Europe Pharmaceutical Filtration Market Size, Growth, Share & Trends Analysis

Europe Pharmaceutical Filtration Market by Product [Membrane Filter, Depth Filter, Virus Filter, Air Filter, Assemblies, Systems (Single-use)], Technique (Ultrafiltration), Type (Sterile), Application (API, Protein), Scale, End User - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

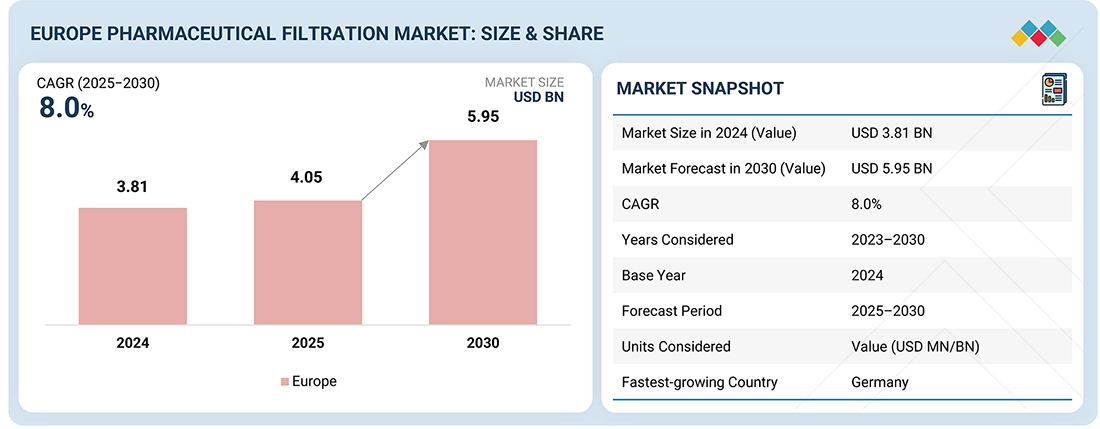

The Europe Pharmaceutical Filtration Market, valued at USD 3.81 billion in 2024, stood at USD 4.05 billion in 2025 and is projected to advance at a resilient CAGR of 8.0% from 2025 to 2030, culminating in a forecasted valuation of USD 5.95 billion by the end of the period. Pharmaceutical filtration is a process wherein solid and semi-solid particles present in a suspension are separated from a liquid or gas by employing membrane filters, such as filter sheets, cartridges & capsules, papers, depth filters, and others. Its market is fueled by the growing development and commercialization of biologics and biosimilars.

KEY TAKEAWAYS

-

BY COUNTRYBy country, Germany held the largest share of 26% of the Europe pharmaceutical filtration market in 2024.

-

BY PRODUCTBy product, the consumables segment is expected to dominate the market, with a share of 84.0% in 2024.

-

BY TECHNIQUEBy Technique, the microfiltration segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY TYPEBy Type, sterile preparations dominate the Europe pharmaceutical filtration market.

-

BY APPLICATIONBy application, the final product processing segment is expected to dominate the market.

-

BY SCALE OF OPERATIONBy scale of operation, the manufacturing-scale operations segment is expected to grow the fastest during the forecast period.

-

BY END USERBy end user, the pharmaceutical & biopharmaceutical companies segment is expected to dominate the market.

-

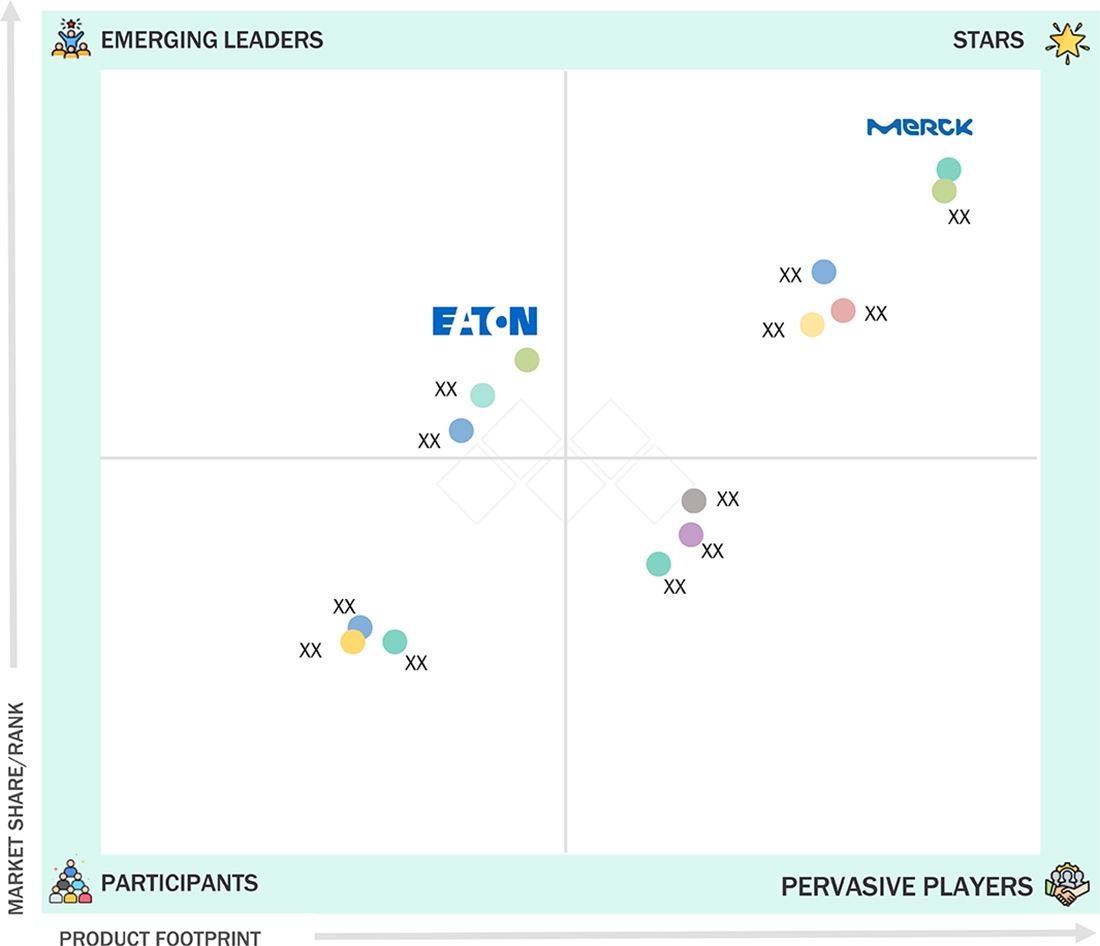

COMPETITIVE LANDSCAPEMerck KGaA (Germany), Sartorius AG (Germany), and Eaton Corporation plc (Ireland) were identified as the Star players in the Europe pharmaceutical filtration market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPEEasy Filtration (Italy) and Sani membrane (Denmark) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Europe pharmaceutical filtration market is expanding quickly. This growth is primarily driven by stringent quality regulations, higher demand for sterile drug production, and increased adoption of biologic therapies. Advanced filtration technologies are the main enablers for safer and more reliable manufacturing of vaccines, injectable medicines, and personalized treatments. As manufacturers gradually shift their focus to contamination control and regulatory compliance, filtration solutions are becoming the key agents not only for sustaining pharmaceutical quality but also for encouraging ??????innovation.

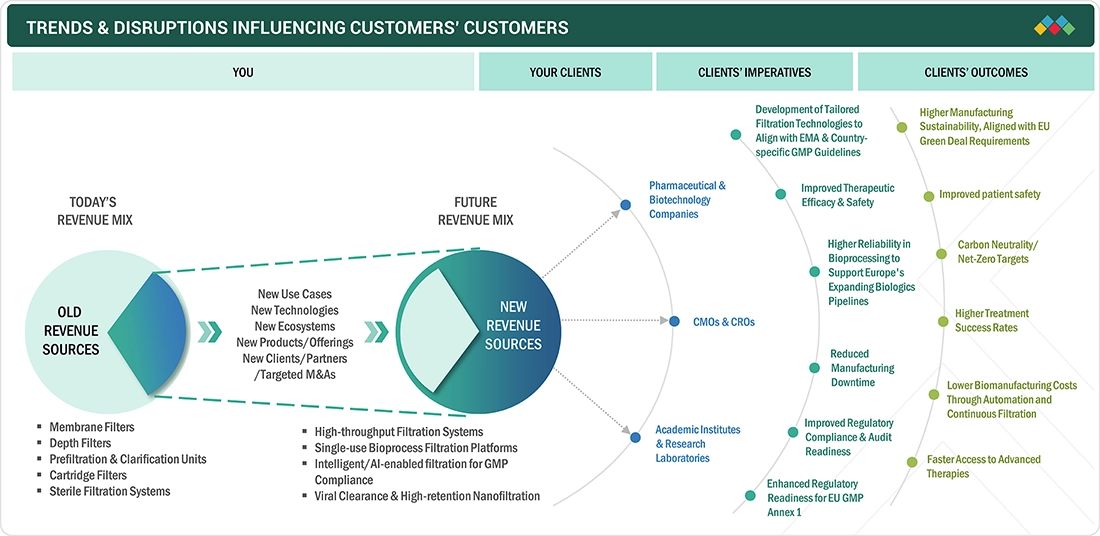

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe pharmaceutical filtration market is being reshaped by rapidly evolving industry, regulatory, and therapeutic trends, with major shifts expected to deepen over the forecast period. Europe biomanufacturers and CDMOs demand more filtration technologies due to the fast growth of advanced therapies such as cell & gene therapies, mRNA vaccines, and recombinant proteins. These CDMOs prioritize regulatory control and compliance, and the EU, as well as national authorities, are increasingly using filtration technologies for quality control and allowing it to be used for expanded innovation across the manufacturing value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising biologics and vaccine production under strict EU quality rules

-

Increased demand for high-efficiency, regulatory-compliant filtration systems that ensure sterility

Level

-

High costs and demanding validation/compliance requirements

Level

-

Expanding use of advanced therapies in Europe

Level

-

Complex, evolving EMA and EU regulations on sterility, safety, and sustainability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising biologics and vaccine production under strict EU quality rules

In Europe, the rapid growth of monoclonal antibodies, recombinant proteins, vaccines, and other biologics is significantly increasing the need for high-capacity, sterile, and virus-retentive filtration across upstream, downstream, and fill-finish steps. This shift toward complex biologic pipelines is prompting manufacturers to upgrade to more efficient, high-throughput filtration platforms to secure product purity and regulatory-compliant quality.

Restraint: High costs and demanding validation/compliance requirements

Across the European market, the significant capital and operating costs of advanced membrane and single-use filtration systems, combined with stringent EU validation and documentation requirements, remain a barrier to rapid adoption. Smaller firms and early-stage biotechs often delay filtration upgrades or rely on legacy systems, which slows the modernization of the regional filtration base.

Opportunity: Expanding use of advanced therapies in Europe

The strong pipeline of cell & gene therapies, mRNA vaccines, and other next-generation biologics in Europe is opening attractive opportunities for high-performance, application-specific filtration solutions. Suppliers that offer flexible, modular, and single-use platforms tailored to these modalities are well-positioned to capture new projects across CDMOs and large biopharma sites.

Challenge: Complex, evolving EMA and EU regulations on sterility, safety, and sustainability

European manufacturers must continually adapt their filtration strategies to meet the increasingly stringent expectations of the EMA and country-level authorities on sterility assurance, extractables and leachables, and environmental sustainability. Keeping pace with these evolving standards, while ensuring robust supply chains and consistent filter performance across multiple sites, poses an ongoing operational challenge for both pharma companies and filtration vendors.

EUROPE PHARMACEUTICAL FILTRATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies a broad range of depth filters, clarification media, and membrane cartridges used for harvest clarification, bioburden control, and final sterile filtration in biologics, vaccines, plasma products, and recombinants | Improves clarification performance and product purity, strengthens viral safety, enables scalable single-use production, and lowers contamination risk at key bioprocessing stages |

|

Provides integrated single-use bioprocessing and sterilizing-grade filtration solutions, including capsules, TFF & virus-removal systems, plus automated skids for upstream, downstream, and final-fill steps in biologics | Increases manufacturing flexibility and throughput, supports continuous or intensified operations, cuts time to batch release, and secures compliant sterility for advanced biologics |

|

Delivers depth filtration, virus-removal media, TFF systems, and filtration trains linked with chromatography for continuous processing and large-scale biologics manufacturing | Raises production efficiency, facilitates continuous processing, helps reduce operating costs, and enhances the purity of high-value therapeutic products |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe pharmaceutical filtration ecosystem comprises closely connected stakeholders, including membrane & equipment manufacturers, system integrators, biopharmaceutical producers, CMOs/CDMOs, distributors, and end users. Filter & media suppliers provide critical components, including sterilizing-grade membranes, microfiltration and ultrafiltration units, single-use assemblies, and depth filtration systems. Biopharma companies and CMOs apply these technologies across upstream, downstream, and fill-finish operations to ensure sterility, product purity, and regulatory compliance. Engineering partners support validation, scale-up, and process optimization, while distributors facilitate reliable delivery to manufacturing sites worldwide. This integrated ecosystem strengthens process efficiency, enhances contamination control, and supports the growing production of biologics, vaccines, and advanced therapies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

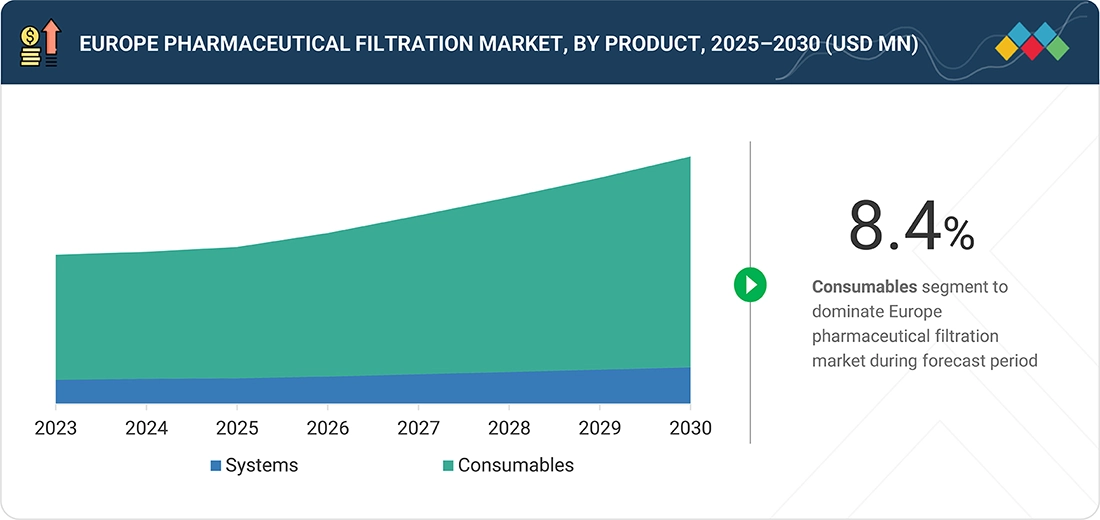

Europe Pharmaceutical Filtration Market, By Product

In 2024, consumables accounted for the largest share of the Europe pharmaceutical filtration market. Their dominance stems from their indispensable use in everyday sterile manufacturing processes and the ongoing need for replacement to ensure regulatory compliance and continuous, contamination-free production.

Europe Pharmaceutical Filtration Market, By Technique

In 2024, microfiltration emerged as the most widely adopted technique, primarily due to its strong ability to remove bacteria and particulate impurities from pharmaceutical solutions. This makes it a key method for safeguarding the quality of injectable medicines and other high-sensitivity formulations.

Europe Pharmaceutical Filtration Market, By Type

Sterile filtration led the market in 2024, supported by its critical role in producing injectable therapeutics, biologics, and parenteral nutrition. The requirement for complete microorganism removal to ensure patient safety reinforces its continued dominance across European pharmaceutical manufacturing.

Europe Pharmaceutical Filtration Market, By Application

In 2024, final product processing emerged as the largest application area, as filtration at this stage is vital for ensuring the necessary sterility and purity standards. Its importance in influencing product safety and meeting regulatory requirements makes it a key contributor to market demand.

Europe Pharmaceutical Filtration Market, By Scale of Operation

In 2024, large-scale manufacturing operations dominated the market, supported by the needs of high-volume pharmaceutical production. These operations rely heavily on continuous and reliable filtration processes to maintain consistent product quality and comply with global standards.

Europe Pharmaceutical Filtration Market, By End User

Pharmaceutical & biopharmaceutical companies held the leading share of the market in 2024. Their extensive use of filtration technologies for large-scale drug production, particularly for sterile and high-purity formulations, drives significant demand within this end-user segment.

REGION

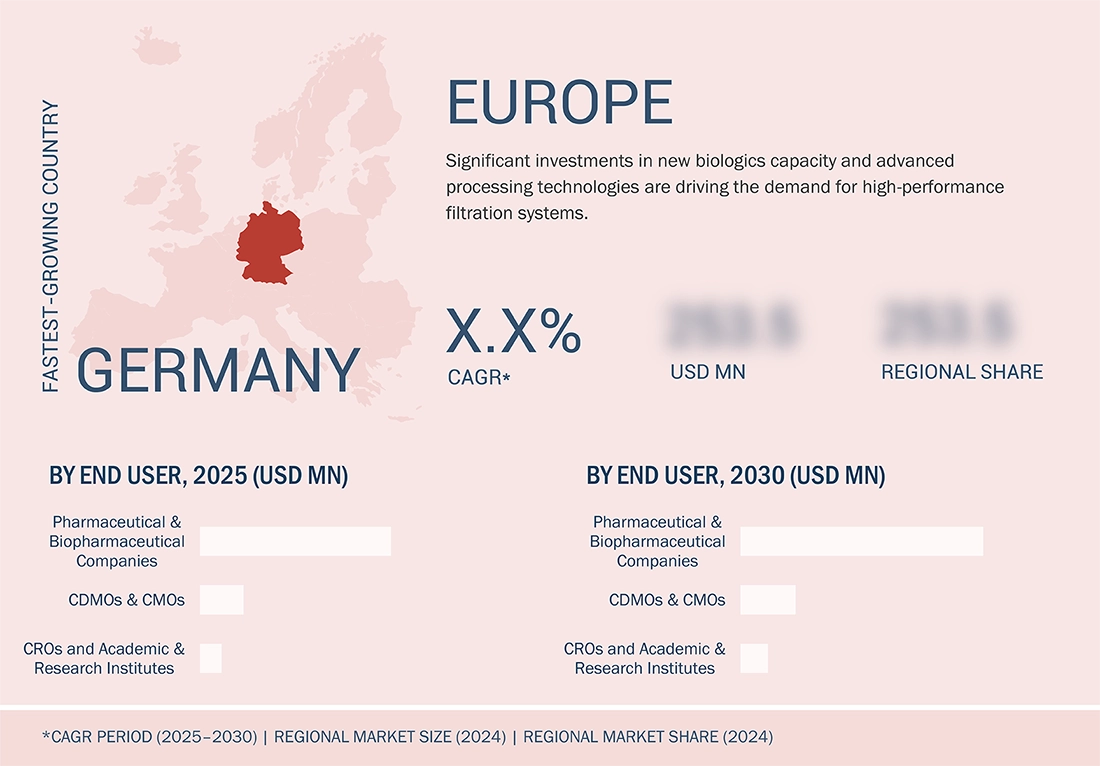

Germany to be fastest-growing country in market during forecast period

Germany is among the fastest-growing markets in Europe for pharmaceutical filtration, driven by the ongoing expansion of biopharmaceutical manufacturing capacity and a robust pipeline of biologics and biosimilars. The rapid growth of CDMOs and CMOs, combined with intensive R&D activity in vaccines, cell & gene therapies, and mRNA platforms, is driving increased deployment of high-performance filtration systems across German facilities. Robust healthcare spending, advanced production infrastructure, and supportive federal and regional funding programs further encourage large-scale investment in innovative filtration technologies.

EUROPE PHARMACEUTICAL FILTRATION MARKET: COMPANY EVALUATION MATRIX

In the Europe pharmaceutical filtration market matrix, Merck KGaA (Star Player) holds a leading position with an extensive portfolio of high-efficiency filters for sterile and non-sterile applications, a global reach, and robust support across manufacturing and research settings. This leadership has driven widespread adoption among biopharma companies, contract manufacturers, and hospital networks. Eaton Corporation Plc (Emerging Leader) is rapidly gaining traction, owing to its innovative membrane technologies, flexible product design, and expanding presence in precision therapeutic areas. Meanwhile, specialist companies focusing on niche filtration needs and agile manufacturing practices show significant growth potential, with strategic advancements positioning them as future contenders in the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Eaton Corporation Plc (Ireland)

- Porvair Plc (UK)

- Donaldson Company, Inc. (US)

- Alfa Laval Corporate AB (Sweden)

- MMS AG (Germany)

- MANN+HUMMEL International GmbH & Co. KG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.81 Billion |

| Market Forecast in 2030 (Value) | USD 5.95 Billion |

| Growth Rate | CAGR of 8.0% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, UK, France, Italy, Spain, Switzerland, Rest of Europe |

| Parent & Related Segment Reports |

Pharmaceutical Filtration Market North America Pharmaceutical Filtration Market Asia Pacific Pharmaceutical Filtration Market Pharmaceutical Filtration Consumables Market Pharmaceutical Microfiltration Market |

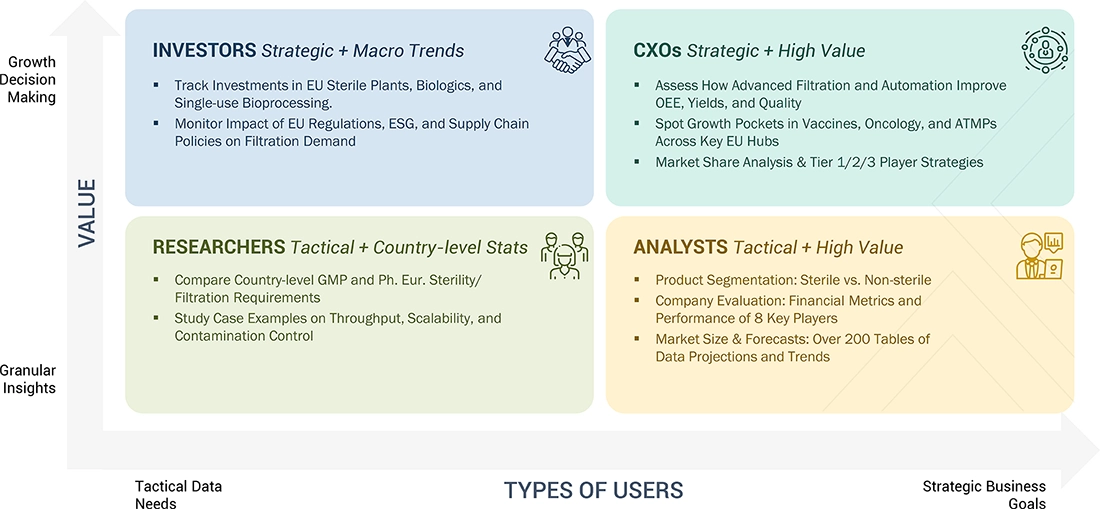

WHAT IS IN IT FOR YOU: EUROPE PHARMACEUTICAL FILTRATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Filtration Technology Insights | Comprehensive analysis of European microfiltration, ultrafiltration, nanofiltration, sterile filtration, and virus filtration technologies, with comparisons based on efficiency, scalability, cost, supply-chain maturity, and EMA regulatory compliance. | Supports filtration equipment suppliers in tailoring product portfolios to varying regulatory environments and manufacturing demands across major European markets, such as Germany, France, the UK, Italy, and Switzerland. |

| Innovation and R&D Trends | Assessment of emerging filtration innovations in Europe, including advancements in single-use systems, continuous bioprocessing, aseptic automation, and PAT-enabled real-time monitoring, supported by analysis of regional R&D funding, collaborations, and patent activity. | Helps guide strategic R&D investment by identifying high-growth areas in Europe’s biopharmaceutical ecosystem and aligning new filtration technologies with regional innovation priorities and partnerships. |

| Unmet Needs | Identification of filtration challenges in high-value biologics, vaccines, sterile injectables, and cell & gene therapy manufacturing in Europe, especially under stringent EMA and country-specific GMP guidelines. | Highlights strong opportunities for advanced filtration systems and specialized services addressing sterility assurance, contamination control, extractables & leachables management, and validation support within European manufacturing facilities. |

RECENT DEVELOPMENTS

- April 2024: Merck is investing over USD 325.46 million in a new research center at its global headquarters in Darmstadt, Germany. This investment aims to enhance Merck's leading position in key technologies for the development and production of innovative medicines.

- January 2023: Sartorius AG and RoosterBio signed a collaboration deal to provide purification solutions and establish scalable downstream manufacturing processes for exosome-based therapies.

- September 2022: Merck expanded its facility in Molsheim, France, to increase the manufacturing capacity of single-use assemblies belonging to the Mobius portfolio by investing around USD 139.97 million. The expansion will span over 3,500 sq. ft. The expanded facility will manufacture Mobius single-use assemblies, such as filters, tubing connectors, needles, and pumps.

Table of Contents

Methodology

This research study extensively used secondary sources, directories, and databases to identify and collect valuable information to analyze the Europe Pharmaceutical Filtration Market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to gather and verify critical qualitative and quantitative information and assess the market's growth prospects. The market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the Europe Pharmaceutical Filtration Market. The secondary sources used for this study include the American Membrane Technology Associations (AMTA), European Membrane Society (EMS), American Association of Pharmaceutical Scientists (AAPS), Pharmaceutical Research and Manufacturers of America (PhRMA), National Center for Biotechnology Information (NCBI), Parenteral Drug Association (PDA), Food and Drug Administration (FDA), European Medicines Agency (EMA), Health Canada, National Institutes of Health (NIH), World Health Organization (WHO), Indian Pharmaceutical Association (IPA), International Society for Pharmaceutical Engineering (ISPE), BioProcess International Magazine, BioPharm International, Journal of Bioprocessing and Biotechniques, BioPlan Associates, ScienceDirect, and Factiva, research journals; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; trade, business, professional associations and among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

Following an initial assessment of the Europe Pharmaceutical Filtration Market landscape through secondary research, comprehensive primary research was undertaken. This involved conducting in-depth interviews with market experts from the demand side, including stakeholders from pharmaceutical and biotechnology firms, CROs, CMOs, and academic and research institutions. Additionally, interviews were held with key supply-side participants, such as C-suite and senior executives, product managers, and marketing and sales leaders from prominent manufacturers, distributors, and channel partners.

Data collection methods included structured questionnaires, email correspondence, online surveys, personal interviews, and telephonic discussions to understand the market dynamics comprehensively.

Market Size Estimation

Both bottom-up and top-down approaches were used to estimate and validate the total size of the Europe Pharmaceutical Filtration Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the market size from the estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Pharmaceutical Filtration is a process wherein solid and semi-solid particles present in a suspension are separated from a liquid or gas by employing membrane filters, such as filter sheets, cartridges and capsules, papers, depth filters, and others. These filters retain solids, thus allowing liquids to pass through in all pharmaceutical and biopharmaceutical development and manufacturing processes.

Stakeholders

- Filter Manufacturers, Vendors, and Distributors

- Academic and Government Research Institutes

- Pharmaceutical & Biotechnology Companies

- Life Science Companies

- Venture Capitalists and Investors

- Government Organizations

- Private Research Firms

- Research & Development (R&D) companies

- Contract Research Organizations (CROs)

- Contract Development and Manufacturing Organizations (CDMOs)

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the Europe Pharmaceutical Filtration Market based on product, technique, type, scale of operation, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the Europe Pharmaceutical Filtration Market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the Europe Pharmaceutical Filtration Market and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product approvals & launches, expansions, agreements, and collaborations in the Europe Pharmaceutical Filtration Market

- To benchmark players within the Europe Pharmaceutical Filtration Market using the company evaluation matrix framework, which analyzes market players based on various parameters within the broad categories of business and service strategy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Pharmaceutical Filtration Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Pharmaceutical Filtration Market