Density Meter Market Size, Share and Growth

Density Meter Market, by Vibrating Tubes, Coriolis Density Meters, Pycnometers, Hydrometers, Ultrasonic, Nuclear, Microwave, Inline Density Meters, Laboratory Density Meters, Portable Density Meters, OEM Embedded Density Meter, Multi-sensor Platforms, and Sample Handling Devices - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The density meter market is projected to reach USD 1,557.4 million by 2032 from USD 1,082.6 million in 2025, at a CAGR of 5.3% from 2025 to 2032. The density meter market is driven by rising demand for precise, real-time measurement solutions that enhance process efficiency, product quality, and automation across industrial operations.

KEY TAKEAWAYS

-

By RegionNorth America accounted for a 29.6% revenue share in 2024.

-

By TypeBy type, the ultrasonic segment is expected to register the highest CAGR of 8.3%.

-

By Implementation TypeBy implementation type, the process segment is projected to grow at the fastest rate from 2025 to 2032.

-

By Measurement MethodBy measurement method, the inline/online density meters segment is expected to dominate the market.

-

By ApplicationBy application, the process control and monitoring segment will register the fastest growth during the forecast period.

-

Competitive LandscapeAnton Paar GmbH (Austria), Mettler-Toledo International Inc. (US), Emerson Electric Co. (US), and Endress+Hauser Group Services AG (Switzerland) were identified as some of the star players in the density meter market (global), given their strong market share and product footprint.

-

Competitive LandscapeSensoTech (Germany), British Rototherm Group (UK), and Berthold Technologies GmbH & Co.KG (Germany) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The adoption of density meters enables industries to support sustainable operations by ensuring accurate material measurement, reducing process waste, and improving resource efficiency, which becomes increasingly important as global manufacturers prioritize environmentally responsible production practices.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses in the density meter market stems from evolving customer needs and industry disruptions. Chemical and petrochemical manufacturers, food & beverage processors, pulp and paper manufacturers, and the pharmaceutical industry are the primary users of density meters. The shift toward smart density meters with AI diagnostics has a direct impact on the operational performance and revenues of these end users. These effects, in turn, drive the demand for advanced density meters, shaping the growth trajectory of the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for process optimization

-

Increasing quality control requirements

Level

-

High cost of advanced digital density meters

-

Sensitivity to environmental conditions leading to measurement errors

Level

-

Development of smart density meters

-

Expansion in emerging economies

Level

-

Limited skilled workforce for operation and calibration

-

Complexity in data management

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for process optimization

The growing demand for process optimization is driving the density meter market, as industries increasingly rely on accurate, real-time measurements to improve operational efficiency and reduce material losses. Density meters help streamline process control, support consistent product quality, and enable better resource use, making them essential tools for companies aiming to enhance performance and maintain competitive, efficient production systems.

Restraint: High cost of advanced digital density meters

High cost of advanced digital density meters remains a key restraint for the market, as many industries face budget limitations when adopting high-precision, automated measurement systems. These instruments require sophisticated sensors, electronics, and calibration features, which increase overall pricing. As a result, small and mid-sized facilities often delay upgrades, limiting wider adoption, and slowing market penetration in cost-sensitive environments.

Opportunity: Development of smart density meters

Development of smart density meters presents a significant opportunity for the market, as industries increasingly seek connected, automation-ready tools that offer advanced diagnostics and real-time performance insights. Smart density meters equipped with digital interfaces, self-calibration, and remote monitoring capabilities enhance process visibility and operational efficiency, enabling companies to transition toward smarter, data-driven production environments and expanding the market’s long-term growth potential.

Challenge: Limited skilled workforce for operation and calibration

Limited skilled workforce for operation and calibration remains a major challenge for the density meter market, as these instruments require technical expertise to ensure accurate installation, configuration, and ongoing maintenance. Many facilities lack trained personnel capable of handling advanced digital systems, resulting in operational errors, reduced measurement reliability, and higher dependence on external service providers, which slows adoption and increases overall operating costs.

density-meter-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A hydroelectric plant in France encountered risks associated with sediment accumulation during the transport of a water-solids slurry. To address this issue, Rhosonics Analytical B.V. from the Netherlands deployed its SDM Slurry Density Meter following competitive testing. This solution provided precise density measurements, seamless integration, and stable performance, allowing the plant to maintain an optimal slurry balance and protect the efficiency of its equipment. | The solution prevented sediment buildup, reduced hydro-turbine wear, improved dredging control, and eliminated regulatory and handling costs linked to nuclear-based measurement systems, ensuring reliable and efficient operations. |

|

A ferrochrome smelter in South Africa needed to remove manual sampling from its thickener underflow while complying with non-nuclear measurement rules. Rhosonics Analytical B.V. (Netherlands) installed its ultrasonic SDM Slurry Density Meter, delivering real-time density data, stable performance, and improved process control without radiation-related regulatory burdens. | The solution removed manual sampling, reduced labor and compliance costs, enabled steady process control, and eliminated all regulatory, training, and licensing requirements linked to nuclear measurement systems. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The density meter market ecosystem comprises density meter providers (Endress+Hauser Group Services AG, Emerson Electric Co., and Yokogawa Electric Corporation) and calibration & testing players (Anton Paar GmbH and Mettler-Toledo International Inc.). The density meter market ecosystem is anchored by density meter providers, who supply advanced measurement technologies for liquid, slurry, and gas applications. It is supported by calibration and testing services, which ensure instrument accuracy, regulatory compliance, and reliable long-term performance across industrial processes.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Density Meter Market, by Type

The ultrasonic segment is expected to record the highest CAGR during the forecast period, as industries are increasingly shifting toward non-nuclear, low-maintenance, and easy-to-integrate technologies that support real-time monitoring and align with rising safety and environmental standards. Ultrasonic systems provide high accuracy for both liquids and slurries, making them well-suited for modern automated plants. In contrast, vibrating tube density meters held the largest market share in 2024 due to their long-standing use, proven precision, and extensive adoption across the chemicals, food processing, and petrochemical industries. Their reliability, established calibration practices, and broad industrial acceptance position them as the dominant technology in the current market.

Density Meter Market, by Implementation Type

The process segment currently dominates the density meter market and is expected to register the highest CAGR during the forecast period. This growth is driven by the increasing need for continuous, real-time measurements in various industries, which help maintain stable operations, improve product consistency, and reduce material losses. As manufacturing plants transition toward higher levels of automation and closed-loop control systems, process-integrated density meters are becoming essential for optimizing production efficiency. Their ability to function reliably under varying temperatures, pressures, and flow conditions further accelerates their adoption, making this segment the most preferred implementation type throughout the forecast period.

Density Meter Market, by Accuracy

Premium/high-precision instruments held the largest market share in 2024 because industries such as chemicals, petrochemicals, food processing, and energy require highly accurate and reliable measurements to maintain strict quality, safety, and compliance standards. These instruments deliver superior performance, stability, and advanced calibration features, making them the preferred choice for mission-critical operations. Meanwhile, the mid-range process instruments segment is projected to register the highest CAGR during the forecast period as more facilities adopt automation but seek cost-effective solutions that balance accuracy with affordability. Their suitability for a wider range of applications and lower ownership costs drives faster uptake across expanding industrial operations.

Density Meter Market, by Measurement Method

Inline/online density meters dominate the market because they enable continuous, real-time monitoring without interrupting operations, improving process accuracy and reducing manual sampling across industrial applications. Panel/OEM-embedded density meters are expected to register the highest CAGR, as manufacturers increasingly prefer integrated, compact modules that can be built directly into equipment, thereby supporting automation, reducing installation effort, and enhancing system efficiency for future-ready industrial processes.

Density Meter Market, by Operating Principle

The digital operating principle dominates the overall density meter market and is projected to register the highest CAGR during the forecast period, as industries rapidly shift toward automation-ready, real-time measurement systems that integrate easily with modern control platforms. Digital density meters offer higher accuracy, faster response, improved diagnostics, and seamless connectivity compared to analog systems. Their ability to support remote monitoring, predictive maintenance, and data-driven process optimization makes them essential for upgrading industrial operations, driving both current adoption and future growth across global manufacturing environments.

Density Meter Market, by Component

Sensors and transducers dominate the overall density meter market by component and are projected to record the highest CAGR during the forecast period because they serve as the core measurement element, directly determining accuracy, response time, and reliability. As industries adopt advanced digital systems and real-time monitoring, demand for high-performance sensing components continues to rise. The push toward automation, smart instrumentation, and tighter process control further accelerates the need for improved sensor designs, driving both current market leadership and strong future growth for this component segment.

Density Meter Market, by Application

Process control and monitoring dominates the density meter market in application and also records the highest CAGR because industries increasingly rely on continuous, real-time measurement to maintain stable operations, improve product consistency, and reduce material waste. Density meters play a critical role in optimizing flow, mixing, and quality parameters, making them essential for automated plant environments. As manufacturers accelerate digital transformation and adopt smarter production systems, the need for accurate, in-line density monitoring grows rapidly, driving both current market leadership and strong long-term expansion for this application segment.

Density Meter Market, by End User

The chemical and petrochemical segment held the largest market share in 2024 because these facilities rely heavily on continuous, precise density measurement for quality control, process optimization, and safety compliance across large-scale production systems, making density meters essential to daily operations. The oil & gas segment is expected to register the highest CAGR as rising automation, stricter regulatory requirements, and expanding upstream and midstream activities are increasing the need for advanced, rugged density measurement technologies to support accurate fluid monitoring and efficient production.

REGION

Asia Pacific to be fastest-growing region in global density meter market during forecast period

The Asia Pacific region is expected to experience the highest CAGR due to rapid industrialization, increased infrastructure investments, and the swift adoption of advanced measurement technologies. These developments are driven by a rising manufacturing capacity, modernization initiatives, and supportive government programs that emphasize process automation and quality control.

density-meter-market: COMPANY EVALUATION MATRIX

In the density meter industry matrix, Anton Paar GmbH (Star) leads with a strong market share and advanced high-precision density measurement systems, widely adopted across chemical, food, and energy industries. Toshiba Corporation (Emerging Leader) is gaining visibility through its expanding real-time process-measurement portfolio, strengthened by scalable and automation-ready solutions. While Anton Paar GmbH dominates with technology depth and global reach, Toshiba Corporation shows strong potential to move toward the leaders’ quadrant as demand for automated, high-efficiency density monitoring grows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Emerson Electric Co. (US)

- Yokogawa Electric Corporation (Japan)

- Mettler-Toledo International Inc (US)

- TOSHIBA CORPORATION (Japan)

- Thermo Fisher Scientific Inc. (US)

- Endress+Hauser Group Services AG (Switzerland)

- AMETEK. Inc. (US)

- Valmet (Finland)

- Anton Paar GmbH (Austria)

- VEGA (Germany)

- Berthold Technologies GmbH & Co.KG (Germany)

- SCHMIDT + HAENSCH (Germany)

- Fluid io Sensor + Control GmbH & Co.KG (Germany)

- A. Krüss, Optronic GmbH (Germany)

- Avenisense (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1,023.2 Million |

| Market Forecast in 2032 (Value) | USD 1,557.4 Million |

| Growth Rate | CAGR of 5.3% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: density-meter-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Chemical & Petrochemical Producers | Competitive profiling of density meter providers (financials, certifications, technology portfolio) |

|

| Oil & Gas Refining & Midstream Operators |

|

|

| Mining & Mineral Processing Plants | Technology comparison across ultrasonic, vibrating tube, Coriolis, and nucleonic instruments; total cost of ownership and calibration frequency analysis | Strengthen positioning in smart, connected measurement technologies; identify long-term opportunities in IoT-enabled density monitoring |

| Food & Beverage Manufacturers |

|

|

| Water & Wastewater Utilities | Global and regional deployment benchmarking; mapping of new product launches and regulatory certifications | Assess product scalability; enhance competitive advantage through performance benchmarking |

| Pharmaceutical & Biotechnology Plants |

|

|

RECENT DEVELOPMENTS

- June 2024 : Endress+Hauser Group Services AG (Switzerland) launched the Proline Promass Q 300/500 series featuring innovative 4-tube technology for enhanced flow and high-precision density measurement.

- March 2024 : Anton Paar GmbH (Austria) enhanced its density meter production by introducing in-house glass U-tube manufacturing and improved calibration processes. This initiative aims to boost measurement precision, quality assurance, and long-term reliability of its density measurement instruments.

- February 2024 : Yokogawa Electric Corporation (Japan) acquired Adept Fluidyne Pvt. Ltd. (India), a manufacturer of electromagnetic flowmeters, which complements Yokogawa’s fluid measurement portfolio and strengthens its capability in precision liquid measurement solutions, including density measurement applications.

- November 2023 : Emerson Electric Co. (US) introduced the G-Series Coriolis Flow and Density Meter along with the 4700 Transmitter, offering enhanced accuracy, compact design, and advanced digital connectivity. The new system enables precise mass flow and density measurement for industrial process applications.

Table of Contents

Methodology

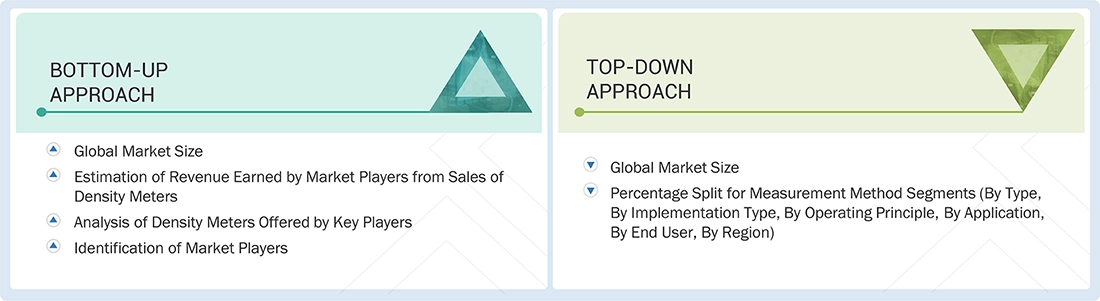

The study involved major activities in estimating the current size of the density meter market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the supply chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Following this, market breakdown and data triangulation methods were employed to determine the market size of each segment and its subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the density meter market.

Secondary Research

Secondary research for this study involved gathering information from various credible sources, including company reports, white papers, academic journals, and industry publications. This process helped in understanding the supply chains, identifying key players, analyzing market segmentation and regional trends, and tracking major market and technology developments. The data collected was used to estimate the overall market size, which was later validated through primary research.

Primary Research

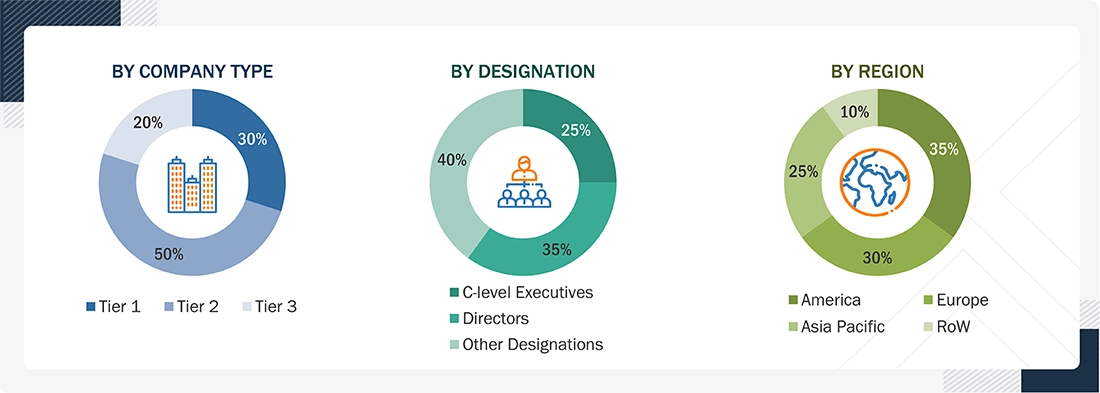

Extensive primary research was conducted after gaining knowledge about the current scenario of the density meter market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions: Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. This primary data was collected through questionnaires, emails, and telephone interviews.

Note: The RoW mainly comprises the Middle East, Africa, and South America.

Other designations include product managers, sales managers, and marketing managers.

Three tiers of companies have been defined based on their total revenue as of 2024: Tier 3, with revenue less than USD 500 million; Tier 2, with revenue between USD 500 million and USD 1 billion; and Tier 1, with revenue exceeding USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, were used to estimate and validate the size of the density meter market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

Approach to arrive at market size using bottom-up analysis (demand side):

- Identified major companies in the density meter market across the supply chain

- Analyzed the total revenue and key offerings of the key players

- Understood the segmental revenue and scope revenue of the key players

- Arrived at the global density meter market size by adding the scope revenue of the key players in the market

- Studied the trend of density meter adoption across type, implementation type, operating principle, component, measurement method, accuracy, application, and end-user segments

- Tracked recent market developments, including technological upgrades, strategic partnerships, and product launches of key players, to accurately forecast market size and growth trends

- Conducted multiple discussions with key opinion leaders across the density meter ecosystem to understand real-time adoption dynamics, operational challenges, and the shift toward data-driven, automated, and sustainable practices

- Validated market estimates through in-depth consultations with industry experts, from R&D heads of leading density meter providers to technical advisors, ensuring alignment with domain insights for robust and accurate market projections

Approach to arrive at market size using top-down analysis (supply side):

- Analysed the measurement method segment level, identified the overall market size associated with each major measurement method in the density meter market through shipment.

- From this measurement method-level data, the figures were further divided into types, such as Coriolis density meters, hydrometers, pycnometers, vibrating tubes, nuclear, ultrasonic, microwave, optical, and other types.

- The measurement method-segment numbers were then further divided into implementation types, including process and lab.

- The measurement method-segment numbers were then further divided into operating principles, including digital, analog, and hybrid.

- The measurement method-segment numbers were then further divided into applications, including process control and monitoring, quality control and assurance, research and development, environmental monitoring, purity testing & verification, concentration measurement, blend optimization, fermentation monitoring, and other applications.

- The measurement method-segment numbers were then further divided into end users, including chemical and petrochemical, pharmaceutical, food & beverages, oil & gas, metals & mining, water and wastewater treatment, pulp & paper, and others.

- The measurement method-segment numbers were then further divided into regions, including the Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

- By applying this top-down methodology, this research indicates a comprehensive view of the global density meter market, linking each measurement method segment with its respective type, implementation types, operating principles, applications, end users, and region

Density Meter Market: Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was classified into several segments and subsegments. To complete the entire market engineering process and obtain precise statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed as applicable. The data was triangulated by examining various factors and trends from both the demand and supply sides of the density meter market.

Market Definition

The density meter market refers to the global industry that designs, manufactures, and supplies instruments for measuring the density of slurry, liquids, or gases with high precision. These devices help improve quality control, process efficiency, and operational safety in many sectors. The market encompasses a diverse range of technologies, including vibrating tube, ultrasonic, Coriolis, and radiation-based systems, which are suitable for both laboratory testing and continuous industrial use. Rising demand for real-time monitoring, compliance with international standards, and the need for consistent product quality continue to drive the adoption of advanced density measurement solutions.

Key Stakeholders

- Process Industry Operators

- Industrial and Laboratory End Users

- Government Agencies and Regulatory Bodies

- Instrumentation and Technology Providers

- Software and Analytics Developers

- Research and Academic Institutions

- Calibration, Consulting, and Service Providers

- Environmental and Compliance Organizations

- Investors and Financial Institutions

- Industrial Automation and Supply Chain Partners

- OEM System Integrators and Equipment Builders

- End users

Report Objectives

- To describe and forecast the density meter market by type, implementation type, accuracy, measuring method, operating principle, component, application, end user, and region, in terms of value

- To describe and forecast the density meter market by measuring method in terms of volume

- To forecast the market size for various segments across the main regions: Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa

- To provide industry-specific information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the density meter market

- To study the complete supply chain and related industry segments for the density meter market

- To identify key density meter manufacturers and analyze their product offerings in the market

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To analyze trends/disruptions impacting customer business, pricing analysis, patents analysis, trade analysis (export and import scenario), Porter's five forces analysis, macroeconomics indicators, case studies, investment and funding scenario, decision-making process, buyer stakeholders and buying evaluation criteria, adoption barriers & internal challenges, unmet needs from various industries, technology analysis, ecosystem analysis, regional regulations and compliance, impact of artificial intelligence, impact of 2025 US tariff, and key conferences and events related to the density meter market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position regarding ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as product launches/enhancements, partnerships, and research and development (R&D) activities carried out by players in the density meter market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Density Meter Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Density Meter Market