Brushless DC motor Market

Brushless DC motor Market Type (Inner Rotor, Outer Rotor), Speed (<500 RPM, 501–2,000 RPM, 2,00–10,000 RPM, >10,000 RPM), End Use Application (Consumer Electronics, Automotive, Manufacturing, Medical Devices) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global brushless DC Motor market is projected to grow at a CAGR of 8.1% between 2025 and 2030, reaching USD 20.68 billion by 2030 from the estimated USD 14.02 billion in 2025. The brushless DC motor (BLDC) market worldwide is rapidly growing due to several converging factors, mainly the need to conserve energy, the rapid advancement of industrial automation, and the increased production of electric vehicles (EV). The high efficiency, durability, and low maintenance of BLDC motors compared to traditional brushed motors have continued to boost their popularity in automobiles, consumer electronics, and other sectors industry.

KEY TAKEAWAYS

-

BY TYPEThe brushless DC motor (BLDC) market is segmented by type into inner rotor and outer rotor motors, with inner rotor motors representing the largest segment, due to its usage across vast applications such as industrial automation, robotics, automotive, and manufacturing.

-

BY SPEEDThe speed segment is segregated into <500 RPM, 501–2,000 RPM, 2,000–10,000 RPM, and >10,000 RPM ranges. The 2,000–10,000 RPM segment represents the largest share in the BLDC market due to its optimal balance of high efficiency, power output, and versatility.

-

BY END USE APPLICATIONThe end use application segment is bifurcated into consumer electronics, automotive, manufacturing, medical devices, and others. Consumer electronics is the largest segment, driven by surging demand for energy-efficient and compact products.

-

BY REGIONThe brushless DC motor (BLDC) market by region is segmented into the Asia Pacific, Europe, North America, South America, and the Middle East & Africa. The Asia Pacific is the largest segment, owing to massive consumer electronics production, rapid industrialization, and strong automotive manufacturing growth

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and investments. For instance, Allient, Inc. , NIDEC CORPORATION, and Johnson Electric Holdings Limited have entered into a various agreements and partnerships to cater the growing demand for brushless dc motors across numerous applications

There will be significant growth in the brushless DC (BLDC) motor market in the next decade due to the advancements made in motor control technologies, automation in industries, and the influx of electric vehicles. The growing attention to energy saving, low maintenance, and high-performance solutions is stimulating the popularization of BLDC motors in many segments of the economy, including consumer electronics, automotive, manufacturing, and medical devices. They are essential in any application that requires reliability and sustainability due to their high efficiency, life span, and accurate control. The rapid changes in smart manufacturing, green mobility, and connected devices only accelerate the trend towards making BLDC motors a fundamental facilitator of the technological innovations of today, preconditioning the large-scale change in the industry.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business arises from customer trends or disruptions. Hot bets are the customers of brushless DC motor manufacturers, and target applications are also the clients of these manufacturers. Changes, which involve shifting trends or disruptions, will influence the revenues of end users. This revenue impact on end users will, in turn, affect the revenues of hotbets, which will further influence the revenues of brushless DC motor manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High demand for HVAC systems

-

Low maintenance costs of brushless DC motors

Level

-

High costs of brushless DC motors

Level

-

Increasing demand for electric vehicles

-

Rapid industrialization in developing countries

Level

-

Widespread accessibility of substandard and inexpensive brushless DC motors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High demand for HVAC systems

The brushless DC (BLDC) motor market is mainly driven by high demand for HVAC systems. The increasing use of energy-efficient heating, air conditioning, and ventilation systems in homes, industries, and commercial buildings is boosting adoption of BLDC motors, which are more efficient, operate quietly, and have a longer lifespan than traditional motors. The growing focus on indoor air quality, climate control, and regulatory standards related to energy conservation further supports integrating BLDC motors into HVAC equipment, aiming to promote market growth and technological advancements in this area.

Restraint: High costs of brushless DC motors

The lack of affordability of brushless DC (BLDC) motors is a significant barrier to market growth. BLDC motors require complex electronic controllers and use advanced materials, which increase their initial manufacturing and purchase costs compared to traditional brushed motors. This higher upfront expense can hinder adoption, especially in price-sensitive applications and new markets where cost is a key decision factor. As a result, potential customers may choose less expensive options despite BLDC motors offering better efficiency and longer lifespan, slowing down market adoption.

Opportunity: Increasing demand for electric vehicles

The growing popularity of electric cars (EVs) presents a significant opportunity for the market of brushless DC (BLDC) motors. With the rapid adoption of EVs worldwide driven by strict emissions laws, increased environmental awareness, and advances in battery technology, the demand for efficient, reliable, and low-maintenance motor solutions like BLDC motors is rising quickly. Their high efficiency, exceptional performance, and precise control of speed and torque make BLDC motors essential for the next generation of EV drivetrains and auxiliary systems. As a result, the market is expected to expand significantly, fueling the growth of electric mobility.

Challenge: Widespread accessibility of substandard and inexpensive brushless DC motors

One of the biggest challenges facing the brushless DC (BLDC) motor market is the influx of poor quality and cheap products. Low-cost, low-quality motors can easily enter the market, compromising the reliability, performance, and safety for end users. This erodes customer confidence in BLDC technology, pressures prices among established manufacturers, and makes it difficult for quality-conscious suppliers to differentiate their products, which harms the adoption of high-performance BLDC motors in critical applications.

Brushless DC motor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrated in appliances, smartphones, and cooling systems for efficiency | Low noise, compact size, enhances performance, improves energy efficiency |

|

Enables precise motion in cameras, gaming consoles, and audio devices | Smooth control, reduced vibration, higher reliability, better user experience |

|

Powers electric drivetrains delivering efficiency, torque, and extended range | Longer driving range, instant torque, lower maintenance, improved sustainability |

|

Supports hybrid and electric powertrains, ensuring reliable vehicle electrification | Fuel savings, reduced emissions, higher performance, better driving experience |

|

Operates surgical robots and medical devices with precise motor control | Silent operation, precision control, reliability, improved patient safety outcomes |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The brushless DC motor market ecosystem includes the main stakeholders such as raw material providers, component manufacturers, brushless DC motor producers and assemblers, distributors (buyers), end users, and regulatory bodies or standards organizations. This list is not exhaustive and is intended to give an overview of the key players involved in the brushless DC motor market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Brushless DC Motor Market, By Type

The brushless DC motor market is segmented by type into inner rotor and outer rotor categories. The main difference lies in their design and construction, although their working principles are alike. In inner rotor BLDC motors, the rotor with permanent magnets is located inside the stator, which contains the electromagnetic windings. This design results in a more compact structure and allows for higher rotational speeds due to a lower moment of inertia. On the other hand, outer rotor BLDC motors have a rotor that surrounds the stator, with magnets on the outer shell. This setup delivers higher torque at lower speeds, making it ideal for applications that require direct drive mechanisms, such as fans or disk drives.

Brushless DC Motor Market, By Speed

Based on speed, the brushless DC motor market is divided into <500 RPM, 501–2,000 RPM, 2,001–10,000 RPM, and >10,000 RPM. Different brushless DC motors are used in various applications depending on their speed needs. Brushless DC motors with a speed range of 2,001 to 10,000 RPM are used in medical and industrial equipment. In HVAC systems, brushless DC motors with a speed range of 501 to 2,000 RPM are employed.

Brushless DC Motor Market, By End Use Application

Based on end-use application, the brushless DC motor market has been segmented into consumer electronics, medical devices, automotive, manufacturing, and others (HVAC systems, agriculture, solar pumps, and aerospace & defense). Brushless DC motors are replacing conventional brushed DC motors in several consumer electronic applications, such as in commercial and residential building air conditioners, refrigerators, mobile phones, and office equipment (printers, copiers, and fans). The demand for consumer electronics is rising across the world, thereby making consumer electronics a significant End-use Application of brushless DC motors. These motors are used in the manufacturing of semiconductors, chips, and microelectronics.

REGION

Asia Pacific to be fastest-growing region in the global Brushless DC Motor market during forecast period

Brushless DC motors are rapidly gaining popularity in the Asia-Pacific region for several reasons. Heavy industrialization and swift automation in China, Japan, and India contribute to their spread in manufacturing, robotics, and industrial automation equipment. The demand for energy-efficient and low-maintenance products is rising in consumer electronics and home appliances. This trend is significantly supported by the boom in the electric vehicle industry, driven by government incentives for clean energy and e-mobility. Additionally, the demand for BLDC motors is strengthened by Asia-Pacific's role as a global center for electronics and automotive manufacturing, along with strong growth in electronics exports.

Brushless DC motor Market: COMPANY EVALUATION MATRIX

In the brushless DC motor market matrix, NIDEC CORPORATION (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across industries like automotive and consumer electronics. Anaheim Automation, Inc. (Emerging Leader) is gaining traction with its solutions used across industries such as medical devices, automotive, and others. ORIENTAL MOTOR Co., Ltd. currently holds an advantage due to its broad portfolio and demonstrates robust growth potential, and could progress into the leaders' quadrant with further advancement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 13.00 Billion |

| Revenue Forecast in 2030 | USD 20.68 Billion |

| Growth Rate | 8.10% |

| Actual data | 2021-2030 |

| Base year | 2024 |

| Forecast period | 2030 |

| Units considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Brushless DC motor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based Brushless DC Manufacturer | Market size of brushless DC motor across regions such as North America, Europe, and Asia Pacific |

|

RECENT DEVELOPMENTS

- June 2025 : NIDEC CORPORATION (Japan) expanded in Karnataka, India, by inaugurating its new manufacturing Orchard Hub campus in Hubli. This expansion marks the launch of plant machinery and equipment installation across the six campus plants, paving the way for production to commence later this year.

- November 2024 : Regal Rexnord Corporation (US) introduced the PCR 56/06 EC SD, an advanced integrated hardware and software motion controller designed specifically for their brushless DC (BLDC) motors.

- July 2024 : Oriental Motor Co., Ltd. (Japan) Oriental Motor launched a new 24 VDC driver for their 400W (1/2 HP) BLV Series R Type brushless motors. This driver powers both the motor and peripheral devices from a single 24 VDC source, simplifying system design and reducing size and cost, which is ideal for battery-powered equipment

- June 2022 : Allied Motion Inc. (US) acquired Airex LLC, a privately owned company with over 70 years of history providing high-precision electromagnetic components and other solutions. This acquisition would allow Allied Motion to strategically expand its motor offerings, quick-turn response times, and custom solutions for its customers

- December 2022 : NIDEC CORPORATION (Japan) launched a new single-phase, low-vibration, and low-cost brushless DC motor that can be installed in an electric fan. This brushless DC motor is lower in price and generates approximately the same amount of noise and vibration as common AC motors

Table of Contents

Methodology

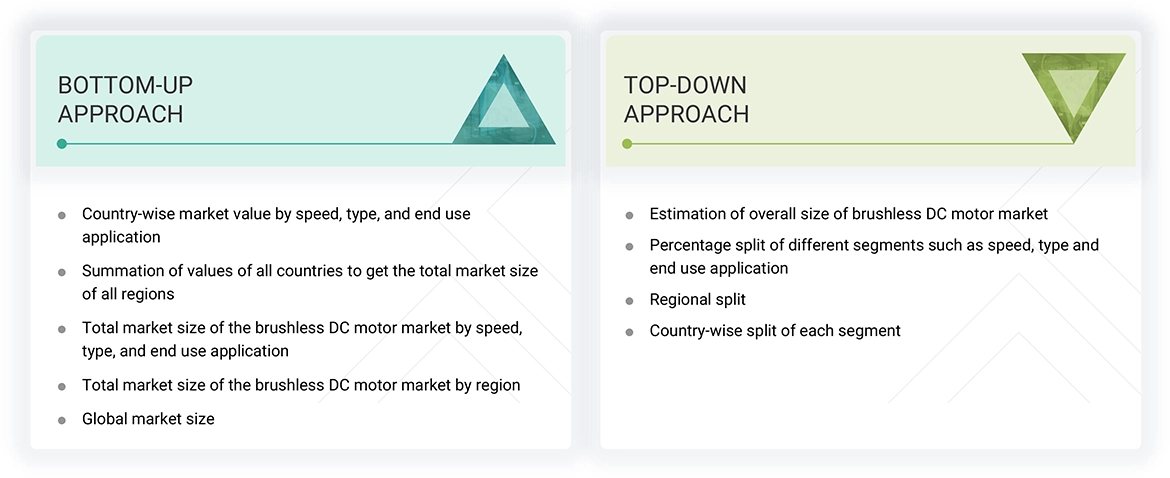

The study involved major activities in estimating the current size of the brushless DC motor market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the brushless DC motor market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect useful information for a technical, market-oriented, and commercial study of the global brushless DC motor market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

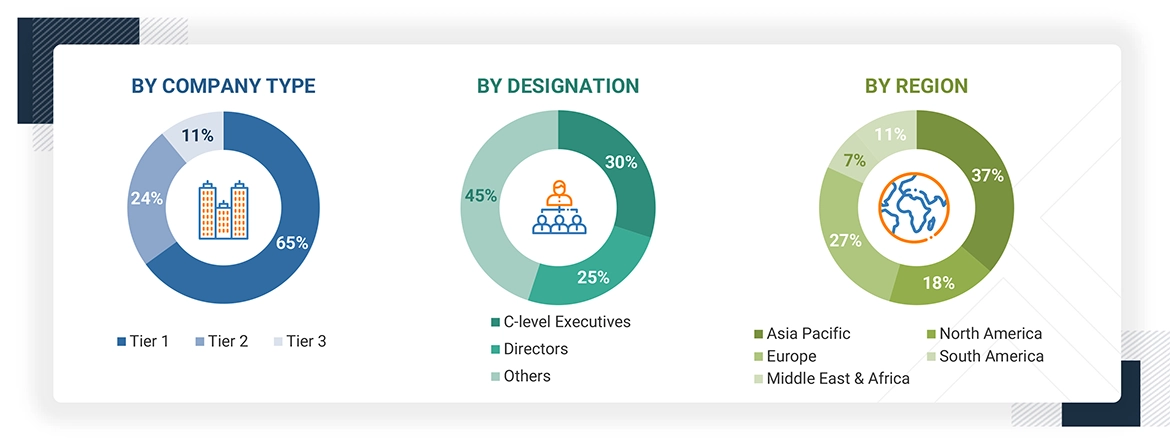

The stakeholders in the brushless DC motor industry include, but are not limited to, the BLDC motor manufacturers, component manufacturers, technology providers, support service providers, among others that make the product offerings in the brushless DC motor value chain. The energy-efficient compact low-maintenance motor solutions application (electric vehicles, HVAC, robotics, and industrial automation) is rapidly spreading to drive the demand side of this market. The growing interest in sustainability, less power consumption, and a rise in performance efficiency are still influencing the requirements in the market. In terms of its supply side, the market is driven by the increased production capacities, growth in the respective motor control technologies, and strategic mergers or acquisitions between major players in the market. Instead, several primary sources in the market's demand and supply side were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

Note: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier

2: USD 500 million–1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the brushless DC motor market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the brushless DC motor market.

Brushless DC Motor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Brushless DC motors are synchronous electric motors driven by direct current (DC) and are sometimes termed electronically commutated (EC) motors. Their high efficiency level is well known, and they provide high levels of torque at a large speed range. Permanent magnets in these provide a rotating field (against non-rotating armatures) that does not require brushes and carries less electrical loss. They are compact, very lightweight, and have low maintenance requirements; hence, they are best suited to various applications.

The brushless DC motor market size depends on the total revenue earned by manufacturers in the world from the sale of BLDC motors. The end applications of these motors are wide ranging, such as consumer electronics, automotive, industrial manufacturing, and medical health. The geographical expansion of the marketing report is North America, Europe, Asia Pacific, the Middle East, Africa, and South America.

Stakeholders

- Government & Research Organizations

- Institutional Investors

- Investors/Shareholders

- Manufacturers’ Associations

- Automotive Electric Association

- Brushless DC Motor Manufacturers, Dealers, and Suppliers

- Organizations, Forums, Alliances, and Associations

- State and National Regulatory Authorities

- Venture Capital Firms

Report Objectives

- To describe and forecast the brushless DC motor market based on speed, type, end use application, and region in terms of value

- To describe and forecast the brushless DC motor market based on region in terms of volume

- To describe and forecast the brushless DC motor market for various segments with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the brushless DC motor supply chain analysis, case study analysis, key stakeholders and buying criteria, patent analysis, trade analysis, regulations and codes, pricing analysis, Porter’s five forces analysis, impact of AI, and US Tariff impact

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the market’s competitive landscape

- To analyze growth strategies adopted by market players, such as joint ventures, partnerships, mergers & acquisitions, contracts, agreements, and product launches in the brushless DC motor market

Micromarkets1 are defined as the segments and subsegments of the brushless DC motor market included in the report.

Core competencies2 of companies are captured in terms of their key developments and product portfolios, as well as the key strategies adopted by them to sustain their position in the brushless DC motor market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the brushless DC motor, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the brushless DC Motor market size in 2024?

The brushless DC Motor market size was USD 13.00 billion in 2024.

What are the major drivers for the brushless DC Motor market?

The brushless DC Motor market is mainly driven by high demand for HVAC systems, low-maintenance costs of brushless DC motors, and a significant increase in the adoption of energy-efficient brushless DC motors.

Which region is projected to be the fastest-growing brushless DC Motor market during the forecast period?

Asia Pacific is expected to be the fastest-growing market between 2025 and 2030, due to the expansion of the automotive sector, especially electric vehicles (EVs), which is a key growth engine, with strong government incentives and rising consumer adoption in the region.

Which will be the largest segment, by type, in the brushless DC Motor market during the forecast period?

The inner rotor segment is expected to hold the dominant share of the brushless DC Motor market.

Which segment is projected to be the largest end user in the brushless DC Motor market during the forecast period?

The consumer electronics segment is estimated to account for the largest market share during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Brushless DC motor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Brushless DC motor Market