Biodefense Market Size, Share & Trends

Biodefense Market by Technology (GHz-band Wave, Microwave Heating, RF-EMR, Cold Plasma, Gamma, UV), Product (Decontamination (Sterilization Devices, Disinfection Units), Biosensors, AI Surveillance), Application, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Biodefense Market is projected to grow from USD 0.89 billion in 2025 to USD 1.81 billion by 2030 at a CAGR of 15.1% during the forecast period. The growth of the Biodefense Industry is propelled by a combination of global awareness of biological threats, increased government spending on national security, and the rapid advancement of detection and decontamination technologies.

KEY TAKEAWAYS

-

BY PRODUCTThe market is segmented into detection & surveillance, decontamination systems, and others, based on product type. The increasing threat of emerging infectious diseases and bioterrorism will drive the detection & surveillance segment. Growing investment in sterilization and disinfection units across defense and healthcare facilities is driving the growth of the decontamination systems segment.

-

BY TECHNOLOGYUV-based, cold plasma, and AI-driven biosensor technologies are emerging as the most disruptive tools in biodefense. Advancements in GHz-band and RF-EMR heating systems are enhancing the speed and efficiency of pathogen inactivation in biodefense applications.

-

BY APPLICATIONMilitary and hospitals/medical institutes remain dominant adopters, while homeland security and public infrastructure drive steady civilian demand. Hospitals, medical institutes, and public infrastructure are focusing on increasing demand for decontamination and biosurveillance solutions.

-

BY REGIONThe Asia Pacific is projected to be the fastest-growing region in the global biodefense market, with a CAGR of 17.0% with significant investments in biodefense infrastructure and R&D, including the development of advanced surveillance systems and protective equipment. North America also maintains dominance due to robust funding from agencies like BARDA and DHS for biosurveillance and biocontainment infrastructure.

-

COMPETITIVE LANDSCAPEMajor players in the biodefense market have adopted both organic and inorganic strategies, including partnerships and investments. In February 2025, Thermo Fisher Scientific announced the acquisition of Solventum’s Purification and Filtration business for USD 1.5 billion in cash. In September 2024, Synexis announced a strategic partnership with Diversey, a global leader in hygiene and infection prevention solutions, to expand the reach of its Dry Hydrogen Peroxide (DHP) technology.

The growth of the biodefense market will be fueled by the increasing risk of bioterrorism and the emergence of infectious diseases. Key enablers include increased government funding, innovation in detection & surveillance, particularly AI-driven tools and biosensors, as well as stronger global coordination in health security infrastructure.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Trends and disruptions impacting customer businesses often stem from the growing demand for biosurveillance and technological advancements that drive the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising threat of bioterrorism

-

Increase in government funding and strategic national stockpiling

Level

-

High R&D costs and long approval times

-

Lack of global standardization in biodefense protocols

Level

-

Emergence of AI-powered biosurveillance & predictive analytics

-

Growth of use of nanotechnology-based biosensors

Level

-

Infrastructure shortages in low-resource areas

-

Cybersecurity risks in connected biodefense systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising threat of bioterrorism

The rising threat of bioterrorism is a significant driver of the biodefense market, as governments, organizations, and public health agencies worldwide recognize the need to enhance their preparedness against intentional biological attacks. The potential use of biological agents as weapons poses risks to public safety, national security, and global security, driving both public and private investments in biodefense technologies.

Restraint: High R&D costs and long approval times

High R&D costs and long approval times serve as significant restraints in the biodefense market, hindering the pace of innovation and limiting market entry for new players. Despite the critical importance of developing advanced biodefense solutions such as diagnostics and protective systems, the complex regulatory landscape and intensive resource demands often act as barriers to progress and scalability.

Opportunity: Emergence of AI-powered biosurveillance and predictive analytics

The emergence of AI-powered biosurveillance and predictive analytics presents a transformative opportunity for the biodefense market, enabling faster, more accurate, and proactive responses to biological threats. As demand grows for smarter and faster pathogen detection tools, companies offering scalable, interoperable, and secure AI solutions will be in high demand by defense departments, public health agencies, and international organizations.

Challenge: Infrastructure shortages in low-resource areas

Infrastructure shortages in low-resource areas pose a challenge to the effective deployment and utilization of biodefense. Such areas often lack essential healthcare infrastructure, such as diagnostic laboratories, reliable cold-chain systems, trained personnel, and communication networks, which are necessary for timely detection, containment, and response to biological threats.

Biodefense Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides sterilization and disinfection systems for hospitals, defense labs, and biodefense facilities | Ensures safe reuse of equipment and reliable pathogen control in critical environments |

|

Manufactures low-temperature sterilizers and disinfectant systems for sensitive medical and defense applications | Protects delicate instruments while enabling rapid decontamination of high-risk areas |

|

Supplies UV-based disinfection lamps and barrier solutions for healthcare and biodefense clean zones | Offers chemical-free, scalable pathogen neutralization and enhanced safety in controlled spaces |

|

Provides sterilization services using gamma/e-beam technology along with purification and testing solutions | Delivers validated large-scale sterilization while ensuring air and water safety in biodefense operations |

|

Provides hydrogen peroxide vapor chambers, isolators, and whole-room decontamination systems | Creates sealed environments for containment and enables rapid eradication of biological threats |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The key stakeholders in the biodefense market ecosystem include prominent companies, private and small enterprises, and end users. Prominent companies in the biodefense market include well-established OEMs. Private and small enterprises have limited product portfolios and low financial strength. The end users of biodefense products include the military, homeland security, hospitals and medical institutes, public infrastructure, and others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Biodefense Market, By Product

The decontamination segment is expected to account for the largest market share of the biodefense market during the forecast period, driven by the growing demand for efficient means to eliminate biological threats in civilian and military environments.

Biodefense Market, By Technology

Based on technology, biosensor technologies are estimated to account for the largest share of the biodefense market due to their pivotal function in providing real-time, precise, and decentralized sensing of biological threats. Biosensor-based technologies are being widely used in hospitals, defense forces, border control, and public health organizations for their high sensitivity and quick response to detecting pathogens.

Biodefense Market, By Application

Based on application, the hospitals & medical institutes segment is projected to contribute the largest market share to the biodefense market during the forecast period, driven by the increasing demand for sophisticated infection control, sterilization, and pathogen monitoring technologies in healthcare settings. Hospitals are frontline facilities during pandemics and bioterrorism attacks, and therefore are key end-users of biodefense technologies.

REGION

Asia Pacific to be the fastest-growing region in global biodefense market during forecast period

The Asia Pacific is projected to be the fastest-growing region in the global biodefense market, amid rising concerns over emerging infectious diseases, cross-border biological threats, and the need for disaster preparedness. Countries in this region, including China, India, Japan, South Korea, and Australia, are increasingly investing in non-pharmaceutical biodefense solutions such as biosurveillance systems, pathogen detection technologies, and protective infrastructure.

Biodefense Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the biodefense market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. Steris (Star) leads the biodefense market with a strong product portfolio, advanced biodefense technologies, and a broad customer base. Bio-Rad Laboratories (Emerging Leader) is a high-potential innovator in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Biodefense Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.89 Billion |

| Market Forecast in 2030 (Value) | USD 1.81 Billion |

| Growth Rate | CAGR of 15.1% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, and Rest of the World |

WHAT IS IN IT FOR YOU: Biodefense Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/subsegments covered at the regional/global level to gain an understanding of market potential by each country |

RECENT DEVELOPMENTS

- February 2025 : Thermo Fisher Scientific (US) announced the acquisition of the Solventum (US) Purification and Filtration business for USD 1.5 billion in cash. This strategic acquisition will expand Thermo Fisher's bioproduction capabilities, particularly in filtration technologies essential for biologics manufacturing.

- May 2025 : Sterigenics (US), a Sotera Health company and a leading global provider of outsourced terminal sterilization services, announced the expansion of its Haw River, North Carolina campus to include a new X-Ray facility adjacent to its existing gamma facility.

- September 2024 : Synexis (US) announced a strategic partnership with Diversey (US), a global leader in hygiene and infection prevention solutions, to expand the reach of its Dry Hydrogen Peroxide (DHP) technology.

- March 2024 : STERIS (US) announced the launch of Verafit Sterilization Bags and Covers, which feature a new, patent-pending viewing window to visually inspect and confirm the dryness of a sterilized part. The unique design helps biopharmaceutical manufacturers conform to the latest EU GMP Annex 1 requirements for dryness confirmation as part of the sterilization cycle acceptance.

Table of Contents

Methodology

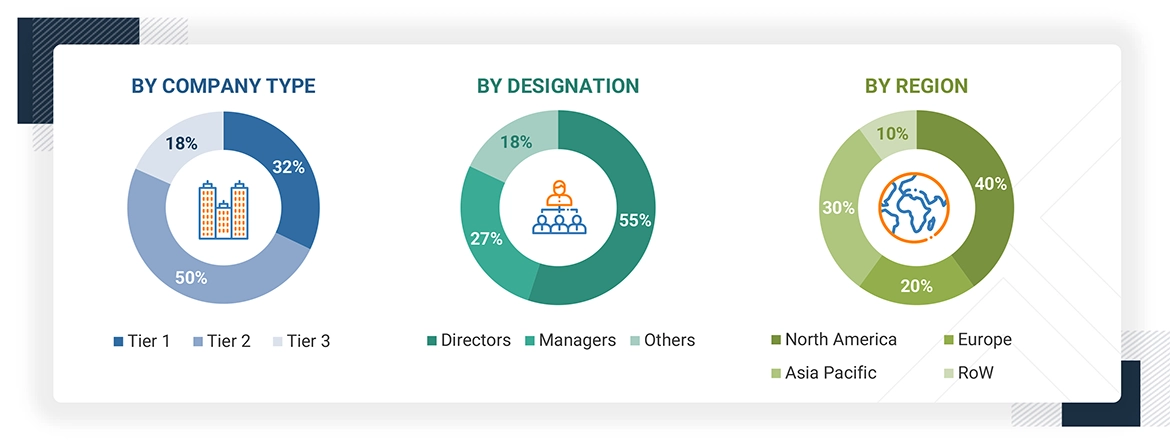

This research study involves the use of extensive secondary sources, directories, and databases (e.g., Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the biodefense market. Primary sources include several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, IP vendors, standards, and organizations related to all the segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess the prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals and certified publications, and articles from recognized authors; and websites, directories, and databases. Secondary research has mainly been used to obtain key information about the industry’s supply chain, the market’s value chain, major players, market classification, and segmentation according to the industry trends to the bottommost level, geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research. A few important secondary sources referred to for this research study are the International Diabetes Federation (IDF), the American Diabetes Association (ADA), and the National Biodefense Analysis and Countermeasures Center (NBACC).

Primary Research

Extensive primary research has been conducted after obtaining information about the current scenario of the biodefense market through secondary research. Several primary interviews have been conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. This primary data has been collected through questionnaires, emails, and telephonic interviews. In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information on the market. Primary interviews have been conducted with the demand (hospital & clinics, clinical laboratories, public infrastructure, and other end users) and supply sides (sterilization device manufacturers, disinfection unit manufacturers, biosensor providers, and other biodefense product manufacturers).

Notes: Tiers of companies are based on their revenue in 2024.

Tier 1: company revenue greater than USD 1 billion; Tier 2: company revenue between USD 100 million and USD 1 billion; and Tier 3: company revenue less than USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

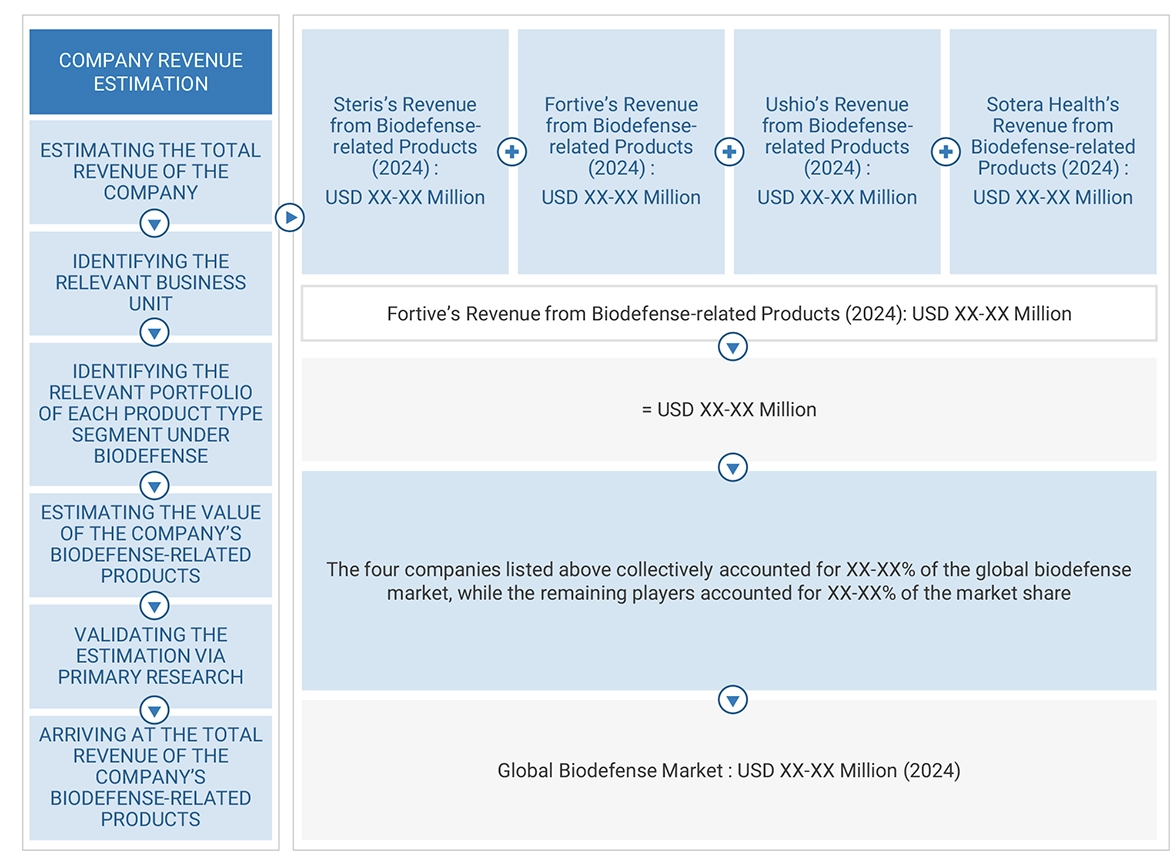

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the biodefense market.

The research methodology used to estimate the market size also includes the following details:

- Key players in the market have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This includes a study of annual financial reports of the top market players and extensive interviews with industry experts who are knowledgeable about cabin management systems.

- The top-down and bottom-up approaches have been used to estimate and validate the size of the global market and the dependent submarkets in the overall market.

Biodefense Market : Bottom-Up Approach

Biodefense Market : Top-down Approach

Data Triangulation

After arriving at the overall size of the biodefense market from the estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the biodefense market size has been validated using the top-down and bottom-up approaches.

Market Definition

Biodefense refers to implementing technologies and systems to counter pathogen threats and prevent bioterrorist incidents. The market focuses on detection, decontamination, purification, and containment & isolation systems that safeguard public health, military personnel, critical infrastructure, and research environments. Biodefense measures in this domain aim to enhance biosafety and biosecurity, ensuring that harmful pathogens or biohazards are effectively neutralized, contained, or prevented from spreading. This market is essential for industries dealing with biological risks, and it is increasingly significant in the context of bioterrorism, biological warfare, and pandemic preparedness.

Key Stakeholders

- Manufacturers of biodefense products

- Hospitals & Medical Institutions

- Biotechnology Companies

- Medical Device Manufacturers

- Government Agencies

- Military Organizations

- Emergency Response and Law Enforcement Agencies

Report Objectives

- market ranking analysis, market share analysis, and revenue analysis of key players To define, describe, segment, and forecast the size of the biodefense market based on product, technology, application, and region

- To forecast sizes of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the regulatory landscape with respect to biodefense regulations across regions

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the current size of the biodefense market?

The biodefense market, in terms of value, is estimated at USD 0.89 billion in 2025.

Who are the winners in the biodefense market?

The winners in the biodefense market are STERIS (US), ASP International Gmbh (a subsidiary of Fortive) (US), Ushio Inc. (Japan), Sotera Health Company (US), and Bioquell, An Ecolab Solution (UK)

What are some of the technological advancements in the market?

- Digital health tools & mobile biosurveillance

- Digital twins & simulation technology

- Remote sensing for detection and identification of biological threats

- Next-generation sequencing (NGS)

- Nanotechnology-enabled biosensors

What are the factors driving the market?

- Rising threat of bioterrorism

- High government funding and strategic national stockpiling

- Increasing technological advancements

- Growing geopolitical tensions and biological warfare risks

Which region held the largest market share in 2024 in the biodefense market?

North America held the largest share of 39.6% of the global biodefense market in 2024.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Biodefense Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Biodefense Market