Ventilators Market: Growth, Size, Share, and Trends

Ventilators Market by Mobility (Intensive Care Ventilators, Transportable Ventilators), Type (Adult & Pediatric Ventilators), Interface (Hybrid Ventilation), Mode (Combined Mode Ventilation), Care Setting (Hospitals & Clinics) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ventilators market is witnessing steady growth, driven by the rising prevalence of chronic respiratory diseases such as COPD and asthma, and the increasing number of ICU admissions post-COVID-19. The expanding geriatric population, which is more prone to respiratory ailments, further supports market demand.

KEY TAKEAWAYS

- Asia Pacific is expected to register the highest CAGR of 5.2%.

- By Type, Intensive Care Ventilators segment dominated the market, with a share of 75.0% in 2024

- By Age Group, Adult/pediatric Ventilators segment dominated the market, with a share of 77.4% in 2024

- By Interface, Hybrid Ventilation will be the fastest-growing segment in the forecast period.

- By Mode, Combined-mode Ventilation segment dominated the market, with a share of 41.5% in 2024

- By Care Setting, Home Care Settings is expected to register the highest CAGR of 5.5%.

- Resmed, Getinge AB, and Philips were identified as Star players in the plant-based supplements market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

- Skanray Technologies, Noccarc Robotics Pvt Ltd, and AgVa Healthcare have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy

The need for both invasive and non-invasive ventilator systems has increased with the rapidly growing geriatric population and increasing rates of respiratory diseases such as pneumonia, ARDS, and COPD. Additionally, advancements in technology, including the development of portable, non-invasive, and AI-integrated ventilators, are enhancing patient care and operational efficiency, boosting adoption across hospitals, home care settings, and emergency medical services globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ventilators market is experiencing notable trends and disruptions that are reshaping customer needs and revenue streams. A clear shift is underway from traditional revenue sources to new, innovative solutions, driven by advancements in ventilator technologies such as high-end, mid-end, and basic ICU ventilators. These changes are influenced by broader healthcare trends, including a rising prevalence of respiratory diseases, growth in the geriatric population, increased demand for home care settings, and a surge in premature births and infectious respiratory illnesses. These factors are prompting healthcare providers to adopt more versatile and advanced ventilation modes—such as combined-mode, volume-mode, and pressure-mode ventilation—leading to significant changes in how care is delivered and how businesses operate in this evolving market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in respiratory diseases

-

Urbanization and rising pollution levels

Level

-

Shortage of skilled medical workers

-

Excessive purchase of ventilators during COVID-19

Level

-

Cost-efficiency of home care services

-

Growth opportunities in emerging economies

Level

-

Low awareness and inadequate resources in emerging economies

-

Harmful effects of respiratory devices on neonates

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing incidences of COPD and asthma

The two most common respiratory illnesses globally are COPD and asthma. According to the WHO, COPD ranks as the fourth highest cause of mortality in the US. Nearly 11.7 million American adults suffer from COPD. One of the major reasons for morbidity and mortality, COPD has an estimated cost of USD 50 billion every year (Source: American Lung Association). COPD is the fourth most common cause of death globally, having caused 3.5 million deaths in 2021, or approximately 5% of all deaths globally. (Source: WHO). In countries and regions such as China, India, Brazil, and Eastern Europe, a considerable proportion of individuals with COPD remain misdiagnosed. A few of the precipitating factors for COPD are long-standing asthma, long-term exposure to smoke, indoor and outdoor air pollution, and occupational dust and fumes. Other comorbid chronic conditions like cardiovascular disease, musculoskeletal impairment, and diabetes mellitus are related to COPD. These diseases may also influence the health status of patients, along with the management of COPD. According to Asthma and Allergy Foundation of America (AAFA), there are nearly 28 million individuals living in the US with asthma as of 2024, or roughly 1 in every 12 persons. There are almost 23 million US adults above the age of 18 years with asthma. By 2025, there are 100 million additional asthmatic patients who will be enrolled all over the world. As per European Respiratory Review, almost 10 million individuals above 45 years are living with asthma. It is estimated that up to 1,000 people die from asthma every day. Both COPD and asthma lead to the constriction of respiratory tracts, which causes breathing to be challenging. Hence, most patients with COPD and asthma need external airway management and ventilation. Consequently, the increase in the number of patients with COPD and asthma is likely to propel the demand for ventilators.

Restraint: Reimbursement Concerns

Most patients depend on reimbursements for getting treated. Medicare Part B in the US pays for medically necessary durable medical equipment, such as ventilators. Medicare has classified devices featuring exhalation valves, adjustable ventilator rates, and alarms as mechanical ventilators. Medicare covers ventilators for managing restrictive thoracic diseases, neuromuscular diseases, chronic respiratory failure, and COPD. Ventilators fall into the Frequently & Substantially Serviced payment category of Medicare. Consequently, Medicare reimburses this category on a monthly rental basis, and patients medically need the equipment for an extended period of time. Medicare does not pay anything for the purchase, nor does it cover any other accessories required for ventilators, including humidifiers. As per the Centers for Medicare & Medicaid Services, a home ventilator (HCPCS code E0465) with the invasive and non-invasive interface can be reimbursed monthly around USD 934- 1,099; however, average invasive ventilation is about USD 200,000 per year with 24-hour care. There is, therefore, a major disparity between patient and caregiver expense and reimbursement made. This is one of the major factors curbing the development of the ventilators market.

Opportunity: Cost efficiency of home care services

Rising healthcare expenses have led to a change in patient preference towards home-based therapies. Devices like nebulizers, ventilators, and continuous positive airway pressure (CPAP) machines are utilized by patients to diagnose, treat, and monitor different respiratory conditions in home care environments. These devices, coupled with home care services, offer economical healthcare to patients. The increasing growth in the world's geriatric population, increasing prevalence of respiratory conditions (such as COPD and asthma), and the cost-effectiveness of home care equipment and services (in comparison to hospital visits) are the major drivers for the home healthcare market. Additionally, the high growth opportunities in emerging markets, decentralization of healthcare, and the development of miniaturized devices are the other key drivers likely to offer tremendous growth opportunities to ventilator products and services providers for home care environments. Convenience and comfort received in home care environments will sooner or later expand demand for transport ventilators. Home care would seek to reduce morbidity, enhance survival, facilitate self-care & autonomy, and enhance the quality of life. Based on patient criticality, different types of respiratory devices are used in order to deal with pain relief as well as emotional comfort. Following the inclusion of devices within home care, global healthcare costs would be eliminated chiefly by eliminating short-term hospital stay in acute care. COPD, cystic fibrosis, and paralytic syndromes patients have high respiratory care needs. With the increasing trend towards home care therapies, firms are coming up with dedicated home care services, including resupply systems and rental services. CHI Health (US) offers cost-effective devices that allow patients to get care and treatment in a comfortable and safe home setting. In the same way, sleep apnea therapy devices require maintenance and replacement to ensure comfortable and effective therapy. Self-medication devices, including oxygen concentrators, inhalers, and nebulizers, are utilized in home care services. When the patient is in a critical state, certain hospitals offer respiratory therapists and nurses who attend to patients, including oxygen therapy and airway management/tracheostomy care. These situations will improve patient outcomes and will motivate businesses to create homecare respiratory care devices in the near future

Challenge: Supply chain disruptions

The ventilators industry was severely hit by supply chain disruptions following the COVID-19 pandemic. The sudden spike in worldwide demand for ventilators, necessitated by the urgent need to ventilate seriously ill COVID-19 patients, revealed weaknesses in the supply chain of these lifesaving machines. With global supply chain disruptions, companies were finding it difficult to procure key components and materials such as valves, sensors, and electronic parts. Most of these materials were obtained from areas that were greatly affected by the pandemic, causing production delays and shortages. More competition for the materials and the resources strained supply chains further, and it was difficult for other producers to keep pace with the exploding demand. Logistical disturbances also entered the picture. Transport curbs, border closure, and reduced airfreight capacity made it difficult to deliver ventilators on schedule to health institutions around the world. This created a challenge for the availability of ventilators and made servicing and maintenance of existing ones challenging. Consequently, the governments and medical professionals have moved to diversify their avenues for ventilator sources, advance in-house capability in producing domestic ventilators, and invest in the resilience of their supply chain so that future medical emergencies do not catch them unprepared. The disruptions revealed a need to achieve greater interaction among governments, producers, and logistic providers for faster delivery of crucial medical items when emergencies are around.

Ventilators Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Non-invasive ventilators and cloud-connected devices for sleep apnea, COPD, and home-based respiratory care | Enhance patient comfort, support long-term respiratory therapy at home, enable remote monitoring, and reduce hospital admissions. |

|

ICU ventilators and advanced life-support systems for invasive and non-invasive ventilation in critical care | Improve patient outcomes in acute care settings, offer advanced lung-protective modes, and ensure adaptability across a wide range of clinical scenarios. |

|

Full-spectrum ventilators for neonatal, pediatric, and adult ICU applications with integrated safety features | Provide precision ventilation with lung-protective strategies, ensure patient safety, and support tailored weaning processes across age groups. |

|

Hybrid ventilators and portable systems with AI-based decision support and remote connectivity | Enable adaptive ventilation strategies, improve operational efficiency, support telehealth integration, and personalize patient care. |

|

Ventilation solutions integrated with critical care systems for seamless respiratory and hemodynamic support | Enhance clinical workflow efficiency, ensure reliable respiratory support in complex ICU environments, and reduce equipment interface complications. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the ventilators market comprises elements present in this market and defines these elements with a demonstration of the bodies involved. It includes manufacturers, distributors, research & product developers, and end users. Manufacturers include organizations involved in the entire process of research, design, product development, optimization, and launch. Distributors include third parties and e-commerce sites linked to the organization for the marketing of medical devices. Research & product developers include in-house research facilities of organizations, contract research organizations, and contract development and manufacturing organizations, which play an important role in outsourcing research for product development. End users include patients who use ventilators. On the other hand, investors/funders and health regulatory bodies are the major influencers in this market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Ventilators Market, By Type

Intensive care ventilators hold the largest share of the ventilators market, driven by their essential role in treating critically ill patients with severe respiratory conditions such as ARDS, COPD, and COVID-19. These ventilators offer advanced features like precise monitoring, multiple ventilation modes, and adaptability across neonatal, pediatric, and adult patients. Their widespread use in hospitals and ICUs, along with the rising prevalence of chronic respiratory diseases and increasing demand for critical care infrastructure, further supports their dominant market position.

Ventilators Market, By Age Group

Adult/pediatric ventilators hold the largest share of the ventilators market due to their versatility and wide applicability across a broad patient population. These devices are extensively used in hospitals, emergency care, and home healthcare settings to support patients with respiratory failure, chronic lung diseases, or during post-operative recovery. Their ability to cater to both adult and pediatric patients with customizable settings enhances clinical efficiency. Growing respiratory disease prevalence and the need for flexible, scalable ventilation solutions continue to drive demand in this segment.

Ventilators Market, By Interface

Hybrid ventilation holds the largest share of the ventilators market due to its ability to combine multiple ventilation modes, offering greater flexibility and adaptability for diverse patient needs. This technology supports both invasive and non-invasive ventilation, making it suitable for various clinical settings, including ICU, emergency, and home care. The growing demand for personalized respiratory support, advancements in ventilator technology, and rising prevalence of respiratory diseases contribute to the increasing adoption of hybrid ventilators, solidifying their dominant position in the market.

Ventilators Market, By Mode

Combined-mode ventilation holds the largest share of the ventilators market due to its ability to integrate both volume-controlled and pressure-controlled ventilation modes, offering clinicians enhanced flexibility in managing complex respiratory conditions. This mode is particularly valuable in ICU settings, where patient needs can rapidly change. Its adaptability across a wide range of clinical scenarios, including acute respiratory distress and post-operative care, has led to widespread adoption. The increasing demand for advanced, personalized ventilation strategies continues to drive the dominance of combined-mode systems in the market.

Ventilators Market, By Care Setting

Hospitals hold the largest share of the ventilators market due to their central role in providing critical care for patients with severe respiratory conditions. Equipped with intensive care units and advanced medical infrastructure, hospitals are the primary setting for the use of high-end ventilators, especially for emergency, surgical, and post-operative care. The rising incidence of respiratory diseases, growing number of ICU admissions, and ongoing demand for advanced life-support systems further strengthen hospitals’ dominant position as the key end users in the ventilator market.

REGION

Asia Pacific to be fastest-growing region in global ventilators market during forecast period

The Asia Pacific region is likely to experience the highest growth rate in the ventilators market as a result of a combination of dynamic forces. Increasing respiratory ailments, compounded by pollution and an aging population, strongly drive demand for sophisticated respiratory support. Market potentials sare also supplemented by the rapid investments in healthcare infrastructure, including the construction of intensive care units and critical care centers. Additionally, pro-government laws and an increase in the application of innovative technologies such as IoT integration and AI-based monitoring enhance patient value and device performance. The growth path of the region is further supplemented by local production and low-cost production models in key countries such as China and India.

Ventilators Market: COMPANY EVALUATION MATRIX

In the ventilators market, ResMed (Star) has a strong and established product portfolio and a vast geographic presence. Asahi Kasei Corporation (Emerging Leader) has substantial product innovations compared to its competitors. While they have broad product portfolios, they do not have a strong growth strategy for business development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 (Value) | USD 3.71 BN |

| Revenue Forecast in 2029 (Value) | USD 4.65 BN |

| Growth Rate | 4.70% |

| Years Considered | 2023–2029 |

| Base Year | 2024 |

| Forecast Period | 2025–2029 |

| Units Considered | Value (USD MN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Intensive Care Ventilators and Portable/transportable Ventilators By Age Group: Adult/pediatric Ventilators and Neonatal/infant ventilators By Interface: Invasive Ventilation, Non-invasive ventilation, Hybrid Ventilation By Mode: Combined-mode Ventilation, Volume-mode Ventilation, Pressure- mode Ventilation and Others By Care Setting: Hospitals & Clinics, Home Care Settings, Ambulatory care centers, Emergency medical services |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

WHAT IS IN IT FOR YOU: Ventilators Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of ventilator types: Invasive, Non-Invasive, Transport, Pediatric, High-Frequency. Coverage of features (AI integration, portability, interface options, advanced monitoring), with details for home care, critical care, and emergency use. | Analysis of technological advancements (smart, portable ventilators, AI-based algorithms, IoT monitoring, compact designs), and new use cases (outside hospital settings, home care, neonatology) . |

| Company Information | Profiles of leading ventilator manufacturers: Medtronic, GE Healthcare, Philips, Drägerwerk, Hamilton Medical, ResMed, Getinge, Fisher & Paykel, Vyaire Medical, Smiths Group, Mindray, ACUTRONIC, Nihon Kohden, and others. | Market share benchmarking and SWOT analysis of top 3–5 companies across North America, Europe, Asia Pacific, Middle East, and key local players. Recent innovations and competitive strategies highlighted . |

| Geographic Analysis | Detailed regional analysis of North America, Europe, Asia Pacific (with a focus on China and India), Latin America, Middle East, and Africa. Segmentation by demand in urban vs. rural, and public vs. private healthcare. | Country-level sizing and growth forecasts for major and emerging markets such as US, Germany, Japan, China, India, and Brazil, with insights on local production trends, demand drivers, and regulatory impacts . |

RECENT DEVELOPMENTS

- October 2024 : Nihon Kohden America announced the availability of the NKV-440 Ventilator System. Previously offered through Nihon Kohden’s subsidiary, OrangeMed, this hybrid ventilator is now accessible to a broader range of healthcare providers.

- November 2023 : Flexicare (Group) Limited (UK) acquired Allied Medical LLC (US). This acquisition allowed Flexicare to expand into new areas such as Medical Gas Systems, Emergency Products, Transport Ventilators, Suction Regulators & Aspirators, CO2 Absorbent, and Home Healthcare products, with well-established brands such as Chemetron, Gomco, Lif-O-Gen, Timeter, Schuco, Vacutron, B&F Medical, Carbolime, and LithoLyme

- August 2023 : Drägerwerk AG & Co. KGaA initiated a worldwide voluntary recall notification for Dräger Carina SubAcute Care Ventilators to address possible contamination of the breathing gas with 1,3- Dichloropropan-2-ol, a constituent of the PE-PUR foam used for sound insulation.

- March 2024 : Inspira Technologies OXY B.H.N Ltd., a pioneer in life support technology, introduced the Liby System. This advanced life support system is designed to treat patients with life-threatening heart and lung failure.Getinge donated extensive medical equipment to Ukraine. The donation, made in collaboration with the Ministry of Health Ukraine, includes a significant number of anesthesia machines and ventilators aimed at directly improving healthcare and increasing the country’s resilience against the challenges of war.

Table of Contents

Methodology

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Ventilators market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Ventilators market. Primary sources from the demand side included hospitals, clinics, researchers, lab technicians, purchase managers etc, and stakeholders in corporate & government bodies.

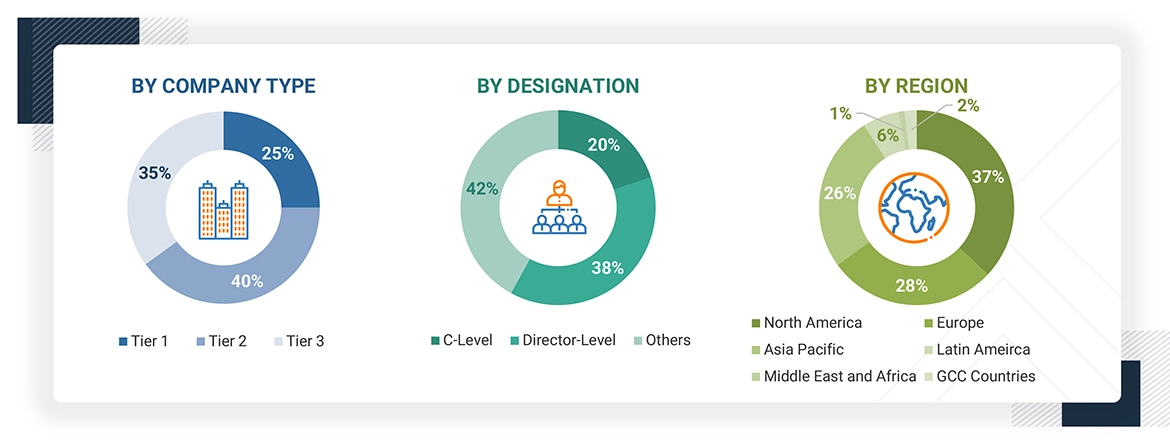

A breakdown of the primary respondents for Ventilators market (supply side) market is provided below:

Note 1: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Other primaries include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

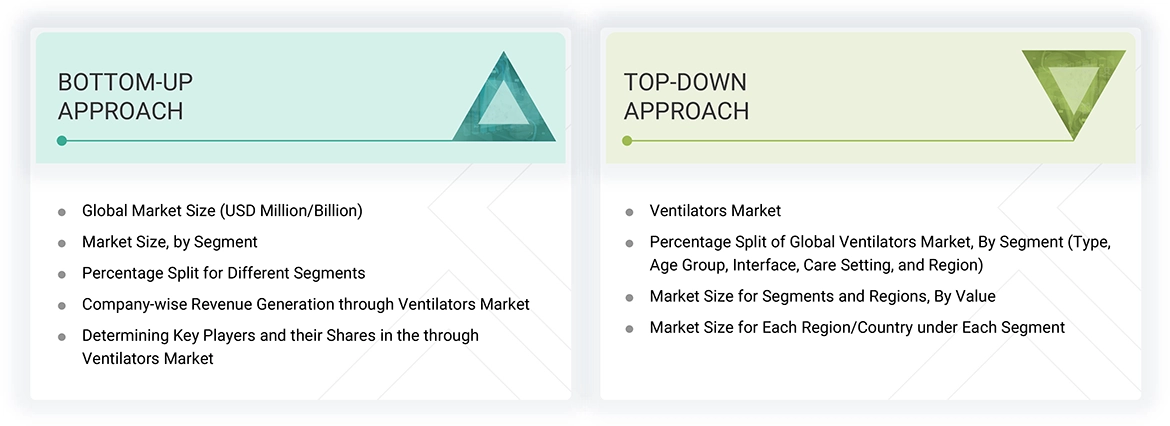

Market Size Estimation

The market size for Ventilators market was calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for Ventilators market was calculated using data from three distinct sources, as will be discussed below:

VentilatorsMarket: Bottom-up Approach & Top-Down Approach

Data Triangulation

The entire market was split up into five segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of Ventilators. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Ventilators are medical devices that assist or replace spontaneous breathing in patients with respiratory failure by mechanically delivering air and oxygen to the lungs. They can operate invasively—via intubation—or non-invasively using masks, and are essential in settings like intensive care units, emergency departments, and home care for improving patient oxygenation and respiratory support.

Stakeholders

- Manufacturers of ventilators

- Original equipment manufacturing companies

- Suppliers and distributors of ventilators

- Healthcare service providers

- Teaching hospitals and academic medical centers

- Health insurance players

- Government bodies/municipal corporations

- Regulatory bodies

- Business research and consulting service providers

- Authorities framing reimbursement policies for ventilators

- Venture capitalists

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the ventilators market based on type, age group, interface, mode, care setting and region.

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall ventilators market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the ventilator market in North America, Europe, the Asia Pacific, Latin America, Middle East & Africa and GCC Countries

- To profile the key players and comprehensively analyze their market shares and core competencies in the ventilators market

- To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, product launches, agreements, and other developments in the ventilators market

- To benchmark players within the ventilators market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Ventilators Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Ventilators Market