Europe Cleanroom Technologies Market Size, Growth, Share & Trends Analysis

Europe Cleanroom Technologies Market by Product (HEPA Filter, HVAC System, Laminar Air Flow System, Pass-Through Cabinets, Fan Filter Units, Disinfectant, Consumables, Controls), Type (Standard, Modular, Mobile, Softwall), End User - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe Cleanroom Technologies market, valued at USD 2.45 billion in 2025, stood at USD 2.60 billion in 2026 and is projected to advance at a resilient CAGR of 6.8% from 2026 to 2031, culminating in a forecasted valuation of USD 3.61 billion by the end of the period. The development of cleanroom technologies in Europe is a result of the inflating high-precision industries, the need to comply with stricter regulations, and increased investments in the manufacturing sector. The main driver of demand for the pharmaceutical and biotechnology industries is due to the high production of biologics, vaccines, and sterile injectables under the EU GMP-compliant cleanroom environments. The robust semiconductor, microelectronics, and aerospace sectors in Europe are also driving the adoption, owing to the ultra-low contamination production areas.

KEY TAKEAWAYS

-

By CountryGermany accounted for a share of 28.4% in 2025 in the cleanroom technologies market.

-

By ProductBy product, the consumables segment is expected to register the highest CAGR of 7.9%.

-

By TypeBy type, the modular cleanrooms segment is expected to dominate the market, accounting for a 51.4% share in 2025.

-

By End UserBy end user, the pharmaceutical industry segment dominated the market, with a share of 48.4% in 2025.

-

Competitive Landscape - CRO Key PlayersExyte AG (Germany), Bouygues Group (France), Ardmac (Ireland), Colandis GMBH (Germany), ABN Cleanroom Technology (Belgium), Octanorm-Vertriebs-GmbH (Germany), Camfil (Sweden), Parteco SRL (Italy), Airplan (Spain), Weiss Technik (Germany), and Atlas Environments, Ltd. (UK) were identified as some of the star players in the European cleanroom technologies market, given their extensive global reach and comprehensive service portfolios.

-

Competitive Landscape - CRO StartupsABN Cleanroom Technology (Belgium), Asgatech Holding Ltd. (Ireland), OCTANORM-Vertriebs-GmbH (Germany), and Parteco srl (Italy), among others, have distinguished themselves among startups and SMEs due to their specialized veterinary expertise and focused service capabilities.

The cleanroom technology market in Europe is primarily driven by the growth of the pharmaceutical, biotechnology, and semiconductor industries, which require strict control over contamination and adherence to EU GMP and ISO standards. There is a rise in the production of biologics, vaccines, and ATMPs. The increasing influence of CDMOs is leading to the need for sophisticated cleanroom environments to double. The established electronics and aerospace industries in Europe, combined with the gradual replacement of old facilities and the transition toward modular, automated, and energy-efficient cleanroom systems, are contributing to the increasing adoption of such technologies in this region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The market has been increasingly characterized by rapid digitalization. The introduction of Industry 4.0 (real-time sensors, cloud monitoring, and predictive analytics) is making compliance and uptime easier and better. There is also a tendency toward modular/pre-engineered cleanrooms. Turnkey solutions also allow for faster time-to-operation and save capital (CAPEX). The market is witnessing a rapid increase in demand from the pharma/biotech (biologics, vaccines, and ATMPs) and CDMO sectors, which in turn need flexible validated sterile environments. New investments in the pharmaceutical and biotechnology industries are increasing the adoption of ultra-low contamination and advanced HVAC/filtration improvements, as well as the major sustainability goal of utilizing energy-efficient HVAC systems, low-carbon materials, and lifecycle cost optimization throughout the entire process.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for biologicals and booming European biopharmaceutical industry

-

Advancements in cleanroom technologies and development of modular designed cleanrooms

Level

-

High operational costs associated with cleanrooms

-

Stringent regulatory framework and quality check parameters

Level

-

Increasing demand for cleanrooms in emerging economies

-

Growing focus on energy-efficient cleanrooms by pharmaceutical and medical device manufacturers

Level

-

Customization of cleanroom designs based on customer requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for biologicals and booming biopharmaceutical industry

The cleanroom technologies market is significantly driven by the rising demand for biologics, vaccines, and advanced therapies, as well as the rapidly growing European biopharmaceutical industry, since these products require very strict, sterile, and contamination-free environments for their entire development and manufacturing process. Biologics and cell & gene therapies are branded as highly sensitive to microbial and particulate contamination, leading companies to invest in higher-grade cleanrooms, isolators, advanced HVAC systems, and real-time environmental monitoring. This ensures compliance with regulations and the safety of products. The requirement for state-of-the-art modular cleanrooms, automated decontamination systems, and improved filtration technologies keeps increasing as biopharma companies grow their production capacity, build new GMP facilities, and more often outsource to CDMOs. This contributes to the strong market growth across the Europe cleanroom technologies market.

Restraint: High operational costs associated with cleanrooms

High operational expenses significantly restrain the cleanroom technologies market. Such expenses accompany very rigorous cleaning, sterilization, and environmental monitoring to meet GMP and ISO standards. This, in turn, requires continuous energy, mainly HVAC operation, frequent filter replacements, and strict monitoring. Such expenses are in addition to the high costs of skilled labor, specialized consumables, and ongoing validation and compliance activities, which make cleanroom operations financially burdensome, particularly for small and mid-sized manufacturers. Therefore, several companies postpone their upgrades, restrict access to the cleanroom area, or seek cheaper alternatives, resulting in slow technical progress of cleanroom technologies in the market.

Opportunity: Growing focus on energy-efficient cleanrooms by pharmaceutical and medical device manufacturers

The growing emphasis on environmentally friendly cleanrooms is driving the Europe cleanroom technologies market. Pharmaceutical and medical device companies need solutions that cut operational costs and help them achieve sustainability goals and comply with the stringent climate and energy regulations in the EU. To combat the increasing energy consumption from HVAC, filtration, and air-handling systems, companies are investing in high-efficiency HEPA/ULPA filters, smart airflow control, low-energy HVAC systems, heat-recovery units, and IoT-enabled environmental monitoring to save energy without compromising product sterility. The EU's shift toward greener production, corporate ESG commitments, and the need to update outdated cleanroom infrastructure are among the factors driving demand for sustainable, energy-efficient cleanroom designs.

Challenge: Customization of cleanroom designs based on customer requirements

The Europe cleanroom technologies market is experiencing rising design complexity, longer project durations, and higher costs due to the increasing demand for highly customized cleanroom designs specifically adapted to certain industry workflows, regulatory demands, and plant layouts. In contrast to standard modular systems, customized cleanrooms entail vast engineering effort, custom HVAC designs, specialized materials, and multiple validation cycles. This makes it challenging to scale and more resource-demanding for the manufacturers. Such a high level of customization may exhaust production capacity, lead to a loss of standardization, and make global distribution more difficult, particularly for suppliers working in areas with very different regulatory conditions. Consequently, the cleanroom technology providers are unable to meet the expectations of the market with their solutions that are fast and cost-effective, due to the longer lead times, higher costs, and operational bottlenecks caused by the demands for customization.

Europe Cleanroom Technologies Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides complete cleanroom construction, modular cleanroom units, and facility design engineering services for the biopharmaceutical, cell & gene therapy, and advanced manufacturing industries. | Modular, future-proof cleanroom infrastructures allow for rapid deployment, scalable facility expansions, and lower lifecycle costs. |

|

Offers complete cleanroom construction (walls, ceilings, HEPA systems, partitions, doors/windows, HVAC/filtration) and cleanroom-fit-out to regulatory and quality standards. | Uses lean construction methods, BIM (Building Information Modeling), and modular systems to achieve faster project timelines, better cost control, and adaptability, reduce operational time, assists in regulatory compliance (e.g., for GMP in pharma/biotech), and makes it easier to scale or relocate cleanrooms when the production needs change. |

|

Designs and manages complete cleanroom infrastructure, controlled-environment facilities, and high-specification technical buildings for the pharmaceutical, biotechnology, semiconductor, and advanced manufacturing industries. | Provides high standard, regulation-compliant cleanroom environments, speeds up the facility construction process, and reduces lifecycle costs by applying effective engineering methods, strong project management, and green building technologies. |

|

Tailors customized clean-air and contamination-control solutions to various needs, including cleanrooms, mini-environments, fan-filter units (FFUs), mobile cleanrooms, workstations, equipment enclosures, and component cleaning & packaging. | Provides flexible solutions to enable cost-effective contamination control, easy retrofitting or expansion, reduced CAPEX for customers, and faster deployment. |

|

Specializes in modular and pre-engineered cleanroom design, construction, commissioning, and lifecycle facility management for pharmaceutical, biotechnology, life sciences, micro-electronics, medical devices, and other critical industries. | Assures quick delivery of cleanrooms to meet regulatory requirements and lower the initial capital investment. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe cleanroom technologies market is an ecosystem comprising a cleanroom constructors network that is tightly integrated with modular cleanroom manufacturers, HVAC and filtration system suppliers, and component providers (panels, doors, pass boxes, FFUs). Across a wide range of industries, including pharmaceuticals, biotechnology, semiconductors, aerospace, and advanced manufacturing, the entire network is supported by contamination-control solution vendors and testing/validation service providers. The ecosystem is relying on CDMOs, regulatory bodies (EU GMP, ISO 14644), engineering consultants, and technology integrators that facilitate compliance, automation, and digital monitoring. The demand from end users for faster deployment, full-lifecycle support, modular solutions, and energy-efficient cleanroom operations across Europe has resulted in increased collaboration among equipment manufacturers, turnkey builders, and maintenance/service companies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cleanroom Technologies Market, By Product

In 2025, the consumables segment held the largest market share in cleanroom technologies. In the product categories, consumables dominated the cleanroom market, driven by the expanding pharmaceutical, biotech, and medical device sectors, which consistently adhere to contamination control to secure regulatory approval. The growing manufacture of biologics, sterile injectables, and sophisticated electronics drives the need for gloves, gowns, wipes, disinfectants, and contaminant-free packaging to maintain aseptic environments. The shift from systems in bioprocessing to enhanced hygiene protocols, as well as preparation for high-precision production, has led to an increased use of single-use products. The demand for consumables in the Europe cleanroom technology market is also growing due to the continuous and recurring supply of consumables driven by the preference for cost-effective, easy-to-replace, and contamination-free materials over reusable ones.

Cleanroom Technologies Market, By Type

In 2025, the Europe cleanroom technologies market, by type, was dominated by the modular cleanroom technology. The rapid spread of these modular cleanroom technologies is primarily driven by the increasing demand for rapid, flexible, and cost-effective cleanroom deployment in the pharmaceutical, biotechnology, medical device, and advanced manufacturing sectors. The modular cleanroom technology is characterized by its rapid installation, scalability, and ease of reconfiguration. The growing demand for modular cleanrooms is driven by the global investments in contract development manufacturing organizations (CDMOs), vaccine production, and cell and gene therapy facilities. This is characterized by reduced construction timelines and predictable validation processes. Modular designs minimize downtime, lower capital expenditure, and facilitate adherence to GMP and ISO cleanroom standards, making them a preferred option over conventional cleanroom construction.

Cleanroom Technologies Market, By End User

The pharmaceutical industry segment is dominant in the market due to its stringent requirements for contamination-free environments. The production of biologics, vaccines, and sterile injectables, as well as advanced therapeutic modalities, is contributing to this demand. Pharmaceutical manufacturers are being urged to upgrade or expand their cleanroom infrastructure due to increasing regulatory pressure from agencies such as the FDA and EMA for compliance with GMP standards. Chronic diseases, personalized medicine, and global clinical trial activity have increased the demand for high-grade cleanrooms to ensure product purity, sterility, and safety. The growth of pharmaceutical manufacturing hubs in emerging markets, with the establishment of new drug development pipelines and investments in CDMOs, has resulted in the accelerated adoption of advanced cleanroom technologies across the pharmaceutical sector.

REGION

Germany to be fastest-growing country in Europe cleanroom technologies market during forecast period

Germany has accounted for the largest share of the Europe cleanroom technologies due to its solid industrial base in the pharmaceutical, biotech, and medical device sectors, which require contamination-free environments. The burgeoning production of biologics and vaccines in Germany, coupled with EU and national funding support for microelectronics and chip manufacturing, is driving the cleanroom space. In addition, the country's commitment to precision engineering, automation, and digitalized production is continuously driving the demand for state-of-the-art, eco-friendly, and modular cleanroom systems. The combination of strict regulatory standards, a well-established CDMO ecosystem, and the upgrading of older facilities contributes to the need for premium cleanroom infrastructure. Thus, Germany is becoming one of the most significant cleanroom markets in Europe in terms of growth.

Europe Cleanroom Technologies Market: COMPANY EVALUATION MATRIX

In the cleanroom technologies market matrix, Exyte AG (Germany) (Star) has a global penetration, cutting-edge environmental control systems, and expertise in providing accurate cleanroom solutions for the pharmaceutical, biotechnology, and healthcare manufacturing sectors. Bouygues Group (France) (Emerging Leader) emphasizes turnkey cleanroom engineering, modular construction, and high-quality contamination-control infrastructure.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Exyte GmbH (Germany)

- Bouygues Group (France)

- Ardmac (Ireland)

- Colandis GMBH (Germany)

- ABN Cleanroom Technology (Belgium)

- Octanorm-Vertriebs-GMBH (Germany)

- Camfil (Sweden)

- Parteco SRL (Italy)

- Airplan (Spain)

- Weiss Technik (Germany)

- Atlas Environments, Ltd. (UK)

- Asgatech Holding Ltd. (Ireland)

- CRT Cleanroom-Technology GmbH (Germany)

- Weiss Technik (Germany)

- Atlas Environments Limited (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.45 Billion |

| Market Forecast in 2031 (Value) | USD 3.61 Billion |

| Growth Rate | CAGR of 6.8% from 2026–2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand/million units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, France, UK, Italy, Spain, and Rest of Europe |

| Parent & Related Segment Reports | Cleanroom Technologies Market |

WHAT IS IN IT FOR YOU: Europe Cleanroom Technologies Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Cleanroom technologies that were compared with each other are namely HVAC and filtration systems, cleanroom consumables, modular cleanroom units, contamination-control equipment, and environmental monitoring solutions. Major technology adoption trends, regulatory compliance (ISO, GMP), energy-efficient systems, automation integration, and differences among leading providers in the pharmaceutical, medical device manufacturers, and biotechnology sectors were discussed. | The identification of the most liked technology specifications, performance requirements, and compliance benchmarks was made possible through users' industries. The decision for equipment upgrades, vendor comparison, sustainability-focused solutions, and cleanroom infrastructure alignment with continuously changing manufacturing needs such as biologics, microelectronics, and high-precision production has been supported. |

| Company Information | Major players were profiled: Exyte AG (Germany), Bouygues Group (France), Ardmac (Ireland), Colandis GMBH (Germany), and ABN Cleanroom Technology (Belgium). They received insights into the cleanroom portfolios, engineering capacities, global presence, R&D, and modular construction expertise of each company, as well as the differentiation of the companies in the pharmaceutical, biotechnology, medical device industries. | A clear view of competitors' positioning, types of partnerships, innovation capabilities, and market expansion strategies was provided. The strategic suppliers for cleanroom design, construction, consumables, and environmental monitoring were evaluated, which helped identify collaborations with high value for facility upgrades and new builds. |

| Geographic Analysis | Analysis of the cleanroom technology usage per country in Europe was provided for countries like Germany, France, the UK, Italy, Spain, and the Rest of Europe as a whole, taking into account the legal environment, the locations of the manufacturing growth, and the investments available. The focus was on the fast growing markets of pharmaceuticals, medical devices, and biotech in Europe; and the maturity of the market, the technology requirements, and the cleanroom infrastructure potential were evaluated in the case of the emerging economies. | The global strategy planning was backed up by the very identification of the regional markets with the highest growth for the cleanroom installations, modular facility deployment, and consumables demand. The clients were guided in their decisions towards the evaluation of the localization opportunities, the regulatory readiness, and the selection of the best regions for capacity expansion and partnerships, especially in fast-growing Europe's manufacturing hubs. |

RECENT DEVELOPMENTS

- December 2024 : Camfil (Sweden) has announced the launch of the Megaflow Pro ULPA Series, which is to be used for cleanroom filtration globally, thus increasing its cleanroom filtration portfolio. The new line of products is aimed at supporting next-generation pharma, semiconductor, and biotech sectors. This product line offers air-quality control solutions to Europe, the Asia Pacific, and North America.

- November 2024 : ABN Cleanroom Technology (Belgium) launched its SmartCleanroom 4.0 Platform, which combines IoT-based monitoring, predictive airflow control, and automated contamination-response systems. This new product reinforces ABN's commitment to digital cleanroom solutions and enables it to penetrate high-growth markets such as cell & gene therapy and high-purity manufacturing.

- October 2024 : Connect 2 Cleanrooms (UK) has rolled out its new and improved CleanCube Modular Cleanroom Series which includes better ISO-classified modular units with better airflow zoning, and more than one power-efficient HVAC modules, and fast assembly frameworks for biopharma, medical devices, and semiconductor productions. The CleanCube platform caters to the increasing need for hygienic, compliant, and affordable contamination-control infrastructure in Europe.

Table of Contents

Methodology

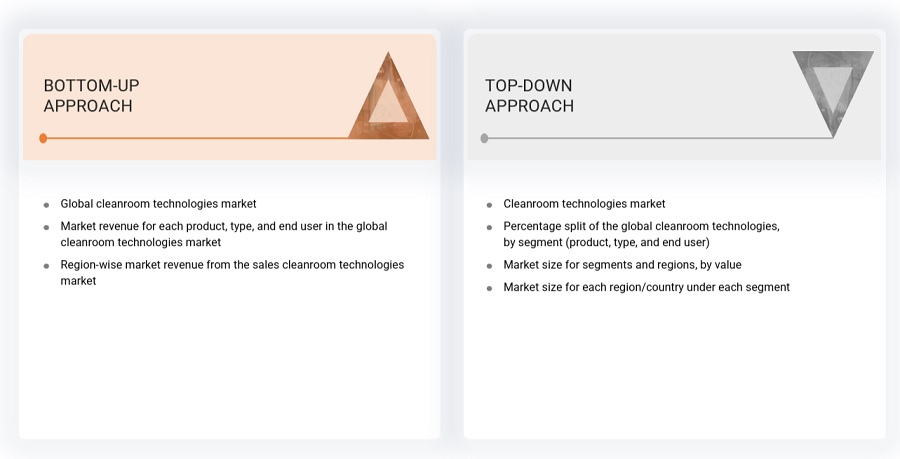

This study involved four major activities in estimating the size of the cleanrooms technologies market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the Europe cleanroom technologies market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the Europe cleanroom technologies market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

The research methodology used to estimate the size of the Europe cleanroom technologies market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the Europe cleanroom technologies market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall Europe cleanroom technologies market was obtained from secondary data and validated by primary participants to arrive at the total Europe cleanroom technologies market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall Europe cleanroom technologies market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Europe Cleanroom Technologies Size: Top-Down and Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Cleanroom technologies are specialized systems, processes, and equipment designed to produce an environment with low concentrations of airborne particulates, contaminants, and pollutants. Such technologies have significant applications in industries including pharmaceuticals, biotechnology, electronics, and aerospace, where a minute contaminant might compromise product quality or safety. Europe cleanroom technologies include such things as air filtration with HEPA and ULPA, environmental control for temperature, humidity, and pressure, and advanced monitoring systems that could be instituted in order to ensure particular standards of cleanliness are met, for instance ISO and GMP.

Key Stakeholders

- Indian Pharmaceutical Association (IPA)

- Pharmaceutical Research and Manufacturers of America (PhRMA)

- European Federation of Pharmaceutical Industries and Associations (EFPIA)

- Central Drugs Standard Control Organization (CDSCO)

- India Brand Equity Foundation (IBEF)

- Pharma & Biopharma Outsourcing Association (PBOA)

- Indian Drug Manufacturers’ Association (IDMA)

- World Health Organization (WHO)

- Organization for Economic Co-operation and Development (OECD)

- National Institutes of Health (NIH)

- Centers for Disease Control and Prevention (CDC)

- Annual Reports/SEC Filings, Investor Presentations, and Press Releases of Key Players

- White Papers, Journals/Magazines, and News Articles

- Paid Databases, such as Factiva, D&B Hoovers, and Bloomberg Business

Report Objectives

- To define, describe, segment, and forecast the Europe cleanroom technologies market by product, type, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall Europe cleanroom technologies market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players in the Europe cleanroom technologies market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, and R&D activities of the leading players in the Europe cleanroom technologies market

- To benchmark players within the Europe cleanroom technologies market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Cleanroom Technologies Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Cleanroom Technologies Market