Asia Pacific Unmanned Underwater Vehicle Market Size & Growth Analysis

Asia Pacific Unmanned Underwater Vehicle Market by AUV (Shallow, Medium, Large), ROV (Observation Class, Medium/Small, Work Class), Application (Military, Oil & Gas, Oceanography, Search & Salvage), Propulsion, System, Speed, Shape, Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Unmanned Underwater Vehicle (UUV) Market in the Asia Pacific is projected to grow from USD 1.63 billion in 2025 to USD 2.48 billion by 2030 at a CAGR of 8.8% during the forecast period. In terms of volume, the market is projected to reach 11,349 units by 2030 from 6,244 units in 2025. The market is supported by the rising demand for subsea inspection and monitoring across expanding offshore energy fields, subsea cable routes, and coastal infrastructure projects in the region.

KEY TAKEAWAYS

-

By CountryThe UUV market in China accounted for a 46.8% market share in 2025.

-

By TypeBy type, the autonomous underwater vehicle (AUV) segment is projected to register the highest CAGR (9.0%) during the forecast period.

-

By ApplicationThe military & defense segment is projected to be the leading application during the forecast period.

-

Competitive Landscape - Key PlayersCOOEC, Mitsubishi Heavy Industries, Ltd., and JOHNAN Corporation were identified as star players in the unmanned underwater vehicle (UUV) market in the Asia Pacific, given their strong market share and product footprint.

-

Competitive Landscape - SMEsXera Robotics Pvt. Ltd., Coratia Technologies Pvt. Ltd., and Hitachi, Ltd., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The unmanned underwater vehicle (UUV) market in the Asia Pacific is witnessing steady growth, driven by the region’s increasing need to monitor and maintain rapidly expanding offshore energy sites and subsea infrastructure that span large and environmentally dynamic coastal zones.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business in the unmanned underwater vehicle (UUV) market is driven by shifting operational needs and advancing underwater mission requirements across the Asia Pacific. Offshore energy operators, subsea cable developers, aquaculture companies, and hydrographic agencies in the region rely on UUVs for deepwater inspection, coastal infrastructure monitoring, and large-scale environmental observation. The move toward autonomous long-endurance missions, advanced sensing, hybrid UUV–ROV capabilities, and data-rich underwater surveys is reshaping how operators plan and execute underwater tasks. These shifts are increasing demand for dependable UUV platforms, integrated payloads, and analytics-driven underwater systems that can support broader and more complex mission profiles across diverse marine environments in the Asia Pacific.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing deepwater inspection and survey requirements from offshore energy and subsea infrastructure expansion

-

Growing adoption of autonomous systems for large-area ocean monitoring under national blue economy programs

Level

-

Limited availability of skilled UUV operators and technical maintenance

-

High operational costs for deepwater-capable platforms

Level

-

Rising demand for AUVs in marine research, climate studies, and long-range environmental monitoring

-

Expansion of offshore wind and subsea cable projects

Level

-

Monsoon and frequent typhoon disruptions

-

Diverse regulatory frameworks increase complexity in cross-border UUV deployments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing deepwater inspection and survey requirements from offshore energy and subsea infrastructure expansion

The Asia Pacific is rapidly expanding its offshore LNG fields, subsea pipelines, and telecom cable networks, creating a constant need for reliable underwater inspection and monitoring. As these assets grow in size and complexity, operators increasingly depend on UUVs to perform routine surveys, identify early faults, and reduce manual intervention in deepwater environments.

Restraint: Limited availability of skilled UUV operators and technical maintenance

Despite growing demand, many parts of the Asia Pacific region face a shortage of trained pilots, technicians, and maintenance specialists. This skill gap can slow down deployment timelines and increase dependence on external service providers, which makes it harder for operators to scale UUV operations quickly.

Opportunity: Rising demand for AUVs in marine research, climate studies, and long-range environmental monitoring

National ocean missions and research programs across the Asia Pacific region are putting more funding into long-endurance AUVs to study climate patterns, map deep-sea ecosystems, and track overall marine health. This support is driving the development of autonomous technologies that can operate on their own across large ocean areas.

Challenge: Monsoon and frequent typhoon disruptions

Severe monsoon seasons and frequent typhoons across the Asia Pacific often disrupt underwater operations, shorten survey windows, and increase overall mission risk. These unpredictable weather patterns mean UUV systems need to handle harsh conditions and allow operators to adjust quickly to changing marine environments.

Asia Pacific Unmanned Underwater Vehicle Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses work-class ROVs to support regular maintenance and anomaly detection in offshore LNG fields through subsea inspection and flowline monitoring | Enhances asset dependability, lowers the need for divers, and permits effective maintenance scheduling for deepwater facilities |

|

Uses compact ROVs for inspection of berths, jetties, and submerged port structures, capturing visual and thickness data for condition assessment | Shortens inspection cycles, enhances diagnostic accuracy, and minimizes downtime for commercial port operations |

|

Enables routine inspections and underwater stock monitoring by providing portable ROVs for aquaculture cage and net inspections | Reduces the need for divers, encourages ongoing farm monitoring, and enhances early infrastructure problem detection |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The unmanned underwater vehicle (UUV) ecosystem operates through a defined value chain that includes platform manufacturers, subsystem suppliers, and multi-sector end users. AUV and ROV manufacturers provide the core vehicles used for offshore inspection, aquaculture monitoring, subsea construction support, and marine research missions, while system and mission payload suppliers deliver the sensing, navigation, and communication technologies that shape overall performance. End users across Asia Pacific’s offshore energy sector, subsea cable operators, port authorities, and environmental agencies rely on these systems for underwater inspection, infrastructure monitoring, and scientific data collection. This structure enables coordinated development of platforms and mission payloads to meet the region’s diverse operational needs across deepwater, coastal, and nearshore environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Unmanned Underwater Vehicle (UUV) Market, By Type

The ROV is projected to be the most dominant UUV type in the Asia Pacific region, as offshore LNG fields, subsea pipelines, and coastal infrastructure projects depend heavily on real-time visual inspection and intervention work. Many operators favor ROVs because they allow direct control in difficult underwater conditions and can handle a wide range of routine maintenance tasks.

Autonomous Underwater Vehicle (AUV) Market, By Type

Large AUVs are becoming dominant in the Asia Pacific region as countries invest more in deep-sea exploration, seabed mapping, and long-range environmental monitoring. These high-endurance platforms are used to study ocean basins, support offshore resource assessments, and collect climate-related data over large marine areas. National programs such as deep ocean missions and marine observatories increasingly need AUVs that can operate at greater depths for a long period of time.

Remotely Operated Vehicle (ROV) Market, By Size

Work-class ROVs dominate the regional market because they are critical for heavy-duty subsea work linked to LNG production, offshore construction, and deepwater maintenance. These vehicles are able to handle complex tasks like valve operations, structural inspections, and pipeline intervention in deep and demanding environments. Growing offshore activity across the Asia Pacific, particularly in Australia, Southeast Asia, and China, continues to underscore the need for robust and stable work-class systems. Their ability to operate for a long period in tough conditions keeps them as the preferred option for industrial subsea operations.

REGION

India to be the fastest-growing region in Asia Pacific unmanned underwater vehicle (UUV) market during forecast period

India is projected to be the fastest-growing market during the forecast period, driven by its expanding need for underwater inspections and seabed surveys linked to large-scale port upgrades, coastal infrastructure expansion, and national deep-ocean research initiatives.

Asia Pacific Unmanned Underwater Vehicle Market: COMPANY EVALUATION MATRIX

In the unmanned underwater vehicle market matrix, COOEC (Star) has a strong competitive position supported by its wide range of work-class ROV capabilities and a large operational presence across offshore energy and subsea infrastructure projects in the Asia Pacific region. Its systems are commonly used for pipeline inspection, deepwater maintenance, and survey work, which helps reinforce its leadership across key industrial and commercial areas. On the other hand, Planys Technologies (Emerging Leader) is gradually strengthening its position through compact inspection-class ROV platforms and tailored solutions for ports, coastal infrastructure, and industrial underwater inspections. Its focus on modular designs and mission-specific inspection tools puts the company in a good position to move closer to the leaders' quadrant as the demand for efficient and fast deployment survey systems continues to grow across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- COOEC (China)

- Mitsubishi Heavy Industries Ltd. (Japan)

- JOHNAN Corporation (Japan)

- CHASING Innovation (China)

- Total Marine Technology (Australia)

- Boxfish Robotics Ltd. (New Zealand)

- QYSEA (China)

- Southern Ocean Subsea (Australia)

- S2 Robotics Co., Ltd. (Thailand)

- Bay Dynamics Ltd. (New Zealand)

- Planys Technologies Pvt. Ltd. (India)

- PT Robo Marine Indonesia (Indonesia)

- EyeROV / IROV Technologies Pvt. Ltd. (India)

- IXAR Robotics Solutions Pvt. Ltd. (India)

- Xera Robotics Pvt. Ltd. (India)

- Coratia Technologies Pvt. Ltd. (India)

- Shenzhen FullDepth Technology (China)

- CHARPIE Intelligence Technology (China)

- ROVMAKER / ROV Maker (China)

- FullDepth Co., Ltd. (Japan)

- KOWA Corporation (Japan)

- Mitsui Engineering & Shipbuilding Co., Ltd. (Japan)

- Hitachi Ltd. (Japan)

- ROVOSTECH Co., Ltd. (South Korea)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.52 Billion |

| Market Forecast in 2030 (Value) | USD 2.48 Billion |

| Growth Rate | CAGR of 8.8% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | China, Japan, India, South Korea, Australia, and Rest of Asia Pacific |

WHAT IS IN IT FOR YOU: Asia Pacific Unmanned Underwater Vehicle Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries |

|

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for more targeted understanding of total addressable market |

RECENT DEVELOPMENTS

- September 2025 : The Indian Navy signed a USD 5.6 million contract with EyeROV to procure advanced indigenously developed underwater drones (ROVs). The systems will enhance underwater inspection, surveillance, and reconnaissance capabilities, supporting India’s defence indigenization efforts.

- August 2025 : Australia’s Department of Defence signed a major agreement with Anduril Australia to start the production of the Ghost Shark extra-large autonomous underwater vehicle fleet. The deal covers long-term development, manufacturing, and sustainment, helping expand Australia’s local UUV capability for deepwater operations and maritime security roles.

- August 2025 : Planys Technologies raised around USD 12 million to boost the production of its inspection-class UUVs and expand its work with maritime infrastructure agencies in India. The funding supports the increasing use of autonomous inspection platforms for ports, dams, and offshore assets and helps the company strengthen its commercial presence across the region.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the Asia Pacific unmanned underwater vehicle (UUV) market. Exhaustive secondary research was done to collect information on the Asia Pacific UUV market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analysis was conducted to estimate the overall market size. After that, market breakdown and data triangulation procedures were employed to estimate the sizes of various segments and subsegments within the market.

Secondary Research

During the secondary research process, various sources were consulted to identify and collect information for this study. The secondary sources included government sources, such as SIPRI; corporate filings, including annual reports, press releases, and investor presentations from companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Asia Pacific UUV market scenario through secondary research. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

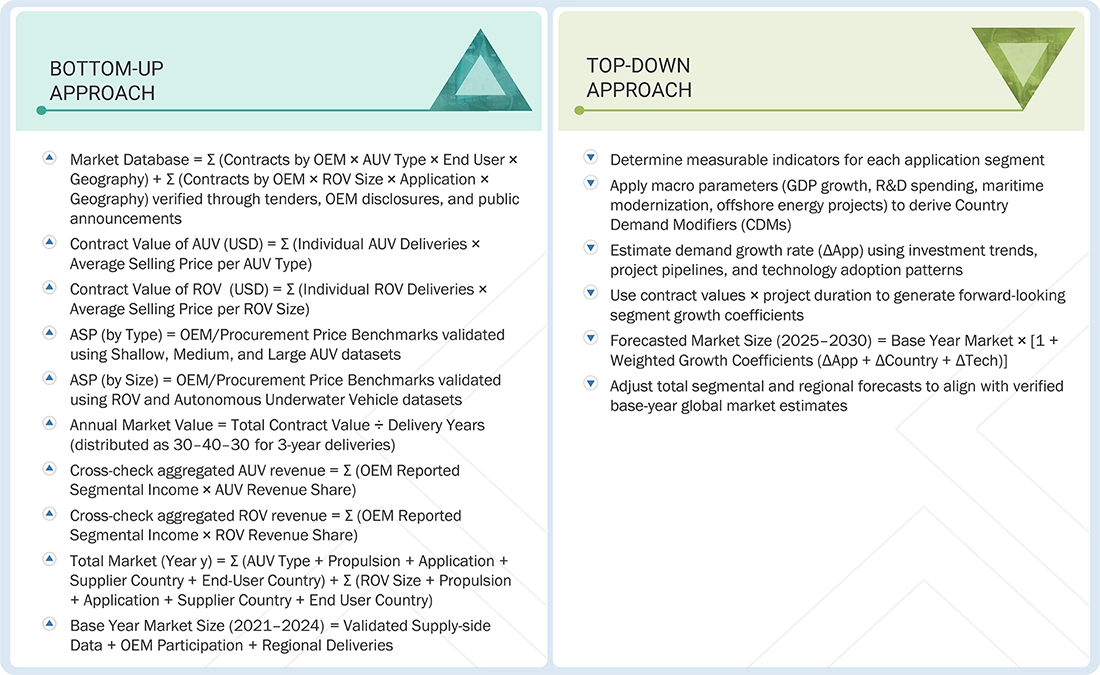

The top-down and bottom-up approaches were used to estimate and validate the size of the Asia Pacific UUV market. The research methodology used to estimate the size of the market included the following details:

- Key players in the Asia Pacific UUV market were identified through secondary research, and their market shares were determined through a combination of primary and secondary research. This included a study of the annual and financial reports of the top market players, as well as extensive interviews with leaders, including directors, engineers, marketing executives, and other key stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Asia Pacific UUV market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Asia Pacific Unmanned Underwater Vehicle Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

Unmanned underwater vehicle (UUV) is a self-propelled underwater robotic system used for autonomous or remotely supervised operations across defense, commercial, and research activities. It supports missions such as seafloor mapping, inspection, surveillance, and data collection, enabling efficient underwater tasks without exposing personnel to operational risks.

Key Stakeholders

- Manufacturers and OEMs

- Component and Subsystem Suppliers

- System Integrators

- End Users

- Service Providers

- Regulatory and Certification Bodies

- Research & Technology Institutions

- Investors and Funding Agencies

Report Objectives

- To define, describe, and forecast the Asia Pacific unmanned underwater vehicle (UUV) market based on type, shape, speed, propulsion, application, system, and cost

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the degree of competition in the market by analyzing recent developments adopted by leading market players

- To provide a detailed competitive landscape of the market, along with a ranking analysis of key players, and an analysis of startup companies in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the market, along with a market share analysis and revenue analysis of key players

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Asia Pacific unmanned underwater vehicle (UUV) market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Asia Pacific unmanned underwater vehicle (UUV) market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Unmanned Underwater Vehicle Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Unmanned Underwater Vehicle Market