Allergy Diagnostics Market Size, Growth, Share & Trends Analysis

Allergy Diagnostics Market by Product & Service (Consumables, Instruments [Immunoassay Analyzers, Luminometers]), Test Type (In Vivo Tests, In Vitro Tests), Allergen (Food Allergens), End User (Hospital-Based Laboratories) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Allergy Diagnostics market, valued at USD 6.23 billion in 2025, stood at USD 6.80 billion in 2026 and is projected to advance at a resilient CAGR of 9.6% from 2026 to 2031, culminating in a forecasted valuation of USD 10.77 billion by the end of the period. Healthcare systems worldwide are shifting from reactive to preventive care models, recognizing that early identification of health risks reduces long-term costs and improves patient outcomes. Allergy diagnostics fit squarely into this paradigm by enabling early detection of sensitization before severe clinical manifestations occur. Routine allergy screening, particularly in high-risk populations such as children with a family history of atopy or individuals living in polluted urban areas, enables interventions that prevent disease progression, such as environmental control measures, allergen avoidance, and early immunotherapy. Public health campaigns and school health programs increasingly include allergy awareness and screening components, especially for food allergies that can pose acute risks. Preventive check-ups for occupational allergies in industries with high exposure to sensitizers (e.g., healthcare, agriculture, chemical manufacturing) are also gaining traction, driving demand for standardized diagnostic panels. Insurers and payers encouraging preventive services through coverage incentives further bolster utilization, as early diagnosis can reduce emergency visits and chronic therapy costs associated with unmanaged allergies. This alignment between healthcare policy and population health strategies reinforces diagnostics as an integral part of preventive care, scaling the market beyond symptomatic treatment and toward holistic long-term health management.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to register the highest CAGR of 10.4% during the forecast period.

-

BY PRODUCT & SERVICEThe consumables segment led the market, accounting for a share of 60.0% in 2025.

-

BY TEST TYPEIn vivo test type dominated the market, with a share of 55.0% in 2025.

-

BY ALLERGENFood allergens are expected to record a higher CAGR during the forecast period.

-

BY END USERDiagnostic laboratories are likely to register the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSThermo Fisher Scientific Inc. (US), Siemens Healthineers AG (Germany), and Danaher Corporation (US) were identified as Star players in the allergy diagnostic market, as they emphasize innovation, have broad industry coverage, and have strong operational and financial strength.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESACON Laboratories, Inc. (US), Biopanda Reagents Ltd. (UK), and Lincoln Diagnostics, Inc. (US) are among the key startups and SMEs due to their strong product portfolios and business strategies.

Environmental factors like air pollution, climate change, and altered ecosystems are increasing exposure to airborne allergens, intensifying allergic disease prevalence and severity. Pollutants such as particulate matter (PM2.5), ozone, and diesel exhaust particles exacerbate respiratory inflammation, making individuals more susceptible to pollen, mold, and other aeroallergens. Climate change has extended pollen seasons in many regions, while rising atmospheric carbon dioxide levels increase plant biomass and the allergenicity of pollen grains. These environmental stressors contribute to higher clinic visits for allergic rhinitis, asthma flares, and sinusitis, prompting physicians to rely more on precise diagnostic tests to distinguish between irritant-driven symptoms versus true allergic sensitization. Allergy diagnostics help identify specific triggers in polluted environments; for example, distinguishing between dust mite and ragweed sensitization informs tailored avoidance and therapeutic strategies. Environmental allergen monitoring programs, often linked with health advisories, indirectly drive diagnostic demand by raising public consciousness about exposure risk. Urbanization trends concentrate populations in areas with poor air quality, shifting greater demand toward comprehensive allergy screening and targeted interventions. As environmental pressures persist, allergy diagnostics become essential tools in both clinical practice and public health planning to mitigate disease burdens tied to ecological change.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The allergy diagnostics market is transitioning from conventional, single-parameter testing toward integrated, technology-enabled diagnostic ecosystems that improve accuracy, speed, and clinical decision-making. The rising prevalence of allergic diseases, the increasing demand for component-resolved diagnostics, and the shift toward personalized allergy management are reshaping customer expectations. Automation, multiplex immunoassays, and AI-enabled data interpretation are increasingly adopted across diagnostic laboratories and reference centers to enhance workflow efficiency and standardize results. Digital platforms that connect testing, clinical interpretation, and treatment pathways are accelerating adoption among hospitals and specialists. As healthcare systems prioritize early diagnosis, optimized treatment outcomes, and cost efficiency, manufacturers are focusing on innovation, strategic partnerships, and scalable, customizable diagnostic solutions to meet evolving end-user and patient needs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High incidence and heavy economic burden of allergic diseases

-

Increasing awareness about allergies

Level

-

Premium cost of allergy diagnostic instruments

-

Lack of adequate knowledge and poor implementation of allergy testing methods

Level

-

Use of mHealth in allergy diagnosis

-

Integration of artificial intelligence in allergy diagnosis

Level

-

Shortage of allergists and lack of training programs

-

Diagnostic challenges in allergic patients

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High incidence and heavy economic burden of allergic diseases

Allergy diagnostics is an important step in treating patients suffering from allergic diseases. Major allergic diseases include asthma, rhinitis, angioedema, urticaria, conjunctivitis, and eczema. At the same time, conditions such as food allergies and drug & insect allergies also affect many people across the globe. Globally, the increasing prevalence of allergies and related diseases has continued for more than 50 years in the industrialized world. According to data from CDC’s (June 2023) National Center for Health Statistics. 27.2% of children and 31.8% of adults show allergy symptoms, which tallies over 100 million people. Cases of allergy are found to be high among children; sensitization rates to one or more common allergens among school children are currently approaching 40–50% A steady increase in the prevalence of allergic diseases globally has occurred, with about 30–40% of the world population now being affected by one or more allergic conditions. According to WHO, hundreds of millions of subjects in the world suffer from rhinitis, and it is estimated that more than 300 million have asthma, markedly affecting the quality of life of these individuals and their families and negatively impacting the socio-economic welfare of society. According to the European Association of Allergy and Immunology, allergies are among the most common chronic diseases in Europe. 150 million Europeans currently have allergies, and by 2025, it is estimated that 50% of the population of Europe will suffer from some or other sensitivity or aversion. Besides, a rise in cases of food allergy has also been observed worldwide in recent years. Food allergy occurs when the body has a specific and reproducible immune response to certain foods. Eight foods or food groups account for the most serious allergic reactions in the US: milk, eggs, fish, crustacean shellfish, wheat, soy, peanuts, and tree nuts. Other than the high incidence rate among children, allergy cases are considerably high among adults. For instance, according to the CDC (January 2023), in 2021, 27.2% of children had one or more selected allergic conditions, of which 1 in 20 had a food allergy (5.8%). With the growing burden of allergic diseases, the new diagnostic market is expected to grow significantly. Furthermore, the latest diagnostic strategies for allergies and research on new treatment approaches are expected to drive the market studied over the forecast period.

Restraint: Premium cost of allergy diagnostic instruments

Several allergy diagnostic instruments, such as luminometers, blot analyzers, scanners, ELISA analyzers, and immunoassay analyzers, are periodically updated by market players. As these instruments are equipped with advanced features and functionalities, they are priced at a premium (the price of each instrument varies based on its accuracy, flexibility, and TAT). For instance, Phadia 2500+ by Thermo Fisher Scientific Inc. (US) costs USD 1,185,895, IMMULITE 2000 xpi by Siemens costs USD 20,953.8, while luminometers cost USD 3,000 and USD 14,000. Semi-automated ELISA readers cost USD 2,000 and USD 5,000, while fully automated analyzers cost around USD 14,000. Furthermore, maintenance and insurance, laboratory supervision, and overheads (including utilities, space, and administration) are additional expenses required to operate this equipment. Large hospitals and diagnostic laboratories have a larger share of this market as they have good capital budgets to afford high-volume systems. However, most small laboratories, physicians’ clinics, and independent practitioners have budget constraints owing to which they generally cannot afford large or very large systems. Thus, high fixed-cost requirements are expected to limit the growth of the allergy diagnostics market.

Opportunity: Use of mHealth in allergy diagnosis

The use of mHealth for the diagnosis of rhinitis is currently limited, with a small number of mHealth tools for allergic rhinitis (AR) diagnoses published in peer-reviewed journals. Recent developments in integrated biosensors, wireless communication, and power harvesting techniques generate a new breed of point-of-care devices. However, AR is a very common disease. Any diagnostic device connected to a smartphone (e.g., peak nasal inspiratory flow meters or intranasal biosensors) would need to be inexpensive to be affordable. Several applications have aimed to monitor the control of allergic multimorbidity (rhinitis, conjunctivitis, and asthma). Allergymonitor, for example, monitors the symptoms and medication intake, which is then matched to local pollen concentrations. Similarly, the MASK (Mobile Airways Sentinel Network) MASK-Air, initially called Allergy Diary, uses a visual analog scale (VAS) for eye, nose, and asthma symptoms, work impairment, and a global assessment. The data collected by the users of this app have led to new insights into work productivity, treatment patterns, and phenotypes of allergic diseases. Mobile health in food allergy plays a promising role for different stakeholders, including patients and patient organizations, doctors, allergy organizations, and the food industry. Within food allergy, different levels of medical management can be approached by mHealth tools. Mobile health tools can support patients in documenting symptoms during allergy diagnosis. Mobile health in food allergy may play a role for different stakeholders, including patients and patient organizations, doctors, allergy organizations, and the food industry. Within food allergy, different levels of medical management can be approached by mHealth tools. At the diagnostic level, mobile health tools can support patients in documenting symptoms.

Challenge: Shortage of allergists and lack of training programs

For several decades, the shortage of a skilled workforce has been a challenge, resulting in an aging workforce and declining enrollment in training programs. Technicians need almost five to ten years of continuous clinical laboratory work experience to gain expertise. The diagnosis and treatment of allergic disorders such as asthma, rhinitis, food allergies, urticaria, and others is multi-faceted and complicated, requires the prowess of a dedicated allergy specialist, and cannot be ideally managed by a general practitioner. Allergists play a vital role in maintaining good health for people of all ages. However, there is now a growing shortage of allergists. For instance, according to the American Academy of Allergy, Asthma & Immunology (AAAAI), it is the leading membership organization of more than 7,000 allergists/immunologists and patients' trusted resource for allergies, asthma, and immune deficiency disorders. Various rural areas have a shortage of allergists. There are long scheduling waits in most areas to see allergists, with one San Francisco study reporting mean wait times to see an allergist of more than 60 days (Source: Barton Associates). In Europe, the UK has already reported low numbers of clinical technicians. The Gatsby Foundation stated in 2019 that over 1.5 million are serving in the health, engineering, science, and technology domains. Over 50,000 people retire every year, and 700,000 technicians will be required to meet the soaring demands in the next decade. The AAMC study projects a shortage of 46,100 to 90,400 physicians by 2025, including 12,500 to 31,100 primary care physicians (PCPs) and 28,200 to 63,700 surgeons and other specialists.

ALLERGY DIAGNOSTICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Comprehensive allergy testing portfolio (ImmunoCAP, component-resolved diagnostics) for accurate identification of specific allergens across respiratory, food, and drug allergies | High diagnostic accuracy | Personalized allergy profiling | Reduced misdiagnosis |

|

Automated immunoassay-based allergy testing integrated into high-throughput laboratory workflows for hospitals and reference labs | Faster turnaround time | Workflow efficiency | Scalable testing |

|

Multiplex and single-allergen testing solutions enabling simultaneous detection of multiple allergen sensitivities | Broad allergen coverage | Efficient sample utilization | Improved clinical insights |

|

Allergy testing solutions integrated with laboratory automation and data management systems for routine and specialty diagnostics | Standardized results | Streamlined lab operations | Improved reproducibility |

|

Cost-effective allergy testing systems designed for small to mid-sized laboratories and emerging markets | Affordable testing | Ease of use | Expanded access to allergy diagnostics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem market map of the overall allergy diagnostic market comprises the elements present in this market and defines them, demonstrating the bodies involved. It includes analyzers, assay kits, and services. The manufacturers of various allergy diagnostics include organizations involved in research and product development, optimization, and launch. Distributors include third parties and e-commerce sites linked with the organization for marketing these devices. The research and product development phase includes in-house research facilities, contract research organizations, and contract development and manufacturing organizations, all of which are key to outsourcing partners for product development services. The end user segment refers to the application areas where these assays are used. These end customers are the key stakeholders in the allergy diagnostics market supply chain. On the other hand, investors and funders, as well as health regulatory bodies, are the major influencers in this market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Allergy Diagnostic Market, by Product & Service

The increasing adoption of broad allergen panels and multiplex testing platforms has substantially increased consumables usage in allergy diagnostics. Modern diagnostic approaches aim to identify sensitivity to multiple allergens in a single testing cycle, requiring a wide array of allergen-specific reagents and assay components. Component-resolved diagnostics, in particular, use highly specific molecular allergens, increasing the number and complexity of consumables required per test. Even though multiplex testing reduces testing time, it significantly increases reagent density and the value of consumables per diagnostic episode. Laboratories offering comprehensive allergy profiling rely heavily on high-value consumables, reinforcing their revenue contribution. This trend toward precision and personalized allergy diagnostics continues to favor consumables over capital equipment.

Allergy Diagnostic Market, by Test Type

In vivo tests demonstrate high sensitivity for frequently encountered allergens, especially inhalant allergens such as pollen, dust mites, and pet dander. For these allergy types, skin testing is often more clinically representative because it measures the immediate hypersensitivity reaction in the patient’s body. This physiological relevance enhances diagnostic confidence and accuracy. Due to their strong performance in detecting common allergies, in vivo tests are widely used as the first diagnostic step before confirming with advanced in vitro methods, sustaining high utilization rates across allergy clinics.

Allergy Diagnostic Market, by Allergen

Inhaled allergens such as pollen, dust mites, mold, and animal dander are the leading triggers of allergic rhinitis and allergic asthma, which represent the most common allergy-related disorders globally. Increasing urbanization, air pollution, climate change–driven pollen exposure, and indoor allergen accumulation have significantly expanded the patient population requiring diagnosis, driving higher testing volumes for inhaled allergens.

Allergy Diagnostic Market, by End User

Hospital-based laboratories are embedded within comprehensive healthcare settings that provide direct access to allergists, pulmonologists, pediatricians, and ENT specialists. This close integration enables timely referral, diagnosis, and treatment of allergic conditions, particularly for complex, chronic, or pediatric cases. Hospitals often act as primary referral centers, resulting in consistently high patient inflow and test volumes. The ability to align diagnostic results with clinical evaluation in a single care pathway significantly drives demand for allergy testing within hospital-based laboratories.

REGION

India to be fastest-growing region in APAC surgical staplers market during forecast period

Economic growth across Asia Pacific is enabling both governments and private healthcare providers to increase investments in diagnostic services. Rising per-capita healthcare spending improves affordability and access to allergy testing, particularly in emerging economies. Expansion of private insurance coverage and employer-sponsored health plans further supports diagnostic uptake. As healthcare systems shift toward early diagnosis and preventive care, allergy diagnostics are increasingly incorporated into routine clinical evaluation, accelerating market growth faster than in mature regions.

ALLERGY DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX

In the allergy diagnostic market, Thermo Fisher Scientific Inc. (Star) has a strong and established product portfolio and a broad geographic presence. ACON Laboratories, Inc. (Emerging Leader) has substantial product innovations compared to its competitors. While the company maintains a broad product portfolio, there is an opportunity to further strengthen and refine its growth strategy for business development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific Inc. (US)

- Siemens Healthineers AG (Germany)

- Danaher Corporation (US)

- Canon (Minaris Medical America, Inc. (US))

- Revvity (EUROIMMUN Medizinische Labordiagnostika AG (Germany))

- bioMérieux SA (France)

- Romer Labs Division Holding (Austria)

- Omega Diagnostics Group Plc (UK)

- HollisterStier Allergy (US)

- Eurofins Scientific (Luxembourg)

- Stallergenes Greer (UK)

- HOB Biotech Group Corp., Ltd. (China)

- HYCOR Biomedical (US)

- R-Biopharm AG (Germany)

- AESKU.GROUP GmbH (Germany)

- ACON Laboratories, Inc. (US)

- Lincoln Diagnostics, Inc. (US)

- Astra Biotech GmbH (Germany)

- Erba Group (UK)

- Alcit India Pvt. Ltd. (India)

- Biopanda Reagents (UK)

- Bioside S.r.l. (Italy)

- Creative Diagnostic Medicare Pvt. Ltd. (India)

- DST Diagnostische Systeme & Technologien GmbH (Germany)

- Dr. Fooke Laboratorien GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 6.23 BN |

| Revenue Size in 2031 (Value) | USD 10.77 BN |

| Growth Rate | 9.6% |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD MN/BN), Volume (Thousand/Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

WHAT IS IN IT FOR YOU: ALLERGY DIAGNOSTICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparative analysis of allergy diagnostic tests by type, including in vivo (skin prick, intradermal) and in vitro assays (specific IgE, component-resolved diagnostics, multiplex immunoassays), along with evaluation by allergen category, such as inhaled, food, drug, and venom allergens | Assessment of diagnostic accuracy, sensitivity/specificity, turnaround time, workflow complexity, and cost per test to support optimal test selection and improved clinical decision-making |

| Company Information | Detailed profiles of leading global and regional allergy diagnostics manufacturers, covering test portfolios, technology platforms, regulatory approvals, geographic presence, partnerships, and recent product launches | Competitive benchmarking across key players highlighting positioning by technology sophistication, test menu breadth, automation level, and pricing strategy |

| Geographic Analysis | In-depth regional assessment of the global allergy diagnostics market covering North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa | Country-level market sizing, CAGR forecasts, testing volume analysis, reimbursement landscape, and adoption trends across major markets such as the US, Germany, UK, China, India, and Japan |

RECENT DEVELOPMENTS

- September 2023 : Stallergenes signed a global agreement with Nestlé to harness the peanut allergy oral immunotherapy treatment Palforzia.

- July 2023 : Canon completed the share transfer procedures with Resonac Corporation. This share transfer aims to acquire Resonac subsidiaries Minaris Medical Co., Ltd. and Minaris Medical America, Inc. (hereinafter referred to collectively as "Minaris Medical"). Upon completion of this share acquisition, Canon Medical will begin the consolidation of Minaris Medical, which operates businesses in in vitro diagnostic reagents and automated analytical instruments.

- August 2022 : Thermo Fisher announced the clearance of ImmunoCAP Specific IgE (sIgE) Allergen Components for wheat and sesame allergies by the US Food & Drug Administration (FDA) for in vitro diagnostic purposes.

- May 2022 : Thermo Fisher launched the Phadia 2500+ Instrument family in the US for autoimmune testing.

Table of Contents

Methodology

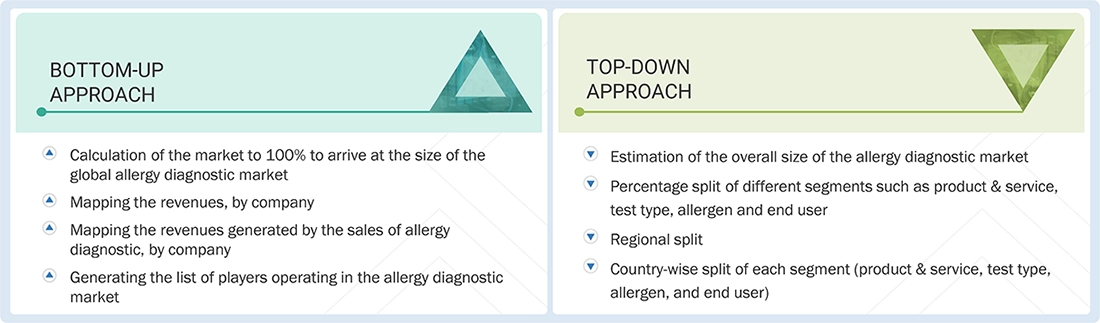

The study involved major activities in estimating the current market size for the global Allergy Diagnostic market. Exhaustive secondary research was done to collect information on the allergy diagnostic market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market sizes of the allergy diagnostic market's segments and subsegments.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, Factiva, whitepapers, and companies’ in-house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the allergy diagnostic market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply- and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs/managing directors, marketing heads/directors and sales directors, marketing/sales managers, regional/area sales managers, export/import heads/managers, and other market-related personnel from various companies and organizations operating in the allergy diagnostic market. Primary sources from the demand side included vice presidents in hospitals & clinics, C-level executives, department heads, doctors/physicians, hospital supply management teams, clinic personnel, and laboratory technicians.

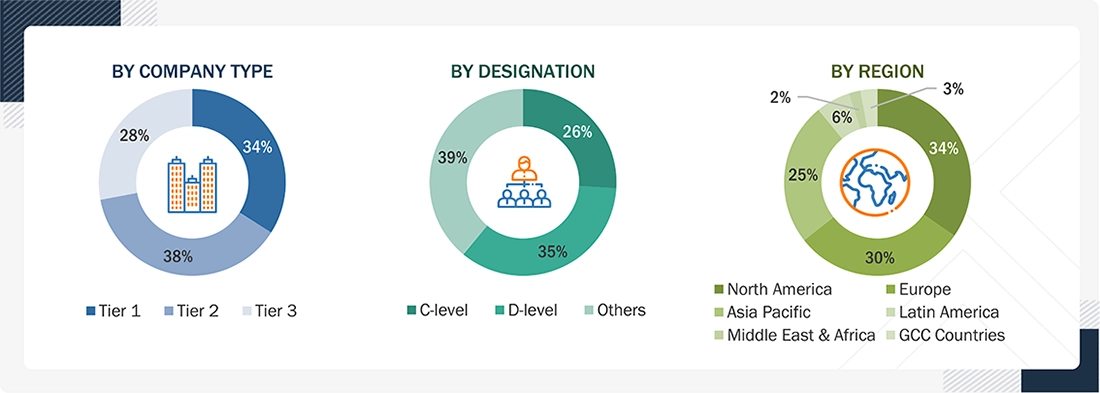

Breakdown of Primary Interviews

Note 1: C-level primaries include CEOs, COOs, and CTOs.

Note 2: Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2025: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3 = <USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the allergy diagnostic market. These methods were also widely used to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The market was divided into four segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth: Using secondary data from paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of allergy diagnostic products. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Allergy testing helps determine the substances causing a patient's allergy symptoms. Tests include skin tests, intradermal tests, challenge tests, blood tests, and patch tests. Allergists commonly conduct challenge tests, including food, inhalation, drug, and physical challenges. Blood tests are generally used when unsafe or unapplicable skin tests are required, such as when consuming certain medications or having a skin condition that may interfere with skin testing. Allergy tests, such as in vitro & in vivo tests, are performed to determine the cause, stage, prognosis, and treatment course for allergic diseases.

Key Stakeholders

- Allergy Diagnostic Reagents, Kits, and Instrument Manufacturers

- Allergy Diagnostic Vendors and Distributors

- Hospitals

- Diagnostic Laboratories

- Allergy Diagnostic Service Providers

- Academic Research Institutes

- Venture Capitalists and Investors

- Contract Research Organizations (CROs)

Report Objectives

- To describe, analyze, and forecast the allergy diagnostic market, by product & service, test type, allergen, end user, and region

- To describe and forecast the allergy diagnostic market for key regions, namely, North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the allergy diagnostic market

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, Porter’s Five Forces, and prices pertaining to the market under study

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies in the allergy diagnostic market

- To analyze competitive developments such as collaborations, acquisitions, product launches, expansions, and R&D activities in the allergy diagnostic market

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific allergy diagnostic market into Vietnam, New Zealand, and others

- Further breakdown of the Rest of Latin America allergy diagnostic market into Colombia, Chile, Ecuador, and others

- Further breakdown of the Rest of Europe allergy diagnostic market into Belgium, Russia, the Netherlands, Switzerland, and others

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Allergy Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Allergy Diagnostics Market