Clinical Analytics Market Size, Growth, Share & Trends Analysis

Clinical Analytics Market by Offering (Raw Data, Platform), Source (EHR, Trials, Claims, RWE), Use Case (CDSS, RPM, PHM, R&D, Pharmacovigilance, Precision Medicine, Regulatory), End User (Hospital, Payer, Pharma, Medtech), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The clinical analytics market is projected to reach USD 81.32 billion by 2030 from USD 33.09 billion in 2025, at a CAGR of 19.7% from 2025 to 2030. The growth of the clinical analytics market is primarily driven by the shift toward value-based care and reimbursement models, pushing healthcare organizations to enhance outcomes while reducing costs. Increasing regulatory openness to real-world evidence (RWE) fosters the integration of advanced analytics into clinical and research workflows. Additionally, the rapid adoption of cloud-based and modern data platforms, enabling scalable, real-time insights and seamless interoperability, further accelerates market expansion.

KEY TAKEAWAYS

-

BY OFFERINGThe clinical analytics market comprises raw data and software & platforms. In 2024, raw data held the largest market share, driven by the increasing volume and complexity of healthcare data generated across hospitals, clinics, and diagnostic centers. The raw data segment of the clinical analytics market held the largest share in 2024. Healthcare providers and researchers are increasingly relying on comprehensive, high-quality datasets to perform advanced analytics, derive actionable insights, and support evidence-based decision-making. Additionally, the growing adoption of electronic health records (EHRs), wearable devices, and remote monitoring systems has significantly expanded the availability of structured and unstructured clinical data, further fueling the demand for raw data solutions in analytics platforms. Robust data accessibility and interoperability requirements across healthcare systems also contribute to the prominence of the raw data segment in the market.

-

BY DATA SOURCEData sources included clinical trials data, claims data, Electronic Health Record (EHR), registries & real-world evidence (RWE), imaging and diagnostics, lab and pathology, multiomics data, and other data sources such as wearable and public health data. EHR segment have registered for the fastest growth in clinical analytics market driven by the widespread adoption of electronic health records (EHRs) across healthcare providers, the EHR segment is registering the fastest growth in the clinical analytics market. EHRs serve as a centralized repository of patient information, including medical history, diagnoses, treatment plans, lab results, and medication records, enabling seamless access to structured and real-time data for analytics. The growing emphasis on value-based care, regulatory compliance, and population health management has accelerated EHR integration with advanced analytics platforms to support predictive modeling, risk stratification, and clinical decision-making. Furthermore, advancements in interoperability standards and the adoption of cloud-based EHR systems have facilitated large-scale data aggregation and analysis, driving the rapid expansion of this segment in the clinical analytics market.

-

BY USE CASEThe clinical analytics market comprises healthcare & life science use cases. Healthcare segment holds significant share in 2024 for clinical analytics market, driven by the increasing demand for data-driven insights to improve patient outcomes, reduce healthcare costs, and enhance operational efficiency, the healthcare segment held a significant share of the clinical analytics market in 2024. Healthcare providers are leveraging clinical analytics to support evidence-based decision-making, optimize care pathways, and enable predictive and preventive care. The rising adoption of electronic health records (EHRs), integration of real-world evidence (RWE), and the growing focus on population health management have further fueled the need for advanced analytics solutions in hospitals, clinics, and other care settings. Additionally, regulatory pressures and value-based care initiatives are pushing healthcare organizations to adopt analytics tools for quality measurement, risk assessment, and improved patient engagement, driving the segment’s strong market presence.

-

BY END USERKey end users include healthcare providers, healthcare payers, life sciences & other end users. Healthcare providers experienced the fastest growth during the forecast period, driven by the increasing reliance on data-driven insights to enhance patient care, streamline clinical workflows, and support value-based care initiatives. During the forecast period, healthcare providers experienced the fastest growth among end users in the clinical analytics market. Hospitals, clinics, and specialty care centers are adopting advanced analytics tools to enable predictive modeling, risk stratification, and real-time decision-making while improving operational efficiency and resource management. Integrating electronic health records (EHRs), real-world evidence (RWE), and remote monitoring data further empowers providers to deliver personalized, outcome-focused care, fueling the rapid adoption of clinical analytics solutions in this segment.

-

BY REGIONThe clinical analytics market covers Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa. North America is the largest market for clinical analytics, driven by the strong adoption of value-based care models, advanced healthcare IT infrastructure, and increasing use of outcome-based metrics by payers and providers to enhance care quality and reduce costs.

The clinical analytics market is growing due to the global shift toward value-based healthcare, genomics and omics data integration to advance precision medicine, and the rising adoption of AI-powered diagnostic support systems. Additionally, the expansion of telemedicine and remote monitoring is generating vast real-time patient data, driving demand for advanced analytics to enhance care delivery and population health management.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of clinical analytics platform providers, and target applications are clients of clinical analytics platform providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of clinical analytics platform providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase data generation from diverse sources

-

Payers and providers use outcome metrics to enhance population health and care quality.

Level

-

Data quality and standardization issues

-

Data privacy and regulatory constraints

Level

-

Analytics for decentralized and hybrid clinical trials.

-

Edge & on device analytics for remote monitoring.

Level

-

Biased training data.

-

Vendor lock in & migration risk.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased data generation from diverse sources

The healthcare industry is witnessing an explosion of data generated from diverse sources such as electronic health records (EHRs), wearable devices, imaging systems, genomics, and remote monitoring tools. This vast and varied data enables advanced analytics, empowering healthcare providers and researchers to uncover deeper insights into patient health, disease trends, and treatment outcomes. By integrating and analysing these datasets, organizations can drive personalized care, improve population health management, and enhance operational efficiency. As value-based care models gain traction, leveraging multi-source healthcare data has become a critical priority for hospitals, payers, and life sciences companies to deliver better outcomes and reduce costs.

Restraint: Data quality & standardisation issues

Data quality and standardization challenges hinder the effective use of healthcare analytics. Healthcare data is often fragmented, unstructured, and stored across disparate systems with varying formats and coding standards. This lack of uniformity creates difficulties in data integration, interoperability, and accurate analysis. Moreover, inconsistent data entry, incomplete patient records, and errors in clinical documentation further compromise data reliability. As a result, healthcare organizations face obstacles in generating actionable insights, meeting regulatory reporting requirements, and supporting advanced analytics initiatives such as AI and predictive modeling, limiting the full potential of data-driven decision-making.

Opportunity: Analytics for decentralized & hybrid clinical trials

The growing adoption of decentralized and hybrid clinical trials is creating significant opportunities for advanced analytics solutions. As trials increasingly leverage remote patient monitoring, digital health tools, and virtual platforms, vast amounts of real-time data are generated from diverse sources such as wearables, mobile apps, and telehealth consultations. This shift drives the need for robust analytics to manage, integrate, and interpret complex datasets, enabling better patient recruitment, adherence tracking, and safety monitoring. Moreover, pharmaceutical companies and CROs are investing in AI-driven predictive analytics to optimize trial design, accelerate drug development timelines, and reduce costs, positioning analytics as a critical enabler of the future of clinical research.

Challenge: Biased Training data

Biased training data poses a significant challenge to the development of reliable healthcare analytics and AI-driven clinical trial solutions. When datasets used to train algorithms lack diversity or are unrepresentative of real-world populations, they can lead to skewed insights and inaccurate predictions. Factors such as underrepresentation of certain demographics, variations in clinical practices across regions, and incomplete or inconsistent data further amplify this issue. In the context of decentralized and hybrid clinical trials, biased data can impact patient recruitment strategies, trial outcomes, and regulatory compliance, potentially leading to safety risks and reduced trust among stakeholders. Addressing these biases through rigorous data curation and standardization is essential to ensure fairness, accuracy, and scalability of analytics solutions.

Clinical Analytics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced analytics to design and manage decentralized & hybrid clinical trials, with AI-powered patient recruitment and real-time safety monitoring | Accelerated drug development timelines, improved trial efficiency, and reduced costs |

|

Population health analytics to manage chronic diseases and predict patient risks using claims and clinical data integration | Better care coordination, reduced hospital readmissions, improved health outcomes |

|

Analytics-driven quality and compliance reporting for healthcare providers and payers | Simplified regulatory reporting, enhanced compliance, reduced administrative burden. |

|

AI-driven clinical decision support integrated within EHR systems to improve care workflows | Streamlined clinician workflows, reduced errors, improved care quality. |

|

Cloud-based clinical data warehousing and analytics platform that integrates EHR, genomics, and real-world evidence to support clinical research, personalized medicine, and operational insights | Scalable and secure data infrastructure for multi-source integration |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The clinical analytics market ecosystem consists of data sources (e.g., EHR systems, wearable devices, claims data), technology providers (e.g., Epic Systems, SAS Institute, Health Catalyst), and end users such as healthcare providers, payers, pharmaceutical companies, and regulatory bodies. Clinical and operational data generated across care settings are collected, standardized, and processed through advanced analytics platforms to generate actionable insights. These insights are used to improve patient outcomes, optimize workflows, reduce costs, and accelerate drug development. End users drive demand for value-based care, personalized medicine, and regulatory compliance, while technology providers deliver solutions that integrate AI, predictive modeling, and real-time decision support. Collaboration across stakeholders, including hospitals, payers, life sciences companies, and technology vendors, is critical to ensuring data interoperability, regulatory alignment, and scalable innovation, ultimately fuelling growth in the clinical analytics market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Clinical Analytics Market, By Offering

The clinical analytics market comprises raw data and software & platforms. In 2024, raw data held the largest market share, driven by the increasing volume and complexity of healthcare data generated across hospitals, clinics, and diagnostic centers. The raw data segment of the clinical analytics market held the largest share in 2024. Healthcare providers and researchers are increasingly relying on comprehensive, high-quality datasets to perform advanced analytics, derive actionable insights, and support evidence-based decision-making. Additionally, the growing adoption of electronic health records (EHRs), wearable devices, and remote monitoring systems has significantly expanded the availability of structured and unstructured clinical data, further fueling the demand for raw data solutions in analytics platforms. Robust data accessibility and interoperability requirements across healthcare systems also contribute to the prominence of the raw data segment in the market.

Clinical AnalyticsMarket, By Data Source

Data sources included clinical trials data, claims data, Electronic Health Record (EHR), registries & real-world evidence (RWE), imaging and diagnostics, lab and pathology, multiomics data, and other data sources such as wearable and public health data. Imaging and diagnostics segment have held the largest market share in 2024 in clinical analytics market driven by the the growing utilization of medical imaging and diagnostic procedures across hospitals, diagnostic centers, and specialty clinics, the increasing volume of radiology, pathology, and laboratory imaging data, coupled with advancements in imaging technologies such as MRI, CT, PET, and digital pathology, has created a substantial need for analytics solutions to process, quantify, and interpret complex datasets. Additionally, the rising adoption of AI- and machine learning-powered imaging analytics for early disease detection, treatment planning, and outcome prediction has fueled demand. Integration of imaging and diagnostic data with other clinical datasets, including EHRs and real-world evidence (RWE), enables comprehensive insights, strengthening the dominance of this segment in the market.

Clinical Analytics Market, By Use Case

The clinical analytics market comprises healthcare & life science use cases. Healthcare segment holds significant share in 2024 for clinical analytics market, driven by the increasing demand for data-driven insights to improve patient outcomes, reduce healthcare costs, and enhance operational efficiency, the healthcare segment held a significant share of the clinical analytics market in 2024. Healthcare providers leverage clinical analytics to support evidence-based decision-making, optimize care pathways, and enable predictive and preventive care. The rising adoption of electronic health records (EHRs), integration of real-world evidence (RWE), and the growing focus on population health management have further fueled the need for advanced analytics solutions in hospitals, clinics, and other care settings. Additionally, regulatory pressures and value-based care initiatives are pushing healthcare organizations to adopt analytics tools for quality measurement, risk assessment, and improved patient engagement, driving the segment’s strong market presence.

Clinical Analytics Market, By End User

Key end users include healthcare providers, healthcare payers, life sciences & other end users. Healthcare providers experienced the largest share in 2024 as well as the fastest growth during the forecast period, driven by the increasing reliance on data-driven insights to enhance patient care, streamline clinical workflows, and support value-based care initiatives. Healthcare providers experienced the fastest growth among end users in the clinical analytics market during the forecast period. Hospitals, clinics, and specialty care centers are adopting advanced analytics tools to enable predictive modeling, risk stratification, and real-time decision-making while improving operational efficiency and resource management. The integration of electronic health records (EHRs), real-world evidence (RWE), and remote monitoring data further empowers providers to deliver personalized, outcome-focused care, fueling the rapid adoption of clinical analytics solutions in this segment.

REGION

Asia Pacific to be fastest-growing region in global clinical analytics market during forecast period

The Asia Pacific region is projected to be the fastest-growing market for clinical analytics during the forecast period, driven by the rapid digitization of healthcare systems and the widespread adoption of Electronic Health Records (EHRs). Rising healthcare expenditures, a growing patient population, and the increasing prevalence of chronic diseases generate vast amounts of healthcare data, fueling the need for advanced analytics solutions. China, India, and Japan are investing heavily in AI, machine learning, and big data technologies to enhance predictive analytics, improve patient outcomes, and optimize resource allocation. Supportive government policies promoting value-based care, data interoperability, and healthcare quality improvement are further accelerating market growth. With expanding healthcare infrastructure, a rising focus on personalized medicine, and growing collaborations between technology providers and healthcare organizations, the Asia Pacific is poised to lead in adopting clinical analytics solutions.

Clinical Analytics Market: COMPANY EVALUATION MATRIX

In the clinical analytics market, Optum, Inc. (Star) holds a leading position with a substantial market share and extensive product portfolio, driven by its integrated analytics platforms that leverage claims, clinical, and social determinants of health (SDoH) data. Its advanced capabilities in predictive analytics, population health management, and value-based care optimization, supported by a vast healthcare data network and continuous investment in AI and machine learning, position Optum as a dominant player. Epic Systems Corporation (Emerging Leader) is gaining momentum through its deeply embedded analytics solutions within its electronic health record (EHR) ecosystem. The company’s strength lies in delivering real-time clinical insights, care coordination analytics, and population health management tools, enabling healthcare organizations to enhance decision-making and patient outcomes. Epic’s growing market influence is further supported by its large installed base, seamless interoperability, and continued investments in AI-driven analytics and advanced reporting capabilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 27.65 Billion |

| Market Forecast in 2030 (Value) | USD 81.32 Billion |

| Growth Rate | CAGR of 19.7% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Clinical Analytics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Further breakdown of the Rest of Europe clinical analytics market |

|

|

| Further breakdown of the Rest of Asia Pacific clinical analytics market |

|

|

| Further breakdown of the Rest of Latin America clinical analytics market |

|

|

| Further breakdown of the Rest of Middle East & Africa clinical analytics market |

|

|

RECENT DEVELOPMENTS

- September 2025 : Epic launched Comet, a medical intelligence platform to deliver advanced clinical and operational insights. Comet integrates data across multiple systems, using AI and real-time analytics to support clinical decision-making, operational forecasting, and population health management. It enables proactive identification of trends and resource needs, improving efficiency and patient outcomes.

- August 2025 : IQVIA entered long-term clinical and commercial partnerships with Veeva Systems to integrate IQVIA’s data and analytics with Veeva’s commercial platforms. The collaboration focuses on improving trial planning, execution, and commercial operations, enhancing operational efficiency, and supporting real-time clinical and commercial insights.

- August 2025 : Optum launched Crimson AI, a predictive analytics platform designed to enhance operating room (OR) efficiency by optimizing schedules, reducing staffing costs, and minimizing surgical supply waste. Crimson AI leverages GPT-based AI and predictive analytics to improve OR utilization and operations.

- June 2024 : IQVIA introduced One Home for Sites, a unified digital platform to streamline clinical trial site operations. It centralizes workflows, reduces administrative burden, and integrates with IQVIA’s broader clinical trial ecosystem, improving trial efficiency and reducing delays in study execution.

- November 2024 : Health Catalyst launched an AI-powered version of BluePrint Protect, a platform that empowers healthcare organizations to screen and identify risks related to cybersecurity threats through third parties. This solution streamlines third-party risk assessments, reduces manual efforts, and provides enhanced risk visibility through intuitive dashboards, helping healthcare organizations respond faster to potential risks.

- November 2024 : Dassault Systèmes (Medidata) and Bioforum extended their decade-long collaboration through a new enterprise agreement, enhancing Bioforum's access to Medidata's AI-powered technologies. This partnership aims to streamline clinical data workflows and improve data quality for Bioforum’s biotech clients. The integration of Medidata Clinical Data Studio and eConsent is expected to accelerate clinical development and ensure compliance across various therapeutic areas.

Table of Contents

Methodology

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the clinical analytics market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the clinical analytics market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), the Organization for Economic Co-operation and Development (OECD), Healthcare Information and Management Systems Society (HIMSS), Centers for Disease Control and Prevention (CDC), ClinicalTrials.gov, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical analytics market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends, to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of clinical analytics offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

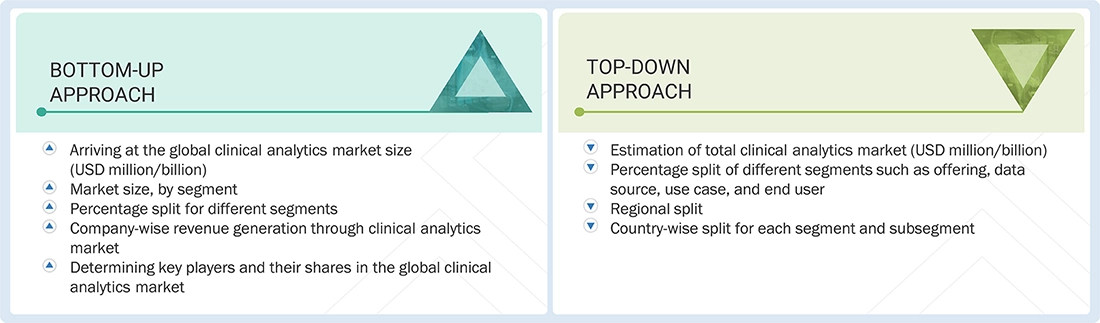

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

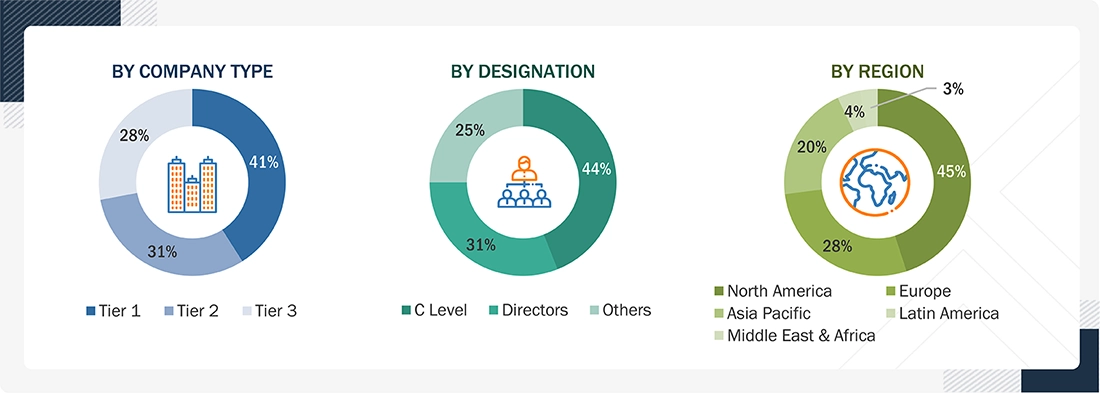

Breakdown of Primary Interviews

Note 1: Other designations include sales, marketing, and product managers.

Note 2: Tiers are defined based on a company’s total revenue, as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends, by offering, mode of interaction, application, end user, and region).

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the clinical analytics market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the clinical analytics market.

Market Definition

The clinical analytics market comprises technologies and software solutions that collect, analyze, and interpret clinical data to support evidence-based decision-making, optimize care delivery, and enhance operational efficiency. Leveraging AI, machine learning, predictive modeling, and data visualization, these platforms transform data from EHRs, medical imaging, labs, and other sources into actionable insights. They enable applications such as clinical decision support, disease surveillance, care coordination, quality improvement, and population health management, helping healthcare providers, payers, life sciences organizations, and public health agencies improve patient outcomes, drive value-based care, streamline workflows, and reduce costs through both real-time and retrospective analytics.

Stakeholders

- Clinical Analytics Software & Solution Providers (including AI-driven analytics vendors, predictive analytics platforms, and reporting software developers)

- Healthcare Providers (Hospitals, Outpatient Clinics, Specialty Care Centers, Telehealth Providers, Primary Care Centers, Long-term & Elder Care Facilities, Mental Health Clinics)

- Payers & Insurers

- Research & Development (R&D) Companies

- Population Health Management & Remote Monitoring Service Providers

- Consulting, Training & Implementation Service Providers (workflow optimization, analytics integration, clinical decision support)

- Medical Research Laboratories & Clinical Trial Organizations

- Academic Medical Centers/Universities/Research Institutes

- Regulatory & Compliance Bodies (e.g., FDA, EMA, HIPAA regulators)

- Data & Algorithm Developers (AI/ML specialists, predictive modeling experts, data scientists)

- Technology Infrastructure Providers (cloud platforms, EHR/PACS integrators, data storage & security providers)

- Venture Capitalists & Private Equity Firms

- Advocacy Groups & Professional Associations

- Investors & Financial Institutions

Report Objectives

- To define, describe, and forecast the clinical analytics market by offering, data source, use case, end user, and region

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall clinical analytics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the clinical analytics market in five main regions (and their respective countries): North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide key industry insights, such as ecosystem, value chain, technology, regulatory, patent, and the impact of the US tariff analysis

- To profile the key players in the market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches & upgrades, collaborations, partnerships, acquisitions, investments, contracts, agreements, alliances, mergers, funding, and expansions of the leading players in the market

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Clinical Analytics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Clinical Analytics Market