AI Detector Market Size, Size, Growth & Latest Trends

AI Detector Market by Offering (Platform, API/SDKs), Detection Modality (AI Generated Text, Image, Video, Voice, Code), Application (Academic Integrity, Plagiarism Detection, Deepfake Detection, Content Authenticity Assessment) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI detector market is undergoing rapid expansion, with estimates projecting a substantial market value surge from approximately USD 0.58 billion in 2025 to USD 2.06 billion by 2030 at a 28.8% CAGR. The market is gaining strong momentum as demand from academic institutions for plagiarism and integrity tools increases. With students increasingly using generative AI, universities and schools are adopting advanced detectors to ensure originality in assignments, safeguard academic standards, and maintain fair evaluation practices. At the same time, election bodies and civic platforms are increasingly adopting AI detectors to safeguard democratic integrity, screening misinformation, synthetic media, and undisclosed AI-authored text. The International Panel on the Information Environment (IPIE) reports that in 2024, AI was used in elections in over 80% of countries, mainly for AI-generated content creation (90% of incidents), often to misguide voters or defame candidates with tailored misinformation such as deepfakes. Together, provenance verification and election integrity checks are emerging as critical drivers, positioning AI detection as an essential safeguard in both commercial and civic ecosystems.

KEY TAKEAWAYS

- North America is estimated to hold the largest market share (33.48%) of the global AI detector market in 2025.

- By offering, the no-code or Iow-code ML tools segment is expected to register the highest CAGR of 38.9% during the forecast period.

- By detection modality, the Al-generated audio & voice segment is expected to register the highest CAGR of 32.696 during the forecast period.

- Based on application, the academic integrity segment is positioned to account for the largest market share.

- By end users, education end users are projected to register the largest market size in 2025.

- Companies such as Turnitin, Grammarly, and Pindrop were identified as some of the star players in the AI detector Market, given their strong market share and product footprint.

- Companies Perfios, ZeroGPT, and AI or Not, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The proliferation of generative AI across education, media, and enterprise sectors is a key driver of the AI detector market, as institutions and businesses increasingly require tools to ensure originality, maintain credibility, and uphold integrity in digital outputs. At the same time, the escalating risk of deepfakes, disinformation, and synthetic fraud is creating urgent demand for reliable detection technologies to safeguard trust in communication, protect brand reputation, and support compliance with tightening regulations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of AI detection providers, and target applications are the clients of AI detection providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of AI detection providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Cross-platform Content Dissemination Fuelling Multi-format AI Detection Adoption

-

•Surge in Low-cost AI Generators Accelerating Demand for Counter-detection Tools

Level

-

•High False Positive Rates Damaging Legitimate Creator Trust

-

•Vulnerability to Paraphrasing and Homoglyph Attacks

Level

-

•Expansion into Real-time API Integrations for Chatbots and Collaboration Tools

-

•Radioactive Data Tracing for Enhanced AI Output Attribution

Level

-

§Limited Explainability of Content Flagging Decisions

-

§Competitive Disadvantage of Small Vendors Against Rapidly Advancing Big Tech AI Capabilities

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Cross-platform content dissemination fueling adoption of AI detectors

Cross-platform content dissemination is a major driver for the adoption of AI detectors as enterprises look to maintain trust and authenticity in digital communications. The rapid rise of generative AI has made it possible to create synthetic text, images, video, and audio at scale, making it clear that detection systems can no longer focus on a single content format. Organizations are increasingly investing in integrated solutions that can work across multiple digital environments, such as social media platforms, advertising networks, customer engagement tools, and enterprise collaboration systems. This shift reflects the need for unified governance and brand protection strategies, where businesses want detection tools that not only identify synthetic content but also scale effectively to keep up with its growing volume. Vendors are responding by developing modular, cross-format detection platforms that combine interoperability with proactive risk management.

Restraint: High false positive rates damaging legitimate creator trust

One of the key restraints in the AI detector market is the high rate of false positives, which continues to undermine trust among legitimate creators and slow down broader adoption. When AI detection tools label authentic content as synthetic, it creates reputational and operational risks for users across sectors such as education, advertising, and digital platforms. This not only damages creator confidence but also reduces the perceived return on investment for organizations deploying these solutions. Vendors face growing pressure to strike the right balance between detection sensitivity and precision, as overly strict algorithms can erode the very trust they are designed to safeguard.

Opportunity: API-Based Detectors Embeddable into SaaS Platforms

Demand for API-based detectors embeddable into SaaS platforms is becoming one of the most attractive opportunities in the AI detector market as enterprises increasingly require seamless integration of content authenticity checks into existing workflows. SaaS adoption continues to expand across industries such as marketing, publishing, education, and customer engagement, creating strong pull for plug-and-play detection capabilities that can be embedded without disrupting operations. APIs and SDKs allow vendors to position their detectors as infrastructure-level enablers, supporting real-time verification within CMS, CRM, LMS, collaboration platforms, and even developer toolchains. For decision makers, this opportunity translates into faster time-to-value, reduced deployment complexity, and lower switching costs, while also enabling scalable compliance with emerging AI disclosure and provenance requirements.

Challenge: Generative Models Outsmart Detection Systems

Adversarial evasion as generative models learn to bypass detectors has become one of the most complex challenges shaping the AI detector market, influencing vendor strategies, enterprise risk frameworks, and long-term adoption priorities. As language models, diffusion systems, and multimodal generators advance, they are increasingly designed with techniques such as paraphrasing, and adversarial training that mimic human patterns and evade traditional detection signals like watermarking or statistical anomalies. This evolving capability creates a cycle where detectors must constantly adapt, raising the cost of R&D while driving enterprises to seek solutions that provide resilience and reliability rather than short-term accuracy.

AI detector market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

IZZ2IZZ’s content protection upgraded to enterprise level through Copyleaks | Copyleaks integration elevated IZZ2IZZ’s content protection to enterprise level, instilling market trust and positioning the platform as a blockchain leader. Clients gained confidence in original-content verification, while IZZ2IZZ maintained competitive transaction pricing and fortified its reputation for innovation and customer satisfaction. |

|

Verifiedhuman partnered with Originality.ai to empower educators in authenticity verification | Originality.ai provided accurate differentiation between AI- and human-authored text, enabling VerifiedHuman to advance its comprehensive study. Educators gain actionable insights into writing authenticity, and the movement solidifies its role in shaping industry standards for content authenticity. |

|

Highrise partnered with Hive Moderation to safeguard and scale its virtual community | By automating moderation with Hive’s AI, Highrise achieved faster review times and improved user safety, supporting sustainable platform growth. The reliable detection of inappropriate and synthetic content fostered user trust, reduced operational burdens, and enabled Highrise to focus on expanding its virtual community experience qualitatively and securely. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI detector ecosystem is evolving rapidly, addressing the growing need to identify and validate content across multiple modalities. It covers solutions for detecting AI-generated text, audio and voice, images and videos, code, as well as integrated multimodal content. These technologies are becoming critical in combating misinformation, preventing misuse of generative models, and ensuring authenticity in digital communication. As enterprises and regulators seek trustworthy tools, the ecosystem provides a structured view of how detection capabilities are being specialized and expanded to secure content integrity across industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI Detector Market, By Offering

The platform segment is estimated to capture the largest market share in 2025, reflecting growing enterprise preference for integrated, scalable AI detection solutions. Platforms provide end-to-end capabilities such as real-time monitoring, multimodal detection, and seamless integration with existing systems. This dominance is driven by the rising need for centralized solutions that offer reliability, scalability, and broad applicability across industries, including education, media, and government. Platforms are seen as future-ready, enabling enterprises to respond quickly to evolving risks of AI-generated content.

AI Detector Market, By Detection Modality

The AI-generated audio & voice detection segment is set to grow at the fastest rate between 2025 and 2030, fueled by the increasing threat of voice cloning and AI-driven impersonation. With deepfake audio being used in fraud, misinformation, and cyberattacks, businesses and governments are prioritizing advanced voice detection solutions. This growth is also supported by rising adoption in financial services, telecommunications, and security-sensitive industries. The demand for accurate, real-time detection tools is driving investment in this modality, making it the most dynamic segment.

AI Detector Market, By Application

The academic integrity application segment continues to dominate the AI detector market, accounting for a significant share in 2024. The widespread use of generative AI in assignments and assessments has accelerated the adoption of detection tools in schools, universities, and online learning platforms. Academic institutions are increasingly investing in AI detectors to maintain trust, fairness, and compliance with educational standards. With global awareness rising around plagiarism and AI-generated submissions, this application segment is expected to remain a cornerstone of the market.

AI Detector Market, By End User

The education sector is estimated to lead as the top end user in 2025, reflecting its urgent need to address challenges posed by generative AI in classrooms. Schools, universities, and e-learning providers are deploying AI detectors to safeguard academic integrity, improve assessment quality, and reduce misuse of AI writing tools. With AI usage among students rapidly increasing, the education sector has become a critical testing ground for detection technologies, reinforcing its role as the dominant end-user segment in the near future.

REGION

Asia Pacific to be fastest-growing region in global AI Detector Market during forecast period

The Asia Pacific region is expected to record the highest CAGR in the AI detector market during 2025–2030, driven by rapid adoption of AI tools in education, government, and enterprise sectors. Countries like China, India, Japan, and South Korea are leading with investments in AI governance and content authenticity solutions. Rising concerns over misinformation, deepfakes, and AI-generated text are pushing demand for detection tools, supported by favorable government initiatives and a growing base of digital users.

AI detector market: COMPANY EVALUATION MATRIX

In the AI detector market, Turnitin is positioned as a Star player, reflecting its strong product footprint and high market share, driven by its established presence in academic integrity solutions and recent AI-detection tools. Reality Defender is highlighted as an Emerging Leader, showcasing rapid innovation and growth potential, particularly in deepfake and multimedia content detection. This positioning indicates Turnitin’s maturity and dominance, while Reality Defender is gaining traction as a promising player in an expanding market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.43 Billion |

| Market Forecast in 2030 (Value) | USD 2.06 Billion |

| Growth Rate | 28.80% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Units Considered | USD Mn |

| Report Coverage | Company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: AI detector market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- May 2025 : Grammarly launched Grammarly Pro as a unified platform replacing Premium and Business tiers, offering flexible subscriptions for individuals and teams with enhanced AI prompt allowances and team collaboration features.

- May 2025 : Copyleaks launched Copyleaks AI Logic, a first-of-its-kind transparent AI detection solution that explains detection reasoning through AI Phrase analysis and AI Source Match identification across major LMS platforms.

- March 2025 : Stanford Libraries' Office of Scholarly Communications implemented iThenticate AI detection service from Turnitin to help faculty review research papers for AI-generated content before publication.

- March 2025 : Quillbot expanded AI Detector support to six languages (English, Spanish, French, German, Dutch, Portuguese) with optimized detection accuracy and localized reporting interfaces.

- January 2025 : The Internet Watch Foundation partnered with Hive Moderation to integrate IWF datasets, including URL lists, keyword lists, and CSAM hashes into Hive content moderation APIs. The collaboration enables all Hive customers to access IWF child safety resources through a single integrated platform.

Table of Contents

Methodology

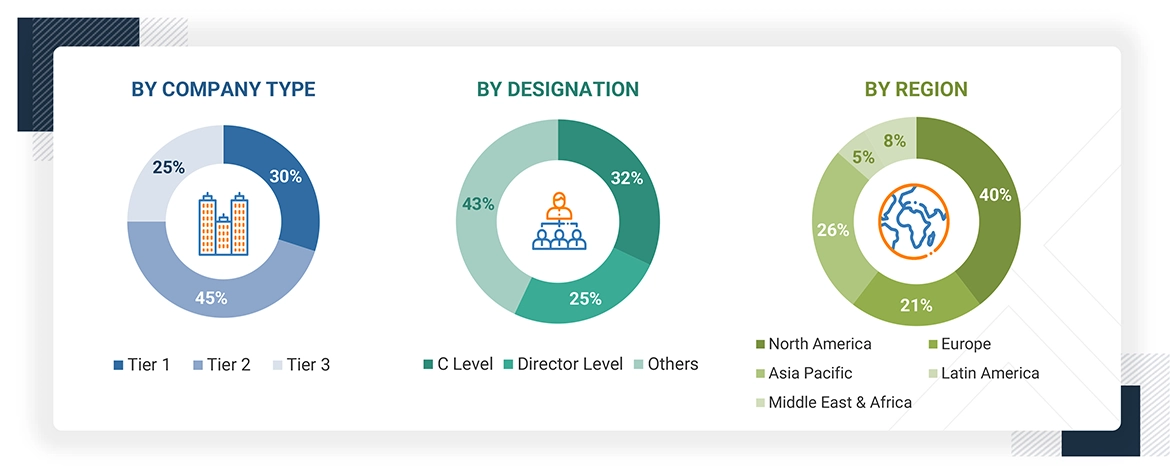

The research study for the AI detector market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred AI detector providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as AI conferences and related magazines. Additionally, the AI detector spending of various countries was extracted from respective sources. Secondary research was used to obtain key information about the industry’s supply chain to identify key players by solution, market classification, and segmentation according to the offerings of major players and industry trends related to offerings, detection modality, application, end user, and regions, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs) and vice Presidents (VPs); directors from business development, marketing, and AI detector expertise; related key executives from AI detector offering vendors, SIs, managed service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to offerings, detection modality, application, end users, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AI detector solutions, were interviewed to understand the buyer’s perspective on suppliers, products, and their current usage of AI detector solutions, which would impact the overall AI detector market.

Note: Tier 1 companies account for annual revenue of >USD 10 billion; tier 2 companies’ revenue ranges between

USD 1 and 10 billion; and tier 3 companies’ revenue ranges between USD 500 million–USD 1 billion

Note: Other designations include vice presidents, product managers, and other designations.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

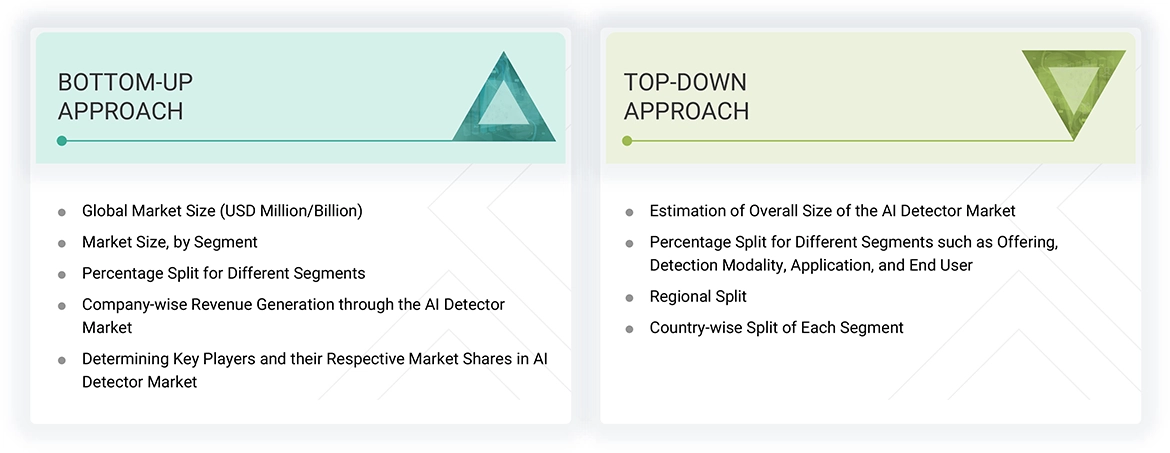

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the AI detector market. The first approach involves estimating the market size by summing up In the top-down approach, an exhaustive list of all the vendors offering solutions in the AI detector market was prepared. The revenue contribution of the market vendors was estimated through press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions according to offering, detection modality, applications, and end users. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of AI detector solutions among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of AI detector solutions among industries, along with different use cases with respect to their regions, was identified and extrapolated. Use cases identified in different regions were given weightage for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the AI detector market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major AI detector providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall AI detector market size and the segments’ size were determined and confirmed using the study.

AI Detector Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

An AI detector refers to software and tools that detect, verify, or classify whether text, image, video, audio, or code content has been created or significantly influenced by generative AI models.

Stakeholders

- AI detector providers

- Third-party administrators

- Business analysts

- Cloud service providers

- Consulting service providers

- Enterprise end users

- Distributors and value-added resellers (VARs)

- Government agencies

- Independent software vendors (ISVs)

- Market research and consulting firms

- Support & maintenance service providers

- System integrators (SIs)/Migration service providers

- Technology providers

Report Objectives

- To define, describe, and forecast the AI detector market by offering, detection modality, application, and end user

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AI detector market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for the five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the AI detector market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup for any requested countries beyond those already covered in the North American AI detector market

- Further breakup for any requested countries beyond those already covered in the European AI detector market

- Further breakup for any requested countries beyond those already covered in the Asia Pacific AI detector market

- Further breakup for any requested countries beyond those already covered in the Middle East & African AI detector market

- Further breakup for any requested countries beyond those already covered in the Latin American AI detector market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is AI detector?

An AI detector refers to software and tools that detect, verify, or classify whether text, image, video, audio, or code content has been created or significantly influenced by generative AI models.

What is the total CAGR expected to be recorded for the AI detector market during 2025-2030?

The AI detector market is expected to record a CAGR of 28.8% from 2025 to 2030.

Which are the key drivers supporting the growth of the AI detector market?

The key factors driving the growth of the AI detector market include cross-platform content dissemination fueling multi-format AI detection adoption, a surge in low-cost AI generators accelerating demand for counter-detection tools, brand safety mandates driving AI-powered ad content verification, and advertiser-led misinformation control on social platforms boosting detector deployment.

Which are the top end users prevailing in the AI detector market?

The leading end users in terms of AI detector deployment include BFSI, healthcare & life sciences, media & entertainment, education, legal, software & technology providers, consumers, and government & defense.

Who are the key vendors in the AI detector market?

Some major players in the AI detector market include: GPTZero (US), Originality.AI (Canada), Copyleaks (US), Turnitin (US), Writer.com (US), Smodin (US), Hive Moderation (US), Truepic (US), BrandWell AI (US), QuillBot (US), Scribbr (Netherlands), Grammarly (US), Surfer (Poland), Winston AI (Canada), AI Detector Pro (AIDP) (US), Illuminarty (US), DuckDuckGoose (Netherlands), Crossplag (US), ZeroGPT (US), Sapling.ai (US), TraceGPT (PlagiarismCheck.org) (UK), Pangram Labs (US), Compilatio (France), Scalenut (US), Quetext (US), Sightengine (France), Sensity (Netherlands), Reality Defender (US), Attestiv (US), AI or Not (US), Facia.ai (UK), Resemble AI (US), Pindrop (US), Blackbrid.AI (US), and Perfios (India).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI Detector Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI Detector Market