AI in Mining Market Size, Share, Industry Growth Analysis Report 2032

AI in Mining Market by Offering (Software, Services), Mining Type (Surface, Underground), Deployment Mode (On-Premises, Cloud, Hybrid), Technology (Generative AI, Machine Learning, NLP), Application, Vertical, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global AI in mining market is projected to grow from USD 2.60 billion in 2025 to USD 9.93 billion by 2032, registering a CAGR of 21.1%. The market is driven by the increasing adoption of autonomous haulage systems, predictive maintenance analytics, ore grade optimization, and AI-enabled mine planning across surface and underground mining operations. The integration of computer vision, real-time sensor intelligence, digital twins, and machine learning enhances worker safety, improving production efficiency, and reducing operational downtime. Additionally, stricter ESG regulations, sustainability-driven process optimization, and national programs supporting smart and automated mining accelerate the deployment of AI platforms.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to account for 42.9% share of the AI in mining market in 2025 due to the massive mining production volume, and strong investments in automation and digital mining technologies.

-

BY OFFERINGServices offering is projected to grow at the highest CAGR of 22.5% from 2025 to 2032.

-

BY APPLICATIONThe operations & process optimizations segment is expected to to account for 35.4% share of the AI in mining market in 2025

-

By DEPLOYMENTCloud deployment segment accounted for the largest market share in 2024.

-

BY TECHNOLOGYThe generative AI segment is expected to grow at a high CAGR during the forecast period.

-

BY MINING TYPEUnderground mining segment is anticipated to grow at a high growth rate between 2025 and 2032.

-

BY VERTICALMetal mining segment is anticipated to hold the largest market share in 2025.

-

COMPETITIVE LANDSCAPECaterpillar, Komatsu Ltd., and Hexagon AB were identified as some of the star players in the AI in mining market (global), given their strong market share and extensive product footprint.

The AI in mining industry is poised for significant growth as mining companies accelerate digital transformation to enhance productivity, safety, and resource efficiency across surface and underground operations. The increasing demand for automated decision-making, optimized ore extraction, and reduced equipment downtime drives the adoption of AI-powered platforms that enable real-time monitoring, autonomous haulage, predictive maintenance, and intelligent mine planning.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI in mining market is witnessing a major shift in revenue composition, moving from traditional offerings to advanced AI-driven solutions. Key growth areas include AI platforms, data management tools, analytics software, consulting, system integration, and managed services. As mineral, metal, and coal mining companies prioritize predictive maintenance, operational optimization, exploration enhancements, and safety & environmental performance, AI adoption is accelerating and reshaping industry value creation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing focus on AI-enabled safety, efficiency, and productivity improvements

-

Rising adoption of predictive maintenance and real-time monitoring solutions

Level

-

High deployment costs and complex integration with legacy systems

-

Poor data quality and limited digital infrastructure in remote mine sites

Level

-

Inclination of mine operators toward digital technologies

-

Growing trend of smart connected mining

Level

-

Interoperability issues between AI platforms, sensors, and mining equipment

-

Rising sustainability concerns hindering technology-led mining expansion

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing focus on AI-enabled safety, efficiency, and productivity improvements

Mining companies are increasingly adopting AI solutions to automate hazardous tasks, reduce human exposure to risks, and improve real-time operational decision-making. AI-driven predictive analytics and autonomous equipment significantly enhance productivity, equipment uptime, and process efficiency across mining operations.

Restraint: High deployment costs and complex integration with legacy systems

Implementing AI solutions requires substantial investment in advanced hardware, software, connectivity infrastructure, and skilled technical resources. Integrating new AI platforms with outdated or incompatible legacy mining equipment often leads to long deployment cycles and increased modernization costs.

Opportunity: Inclination of mine operators toward digital technologies

Mining companies are actively investing in digital transformation to improve sustainability, reduce operational variability, and enhance data visibility. The rising adoption of remote operations centers, digital twins, and intelligent automation creates strong potential for AI-driven optimization.

Challenge: Interoperability issues between AI platforms, sensors, and mining equipment

The mining industry faces fragmentation due to multiple proprietary systems that lack standardization and seamless data exchange. Limited compatibility between equipment suppliers, AI software vendors, and sensor ecosystems restricts full automation and integrated real-time analytics.

ai-in-mining-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Caterpillar delivers AI-enabled autonomous haulage and fleet management systems for open-pit mines. Its MineStar platform supports autonomous trucks, predictive equipment health analytics, real-time terrain mapping, collision avoidance, and optimized haul route planning. | Increases productivity through continuous autonomous operations with reduced downtime | Enhances worker safety by removing personnel from hazardous areas | Improves fuel efficiency and lowers operating costs with optimized haul cycles and predictive maintenance |

|

Komatsu’s Autonomous Haulage System (AHS) and Smart Mining analytics platform leverage AI for autonomous truck control, drilling optimization, and automated load and dump cycle planning. Integrated real-time data helps coordinate mixed fleets and improve mine planning. | Boosts production output with precise and automated machine coordination | Reduces accidents with real-time hazard detection and controlled navigation | Enhances asset lifetime using machine learning-based equipment diagnostics |

|

Hexagon provides AI-based collision avoidance, operator fatigue monitoring, and drill & blast optimization technology for surface and underground mines. Its AI-based MineProtect and MinePlan platforms support real-time decision intelligence and predictive planning. | Improves mine safety by reducing fatigue-related incidents and collision risks | Enhances drilling accuracy and reduces explosives waste | Enables optimized resource utilization through integrated data-driven planning |

|

Sandvik offers AI-powered automation and analytics systems, including AutoMine and OptiMine, for underground mining equipment. The platform uses AI for real-time equipment tracking, automated loading and hauling, ventilation optimization, and predictive maintenance. | Enhances operational efficiency with autonomous machine coordination and ventilation energy savings | Increases equipment uptime through failure prediction | Supports safer remote operations in confined underground environments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI in mining ecosystem comprises a multi-layered network of hardware providers, software and service providers, system integrators, and end users, all working together to enable smarter, safer, and more efficient operations. Hardware providers, such as Caterpillar, Komatsu, Sandvik, and Epiroc, supply autonomous haul trucks, smart drills, loaders, and sensor-enabled equipment that collect real-time operational data. Software and service providers, such as Hexagon Mining, IBM, and SolveIT, deliver AI-driven analytics, digital twins, predictive maintenance, and planning platforms that transform raw data into actionable insights. System integrators, including Rockwell Automation, FLSmidth, Siemens, Schneider Electric, and Hatch, combine hardware and software to implement end-to-end automation solutions across mining sites. End users, such as Rio Tinto, BHP, Anglo American, Fortescue Metals Group, and Codelco, leverage these technologies to optimize fleet operations, improve safety, reduce environmental impact, and enhance overall productivity, creating a synergistic ecosystem where each layer reinforces the others to drive innovation and digital transformation in the mining industry.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in Mining Market, By Offering

The software segment is expected to hold a larger market share by 2030 as it enables scalable deployment, faster ROI, and real-time analytics for optimizing operations, safety, and asset performance. The growing demand for predictive insights, automation, and cloud-based solutions across mining workflows further accelerates software adoption over hardware.

AI in Mining Market, By Application

Operations & process optimization application will hold a larger market share as mining companies are prioritizing efficiency improvements, cost reduction, and productivity enhancement across extraction, hauling, crushing, and processing workflows. AI-driven optimization helps minimize downtime, improve throughput, reduce energy and fuel consumption, and maximize resource utilization delivering measurable financial benefits.

AI in Mining Market, By Vertical

Coal mining vertical held the largest share of the AI in mining market in 2024 due to its massive production scale, higher safety risks, and strong need for AI-driven automation, predictive monitoring, and efficiency optimization.

REGION

Asia Pacific to be fastest-growing region in global AI in mining market during forecast period

Asia Pacific is projected to grow at the highest CAGR in the AI in mining market during the forecast period due to the rapid expansion of mining activities in China, Australia, and India, strong government focus on digital transformation, and heavy investments in automation and smart mining technologies. The rising demand for minerals, the increasing labor safety regulations, and the growing adoption of AI-driven productivity and sustainability solutions further accelerate growth.

ai-in-mining-market: COMPANY EVALUATION MATRIX

In the AI in mining market matrix, Caterpillar (Star) leads with a comprehensive autonomous mining ecosystem that integrates AI-driven haulage, real-time equipment health analytics, terrain intelligence, and centralized fleet coordination through its MineStar platform. Epiroc (Emerging Leader) is rapidly strengthening its standing through continuous innovation in AI-enabled underground and surface automation, supported by strategic technology partnerships and intelligent platforms such as Mobilaris and Certiq.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS - Top AI in Mining Companies

- Caterpillar (US)

- Komatsu Ltd. (Japan)

- Sandvik AB (Sweden)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Hexagon AB (Sweden)

- Epiroc AB (Sweden)

- Rockwell Automation (US)

- Siemens (Germany)

- Trimble Inc. (US)

- ABB (Switzerland)

- Microsoft (US)

- SAP SE (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.45 Billion |

| Market Forecast in 2032 (Value) | USD 9.93 Billion |

| Growth Rate | CAGR of 21.1% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, and RoW |

WHAT IS IN IT FOR YOU: ai-in-mining-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Mining Operator / Mining Company | Comparative evaluation of AI-enabled autonomous haulage, drilling, and fleet analytics platforms, assessing deployment readiness, integration with mine control systems, and ROI impact on productivity, cost savings, and safety performance across surface and underground operations. | Data-driven technology selection and acceleration of automation initiatives while improving operational efficiency, equipment uptime, workforce safety, and OPEX optimization. |

| Mining Equipment OEM / Technology Provider | Benchmarking of automation capabilities versus competitors, evaluates interoperability with telematics and mine planning systems, and analyzes strategic partnership and integration opportunities to expand digital mining ecosystems. | Strengthens product differentiation, accelerates innovation and roadmap planning, and enhances competitive positioning for scalable mixed-fleet automation. |

| Software Vendor / System Integrator | Mapping of competitive landscape and opportunity sizing across predictive maintenance, safety analytics, ore-grade intelligence, and autonomous control platforms, while benchmarking pricing and licensing across cloud, edge, and hybrid deployments. | Identifies high-growth opportunities, improves go-to-market strategy, and supports scalable solution expansion, partnership development, and customer acquisition. |

RECENT DEVELOPMENTS

- September 2025 : Komatsu Ltd. and Applied Intuition Inc. formed a major technology collaboration to accelerate mining innovation by co-developing a unified software-defined vehicle and autonomy platform for Komatsu’s next-generation mining equipment. Combining Applied Intuition’s strengths in autonomy systems and Komatsu’s mining expertise, the partnership aims to deliver smarter, more adaptive, and highly autonomous machines that increase productivity, reduce downtime, and enhance operational precision.

- March 2025 : Luminar and Caterpillar partnered to integrate Luminar’s Iris LiDAR sensors into Caterpillar’s next-generation autonomous off-highway trucks. The LiDAR enables precise environmental scanning for navigation and obstacle detection, enhancing Cat Command for hauling in quarry and aggregate operations. The collaboration supports autonomous hauling systems an AI-driven mining application involving perception, navigation, and automated fleet operations.

- June 2024 : Sandvik Mining and Rock Solutions introduced the AutoMine Interoperable Access Control System (ACS), enabling third-party autonomous equipment to operate safely within AutoMine-controlled underground zones. By retrofitting non-Sandvik machines with an ACS Onboard Box, mines can manage mixed fleets—loaders, trucks, drills and auxiliaries—under one safety system, improving productivity, flexibility and seamless multi-brand automation integration.

Table of Contents

Methodology

The research process for this technical, market-oriented, and commercial study of the AI in mining market included the systematic gathering, recording, and analysis of data about companies operating in the market. It involved the extensive use of secondary sources, directories, and databases (Factiva and Oanda) to identify and collect relevant information. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess the growth prospects of the market. Key players in the AI in mining market were identified through secondary research, and their market rankings were determined through primary and secondary research. This included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These include annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, and articles from recognized associations and government publishing sources. Research reports from a few consortia and councils were also consulted to structure qualitative content. Secondary sources included corporate filings (annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Primary Research

Primary research was conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the AI in mining market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the AI in mining market scenario through secondary research. Several primary interviews have been conducted with experts from both the demand (vertical) and supply side (AI in mining offering providers) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews were conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

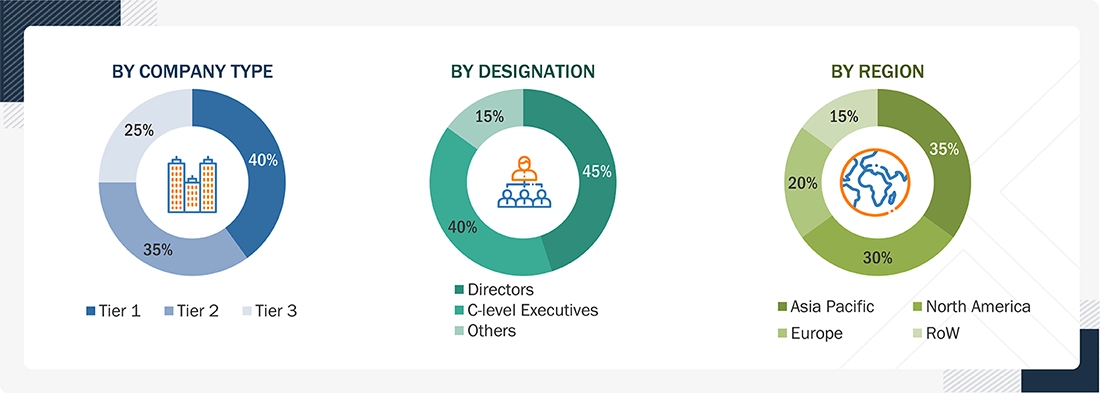

Breakdown of Primary Interview Participants

Notes: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of the companies are based on their total revenues as of 2024; Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

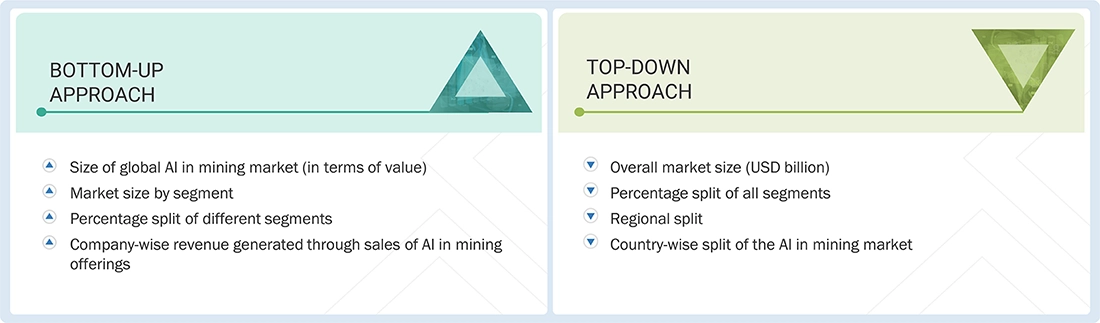

In the complete market engineering process, the top-down and bottom-up approaches have been used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights pertaining to the AI in mining market.

Key players in the AI in mining market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players and interviews with industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for quantitative and qualitative insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

BOTTOM-UP APPROACH

- More than 25 companies in the AI in mining market were identified, and their offerings were mapped based on their deployment mode, mining type, technology, application, vertical, and region.

- The global AI in mining market size was derived through the data sanity method. The revenues of AI in mining software and service providers were analyzed through annual reports and press releases and summed up to derive the overall market size.

- For each company, a percentage was assigned to the overall revenue to derive the revenues from the AI in mining segment.

- Each company’s percentage was assigned after analyzing various factors, including its product offerings, geographical presence, R&D expenditures and initiatives, and recent developments/strategies adopted for growth in the AI in mining market.

- For the CAGR, the market trend analysis of AI in mining was carried out by understanding the industry penetration rate and the demand and supply of AI in mining offerings in different sectors.

- Estimates at every level were verified and cross-checked by discussing them with key opinion leaders, including sales heads, directors, operation managers, and market domain experts of MarketsandMarkets.

- Various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, were studied.

TOP-DOWN APPROACH

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of AI in mining; further splitting into deployment, mining type, technology, application, and vertical, and listing key developments in key market areas

- Identifying all major players in the AI in mining market by offering and their penetration in various applications through secondary research, and verifying with a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications for which all identified players serve AI in mining to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with the industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

The AI in mining market refers to the adoption and deployment of artificial intelligence technologies, such as machine learning, computer vision, generative AI, and natural language processing, across mining operations to optimize productivity, enhance safety, reduce operational costs, and ensure sustainable practices. It encompasses software and services that help analyze data from mining equipment, sensors, and processes to enable real-time decision-making, predictive maintenance, ore grade optimization, and safety monitoring.

Stakeholders

- Software Providers

- Service Providers

- System Integrators

- End Users/Mining Companies

- Regulators & Government Bodies

- Research & Academic Institutions

- Investors/Venture Capitalists

Report Objectives

- To describe, segment, and forecast the size of the AI in mining market, by offering, mining type, technology, application, vertical, and region, in terms of value

- To forecast the size of the market segments for four major regions: North America, Europe, Asia Pacific, and RoW, along with their country-level analysis, in terms of value

- To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the AI in mining market

- To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter’s five forces analysis, investment and funding scenario, and regulations pertaining to the market

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies, and provide a competitive market landscape

- To analyze strategic approaches, such as product launches, collaborations, and partnerships, in the AI in mining market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Mining Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Mining Market