Disposable Endoscopes Market Size, Growth, Share & Trends Analysis

Disposable Endoscopes Market by Type (GI Endoscopes, Urology Endoscopes, Laryngoscopes), Clinical Usage (Diagnostic, Surgical), Application (Urology, Gastroenterology, ENT Endoscopy), End User (Hospitals, ASCs, Clinics), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global disposable endoscopes market is projected to reach USD 2.67 billion by 2030, growing from USD 0.95 billion in 2025, at a CAGR of 22.9% during the forecast period. The growth of the disposable endoscopes market is primarily driven by increasing demand for minimally invasive surgeries, a rising prevalence of chronic conditions requiring pulmonary, gastroenterology, urology, and orthopedics procedures, and ongoing technological advancements such as 4K/3D visualization and fluorescence imaging. However, challenges include high device costs and strict regulatory approval processes pathways.

KEY TAKEAWAYS

-

BY TYPEThe disposable endoscope market is segmented by type into urology endoscopes, bronchoscopes, cystoscopes, laryngoscopes, GI Endoscopes, arthroscopes, and other disposable endoscopes. The urology endoscopes commanded the largest market share due to the high prevalence of urinary tract disorders, the rising incidence of kidney stones, and the increasing adoption of minimally invasive procedures. Single-use ureteroscopes reduce cross-contamination risks, eliminate costly reprocessing, and improve procedural efficiency, leading to widespread preference among hospitals and clinics worldwide.

-

BY CLINICAL USAGEBy clinical usage, the disposable endoscope market has been divided into diagnostic and surgical usage. The surgical usage segment accounted for the largest share of the market in 2024 due to the growing adoption of minimally invasive procedures across multiple specialties, including gastroenterology, urology, and orthopedics. The demand is driven by the need to reduce infection risks, improve procedural efficiency, and ensure patient safety. High procedure volumes and advancements in disposable endoscope technology further strengthen this dominant market share.

-

BY APPLICATIONBy application, the disposable endoscopes market is segmented into urology, bronchoscopy, ENT Application, gastroenterology and other applications. The gastroenterology segment is expected to grow at the fastest rate during the forecast period due to the rising prevalence of GI disorders, increasing endoscopic screenings, and the adoption of single-use scopes, driven by infection control priorities and procedural efficiency demands.

-

BY END USERBy end user, the disposable endoscopes market is segmented into hospitals, ambulatory surgical centers, clinics, and other end users (diagnostic centers, mobile endoscopy facilities, and office-based endoscopy service providers).

-

BY REGIONThe global disposable endoscopes market is segmented into five key regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. In 2024, North America holds the largest market share. This is mainly driven by the rising rates of chronic diseases, an aging population, and strong regulatory and technological support. The increasing occurrence of cancer and urological disorders is boosting the demand for frequent endoscopic procedures.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including product launches, partnerships, and acquisitions. Leading companies such as Ambu A/S (Denmark), Olympus Corporation (Japan), KARL STORZ SE & Co. KG (Germany), Boston Scientific Corporation (US), Verathon Inc. (US), and among others have strengthened their product portfolios and expanded their global presence to meet the rising demand for endoscopes. Continuous innovation in disposable endoscopes, and advancement in technology has helped these players maintain competitive advantage in a rapidly evolving market.

The disposable endoscopes market is fueled by increasing demand for infection-free procedures, rising prevalence of chronic diseases, and greater adoption of minimally invasive surgeries. Growth is limited by high device costs and restricted reimbursement in some regions. Major challenges include strict regulatory approvals, technological complexities, and competition from reusable endoscopes, which could affect market expansion and adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the disposable endoscopes market, major trends and disruptions impacting the end customer include increasing demand for infection-free procedures, technological improvements in HD imaging and ergonomic design, and the move toward minimally invasive procedures. Disruptions originate from regulatory challenges, supply chain issues, and the emergence of cost-effective single-use devices, prompting hospitals and clinics to balance quality, efficiency, and cost. Moreover, rising awareness of patient safety and the need for quick, bedside-ready endoscopes are transforming purchasing choices and procedural workflows worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing preference for minimally invasive surgeries

-

Increasing awareness of hospital-acquired infections and need for infection prevention.

Level

-

High overhead costs of endoscopy procedures

Level

-

Rapidly developing healthcare sector in emerging economies

Level

-

Environmental concerns related to medical waste from disposable devices

-

Limited awareness and training among healthcare professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing preference for minimally invasive surgeries

The increasing adoption of minimally invasive procedures is a major driver for the disposable endoscopes market, as these procedures require high-precision, sterile, and readily available instruments. Single-use endoscopes lower cross-contamination risks, eliminate costly reprocessing, and improve procedural efficiency, aligning with hospitals’ and outpatient centres' focus on patient safety and operational efficiency. Growing preference for bedside-ready, portable, and technologically advanced endoscopes further boosts market growth, especially in urology, gastroenterology, and pulmonology worldwide.

Restraint: High overhead costs of endoscopy procedures

The high overhead costs associated with endoscopy procedures are slowing the growth of the disposable endoscopes market. Single-use devices, while lowering reprocessing expenses, have higher per-procedure costs compared to reusable scopes, affecting hospital budgets. Extra expenses for disposable accessories, staff training, and waste management further add to operational costs. As healthcare providers try to balance patient safety with cost-efficiency, these financial limits hinder widespread adoption of disposable endoscopes, especially in cost-sensitive regions and smaller healthcare facilities.

Opportunity: Rapidly developing healthcare sector in emerging economies

The rapidly growing healthcare sector in emerging countries offers a major opportunity for the disposable endoscopes market. Increasing hospital infrastructure, higher investments in advanced medical technology, and greater awareness of infection control and minimally invasive procedures are boosting demand. Rising patient numbers and the development of modern outpatient and diagnostic centers further enhance adoption. These factors create a positive environment for market growth, especially for single-use endoscopes that provide efficiency, safety, and lower reprocessing costs in resource-limited yet evolving healthcare systems.

Challenge: Environmental concerns related to medical waste from disposable devices

The limited awareness and training among healthcare professionals present a major challenge for the disposable endoscopes market. Many clinicians remain unfamiliar with the benefits of single-use devices, handling protocols, and how to incorporate them into existing workflows, which causes hesitation in adoption. Inadequate training can lead to improper use, decreased procedural efficiency, and underuse of advanced features. As a result, healthcare providers may favor traditional reusable endoscopes, slowing market growth despite the infection control, cost savings, and operational benefits that disposable options offer.

Disposable Endoscopes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

RenaFlex single-use flexible ureteroscope used to access and visualize the urinary tract (urethra, bladder, ureter, calyces, renal papillae) for diagnostic and therapeutic ureteroscopy and stone management | Consistent high-quality visualization via distal chip with 120° field of view and auto white balance, plus 270° articulation for navigation; 9.5 Fr outer diameter with 3.6 Fr working channel and a lightweight ergonomic handle support simple OR setup |

|

aScope 4 Cysto sterile single-use flexible cystoscope intended for endoscopic access to and examination of the lower urinary tract, used with an Ambu display unit in hospital or office settings. | Clear, sharp imaging and smooth maneuverability for every case because a new scope is used each time; high bending angles (about 210°/120°) and portable, always-available setup reduce reprocessing delays |

|

C-MAC S single-use video laryngoscopes and FIVE S single-use flexible intubation video endoscope for airway management and flexible endoscopic procedures such as bronchoscopy and laryngoscopy, integrating with C-MAC monitors. | Slim, break-resistant single-use blades and scopes provide clear images and maneuverability while minimizing cross-contamination; connects seamlessly to C-MAC HD and Pocket Monitor platforms and is offered in multiple sizes for varied patients |

|

LithoVue Elite single-use digital flexible ureteroscope system for access, visualization, and treatment of stones throughout the urinary tract; used with the StoneSmart/Connect console. | Real-time intrarenal pressure monitoring at the ureteroscope tip with enhanced image quality supports clinical decisions; 120° field of view, 270° deflection, 9.5 Fr outer diameter, and 3.6 Fr working channel enable navigation and instrument passage. |

|

BFlex single-use bronchoscopes for routine and emergent airway and bronchoscopy procedures across ICU, OR, and ED settings, with adult and pediatric sizes and GlideScope platform integration. | Bright, crisp imaging with Dynamic Light Control and anti-fog plus improved suction and increased articulation in BFlex 2 enhance efficiency, while single-use design reduces cross-contamination risk and eliminates reprocessing burdens |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The disposable endoscopes market ecosystem involves a complex network of stakeholders that drive production, distribution, and adoption. Manufacturers create technologically advanced, single-use endoscopes and oversee R&D, quality control, and regulatory compliance. Distributors and supply chain partners guarantee timely delivery to hospitals, clinics, and outpatient centers, while regulatory authorities enforce strict safety and performance standards. SMEs and start-ups provide innovation, niche solutions, and cost-effective alternatives. End users, including surgeons, gastroenterologists, urologists, and pulmonologists, influence demand based on procedural needs and safety concerns. Effective coordination among these players is crucial to ensure product availability, compliance, clinical effectiveness, and adoption, which collectively shape market growth and technological progress worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Disposable Endoscopes Market, By Type

By type, the disposable endoscopes market is divided into urology endoscopes, bronchoscopes, cystoscopes, laryngoscopes, GI endoscopes, arthroscopes, and other disposable endoscopes. The urology endoscopes segment leads the market because of the high prevalence of urinary tract disorders, increasing cases of kidney stones, and rising demand for minimally invasive procedures. Single-use cystoscopes and ureteroscopes reduce infection risks, lower reprocessing costs, and improve procedural efficiency, making them very appealing to hospitals and outpatient clinics. Additionally, growing awareness of patient safety and regulatory focus on sterile instruments further strengthen the preference for disposable urology endoscopes, supporting sustained market leadership worldwide.

Disposable Endoscopes Market, By Clinical Usage

The surgical usage segment currently leads the disposable endoscopes market due to the rising demand for minimally invasive surgeries, increasing procedural volumes, and the need for sterile, ready-to-use instruments. Single-use endoscopes help reduce cross-contamination risks, eliminate costly reprocessing, and improve operational efficiency, aligning with hospitals’ focus on patient safety and workflow optimization. Growing adoption in urology, gastroenterology, pulmonology, and ENT surgeries, along with technological advancements in imaging and maneuverability, strengthen the segment’s dominance and support sustained market growth.

Disposable Endoscopes Market, By Application

The urology application leads the disposable endoscopes market because of the high rates of urinary tract disorders, kidney stones, and bladder problems, along with the growing use of minimally invasive procedures. Single-use urology endoscopes improve patient safety by reducing infection risks, cut reprocessing costs, and boost procedural efficiency, making them the top choice for hospitals and outpatient centers. Increased awareness among clinicians and regulatory emphasis on sterile instruments further support the segment’s dominance and speed up market growth worldwide.

Disposable Endoscopes Market, By End User

Hospitals hold the largest share in the disposable endoscopes market because of their high procedural volumes, focus on patient safety, and need for infection-free, ready-to-use instruments. Single-use endoscopes decrease cross-contamination risks, remove reprocessing costs, and improve operational efficiency, aligning with hospital priorities. Additionally, hospitals have advanced infrastructure, trained staff, and access to multiple specialty departments—factors that drive adoption in urology, gastroenterology, pulmonology, and surgical procedures, strengthening their leading role in the global market.

REGION

North America region is the largest & Fastest growing region in the disposable endoscopes market

North America holds the largest and fastest-growing share in the disposable endoscopes market due to high healthcare expenditure, advanced hospital infrastructure, and early adoption of innovative medical technologies. Strong emphasis on infection control, patient safety, and minimally invasive procedures drives single-use endoscope adoption. Supportive regulatory frameworks, robust reimbursement policies, and widespread clinician awareness further accelerate growth. Additionally, the presence of key market players and ongoing product innovations ensures availability and adoption, solidifying North America’s leadership in the global disposable endoscopes market.

Disposable Endoscopes Market: COMPANY EVALUATION MATRIX

The disposable endoscopes market is led by Olympus Corporation (Japan), Karl Storz SE & CO. KG (Germany), Ambu A/S (Denmark), Boston Scientific Corporation (US), and Verathon Inc. (US) because of their strong brand reputation, broad product ranges, and ongoing innovation in imaging, miniaturization, and ergonomic designs. Olympus Corporation (Japan) and Karl Storz SE & CO. KG (Germany) excel with high-quality optics. Ambu A/S (Denmark) and Boston Scientific Corporation (US) utilize solid portfolios and global distribution channels, while Karl Storz SE & CO. KG (Germany) emphasizes reliability and precision. Their leadership is strengthened by strong R&D, regulatory compliance, and comprehensive after-sales support, which build customer trust and sustain their market position.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 0.84 Billion |

| Revenue Forecast in 2030 | USD 2.67 Billion |

| Growth Rate | CAGR of 22.9% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type: Urology Endoscopes, Bronchoscopes, Cystoscopes, Laryngoscopes, GI Endoscopes, Arthroscopes, Others By Clinical Usage: Diagnostic Usage & Surgical Usage By Application: Urology endoscopy, Bronchoscopy, ENT Application, Gastroenterology, Others By End User: Hospitals, Ambulatory surgery centers, clinics, and others |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Disposable Endoscopes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Application Analysis | Further breakdown of other applications in the market | Insights on Other applications involved in the market |

| Company Information | Market Share Analysis, By Region (North America and Europe) & Competitive Leadership Mapping for Established Players in the US | Insights on market share analysis by region |

| Geographic Analysis |

|

Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- June 2025 : Ambu announced that the US Food and Drug Administration (FDA) has granted expanded 510(k) clearance for its aScope 5 Cysto HD, extending its approved indications to include use in percutaneous nephrolithotomy (PCNL) procedures.

- May 2025 : Ambu launched the additional sizes of video laryngoscope blades for the new Ambu SureSight Connect video laryngoscopy solution.

- February 2025 : Ambu expanded its European regulatory clearance (CE mark) for the Ambu aScope 5 Cysto HD, enabling the platform to serve as a single-use flexible cysto-nephroscopy solution and tapping into a new niche procedure segment within urology.

- April 2025 : KARL STORZ launched the Slimline C-MAC S single-use video laryngoscope, engineered for high-performance airway management. The device offers enhanced visualization for reliable intubation, even in complex clinical scenarios, while upholding the company’s renowned quality standards.

Table of Contents

Methodology

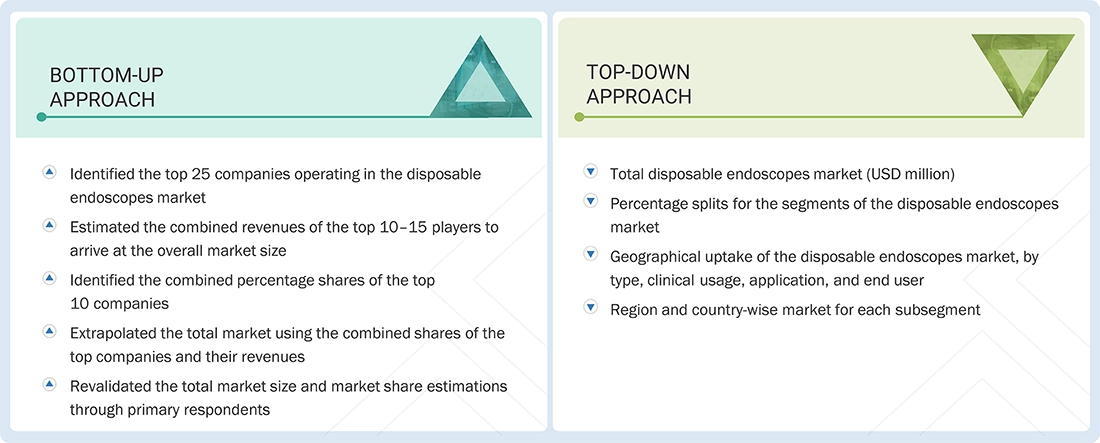

The research study involved key activities in estimating the current market size for disposable endoscopes. Extensive secondary research was conducted to collect information on the market. The next step was to validate these findings, assumptions, and estimates with industry experts across the value chain using primary research. Different methods, such as top-down and bottom-up approaches, were used to calculate the total market size. Following that, market segmentation and data triangulation procedures were employed to determine the market size of the segments and subsegments of the disposable endoscopes market.

Secondary Research

The secondary research process involved extensive use of secondary sources, including directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies, and publications from government agencies like the National Institutes of Health (NIH), US Food and Drug Administration (FDA), US Census Bureau, World Health Organization (WHO), International Trade Administration (ITA), Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS). These sources were used to identify and gather information for the global disposable endoscopes market study. They also provided essential details about key players, market classification, and segmentation based on industry trends down to the most detailed levels, as well as key developments related to market and technology perspectives. Additionally, a database of leading industry players was created using secondary sources research.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. On the supply side, primary sources include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and other key executives from various companies and organizations in the disposable endoscopes market. On the demand side, sources include ambulatory surgical centers, hospitals, clinics, and other end users. This primary research was conducted to validate market segmentation, identify key players, and gather insights on major industry trends and market dynamics.

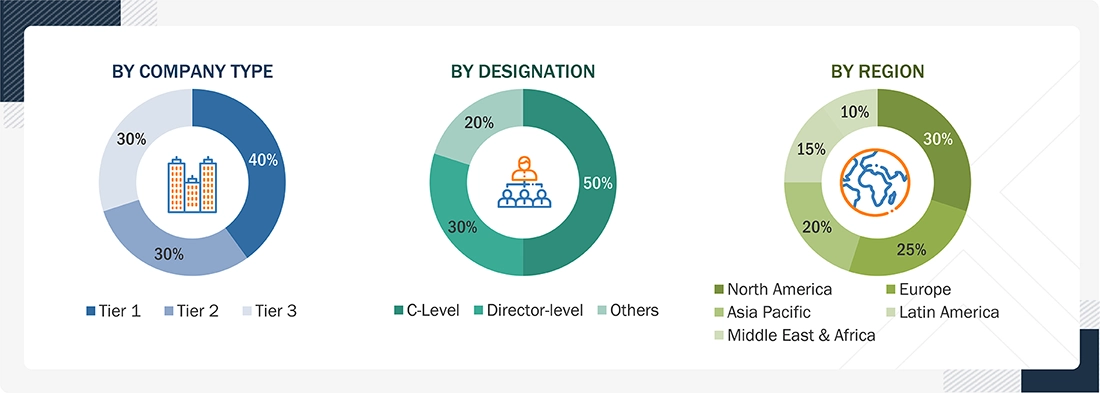

A breakdown of the primary respondents is provided below:

C-level primaries include CEOs, CFOs, COOs, and VPs.

*Others include Sales Managers, Marketing Managers, Business Development Managers, Product Managers, Distributors, and Suppliers.

Companies are classified into tiers based on their total revenue. The tiers are as follows:

Tier 1 = > USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenue figures were calculated based on revenue mapping of major product manufacturers and OEMs active in the worldwide disposable endoscopes market. All major product manufacturers were identified at the global and/or country or regional level. Revenue mapping for the relevant business segments or sub-segments was conducted for the key players. Additionally, the global disposable endoscopes market was divided into various segments and sub-segments based on,

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various disposable endoscope manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from disposable endoscopes (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global disposable endoscopes market

The data mentioned above was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-Up & Top-down Approaches)

Data Triangulation

After determining the overall size of the global disposable endoscopes market using the methodology described above, this market was divided into several segments and subsegments. Data triangulation and market segmentation techniques were used, where applicable, to complete the entire market analysis and obtain precise market value data for the key segments and subsegments. The estimated market data was validated by analyzing various macro indicators and regional trends from both demand and supply perspectives.

Market Definition

Disposable endoscopes are single-use medical devices designed for diagnostic and therapeutic procedures that provide direct visualization of internal organs. These sterile, ready-to-use instruments eliminate the need for reprocessing, reduce infection risks, and improve operational efficiency across various specialties such as gastroenterology, urology, pulmonology, and otolaryngology.

Stakeholders

- Manufacturers of endoscopes and related devices

- Suppliers and distributors of endoscopy devices

- Hospitals, diagnostic centers, and medical colleges

- Independent surgeons and private offices of physicians

- Ambulatory surgery centers

- Teaching hospitals and academic medical centers

- Government bodies/Municipal corporations

- Business research and consulting service providers

- Venture capitalists

Report Objectives

- To define, describe, segment, and forecast the disposable endoscopes market by type, clinical usage, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall disposable endoscopes market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the disposable endoscopes market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the disposable endoscopes market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, and R&D activities of the leading players in the disposable endoscopes market

- To benchmark players within the disposable endoscopes market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Disposable Endoscopes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Disposable Endoscopes Market