Europe Digital Denture Market Size, Growth, Share & Trends Analysis

Europe Digital Denture Market by Type (Complete Dentures, Partial Dentures), Tool (Equipment, Software), Usability (Removable Dentures, Fixed Dentures), Material (Resins, Plastics), End User (Dental Hospitals, Dental Clinics) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe Digital Denture market, valued at USD 495.2 million in 2025, stood at USD 533.1 million in 2026 and is projected to advance at a resilient CAGR of 7.1% from 2026 to 2031, culminating in a forecasted valuation of USD 805.3 million by the end of the period. Digital dentures refer to technologically advanced, digitally enabled methods for the design, fabrication, and delivery of complete and partial dentures via CAD/CAM and additive manufacturing workflows. In short, these solutions involve intraoral scanners, denture design software, milling systems, 3D printers, and advanced denture materials such as PMMA and printable resins. Digital denture technologies can facilitate routine tooth replacement through clinical, laboratory, or hybrid workflows, and their use is increasing for complex full-arch rehabilitations. Such systems are being progressively implemented in dental hospitals, dental clinics, and dental laboratories throughout Europe to increase workflow efficiency, improve prosthetic accuracy, shorten the work cycle, and deliver consistent, high-quality patient outcomes in a shorter duration.

KEY TAKEAWAYS

-

BY PRODUCTBy product, the equipment garnered the highest share in the Europe digital dentures market.

-

BY TYPEBy type, the partial dentures garnered the highest share in the Europe digital dentures market.

-

BY USABILITYBy usability, the fixed dentures segment is projected to increase at highest CAGR during the forecast period at the Europe digital dentures market.

-

By END USERBy end user, dental hospitals & clinics segment accounted for the largest share of the Europe digital dentures market.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSDentsply Sirona, Planmeca OY, 3Shape A/S were identified as some of the star players in the Europe digital dentures market, given their strong market share and product/service footprint.

-

COMPETITIVE LANDSCAPE- STARTUPSCompanies such as Novenda Technologies, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The Europe digital dentures market is driven by rapid advances in digital dentistry technologies, including intraoral scanning, CAD/CAM software, and 3D printing, as well as a rising prevalence of edentulism and age-related tooth loss. Growing patient preference for esthetic and functionally superior tooth-replacement solutions, coupled with increasing adoption of digitally enabled workflows by dental clinics and laboratories, is accelerating the shift from conventional to digital denture fabrication across Europe.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe digital dentures market is being reshaped significantly as a result of the wide adoption of advanced digital workflows, the increasing use of various applications, and innovation at the ecosystem level throughout the region. The conversion of standard removable dentures to digitally designed and manufactured ones—made possible by intraoral scanning, CAD/CAM software, 3D printing, and AI-assisted design—is, by and large, changing the way dental hospitals, clinics, and laboratories operate across Europe. These innovations are providing a range of benefits to healthcare providers, such as reduced chairside time, fewer patient visits, better-fitting appliances, and greater clinical predictability, increased production efficiency, and reduced manual technician labor. On top of that, the expanded use of connected devices, automation, and advanced visualization tools is helping with treatment planning, workflow coordination, and achieving consistent outcomes. Taken together, these factors are enabling quicker case completion, high-quality, reproducible prostheses, and rising patient satisfaction across the European market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing focus on technological innovation for dental materials

-

Increasing prevalence of oral health disorders

Level

-

High cost of dental imaging systems and inadequate reimbursements

Level

-

Impact of DSOs on dental industry

-

Investments in CAD/CAM technologies by dentist laboratories

Level

-

Shortage of skilled dental practitioners

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of oral health disorders

The widespread and long-lasting prevalence of oral health disorders in Europe is one of the main factors leading to the expansion of the digital dentures market. The World Health Organization (WHO), states that Europe is the region with the highest global burden of major oral diseases, where over half of the adult population is affected, thus, indicating a vast number of dental care needs that remain unfulfilled. Particularly, severe periodontitis affects 5–20% of middle-aged adults and goes up to 40% of older individuals, hence, greatly elevating the risk of partial and complete edentulism. The problem of diseases is also magnified by Europe's aging population; according to Eurostat, as of January 2024, 21.6% of the EU population is 65 years old or older. These factors are leading to a continuous demand for tooth replacement solutions, which is why dental clinics and laboratories are turning to digital denture workflows to meet the increasing patient numbers. The digital denture workflow provides them with higher accuracy, faster turnaround times, better clinical predictability, and the possibility to produce more without having to extend the time of their visits.

Restraint: High cost of dental imaging systems and inadequate reimbursements

The expansion of the European advanced digital denture technology market is mostly limited by the high costs of the systems and the dental procedure reimbursements being very low. For example, a system for computer-aided design and manufacturing, an intraoral scanner, a 3D printer, and a cone-beam CT require a significant investment initially, and also there is a need for maintenance, software upgrading, and staff training for which money has to be paid. Usually, these expenses are such that small- and medium-sized dental clinics with limited capital cannot afford to take on new technologies. Moreover, reimbursement for dental procedures, including digital dentures, differs substantially in various European countries and is often only partial or quite low, thus patients are to pay a large portion of the costs themselves. This situation of financial barriers pushes dental professionals not to invest in digital denture technologies and patients not to choose advanced prosthetic solutions, thereby the pace of market adoption and growth is low in the whole region.

Opportunity: Impact of DSOs on dental industry

Dental Service Organizations (DSOs) are changing the Europe dental industry one step at a time. They are changing the way of practice ownership, the direction of investments, and the adoption of new technology thus having an immediate effect on the market of digital dentures. Although the DSO model in Europe is more fragmented and regulated than in the US, the increasing consolidation of large dental groups especially in markets such as the UK, Germany, Spain, and the Nordics, is facilitating them to achieve scale efficiencies and invest in advanced digital workflows such as CAD/CAM systems, intraoral scanners, and 3D printing technologies used in digital denture fabrication. For example, in the UK, Christie & Co.’s 2022 Dental Market Review pointed out that around 1,300 dental practices are annually put up for sale, about 520 transactions are completed, thus revealing active consolidation in the market. An 8.6% increase in the average dental practice sale prices was recorded in 2021 as a result of a return to pre-COVID-19 investment levels, thus showing strong investor confidence. The acquisition and integration of clinics by DSOs and group practices, which usually offer NHS, private, or mixed-service models, is enabling them to centralize laboratory services, standardize digital workflows, and invest in high-cost digital denture technologies. This pattern will lead to the rapid implementation of digitally fabricated dentures all over Europe as they will have easier access to capital, workflow standardization will be driven, and higher-volume, more efficient prosthetic production will be supported.

Challenge: Shortage of skilled dental practitioners

One of the main factors limiting the growth of the digital dentures market in Europe is the deficiency of suitably skilled dentists and dental technicians who can effectively operate digital workflows. The adoption of CAD/CAM systems, intraoral scanners, 3D printing, and AI-assisted design tools is indeed on the rise, but their effective utilization still calls for specialized training and practical experience. A large number of dental clinics and laboratories in Europe are still encountering the problem of staff inadequately trained in advanced software operations, digital design process management, and the integration of end-to-end digital denture workflows. The issue of dental skill shortages is exacerbated by the disparity in the availability of training programs for digital dentistry in various countries and the fact that the dental workforce is getting older in some European markets. Consequently, the limited level of technical skills can make the pace of technology adoption slow, lead to the lesser achievement of productivity gains, and thus, continuing as rent from external laboratories will increase and the region's wide and efficient implementation of digital denture solutions will be restrained.

EUROPE DIGITAL DENTURE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

TRIOS 3 intraoral scanner is used to capture high-accuracy digital impressions for edentulous and partially edentulous patients, enabling fully digital denture design and fabrication workflows | Accurate digital impressions, reduced chairside time, improved denture fit and reproducibility, seamless integration with denture CAD workflows |

|

Lucitone Digital Denture Base System supports digitally milled and 3D-printed denture bases for complete, partial, and implant-supported digital dentures | Lucitone Digital Denture Base System supports digitally milled and 3D-printed denture bases for complete, partial, and implant-supported digital dentures |

|

Pro Resins are 3D-printable denture materials used for manufacturing denture bases and teeth within digital denture production workflows | Predictable mechanical performance, biocompatibility, faster production cycles, enables scalable and high-volume digital denture fabrication |

|

Flexcera Base is an advanced 3D-printable resin designed for digitally manufactured denture bases requiring high strength and long-term wear performance | Enhanced fracture resistance, superior esthetics, long-term durability, suitable for premium and full-arch digital denture applications |

|

Emerald S intraoral scanner is used for fast digital scanning of denture cases, supporting efficient data capture for digital denture planning and fabrication | Fast and accurate scans, improved patient comfort, streamlined clinic–lab communication, reduced impression-related errors |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The value chain for the Europe digital dentures market is complicated and has many stakeholders in areas like technology development, manufacture, regulation, distribution, and clinical adoption. By creating digital denture solutions such as intraoral scanners, CAD/CAM software, and additive manufacturing platforms that are aimed at improving prosthetic accuracy, production efficiency, and clinical outcomes, leading manufacturers like Dentsply Sirona, Straumann Group, 3Shape A/S, and Planmeca are setting the pace. The main emphasis of innovation in the area is on fully digital, minimally manual workflows that enhance denture fit, aesthetics, reproducibility, and shorten turnaround times. The distribution of dental equipment, materials, and software to dental laboratories and clinics is facilitated by established dental supply companies, specialist distributors, and laboratory service providers who make use of regional logistics networks and digital ordering platforms. The regulatory oversight, both under the EU Medical Device Regulation (MDR 2017/745) and national authorities, that ensures product safety, performance, and compliance is a major factor that determines the speed of technology commercialization. The reimbursement frameworks and insurance coverage that are available in different countries, thereby, influencing the pace of adoption by changing affordability and investment decisions are further factors that shape the market. Consequently, the end users who are the dental laboratories, prosthodontists, and general dentists, on the one hand, and key opinion leaders, on the other, are instrumental in confirming and digitally integrating routine care technologies of dentures. Besides this, professional associations, dental councils, and academic institutions facilitate the expansion of the market by providing clinical guidelines, promoting training programs, and endorsing best practices in digital prosthodontics.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Digital Dentures Market, By Type

The type segment is divided into partial and complete dentures. Complete dentures are expected to grow at the highest CAGR during the forecast period. They are particularly useful for patients who have lost all their teeth in one dental arch, providing a fully removable prosthetic device that restores both function and aesthetics. Generally, complete dentures are made of acrylic resin, and metal may be used to strengthen them. Moreover, they are tailor-made for the patient's gums, so the new dentures fit perfectly and provide comfort and stability. The procedure to make the dentures involves several stages. It begins with a doctor's visit and patient assessment, followed by a gum impression. A wax replica is then prepared to test the fit, bite, and appearance before the final denture is produced. With the help of complete dentures, patients can regain necessary oral functions such as chewing, talking, and smiling at ease, thereby using total tooth loss solutions in a holistic way. By contrast, partial dentures are designed to replace only the lost teeth, while natural teeth can still remain; hence, complete dentures become the most natural option for full-arch rehabilitation and total oral restoration.

Europe Digital Dentures Market, By usability

The usability segment is divided into fixed and removable dentures. Fixed dentures hold the highest share of the market and are among the top choices for many patients who prefer them over removable options because of the benefits they offer. Unlike removable dentures, which are washable and can be taken out of the mouth, fixed dentures are firmly attached to existing teeth or dental implants, providing greater stability, better functionality, and a more natural feel. They not only make the dental structure look natural but also support chewing and speech, positively affecting the patient’s confidence and satisfaction. In most cases, fixed dentures are made of durable porcelain or metal and are crafted to closely resemble real teeth in both shape and color. They are custom-fitted and aligned through accurate examination and careful planning by dental professionals, delivering alignment and oral health benefits. Among the top reasons for choosing fixed dentures in Europe is the permanent stability they provide. As a result, patients no longer have to worry about the shifting or slipping that usually occurs during daily activities, and they gain greater comfort, consistent functionality, and long-term oral health results.

Europe Digital Dentures Market, By Material

The materials segment of the Europe digital dentures market is divided into resins, metals, plastics, and other materials, with resins anticipated to record the highest CAGR throughout the forecast period. Resins are the most commonly selected materials in dental practice due to their compatibility with living tissues, long service life, and aesthetic versatility. Photopolymerizable polymers, among other high-performance resins, enable the accurate production of dentures with a superior fit and finish compared to conventional methods. These materials also possess the essential characteristics of a dental product, such as strength, flexibility, and wear resistance, making them a perfect choice for dental prosthetics that are guaranteed to provide patients' comfort for a long period. What is more, resins are lightweight, resistant to stains, and easy to care for, while their flexibility enables the dental professional to select the color of the natural teeth and thus achieve a highly aesthetic result. Besides, their ability to be directly bonded to tooth structures and to allow exact shaping and polishing further improves restoration durability, patient comfort, and clinical efficiency in contemporary dental practices in Europe.

REGION

France is the fastest growing country in the Europe Digital Dentures Market

France is expected to post the highest CAGR in Europe digital dentures market, supported by a strong public healthcare reimbursement framework and a well-developed dental care ecosystem. Dental procedures, including prosthetic treatments, are partially reimbursed under France’s national health insurance system, improving patient access and driving higher treatment volumes. According to Eurostat, France had 45,989 practicing dentists in 2022, ensuring widespread availability of professional dental services and accelerating the adoption of advanced digital workflows across clinics and dental laboratories. This combination of broad practitioner presence, favorable reimbursement, and growing uptake of CAD/CAM-based fabrication and AI-enabled design tools is driving rapid demand growth for digital dentures in the country.

EUROPE DIGITAL DENTURE MARKET: COMPANY EVALUATION MATRIX

In the Europe digital dentures market competitive matrix, 3Shape A/S is positioned as a Star player, supported by its strong software-centric ecosystem, advanced denture design solutions, and widespread adoption among US dental laboratories. The company’s leadership is reinforced by deep integration of intraoral scanning, CAD software, and open digital workflows tailored for removable prosthetics. Amann Girrbach is categorized as an Emerging Player, gaining traction in the US market through its high-precision milling systems and expanding digital denture manufacturing capabilities. While 3Shape A/S maintains a leading position through technological depth and broad laboratory penetration, Amann Girrbach’s continued innovation and growing US footprint position it for accelerated growth within the competitive landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Dentsply Sirona (US)

- Planmeca OY (Finland)

- 3Shape A/S (Denmark)

- Desktop Metal, Inc. (US)

- Modern Dental Group Ltd (Hong Kong)

- Midmark Corporation (US)

- Amman Girbach AG (Austria)

- Institut Straumann AG (Switzerland)

- Asiga (Australia)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 495.2 Million |

| Revenue Forecast in 2031 | USD 805.3 Million |

| Growth Rate | CAGR of 7.1% from 2026-2031 |

| Actual data | 2023-2031 |

| Base year | 2025 |

| Forecast period | 2026-2031 |

| Units considered | Value (USD Million), Volume (Thousands Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product: Equipment, Software I By Type: Partial dentures, Complete dentures I By Usability: Removable dentures, Fixed dentures I By Material: Metal, Plastic, Resins, Other materials I By End User: Dental hospitals and clinics, Dental laboratories, Other end users |

| Parent & Related Segment Reports |

Digital Dentures Market US Digital Dentures Market |

WHAT IS IN IT FOR YOU: EUROPE DIGITAL DENTURE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for dental equipments used in digital dentures ecosystem |

|

| Company Information | Key players: Dentsply Sirona (US), 3Shape A/S (Denmark), Desktop Metal, Inc. (US), Planmeca OY (Finland). Top 3-5 players market share analysis at APAC and the North American country level | Insights on revenue shifts toward emerging innovations |

RECENT DEVELOPMENTS

- May 2024 : Dentsply Sirona partnered with Google to launch medical-grade 3D printing solutions with integrated end-to-end workflows for dental practices and labs.

- February 2024 : A-dec and Dentsply Sirona expanded their collaboration by integrating the Dentsply Sirona Primescan Connect intraoral scanner with A-dec 500 and A-dec 300 delivery systems.

- November 2023 : Stratasys showcases its new F3300 Fused Deposition Modeling (FDM) 3D printer at the Formnext conference, in Frankfurt, Germany. This innovative printer offers unparalleled value to customers with reduced labor, maximized uptime, and higher part quality and yield.

- May 2022 : Dentsply Sirona launched Primeprint, a medical-grade 3D printing solution

Table of Contents

Methodology

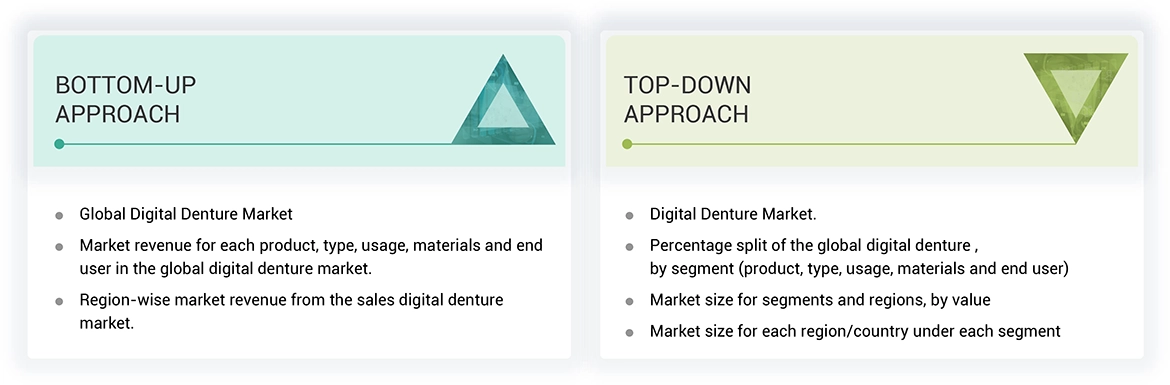

The study involved four major activities in estimating the current size of the Europe digital denture market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the Europe digital denture market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the Europe digital denture market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Europe digital denture market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the Europe digital denture market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall Europe digital denture market was obtained from secondary data and validated by primary participants to arrive at the total Europe digital denture market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall Europe digital denture market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Europe Digital denture Size: Top-Down Approach & Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Digital dentures are dental prostheses created with the help of scanners, design software and mills or printers. These digital tools can provide for more accuracy, efficiency and often more comfort for the patient. The digital denture workflow can start in different ways: sometimes a conventional impression is still needed, sometimes a direct scan in the patient’s mouth can be done to create a digital impression for dentures, and sometimes an impression isn't needed because the clinician does a duplicate of an existing denture. The way the workflow looks depends entirely on the clinical situation and the type of denture that is created.

Stakeholders

- Manufacturers and distributors of medical devices

- Manufacturers and distributors of medical device components

- Europe Digital denture companies

- Healthcare institutes

- Diagnostic laboratories

- Hospitals and clinics

- Academic institutes

- Research institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, segment, analyze, and forecast the global Europe digital denture market product, type, usage, materials, end userand region

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To profile the key players in the Europe digital denture market and comprehensively analyze their core competencies.

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches and approvals in the Europe digital denture market.

- To analyze the impact of the recession on the Europe digital denture market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Digital Denture Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Digital Denture Market