2

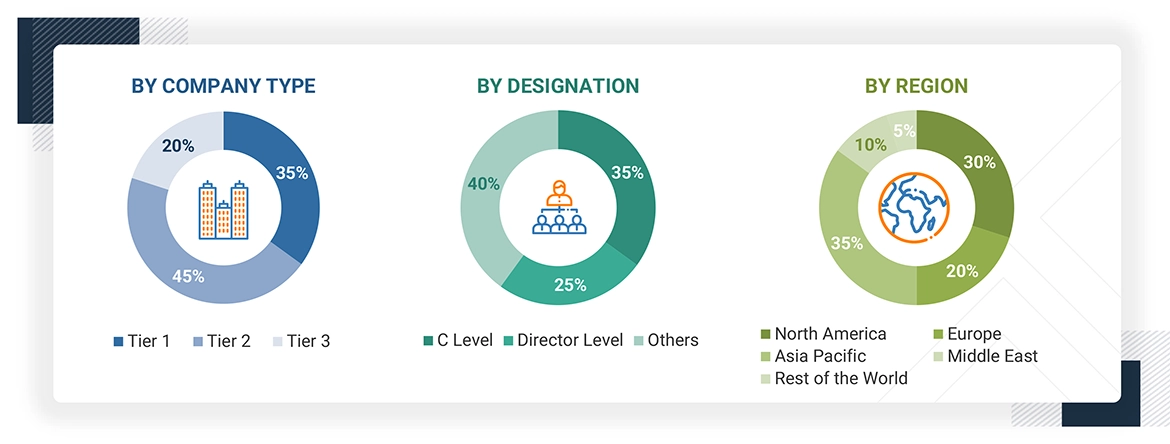

RESEARCH METHODOLOGY

36

5

MARKET OVERVIEW

VSAT technology revolutionizes connectivity in maritime, oil, and remote sectors amid rising cybersecurity challenges.

52

5.2.1.1

GROWING ADOPTION OF VSAT TECHNOLOGY FOR CREW WELFARE IN OIL & GAS INDUSTRY

5.2.1.2

INCREASING NEED FOR VSAT SYSTEMS IN MARITIME INDUSTRY

5.2.1.3

SURGING DEMAND FOR BROADBAND DATA CONNECTIONS FROM GOVERNMENT AND BUSINESS SECTORS

5.2.1.4

LOW INVESTMENT AND OPERATING COSTS

5.2.1.5

INCREASING USE OF KU- AND KA-BAND VSATS

5.2.1.6

HIGH USE OF USATS FOR ON-THE-MOVE APPLICATIONS

5.2.2.1

ISSUES WITH CONNECTIVITY AT SEA

5.2.2.2

LONG DURATION OF PRODUCT CERTIFICATION

5.2.3.1

RISING NEED FOR VSAT SYSTEMS TO ENABLE TELEMEDICINE IN REMOTE LOCATIONS

5.2.3.2

GROWING DEMAND FOR AUTONOMOUS AND CONNECTED VEHICLES

5.2.3.3

INCREASING USE OF ULTRA-COMPACT KU-BAND VSATS FOR TACTICAL UAVS

5.2.3.4

RISING NUMBER OF LEO-HTS CONSTELLATIONS

5.2.4.1

CYBERSECURITY CONCERNS

5.2.4.2

RADIO SPECTRUM AVAILABILITY ISSUES

5.3

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.3.1

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.5.1

PROMINENT COMPANIES

5.5.2

PRIVATE AND SMALL ENTERPRISES

5.6.1

REGULATORY FRAMEWORK

5.7.2

EXPORT SCENARIO (HS CODE 880260)

5.8

KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.9.1.1

BEAMFORMING TECHNOLOGY

5.9.1.2

SOFTWARE-DEFINED NETWORKING (SDN) IN SATELLITE NETWORKS

5.9.2

COMPLEMENTARY TECHNOLOGIES

5.9.2.1

POWER OVER ETHERNET (POE) SYSTEMS

5.9.2.2

REMOTE TERMINAL MANAGEMENT SOFTWARE

5.9.3

ADJACENT TECHNOLOGIES

5.9.3.1

5G NON-TERRESTRIAL NETWORKS (NTN)

5.9.3.2

NETWORK MANAGEMENT SYSTEMS (NMS)

5.10.1

CASE STUDY 1: L3HARRIS TACTICAL TERMINALS – ENABLING MISSION-CRITICAL VSAT COMMUNICATIONS FOR DEFENSE FORCES

5.10.2

CASE STUDY 2: KYMETA'S FLAT-PANEL VSAT ANTENNA LAUNCH FOR MARITIME CONNECTIVITY VIA ONEWEB LEO

5.10.3

CASE STUDY 3: METAMATERIAL ANTENNA DEVELOPMENT BY UNIVERSITY OF EXETER, TECHNICAL COMPOSITE SYSTEMS, AND COBHAM AEROSPACE CONNECTIVITY

5.11

KEY CONFERENCES AND EVENTS, 2025–2026

5.12

IMPACT OF 2025 US TARIFFS ON VSAT MARKET

5.15

PRICE IMPACT ANALYSIS

5.16

IMPACT ON COUNTRY/REGION

5.17

IMPACT ON END-USE INDUSTRIES

5.17.2

GOVERNMENT & DEFENSE

5.17.3

INDUSTRIAL & MOBILITY

5.18

MACROECONOMIC OUTLOOK

5.19

IMPACT OF AI/ GENERATIVE AI ON VSAT MARKET

5.19.1

NETWORK OPTIMIZATION AND PREDICTIVE MAINTENANCE

5.19.2

AI-BASED BEAM MANAGEMENT AND DYNAMIC BANDWIDTH ALLOCATION

5.19.3

AUTOMATED FAULT DETECTION AND REMOTE DIAGNOSTICS

5.19.4

NETWORK SIMULATION AND DESIGN

5.19.5

PERSONALIZED SERVICE DELIVERY AND USER EXPERIENCE

5.21.1

AVERAGE SELLING PRICE OF VSAT FOR TOP 3 PLATFORMS, BY KEY PLAYERS

5.22.1

BUSINESS MODELS IN VSAT MARKET

5.24

INVESTMENT AND FUNDING SCENARIO

5.25

TOTAL COST OF OWNERSHIP

5.28.1

INNOVATIONS IN ROUTER TECHNOLOGY TO SUPPORT WIDE RANGE OF CRITICAL APPLICATIONS

5.28.2

IMPROVEMENT IN BANDWIDTH EFFICIENCY TO ACHIEVE MORE THROUGHPUT IN VSAT SYSTEMS

5.28.3

USE OF TIME DIVISION MULTIPLE ACCESS (TDMA) TECHNOLOGY IN VSAT SYSTEMS

5.28.4

4-AXIS STABILIZED VSAT ANTENNA SYSTEMS

5.28.5

ADVANCED 1M KA-/KU-BAND MARITIME VSAT ANTENNAS

5.28.6

USE OF KA- AND KU-BAND VSATS FOR SATELLITE COMMUNICATIONS

5.28.7

MULTIBAND TACTICAL COMMUNICATION AMPLIFIERS

5.28.8

ADVANCED ANTENNAS TO ENABLE NEXT GENERATION OF VSATS

5.28.9

ULTRA-COMPACT & HIGH THROUGHPUT ON-THE-MOVE (OTM) TERMINALS FOR TACTICAL UAVS

5.28.10

HYBRID MARITIME VSAT NETWORK SOLUTIONS

5.29

IMPACT OF MEGATRENDS

5.29.1

SUPPLY CHAIN DISRUPTIONS

5.29.2

DEVELOPMENT OF SMART ANTENNAS

5.29.3

HYBRID BEAMFORMING METHODS

6

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

96

6.2.1

INCREASING DEMAND FOR STANDARD VSAT TECHNOLOGY ACROSS VERTICALS TO DRIVE GROWTH

6.3.1

INCREASING RELIANCE ON SATCOM-ON-THE-MOVE SOLUTIONS TO SUPPORT BATTLEFIELD COMMUNICATIONS TO DRIVE GROWTH

7

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY DESIGN

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

99

7.2.1

GROWING DEMAND FOR RESILIENT, HIGH-PERFORMANCE SATELLITE COMMUNICATION IN CHALLENGING ENVIRONMENTS TO DRIVE GROWTH

7.3.1

INCREASING USE IN COMMERCIAL APPLICATIONS ACROSS VARIOUS INDUSTRIES TO DRIVE GROWTH

8

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FREQUENCY

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

102

8.2.1

WIDELY USED FOR DATA COMMUNICATIONS AND TRAFFIC INFORMATION

8.3.1

USED FOR VARIOUS CROSS-INDUSTRY APPLICATIONS

8.4.1

USED IN SATELLITE COMMUNICATION SYSTEMS FOR CRUISE SHIPS

8.5.1

RESILIENT TO RAIN FADE AND SIGNAL PROBLEMS

8.6.1

WIDELY USED ON MERCHANT VESSELS TO ALLOW TRANSMISSION OF LARGE VOLUMES OF DATA AT LOW COST

8.7.1

TRANSMITS DATA AT FASTER RATE THAN KU-BANDS

8.8.1

USED FOR COHERENT DETECTION AND TRACKING OF MOVING TARGETS

9

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY NETWORK

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

107

9.2.1

USED FOR LARGE ANTENNA GAINS

9.3.1

ENABLES MULTIPLE DEVICES TO TRANSMIT DATA SIMULTANEOUSLY

9.4.1

USES CHARACTERISTICS OF BOTH STAR AND MESH TOPOLOGIES

9.5.1

DESIGNED FOR VERY SMALL NETWORKS

10

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million and Units | 10 Data Tables

111

10.2.1

OUTDOOR UNITS TO COMMAND LARGEST MARKET SHARE

10.2.2.2

MECHANICALLY AUGMENTED PHASED ARRAY ANTENNAS

10.2.2.3

ELECTRONICALLY SCANNED ARRAY ANTENNAS

10.2.2.4

BLOCK UPCONVERTERS

10.2.2.5

LOW NOISE BLOCK DOWNCONVERTERS

10.2.3.1

SATELLITE MODEMS

10.2.3.2

SATELLITE ROUTERS

10.2.5

ANTENNA CONTROL UNITS

10.3.1

MANAGED SERVICES TO ACQUIRE DOMINANT MARKET SHARE

10.3.2.1

INSTALLATION & SETUP

10.3.2.2

NETWORK DESIGN & OPTIMIZATION

10.3.2.3

NETWORK OPERATIONS

10.3.3

PROFESSIONAL SERVICES

10.3.3.1

ENGINEERING AND CONSULTING

10.3.3.2

MAINTENANCE AND SUPPORT SERVICES

10.4

CONNECTIVITY SERVICES

10.4.1

NEED TO OPTIMIZE BUSINESS OPERATIONAL COSTS TO DRIVE GROWTH

10.4.1.3

USE-WHAT-YOU-NEED

11

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 12 Data Tables

122

11.2.1

FIXED SEGMENT TO CAPTURE LARGEST MARKET SHARE

11.2.2.1

COMMAND & CONTROL CENTERS

11.2.2.3

COMMERCIAL BUILDINGS

11.2.4.1

COMMERCIAL VEHICLES

11.2.4.2

MILITARY VEHICLES

11.2.4.3

EMERGENCY VEHICLES

11.2.4.4

UNMANNED GROUND VEHICLES

11.2.4.5

HIGH-SPEED TRAINS

11.3.1

COMMERCIAL SHIPS SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

11.3.4

UNMANNED MARINE VEHICLES

11.4.1

COMMERCIAL AIRCRAFT SEGMENT TO HOLD LARGEST MARKET SHARE

11.4.2

COMMERCIAL AIRCRAFT

11.4.4

UNMANNED AERIAL VEHICLES

12

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

132

12.2

BROADBAND/DATA NETWORK SERVICES

12.2.1

INCREASING DEMAND FOR EFFICIENT BROADBAND CONNECTIVITY TO DRIVE GROWTH

12.3

VOICE COMMUNICATIONS SERVICES

12.3.1

NEED FOR EFFECTIVE VOICE COMMUNICATIONS IN MILITARY AND NAVAL APPLICATIONS TO DRIVE GROWTH

12.4

PRIVATE NETWORK SERVICES

12.4.1

NEED FOR OPTIMUM SECURITY AND END-TO-END CONNECTIVITY TO DRIVE GROWTH

12.5.1

INCREASED DEMAND FOR EFFECTIVE BROADCASTING NETWORKS TO PROPEL MARKET GROWTH

13

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

136

13.2.1

VSAT ENABLES CRUCIAL COMMUNICATION BETWEEN REMOTE CLINICS AND DOCTORS

13.3.1

NEED FOR RELIABLE TELECOMMUNICATIONS NETWORK TO DRIVE GROWTH

13.4.1

RAPID GROWTH OF ONLINE EDUCATION TO DRIVE GROWTH

13.5.1

SHIFT TO CONNECTIVITY-BASED APPLICATIONS TO DRIVE GROWTH

13.6

MEDIA & ENTERTAINMENT

13.6.1

TO CAPTURE PROMINENT MARKET SHARE DURING FORECAST PERIOD

13.7.1

INCREASING NUMBER OF POINT-OF-SALE TERMINALS TO DRIVE GROWTH

13.8

TRANSPORTATION & LOGISTICS

13.8.1

DEMAND FOR SMOOTH OPERATIONAL EFFICIENCY TO DRIVE GROWTH

13.9.1

NEED FOR EXPANSION OF WI-FI CONNECTIVITY TO DRIVE MARKET

13.10.1

DEMAND FOR EFFECTIVE SHIP-TO-SHORE COMMUNICATIONS TO DRIVE MARKET

13.11.1

DEMAND FOR HIGH-SPEED SATELLITE COMMUNICATION LINK TO DRIVE GROWTH

13.12

AGRICULTURE & FORESTRY

13.12.1

NEED FOR SMART MONITORING SOLUTIONS TO DRIVE GROWTH

13.13

MINING & CONSTRUCTION

13.13.1

NEED FOR PROPER COMMUNICATION NETWORK IN REMOTE MINING SITES TO DRIVE GROWTH

13.14.1

VSAT PROVIDES ABILITY TO EXTEND COMPANY'S WIDE AREA NETWORK

13.15.1

NEED FOR IMPROVED NAVIGATION IN AUTOMOBILES TO DRIVE GROWTH

13.16

GOVERNMENT & DEFENSE

13.16.1

VSAT ENSURES UNINTERRUPTED AND EFFICIENT BATTLEFIELD COMMUNICATION

13.16.1.2

HOMELAND SECURITY AND EMERGENCY MANAGEMENT

14

REGIONAL ANALYSIS

Comprehensive coverage of 7 Regions with country-level deep-dive of 14 Countries | 170 Data Tables.

145

14.2.2.1

PRESENCE OF A MATURE SATELLITE COMMUNICATIONS ECOSYSTEM TO DRIVE GROWTH

14.2.3.1

NATIONAL BROADBAND INITIATIVES AND REMOTE CONNECTIVITY DEMANDS TO DRIVE GROWTH

14.3.2.1

NATIONAL SPACE STRATEGY AND SUPPORT FOR DOMESTIC SATELLITE OPERATORS TO BOOST MARKET

14.3.3.1

GOVERNMENT SUPPORT THROUGH FRANCE 2030 INVESTMENT PLAN TO DRIVE GROWTH

14.3.4.1

DEFENSE MODERNIZATION TO DRIVE GROWTH

14.4.2.1

GOVERNMENT INVESTMENT IN NATIONAL SATELLITE INFRASTRUCTURE TO DRIVE GROWTH

14.4.3.1

POLICY LIBERALIZATION AND RISING ENTERPRISE DEMAND TO DRIVE GROWTH

14.4.4.1

INSTITUTIONAL DEMAND FOR VSAT SYSTEMS TO PROVIDE UNINTERRUPTED COMMUNICATION DURING EMERGENCIES TO DRIVE GROWTH

14.4.5.1

GOVERNMENT BACKED DIGITAL INNOVATION AND SECURE COMMUNICATION PRIORITIES DRIVING VSAT DEMAND

14.4.6

REST OF ASIA PACIFIC

14.5.3

REST OF MIDDLE EAST

14.6.2.1

WI-FI BRASIL PROGRAM TO DRIVE GROWTH

14.6.3.1

DEPLOYMENT OF SATELLITE-BASED BROADBAND TO DRIVE MARKET

14.6.4

REST OF LATIN AMERICA

14.7.2.1

DIGITAL TRANSFORMATION GOALS TO DRIVE GROWTH

14.7.3.1

NATIONAL BROADBAND PLAN TO DRIVE GROWTH

15

COMPETITIVE LANDSCAPE

Discover key players' strategies and market positions shaping the VSAT industry's competitive dynamics.

219

15.3

MARKET SHARE OF ANALYSIS

15.4

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

15.4.3

PERVASIVE COMPANIES

15.5.1

SOLUTION FOOTPRINT

15.5.2

PLATFORM FOOTPRINT

15.6

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

15.6.1

PROGRESSIVE COMPANIES

15.6.2

RESPONSIVE COMPANIES

15.6.4.1

COMPETITIVE BENCHMARKING

15.7

BRAND/PRODUCT COMPARISON

15.8

COMPANY VALUATION AND FINANCIAL METRICS

15.9

COMPETITIVE SCENARIO

15.9.1

PRODUCT LAUNCHES/DEVELOPMENTS

16

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

256

16.1.1

ORBIT COMMUNICATION SYSTEMS LTD.

16.1.1.1

BUSINESS OVERVIEW

16.1.1.2

PRODUCTS OFFERED

16.1.1.3

RECENT DEVELOPMENTS

16.1.2

L3HARRIS TECHNOLOGIES INC.

16.1.4

GILAT SATELLITE NETWORKS LTD.

16.1.5

ECHOSTAR CORPORATION (US)

16.1.6

COMTECH TELECOMMUNICATIONS CORPORATION

16.1.7

ST ENGINEERING IDIRECT

16.1.8

KVH INDUSTRIES, INC.

16.1.9

GENERAL DYNAMICS CORPORATION

16.1.11

HONEYWELL INTERNATIONAL INC.

16.1.13

MITSUBISHI ELECTRIC CORPORATION

16.1.14

ULTRA ELECTRONICS

16.1.15

SATIXFY COMMUNICATIONS LTD

16.2.2

THURAYA TELECOMMUNICATIONS COMPANY

16.2.3

SPEEDCAST INTERNATIONAL LTD.

16.2.5

NORSAT INTERNATIONAL INC.

16.2.6

NSSL GLOBAL SOLUTIONS PVT. LTD.

16.2.8

KYMETA CORPORATION

16.2.9

KOGNITIVE NETWORKS

16.2.10

VIKING SATCOM LLC

17.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3

CUSTOMIZATION OPTIONS

TABLE 1

USD EXCHANGE RATES, 2019–2024

TABLE 2

VSAT (VERY SMALL APERTURE TERMINAL) MARKET: INCLUSIONS AND EXCLUSIONS

TABLE 3

KEY INFORMATION ON LEO AND MEO CONSTELLATIONS

TABLE 4

VSAT MARKET: ROLE IN ECOSYSTEM

TABLE 5

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8

MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10

IMPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 11

EXPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020–2024 (USD THOUSAND)

TABLE 12

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 PLATFORMS (%)

TABLE 13

KEY BUYING CRITERIA FOR TOP 3 PLATFORMS

TABLE 14

KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 15

RECIPROCAL TARIFF RATES ADJUSTED BY US

TABLE 16

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY MARINE PLATFORM, 2021–2024 (UNITS)

TABLE 17

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY MARINE PLATFORM, 2025–2030 (UNITS)

TABLE 18

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY AIRBORNE PLATFORM, 2021–2024 (UNITS)

TABLE 19

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY AIRBORNE PLATFORM, 2025–2030 (UNITS)

TABLE 20

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY LAND PLATFORM, 2021–2024 (UNITS)

TABLE 21

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, DELIVERIES BY LAND PLATFORM, 2025–2030 (UNITS)

TABLE 22

AVERAGE SELLING PRICE TREND OF VSAT, BY PLATFORM, 2024 (USD THOUSAND)

TABLE 23

COMPARISON BETWEEN DIFFERENT BUSINESS MODELS

TABLE 24

LIST OF MAJOR PATENTS FOR VSAT MARKET, APRIL 2023–MARCH 2025

TABLE 25

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 26

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 27

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY DESIGN, 2021–2024 (USD MILLION)

TABLE 28

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY DESIGN, 2025–2030 (USD MILLION)

TABLE 29

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FREQUENCY, 2021–2024 (USD MILLION)

TABLE 30

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FREQUENCY, 2025–2030 (USD MILLION)

TABLE 31

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY NETWORK, 2021–2024 (USD MILLION)

TABLE 32

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY NETWORK, 2025–2030 (USD MILLION)

TABLE 33

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 34

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 35

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY EQUIPMENT, 2021–2024 (USD MILLION)

TABLE 36

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY EQUIPMENT, 2025–2030 (USD MILLION)

TABLE 37

VSAT (VERY SMALL APERTURE TERMINAL) EQUIPMENT MARKET, BY OUTDOOR UNITS, 2021–2024 (USD MILLION)

TABLE 38

VSAT (VERY SMALL APERTURE TERMINAL) EQUIPMENT MARKET, BY OUTDOOR UNITS, 2025–2030 (USD MILLION)

TABLE 39

VSAT (VERY SMALL APERTURE TERMINAL) OUTDOOR UNITS MARKET, BY ANTENNAS, 2021–2024 (USD MILLION)

TABLE 40

VSAT (VERY SMALL APERTURE TERMINAL) OUTDOOR UNITS MARKET, BY ANTENNAS, 2025–2030 (USD MILLION)

TABLE 41

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SUPPORT SERVICES, 2021–2024 (USD MILLION)

TABLE 42

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SUPPORT SERVICES, 2025–2030 (USD MILLION)

TABLE 43

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 44

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 45

VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY LAND VSAT, 2021–2024 (USD MILLION)

TABLE 46

VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY LAND VSAT, 2025–2030 (USD MILLION)

TABLE 47

LAND VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FIXED SEGMENT, 2021–2024 (USD MILLION)

TABLE 48

LAND VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY FIXED SEGMENT, 2025–2030 (USD MILLION)

TABLE 49

LAND VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY MOBILE SEGMENT, 2021–2024 (USD MILLION)

TABLE 50

LAND VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY MOBILE SEGMENT, 2025–2030 (USD MILLION)

TABLE 51

VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY MARITIME VSAT, 2021–2024 (USD MILLION)

TABLE 52

VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY MARITIME VSAT, 2025–2030 (USD MILLION)

TABLE 53

VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY AIRBORNE VSAT, 2021–2024 (USD MILLION)

TABLE 54

VSAT (VERY SMALL APERTURE TERMINAL) PLATFORM MARKET, BY AIRBORNE VSAT, 2025–2030 (USD MILLION)

TABLE 55

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 56

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 57

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 58

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 59

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 60

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 61

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 62

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 63

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 64

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 65

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 66

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 67

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 68

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 69

US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 70

US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 71

US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 72

US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 73

US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 74

US: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 75

CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 76

CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 77

CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 78

CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 79

CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 80

CANADA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 81

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 82

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 83

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 84

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 85

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 86

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 87

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 88

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 89

UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 90

UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 91

UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 92

UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 93

UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 94

UK: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 95

FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 96

FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 97

FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 98

FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 99

FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 100

FRANCE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 101

GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 102

GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 103

GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 104

GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 105

GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 106

GERMANY: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 107

REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 108

REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 109

REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 110

REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 111

REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 112

REST OF EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 113

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 114

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 115

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 116

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 117

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 118

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 119

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 120

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 121

CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 122

CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 123

CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 124

CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 125

CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 126

CHINA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 127

INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 128

INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 129

INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 130

INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 131

INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 132

INDIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 133

JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 134

JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 135

JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 136

JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 137

JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 138

JAPAN: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 139

SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 140

SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 141

SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 142

SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 143

SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 144

SOUTH KOREA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 145

REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 146

REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 147

REST OF ASIA PACIFIC VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 148

REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 149

REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 150

REST OF ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 151

MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 152

MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 153

MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 154

MIDDLE EAST VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 155

MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 156

MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 157

MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 158

MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 159

UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 160

UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 161

UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 162

UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 163

UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 164

UAE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 165

SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 166

SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 167

SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 168

SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 169

SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 170

SAUDI ARABIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 171

REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 172

REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 173

REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 174

REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 175

REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 176

REST OF MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 177

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 178

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 179

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 180

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 181

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 182

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 183

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 184

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 185

BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 186

BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 187

BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 188

BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 189

BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 190

BRAZIL: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 191

MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 192

MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 193

MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 194

MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 195

MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 196

MEXICO: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 197

REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 198

REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 199

REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 200

REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 201

REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 202

REST OF LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 203

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 204

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 205

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 206

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 207

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 208

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 209

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 210

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 211

SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 212

SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 213

SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 214

SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 215

SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 216

SOUTH AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 217

NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 218

NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 219

NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 220

NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 221

NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 222

NIGERIA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 223

REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2021–2024 (USD MILLION)

TABLE 224

REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY SOLUTION, 2025–2030 (USD MILLION)

TABLE 225

REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2021–2024 (USD MILLION)

TABLE 226

REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY PLATFORM, 2025–2030 (USD MILLION)

TABLE 227

REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2021–2024 (USD MILLION)

TABLE 228

REST OF AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY END USE, 2025–2030 (USD MILLION)

TABLE 229

KEY DEVELOPMENTS OF LEADING PLAYERS IN VSAT MARKET (DECEMBER 2021−MAY 2025)

TABLE 230

VSAT MARKET: DEGREE OF COMPETITION

TABLE 231

VSAT MARKET: SOLUTION FOOTPRINT

TABLE 232

VSAT MARKET: PLATFORM FOOTPRINT

TABLE 233

VSAT MARKET: TYPE FOOTPRINT

TABLE 234

VSAT MARKET: REGION FOOTPRINT

TABLE 235

VSAT MARKET: LIST OF KEY STARTUPS/SMES

TABLE 236

VSAT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

TABLE 237

VSAT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020–APRIL 2025

TABLE 238

VSAT MARKET: DEALS, JANUARY 2020–APRIL 2025

TABLE 239

VSAT MARKET: OTHERS, DECEMBER 2020−JUNE 2025

TABLE 240

ORBIT COMMUNICATION SYSTEMS LTD.: COMPANY OVERVIEW

TABLE 241

ORBIT COMMUNICATION SYSTEMS LTD.: PRODUCTS OFFERED

TABLE 242

ORBIT COMMUNICATION SYSTEMS LTD.: DEALS

TABLE 243

ORBIT COMMUNICATION SYSTEMS LTD.: OTHERS

TABLE 244

L3HARRIS TECHNOLOGIES INC.: COMPANY OVERVIEW

TABLE 245

L3HARRIS TECHNOLOGIES INC.: PRODUCTS OFFERED

TABLE 246

L3HARRIS TECHNOLOGIES INC.: PRODUCT LAUNCHES

TABLE 247

L3HARRIS TECHNOLOGIES INC.: DEALS

TABLE 248

L3HARRIS TECHNOLOGIES INC.: OTHERS

TABLE 249

VIASAT INC.: COMPANY OVERVIEW

TABLE 250

VIASAT INC.: PRODUCTS OFFERED

TABLE 251

VIASAT INC.: DEALS

TABLE 252

VIASAT INC.: OTHERS

TABLE 253

GILAT SATELLITE NETWORKS LTD.: COMPANY OVERVIEW

TABLE 254

GILAT SATELLITE NETWORKS LTD.: PRODUCTS OFFERED

TABLE 255

GILAT SATELLITE NETWORKS LTD.: PRODUCT LAUNCHES

TABLE 256

GILAT SATELLITE NETWORKS LTD.: DEALS

TABLE 257

GILAT SATELLITE NETWORKS LTD.: OTHERS

TABLE 258

ECHOSTAR CORPORATION: COMPANY OVERVIEW

TABLE 259

ECHOSTAR CORPORATION: PRODUCTS OFFERED

TABLE 260

ECHOSTAR CORPORATION: PRODUCT LAUNCHES

TABLE 261

ECHOSTAR CORPORATION: DEALS

TABLE 262

ECHOSTAR CORPORATION: OTHERS

TABLE 263

COMTECH TELECOMMUNICATIONS CORPORATION: COMPANY OVERVIEW

TABLE 264

COMTECH TELECOMMUNICATIONS CORPORATION: PRODUCTS OFFERED

TABLE 265

COMTECH TELECOMMUNICATIONS CORPORATION: PRODUCT LAUNCHES

TABLE 266

COMTECH TELECOMMUNICATIONS CORPORATION: DEALS

TABLE 267

COMTECH TELECOMMUNICATIONS CORPORATION: OTHERS

TABLE 268

ST ENGINEERING IDIRECT: COMPANY OVERVIEW

TABLE 269

ST ENGINEERING IDIRECT: PRODUCTS OFFERED

TABLE 270

ST ENGINEERING IDIRECT: PRODUCT LAUNCHES

TABLE 271

ST ENGINEERING IDIRECT: DEALS

TABLE 272

ST ENGINEERING IDIRECT: OTHERS

TABLE 273

KVH INDUSTRIES, INC.: COMPANY OVERVIEW

TABLE 274

KVH INDUSTRIES, INC.: PRODUCTS OFFERED

TABLE 275

KVH INDUSTRIES, INC.: PRODUCT LAUNCHES

TABLE 276

KVH INDUSTRIES, INC.: DEALS

TABLE 277

KVH INDUSTRIES, INC.: OTHERS

TABLE 278

GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

TABLE 279

GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

TABLE 280

GENERAL DYNAMICS CORPORATION: DEALS

TABLE 281

GENERAL DYNAMICS CORPORATION: OTHERS

TABLE 282

THALES GROUP: COMPANY OVERVIEW

TABLE 283

THALES GROUP: PRODUCTS OFFERED

TABLE 284

THALES GROUP: DEALS

TABLE 285

THALES GROUP: OTHERS

TABLE 286

HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

TABLE 287

HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

TABLE 288

HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

TABLE 289

HONEYWELL INTERNATIONAL INC.: DEALS

TABLE 290

HONEYWELL INTERNATIONAL INC.: OTHERS

TABLE 291

SINGTEL: COMPANY OVERVIEW

TABLE 292

SINGTEL: PRODUCTS OFFERED

TABLE 293

SINGTEL: PRODUCT LAUNCHES

TABLE 295

SINGTEL: OTHERS

TABLE 296

MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

TABLE 297

MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

TABLE 298

MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 299

MITSUBISHI ELECTRIC CORPORATION: DEALS

TABLE 300

MITSUBISHI ELECTRIC CORPORATION: OTHERS

TABLE 301

ULTRA ELECTRONICS: COMPANY OVERVIEW

TABLE 302

ULTRA ELECTRONICS: PRODUCTS OFFERED

TABLE 303

ULTRA ELECTRONICS: PRODUCT LAUNCHES

TABLE 304

ULTRA ELECTRONICS: DEALS

TABLE 305

ULTRA ELECTRONICS: OTHERS

TABLE 306

SATIXFY COMMUNICATIONS LTD.: COMPANY OVERVIEW

TABLE 307

SATIXFY COMMUNICATIONS LTD.: PRODUCTS OFFERED

TABLE 308

SATIXFY COMMUNICATIONS LTD.: PRODUCT LAUNCHES

TABLE 309

SATIXFY COMMUNICATIONS LTD.: DEALS

TABLE 310

SATIXFY COMMUNICATIONS LTD: OTHERS

TABLE 311

THE MARLINK GROUP: COMPANY OVERVIEW

TABLE 312

THURAYA TELECOMMUNICATIONS COMPANY: COMPANY OVERVIEW

TABLE 313

SPEEDCAST INTERNATIONAL LTD.: COMPANY OVERVIEW

TABLE 314

ND SATCOM GMBH: COMPANY OVERVIEW

TABLE 315

NORSAT INTERNATIONAL INC.: COMPANY OVERVIEW

TABLE 316

NSSL GLOBAL SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

TABLE 317

OMNIACCESS S.L.: COMPANY OVERVIEW

TABLE 318

KYMETA CORPORATION: COMPANY OVERVIEW

TABLE 319

KOGNITIVE NETWORKS: COMPANY OVERVIEW

TABLE 320

VIKING SATCOM LLC: COMPANY OVERVIEW

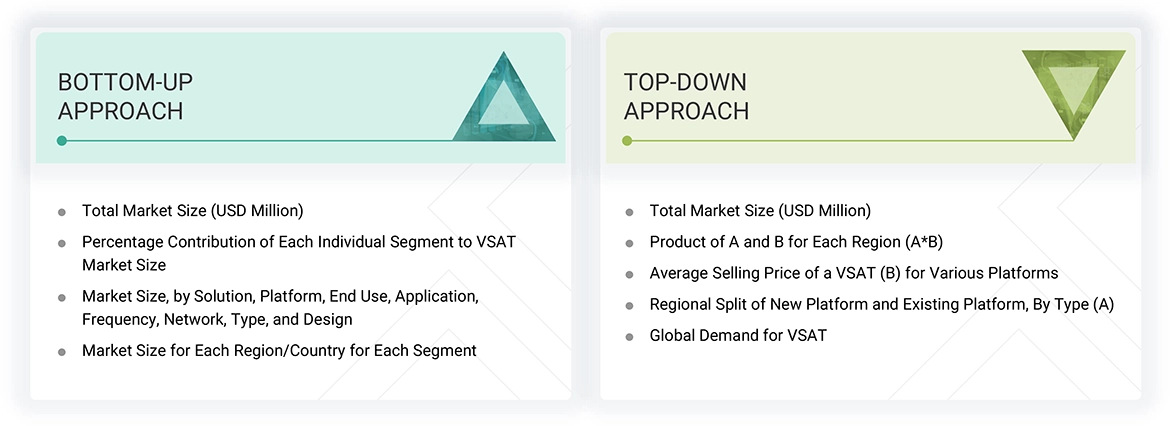

FIGURE 1

RESEARCH PROCESS FLOW

FIGURE 3

MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4

MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5

DATA TRIANGULATION

FIGURE 6

LAND PLATFORM TO LEAD VSAT MARKET IN 2025

FIGURE 7

SUPPORT SERVICES SOLUTION TO DOMINATE MARKET IN 2025

FIGURE 8

BROADBAND/DATA NETWORK SERVICES END USE TO LEAD MARKET IN 2025

FIGURE 9

STAR TOPOLOGY NETWORK TO LEAD MARKET IN 2025

FIGURE 10

NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2025

FIGURE 11

INCREASING NEED FOR HIGH-THROUGHPUT SATELLITE CONNECTIVITY TO DRIVE VSAT (VERY SMALL APERTURE TERMINAL) MARKET

FIGURE 12

BROADBAND/DATA NETWORK SERVICES SEGMENT TO LEAD VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2030

FIGURE 13

SUPPORT SERVICES SEGMENT TO LEAD VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2030

FIGURE 14

STAR TOPOLOGY SEGMENT TO LEAD VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2030

FIGURE 15

KU- BAND SEGMENT TO LEAD VSAT (VERY SMALL APERTURE TERMINAL) MARKET IN 2030

FIGURE 16

VSAT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 17

TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 18

VALUE CHAIN ANALYSIS

FIGURE 19

ECOSYSTEM: VSAT MARKET

FIGURE 20

IMPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 21

EXPORT DATA FOR HS CODE 880260, BY COUNTRY, 2020–2024 (USD THOUSAND)

FIGURE 22

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 PLATFORMS

FIGURE 23

KEY BUYING CRITERIA FOR TOP 3 PLATFORMS

FIGURE 24

VSAT MARKET: IMPACT OF AI/GEN AI

FIGURE 25

AVERAGE SELLING PRICE OF VSAT FOR TOP 3 PLATFORMS, BY KEY PLAYERS, 2024

FIGURE 26

BUSINESS MODELS IN VSAT MARKET

FIGURE 27

EVOLUTION OF TECHNOLOGY

FIGURE 28

TECHNOLOGY ROADMAP, 2020–2025

FIGURE 29

INVESTMENT AND FUNDING SCENARIO, JANUARY 2020–JULY 2025

FIGURE 30

TOTAL COST OF OWNERSHIP

FIGURE 31

BILL OF MATERIALS

FIGURE 32

LIST OF MAJOR PATENTS RELATED TO VSAT MARKET, JULY 2015−JULY 2025

FIGURE 33

STANDARD VSAT TO REGISTER HIGHER CAGR THAN USAT DURING FORECAST PERIOD

FIGURE 34

RUGGED VSAT SEGMENT TO REGISTER HIGHER CAGR THAN NON-RUGGED VSAT SEGMENT DURING FORECAST PERIOD

FIGURE 35

MULTIBAND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 36

HYBRID TOPOLOGY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37

EQUIPMENT SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 38

AIRBORNE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 39

BROADBAND/DATA NETWORK SERVICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 40

TELECOMMUNICATIONS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 41

VSAT (VERY SMALL APERTURE TERMINAL) MARKET, BY REGION, 2025–2030

FIGURE 42

NORTH AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

FIGURE 43

EUROPE: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

FIGURE 44

ASIA PACIFIC: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

FIGURE 45

MIDDLE EAST: VSAT (VERY SMALL APERTURE TERMINAL) MARKET

FIGURE 46

LATIN AMERICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

FIGURE 47

AFRICA: VSAT (VERY SMALL APERTURE TERMINAL) MARKET SNAPSHOT

FIGURE 48

REVENUE ANALYSIS FOR KEY COMPANIES IN VSAT MARKET, 2020–2024

FIGURE 49

MARKET SHARE OF KEY PLAYERS, 2024

FIGURE 50

COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

FIGURE 51

VSAT MARKET: COMPANY FOOTPRINT

FIGURE 52

COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

FIGURE 53

BRAND/PRODUCT COMPARISON

FIGURE 54

FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

FIGURE 55

VALUATION OF PROMINENT MARKET PLAYERS

FIGURE 56

ORBIT COMMUNICATION SYSTEMS LTD.: COMPANY SNAPSHOT

FIGURE 57

L3HARRIS TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 58

VIASAT INC.: COMPANY SNAPSHOT

FIGURE 59

GILAT SATELLITE NETWORKS LTD.: COMPANY SNAPSHOT

FIGURE 60

ECHOSTAR CORPORATION: COMPANY SNAPSHOT

FIGURE 61

COMTECH TELECOMMUNICATIONS CORPORATION: COMPANY SNAPSHOT

FIGURE 62

ST ENGINEERING IDIRECT: COMPANY SNAPSHOT

FIGURE 63

KVH INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 64

GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

FIGURE 65

THALES GROUP: COMPANY SNAPSHOT

FIGURE 66

HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 67

SINGTEL: COMPANY SNAPSHOT

FIGURE 68

MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 69

SATIXFY COMMUNICATIONS LTD.: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in VSAT Market