products play a critical role in dental hospitals, periodontal specialty clinics, and general dental practices across the US, supporting effective disease management, improved clinical outcomes, and high standards of patient care.

KEY TAKEAWAYS

-

BY DISEASEBy disease, the US periodontal disease treatment market was dominated by the gingivitis segment in 2025.

-

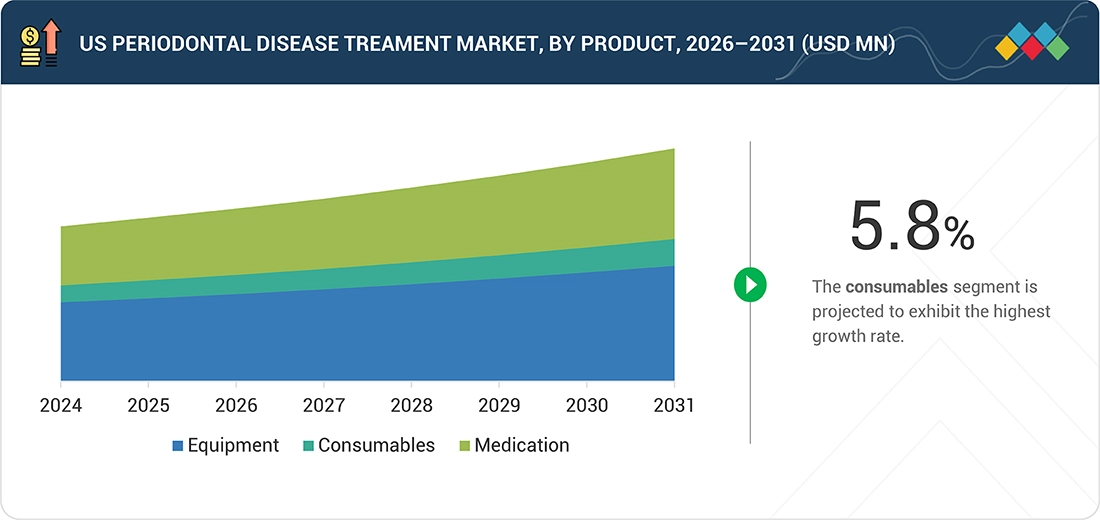

BY PRODUCTBy product, the consumables segment is expected to register the highest CAGR during the forecast period.

-

BY TREATMENTBy treatment, the guided tissue regeneration segment is projected to grow at the fastest rate from 2026 to 2031.

-

By END USERBy end user, the hospitals segment is expected to lead the US periodontal disease treatment market from 2026 to 2031.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSDentsply Sirona, Envista, and Institut Straumann AG were identified as star players in the US periodontal disease treatment market, given their strong market share and product/service footprint.

-

COMPETITIVE LANDSCAPE - STARTUPSCompanies such as Implify and Overjet distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The periodontal disease treatment market in US is driven by the increasing prevalence of oral health disorders and the rising cases of edentulism, which are creating a growing need for effective periodontal care. Furthermore, the emergence of innovative dental treatment procedures, including advanced diagnostic and therapeutic technologies, is accelerating the adoption of modern solutions in dental practices across the country, enhancing treatment outcomes and patient care.

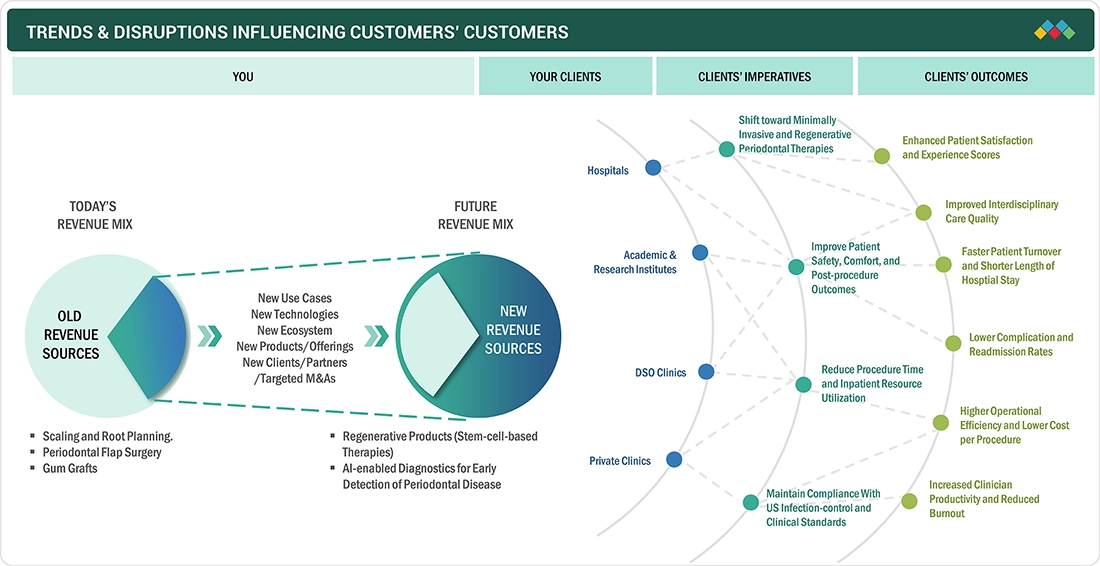

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the United States, the growing adoption of periodontal disease treatments is reshaping revenue streams across hospitals, dental clinics, dental laboratories, and academic and research institutes. This shift is supported by wider use of advanced diagnostic technologies, an expanding dentist workforce, and the steady growth in the number of dental clinics and laboratories. Collectively, these developments are expected to create substantial business opportunities for participants in the US periodontal disease treatment market. Providers are moving beyond traditional disease-, product-, and treatment-based revenues by adopting new technologies, services, partnerships, and integrated care models. Hospitals, academic and research institutes, DSO clinics, and private clinics are increasingly focused on minimally invasive periodontal therapies, patient safety and comfort, operational efficiency, and compliance with US clinical standards. These changes are leading to better patient outcomes, shorter hospital stays, lower costs, improved efficiency, and higher clinician productivity, signaling a shift toward value-based care and advanced periodontal solutions as key drivers of future revenue growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing prevalence of oral health disorders

-

Rising cases of edentulism

Level

-

High cost of advanced treatments and inadequate reimbursements for dental procedures

Level

-

Impact of DSOs on dental industry

-

Growing awareness about oral health

Level

-

Dearth of trained dental practitioners

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of oral health disorders

The rising prevalence of oral health diseases, particularly periodontal conditions, is a major driver of the US periodontal disease treatment market. A large proportion of the adult population continues to experience gum disease, tooth decay, and tooth loss, largely due to aging demographics, lifestyle factors, and gaps in preventive oral care. Periodontal disease remains one of the leading causes of tooth loss among adults, creating sustained demand for both non-surgical and surgical periodontal treatments. Additionally, higher awareness of oral health, increased dental visits, and improved diagnostic capabilities are leading to earlier identification of periodontal conditions, further accelerating treatment adoption. Collectively, the growing disease burden and the need for long-term periodontal management are driving market growth across the United States.

Restraint:High cost of advanced treatments and inadequate reimbursements for dental procedures

The high cost of advanced periodontal treatments, along with inadequate reimbursement for dental procedures, hinders the US periodontal disease treatment market growth. Advanced therapies such as laser-based procedures, regenerative treatments, dental implants, and surgical interventions often involve out-of-pocket expenses, limiting accessibility for a large segment of the population. Moreover, dental insurance coverage in the US remains fragmented, with many plans offering limited benefits, or partial reimbursement for periodontal care. This financial burden discourages patients from seeking timely or comprehensive treatment, leading to delayed care and reduced adoption of advanced periodontal solutions, thereby constraining overall market growth.

Opportunity: Impact of DSOs on dental industry

Dental service organizations (DSOs) contract with dental practices to provide crucial business management and support, including non-clinical activities. DSOs enable dentists to concentrate on their clinical practice while the DSO handles operations through professional office management. The American Dental Association (ADA) reports that 7.4% of all dentists work at DSOs. However, the percentage of young dentists working at DSOs is much higher, with almost 16% of dentists between the ages of 21 and 34 employed by DSOs. The growth of DSOs has helped improve access to high-quality dental care to some extent. Despite federal programs such as Medicaid mandating dental coverage for children, nearly half of the US population continues to face limited access to adequate dental care. The Oral Health Workforce Research Center (OHWRC) conducted a study and compiled important data to demonstrate how DSOs identify their role. Dentists linked with DSOs were divided into three categories: associates (66.7%), owners (66.7%), and employees (53.7%). General dentists primarily staffed most DSO affiliate practices. It was estimated that 61-100% of dentists in the organization, according to 90% of survey respondents, are general dentists. The introduction of DSOs and their increasing adoption by dentists worldwide are expected to offer significant growth opportunities for the US periodontal disease treatment market. DSO affiliation also offers monetary benefits to dentists and allows them to save time on administrative tasks. This enables them to focus more on clinical tasks where their expertise lies. In the US, solo practitioners typically spend 40% of their time on administrative/non-clinical activities and 60% on patients. In contrast, dentists affiliated with DSOs spend approximately 90% of their time on clinical activities.

Challenge: Dearth of trained dental practitioners

The demand for dental care services is expected to rise steadily due to changing demographics, growing awareness of oral health, sedentary lifestyles, and the increasing prevalence of dental diseases such as caries and periodontal disorders. As populations age and urbanization continues, more individuals are seeking preventive, restorative, and cosmetic dental treatments. However, a shortage of trained dental professionals in many countries presents a significant challenge, limiting access to care and slowing the adoption of advanced dental technologies. This widening gap between growing patient demand and the available dental workforce poses a significant challenge, as it can reduce practice efficiency and limit the overall growth potential of the US periodontal disease treatment market.

US PERIODONTAL DISEASE TREATMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Periodontal treatment solutions, including ultrasonic scalers, hand instruments, adjunctive therapy tools, digital diagnostics for periodontal assessment, integrated workflows supporting scaling & root planing, and surgical periodontal procedures | Improved periodontal diagnosis accuracy | higher treatment efficiency | reduced chair time | enhanced patient comfort| standardized periodontal workflows across practices |

|

Regenerative periodontal solutions including biomaterials (bone grafts, membranes), biologics, and implant-adjacent periodontal therapies for advanced periodontitis and peri-implantitis | Enhanced tissue regeneration | improved long-term periodontal stability | predictable clinical outcomes | higher treatment success rates | improved patient satisfaction |

|

Distribution of periodontal consumables and therapeutics including scaling & root planing instruments, local antimicrobial delivery systems, regenerative materials, and maintenance-phase products | Broad product access and availability | cost efficiency| streamlined procurement | consistent quality of periodontal care|improved clinical outcomes across general and specialist practices |

|

Periodontal and surgical solutions including ultrasonic scalers, handpieces, diagnostic tools, regenerative biomaterials, and peri-implant disease management products | Durable, high-performance equipment | improved clinical outcomes | ergonomic designs | expanded treatment capabilities |

|

Dental laser systems used in minimally invasive periodontal therapy (LANAP and laser-assisted periodontal procedures) | Reduced bleeding and discomfort | faster healing| minimally invasive treatment options | improved patient acceptance| shorter recovery times| higher procedural differentiation for clinics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US periodontal disease treatment market is a complex environment that includes product innovation, manufacturing, regulatory oversight, distribution, and clinical adoption. This environment is fueled by the increase in dental disease cases, greater public awareness of the connection between oral and systemic health, and also the trend toward use of more minimal and regenerative treatment options. Manufacturers such as Dentsply Sirona, Envista, Straumann Group, Nakanishi, and BIOLASE play a central role in advancing and commercializing a broad portfolio of periodontal treatment solutions. Their offerings span non-surgical therapy tools, including ultrasonic scalers and hand instruments, as well as antimicrobial delivery systems, regenerative biomaterials such as bone grafts, membranes, and biologics, and laser-based periodontal therapies. Across these product categories, their innovation efforts are focused on improving clinical outcomes, minimizing treatment invasiveness, enhancing patient comfort, and increasing the predictability of long-term periodontal health. Distributors such as Henry Schein, McKesson, Medline, and Cardinal Health play key intermediary roles in that they ensure reliable access to periodontal therapeutics and supplies across the US. Through national logistics networks, procurement platforms and e-commerce tools they connect manufacturers with private dental practices, dental service organizations (DSOs), hospitals, and academic institutions. Their size and supply chain efficiency helps reduce procurement complexity, improve product availability, and support standardized periodontal care delivery. Market adoption is primarily driven by hospitals, large academic medical centers, dental service organizations (DSOs), and private dental clinics. Academic and healthcare institutions tend to lead in the early adoption of advanced periodontal treatments, particularly for complex cases and research-driven applications. DSOs emphasize standardization of care and cost efficiency across their multi-site networks, while private clinics focus on patient-centered care, practice differentiation, and improved clinical outcomes. Clinicians, including periodontists, general dentists, dental hygienists, and oral surgeons, play a crucial role in selecting and utilizing these solutions as they are integrated into routine clinical practice. Regulatory and professional bodies form the foundation of the market framework. In the United States, the Food and Drug Administration (FDA) oversees the approval, classification, and safety of periodontal drugs, biomaterials, and medical devices, ensuring compliance with rigorous quality and clinical standards. The Centers for Disease Control and Prevention (CDC) influences practice through infection-control guidance and public health recommendations, while professional organizations such as the American Dental Association (ADA) shape clinical adoption by issuing treatment guidelines, practice protocols, and best-practice recommendations that guide clinician decision-making and patient care.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Periodonatal Disease Treatment Market, by Disease

Based on disease, the US periodontal disease treatment market is segmented into gingivitis, acute periodontitis, aggressive periodontitis, and others. Gingivitis accounts for the largest share of the US periodontal disease treatment market, primarily due to its high prevalence. As a mild and widely occurring form of periodontal disease, gingivitis affects a substantial portion of the population, driven by factors such as poor oral hygiene, smoking, and underlying health conditions, including diabetes. This widespread incidence fuels strong demand for preventive and early-stage interventions, particularly routine dental scaling and related periodontal procedures.

US Periodonatal Disease Treatment Market, by Product

Based on product, the US periodontal disease treatment market is segmented into equipment, consumables, and medication. The equipment segment represents the largest share of the US periodontal disease treatment market, supported by several interconnected factors. A key driver is the growing need for accurate and early diagnosis of dental conditions, as the prevalence of oral health issues such as periodontal disease, dental caries, and oral cancers continues to rise. Advanced diagnostic and treatment equipment enable clinicians to identify conditions at earlier stages, resulting in improved clinical outcomes and higher patient satisfaction. In parallel, the continued expansion of hospitals, dental clinics, and specialized dental care centers has accelerated the adoption of modern dental equipment, as new and existing facilities increasingly invest in advanced technologies to improve care quality and operational efficiency.

US Periodonatal Disease Treatment Market, by Treatment

Based on treatment, the US periodontal disease treatment market is segmented into non-surgical treatment, flap surgery, soft tissue graft, bone grafting, guided tissue regeneration, and other treatments. Among these, the non-surgical treatment segment accounts for the largest share in the periodontal disease treatment market. Non-surgical treatments hold the largest share in the treatment of periodontal disease owing to several different factors, including the patients' preference for less invasive options, quicker recoveries, and cost-effectiveness. Generally, non-surgical intervention, such as scaling and root planing (deep cleaning), antimicrobial agents, and laser therapy usually hold a first line of defense to the management of periodontal disease discovered in its early stages. These treatments will control infection, remove plaque and tartar from below the gum line, and will promote healing without the need for surgery.

US Periodonatal Disease Treatment Market, by End User

Based on end user, the US periodontal disease treatment market is segmented into hospitals, private and DSO clinics, and academic and research institutes. The hospitals segment accounted for the largest share of the US periodontal disease treatment market. The large share and high growth rate of the hospitals segment can be attributed to a combination of structural, technological, and demand-driven factors. The increasing establishment of dental hospitals and multispecialty healthcare facilities has significantly expanded the patient base, as these institutions are often preferred for comprehensive and specialized dental care services. Dental hospitals are equipped to handle high patient volumes and complex procedures, which drives consistent demand for advanced dental technologies.

US PERIODONTAL DISEASE TREATMENT MARKET: COMPANY EVALUATION MATRIX

In the US periodontal disease treatment market matrix, Dentsply Sirona (Star) leads with scale, extensive distribution, and a broad solutions portfolio. A-Dec, Inc (Emerging Leader) is gaining momentum with innovative products and packaging technologies. While Dentsply Sirona dominates due to its market reach, while A-Dec Inc's innovation positions it for rapid growth toward the Emerging Leader quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- DENTSPLY SIRONA (US)

- Institut Straumann AG (Switzerland)

- Envista (US)

- Henry Shein, Inc (US)

- Geistlich Pharma AG. (Switzerland)

- A-dec Inc. (US)

- BIOLASE MG LLC. (Subsidiary of MEGA’GEN IMPLANT CO., LTD) (US)

- J. MORITA CORP. (Japan)

- RTI SurgicaL (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.65 Billion |

| Market Forecast in 2031 (Value) | USD 0.94 Billion |

| Growth Rate | CAGR of 5.5% from 2026-2031 |

| Years Considered | 2023-2031 |

| Base Year | 2025 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Billion), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Parent & Related Segment Reports |

Periodontal Disease Treatment Market APAC Periodontal Disease Treatment Market |

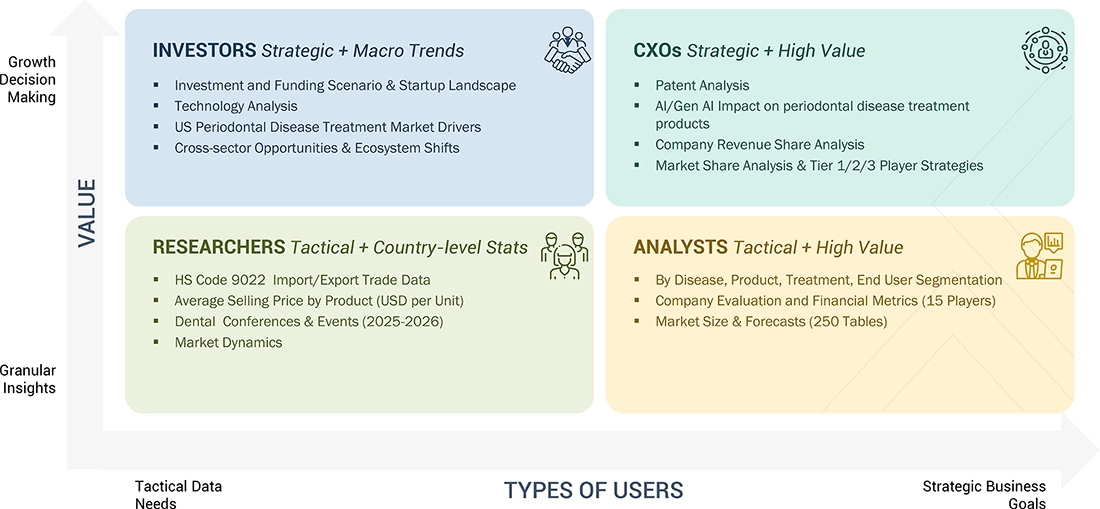

WHAT IS IN IT FOR YOU: US PERIODONTAL DISEASE TREATMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Assessment of the US periodontal treatment market Detailed analysis of the periodontal treatment product pipeline, highlighting late-stage and emerging innovations | Identify interconnections and potential supply chain blind spots within the dental ecosystem |

| Company Information | Key players: Dentsply Sirona (US), Envista (US), Institut Straumann AG (Switzerland), Henry Shein, Inc (US), and Geistlich Pharma AG (Switzerland) | Insights on revenue shifts toward emerging innovations |

RECENT DEVELOPMENTS

- October 2024 : RTI Surgical acquired Collagen Solutions, enhancing its portfolio with a leading global supplier of engineered medical-grade collagen and xenograft tissue solutions.

- February 2024 : BIOLASE, Inc., a subsidiary of MegaGen Implant, announced the launch of its advanced all-tissue laser system, the Waterlase iPlus Premier Edition. This latest release significantly enhances the industry-leading Waterlase iPlus platform, providing innovative features and establishing a new standard for precision, versatility, and performance in modern dental care.

- December 2023 : Dentsply Sirona launched the OSSIX Agile biomaterial, a long-lasting pericardium membrane used for bone graft & tissue regeneration.

Table of Contents

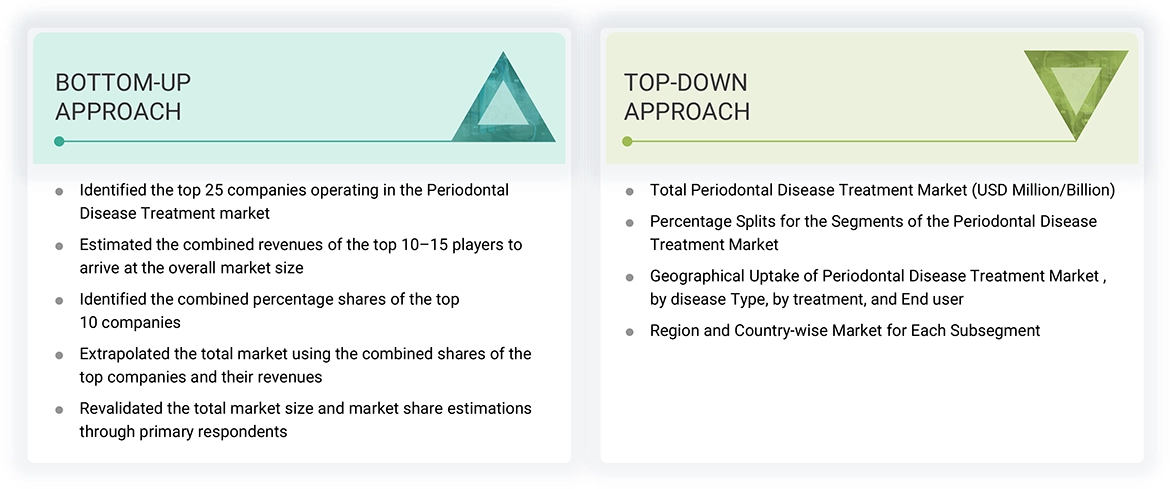

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), International Trade Administration (ITA), Global Burden of Disease Study , International Diabetes Federation (IDF), and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the US periodontal disease treatment market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the US periodontal disease treatment market. The primary sources from the demand side include pharmaceutical, biopharmaceutical companies, contract development and manufacturing organizations, and research academics and universities. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the US periodontal disease treatment market. All the major product manufacturers were identified at the country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. Also, the US periodontal disease treatment market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various US periodontal disease treatment manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from pain management devices(or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 70-75% of the market share as of 2023

- Extrapolation of the revenue mapping of the listed major players to derive the market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the point-of-care diagnostics market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall size of the US periodontal disease treatment market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

US periodontal disease treatment refers to the medical interventions aimed at preventing, controlling, and treating the inflammation and damage caused by infections of the structures around the teeth, including the gums, periodontal ligament, and alveolar bone. Treatments typically range from non-surgical methods such as scaling and root planing (deep cleaning) to surgical procedures like flap surgery or bone grafting, depending on the severity of the disease. The goal is to eliminate the bacterial infection and halt the progression of the disease, thereby preserving the teeth and surrounding tissues.

Stakeholders

- Manufacturers and distributors of medical devices

- US periodontal disease Treatment manufacturers

- Contract manufacturers of dental equipment

- Distributors of dental equipment

- Research and consulting firms

- Raw material suppliers of US periodontal disease Treatment

- Dental hospitals and clinics

- Dental laboratories and associations

- Dental practitioners

- Dental laboratory technicians

- Healthcare institutions

- Diagnostic laboratories

- Hospitals and clinics

- Academic institutions

- Research institutions

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the US periodontal disease treatment market based on disease type, treatment type, end user, and region.

- To forecast the market size based on five key regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To strategically analyze the industry trends, technology trends, pricing analysis, regulatory scenario, supply/value chain, ecosystem mapping, porter’s five forces, patent analysis, key stakeholders and buying criteria, and conference and events.

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall US periodontal disease treatment market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically profile key players in the US periodontal disease treatment market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, collaborations, joint ventures, expansions, and acquisitions in the overall US periodontal disease treatment market.

- To benchmark players within the market using the proprietary “Competitive Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product/service strategy

- To analyze the generative AI impact on the US periodontal disease treatment market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Periodontal Disease Treatment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Periodontal Disease Treatment Market