Europe Companion Animal Diagnostics Market

Europe Companion Animal Diagnostics Market by Product (Consumables, Instruments), Technology (Clinical Biochemistry, Molecular Diagnostics), Application (Clinical Pathology, Virology, Hematology), Animal (Dogs, Cats), End User - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe companion animal diagnostics market, valued at USD0.43 billion in 2025, stood at USD0.46 billion in 2026 and is projected to advance at a resilient CAGR of 8.6% from 2026 to 2031, culminating in a forecasted valuation of USD0.70 billion by the end of the period. The market for diagnostics of companion animals in Europe is experiencing fast growth owing to factors such as increased pet ownership, animal health awareness, and advanced veterinary care being more widely accepted and costly. The presence of chronic and infectious diseases in pets is, therefore, a major factor that drives the need for accurate and early diagnostic testing, while technological improvements, like rapid point-of-care tests and molecular diagnostics, are positively impacting the overall detection process with regard to speed and reliability. In this respect, the abovementioned conditions are together pushing the veterinary diagnostic solutions market through clinics and laboratories in Europe.

KEY TAKEAWAYS

-

By CountryThe companion animal diagnostics market in Germany accounted for 18.9% revenue share in 2025.

-

By ProductThe consumables segment accounted for the largest share of the Europe companion animal diagnostics market in 2025.

-

By Animal TypeDogs held the largest market share of 64.0% of the Europe companion animal diagnostics market in 2025.

-

By TechnologyThe clinical biochemistry segment accounted for the largest market share in 2025.

-

By ApplicationThe clinical pathology segment is projected to be the fastest-growing segment with a CAGR of 10.4% during the forecast period.

-

By End UserThe diagnostic laboratories segment accounted for the largest market share in 2025.

-

Competitive Landscape: Key PlayersIdexx and Zoetis Service LLC were identified as some of the star players in Europe, given their strong market share and product footprint.

-

Competitive Landscape: SMEsBiopanda Reagents Ltd. and EurolyserDiagnostica GmbH, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The growth of the companion animal diagnostics market in Europe is expanding with the rise in the number of pet owners, the health of animals becoming a more critical aspect, and the rise in spending on modern veterinary services. At the same time, the increased occurrence of chronic and infectious pet diseases is making the demand for accurate and quick diagnostic tools more pronounced. Innovative methods such as rapid point-of-care testing and molecular tests, on the other hand, are making the diagnostic process more accurate and faster. All these factors are facilitating the increased adoption of diagnostic technologies in the veterinary practices and labs in the region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Pet humanization and the advancement of technology are the major causes for the change in the Europe companion animal diagnostics market. The main trend is that owner spending has increased significantly, as owners consider their pets as family members, which in turn drives the demand for preventive and early-stage diagnostics. The market for these diagnostics has been immensely disrupted, along with the rapidly increasing acceptance of Point-of-Care (POC) diagnostics that allow veterinarians to perform advanced tests such as immunodiagnostics, clinical biochemistry, and molecular assays in a matter of minutes at the clinic. Besides, the use of AI in the analysis of imaging and urine sediment is among the top technological trends in enhancing diagnostic speed and accuracy. Despite this progress, the situation is worsened by the high prices of the state-of-the-art instruments and the lack of skilled veterinary practitioners who could work with and interpret the results of these technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing companion animal population

-

Rising demand for pet insurance and growing animal health expenditure

Level

-

Rising pet care costs

Level

-

Use of advanced technologies to improve disease diagnosis accuracy in companion animals

-

Growing demand for rapid tests and portable instruments for point-of-care diagnostic services

Level

-

Shortage of veterinary practitioners

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

DRIVERS: Increasing companion animal population

The growth of the Europe companion animal diagnostics market is fundamentally anchored in the trend of "pet humanization", where companion animals are increasingly viewed as family members. This shift is deeply rooted in the well-documented positive health benefits of pet ownership for humans, including reduced stress and improved psychological well-being, which has fueled a surge in adoption rates across the continent. Data confirms this, with the canine population in Europe expanding from USD 104.34 million in 2022 to USD 106.36 million in 2023 ( Source: European Pet Food Industry Federation, FEDIAF), and a total European pet population nearing USD 352 million. This continually expanding and aging pet population directly drives a proportionate rise in demand for premium pet care products and advanced veterinary services, acting as the primary engine of growth for dependent industries such as the companion animal diagnostics market, particularly for tools used in early and preventative care.

RESTRAINTS: Rising pet care costs

The increase in diagnostic market sales of companion animals in Europe is extremely limited due to the rising costs of pet care, which makes a financial burden on the pet owners and, at the same time, limits the demand for modern diagnostic services. The veterinary labs, consultations, and treatments with preventive care have all experienced price surges owing to the rising costs of labor, medical supplies, and the use of advanced diagnostic technologies. Thus, a considerable proportion of pet owners, more so the ones with no comprehensive pet insurance, are inclined to defer or even refuse diagnostic testing, preferring to go for basic care or symptomatic treatment instead. The sensitivity to cost is most apparent in Southern and Eastern Europe, which consumes less household resources, thus leading to an uneven adoption of advanced diagnostics across the region. Therefore, while diagnostic technology and methods keep progressing, the high expenses that are not covered by the insurance still remain a big hurdle, which slows down the growth of the market, and the veterinarians do not have the possibility to explore the full potential of the new diagnostic platforms.

OPPORTUNITIES: Use of advanced technologies to improve disease diagnosis accuracy in companion animals

The veterinary healthcare sector is just at the beginning of the adoption of advanced technologies such as AI and ML, but the first applications already indicate that these technologies can be very useful for diagnosing companion animals accurately. With the help of these tools, the imaging datasets, and electronic medical records are getting integrated to spot disease patterns already and more reliably than the traditional ways. One example is the Aptech Diagnostics by Mars Petcare scientists who introduced RenalTech, an AI-powered predictive tool that has the ability to detect chronic kidney disease (CKD) in cats up to two years earlier than the clinical diagnosis, which is a substantial progress considering that CKD affects almost one-third of the cat population and is the number one cause of death in cats older than five years. These advancements are clear indicators that AI and ML are going to be very useful in veterinary diagnostics as they will make it possible to detect the disease earlier, lessen the uncertainty surrounding the diagnosis and thus promote health management to be more proactive.

CHALLENGES: Shortage of veterinary practitioners

The companion animal healthcare ecosystem is increasingly strained by a persistent shortage of veterinary practitioners. As pet ownership grows and the demand for timely diagnostic testing rises, many clinics and diagnostic facilities face capacity limitations due to insufficient staffing. This shortage leads to longer wait times, delayed diagnostic workups, and reduced access to specialized testing, ultimately affecting the accuracy and speed of clinical decision-making. The limited availability of trained veterinarians also places additional pressure on existing staff, hindering their ability to adopt new diagnostic technologies or expand service offerings. As a result, the shortage of veterinary professionals acts as a significant challenge to market growth, affecting both diagnostic throughput and the adoption of advanced companion animal diagnostic solutions.

EUROPE COMPANION ANIMAL DIAGNOSTICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

In-clinic diagnostic analyzers, rapid test kits, imaging systems, and reference laboratory services for companion animals | Fast and accurate diagnostics, improved clinical decision-making, streamlined veterinary workflows |

|

Point-of-care diagnostic tests and reference lab services integrated with animal health solutions | Early disease detection, integrated diagnostics–therapeutics approach, improved treatment outcomes |

|

Diagnostic imaging systems, hematology and biochemistry analyzers for veterinary use | High-quality imaging, reliable lab results, enhanced diagnostic confidence |

|

Microbiology and infectious disease diagnostics for veterinary applications | Accurate pathogen detection, improved infection control, strong European lab presence |

|

Diagnostic support tools and disease-specific testing solutions for companion animals | Targeted diagnostics, strong alignment with therapeutic portfolios, trusted European brand |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The landscape of the Europe companion animal diagnostics market is primarily dictated by the manufacturers who are creating advanced testing kits along with imaging systems and digital diagnostic tools, and also by the veterinary surgeons and hospitals, and other end users that comprise diagnostic laboratories, research institutes, universities, and a rapidly growing segment of pet owners practicing home-care who depend upon fast and dependable diagnostics to make the right decisions regarding treatment and thus improve animal health outcomes. The regulatory bodies, such as the European Medicines Agency (EMA), national veterinary authorities, and the EU regulatory framework that supervises diagnostic device safety, quality, and data integrity, are the ones controlling this environment. Their policies will affect product approvals, laboratory standards, and the usage of digital tools, whereas the latter will impact innovations and the adoption of the market in Europe.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Companion Animal Diagnostics Market, By Product

The Europe companion animal diagnostics market is divided into consumables and instruments based on product. The consumables segment dominates the market, as the demand for routine diagnostocs testing is increasing in tandem with the growth of chronic and infectious diseases, including diabetes and parasitic infections, in pets.

Europe Companion Animal Diagnostics Market, By Animal Type

By animal type, the companion animal diagnostics market in Europe is dominated by dogs. They are susceptible to a number of diseases, such as heart problems, tumors, diabetes, and infections; they need frequent diagnostic tests to be managed properly.

Europe Companion Animal Diagnostics Market, By Application

The clinical pathology segment is projected to experience significant growth due to the high frequency of pathology testing performed on pets. The use of clinical pathology in vet practice has increased over the years due to its reliability in diagnosing and monitoring diseased conditions, particularly chronic ones, thereby making it the most widely used diagnostic method.

Europe Companion Animal Diagnostics Market, By End User

The diagnostic laboratories segment held the largest market share in 2025. This dominance is driven by the high volume of samples sent from both small and large veterinary practices for advanced analysis. Growing awareness among pet owners about routine and preventive diagnostic testing continues to boost sample inflow to these labs. As preventive care becomes more widely adopted across Europe, the demand for comprehensive laboratory-based diagnostics is expected to further accelerate during the forecast period.

REGION

UK to be fastest-growing country in Europe companion animal diagnostics market during forecast period

The UK is projected to record the highest CAGR over the forecast period. This is driven by factors such as the increasing adoption of automated therapeutic apheresis procedures, recent supportive initiatives within the NHS, and the renewed focus on boosting domestic plasma collection for essential plasma-derived therapies.

EUROPE COMPANION ANIMAL DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX

In the Europe companion animal diagnostics market matrix, Zoetis (Star) dominates with its massive scale, deep integration, and advanced diagnostic ecosystem, notably including the AI-powered Vetscan Imagyst platform for rapid, in-clinic testing. Conversely, Virbac (Emerging Leader) is gaining momentum, leveraging its strong European presence and focus on specialized, integrated health solutions, positioning itself to capture a larger share from veterinary practices seeking a broader, holistic product line.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IDEXX (US)

- Zoetis Services LLC (US)

- Mars, Incorporated (US)

- FUJIFILM Corporation (Japan)

- bioMérieux (France)

- Thermo Fisher Scientific Inc (US)

- Virbac (France)

- Neogen Corporation (US)

- INDICAL BIOSCIENCE GmbH (Germany)

- IDvet (France)

- Randox Laboratories Ltd. (UK)

- Shenzhen Mindray Animal Medical Technology Co., LTD. (China)

- Bionote USA Inc. (US)

- Boule (Sweden)

- EUROIMMUN Medizinische Labordiagnostika AG (Germany)

- Biopanda Reagents Ltd (UK)

- Nova Biomedical (US)

- Megacor Veterinary Diagnostics (Austria)

- Eurolyser Diagnostica GmbH (Austria)

- URIT MEDICAL ELECTRONIC CO., LTD. (China)

- Fassisi GmbH (Germany)

- Swissavans AG (Switzerland)

- Ring Biotechnology Co Ltd (China)

- Alvedia (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.43 Billion |

| Market Forecast in 2031 (Value) | USD 0.70 Billion |

| Growth Rate | CAGR of 8.6% from 2026-2031 |

| Years Considered | 2024-2031 |

| Base Year | 2025 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, Italy, France, Spain, UK, Benelux, Netherlands, Belgium, Denmark, Rest of Europe |

| Parent & Related Segment Reports | Companion Animal Diagnostics Market |

WHAT IS IN IT FOR YOU: EUROPE COMPANION ANIMAL DIAGNOSTICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | In-depth assessment of companion animal diagnostic solutions by product type (diagnostics), animal type, and end use (veterinary clinics, diagnostic labs, home care testing) | Evaluation of emerging diagnostic technologies such as point-of-care testing (POCT), AI-enabled diagnostic imaging, multiplex assays, portable analyzers, and rapid PCR innovations driving efficiency and accuracy in European veterinary practices |

| Company Information | Comprehensive profiles of key European and global players such as IDEXX Laboratories, Zoetis, Heska, Virbac, Eurolyser, Randox, Thermo Fisher Scientific, and others active in the region | Identification of strategic partnerships with veterinary networks, R&D collaborations, M&A activities, product launches, and distributor expansions accelerating market penetration in Europe |

| Geographic Analysis | Country-level demand mapping across major European markets, including Germany, the UK, France, Italy, Spain, Benelux; assessment of regulatory frameworks (EU Veterinary Regulations), adoption patterns, and testing infrastructure maturity | Regional market outlook detailing growth opportunities in preventive care diagnostics, increasing pet insurance adoption, rising veterinary healthcare expenditure, and digital diagnostic integration across major European countries |

RECENT DEVELOPMENTS

- July 2024 : Mars, Incorporated acquired Cerba HealthCare’s ownership stake in Cerba Vet and ANTAGENE. Cerba Vet and ANTAGENE now complement the diagnostics portfolio in Mars Petcare’s Science & Diagnostics division.

- June 2024 : IDEXX launched the Catalyst Pancreatic Lipase Test (Chemistry Analyzer). The Catalyst Pancreatic Lipase test is a single-slide solution for canine and feline patients that helps identify pancreatitis.

- May 2024 : Zoetis Services LLC launched the Vetscan OptiCell (Analyzer), which is a cartridge-based AI-powered hematology analyzer that provides advanced Complete Blood Count (CBC) analysis.

Table of Contents

Methodology

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Europe companion animal diagnostics market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Europe companion animal diagnostics market. Primary sources from the demand side included veterinary hospitals, clinics, researchers, lab technicians, purchase managers etc, and stakeholders in corporate & government bodies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

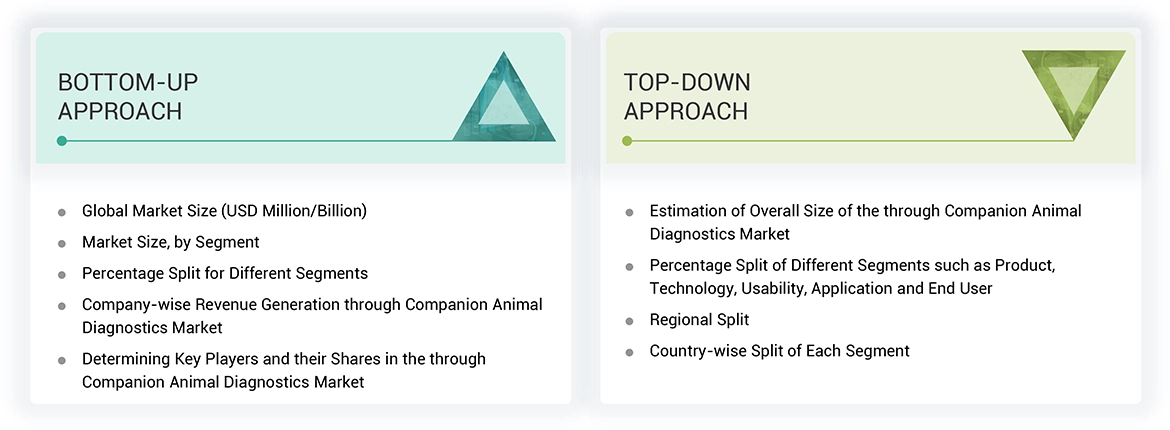

The market size for Europe companion animal diagnostics market was calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for Europe companion animal diagnostics market was calculated using data from three distinct sources, as will be discussed below:

Data Triangulation

The entire market was split up into five segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of Europe companion animal diagnostics. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Companion animal diagnostics are tools that utilize plasma, serum, blood, urine, feces, and tissue samples for the diagnosis of animal diseases and disorders. Companion animal diagnostics includes various test kits, tools, and instruments such as clinical chemistry analyzers, hematology analyzers, glucose monitoring systems, urine analyzers, blood gas-electrolyte analyzers, and ELISA test kits.

Stakeholders

- Companion animal diagnostic manufacturers

- Companion animal diagnostic distributors & suppliers

- Companion animal R&D companies

- Veterinary reference laboratories

- Veterinary hospitals & clinics

- Veterinary universities & research institutes

- Government associations

- Market research & consulting firms

- Venture capitalists & investors

- Distributors, channel partners, and third-party suppliers

Report Objectives

- To define, describe, and forecast the Europe companion animal diagnostics market based on product, technology, animal type, application, end user and region.

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the Europe companion animal diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players and comprehensively analyze their market shares and core competencies in the Europe companion animal diagnostics market

- To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, product launches, agreements, and other developments in the Europe companion animal diagnostics market

- To benchmark players within the Europe companion animal diagnostics market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Companion Animal Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Companion Animal Diagnostics Market