Military Vehicle Electrification Market Size, Share & Analysis, 2025 To 2030

Military Vehicle Electrification Market by Platform (Combat Vehicles, Support Vehicles, Unmanned Armored Vehicles), System, Technology (Hybrid, Fully Electric), Mode of operation, Voltage Type and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The military vehicle electrification market is projected to reach USD 6.82 billion by 2030 from USD 3.47 billion in 2025, at a CAGR of 14.5% from 2025 to 2030. The growth of the military vehicle electrification market is driven by he need for quieter, more efficient vehicles that use less fuel and support longer missions.

KEY TAKEAWAYS

- North America is expected to account for a 45.9% share of the military vehicle electrification market in 2025.

- By technology, the fully electric segment is expected to register the highest CAGR of 16.5%.

- By system, the power generation segment is projected to grow at the fastest rate from 2025 to 2030.

- By mode of operation, the autonomous/semi-autonomous segment is expected to dominate the market.

- Oshkosh Corporation, GM Defense, and BAE Systems were identified as some of the star players in the military vehicle electrification market, given their strong market share and product footprint.

- Arquus Defense, Alke, and Nextar Group, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The military vehicle electrification market is witnessing steady growth, driven by the increasing defense modernization programs, demand for silent mobility, and the need for enhanced onboard power efficiency in combat and tactical operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the military vehicle electrification market is driven by rising defense needs for silent mobility, greater onboard power, and reduced fuel dependence. These shifts are accelerating demand for hybrid and electric propulsion technologies across combat and tactical fleets, reshaping OEM revenue models and future modernization priorities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Modern battlefield requirements

-

Elevated demand for electric power sources

Level

-

Need for balanced power-to-weight ratio

-

Limited range of military electric vehicles

Level

-

Surge in demand for hydrogen fuel systems

-

Development of modular hybrid-electric architectures

Level

-

Lifecycle and durability constraints

-

Lack of standardized charging protocols

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Modern battlefield requirements

Modern battlefield missions require silent mobility, greater onboard power for C4ISR and weapon systems, and reduced fuel dependence. These needs are accelerating the adoption of electrified combat and tactical vehicles.

Restraint: Need for balanced power-to-weight ratio

Electrification adds battery mass and system complexity, which can impact mobility and payload. Maintaining a strong power-to-weight ratio is essential to ensure combat-readiness and vehicle agility.

Opportunity: Surge in demand for hydrogen fuel systems

Hydrogen propulsion offers high energy density, longer operational range, and fast refueling compared to current batteries. This creates a significant opportunity for next-generation hybrid-hydrogen military vehicles.

Challenge: Lifecycle and durability constraints

Batteries and electrical systems must operate reliably under extreme temperatures, shocks, and field hazards. Ensuring long service life and durability remains a major technical and logistical challenge.

Military Vehicle Electrification Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hybrid and all-electric propulsion in next-generation MBTs by companies like General Dynamics | Improves fuel efficiency and mobility, reduces logistic burden of fuel supply, and enables silent operations during combat |

|

Hybrid-electric tactical trucks under US Army’s CTT program with regenerative braking and modular power systems | Cuts fuel consumption and maintenance costs, improves operational endurance, and increases survivability in contested areas |

|

Electrified UGVs such as Mission Master SP and SMET with lithium-ion batteries and silent drive | Increases stealth and range, supports autonomous missions, and allows mobile recharging for longer deployment |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The military vehicle electrification ecosystem includes solution providers like Rheinmetall and Oshkosh delivering integrated hybrid and electric platforms, supported by component suppliers such as GM Defense and QinetiQ providing batteries and power systems. Manufacturers including BAE Systems, Textron, and Thales enable large-scale production and deployment of next-generation electrified military vehicles, driving operational efficiency and battlefield sustainability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Military Vehicle Electrification Market, By Platform

Combat vehicles will dominate the market in 2025 due to rising hybrid and electric upgrades for frontline armored fleets. Electrification enhances silent mobility, onboard power availability, and operational endurance. Major modernization programs in the US and Europe are accelerating this shift.

Military Vehicle Electrification Market, By Technology

Hybrid technology will lead in 2025 as it offers extended range, reduced fuel usage, and lower acoustic and thermal signatures. It provides a practical transition path before full electrification becomes widely feasible on the battlefield.

Military Vehicle Electrification Market, By Mode of Operation

Manned vehicles will hold the largest share in 2025 as electrification is first being applied to existing crewed combat and tactical platforms. The benefits are immediate, while unmanned fleets are still scaling in deployment and investment.

Military Vehicle Electrification Market, By Voltage Type

Medium voltage systems will dominate the market in 2025 due to higher power demand for propulsion and mission systems. They offer a reliable balance of efficiency, safety, and performance for hybrid electric military vehicles.

REGION

North America to be the fastest-growing region in the global military vehicle electrification market during the forecast period

The North American military vehicle electrification market is expected to register the highest CAGR during the forecast period, driven by major defense modernization initiatives, strong investment in hybrid and electric combat platforms, and rapid adoption of advanced energy technologies by the US DoD.

Military Vehicle Electrification Market: COMPANY EVALUATION MATRIX

In the military vehicle electrification market matrix, Oshkosh (Star) leads with a strong market share and broad product deployment in electrified tactical and combat vehicles, solidifying its dominant position. Rheinmetall (Emerging Leader) is rapidly gaining presence through advanced hybrid propulsion solutions and expanding global defense programs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.14 Billion |

| Market Forecast in 2030 (Value) | USD 6.82 Billion |

| Growth Rate | CAGR of 14.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Military Vehicle Electrification Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at the regional/global level to gain an understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding of the total addressable market |

RECENT DEVELOPMENTS

- February 2025 : GM Defense signed an MoU with EDGE to jointly explore opportunities in light tactical vehicles and related defense technologies across the Middle East, Africa, Malaysia, and Indonesia.

- January 2025 : Krauss-Maffei Wegmann established a joint venture with a Ukrainian enterprise to support and service Leopard 2 tanks, PzH 2000 howitzers, and RCH 155 artillery systems.

- December 2024 : Lithuania signed an agreement with Germany to procure 44 Leopard 2A8 tanks, marking its largest military contract and strengthening NATO interoperability.

Table of Contents

Methodology

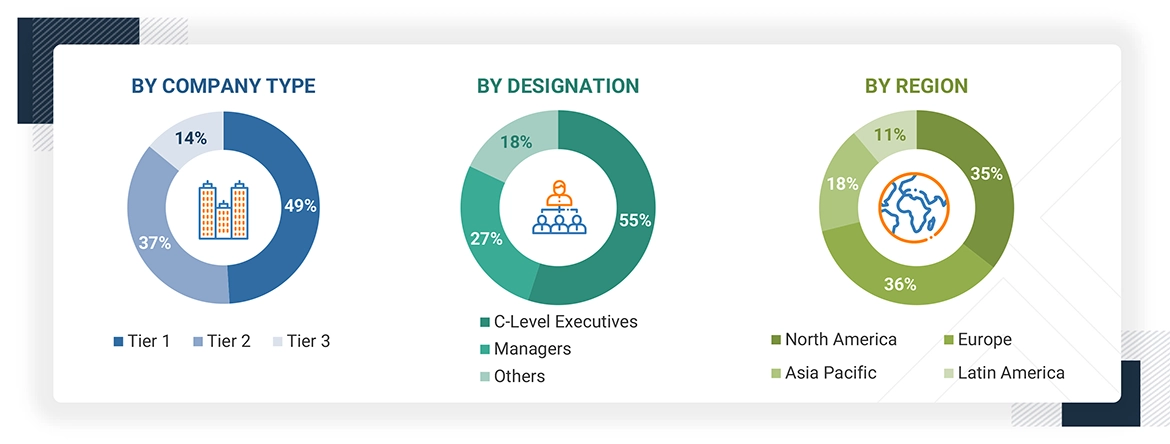

This research study involved the extensive use of secondary sources, directories, and databases, such as the Stockholm International Peace Research Institute (SIPRI), Department of Defense (DoD), UN Comtrade, Organization for Economic Cooperation and Development (OECD), and Factiva, to identify and collect relevant information on the military vehicle electrification market. Primary sources included industry experts from the market concerned, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information, as well as assess the prospects of the market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

The market share of companies in the military vehicle electrification market was determined using secondary data made available through paid and unpaid sources and by analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the military vehicle electrification market included government sources such as the US Department of Defense (DoD), defense budgets, military modernization program documents, corporate filings such as annual reports, investor presentations, and financial statements, and trade, business, and professional associations. This secondary data was collected and analyzed to arrive at the overall size of the military vehicle electrification, which was further validated by primary respondents.

Secondary research was primarily used to obtain critical information about the value and supply chain of the market. It was also used to identify key players by various products, market classifications, and segmentation per their offerings. Secondary information helps understand industry trends related to Military vehicle electrification technology, mode of operation, voltage, platform, system, and region, and developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents, directors from business development, marketing, and product development/innovation teams, related key executives from the EV industry, manufacturers, integrators, and key opinion leaders. Extensive primary research was conducted after obtaining information about the current scenario of the military vehicle electrification market through secondary research. Several primary interviews were conducted with the market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World.

Note: Tiers of companies are based on their revenue in 2021–2022.

Tier 1: Company revenue greater than USD 1 billion; Tier 2: Company revenue between USD 100 million and USD 1 billion; and Tier 3: Company revenue lower than USD 100 million.

Others include Sales Managers, Marketing Managers, and Product Managers.

To know about the assumptions considered for the study, download the pdf brochure

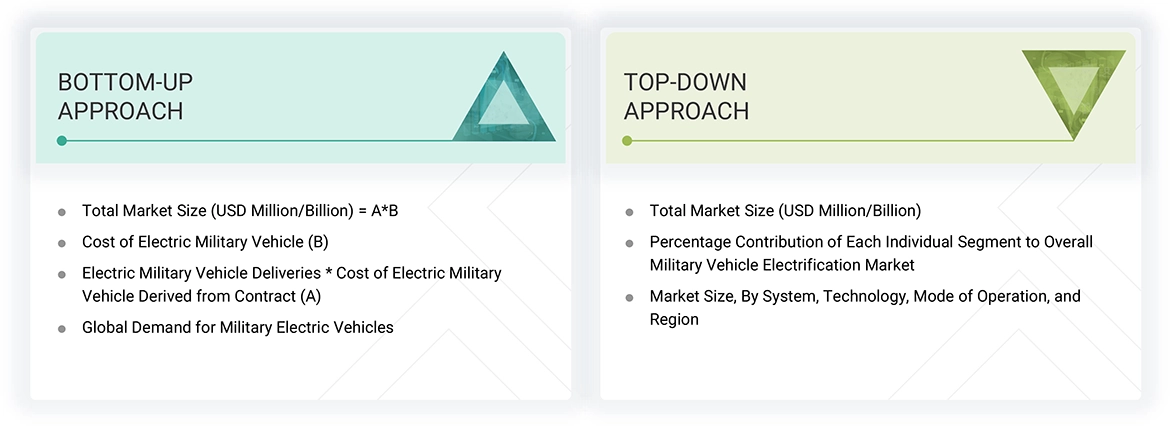

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the market. The research methodology used to estimate the market size also included the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed input, analyzed by MarketsandMarkets, and presented in this report.

Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the military vehicle electrification market.

Market Size Estimation Methodology: Bottom-up Approach

|

Step 1 |

Mapped deliveries of military electric vehicles |

Mapped deliveries of all types of electric military vehicles considered under military vehicle electrification segments from 2025 to 2030 |

|

Step 2 |

Classified the components required for each vehicle type |

Each vehicle technology considered in the scope (fully electric and hybrid) requires different types of electric components, and the penetration of each technology is different |

|

Step 3 |

Identified the total cost of manufacturing electric military vehicle |

Identified and mapped the total cost of manufacturing vehicles for each electric military vehicle considered in the study |

|

Step 4 |

Listing contracts for military electric vehicles |

Listing all the contracts for military electric vehicles to validate the market size |

|

Step 5 |

Arriving at the global market size (2025) |

Global market 2025 (Electric military vehicle delivery for 2025 * cost of electric military vehicle derived from contract) |

|

Step 6 |

Arriving at the global market size (2025-2030) |

Global market estimated based on data on existing and upcoming projects announced by OEMs, average digital readiness Index percentage of commercial electric vehicles, and average defense growth rate |

Top-Down Approach

In the top-down approach, military electric vehicle manufacturers were identified. The revenue of players as per their revenue specific to the market was identified. The base market number for each player was determined by assigning a weight to the contracts for military electric vehicles by these companies for the stages of electrification.

Military Vehicle Electrification Market : Top-Down and Bottom-Up Approach

Data Triangulation

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process to develop this report.

The figure above demonstrates the core data triangulation procedure used in this report for every market, submarket, and subsegment. The percentage split for various market segments, including system, platform, technology, mode of operation, voltage, and region, was used to determine the size of the military vehicle electrification market.

Market Definition

Military vehicle electrification is the method of adapting new technologies for the use of electrical power for the operation of automotive drivetrains, auxiliary systems, turret motors/drives, and other mechanical subsystems in military vehicles. It involves the use of hybrid engines, battery technologies, fuel cells, and other primary power sources for military tactical and combat vehicles. It helps increase efficiency, power, and performance in critical missions and operations.

Key Stakeholders

- Military Vehicle Electrification Solution Providers

- Military Vehicle Electrification Platform Providers

- Military Vehicle Electrification System Providers

- Technology Providers

- Armed Forces

- Military Vehicle Electrification Product Manufacturers

- Component Manufacturers

- Distributors and Suppliers

- Investors and Venture Capitalists

- Component Manufacturers

- Distributors and Suppliers

- Universities, Research Organizations, Forums, Alliances, and Associations

- Ministries of Defense

- Original Equipment Manufacturers (OEMs)

- Regulatory Bodies

- R&D Companies

Report Objectives

- To define, describe, and forecast the size of the military vehicle electrification market based on platform, system, technology, mode of operation, and voltage from 2025 to 2030

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the military vehicle electrification market across the globe

- To strategically analyze micromarkets 1 with respect to individual growth trends, prospects, and their contribution to the military vehicle electrification market

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, partnerships, product launches, and research & development (R&D) activities in the market

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players

- To strategically profile key market players and comprehensively analyze their core competencies2

Micromarkets refer to segments and subsegments of the military vehicle electrification market included in the report.

Core competencies of the companies were captured in terms of their key developments and strategies to sustain their position in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Military Vehicle Electrification Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Military Vehicle Electrification Market