Europe Point of Care Diagnostics Market

Europe Point of Care Diagnostics Market by Product [Glucose, Infectious Disease (TB, HAI, STD), Pregnancy], Purchase Mode (Rx, OTC), Technology [Biochemistry, MDx (RT-PCR, INAAT)], Sample (Blood, Urine), End User (Home Care, Hospitals) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe point-of-care testing market is expanding constantly due to the rising need for quick and accurate testing, the increasing prevalence of chronic and infectious diseases, and the aging population. Advancements in the country’s healthcare infrastructure, increased investment in decentralized and near-patient testing, and the rising use of self-testing solutions are fueling the market’s growth. The Europe PoC market is expected to increase to USD 7,174.4 million in 2031 from USD 4,449.9 million in 2026, registering a CAGR of 10.0% during the forecast period.

KEY TAKEAWAYS

-

By CountryBy country, the UK is expected to register the highest growth rate of 11.8% during the forecast period.

-

By ProductBy product, the glucose monitoring products segment held the highest market share of 43.3% in 2025.

-

By Mode of PurchaseBy mode of purchase, the prescription-based segment holds the highest market share.

-

By TechnologyBy technology, the molecular diagnostics segment posted the highest CAGR of 11.8% over the forecast period.

-

By Sample TypeBy sample type, blood samples are expected to show the highest growth rate.

-

By End UserBy end user, home care settings & self-testing are expected to hold the largest market share.

-

Competitive LandscapebioMérieux (France), Roche (Switzerland), Abbott (US), Siemens (Germany), and Danaher Corporation (US) are identified as star players due to their strong market presence and extensive product portfolios.

-

Competitive LandscapeResponse Biomedical (Canada) and Moditech Med (Korea) have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas.

The Europe point-of-care diagnostics market is being fueled by a number of key drivers, including the increasing trend towards decentralized and community-based healthcare practices and the increasing demand for rapid clinical decision-making at or near the point of patient care. The increasing demand for early and timely diagnosis is also fueling the adoption of point-of-care testing in hospitals, primary care, pharmacies, and home-care settings. In addition, the favorable regulatory environment and the increasing availability of CE-marked and OTC diagnostic solutions are also facilitating the use of POC testing outside of traditional laboratory settings. Technological advancements that improve test performance, usability, and connectivity with electronic health records are also facilitating the adoption of point-of-care diagnostic solutions in Europe. In addition, the increasing focus on managing healthcare costs, reducing the burden on hospitals, and improving patient convenience and accessibility is also fueling the adoption of point-of-care diagnostic solutions in Europe.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe point-of-care diagnostics market is growing steadily as the healthcare infrastructure is shifting towards faster and more accessible decision-making. One of the major trends in the Europe market is the growing inclusion of point-of-care diagnostics in hospitals, physician offices, pharmacies, retail clinics, and home care settings. The increasing use of CE-marked, digital-enabled, and self-testing point-of-care solutions, along with the shift towards decentralized testing models, is changing the dynamics of diagnostics. At the same time, developments in compact, user-friendly, and connected point-of-care devices are making it possible to use them in emergency departments, urgent care settings, and home-based care settings in Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing incidence of infectious diseases

-

Favorable government initiatives for point-of-care testing

Level

-

Pricing pressure on manufacturers

-

Stringent regulatory approval process for product commercialization

Level

-

Increasing growth potential in emerging markets

-

Rising inclination toward decentralized healthcare system

Level

-

Inadequate standardization with centralized lab methods

-

Premium pricing of novel platforms

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing incidence of infectious diseases

The increasing number of cases of infectious diseases is a key driving factor for the growth of the Europe point-of-care diagnostics market. The increasing number of cases of respiratory infections, sexually transmitted diseases, and viral diseases in European countries has increased the need for point-of-care diagnostics, which provide immediate results at or near the patient. The increasing use of point-of-care diagnostics in European countries is improving the diagnosis of infectious diseases. The increasing use of point-of-care diagnostics in European countries is improving the diagnosis of infectious diseases.

Restraint: Pricing pressure on manufacturers

Cost pressures continue to be a significant hindering factor in the European point-of-care diagnostics market, due to tight controls over healthcare budgets, limitations on reimbursements, and cost-containment strategies in many countries. Pressures on pricing due to public-funded healthcare systems and payers, especially in outpatient and home care settings, make it difficult for companies to demand high prices. At the same time, companies have to strike a balance between keeping their margins and complying with complex regulations, investing in innovation, and providing affordable and quality point-of-care diagnostic solutions to various healthcare systems in Europe.

Opportunity: Increasing growth potential in emerging markets

The European point-of-care diagnostics market provides immense opportunities for growth, especially in the Eastern and Southern European markets, due to the increasing emphasis on early diagnosis and the prevalence of diseases. In certain regions, the lack of infrastructure in centralized laboratories makes point-of-care testing an attractive option. The increasing emphasis on preventive healthcare and the need for cost-effective testing solutions are also creating favorable market conditions for companies to enter the underserved and emerging markets in Europe. The increasing emphasis on preventive healthcare and the need for cost-effective testing solutions are also creating favorable market conditions for companies to enter the underserved and emerging markets in Europe.

Challenge: Inadequate standardization with centralized lab methods

The absence of standardization to the same extent as in centralized laboratory testing is one of the major challenges that the Europe point-of-care diagnostics market faces. This is because the testing processes may vary from one country to another, and hence the results may not be consistent. In contrast to centralized laboratories, which work under strictly controlled conditions, point-of-care testing in Europe is conducted by individuals who are not laboratory personnel in a decentralized setting. This is a challenge because, in point-of-care testing, the results may be affected by human error, which may not be the case in centralized laboratories.

EUROPE POINT OF CARE DIAGNOSTICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of rapid point-of-care platforms such as ID NOW and i-STAT for infectious disease, cardiac markers, and metabolic disorders in European hospitals, urgent care centers, and home settings | Facilitates decentralized testing, helps in quick decision-making, improves turnaround time, and enhances patient flow in European healthcare systems |

|

Use of immunoassay and blood gas analyzers with CE mark for emergency, critical care, and outpatient use in European healthcare facilities | Offers high-quality, standardized results, facilitates rapid diagnosis in acute care, and easily integrates into European healthcare environments |

|

Application of cobas series molecular point of care systems for the diagnosis of infectious diseases, such as STDs, respiratory and hospital acquired diseases, in European healthcare segments | Facilitates quick molecular diagnosis, enhances control programs for infections, and optimizes clinical outcomes |

|

Use of rapid antigen, immunoassay, and molecular point-of-care tests for respiratory infections, women’s health, and cardiac markers in physician offices, pharmacies, and retail clinics in Europe | Improves patient access to rapid testing |

|

Distribution of point-of-care diagnostic instruments and infectious disease consumables within European hospital networks and emergency care environments | Aids scalable point-of-care testing, reliable function, and effective infectious disease management within European healthcare settings |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe point-of-care diagnostics market comprises a broad spectrum of important stakeholders in the value chain, including point-of-care test and device manufacturers, distributors, retail and pharmacy chains, and research and development partners. The end users, including hospitals, physician practices, primary care facilities, pharmacies, urgent and retail clinics, home care settings, and diagnostic laboratories, utilize point-of-care tests and devices to facilitate immediate testing in a decentralized and near-patient setting.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Point of Care Diagnostics Market, By Product

By product, the Europe point-of-care diagnostics market comprises glucose monitoring, infectious disease testing, cardiometabolic testing, coagulation testing, pregnancy and fertility testing, cancer markers, urinalysis, and other point-of-care tests. In 2025, glucose monitoring was the largest product segment in the market. This is due to the high prevalence of diabetes.

Europe Point of Care Diagnostics Market, By Mode of Purchase

The market for point-of-care diagnostics in Europe is divided based on over-the-counter and prescription-based testing products. In 2025, the prescription-based testing products will have a larger market share because of the stringent regulatory requirements that ensure the accuracy and reliability of the tests. The prescription-based tests are widely used in hospitals, clinics, and diagnostic laboratories and have been approved by the European Medicines Agency (EMA) and the country’s health regulatory bodies, which increases the confidence of physicians in these tests.

Europe Point of Care Diagnostics Market, By Technology

By technology, the market includes biochemistry, immunochemistry, and molecular diagnostics. In 2025, biochemistry-based technologies accounted for the largest market share in the European point-of-care diagnostics market. This is due to their widespread use in rapid and cost-effective testing for diabetes, cardiovascular diseases, and kidney disorders. Biochemistry point-of-care tests, such as glucose meters and lipid profile analyzers, are capable of providing instant results and are easy to use. They can be used for home care, emergency care, and outpatient care. The capacity of these tests to provide accurate results without requiring extensive laboratory facilities has been a major factor in their adoption in European healthcare systems.

Europe Point of Care Diagnostics Market, By Sample

On the basis of sample type, the market is divided into blood samples, urine samples, nasal and oropharyngeal swabs, and other sample types. In 2025, blood-based tests accounted for the largest share of the European point-of-care diagnostics market, as blood samples are used for a variety of point-of-care diagnostics. They are especially useful for the observation of chronic diseases such as diabetes and cardiovascular diseases. The ease of blood sampling, such as finger-sticking, has made blood the preferred sample type for point-of-care diagnostics.

Europe Point of Care Diagnostics Market, By End user

On the basis of end users, the European point of care diagnostics market is divided into clinical laboratories, ambulatory care facilities and physician offices, hospitals, critical care and urgent care facilities, home care and self-testing, and other end users. In 2025, the home care and self-testing market is expected to account for the largest market share in Europe, owing to the increasing demand from consumers for convenient, private, and rapid testing solutions outside the traditional healthcare setting. The rising cases of lifestyle diseases and the availability of quick, accurate, and affordable point-of-care devices are expected to drive the home-based diagnostics market in Europe.

REGION

The UK is the fastest-growing segment, by country

The UK is anticipated to demonstrate the highest growth rate in the European point-of-care diagnostics market, owing to the increasing adoption of rapid testing technologies and significant investments in the healthcare infrastructure. The rising availability of advanced diagnostic technologies, the growing focus on early disease detection, and the increasing need for decentralized testing are some of the factors that are driving the market growth in the region.

EUROPE POINT OF CARE DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX

Abbott Diagnostics (US) is a key player in the European POC testing market, with a large portfolio of popular POC platforms and innovation in rapid testing technology. The company’s broad test menu, scalable solutions, and strong installed base help drive steady demand for Abbott’s POC consumables. On the other hand, Siemens focuses on clinical performance, ease of use, and regulatory requirements, which helps the company sustain a strong position in the various POC segments of the European market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 4.14 Billion |

| Market Forecast in 2031 (Value) | USD 7.17 Billion |

| Growth Rate | CAGR of 10.0% from 2026-2031 |

| Years Considered | 2024-2031 |

| Base Year | 2024 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, UK, France, Italy, Spain and Rest of Europe |

WHAT IS IN IT FOR YOU: EUROPE POINT OF CARE DIAGNOSTICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Product matrix, which provides a detailed comparison of the product portfolio of each company in the Europe Point of Care Diagnostics market | Enables easy comparison of competitors’ offerings, helping identify gaps, overlaps, and differentiation opportunities. |

| Company Information | Additional five company profiles of players operating in the Europe Point of Care Diagnostics market | Provides insights into competitors’ strategies, innovation focus, and partnerships, supporting strategic planning. |

RECENT DEVELOPMENTS

- December 2025 : Roche has announced that it has achieved CE IVDR certification (the Europe regulatory mark) and FDA clearance for its point-of-care PCR test for Bordetella, which provides reliable results in 15 minutes and is intended for use in GP practices and emergency departments.

- January 2025 : bioMérieux has broadened its range of point-of-care diagnostics with the acquisition of Norwegian firm SpinChip Diagnostics ASA, whose technology is a rapid immunoassay platform that provides blood test results in less than 10 minutes. The acquisition is intended to complement bioMérieux’s existing molecular point-of-care offerings, such as BIOFIRE SPOTFIRE, with high-sensitivity immunoassays for acute care biomarkers.

Table of Contents

Methodology

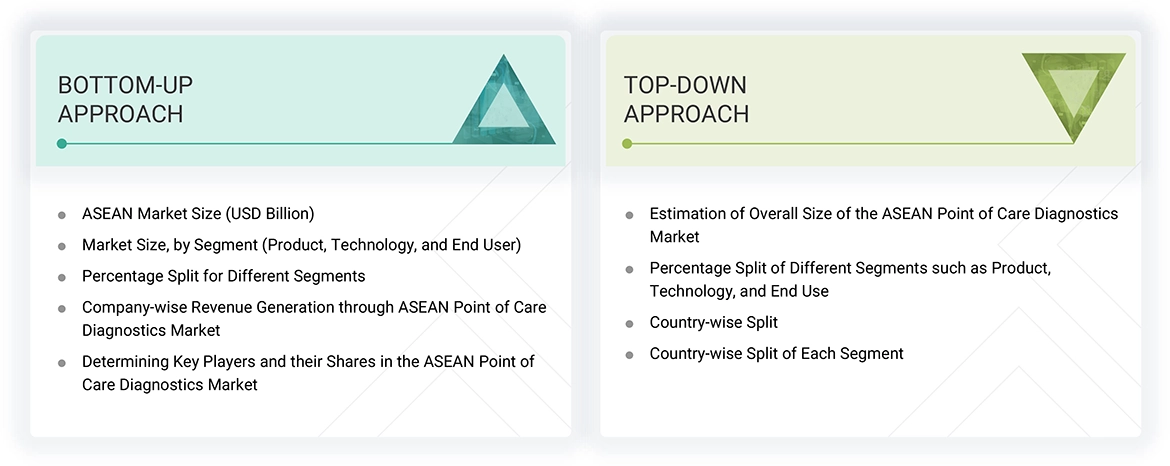

The study involved major activities in estimating the current market size for the europe point of care diagnostics market. Exhaustive secondary research was done to collect information on the europe point of care diagnostics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the europe point of care diagnostics market.

The four steps involved in estimating the market size are:

Secondary Research

In the secondary research process, various secondary sources, such as company annual reports, press releases, and investor presentations, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva), were referred to identify and collect information for this study.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects.

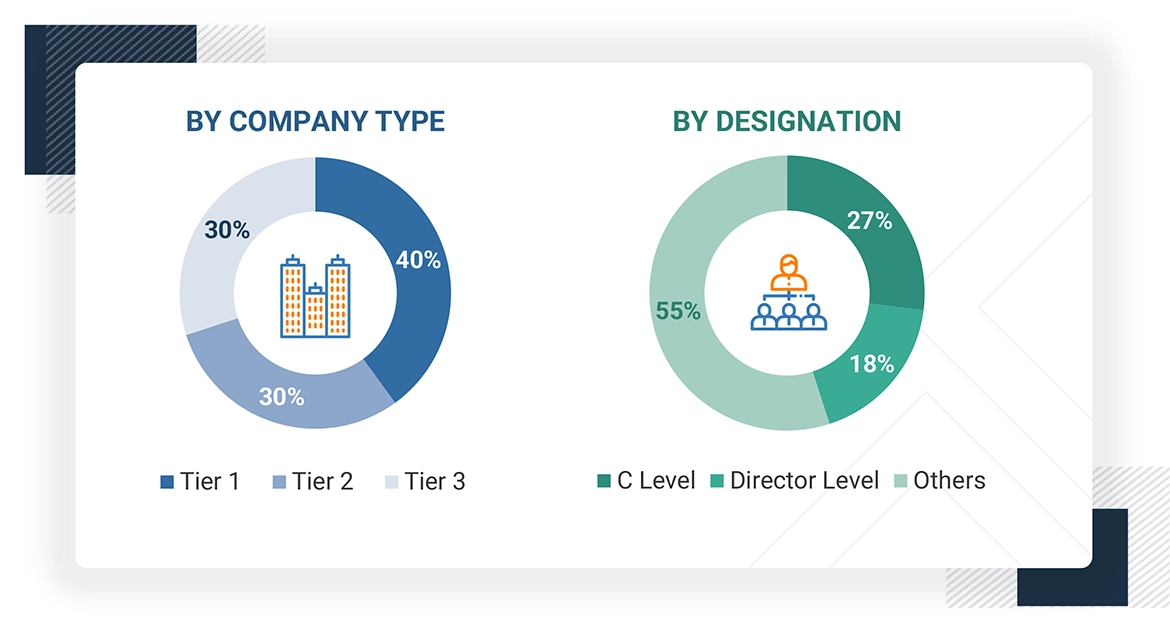

The following is a breakdown of the primary respondents:

Note 1: Others include sales, marketing, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION |

|---|---|

| PTS Diagnostics | Regional Sales Manager |

| EKF Diagnostics Holdings plc | Product Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the europe point of care diagnostics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- Primary and secondary research has determined the revenues of leading players operating in the europe point of care diagnostics market.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size by applying the abovementioned process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Point of care testing (POCT) includes tests designed to be used at or near the patient's site (such as at home, in an ambulance, at a physician’s office, and other locations). POCT allows rapid & reliable diagnostic testing to obtain outcomes instantly, helping physicians/patients make care decisions remotely and rapidly.

Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the europe point of care diagnostics market based on product, technology, end user, and country

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall europe point of care diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to ten countries, namely, Vietnam, Laos, Cambodia, Malaysia, Myanmar, Philippines, Singapore, Thailand, Indonesia, and Brunei

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business & product excellence

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Point of Care Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Point of Care Diagnostics Market