Battery Manufacturing Equipment Market Growth, Size, Share and Trends

Battery Manufacturing Equipment Market by Electrode Stacking Machines, Calendering Machines, Slitting Machines, Mixing, Coating & Drying, Assembling, Formation & Testing Machines, Lithium-ion Battery (NMC, LFP, NCA, LCO, LMO, LTO) -Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global battery manufacturing equipment market is projected to grow from USD 13.09 billion in 2024 to USD 36.94 billion by 2030, registering a CAGR of 18.8%. Market expansion is driven by the increasing demand for lithium-ion batteries across electric vehicles, renewable energy storage, and industrial applications. The integration of automation, AI-based quality control, and predictive maintenance is enhancing productivity, yield, and cost efficiency in battery production lines. Additionally, government incentives for domestic manufacturing and renewable energy initiatives are accelerating investments in advanced production technologies, particularly across the Asia Pacific, Europe, and North America.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific leads the battery manufacturing equipment market with a 59.9% share in 2024, driven by the growing demand for EV battery production, supportive government policies, and a well-established regional supply chain.

-

BY MACHINE TYPEFormation & testing machines held the highest share of 31.6% in 2024, driven by their critical role in ensuring battery performance, safety, and quality validation during large-scale lithium-ion cell production.

-

BY APPLICATIONThe automotive segment is projected to grow at the highest CAGR of 20.0% from 2025 to 2030, driven by the accelerating adoption of EVs and increasing investments in advanced battery production lines.

-

COMPETITIVE LANDSCAPEHitachi High-Tech Corporation, Lead Intelligent Equipment, Bühler, and Yinghe Technology were identified as star players market, recognized for their advanced automation technologies, process optimization expertise, and strategic partnerships.

The battery manufacturing equipment industry is projected to expand significantly over the next decade, driven by the rising demand for high-performance lithium-ion batteries used in electric vehicles, renewable energy storage systems, industrial applications, and consumer electronics. Advancements in automation, AI-enabled quality inspection, and process optimization are enhancing production efficiency, precision, and scalability across manufacturing lines. These developments position advanced battery production systems as a cornerstone for accelerating the energy transition, supporting clean mobility, and enabling large-scale electrification under global sustainability initiatives.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses in the battery manufacturing equipment market stems from the growing need for high-performance, cost-efficient, and scalable battery production. End users, including battery manufacturers, electric vehicle producers, and energy storage system providers, are increasingly investing in automated and AI-driven production lines to enhance yield, quality consistency, and throughput. The integration of smart inspection systems, digital twins, and predictive maintenance is transforming manufacturing efficiency, reducing operational downtime, and optimizing resource utilization. These advancements are accelerating the adoption of next-generation coating, formation, and testing equipment, shaping the market’s long-term growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising EV adoption drives demand for next-gen manufacturing technologies

-

Global gigafactory expansion initiatives

Level

-

Capital-intensive plant setups limit scalability

Level

-

Renewable energy integration fuels demand for advanced equipment

-

Customization in production systems unlocks scalability and efficiency

Level

-

Keeping pace with rapid technological shifts

-

Evolving consumer demands and market volatility

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rising EV adoption drives demand for next-gen manufacturing technologies

The surge in electric vehicle production is driving large-scale investments in advanced battery manufacturing infrastructure. Growing emphasis on higher energy density, faster charging, and cost-efficient cell production is boosting the demand for precision machinery, automation, and AI-integrated process control systems.

Capital-intensive plant setups limit scalability

Establishing battery manufacturing facilities requires substantial capital investment in equipment, cleanrooms, and automation technologies. The high initial cost of machinery and setup acts as a barrier, particularly for small and medium enterprises, limiting large-scale market penetration.

Renewable energy integration fuels demand for advanced equipment

The global shift toward renewable energy and grid-scale storage is creating opportunities for advanced battery manufacturing systems. Equipment supporting the production of high-efficiency lithium-ion batteries is gaining traction to meet the increasing demand for energy storage.

Keeping pace with rapid technological shifts

Continuous evolution in battery chemistries, such as LFP and solid-state, requires equipment manufacturers to constantly upgrade production lines. Adapting machinery to new materials, formats, and process requirements poses technical and financial challenges, impacting production scalability and flexibility.

battery-production-machine-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hitachi High-Tech’s equipment portfolio, comprising Li-ion battery assembling machines, electrode stacking systems, roll coaters, and slitting machines, enables high-precision electrode production and final cell assembly under controlled dry room environments. | Enhances production precision and efficiency, ensures safety and quality consistency, and supports sustainable operations through NMP recovery and advanced environmental control systems. |

|

Dürr provides turnkey solutions including slurry mixing and fluid delivery, coating, calendering, drying, and cell finishing systems. Its integrated solvent recovery systems and automation platforms streamline the full battery manufacturing value chain. | Improves process automation and scalability, reduces NMP emissions by over 99%, and enhances energy efficiency while maintaining superior coating and formation quality for lithium-ion batteries. |

|

Lead Intelligent delivers lithium-ion battery manufacturing systems encompassing slurry mixing, electrode making, cell assembly, formation, coating, and module/pack assembly—supported by proprietary feedback and cell testing software. | Enables large-scale gigafactory automation, reduces energy consumption, and enhances throughput and reliability across pilot and mass-production battery lines. |

|

ANDRITZ Schuler offers comprehensive solutions for cathode active material production, electrode calendering, cell assembly, and finishing. Its modular roll-to-roll and laser-based notching systems deliver high-speed, precision-driven cell manufacturing. | Supports high-efficiency and flexible production, enhances coating and calendering uniformity, and enables circular manufacturing through integrated solvent recovery and recycling technologies. |

|

Yinghe’s product line spanning coating, calendering, slitting, winding, stacking, and assembly line systems—provides complete automation for lithium-ion battery production with integrated control for precision and consistency. | Boosts production flexibility, enhances automation scalability, reduces operational costs, and ensures consistent cell quality across high-volume manufacturing. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The battery manufacturing equipment market ecosystem comprises a collaborative network of battery production machine providers and battery manufacturers, driving innovation and large-scale production. Key battery production machine providers include Hitachi High-Tech Corporation (Japan), Dürr Group (Germany), Lead Intelligent Equipment Co., Ltd. (China), ANDRITZ Schuler GmbH (Germany), Bühler (Switzerland), Yinghe Technology Co., Ltd. (China), and Jiangsu KATOP Automation Co., Ltd. (China). Leading end users such as Panasonic, LG Energy Solution, EVE Energy, SVOLT Energy, CALB, and GS Yuasa play a crucial role in driving demand for advanced battery manufacturing equipment, supporting large-scale production of lithium-ion batteries, and accelerating the global shift toward electrification and renewable energy integration.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Battery Manufacturing Equipment Market, By Machine Type

Formation & testing machines are expected to hold the largest share of the battery manufacturing equipment market, driven by their critical role in validating battery performance, safety, and reliability. Rising automation in end-of-line testing and increasing EV battery production are further boosting demand for precision-controlled formation and testing systems.

Battery Manufacturing Equipment Market, By Battery Type

The LFP battery segment is projected to hold the largest market share, supported by its superior safety, long cycle life, and cost advantages. The growing adoption of EVs, energy storage systems, and consumer electronics is driving investment in specialized equipment for efficient and scalable LFP cell manufacturing.

Battery Manufacturing Equipment Market, By Application

The automotive segment will dominate the battery manufacturing equipment market, fueled by accelerating EV production and supportive government initiatives. The expansion of gigafactory projects and the demand for automated, high-throughput production lines continue to strengthen equipment adoption across global EV manufacturing hubs.

REGION

Asia Pacific to be fastest-growing region in global Battery Manufacturing Equipment Market during forecast period

The Asia Pacific is projected to grow at the highest CAGR in the market during the forecast period, driven by the rapid expansion of gigafactories, rising EV production, and government-backed initiatives supporting domestic battery manufacturing. Countries such as China, Japan, South Korea, and India are promoting large-scale investments in clean energy, Industry 4.0, and advanced automation, creating favorable conditions for the deployment of battery equipment. The region’s strong presence of key battery manufacturers, combined with increasing adoption of AI-enabled production systems and energy-efficient machinery, reinforces its leadership in the global market. With the expansion of the EV, renewable energy, and consumer electronics sectors, the Asia Pacific continues to emerge as a hub for next-generation battery manufacturing innovation and capacity expansion.

battery-production-machine-market: COMPANY EVALUATION MATRIX

In the battery manufacturing equipment market matrix, Lead Intelligent Equipment Co., Ltd. (Star) leads with a comprehensive portfolio spanning electrode processing, coating, stacking, and assembly systems, supported by AI-driven inspection and sustainable production technologies. Its strong automation expertise and global partnerships position it as a key enabler of large-scale, high-precision battery manufacturing. DAIICHI JITSUGYO CO., LTD. (Emerging Leader) is expanding rapidly through strategic collaborations and the distribution of advanced machinery, driving the adoption of efficient, high-yield battery production systems and strengthening its position in the leaders’ quadrant of the evolving market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.09 Billion |

| Market Forecast in 2030 (Value) | USD 36.94 Billion |

| Growth Rate | CAGR of 18.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: battery-production-machine-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Battery Manufacturer |

|

|

| Automotive OEM |

|

|

| Equipment Supplier/Integrator |

|

|

RECENT DEVELOPMENTS

- October 2025 : Dürr Group (Germany) launched XCellify DC, a new dry coating system for electrode manufacturing that forms a recyclable free-standing film of active material before lamination onto the collector foil. This innovation removes the need for solvents and drying ovens, reducing production space by up to 65% and energy consumption by 70%. Developed in collaboration with LiCAP Technologies, the system integrates the Activated Dry Electrode process with Dürr’s Ingecal calendering technology, delivering scalable, high-efficiency solutions for lithium-ion and future solid-state batteries.

- September 2025 : Lead Intelligent Equipment Co., Ltd. (China) launched the PHM System (Predictive Health Management System for Battery Production), an AI-driven predictive maintenance solution tailored for gigafactories. The system leverages industrial big data and advanced algorithms to forecast faults, optimize maintenance schedules, and minimize downtime. Featuring seamless multi-brand data integration, real-time predictive alerts, and standardized fault databases, it enables closed-loop execution for enhanced process reliability. Validated in large-scale deployments, the system achieved over 85% prediction accuracy, prevented more than 159 hours of downtime in six months, and delivered significant cost savings and improved production continuity.

- September 2025 : Yinghe Technology Co., Ltd. (China) launched an Ultra-High-Speed Multi-Station Notching and Stacking Machine for battery production, offering a processing efficiency of ≤0.1 seconds per piece. The system supports up to four workstations, achieving 0.05 mm stacking alignment and a CPK of≥2.5 for cutting quality unmatched precision. Its modular design ensures high efficiency, compact footprint, and broad compatibility, achieving a cell yield rate of ≥99.5%. This innovation significantly enhances battery production speed, consistency, and overall manufacturing efficiency.

- August 2025 : Yinghe Technology Co., Ltd. (China) entered a partnership with a leading global lithium battery manufacturer (Europe) to support its European expansion. As part of the collaboration, Yinghe deployed its upgraded calendering and slitting integrated machine along with a high-performance double-layer extrusion coating system. These advanced solutions, capable of speeds up to 120 m/min and widths up to 1.8 m, feature full automation and precision control, enhancing manufacturing efficiency, product quality, and sustainability in next-generation lithium battery production.

- September 2024 : Dürr Group (Germany) introduced the GigaCoater, an advanced simultaneous two-sided coating machine designed for battery electrode production. The system supports wider substrates up to 1,200 mm, enabling faster, high-precision two-sided coating with a compact straight-path layout and non-contact flotation drying. It significantly reduces energy use, space requirements, and material waste while improving electrode alignment and eliminating edge curl.

Table of Contents

Methodology

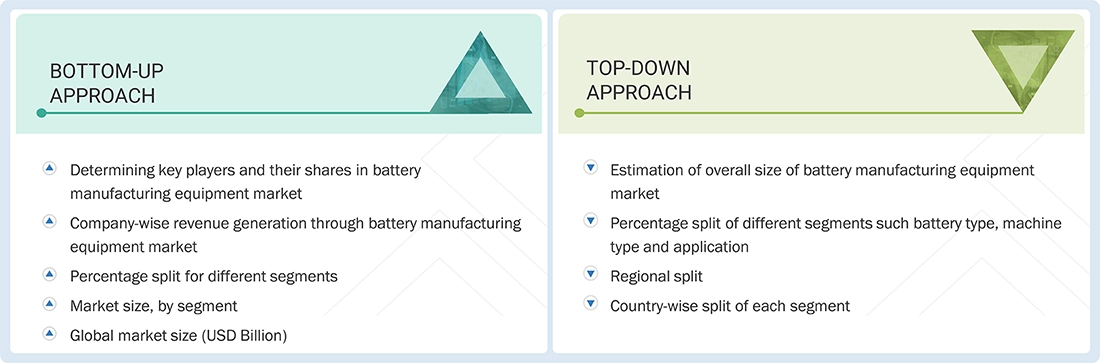

The study involved four major activities in estimating the current size of the battery manufacturing equipment market. Exhaustive secondary research has been conducted to gather information on the market, adjacent markets, and the broader landscape of battery manufacturing equipment. These findings, along with assumptions and projections, were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the battery manufacturing equipment market.

Secondary Research

Various secondary sources were consulted during the secondary research process to identify and collect relevant information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, as well as websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data have been collected and analyzed to determine the overall market size, which has been further validated by primary research.

Primary Research

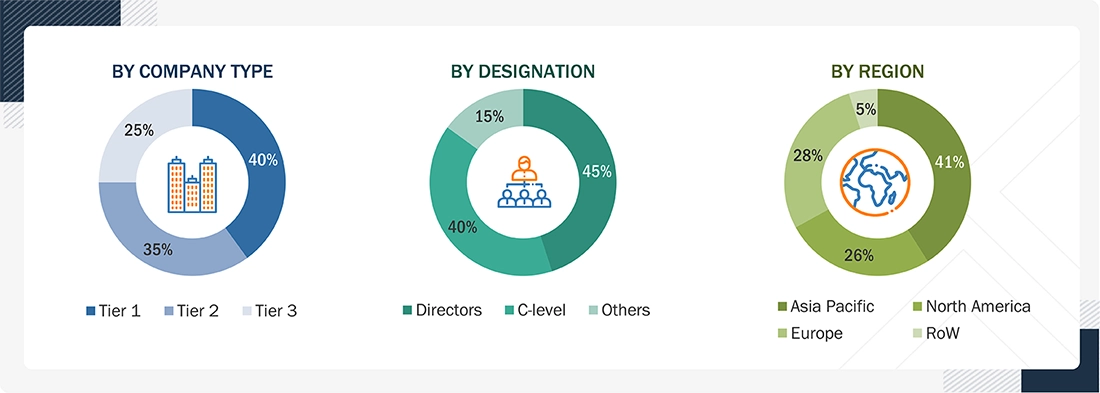

Extensive primary research was conducted after gaining knowledge about the current scenario of the battery manufacturing equipment market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. The tiers of companies have been defined based on their total revenue as of 2024: Tier 3, with revenue less than USD 300 million; Tier 2, with revenue between USD 300 million and USD 1 billion; and Tier 1, with revenue exceeding USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the battery manufacturing equipment market. These methods have also been extensively used to estimate the size of various market subsegments.

The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Battery Manufacturing Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall size of the battery manufacturing equipment market through the market size estimation process explained above, the total market has been segmented into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

The battery manufacturing equipment market comprises machinery and systems used in the production of battery cells and packs, including mixing machines, coating & drying machines, calendering machines, slitting machines, and electrode stacking machines. These equipment types play a crucial role in ensuring precision, efficiency, and quality across various stages of battery manufacturing. The market primarily serves producers of lithium-ion advanced batteries for applications in automotive, renewable energy, industrial, and consumer electronics sectors. Growing investments in automation, AI-based quality control, and smart manufacturing are transforming production processes, enabling large-scale gigafactory operations and improving yield and consistency. As global electrification accelerates and demand for high-performance energy storage increases, the battery manufacturing equipment market continues to expand, serving as a cornerstone of the sustainable energy ecosystem.

Key Stakeholders

- Government bodies and policymakers

- Industry-standard organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Battery manufacturing equipment suppliers

- Battery cell and battery pack manufacturers

- Testing, inspection, and certification providers

- Distributors and resellers

- End users

Report Objectives

- To describe and forecast the size of the battery manufacturing equipment market based on battery type, machine type, application, and region.

- To study and forecast the size of the market based on region: North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries

- To provide detailed information on the drivers, restraints, opportunities, and challenges influencing market growth

- To define, describe, and forecast the battery production machine market, based on volume

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, value chain analysis, trends/disruptions impacting customers' business, the impact of AI/generative AI, key conferences & events, pricing analysis, Porter’s five forces analysis, and regulations pertaining to the market under study

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the battery production machine market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies, along with a detailed market competitive landscape

- To analyze competitive developments, such as product launches, agreements, contracts, collaborations, and partnerships, in the market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Battery Manufacturing Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Battery Manufacturing Equipment Market