Asia Pacific IoT Technology Market

Asia Pacific IoT Technology Market by Node Component (Sensor, Memory Device, Connectivity IC, Processor, Logic Devices), Software Solution (Remote Monitoring, Data Management), Platform, Service, End-Use Application, and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific IoT technology market is projected to reach USD 351.03 billion by 2030 from USD 260.76 billion in 2025, at a CAGR of 6.1%. The market in the Asia Pacific region is witnessing robust growth, driven by the rising adoption of smart devices, the accelerated rollout of 5G networks, and the large-scale implementation of smart city and digital infrastructure projects across the region.

KEY TAKEAWAYS

-

By RegionChina accounted for the largest share of 38.6% in the Asia Pacific IoT technology market in 2024.

-

By IoT Software SolutionBy IoT software solution, the remote monitoring segment is expected to register a CAGR of 9.4% from 2025 to 2030.

-

By IoT PlatformBy IoT platform, the network management segment account for a share of 48.1% of the overall market in 2024.

-

By IoT ServiceBy IoT service, the managed service segment is projected to register the highest CAGR during the forecast period.

-

By IoT Node ComponentBy IoT node component, the processor segment is estimated to account for the largest market share in 2024.

-

By End-use ApplicationBy end-use application, the consumer application segment is estimated to account for the largest market share in 2024.

-

Competitive LandscapeHuawei Technologies Co., Ltd. (China) and Tuya Inc. (China) are identified as the star players in the IoT technology market, given their strong market share and product footprint.

-

Competitive LandscapeKonstant Infosolutions (India) distinguished itself among startups and SMEs by securing strong footholds in specialised niche areas, underscoring its potential as an emerging market leader.

The IoT technology market is experiencing rapid growth due to the increasing adoption of connected devices across industries. Advancements in cloud computing, AI, and 5G networks are enabling real-time data analytics and scalable IoT deployments. Growing use cases in smart homes, industrial automation, healthcare, and transportation continue to drive market expansion in Asia Pacific.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The visual illustrates how disruptive trends are transforming customer business models in the Asia Pacific region. While current revenues are still largely driven by established IoT components, platforms, and services, future growth is expected to stem from segments such as wearable devices, smart homes, connected vehicles, and smart appliances. These “hot bets” are prompting enterprises to reassess their strategies across key Asia Pacific industries, including healthcare, automotive, manufacturing, building automation, and retail. As this transition accelerates, a greater share of revenue will be generated from advanced applications such as ADAS, remote healthcare and telemedicine, EV battery monitoring, industrial automation, and RFID-based tracking, highlighting the importance of investing in future-ready IoT technologies to unlock new value streams across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid digitalization and smart infrastructure development

Level

-

Data security and privacy concerns

Level

-

Expansion of 5G and Edge computing

Level

-

Interoperability and integration complexity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rapid digitalization and smart infrastructure development

The Asia Pacific region is witnessing rapid digital transformation across industries, supported by government-led smart city programs, industrial automation initiatives, and expanding 5G connectivity. Countries such as China, India, Japan, and South Korea are actively investing in IoT-enabled infrastructure to improve efficiency, productivity, and public services. Rising adoption of smart manufacturing, connected healthcare, and intelligent transportation systems is strongly driving IoT deployment across the region.

Data security and privacy concerns

Despite strong growth, concerns related to data security, privacy, and cyber threats remain a key restraint in the Asia Pacific IoT technology market. Varying data protection regulations across countries create compliance challenges for enterprises deploying large-scale IoT systems. Additionally, limited awareness and cybersecurity capabilities among small and mid-sized enterprises increase the risk of data breaches, slowing IoT adoption in some markets.

Expansion of 5G and Edge computing

The rapid rollout of 5G networks and increasing adoption of edge computing present major growth opportunities for IoT technology in Asia Pacific. These technologies enable low-latency, high-bandwidth connectivity and real-time data processing, unlocking advanced use cases such as autonomous systems, smart factories, and remote monitoring. Key players can capitalize on this opportunity by offering scalable, AI-enabled, and low-power IoT solutions tailored to high-growth industries.

Interoperability and integration complexity

A major challenge in the Asia Pacific IoT technology market is the lack of standardization and interoperability across devices, platforms, and communication protocols. Enterprises often struggle to integrate IoT solutions from multiple vendors into existing IT and operational systems. This complexity increases deployment costs and implementation timelines, particularly in large, multi-country IoT projects, posing challenges for widespread and seamless adoption.

ASIA PACIFIC IOT TECHNOLOGY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Huawei’s IoT solutions are deployed across smart cities, industrial automation, energy management, and transportation to connect devices, sensors, and infrastructure through cloud and edge platforms with AI analytics. | Improved operational efficiency, real-time monitoring, enhanced asset management, reduced energy consumption, and scalable deployment across large infrastructures |

|

Samsung integrates IoT across smart homes, consumer electronics, and industrial environments using its SmartThings platform to connect appliances, wearables, and sensors. | Enhanced consumer convenience, energy efficiency, centralized device control, improved automation, and personalized digital experiences |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The IoT technology ecosystem comprises key hardware providers, including Intel, Qualcomm, Texas Instruments, and STMicroelectronics, which supply the essential semiconductor components and devices that enable connectivity and sensing. On the software and platform side, major players like IBM, AWS, SAP, Hewlett Packard Enterprise, and PTC offer cloud services, data analytics, and IoT management platforms critical for device orchestration and data processing. This ecosystem supports a diverse range of end users across various sectors, including smart homes, banking, commercial buildings, aviation, industrial manufacturing, agriculture, and automotive. The integration of hardware, software, and diverse applications illustrates the interconnected and multi-layered nature of the IoT industry, driving innovation and adoption across industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific IoT Technology Market, By Region

China is poised to capture the largest share of the Asia Pacific IoT technology market due to its well-established technology ecosystem, large-scale investments in digital infrastructure, and rapid rollout of 5G networks across industries. A supportive policy environment, combined with strong government backing, is accelerating IoT adoption across smart cities, manufacturing, healthcare, and transportation sectors. Additionally, the presence of a robust mix of global technology leaders, domestic enterprises, and innovative startups is driving large-scale deployment of IoT solutions across the region.

Asia Pacific IoT Technology Market, By Node Component

By node component, the processor segment is estimated to account for the largest share in the Asia Pacific IoT technology market during the forecast period. IoT deployments are rapidly expanding across smart manufacturing, smart homes, healthcare, energy management, and smart city initiatives, with each connected device requiring a processor to handle local data processing, connectivity, and core functionalities. As IoT applications in the region increasingly emphasize industrial automation, large-scale urbanization, and real-time analytics, demand is growing for advanced processors that support edge computing, AI-enabled analytics, and secure data processing.

Asia Pacific IoT Technology Market, By Software Solution

By software solution, the data management software segment accounted for the largest share of the Asia Pacific IoT technology market. This is driven by the rapid expansion of connected devices and the resulting surge in IoT-generated data. Software platforms play a crucial role in addressing interoperability challenges across diverse and fragmented IoT ecosystems while enabling efficient data collection, storage, and processing. As IoT adoption accelerates across industries, the volume of structured and unstructured data continues to grow, increasing the need for robust data organization, security, and governance solutions. By enabling enterprises to derive actionable insights through advanced analytics and real-time data processing, data management software has become a foundational element of IoT deployments across the Asia Pacific region.

Asia Pacific IoT Technology Market, By Platform

IBy platform, the network management segment accounts for the largest share in the Asia Pacific IoT technology market. Network management platforms provide critical functions such as device authentication, provisioning, configuration, monitoring, connectivity management, and remote firmware and security updates, ensuring reliable performance across large-scale and geographically distributed IoT deployments. These platforms are generally device-agnostic, allowing enterprises in the region to seamlessly integrate multi-vendor hardware, diverse communication protocols, and varying data models through a unified and simplified management interface.

Asia Pacific IoT Technology Market, By Service

By service, the professional services segment account for the larger share of the Asia Pacific IoT technology market, both during deployment and throughout the post-implementation lifecycle. These services encompass planning, solution architecture design, consulting, system integration, and ongoing upgrades, which are increasingly essential as IoT deployments become more complex. The involvement of multiple vendors, diverse technologies, and varying regulatory requirements across countries in the region further drives demand for professional IoT services.

Asia Pacific IoT Technology Market, By End-use Application

The industrial segment is expected to register the highest CAGR as enterprises rapidly adopt connected solutions for automation, predictive maintenance, and end-to-end process optimization. Growth is driven by widespread industrial digitalization and smart manufacturing initiatives across manufacturing, logistics, energy, and utilities sectors. Large-scale deployment of connected machinery, sensors, and smart infrastructure is accelerating across the region. Furthermore, the increasing integration of IoT with AI, robotics, and advanced analytics is enabling significant productivity gains, operational efficiency, and cost optimization, thereby driving industrial IoT adoption across Asia Pacific.

REGION

India to be fastest-growing country in Asia Pacific IoT Technology market during forecast period

India is expected to witness the highest growth rate in the Asia Pacific IoT technology market due to rapid digitalization across industries and strong government initiatives such as Digital India and Smart Cities Mission. Increasing adoption of IoT solutions in manufacturing, agriculture, healthcare, and transportation is driving large-scale deployments. The expansion of 4G and 5G networks, along with growing cloud infrastructure, is enabling scalable and cost-effective IoT implementations. Additionally, a rapidly growing startup ecosystem and rising enterprise investments are accelerating IoT innovation and adoption across the country.

The North America IoT Technology market is projected to reach USD 314.75 billion by 2030 from USD 279.90 billion in 2025, at a CAGR of 2.4% from 2025 to 2030. The market is experiencing strong growth, driven by the early adoption of advanced digital technologies across various industries. Increased investments in smart manufacturing, smart cities, healthcare IoT, and connected vehicles are accelerating market expansion. Additionally, the widespread deployment of 5G and the development of strong cloud and AI ecosystems are further supporting IoT adoption in the region.

The Europe IoT Technology market is projected to reach USD 272.11 billion by 2030 from the estimated USD 246.63 billion in 2025, at a CAGR of 2.0% from 2025 to 2030. The IoT technology market in Europe is experiencing strong growth due to increased adoption of smart devices, the rollout of 5G, and the deployment of smart cities.

.

ASIA PACIFIC IOT TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX

Stars are the leading players in the Asia Pacific IoT technology market. These players implement product launches, innovative technologies, and growth strategies. They have a broad portfolio, innovative product offerings, and a global presence. They have well-established channels throughout the value chain. These companies are well-known in the market. Huawei Technologies Co., Ltd. (China) and Tuya Inc. (China) come under this category.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Huawei Technologies Co., Ltd. (China)

- Tuya Inc.(China)

- Konstant Infosolutions (India)

- Invengo Information Technology Co., Ltd. (China)

- UNISOC (Shanghai) Technologies Co., Ltd. (China)

- Moxa Inc. (Taiwan)

- TATA Consultancy Services Limited (India)

- HCL Technologies Limited (India)

- Xperanti IoT (Malaysia)

- Tech Mahindra Limited (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 246.72 Billion |

| Market Forecast in 2030 (Value) | USD 351.03 Billion |

| Growth Rate | CAGR of 6.1% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific (China, Japan, South Korea, India, Australia, Indonesia, Malaysia, Thailand, Vietnam, and Rest of Asia Pacific) |

WHAT IS IN IT FOR YOU: ASIA PACIFIC IOT TECHNOLOGY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Enterprise & Industrial Clients |

|

Enables enterprises to select cost-effective and scalable IoT solutions, improve asset reliability through predictive maintenance, enhance energy efficiency and sustainability, ensure regulatory compliance, and accelerate Industry 4.0 and digital transformation initiatives across Asian operations |

RECENT DEVELOPMENTS

- June 2025 : M2M One introduced a new satellite IoT service tailored to industries in Australia and New Zealand, enabling connectivity in remote and hard-to-reach locations where traditional networks are limited.

- June 2023 : Texas Instruments Incorporated announced plans to expand its internal manufacturing footprint in Malaysia with two new assembly and test factories in Kuala Lumpur and Melaka. Together, these new investments will support TI's plan to bring 90% of its internal assembly and test operations by 2030 to have greater supply control.

Table of Contents

Methodology

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the Asia Pacific IoT technology market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the Asia Pacific IoT technology market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the Asia Pacific IoT technology market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; Asia Pacific IoT technology products-related journals; certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification, and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the Asia Pacific IoT technology market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

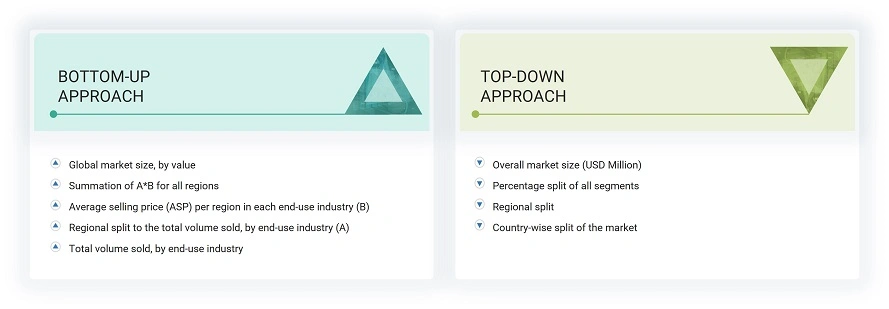

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the Asia Pacific IoT technology market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Asia Pacific IoT Technology Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Asia Pacific IoT technology market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

IoT is a key digital transformation technology, enabling businesses to increase their operational efficiency. Other technologies, such as edge computing, digital twin, Wi-Fi, and big data analytics, are spurring the demand for the digital transformation of businesses. Various application areas, such as retail, manufacturing, transportation, and healthcare, are undergoing digital transformation. Hence, the growing demand for IoT-based digital transformation of businesses is expected to provide growth opportunities for the IoT technology market during the forecast period.

Key Stakeholders

- Original Technology Designers and Suppliers

- System Integrators

- Electronic Hardware Equipment Manufacturers

- Technical Universities

- Government Research Agencies and Private Research Organizations

- Research Institutes and Organizations

- Market Research and Consulting Firms

- Sensor Manufacturers

- Technology Standard Organizations, Forums, Alliances, and Associations

- Raw Material and Manufacturing Equipment Suppliers

- Semiconductor Wafer Vendors

- Fabless Players

- EDA and IP Core Vendors

- Foundry Players

- Original Equipment Manufacturers (OEMs)

- Original Design Manufacturers (ODM) and OEM Technology Solution Providers

- Distributors and Retailers

- Technology Investors

- Operating System (OS) Vendors

- Content Providers

- Software Providers

Report Objectives

- To define and forecast the Asia Pacific IoT technology market size, by node component, software solution, platform, service, and end-use application, in terms of value.

- To describe and forecast the Asia Pacific IoT technology market, by node components, in terms of volume.

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze the supply chain, trends/disruptions impacting customer business, market/ecosystem map, pricing analysis, and regulatory landscape pertaining to the Asia Pacific IoT technology market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To describe in brief the value chain of Asia Pacific IoT technology solutions

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To profile key players and comprehensively analyze their market position in terms of their ranking and core competencies, along with the detailed competitive landscape of the market.

- To analyze competitive developments, such as product launches and developments, partnerships, agreements, expansions, acquisitions, contracts, alliances, and research & development (R&D), undertaken in the Asia Pacific IoT technology market.

- To benchmark market players using the proprietary ‘Company Evaluation Matrix,’ which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio.

- To analyze the probable impact of the recession on the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific IoT Technology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific IoT Technology Market