Chromatography Columns Market Size, Growth, Share & Trends Analysis

Chromatography Columns Market by Column Type (Ion Exchange, Size Exclusion, Reverse and Normal Phases, HPLC, Affinity, Chiral), Capacity (1-100 ml, 100-1000 ml, >1 liter), End User (Pharma & Biotech, CRO, CDMO) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

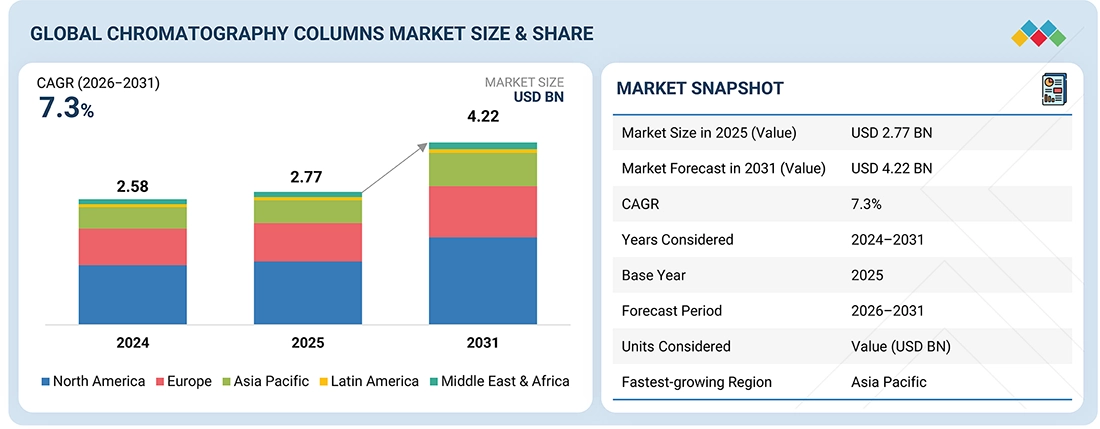

The global chromatography columns market, valued at US$2.58 billion in 2024, stood at US$2.77 billion in 2025 and is projected to advance at a resilient CAGR of 7.3% from 2025 to 2031, culminating in a forecasted valuation of US$4.22 billion by the end of the period. Demand is underpinned by increased reliance on chromatography-based purification and analytical workflows across drug development, bioprocessing, where high-resolution, high-throughput columns improve reproducibility, scalability, and regulatory compliance. On the demand side, the rising global burden of chronic diseases, accelerated biologics production, growing adoption of advanced UHPLC and specialty columns, and broader use in academic research are collectively increasing the number of assays, purification runs, and QC analyses performed using chromatography columns.

KEY TAKEAWAYS

-

BY REGIONThe North America chromatography columns market accounted for a 44.4% revenue share in 2025.

-

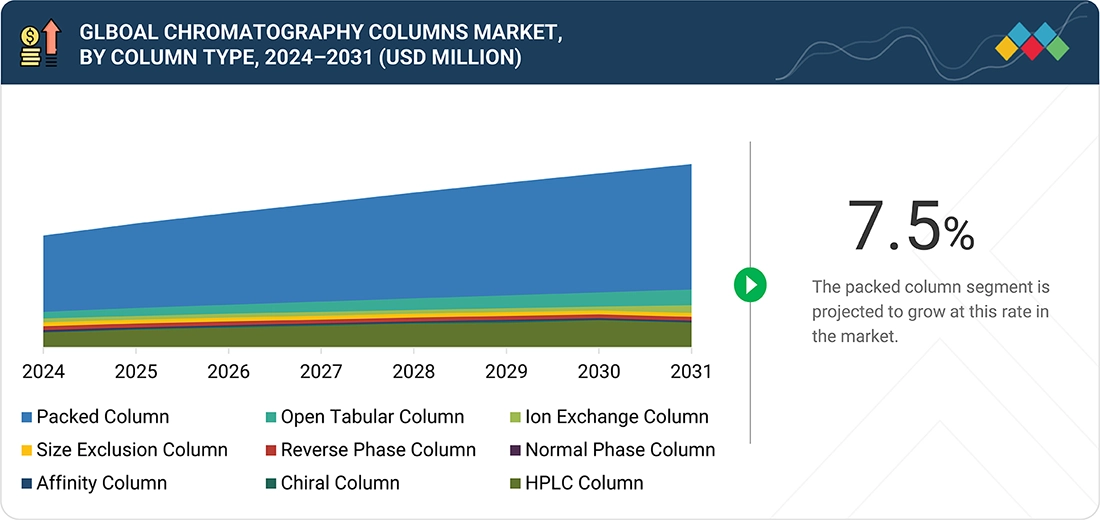

BY COLUMN TYPEThe packed columns are expected to register the highest CAGR of 7.5%

-

BY END USERThe pharmaceutical & biotech companies segment accounted for 38.0% of the chromatography columns market in 2025.

-

BY CAPACITYThe more than 1000 ml segment is expected to register the highest CAGR of 8.0% during the forecast period.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSThermo Fisher Scientific (US), Agilent Technologies (US), and Waters Corporation (US) were identified as some of the key players in the chromatography columns market (global), given their broad clinical LC-MS/MS portfolios, sizeable installed bases, and strong application-support networks.

-

COMPETITIVE LANDSCAPE- STARTUPSRestek Corporation (US), Sartorius AG (Germany), and Avantor (US), among others, have established a presence in the chromatography columns space by launching advanced chromatography columns, indicating their potential as emerging participants for further competitive assessment.

The chromatography columns market is evolving from a fragmented consumables segment into a strategically critical component of analytical and clinical laboratory workflows, driven by the increasing demand for reproducibility, method standardization, and high-throughput performance across regulated environments. Laboratories are prioritizing columns that deliver consistent lot-to-lot performance, extended lifetime, and compatibility with UHPLC and LC-MS systems, particularly for applications such as pharmaceutical quality control, biopharmaceutical characterization, and clinical research. Capital and procurement strategies are increasingly focused on platform-aligned column chemistries and standardized column families that allow laboratories to harmonize methods across instruments, sites, and geographies, reducing validation burden and method-transfer risk. Growth in biopharmaceutical development, especially monoclonal antibodies, oligonucleotides, peptides, and mRNA-based therapeutics, is driving strong demand for specialized columns for reversed-phase, ion-exchange, size-exclusion, and HILIC separations. At the same time, routine testing volumes in contract research organizations (CROs), contract development and manufacturing organizations (CDMOs), and regulated QC labs are supporting recurring consumables revenue and premium pricing for high-performance columns.

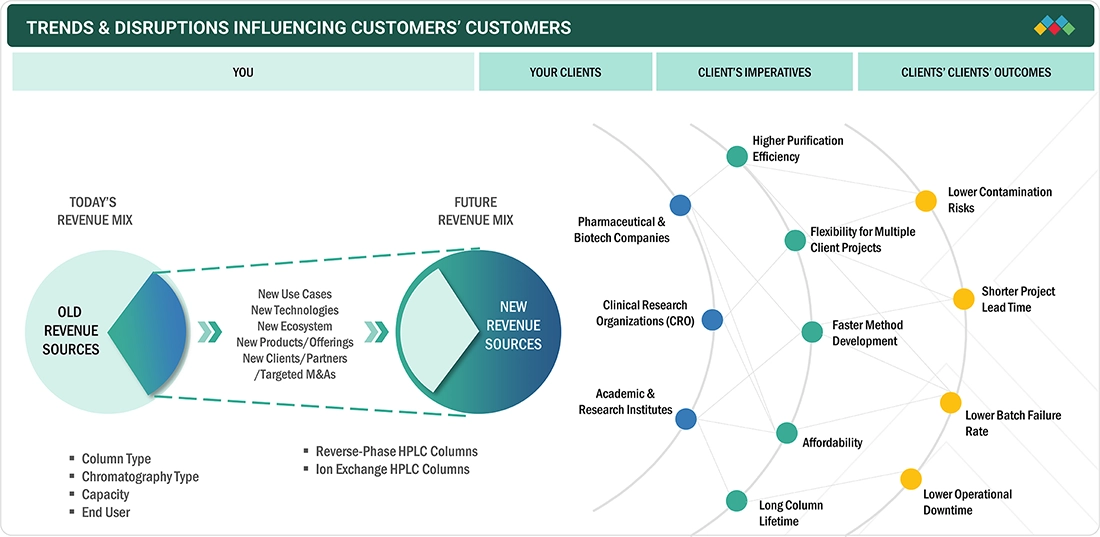

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The chromatography columns market is driven by expanding activities in the pharmaceutical and biopharmaceutical industries, where these tools are fundamental to critical analytical and purification tasks. Pharmaceutical companies are performing more high-throughput quality control tests, stability studies, and impurity profiling as part of routine batch release and regulatory compliance, leading to frequent replacement and upgrading of columns in quality assurance labs. Nearly half of total chromatography column usage is attributed to pharmaceutical analysis, where columns are employed to separate active pharmaceutical ingredients, detect trace impurities, and validate drug formulations with precision and accuracy. Moreover, in biotechnology, the rapid growth of biologics, including monoclonal antibodies, recombinant proteins, and other complex biomolecules, has significantly increased demand for specialized chromatography columns capable of handling large molecules with high resolution. Biopharmaceutical manufacturers are scaling up production capacities and adopting single-use and pre-packed column formats to streamline purification processes, reduce contamination risk, and improve throughput.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Demand in Quality Control and Regulatory Compliance

-

Growth in Pharmaceutical and Biotechnology Manufacturing

Level

-

High Cost of Equipment and Columns

-

Short Column Lifespan and Recurring Costs

Level

-

Expansion of End-use Industries in Emerging Markets

-

Continuous and Green Chromatography Technologies

Level

-

Complex Regulatory and Validation Requirements

-

Shortage of Skilled Workforce

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Demand in Quality Control and Regulatory Compliance

A major driver of the chromatography columns market is the increasing emphasis on stringent quality control and regulatory compliance across the pharmaceutical and biotechnology sectors. Regulatory bodies such as the FDA, EMA, and other global pharmacopeias require comprehensive analytical testing at multiple stages of drug development and manufacturing to ensure that products meet safety, purity, and efficacy standards. Chromatography columns are central to these testing protocols because they are widely used for impurity profiling, stability testing, residual solvent analysis, and method validation, all of which are mandatory components of regulatory submissions and batch release procedures.

Restraint: High Cost of Equipment and Columns

The high cost of chromatography equipment and columns acts as a significant restraint on market growth. Advanced chromatography systems, including HPLC, UHPLC, and preparative chromatographs, require substantial initial investment, which can be prohibitive for smaller research laboratories, academic institutions, and facilities in emerging markets. Individual high-performance columns are also expensive due to their specialized manufacturing and materials, and in high-throughput or complex workflows, columns often need frequent replacement because of wear, contamination, or degradation, leading to recurring costs. Beyond the column itself, laboratories must account for ongoing operational expenses such as solvents, reagents, filters, system maintenance, waste disposal, and the need for trained personnel to operate and maintain the equipment.

The expansion of emerging markets is a significant driver of growth in the chromatography columns market. Regions such as the Asia Pacific, Latin America, and the Middle East & Africa are witnessing rapid development in pharmaceutical manufacturing, biotechnology research. In the Asia Pacific, countries like China and India are modernizing their analytical laboratories and increasing the adoption of pre-packed and high-performance chromatography columns to support biopharmaceutical production, drug development, and quality-control workflows. The rising regulatory standards in these regions for pharmaceuticals, environmental monitoring, and food safety are further pushing demand for chromatography-based analyses.

Challenge: Shortage of Skilled Workforce

A notable factor challenging the growth of the chromatography columns market is the shortage of skilled professionals capable of operating, maintaining, and optimizing modern chromatographic systems. Advanced chromatography techniques, including method development, validation, data interpretation, and troubleshooting, require specialized training and experience, and many laboratories report difficulty in finding qualified analysts and separation scientists, particularly in regions where training resources and formal educational programs are limited. Industry surveys indicate that a significant percentage of laboratories experience longer method development cycles and lower productivity due to staffing gaps in separation science roles.

CHROMATOGRAPHY COLUMNS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers pre-packed columns for high-throughput biopharmaceutical purification | Used for the purification of biologics such as monoclonal antibodies, vaccines, and recombinant proteins |

|

Delivers superior separation efficiency and tight, symmetrical peaks with excellent resolution for complex samples | API assay, impurity profiling, and dissolution testing, helping to meet FDA, USP, and ICH requirements |

|

Offers MaxPeak High Performance Surfaces (HPS) technology that minimizes non-specific adsorption of metal-sensitive analytes (e.g., organophosphates, chelating compounds) | Improved detection and quantification of metal-sensitive pharmaceuticals, and other trace compounds |

|

Offers Foresight Pro Process-Scale prepacked columns | Used in large-scale, downstream purification (capture, intermediate, and polishing) of biologics, including monoclonal antibodies and other recombinant proteins |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The chromatography columns ecosystem spans column manufacturers (Agilent Technologies, Thermo Fisher Scientific, Waters Corporation, Merck KGaA, Bio-Rad Laboratories, Restek Corporation, and others), raw material and subsystem suppliers (stationary phase providers, silica and polymeric particle manufacturers, precision hardware and accessory vendors), distributors, and end users such as pharmaceutical and biotechnology R&D laboratories, contract research and manufacturing organizations (CROs/CMOs), and academic institutions. Manufacturers differentiate through high-performance HPLC, UHPLC, and specialty columns, advanced stationary phase chemistries, and application-specific solutions, while component suppliers provide packing materials, precision modules, and ancillary components that underpin column performance, reproducibility, and reliability. Distributors manage installation and service, and support localized regulatory and procurement requirements, particularly in Europe, North America, and emerging Asian markets. On the demand side, pharmaceutical and biotechnology companies adopt chromatography columns for drug discovery, impurity profiling, and method validation, while clinical laboratories and CROs/CMOs use them for bioanalysis, therapeutic monitoring, and purification workflows. Academic and research institutions also leverage chromatography columns for life sciences research, highlighting their broad utility across multiple sectors that require high-resolution separation and reliable analytical performance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Chromatography Columns Market, By Column Type

Packed columns hold the major share of the chromatography columns market due to their widespread applicability, versatility, and proven performance across analytical and preparative workflows. These columns, filled with carefully engineered stationary-phase particles, provide high separation efficiency, reproducibility, and resolution, making them suitable for a broad range of applications, including pharmaceutical analysis and biopharmaceutical purification. Their compatibility with both HPLC and UHPLC systems, along with the ability to handle complex samples and high-throughput workflows, makes packed columns the preferred choice for laboratories seeking reliability and consistent performance.

Chromatography Columns Market, By Capacity

Columns with capacities more than 1000?ml hold the largest market share due to their critical role in large-scale purification and production workflows, particularly in the biopharmaceutical and industrial sectors. These high-capacity columns are essential for processing substantial volumes of complex biological materials, such as monoclonal antibodies, recombinant proteins, vaccines, and other biologics, where high throughput and scalability are key requirements. Their large volume allows for efficient separation and purification at production scales, reducing the number of runs required and improving overall process efficiency.

Chromatography Columns Market, By End User

Pharmaceutical & biotechnology companies hold the major share of the chromatography columns market due to their extensive and continuous need for analytical and preparative separations throughout drug discovery, development, and manufacturing processes. These companies rely heavily on chromatography columns for tasks such as active pharmaceutical ingredient (API) analysis, impurity profiling, method validation, therapeutic drug monitoring, and large-scale purification of biologics, including monoclonal antibodies, vaccines, and recombinant proteins. The stringent regulatory requirements from agencies like the FDA and EMA further necessitate the use of high-performance columns to ensure product safety, efficacy, and consistency.

REGION

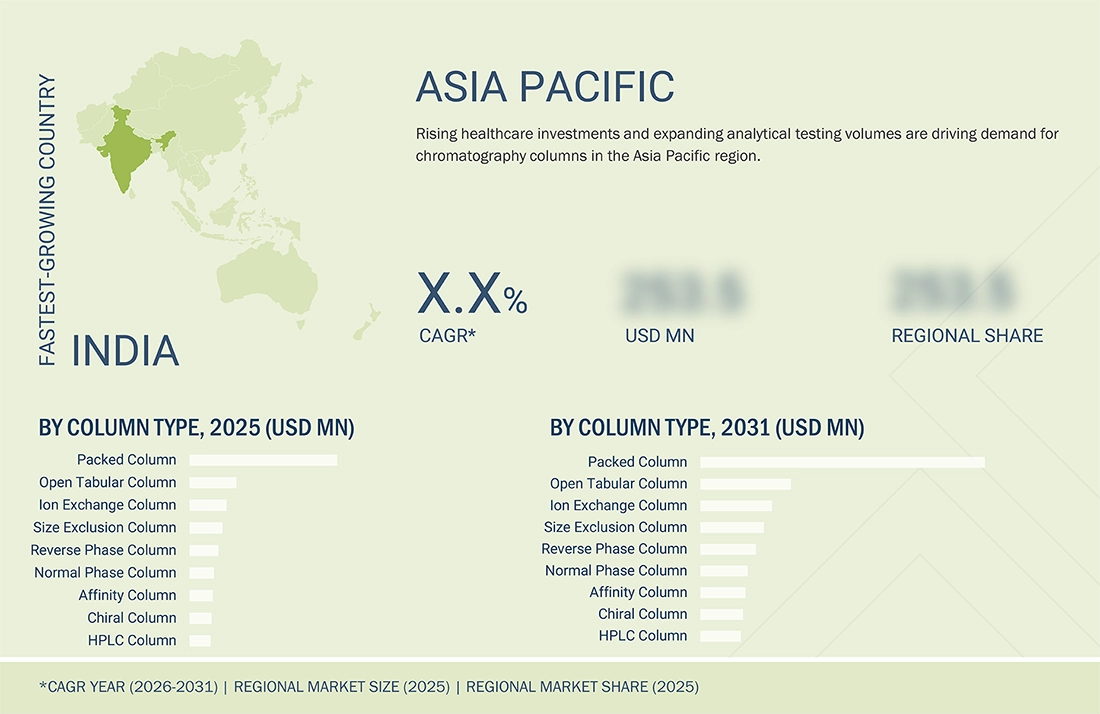

Asia Pacific to be fastest-growing region in global chromatography columns market during forecast period

The chromatography columns market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is experiencing significant growth due to the expansion of pharmaceutical and biotechnology industries, increasing R&D investments, and rising regulatory compliance requirements in the region. Countries like China and India are scaling up drug discovery, biologics manufacturing, and contract research/contract manufacturing activities, all of which require high-performance chromatography columns for analytical testing, purification, and quality control. The growing adoption of modern laboratory infrastructure, coupled with the establishment of new research centers and clinical laboratories, is further boosting demand. Additionally, the rising focus on environmental monitoring, food safety, and clinical diagnostics contributes to a broadening end user base in the region. Favorable government initiatives, increasing healthcare expenditure, and the expansion of pharmaceutical exports from the Asia Pacific are also driving the adoption of chromatography columns, making the region the fastest-growing market globally.

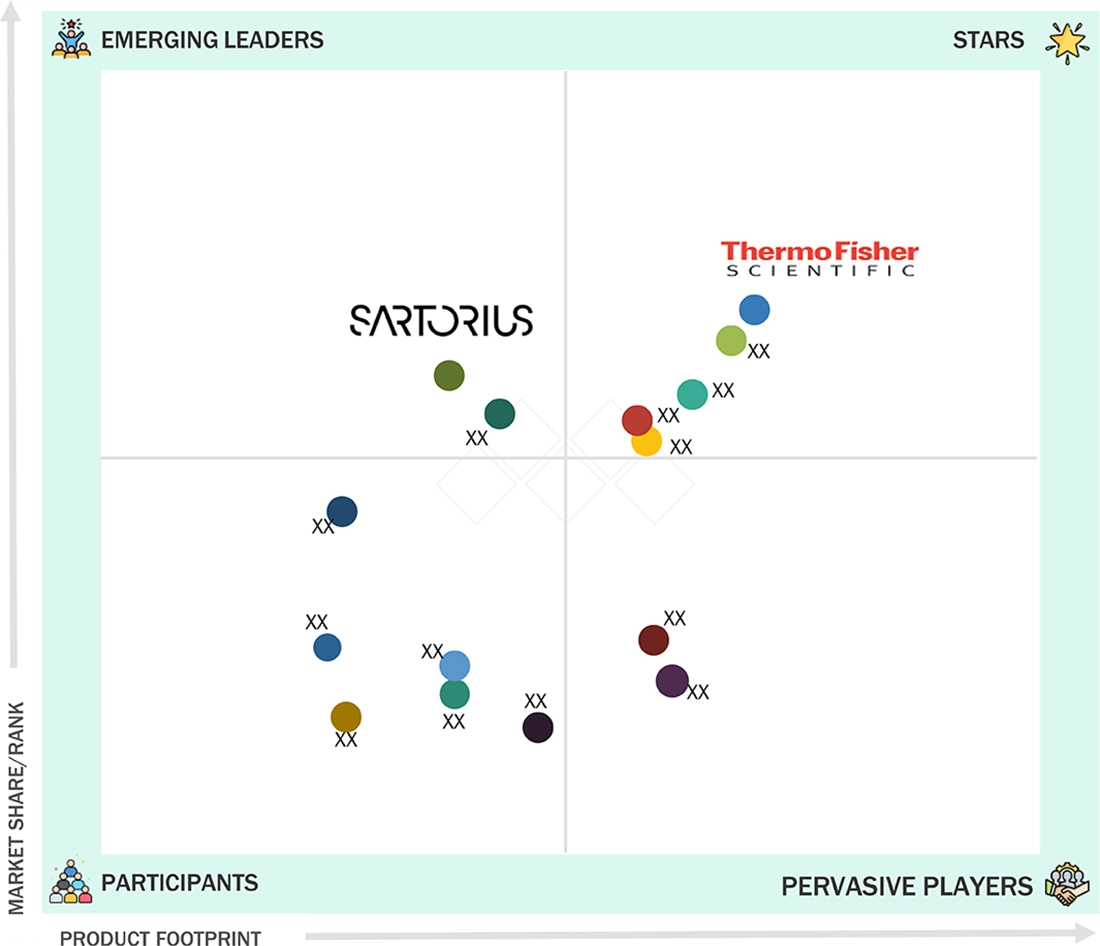

CHROMATOGRAPHY COLUMNS MARKET: COMPANY EVALUATION MATRIX

In the chromatography columns market matrix, Agilent Technologies, Thermo Fisher Scientific, and Waters Corporation dominate the "stars" cluster, anchored by a diverse portfolio, strong regional presence, and a tie-up with the end user. The competitive landscape is intensifying as multinational leaders are focusing on expansion in the emerging market with advanced products, and emerging market players are focusing on launching cost-effective chromatography columns.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.77 Billion |

| Market Forecast in 2030 (value) | USD 4.22 Billion |

| Growth Rate | CAGR of 7.3% from 2026–2031 |

| Years Considered | 2023–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Billion), Volume (Unit Installed) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

| Parent & Related Segment Reports |

Chromatography Accessories Market Asia-Pacific chromatography accessories and consumables market European chromatography accessories and consumables market US chromatography accessories and consumables market |

WHAT IS IN IT FOR YOU: CHROMATOGRAPHY COLUMNS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Biopharmaceutical Companies |

|

|

RECENT DEVELOPMENTS

- January 2025 : Bio-Rad Laboratories, Inc. a global life science and clinical diagnostic company, annouced the launch of Foresight Pro 45 cm inner diameter (ID) chromatography columns, designed to support downstream process-scale chromatography applications across different stages of biological drug production.

- January 2025 : Waters Corporation, which is a provider of analytical instruments, announced the expansion of its MaxPeak Premier Reversed-Phase Column portfolio with MaxPeak Premier OBD Preparative Columns. The new columns were introduced at the 29th Symposium on the Interface of Regulatory and Analytical Sciences for Biotechnology Health Products (WCBP 2025) in Washington, DC.

- June 2025 : Waters Corporation announced the launch of the BioResolve Protein A Affinity Columns with MaxPeak Premier Technology, providing precise titer measurements. This launch marked the first set of affinity chromatography columns that Waters brought to market.

Table of Contents

Methodology

This study relied heavily on both primary and secondary sources. Extensive secondary research was conducted to gather information about the chromatography accessories & consumables industry. The next step involved validating these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Various approaches were employed to estimate the overall market size, including top-down and bottom-up methods. Subsequently, market segmentation and data triangulation procedures were applied to determine the market size of different segments and subsegments within the chromatography accessories and consumables market. The research also examined various factors influencing the industry to identify segmentation types, industry trends, key players, the competitive landscape, essential market dynamics, and strategies employed by key market participants.

Secondary Research

The secondary research process relies heavily on secondary sources, including directories, databases such as Bloomberg Business, Factiva, and D&B Hoovers, white papers, annual reports, company documents, investor presentations, and SEC filings. This type of research was utilized to gather valuable information for a comprehensive, technical, market-oriented, and commercial analysis of the chromatography accessories and consumables market. It also helped me acquire crucial insights into key players and the market's classification and segmentation based on industry trends down to the most detailed level. Additionally, significant developments related to market and technology perspectives were identified. A database of the key industry leaders was created using this secondary research.

The market for companies offering chromatography accessories & consumables services is assessed through secondary data from paid and unpaid sources. This analysis involves examining major companies' product portfolios and evaluating their performance and quality. Various sources were consulted during the secondary research process to gather comprehensive information for this study. The secondary research provided essential insights into the industry's value chain, identified the key players, and facilitated market classification and segmentation from market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to gather qualitative and quantitative information for this report. The supply-side primary sources included industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from prominent companies and organizations in the chromatography accessories and consumables market. On the demand side, primary sources included OEMs, private and contract testing organizations, and service providers. This primary research validated market segmentation, identified key players and gathered insights on significant industry trends and market dynamics.

After completing the market engineering process, which included calculations for market statistics, market breakdown, estimation, forecasting, and data triangulation, we conducted extensive primary research. This research aimed to gather information and verify the critical numbers obtained through initial calculations. Additionally, we identified various segmentation types, industry trends, and the competitive landscape of chromatography accessories and consumables devices offered by different market players. We also examined key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and the strategies of major players in the market.

In the comprehensive market engineering process, top-down and bottom-up approaches and various data regulation methods were utilized to estimate and forecast the overall market segments and subsegments outlined in this report. Extensive qualitative and quantitative analyses were conducted throughout the market engineering process to highlight key information and insights presented in the report.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the chromatography accessories & consumables market size. These methods were also used extensively to estimate the size of various segments in the market.

Revenue share analysis was employed to determine the size of the global chromatography accessories and consumables market about the leading players to determine the size of the global chromatography accessories and consumables market. In this case, key players in the market have been identified, and their chromatography accessories and consumables business revenues were determined through various insights gathered during the primary and secondary research phases. Secondary research included studying top market players' annual and financial reports. On the other hand, primary research incorporated in-depth interviews with key opinion leaders, particularly chief executive officers, directors, and key marketing executives.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global chromatography accessories and consumables market was split into segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics for all segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, top-down and bottom-up approaches validated the chromatography accessories and consumables market.

Market Definition

Chromatography is used in analytical chemistry to separate and analyze volatile compounds without decomposition. It conducts complicated separations like amino acid sequencing or pollutant separation. In this non-destructive technique, separation is based on differential partitioning between the mobile and stationary phases. Chromatography accessories and consumables play a vital role in the operation of chromatography systems. These products are usually required to operate and maintain chromatography instruments and systems.

Stakeholders

- Chromatography instrument manufacturers

- Chromatography consumable manufacturers

- Third-party chromatography instrument suppliers

- Raw material suppliers for instruments

- Oil & gas companies

- Environmental protection agencies & institutes

- Food & beverage companies

- Pharmaceutical & biotechnology companies

- Cosmetics companies

- Market research & consulting firms

- Regulatory bodies

- Venture capitalists

Report Objectives

- To define, describe, and forecast the chromatography accessories and consumables market based on technology, product, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global chromatography accessories and consumables market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global chromatography accessories and consumables market

- To analyze key growth opportunities in the global chromatography accessories and consumables market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain and Rest of Europe), Asia Pacific (Japan, China, India, Australia, Thailand, Singapore, Indonesia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (GCC Countries and the rest of Middle East & Africa)

- To profile the key players in the global chromatography accessories & consumables market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global chromatography accessories & consumables market, such as agreements, expansions, and product launches

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Chromatography Columns Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Chromatography Columns Market