Asia Pacific Head-Up Display Market

Asia Pacific Head-Up Display Market by Combiner HUD, Windshield HUD, Wearable HUD, Augmented Reality (AR) HUD, Conventional HUD, Display Unit, Video Generator/Processing Unit, and Projector/Projection Unit – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

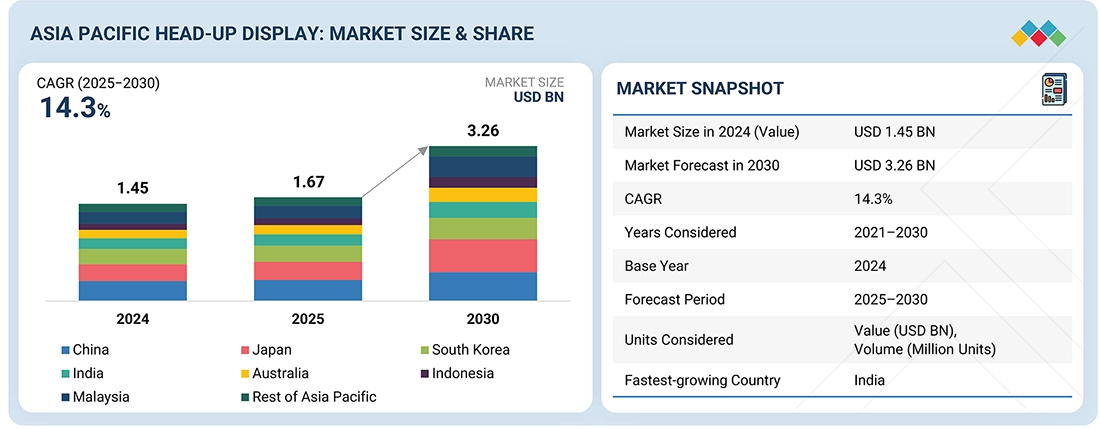

The Asia-Pacific head-up display market is projected to reach USD 3.26 billion by 2030, growing from USD 1.67 billion in 2025, at a CAGR of around 14.3%. The market is driven by rising vehicle production, rapid adoption of advanced driver-assistance systems, and increasing penetration of premium and electric vehicles across key automotive markets such as China, Japan, South Korea, and India. Demand for enhanced vehicle safety, improved driver awareness, and digitally advanced in-vehicle user experiences is also growing. Automakers across the region are increasingly integrating windshield-based and augmented reality head-up displays to support real-time navigation, hazard alerts, and vehicle status visualization. A strong focus on smart mobility, electrification, and software-defined vehicle architectures, along with continuous investments in automotive electronics, optics, and human-machine interface innovation, is accelerating HUD deployment across passenger cars and light commercial vehicles in the Asia-Pacific region.

KEY TAKEAWAYS

-

BY COUNTRYBy country, India is expected to dominate the market, growing at a 24.2% CAGR during the forecast period.

-

BY COMPONENTBy component, the video generators/processing units segment is expected to register the highest CAGR during the forecast period.

-

BY TYPEBy type, the conventional HUDs segment is expected to dominate in terms of market size.

-

BY FORM FACTORBy form factor, the wearable HUDs segment is expected to register the highest CAGR of 27.4% during the forecast period.

-

BY END USEBy end use, the automotive segment is expected to register the highest CAGR of 14.9%.

-

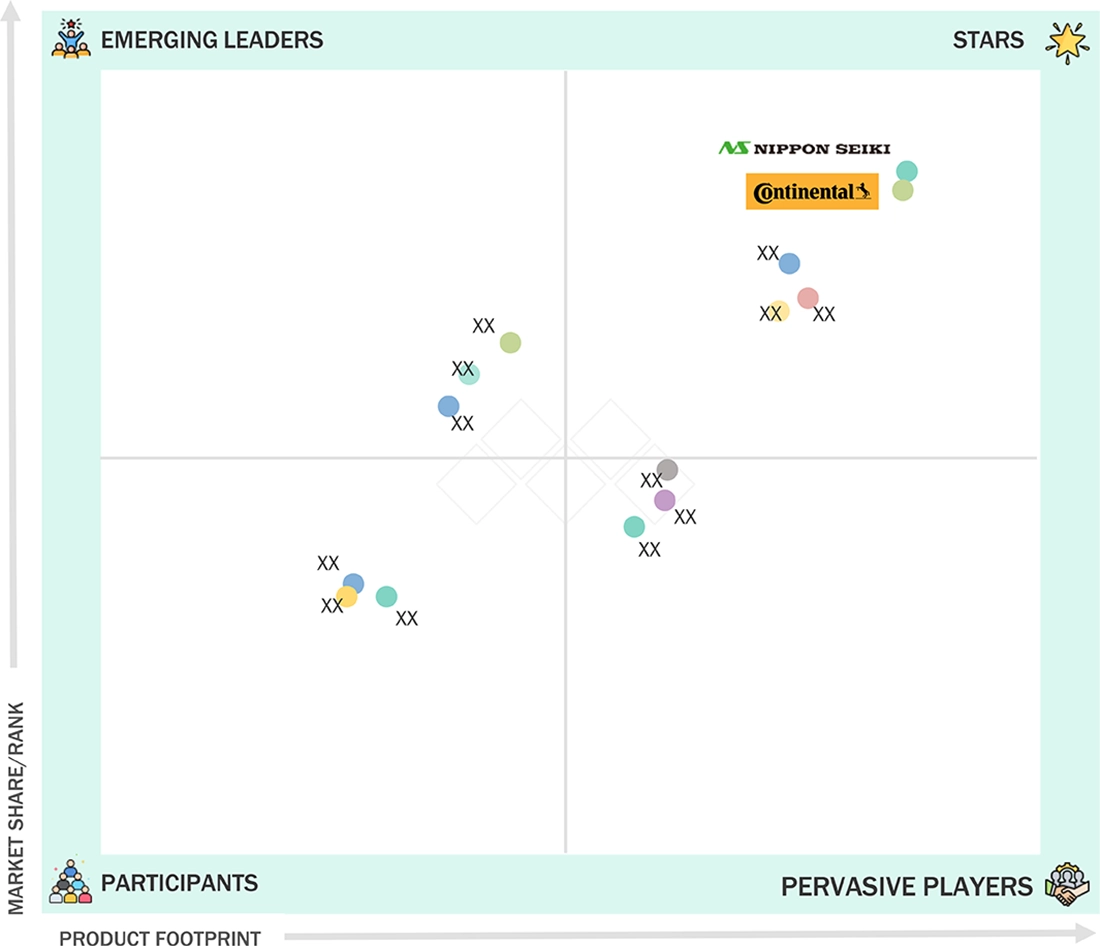

COMPETITIVE LANDSCAPE - KEY PLAYERSNippon Seiki, Continental, Valeo, DENSO, HARMAN International, and YAZAKI, among others, were identified as some of the star players in the Asia Pacific head-up display market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESCY Vision and Epic Optix, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Countries such as China, Japan, South Korea, India, Australia, Indonesia, Malaysia, Thailand, Vietnam, and the Rest of Asia Pacific are key contributors to growth in the Asia Pacific head-up display market. The region benefits from large-scale automotive manufacturing bases, a strong presence of global and domestic OEMs, and a well-established network of Tier 1 suppliers and electronics manufacturers. The rapid adoption of electric and connected vehicles, particularly in China, Japan, and South Korea, along with increasing integration of advanced driver assistance systems, is accelerating HUD deployment.

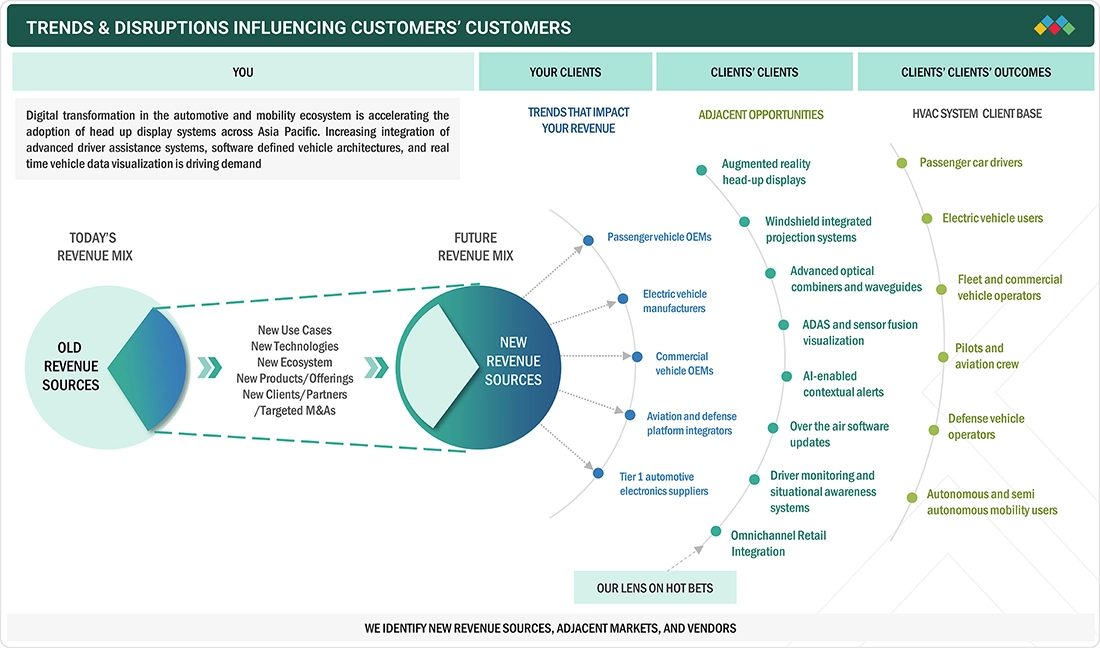

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customer expectations and rapid automotive innovation are transforming vehicle interfaces across the Asia Pacific region. Head-up displays are increasingly positioned as a core element of digital cockpit strategies, supporting safer, more intuitive driving by delivering real-time, context-aware information without diverting driver attention. The Asia Pacific market is characterized by growing adoption of windshield-based and augmented reality head-up displays, driven by advances in optical components, high-brightness projection units, and increasing integration with vehicle electronics. Strong momentum in electric vehicles, connected mobility, and software-defined vehicle platforms across key markets such as China, Japan, and South Korea is further accelerating HUD adoption across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing emphasis on vehicle and passenger safety

-

Rising integration of HUDs with ADAS and real-time data

Level

-

Spatial limitations in vehicle cockpits

-

Display visibility issues in bright sunlight or adverse conditions

Level

-

Increasing interest in HUDs for electric and software-defined vehicles

-

Rising application in two-wheeler and commercial vehicles

Level

-

Regulatory challenges

-

Limited field of view (FOV)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing emphasis on vehicle and passenger safety

The growing emphasis on vehicle and passenger safety remains a key driver of the adoption of head-up display systems. Road traffic accidents continue to cause significant fatalities and injuries worldwide, with driver distraction identified as one of the leading contributors. Increasing regulatory focus on road safety and rising consumer awareness are pushing automakers to integrate technologies that reduce in-vehicle distraction.

Restraint: Spatial limitations in vehicle cockpits

Spatial constraints in vehicle cockpits are a key restraint on the head-up display market. Windshield-based and augmented reality head-up displays require significant dashboard and windshield space, creating integration challenges, particularly in compact and mid-sized vehicles. Automakers struggle to redesign cockpit layouts to accommodate projection units without compromising ergonomics or interior aesthetics.

Opportunity: Increasing interest in HUDs for electric and software-defined vehicles

Increasing adoption of electric and software-defined vehicles presents a strong growth opportunity for head-up displays. EVs rely heavily on digital interfaces for battery status, range, and energy management, while software-defined vehicles enable HUD features to evolve through over-the-air updates. HUDs provide a natural platform for real-time, contextual visualization of ADAS, V2X, and software-driven vehicle data, enhancing user experience and safety.

Challenge: Regulatory challenges

Regulatory compliance remains a key challenge for the head-up display market. Manufacturers must meet varying safety standards for brightness, content visibility, and driver distraction across regions. Extensive testing and validation are required to ensure compliance, increasing development time and costs. Balancing innovation with strict regulatory requirements while maintaining a consistent user experience limits the pace of advanced HUD feature deployment.

ASIA PACIFIC HEAD-UP DISPLAY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Nippon Seiki supplied windshield-based head up display systems to leading Asia Pacific passenger and premium vehicle OEMs, particularly in Japan, China, and South Korea. The HUDs focus on speed, navigation, and regulatory warning visualization and are integrated with ADAS and digital cockpit platforms to project critical driving information directly into the driver’s line of sight. | Improved driver focus and situational awareness, reduced distraction, and enhanced compliance with regional vehicle safety requirements. OEMs benefited from improved cockpit ergonomics and strong customer acceptance of advanced safety features. |

|

Continental deployed advanced HUD solutions, including augmented reality capable displays, across premium, electric, and connected vehicle models in Asia Pacific. These systems visualize navigation guidance, lane level cues, and hazard alerts using real time sensor fusion data to support advanced driver assistance functions. | Enhanced driving safety and comfort, improved ADAS effectiveness, and strong differentiation for OEMs in premium and EV segments. AR HUDs supported smoother integration of semi-automated driving features. |

|

Panasonic developed high brightness HUD projection modules and optical components for Asia Pacific automotive OEMs, enabling clear image visibility under diverse lighting and climatic conditions. The systems are designed for seamless integration with connected and software defined vehicle architectures. | Reliable HUD performance across varied Asia Pacific driving environments, improved image clarity, and reduced system failure risks. OEMs achieved higher product reliability and stronger positioning in connected vehicle offerings. |

|

Valeo implemented compact and scalable HUD systems for mid-segment and premium passenger vehicles across Asia Pacific, focusing on efficient packaging, cost optimized designs, and compatibility with multiple vehicle platforms. The solutions support navigation prompts and driver assistance alerts. | Broader HUD adoption beyond luxury vehicles, improved safety feature penetration, and reduced cockpit complexity. Automakers benefited from scalable HUD integration across diverse Asia Pacific vehicle portfolios. |

|

DENSO supplied HUD systems integrated with driver assistance and vehicle sensing technologies for Asia Pacific OEMs. The displays enable real time visualization of vehicle status, navigation, and warning information aligned with next generation vehicle safety architectures. | Improved real time driver awareness, enhanced safety outcomes, and better integration with advanced ADAS ecosystems. OEMs benefited from robust system reliability and alignment with evolving safety and automation strategies across the region. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific head-up display market ecosystem comprises multiple interconnected layers, including component suppliers, HUD system manufacturers, distribution and integration partners, and automotive OEMs. Component suppliers, such as optics specialists, semiconductor vendors, and holographic technology providers, supply critical elements, including projection units, waveguides, holographic optical elements, display drivers, and processing chips, that form the technological foundation of HUD systems. On the manufacturing side, companies such as Nippon Seiki, Continental, DENSO, Panasonic, and Valeo design and integrate windshield-based and augmented reality head-up display solutions by combining advanced optics, electronics, and software platforms. Distribution and integration partners support OEM programs, regional manufacturing hubs, and vehicle platform localization across key Asia-Pacific markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Head-up Display Market, By Country

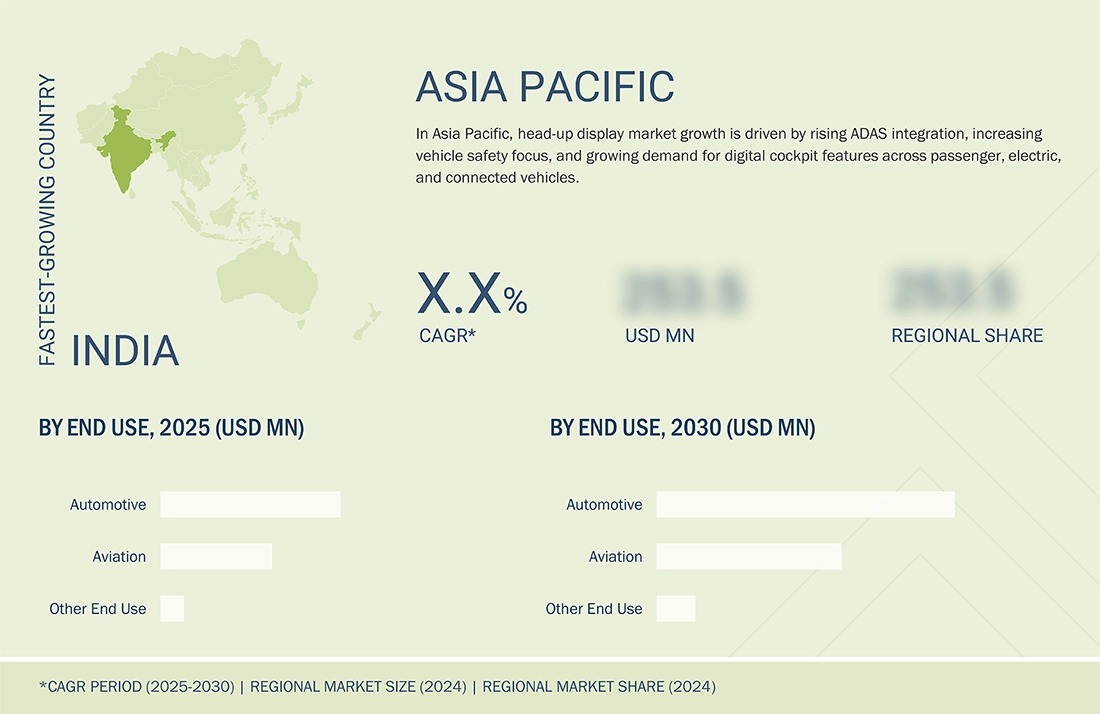

In the Asia Pacific head-up display market by country, India is expected to post the highest CAGR during the forecast period, driven by rapid growth in passenger-vehicle production, rising electric-vehicle penetration, and increasing adoption of advanced driver-assistance features in mid-segment cars. Strong government focus on road safety, digital mobility, and vehicle localization is encouraging OEMs to integrate HUDs as differentiating features. Additionally, growing consumer preference for connected, feature-rich vehicles is accelerating HUD adoption across Indian automotive platforms.

Asia Pacific Head-up Display Market, By Component

In the Asia Pacific head-up display market by component, video generators and processing units are expected to post the highest CAGR due to their critical role in enabling advanced visualization and real-time data processing. Rapid adoption of augmented reality HUDs, deeper integration of ADAS, and increased use of sensor fusion require high-performance processors capable of rendering complex graphics and dynamic alerts.

Asia Pacific Head-up Display Market, By Type

Conventional head-up displays are expected to dominate the market due to widespread adoption across premium and mid-segment vehicles. Their proven reliability, lower system complexity, and cost-effectiveness compared to augmented reality HUDs make them the preferred choice for automakers seeking scalable safety and display solutions.

Asia Pacific Head-up Display Market, By Form Factor

Wearable head-up displays are expected to post the highest CAGR, supported by growing applications in defense, aviation, industrial safety, and specialized mobility use cases. Lightweight designs, hands-free information access, and compatibility with connected systems are driving adoption beyond traditional automotive environments.

Asia Pacific Head-up Display Market, By End User

The automotive segment is expected to register the highest CAGR, driven by increasing vehicle production, rising safety regulations, and growing integration of ADAS and software-defined vehicle architectures. The rising adoption of HUDs in electric and premium vehicles further accelerates growth across the passenger and commercial automotive segments.

REGION

India is expected to be the fastest-growing country across the Asia Pacific head-up display market during the forecast period

The head-up display market in the Asia Pacific region is witnessing strong growth, driven by rising vehicle production, increasing adoption of advanced driver-assistance systems, and a growing emphasis on digitally enhanced in-vehicle user experience. Expanding integration across passenger, premium, and electric vehicles is accelerating market development. Demand is increasing for high-brightness projection units, advanced optical components, and augmented-reality-based HUDs, particularly as automakers across Asia-Pacific advance connected and software-defined vehicle platforms that require real-time, context-aware information delivery within the driver’s line of sight.

The European head-up display market is projected to reach USD 1.48 billion by 2030, growing from USD 0.99 billion in 2025, at a CAGR of around 8.4% from 2025 to 2030. The market is driven by the increasing integration of advanced driver-assistance systems, stringent vehicle safety regulations, and high penetration of premium and technologically advanced vehicles across the region. European automakers are actively adopting windshield-based and augmented reality head-up displays to enhance driver safety, reduce distractions, and support real-time navigation, hazard warnings, and vehicle status visualization.

The North America head-up display market is projected to reach USD 1.90 billion by 2030 from USD 1.15 billion in 2025, at a CAGR of 10.7%. Growth is driven by rising integration of advanced driver-assistance systems, increasing demand for enhanced driver safety and situational awareness, and the strong presence of OEMs offering premium and mid-range vehicles in the region. Automakers are increasingly adopting windshield-based and AR head-up displays to reduce driver distraction and support real-time navigation, hazard alerts, and vehicle status visualization.

ASIA PACIFIC HEAD-UP DISPLAY MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific head-up display market matrix, Nippon Seiki Co., Ltd. (Star) and Continental AG (Star) lead with strong market presence and well-established automotive HUD portfolios, supporting widespread adoption across passenger, premium, and electric-vehicle segments. Their advanced windshield-based and augmented reality head-up display solutions, close integration with ADAS and vehicle electronics, and longstanding partnerships with Asia-Pacific OEMs enable large-scale deployments. Strong alignment with regional safety requirements, rapid EV adoption, and digital cockpit strategies reinforce their leadership position across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Nippon Seiki Co., Ltd.

- Continental AG

- DENSO CORPORATION

- E-LEAD ELECTRONIC CO. LTD

- BAE Systems

- Yazaki Corporation

- HARMAN International

- Valeo

- Panasonic Holdings Corporation

- Garmin Ltd.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.45 Billion |

| Market Forecast in 2030 (Value) | USD 3.26 Billion |

| Growth Rate | CAGR of 14.3% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) and Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | China, Australia, Japan, India, South Korea, Southeast Asia, Rest of Asia Pacific |

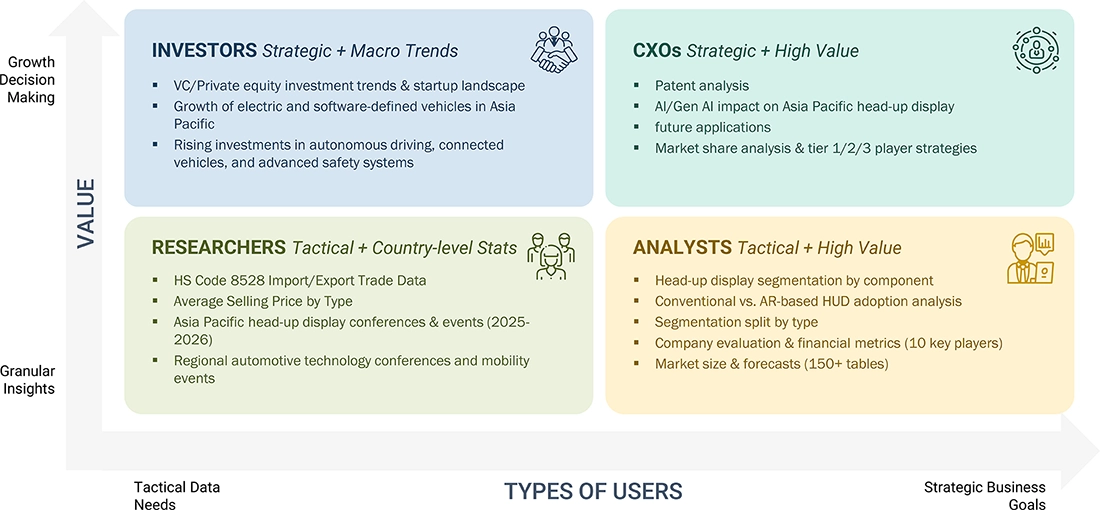

WHAT IS IN IT FOR YOU: ASIA PACIFIC HEAD-UP DISPLAY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific Passenger Vehicle OEM (Premium & EV Focus) |

|

|

| Automotive Tier 1 Electronics Supplier (Asia Pacific) |

|

|

| Electric Vehicle Startup or New OEM Entrant (Asia Pacific) |

|

|

| Automotive Semiconductor or Optics Supplier (Asia Pacific) |

|

|

| Mobility Technology or ADAS Software Provider (Asia Pacific) |

|

|

RECENT DEVELOPMENTS

- April 2025 : Nippon Seiki Co., Ltd. entered into a joint venture agreement with Emerging Display Technologies Corporation, a manufacturer of high-definition TFT LCD modules. Under the partnership, the two companies will establish a new jointly funded entity, EDT-India Private Limited, to manufacture TFT LCD modules in India.

- June 2024 : Valeo partnered with Dassault Systèmes to advance the digital transformation of its research & development operations. Through this collaboration, Valeo will leverage Dassault Systèmes' Global Modular Platform and Smart, Safe & Connected industry solution experiences, built on the 3DEXPERIENCE platform.

Table of Contents

Methodology

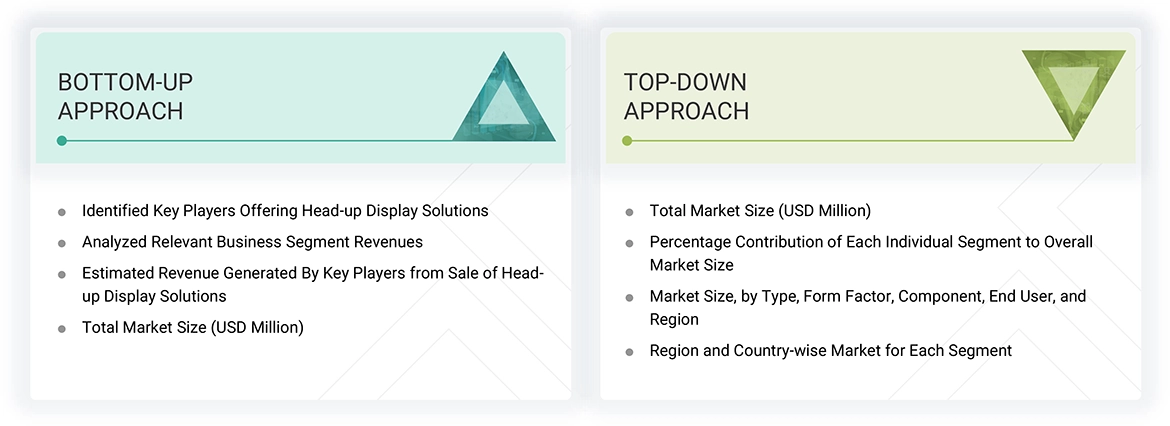

The study involved major activities in estimating the current market size for the asia pacific head-up display market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the asia pacific head-up display market.

Secondary Research

The secondary research for this study involved gathering information from a range of credible sources. These included company annual reports, investor presentations, press releases, whitepapers, certified publications, and articles from reputable associations and government publications. Additional data was obtained from corporate filings, professional and trade associations, journals, and industry-recognized authors. Research from consortia, councils, and gold- and silver-standard websites, directories, and databases also contributed to the qualitative framework. Key global sources, such as the International Trade Centre (ITC) and the International Monetary Fund (IMF), were consulted to support and validate the market analysis.

Primary Research

Extensive primary research was conducted after understanding and analyzing the asia pacific head-up display market scenario through secondary research. Approximately 20% of the primary interviews were conducted with the demand side and 80% with the supply side. Primary data was collected through questionnaires, e-mails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the asia pacific head-up display market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Asia Pacific Head-up Display (HUD) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the asia pacific head-up display market through the process explained above, the overall market has been split into several segments. Data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using top-down and bottom-up approaches.

Market Definition

Head-up display (HUD) is a visual system that projects key information, such as speed, navigation cues, or safety alerts, directly into the user’s line of sight, typically onto a windshield, combiner, or wearable device. Its purpose is to provide critical data without requiring the driver or pilot to look away from their primary viewpoint, thereby enhancing safety, reducing distractions, and improving situational awareness.

Key Stakeholders

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODM)

- Research institutes

- Asia pacific head-up display solution providers

- Forums, alliances, and associations

- Governments and financial institutions

- Analysts and strategic business planners

- Distributors

- End users

Report Objectives

- To describe and forecast the size of the asia pacific head-up display market, by type, component, form factor, and end user, in terms of value

- To describe and forecast the size of the asia pacific head-up display market, by end user, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the asia pacific head-up display market

- To provide an overview of the value chain pertaining to the asia pacific head-up display ecosystem and the average selling prices of asia pacific head-up displays

- To provide a detailed overview of the impact of AI/Gen AI and the US 2025 tariff on the asia pacific head-up display market

- To provide information about key technological trends, trade analysis, and patents related to asia pacific head-up displays

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments, such as partnerships, acquisitions, agreements, collaborations, and product launches

- To strategically profile key players and analyze their market share, ranking, and core competencies

Customization Options

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Head-Up Display Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Head-Up Display Market