Cloud OSS/BSS Market

Cloud OSS/BSS Market by OSS (Network Management & Orchestration, Resource Management, Analytics & Assurance, Service Design & Fulfilment), BSS (Billing & Revenue Management, Product Management, Customer Management) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

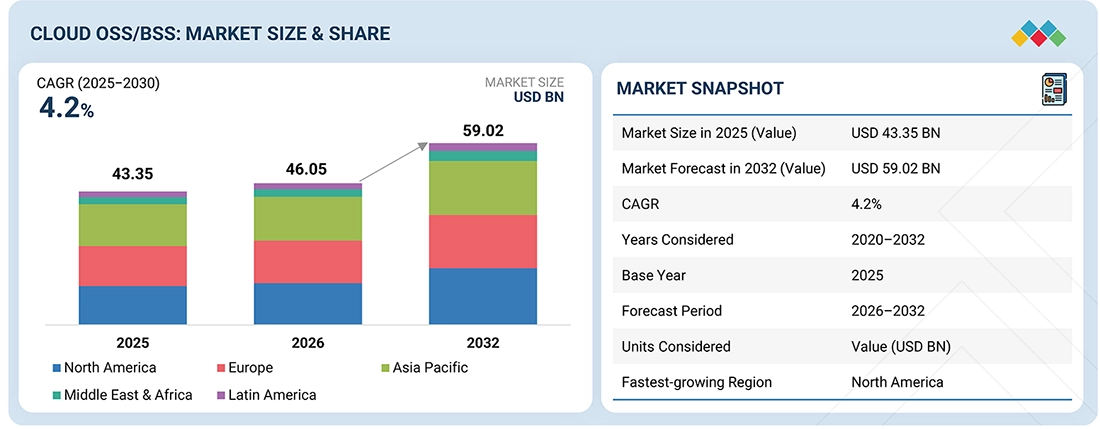

The global cloud OSS/BSS market is projected to grow from USD 43.35 billion in 2025 to USD 59.02 billion by 2032, at a CAGR of 4.2% over the forecast period from 2026-2032. The market is fundamentally transforming telecom operations by enabling real-time, agile, and scalable service delivery across cloud-native platforms. These systems enhance critical functions such as billing, charging, order orchestration, customer engagement, and network performance by replacing legacy infrastructure with containerized, API-driven microservices and AI-powered automation. Adoption of Open Digital Architecture standards and Kubernetes enables interoperability and rapid deployment across hybrid environments, reducing vendor lock-in and accelerating innovation.

KEY TAKEAWAYS

-

By RegionThe North American cloud OSS/BSS market is projected to have the largest share, 31.18%, in 2032.

-

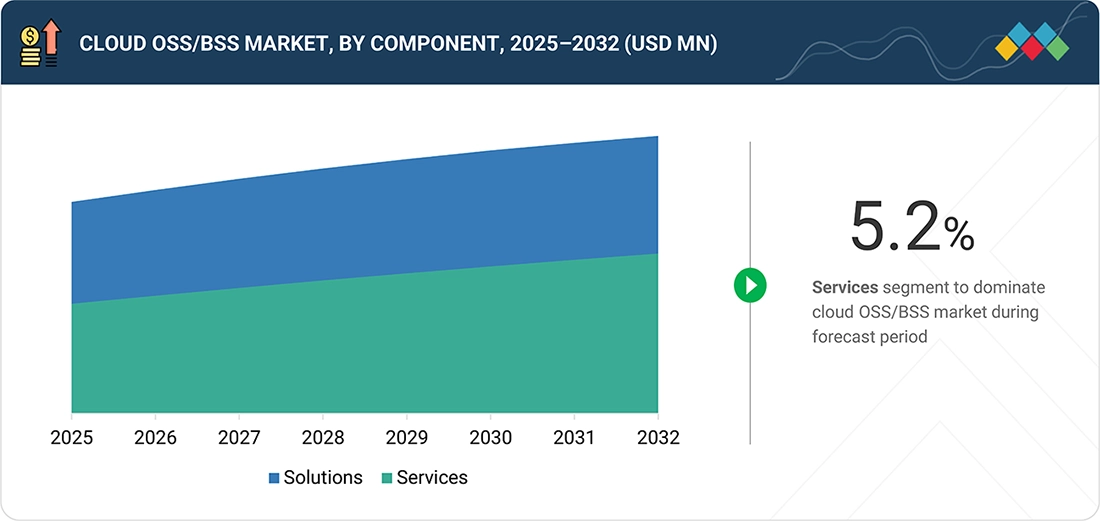

By ComponentBy component, the services segment is expected to register a higher CAGR of 5.2%.

-

By Cloud TypeBy cloud type, the hybrid cloud segment is projected to grow at the highest rate of 5.9% from 2026 to 2032.

-

By Operator TypeBy operator type, the mobile operator segment is expected to dominate the market.

-

Competitive Landscape - Key PlayersAmdocs, Salesforce, and NEC were identified as star players in the cloud OSS/BSS market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsKentik, BlueCat, and NMSWorks Software, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The cloud OSS/BSS market is growing rapidly as 5G, IoT, and cloud-native systems become more widespread. Governments in the US, India, and EU countries are backing digital infrastructure and telecom upgrades through funding and regulations. This support accelerates cloud migration. There are new opportunities in AI-driven service orchestration, automation, and real-time analytics as operators work to improve the customer experience and cut operational costs. The shift to SaaS-based models and the increasing demand for convergent billing and flexible service delivery are also boosting global market growth.

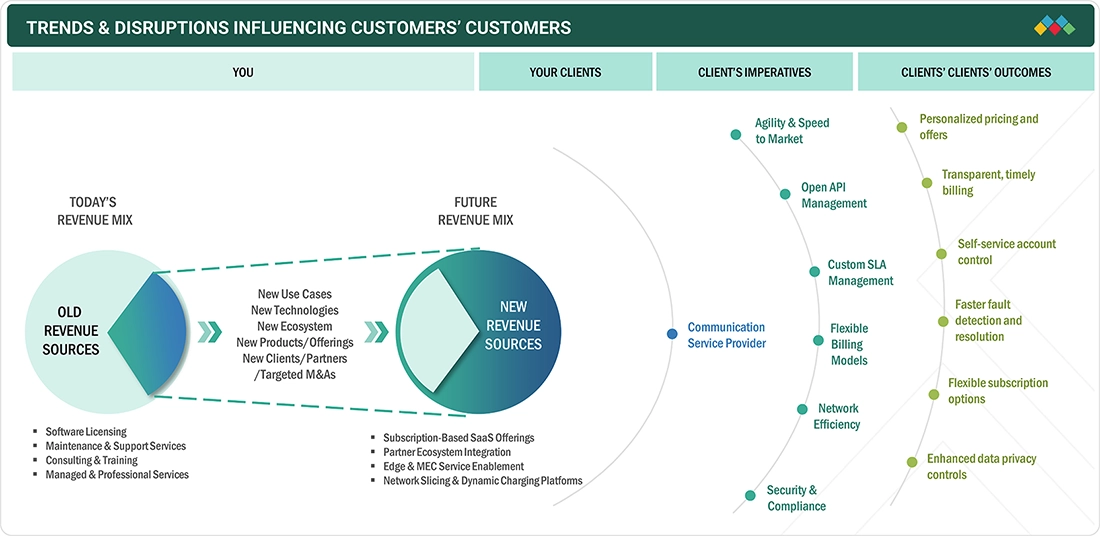

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

As operators shift from traditional, product-focused OSS/BSS to cloud-based platforms that rely on subscriptions and APIs, their customers’ customers see clear improvements in operations and experience. Real-time charging, open APIs, and catalog-driven product development enable faster service activation and customized pricing and bundles. Edge and MEC integration reduces latency and supports high-performance applications for both consumers and businesses. Network slicing, dynamic charging, and policy automation offer adjustable SLAs and flexible billing, with options based on usage or subscriptions. Detailed telemetry, analytics, and automation improve fault detection and resolution, boosting service reliability and user satisfaction. Better identity controls, policy management, and secure cloud placement address privacy and regulatory issues for sensitive industries. These changes aim to increase transparency, deliver personalized experiences, and create new revenue streams through partner networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of tailored cloud OSS/BSS solutions

-

Growing demand for convergent billing systems

Level

-

Concerns over data privacy hindering adoption

-

Fragmented legacy infrastructure

Level

-

Growth of telecom industry with next-generation operation systems and software framework

-

Adoption of cloud technologies to transform telecom industry

Level

-

High volume of customer transactions and increasing complexities in network management

-

Lack of technical proficiency for implementing cloud-native OSS/BSS solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of tailored cloud OSS/BSS solutions

The increasing adoption of customized cloud OSS/BSS solutions and services has led CSPs to enhance the customer experience by offering bundled services. With the growing number of service options and the complexity of cloud service providers' IT architectures, these solutions and services are gaining significant traction. These bundled services deliver lower costs and improved operational agility. Moreover, the flexibility of customized cloud OSS/BSS solutions and services offers operational benefits, including cost reductions through revenue and billing management, service assurance, maximized Return on Investment (ROI), faster time-to-market, and an improved customer experience. Furthermore, Business Intelligence (BI), CRM, revenue assurance, and convergent billing are important business functions that can be delivered to customers through customized cloud OSS/BSS solutions and services to support efficient business operations.

Restraint: Concerns over data privacy hindering adoption

Data privacy management is becoming more challenging as telecom subscriber numbers grow and digital service usage rises. Rising data volumes and more online transactions have heightened concerns about data and payment security. Customers must share sensitive financial and personal information to access additional services. Therefore, protecting this confidential data with full integrity is critical. Communication service providers are increasingly relying on controlled, secure cloud environments to ensure safe operations and improve productivity. Cloud-based OSS/BSS platforms provide a unified view of customers across channels, leading to better service management and personalization. However, concerns about data misuse, weak governance, or unethical practices can erode customer trust. As a result, some customers hesitate to share personal details. This hesitation can limit service adoption and slow overall growth in the cloud OSS/BSS market.

Opportunity: Growth of telecom industry with next-generation operation systems and software framework

The telecom industry's rapid growth is driven by Next Generation Operations Systems and Software (NGOSS), creating significant opportunities for the cloud OSS/BSS market. NGOSS promotes standardized, modular frameworks that simplify service fulfillment, assurance, and inventory management in cloud-native environments. By adopting microservices, containerized architectures, and open APIs, operators can integrate analytics, automation, and intent-based orchestration, accelerating the delivery of 5G, IoT, and edge services. Platforms aligned with NGOSS provide real-time service updates, flexible provisioning, and interoperability across public and hybrid cloud infrastructures. As operators modernize legacy systems, this approach enhances resource utilization, lowers operational costs, and supports scalable deployment models. Overall, incorporating NGOSS principles into cloud OSS/BSS platforms boosts operational agility and positions these solutions as vital to the evolution of next-generation networks.

Challenge: High volume of customer transactions and increasing complexities in network management

High transaction volumes and increasing network complexity pose major challenges for the cloud OSS/BSS market. Communication service providers manage millions of real-time events daily, including service activations, billing transactions, and IoT data streams. These activities require platforms that deliver low-latency processing, high scalability, and fault tolerance. Managing diverse network elements across 5G, edge, and hybrid cloud environments further increases operational complexity. This, in turn, requires better orchestration, monitoring, and automation. Ensuring data consistency, meeting regulatory requirements, accurate billing, and maintaining records at scale further strain the system. Combining multiple data sources, such as CRM systems, network analytics, and third-party APIs, complicates workflows and increases the risk of disruptions. To tackle these issues, vendors must improve microservices architectures, adopt event-driven processing, apply AI-based anomaly detection, and implement continuous integration, automated testing, and elastic resource management.

CLOUD OSS BSS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Upp (UK FTTH operator) upgraded from its initial BSS setup to an industry-standard Communications Cloud with Enterprise Product Catalog (EPC), implementing a catalog-driven approach with a Product, Offer, Customer Facing Service (CFS), and Resource Facing Service (RFS) model. | Enabled Tier-1 grade BSS platform compliant with TM Forum standards, provided greater flexibility in quoting and order capture modules | Filled functional gaps for website add-on orders | Enabled advanced MACD operations through self-service | Reduced IT intervention for new products/offers |

|

du (Emirates Integrated Telecommunications) deployed HPE's end-to-end service orchestration software, including Service Order Manager and Service Director, for next-generation OSS migration from legacy systems to support 5G network monetization. | Provided a single orchestration platform enabling traditional mobile/fixed services to 5G slice management | Enhanced agility and elasticity | Improved time-to-market advantage | Enabled new revenue streams from growing 5G network | Future-proofed architecture for 5G network functions |

|

Telstra implemented Ericsson Digital BSS technology for prepaid customer digital transformation, including Charging, a Digital Experience Platform (DXP), a Catalogue Manager, and Order Care, with cloud deployments and CI/CD methodologies. | Achieved 50% faster service activation speeds (from 10 minutes to under 2 minutes) | Provided superior omni-channel customer experiences | Reduced total cost of ownership, enabled digital operation transition | Delivered breakthrough quality through CI/CD approach |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

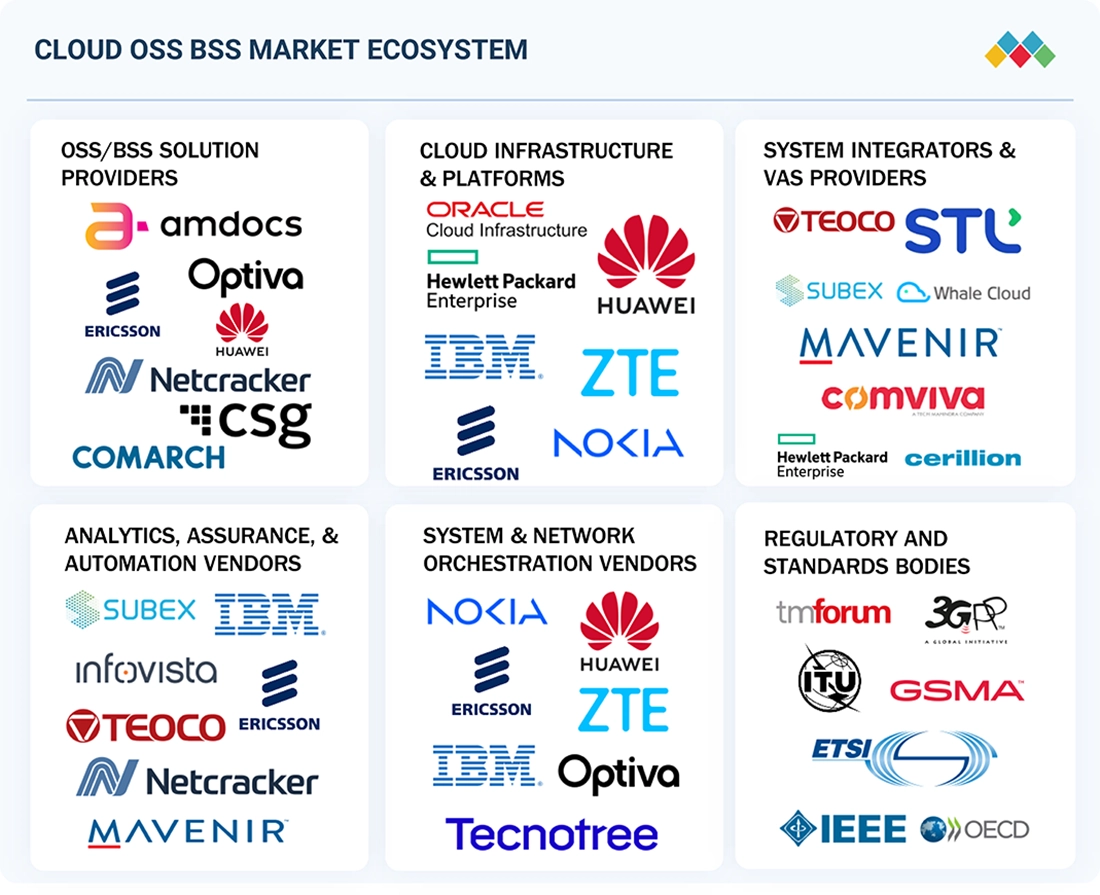

MARKET ECOSYSTEM

The cloud OSS/BSS market comprises many stakeholders collaborating to enable flexible, scalable telecom operations. OSS/BSS solution providers such as Amdocs, Ericsson, Netcracker, and Optiva offer essential platforms for billing, service management, and operations. Cloud infrastructure leaders such as Oracle, IBM, Huawei, and HPE provide the computing backbone for these solutions. System integrators and VAS providers, including STL, Comviva, and Mavenir, handle implementation and tailored services. Vendors such as Subex and Infovista focus on analytics, assurance, and automation. Meanwhile, companies like Nokia, ZTE, and Tecnotree focus on orchestration. Regulatory bodies, including ITU, 3GPP, and GSMA, set global standards and ensure interoperability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cloud OSS/BSS Market, By Component

Cloud-native OSS/BSS solutions are expected to grow fastest during the forecast period, driven by rising demand from communication service providers for agile, scalable, and cost-efficient digital transformation platforms. The expansion of 5G, the growth of IoT ecosystems, and the need for real-time service monetization are making cloud OSS/BSS systems increasingly critical. These platforms enable rapid service launches, AI-enabled automation, and seamless customer experiences across hybrid network environments. Operators are adopting capabilities such as dynamic pricing, converged charging, and intent-based orchestration to enhance service flexibility. Strategic collaborations between CSPs and cloud-native OSS/BSS vendors are accelerating deployment and modernization initiatives. As a result, cloud-based platforms are becoming the core digital backbone of telecom infrastructure, increasingly replacing traditional service-led models in both adoption and growth.

Cloud OSS/BSS Market, By Cloud Type

The public cloud segment is projected to account for the largest share of the cloud OSS/BSS market, supported by its scalability, cost advantages, and ability to accelerate digital transformation for communication service providers. As operators move away from legacy systems toward cloud-native architectures, public cloud platforms are increasingly favored for OSS/BSS deployments. These platforms enable faster service rollout, real-time analytics, and AI-driven automation. Recent efforts reflect this shift, with operators partnering with hyperscalers to modernize operations and introduce flexible OSS/BSS frameworks. These deployments enable smooth service orchestration, automated customer interactions, and innovation in 5G and IoT services. With availability across multiple regions, strong security controls, and compliance features, public cloud solutions are becoming the top choice and the most widely used model for cloud OSS/BSS platforms.

Cloud OSS/BSS Market, By Operator Type

The mobile operator segment is expected to dominate the cloud OSS/BSS market during the forecast period, supported by rapid 5G deployments, rising mobile data usage, and growing demand for real-time digital services. Mobile networks operate in highly dynamic environments, requiring advanced OSS/BSS capabilities to manage mobility, optimize network performance, and support diverse service portfolios. Cloud-native platforms provide the scalability, agility, and AI-driven automation needed to meet these demands. Unlike fixed operators, mobile providers require seamless orchestration, converged charging, and consistent customer engagement across devices and regions. Industry initiatives reflect this trend, as operators migrate OSS/BSS workloads to public cloud environments to improve efficiency and accelerate innovation. Regulatory policies that encourage digital inclusion and efficient spectrum use further support modernization efforts, enabling mobile operators to launch personalized services faster, improve the customer experience, and strengthen competitive positioning.

REGION

North America is expected to be fastest-growing region in the Cloud OSS/BSS market during forecast period.

North America is expected to record the fastest growth in the cloud OSS/BSS market during the forecast period, supported by heavy investments in 5G infrastructure, rising mobile data consumption, and growing demand for real-time service monetization. Major communications service providers in the region are advancing digital transformation by adopting cloud-native OSS/BSS platforms to improve agility and the customer experience. The presence of a strong hyperscaler ecosystem and supportive regulatory frameworks further accelerates adoption. Strategic collaborations between operators and technology vendors demonstrate the effectiveness of cloud-based OSS/BSS in delivering scalable operations, real-time billing, and automated service orchestration. With mature telecom infrastructure and a strong focus on automation and customer-centric services, North America continues to lead innovation and adoption of modern OSS/BSS frameworks, positioning the region as a key driver of global market transformation.

CLOUD OSS BSS MARKET: COMPANY EVALUATION MATRIX

In the cloud OSS/BSS market, Amdocs (Star Player) maintains a commanding position, supported by its comprehensive product portfolio, mature cloud-native OSS/BSS capabilities, and deep relationships with tier-1 and multinational communications service providers. Kentik (Emerging Leader) is gaining momentum by strengthening its analytics-driven network visibility and assurance capabilities. Its solutions resonate particularly with small and mid-sized operators seeking improved cost control, performance insights, and compliance readiness without the complexity of large, full-stack deployments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Amdocs (US)

- Salesforce (US)

- NEC (Japan)

- Ericsson (Sweden)

- Oracle (US)

- Huawei (China)

- Hewlett Packard Enterprise (US)

- Optiva (Canada)

- Nokia (Finland)

- Kloudville (Canada)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 43.35 Billion |

| Market Forecast in 2032 (Value) | USD 59.02 Billion |

| Growth Rate | CAGR of 4.2% from 2026-2032 |

| Years Considered | 2020-2032 |

| Base Year | 2025 |

| Forecast Period | 2026-2032 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

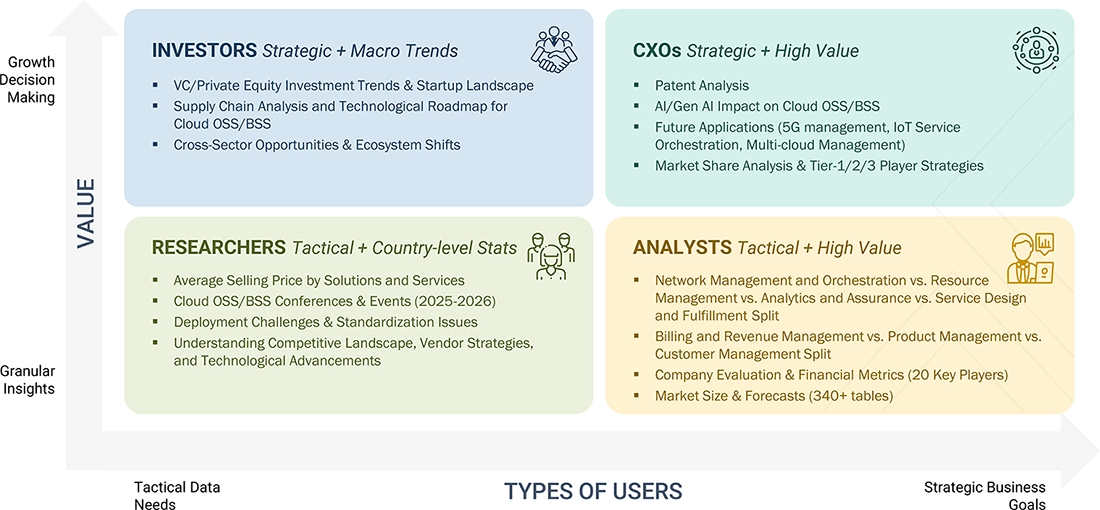

WHAT IS IN IT FOR YOU: CLOUD OSS BSS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| India Telecom Provider |

|

|

| Latin American Telecom provider |

|

|

| North American Telecom Provider |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- February 2025 : Amdocs expanded its partnership with Google Cloud to deliver AI-driven automation and BigQuery-powered analytics for 5G network optimization. The initiative focuses on automated network operations, faster service assurance, and joint solutions that speed 5G service launch and lifecycle management for operators.

- October 2025 : NEC announced a definitive agreement to acquire CSG Systems (enterprise BSS/OSS and billing), a strategic acquisition to expand NEC’s cloud and software capabilities for communications customers and strengthen its offerings for digital monetization and managed services globally.

- December 2025 : Ericsson and Telstra announced a strategic collaboration to accelerate autonomous networks, focusing on programmable control, automation and AI-driven operations. The agreement frames joint work on closed-loop automation, observability and operational tools to reduce manual operations and improve service SLAs.

- March 2025 : HPE launched new telco-focused solutions and partner initiatives for edge, cloud, and AI-driven services; the activity emphasized edge-to-cloud systems, validated telco reference stacks, and partner labs to accelerate operator deployments.

Table of Contents

Methodology

This research study used extensive secondary sources, directories, and databases, including Dun & Bradstreet (D&B), Hoovers, and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the global cloud OSS/BSS market. The primary sources were industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations across all segments of this market's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

In the secondary research process, various sources were consulted to identify and collect information for the study. The secondary sources included annual reports, press releases, company investor presentations, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations, such as the Journal of Telecommunications and Information Technology, the Journal of Telecommunications and the Digital Economy, and the Journal of Cloud Computing: Advances, Systems and Applications, were also consulted. Secondary research was used to obtain key information on industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends down to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, interviews were conducted with sources from both, the supply and demand sides to gather qualitative and quantitative information for the report. The primary sources on the supply side included industry experts such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and other key executives from leading companies and organizations operating in the global cloud OSS/BSS market. The primary sources on the demand side included cloud OSS/BSS end users, consultants and specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

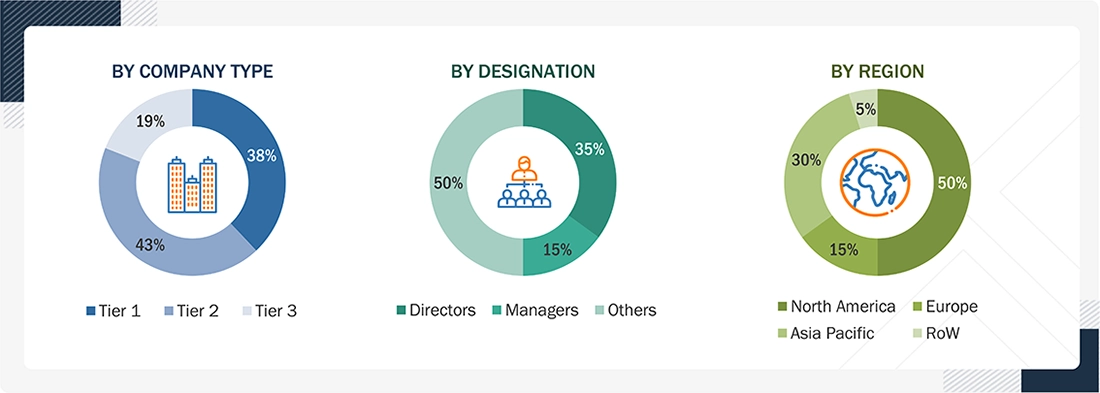

Breakdown of Primaries:

*Others include sales managers, marketing managers, and product managers. Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies ‘revenue ranges between USD 500 million to 1 billion; and Tier 3 companies’ revenue ranges between USD 100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were used to estimate and forecast the size of the global cloud OSS/BSS market. The first approach estimates market size by summing the revenue generated by companies from the sale of cloud OSS/BSS solutions.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global cloud OSS/BSS market. These methods were widely used to estimate the sizes of various market segments. The research methodology for estimating the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Cloud OSS/BSS Market Size: Estimation Approaches

Data Triangulation

After determining the overall market size, the global cloud OSS/BSS market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by analyzing various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated using the top-down and bottom-up approaches.

Market Definition

Operating support systems (OSS) and business support systems (BSS) are becoming increasingly important to telecom infrastructure providers and operators. With rapid digitization, there is greater emphasis on personalization, seamless service usage, and an enhanced customer experience, which are central to the operator's business today.

Cloud OSS/BSS is shaping the service portfolios of communication service providers. With solutions deployed on cloud platforms, it is helping the telecommunications industry overcome business and technical challenges, enabling CSPs to respond more quickly, lower costs, scale operations on an on-demand basis, and support resource sharing, automation, and monitoring.

Stakeholders

- Cloud OSS/BSS solution providers

- CSPs

- Telecom equipment providers

- Mobile network operators (MNOs)

- Mobile virtual network operators (MVNOs)

- Mobile virtual network enablers (MVNEs)

- Mobile virtual network aggregators (MVNAs)

- System integrators

- Research organizations

- Consulting companies

- Government agencies

- Value-added resellers (VARs)

Report Objectives

- To determine and forecast the global cloud OSS/BSS market based on component, cloud type, and operator type, from 2026 to 2032, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments concerning five regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the global cloud OSS/BSS market

- To analyze each submarket in terms of individual growth trends, prospects, and contributions to the overall global cloud OSS/BSS market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the global cloud OSS/BSS market

- To profile key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the global cloud OSS/BSS market’s competitive landscape

- To track and analyze competitive developments in the market, such as mergers & acquisitions, product developments, partnerships, collaborations, and research & development (R&D) activities in the global cloud OSS/BSS market

Key Questions Addressed by the Report

What is the definition of the Cloud OSS BSS market?

Operating Support Systems (OSS) and Business Support Systems (BSS) are becoming key to telecom infrastructure providers and operators. With rapid digitization, more emphasis is placed on personalization, seamless service usage, and enhanced customer experience, which are all part of the operator's business today.

Cloud OSS/BSS is shaping the service portfolios of communication service providers. With solutions deployed over cloud platforms, it is helping the telecommunications industry overcome business and technical challenges. This allows CSPs to respond quicker, lower costs, scale up operations on an on-demand basis, and enable resource sharing, automation, and monitoring.

What is the market size of the Cloud OSS BSS market?

The Cloud OSS BSS market is estimated at USD 44,206.3 million in 2025 and is expected to reach USD 56,848.3 million by 2030 at a compound annual growth rate (CAGR) of 5.2% from 2025 to 2030.

What are the major drivers in the Cloud OSS BSS market?

The Cloud OSS BSS market is experiencing strong growth driven by multiple technological and operational factors. Communication service providers are increasingly adopting tailored cloud OSS BSS solutions to manage the complexity of modern service portfolios and deliver personalized customer experiences. The widespread rollout of 5G networks is accelerating the demand for scalable and flexible OSS BSS platforms that support real-time charging, dynamic service orchestration, and enhanced network visibility. In parallel, there is a rising demand for convergent billing systems that unify billing across mobile, fixed, and digital services, simplifying revenue management.

Large-scale implementation of software-defined networking (SDN) and network functions virtualization (NFV) is also driving the shift to cloud-based OSS BSS as operators seek agility and programmability. Furthermore, the ongoing need to reduce capital and operational expenditure is encouraging CSPs to embrace cloud-native solutions that offer automation, scalability, and cost-efficiency. These drivers collectively position cloud OSS BSS as a cornerstone for telecom transformation.

Who are the key players operating in the Cloud OSS BSS market?

The key market players profiled in the Cloud OSS BSS market include Amdocs (US), Salesforce (US), NEC (Japan), Ericsson (Sweden), Oracle (US), Huawei (China), Hewlett Packard Enterprise (US), Optiva (Canada), Nokia (Finland), CSG International (US), ZTE Corporation (China), Comarch (Finland), Subex (India), Sterlite Technologies Limited (India), TEOCO Corporation (US), IBM Corporation (US), InfoVista (US), Comviva (India), Cerillion (UK), Tecnotree (Finland), Whale Cloud (Whale Cloud), Bill Perfect (US), Telgoo5 (US), NMSWorks Software (India), Wavelo (US), ChikPea (US), BlueCat (US), Kentik (US), Knot Solutions (India), Hughes Network Systems (US), and Mavenir Systems (US)

What are the key technological trends in the Cloud OSS BSS market?

The Cloud OSS BSS market is experiencing rapid transformation driven by several key technological trends. A major shift toward cloud-native architectures is enabling communication service providers to deploy containerized microservices with Kubernetes orchestration across public, private, and hybrid cloud environments. This enhances flexibility, scalability, and resilience while simplifying service rollout and upgrades. Artificial intelligence and machine learning are being widely integrated into OSS BSS platforms to support predictive analytics, customer experience management, automated network operations, and dynamic resource optimization, helping reduce costs and improve service quality.

The adoption of open APIs, aligned with TM Forum’s Open Digital Architecture, is further enhancing interoperability and accelerating collaboration across the telecom ecosystem. In parallel, edge computing is gaining prominence as it supports real-time decision-making and low-latency processing, especially critical for 5G use cases. CSPs are also increasingly adopting zero-touch automation and closed-loop assurance models to boost operational efficiency and agility. Collectively, these technologies are reshaping the cloud OSS BSS landscape into a more intelligent, scalable, and service-driven framework that meets the evolving demands of next-generation networks.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cloud OSS/BSS Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cloud OSS/BSS Market