US Variable Frequency Drive Market

US Variable Frequency Drive Market by Type, Power Rating, End User (Oil & Gas, Mining & Metal, Chemicals & Petrochemicals, Power, Food & Beverage, Water & Wastewater Treatment, Automotive, Construction/Infrastructure) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

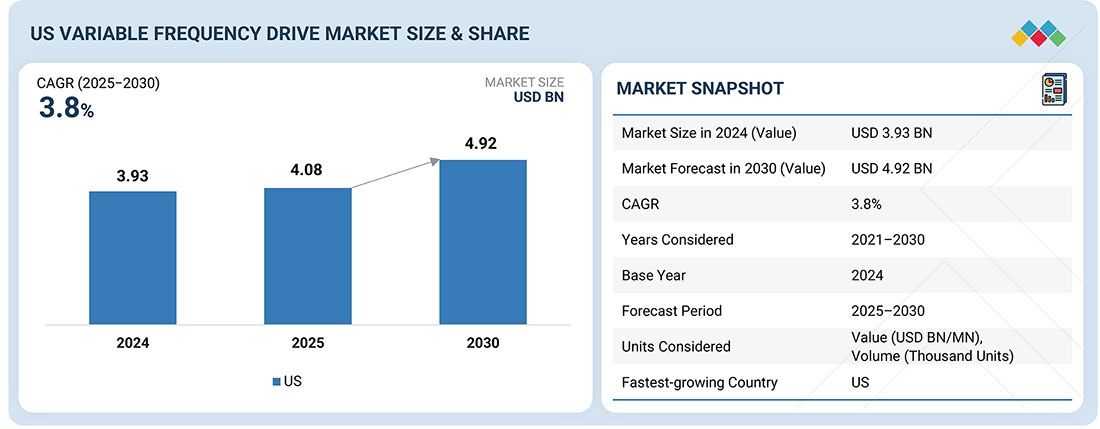

The US variable frequency drive market is projected to grow from USD 4.08 billion in 2025 to USD 4.92 billion by 2030, at a CAGR of 3.8% during the forecast period. This is due to increased industrial automation and energy-saving requirements in manufacturing, oil and gas, and other sectors, where VFD maximizes motor performance and reduces operating costs and energy consumption.

KEY TAKEAWAYS

-

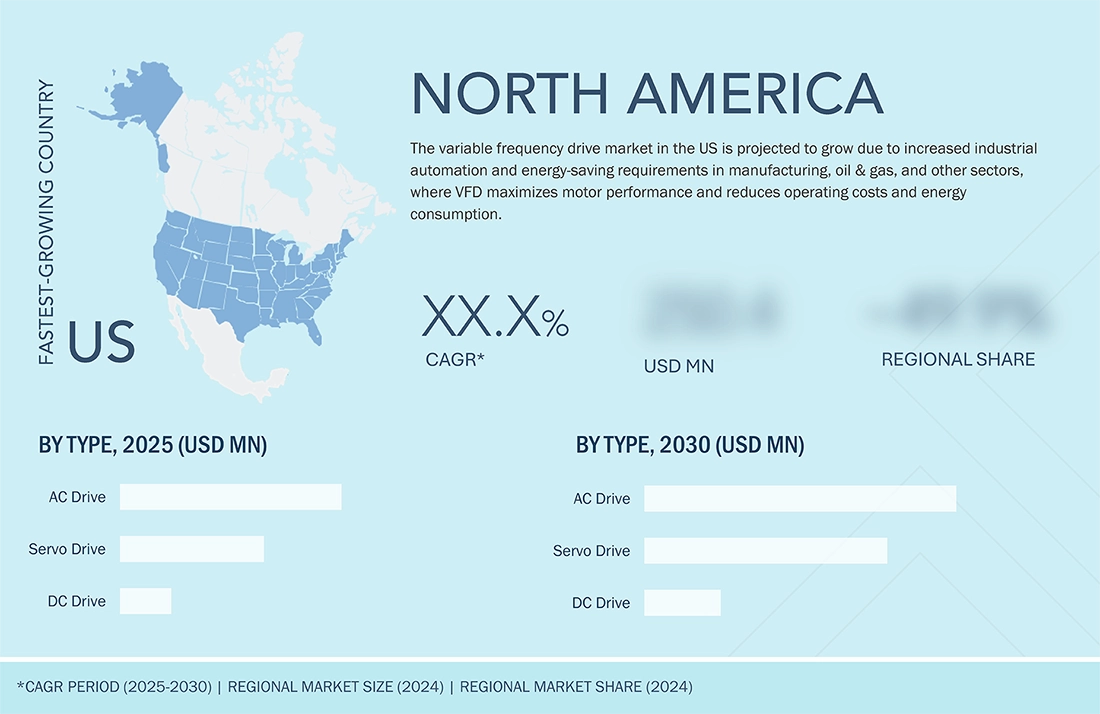

BY TYPEBy type, the AC drives segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY POWER RATINGBy power rating, the high power segment is likely to exhibit a CAGR of 4.8% between 2025 and 2030.

-

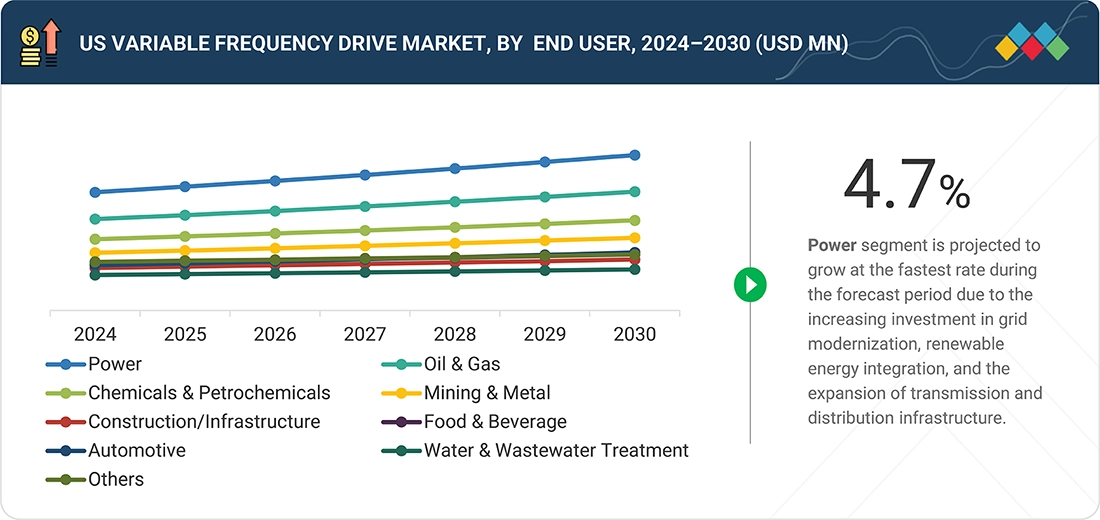

BY END USERBy end user, the power segment is estimated to register a CAGR of 4.7% during the forecast period.

-

COMPETITIVE LANDSCAPECompanies such as Rockwell Automation (US), General Electric (US), Parker Hannifin Corp (US), and Anaheim Automation (US) were identified as some of the star players in variable frequency drive market in the US.

-

COMPETITIVE LANDSCAPECompanies such as Dart Controls (US) were identified as of the startups and SMEs in variable frequency drive market in the US.

The increasing demand for energy efficiency in industrial automation and production processes continues to boost the adoption of variable frequency drives (VFDs), as companies seek to reduce energy consumption and optimize process control. Government regulations supporting sustainability and the integration of Industrial Internet of Things and robotics create growth opportunities for players in the US, encouraging VFD deployment in smart manufacturing and automated environments.

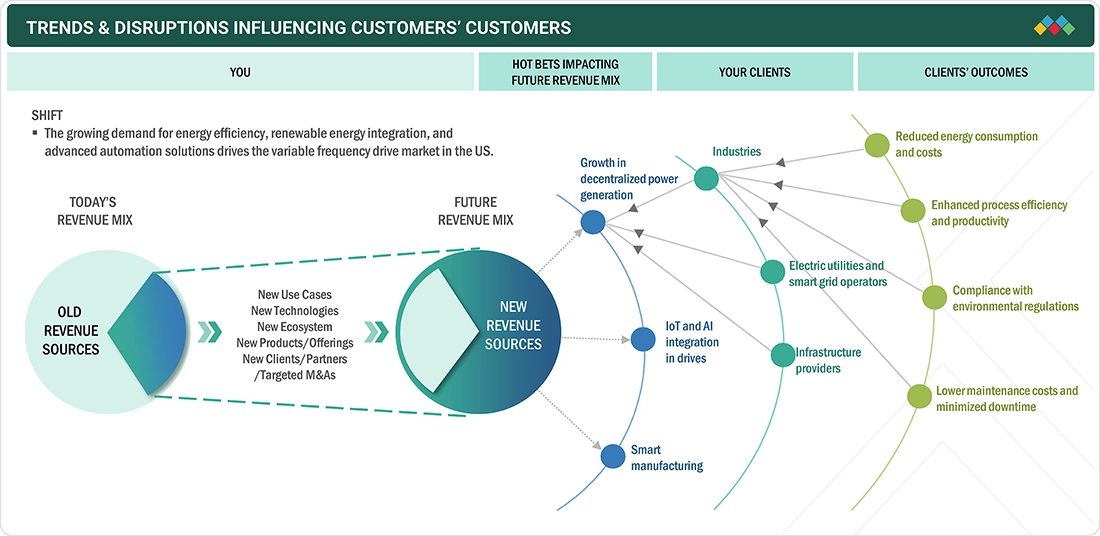

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The variable frequency drive market is poised for significant growth over the coming years due to the rising demand for energy efficiency, renewable integration, and automation. IoT-integrated smart VFDs enable real-time diagnostics and predictive maintenance, boosting Industry 4.0 adoption in manufacturing, HVAC, and oil & gas sectors. Industries, electric utilities, and infrastructure providers benefit from reduced energy costs, improved productivity, and regulatory compliance. Decentralized power generation and predictive maintenance minimize downtime and enhance system reliability. By embracing these shifts, businesses can unlock new revenue opportunities and stay competitive in an evolving energy landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising need to enhance efficiency and lower energy consumption

-

Requirement for motion control systems in automated production plants

Level

-

High installation and maintenance costs

-

Stagnant growth of oil & gas industry

Level

-

Government regulations for sustainability

-

Modernization of power infrastructure

Level

-

Availability of low-cost products in gray market

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising need to enhance efficiency and lower energy consumption

All industries across US have pursued technological developments to deliver high energy efficiency, which has become a significant concern. The industrial sector reportedly consumes 37% of the energy consumed globally, whereas 30% is consumed worldwide by buildings. By optimizing motor speed to match specific load requirements, VFDs eliminate the need for wasteful constant-speed operation. This results in substantial energy savings, lower operational costs, and a reduced carbon footprint. As industries and governments worldwide increase energy efficiency and sustainability, the use of VFDs will continue to grow. It is expected that electrical motors in industrial applications would consume a quarter of global electrical energy. Energy experts agree that 90% of motor life-cycle expenditures for fans and pumps are spent on energy. When these motors are fitted with variable frequency drives in service conditions with centrifugal load, their efficiency improves. Motors are applied in pumps, compressors, conveyors, and machines that depend on the rotational force to function. Variable frequency drives allow motors to be run on demand for required current, rather than running full speed and then reducing output through mechanical controls like throttles, dampers, or gears.

Restraint: Stagnant growth of oil & gas industry

Variable frequency drives are increasing used in the oil & gas industry. This US oil & gas industry has been under stagnant growth phase for last few years due to declining exploration and production activities. The demand for variable frequency drives in this industry depends directly on the parameters of exploration, development, and production activities, as well as capital spending by oil and natural gas companies. Activities fluctuations in oil and natural gas prices directly affect these activities. The fluctuations are experienced due to changes in the supply of and demand for oil and natural gas, governmental regulations, including policies on the exploration, production, and development of oil and natural gas reserves, weather conditions, natural disasters, and other factors. Oil and gas companies may cut or postpone major investments on the presumption of lower oil and natural gas prices over a long run, considering that most large-scale developmental projects undertaken are for a long-term period. In addition, the market growth for variable frequency drives is also directly impacted by lower capital expenditures by oilfield operators and service providers.

Opportunity: Modernization of power infrastructure

Stable, reliable T&D networks have been created to meet growing energy demand. The DOE can ensure a continuous supply of electricity only through a system that can manage sudden power fluctuations. Such an increase in blackouts has been caused by several reasons, including aging infrastructure, limited investments, and unclear policies to modernize the grid. More often than any other developed country, the US experiences blackouts. Power cuts in the country take longer than an hour and have risen steadily in the last few years, thus costing American businesses about USD 150 billion per year. According to the Canadian Electricity Association, at current consumption rates, it will require a USD 400 billion investment for the electricity sector over the next 20 years in Canada. Over the last ten years, electricity demand has increased by 10% even though there are more energy-efficient products and buildings than ever. Many regulations are introduced to prevent or limit power blackouts and upgrade the aging power networks within the whole world, but especially in North America.

Challenge: Availability of low-cost products in gray market

The variable frequency drive market is highly fragmented, with many local and international players. Product quality is the primary differentiating parameter in this market. The players from the organized sector target industrial buyers and maintain high product quality by following various industrial standards. At the same time, the players from the unorganized sector offer low-cost alternatives. Local manufacturers in most countries operate in the unorganized sector and compete strongly with global suppliers. These gray market players overpower the large players in terms of price competitiveness and local distribution networks. Gray market products are sold at a fraction of the price for legitimate, branded VFDs. The result is extremely intense pricing competition, with traditional manufacturers struggling to explain higher prices that reflect R&D and compliance charges. Moreover, gray market VFDs do not come equipped with advanced features and after-sales service, which prevents innovation and uptake of newer technologies in the market. Better ways to address this are customer education, authentication of the product, cost-effective solutions, and collaborative regulation so as to protect the market and ensure a sustainable growth.

US VARIABLE FREQUENCY DRIVE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

DSI Inc. modernizes well-pad motor control infrastructure by replacing aging VFDs using dynamic braking resistors (DBRs) with PowerFlex 755TR regeneration drives. Drive improvements were needed for reduced energy waste, lower costs, and enhanced sustainability. | Faster and more efficient well-pad operations | Energy savings and accomplished 17% regeneration with 95% reuse of energy | Lower operational costs, eligibility for carbon credits | Reliability | Improved reporting on pump performance |

|

CAESB improves operational reliability and predictability for water and wastewater management through tailored maintenance, refurbished drives, and ultra-low-harmonic (AFE) drive upgrades. The requirement focused on minimizing downtime risk and maintaining full visibility and control of 500+ critical drives operating in harsh conditions. | Reliable, planned maintenance with guaranteed response time | Extended equipment lifetime | Reduced risk of downtime | Enhanced operational and budgetary control | Improved power quality |

|

Enhance energy efficiency and reduce operating costs at the Gliwice ceramics factory by modernizing ventilation, conveyors, and mixers. Required investment in Danfoss VLT variable frequency drives (VFDs) to allow process-demand-based speed control across multiple systems. | Reduction in annual energy consumption | Faster payback (7 months) | Reduced CO2 emissions | Improved equipment reliability | Enabled process optimization | Minimized waste | Reduced the need for new equipment | Support for sustainability and climate neutrality goals |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US variable frequency drive ecosystem includes component providers, manufacturers, distributors/resellers, service providers, and end users, each playing a critical role in the value chain. Component providers, such as Vishay and Texas Instruments, supply essential power electronics and control components that enable efficient and reliable VFD operation. Manufacturers including Rockwell Automation and General Electric (GE) design and produce VFD solutions integrated with automation and control technologies for diverse industrial applications. Service providers, such as EMA and Quad Plus, support the market through drive repair, refurbishment, testing, and lifecycle services, helping extend equipment life and reduce downtime. Distributors/resellers, including RS Group and Allied Electronics & Automation, facilitate market reach by ensuring product availability, technical assistance, and timely delivery. End users, represented by ExxonMobil and Valero, deploy VFDs across energy-intensive sectors including oil & gas, power generation, chemicals, water & wastewater, food & beverage, automotive, and infrastructure to enhance energy efficiency, operational control, and regulatory compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US VARIABLE FREQUENCY DRIVE MARKET, BY TYPE

The type segment has AC drive and DC drive segments. The demand for AC drives in VFDs is higher as AC drives can control speed and torque more efficiently. The frequency of the motor is changed by AC drives according to the operational need. Therefore, they save energy and give better efficiency. These are more adaptable and energy-efficient for applications with pumps, fans, or conveyors. Due to strict requirements of industries in terms of energy efficiency and cost reduction, the market leverages AC drives to save energy without compromising the desired output at which it should operate. Moreover, their capacity to integrate with advanced automation and Internet of Things (IoT) technologies enhances operational efficiency and corresponds with the increasing emphasis on energy efficiency and sustainability across various sectors.

US VARIABLE FREQUENCY DRIVE MARKET, BY POWER RATING

The low power drives segment is the largest segment due to their extensive use across manufacturing, HVAC, water & wastewater treatment, food & beverage, and automotive industries. In manufacturing, low-power drives efficiently control motors for conveyors, pumps, compressors, and fans, ensuring precise operations. HVAC systems utilize these drives in air handling units, chillers, and cooling towers to optimize energy use, while water & wastewater industries benefit from improved pump control and reduced energy consumption. In food & beverages and automotive sectors, low-power drives support automation for processing, mixing, packaging, assembly line automation, and robotic systems. The demand for energy efficiency, compliance with stringent regulations, and seamless integration with smart manufacturing and IoT-enabled automation further contribute to the segmental growth.

US VARIABLE FREQUENCY DRIVE MARKET, BY END USER

The power end user segment is the largest market for variable frequency drives as the power industry places a major emphasis on energy efficiency, which drives extensive adoption of VFDs in conventional and nuclear power generation. VFDs are widely used in draft fans, cooling tower pumps, compressors, and auxiliary systems, such as feedwater pumps, optimizing internal power consumption and improving operational efficiency in power plants. Significant investments in capacity expansion, such as India’s major nuclear initiatives and the diverse US energy mix, including fossil fuels, nuclear, and renewables, further accelerate VFD deployment. The ability of VFDs to provide precise control of motor speeds leads to substantial energy savings and operational cost reductions, making them crucial for utilities and power generators worldwide.

REGION

AC drive to be largest-growing segment in US variable frequency drive market during forecast period

The AC drive segment is expected to be the largest due to its widespread use across industrial, commercial, and infrastructure applications, particularly in pumps, fans, compressors, and HVAC systems. Its cost-effectiveness, high reliability, and compatibility with a range of motor types make it the preferred choice for new installations and retrofits. Moreover, growing energy-efficiency mandates and rapid digitalization across US industries continue to strengthen the dominance of AC drives over DC and servo counterparts.

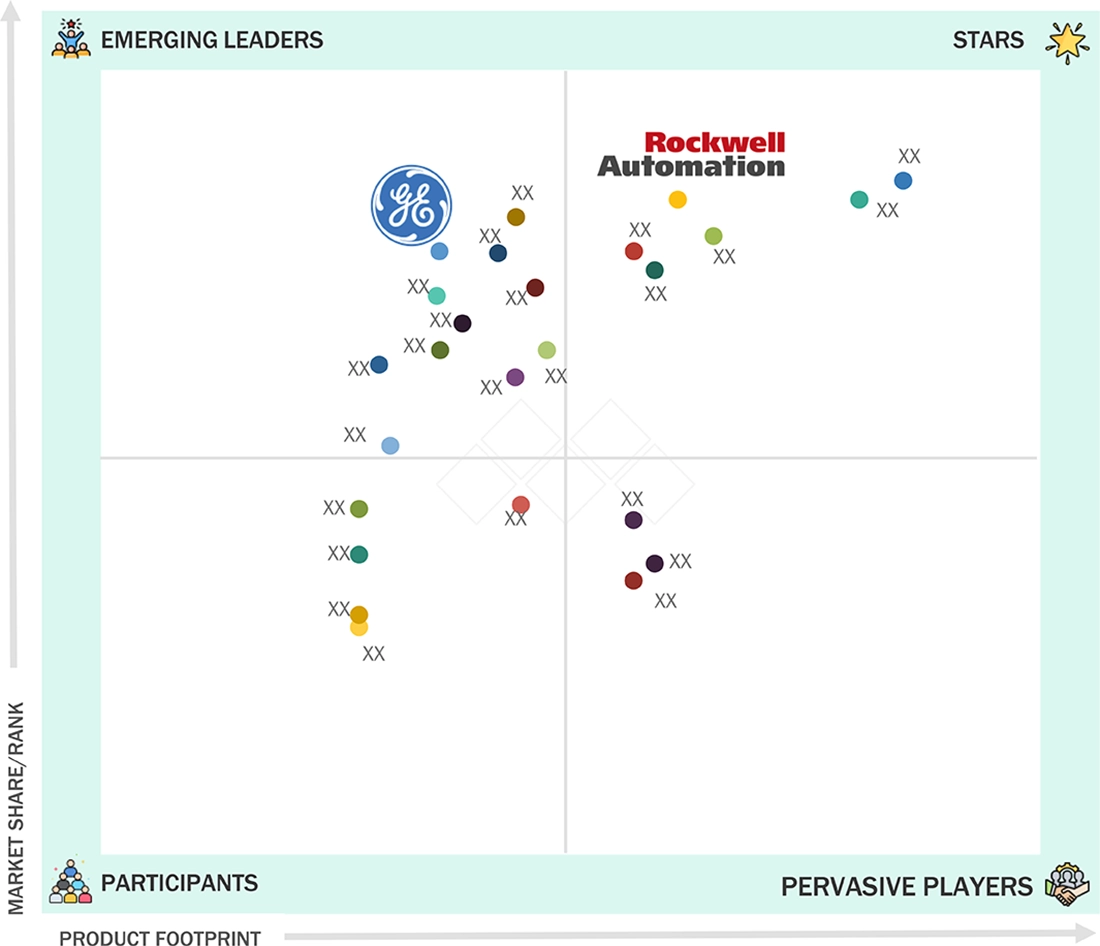

US VARIABLE FREQUENCY DRIVE MARKET: COMPANY EVALUATION MATRIX

Rockwell Automation is positioned as a star in the US variable frequency drive market matrix, reflecting leadership in market share and product breadth. The company differentiates itself through an extensive VFD portfolio, integrated digital and automation platforms, and strong reach across industries such as manufacturing, oil & gas, and utilities. Anaheim Automation is recognized among pervasive players for its cost-effective offerings, application flexibility, and focus on efficient motor control solutions that support sustainability goals. General Electric is viewed as an emerging leader, leveraging its broad industrial portfolio and installed base to drive VFD adoption across critical infrastructure and energy applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Rockwell Automation

- General Electric

- Parker Hannifin Corp

- Anaheim Automation

- Siemens

- ABB

- Danfoss

- Eaton

- Hitachi

- Honeywell International Inc.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.93 Billion |

| Market Forecast in 2030 (Value) | USD 4.92 Billion |

| Growth Rate | CAGR of 4.0% from 2024-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: AC Drive and DC Drive By Power Rating: Micro Power Drive, Low Power Drive, Medium Power Drive, and High Power Drive By End User: Oil & gas, Mining & Metal, Chemicals & Petrochemicals, Power, Food & Beverage, Water & Wastewater Treatment, Automotive, Construction/Infrastructure, and Other End Users |

| Country Covered | US |

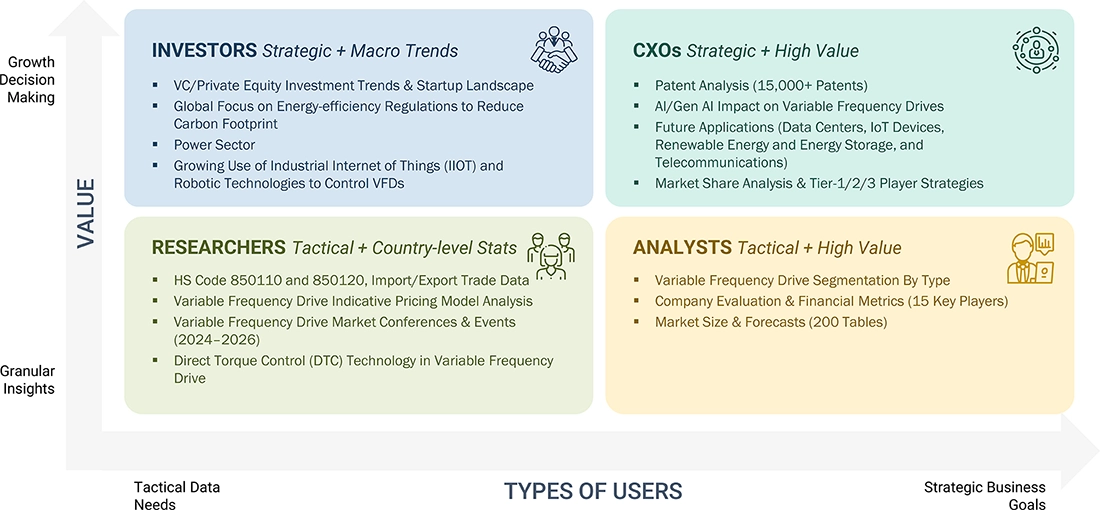

WHAT IS IN IT FOR YOU: US VARIABLE FREQUENCY DRIVE MARKET REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- September 2024 : Rockwell Automation introduced PowerFlex 755TS frame 7A drives with TotalFORCE technology. This technology expands the power range to 355 kW and provides a new panel-mount solution for high horsepower applications.

- August 2023 : Parker Hannifin launched two new ranges of AC drives, AC15 and AC20, which meet the latest requirements for the industrial market. These drives are ideal for multiple applications such as fan/pump controllers and conveyors to multi-drive production lines requiring speed following and winder calculators.

- October 2022 : Rockwell Automation enhanced its PowerFlex 6000T medium voltage VFDs with TotalFORCE technology, offering real-time system data for improved efficiency. The expanded output frequency range of up to 120 Hz supports high-speed applications.

- February 2021 : Garden Reach Shipbuilders & Engineers Ltd (GRSE) signed a Memorandum of Understanding (MoU) with GE Power Conversion. This MoU is a stepping-stone to leverage the technological expertise of GE Power Conversion and the shipbuilding expertise of GRSE and drive synergy to design electric and hybrid propulsion systems for future commercial and naval shipbuilding projects.

Table of Contents

Methodology

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the US Variable Frequency Drive Market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; directories and databases, which include D&B, Bloomberg, and Factiva; white papers and articles from recognized authors, and publications and databases from associations, such as International Energy Agency (IEA), US Energy Information Administration (EIA), International Renewable Energy Agency (IRENA), National Electrical Manufacturers Association (NEMA). Secondary research has been used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders has also been prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain and verify qualitative and quantitative information for this report and analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the US Variable Frequency Drive Market. Primary sources from the demand side include experts and key persons.

After the complete market engineering process (which includes calculations of market statistics, market breakdown, market size estimations, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, applications, Porter’s Five Forces, key players, competitive landscape, and key market dynamics such as drivers, opportunities, challenges, industry trends, and strategies adopted by key players.

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been extensively used along with several data triangulation methods to estimate and forecast the overall market segments listed in this report.

Top-down and bottom-up approaches have been used to estimate and validate the market size of variable frequency drives for various end user in each region. The key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the key market players and extensive interviews for insights from industry leaders such as CEOs, vice presidents, directors, and marketing executives. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

A variable frequency drive (VFD) is an electronic motor control device that drives an electric motor by changing the voltage and frequency supplied in the electric motor circuit. VFD works by converting fixed frequency and fixed voltage sine wave power to a variable frequency or variable output voltage, which is used to control the speed of a motor. It is also referred to as variable speed drive, adjustable speed drive, adjustable frequency drive, AC drive, micro drive, and inverter. The primary advantages associated with the use of VFD include less energy consumption and energy cost, controlled performance, extended equipment life, and low maintenance cost. It is mainly used for variable torque applications in various industries, such as oil & gas, water & wastewater treatment, power, paper & pulp, textile, and mining. The market for variable frequency drives is defined as the sum of revenues generated by companies through the sale of variable frequency drives.

Stakeholders

- Government organizations and regulatory agencies

- VFD manufacturing companies

- Automotive, aerospace, marine, and industrial equipment manufacturers

- Research and development institutes

- Environmental and sustainability organizations

- Trade associations and industry forums related to VFD technologies

- Original Equipment Manufacturers (OEMs)

- Component and parts suppliers for VFD

- Consulting companies in energy, automotive, and manufacturing sectors

- Transportation and logistics companies

- Maintenance and repair service providers

Report Objectives

- To describe and forecast the US Variable Frequency Drive Market in terms of value based on type, voltage, power rating, application, end user, region

- To describe and forecast the US Variable Frequency Drive Market in terms of volume based on region and power rating segment

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the US Variable Frequency Drive Market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To forecast the market size for five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete supply chain and allied industry segments and perform a supply chain analysis of the US Variable Frequency Drive Market’ landscape

- To study market trends, patent analysis, trade analysis, tariff and regulatory landscape, Porter’s five forces analysis, ecosystem mapping, technologies, investment and funding scenario, key stakeholders & buying criteria, case studies pertaining to off US Variable Frequency Drive Market

- To analyze the opportunities for various stakeholders by identifying the high-growth segments of the variable frequency drivemarket

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as contracts, collaborations, expansions, product launches, investments, and acquisitions, in the variable frequency drivemarket

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the VFD market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Variable Frequency Drive Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Variable Frequency Drive Market